In the annals of ruses used to provoke fear in the voting public about government…

The Japanese wage problem

I read a lot about Japan. It has interested me since the early 1990s commercial property collapse and the subsequent fiscal and monetary policy measures that the Japanese government deployed to deal with it, which took policy settings outside the bounds that mainstream economists could cope with. These economists predicted the worst based on mindless extrapolations of their ‘theoretical’ models, which are really incapable of dealing with the real world in any meaningful way. Their worst didn’t come and some 3 decades later, with policy settings still at ‘extreme’ levels compared to the way mainstream economists think (and the policy makers are not budging it seems), Japan continues to demonstrate why New Keynesian macroeconomics is inapplicable and why Modern Monetary Theory (MMT) has traction. And while Japan provides first-class public transport, health and education systems, a viable housing policy, good urban systems, and has maintained low unemployment rates even during the GFC and the pandemic, there is one feature that is troublesome – the flat lining wages growth over the last 20 years. I have been very interested in learning the reasons for this phenomenon, which sets Japan apart from most other nations (who have also experienced low wages growth – but not that low). I plan to work on this aspect, in part, when I move to Kyoto next month for an extended stay.

OECD.Stat publishes – average annual wages – for the Member nations.

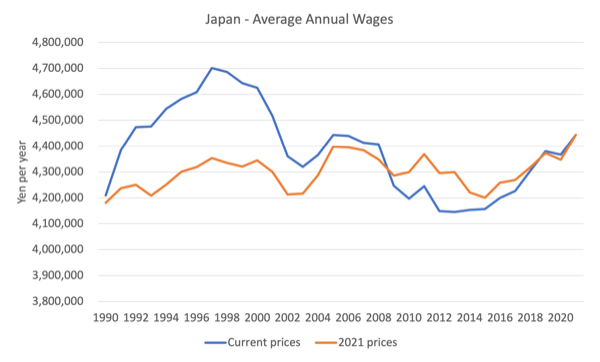

The following graph shows the movement in nominal and real (using 2021 prices) average annual wages in Japan since 1990 (up until 2021).

After the disruption in the 1990s as a result of the real estate bubble bursting, nominal wages initially rose as Japan avoided recession (aided by the fiscal boost), but the rot set in after 1996 and Japanese workers, on average, have had to cope with falling or flat wages growth.

In real terms there has been only 6 per cent growth in average annual wages since 1990 and all of that has come since 2015.

The average annual growth in nominal wages since 2000 has been -0.19 per cent.

The question, then, is why?

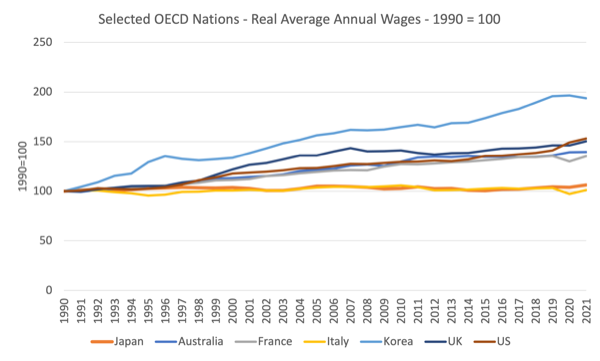

The next graph provides some comparative data.

Japan and Italy are standouts in the low wages growth department.

Real average annual wages in Italy have risen by just 1.2 per cent since 1990, which is an appalling statement of a failed state.

For Japan, that growth has been just 6.2 per cent.

Compare that to another East Asian trading nation Korea, which has seen real average annual wages growth by 93.8 per cent since 1990.

If you also consider that in 1990, real (in USD PPP terms – so comparable across nations) in Japan were $US36,739, while in the UK they were $US33,334.

In 2021, the same measure for Japan was $US40,849 and for the UK $US51,724.

And one would hardly call the UK an exemplar of adequate real wages growth.

So there is a wages problem in Japan.

