Off to Japan I go – again

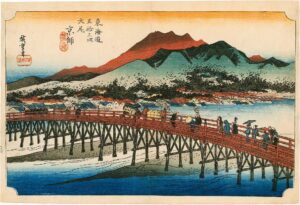

Today, I am heading to the airport for travel to Japan. For the next several months I will once again be working as a professor at Kyoto University as part of the research team concerned with integrating the macroeconomic principles in Modern Monetary Theory (MMT) principles into a broader framework to build national resilience in the face of climate change, demographic challenges, transport and housing challenges and more. So from tomorrow I will be in Kyoto and depending on commitments my blog posts might be a little less regular although I think I will be able to continue the usual output. I will have more to say about what we are working on, including the release of a book we have been completing from last year’s collaborations. There is also a major event planned for later in November in Tokyo to launch our latest work. I will provide details later when I know them. We are also talking about hosting an Modern Monetary Theory symposium in Kyoto next April to welcome in the Spring and the cherry blossoms. When I know more I will relate the details here. I am also working on my next book which will traverse the topics of degrowth, the sustainability of capitalism and more. Japan’s shrinking population presents an opportunity to lead the world in reducing the society’s reliance on economic growth and exploring more substantial aspects of human existence. I mapped out that argument in this blog post – Degrowth, deep adaptation, and skills shortages – Part 4 (October 31, 2022). Anyway, until I resurface tomorrow beside the Kamo River, we can listen to some music.