It is clear that the wages problem in Japan is now becoming acute as a result of the recent higher inflation, which has been driven by imported energy price hikes, and, to some extent, the depreciation in the yen (as funds shift towards nations that have been foolishly hiking their interest rates).

While companies have resisted passing on the full extent of the imported price rises and the depreciation will help exports (but not to the extent that some might imagine – given Japan has shifted manufacturing offshore), it apparent that Japanese consumers are experiencing real income losses as a result of some price rises in basic items in the CPI.

I wrote about that this, in part, in this blog post – Why has Japan avoided the rising inflation – a more solidaristic approach helps (July 4, 2022).

The price pressures on basic food items and fast food etc are impacting most on low-income families, and the Japanese government has used its fiscal capacity to reduce transport costs (oil and gas subsidies) and provide cash transfers.

The Bank of Japan is also not falling into the idiocy of central banks elsewhere and is refusing to push up rates.

It knows that interest rate rises will not address the sources of the inflationary pressures and, if they do anything, will exacerbate cost pressures for firms with debt and push the economy into recession as consumers take a double hit.

Which has focused attention of the new Prime Minister on the wages question.

When Fumio Kishida took over from Shinzo Abe, he said that he wanted Japan to create a “new form of capitalism”, which would reduce inequalities, address climate change more quickly, increase investment in skills development, and promote wages growth.

He also wanted to finally increase the minimum wage from 930 yen to 1000 yen per hour – after more than a decade of failed deliberations within government.

You can guess that this call attracted criticism from the vested interests in the financial markets – because he proposed increasing speculative taxes (like the capital gains tax) and regulating markets more tightly (stopping share buybacks, for example).

His conservative Liberal Democratic Party – his government mates – also were pressured to resist a redistributive agenda.

So the ‘new capitalism’ agenda that finally was approved in June 2022 was fairly lame.

In part, the wages problem in Japan is due to government policy.

Corporations have large pools of retained earnings (which could easily be passed on, in part, as wage increases) and have been enjoying lower company tax rates under the Liberal Democrats.

And, on the other side, the government has also tried on occasions to reduce the fiscal deficit by pushing up sales taxes, which directly hurt workers.

Yet, now, under the ‘new capitalism’ narrative, corporations are under significant ‘moral’ pressure not to pass on current cost pressures to final consumers and also to redistribute some of their booming profits to boost wages and address the malaise identified in the graph above.

Fumio Kishida has repeated the calls from Shinzo Abe that Japanese corporations should increase wages by 3 per cent per annum.

So far there has been resistance on that front. Only the exporters who are enjoying higher profits as a result of the depreciation are showing signs of increasing wages for their workers.

The question is why is Japan in this position?

This is something I am investigating.

Some of the possible explanations that are given are:

1. The real estate bubble collapse argument

The real estate collapse effectively brought wages growth to a halt, and the Asian Financial Crisis in 1997 further curbed opportunities for growth.

But this explanation doesn’t provide any rationale for why growth hasn’t resumed as the economy experience GDP growth in the 2000s

2. The general deflationary mindset is entrenched in Japan argument

This argument goes that the persistently low inflation with periods of deflation since the 1990s has created a sort of ‘vicious cycle’, where firms are reluctant to increase prices because they fear consumers, who are enduring low wages growth, will withdraw expenditure, but, at the same time, they are reluctant to pay higher wages because consumers are not driving sales sufficiently.

There is some truth to this argument but it also falls short when we consider the booming profits and retained earnings.

The Japanese Cabinet formed a ‘Council of New Form of Capitalism Realization’ to work out how to implement the Japanese government’s new agenda.

On November 8, 2021, the Office of Prime Minister of Japan and Cabinet published an – Outline of Emergency Proposal Toward the Launch of a “New Form of Capitalism” that Carves Out the Future.

It is a very interesting document.

It notes, in part, that:

… since the 1980s, a growing emphasis has been placed on short-term shareholder value, resulting in a sluggish growth of the middle class, widening disparities, an increasing burden on subcontractors and adverse effects on the natural environment and others …

Private companies are requested to enhance their mid- to long-term earning power by strengthening their investment in the future in areas such as human capital, and to achieve sustainable growth by circulating the profits through wage increases and other distributions as well as through further investment in the future.

That was a very emphatic statement.

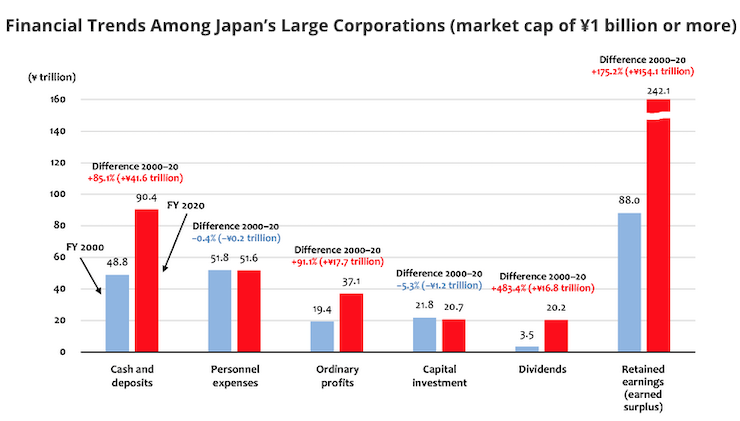

This article from the Tokyo Foundation for Policy Research (March 10, 2022) – Changing Corporate Behavior to Jump-Start the New Capitalism: The North Wind Versus the Sun – provides further insights into how Japanese corporations have let the Japanese people down.

It examines ‘corporate financial data’ over the last two decades and finds that even as profits have been rising there has been a decline in wages paid (‘personnel expenses’) and investment in plant and equipment.

So where have the profits been going?

Into ever increasing accumulations of retained earnings.

They produced this graph, which is rather telling.

They conclude that:

… between 2000 and 2020, the combined ordinary profits of Japan’s large corporations rose 91.1% (up ¥17.7 trillion). During the same span, cash and deposits increased by 85.1% (up ¥41.6 trillion), and dividends rose 483.4% (up ¥16.8 trillion). Meanwhile, personnel expenses decreased by 0.4% (down ¥200 billion), and capital investment fell 5.3% (down ¥1.2 trillion). Accumulated retained earnings at large Japanese corporations rose by a full 175.2% for an increase of ¥154.1 trillion.

Similar behaviour was found in SME.

It is clear that:

Japanese businesses have been far more intent on rewarding their shareholders than on giving back to their employees.

So the ‘deflationary’ mindset argument doesn’t hold up very well.

3. The neoliberal casualisation of the labour market argument

This explanation has more credibility.

As well as hoarding profits and providing largesse for the shareholders, Japanese companies have also been actively casualising their labour markets, in line with the global neoliberal trends.

There is a dual labour market in Japan.

The primary labour market still runs according to the – nenkō joretsu – system, where workers are rewarded at higher rates as they approach retirement.

This is a loyalty type arrangement, which also provides an incentive to skilled and experienced workers to pass on their knowledge to younger staff coming up the ladder.

The older workers feel no threat and so are happy to pass on knowledge.

The downside is that the heirarchy can become sclerotic as promotional opportunities are limited by the retirement rate.

The system is changing now and less companies are willing to lock themselves in the Nenko system.

The question then is how do Japanese companies deal with the flux and uncertainty of capitalism – fluctuations in aggregate demand.

In other countries, the flux is dealt with by creating unemployment.

In Japan, it is the secondary labour market that traditionally plays this role and it consists often of small subcontracting firms that use labour hire companies, which come into and out of existence dependent on the state of the cycle.

However, that strict dichotomy has been breaking down since the 1990s and more firms are creating secondary labour market conditions as core business.

Data from the Japan’s National Statistical Agency – Summary of 2021 Annual Average (II Detailed Tabulation) – reveals a substantial shift in the Japanese labour market since the 1990s.

In 2021, there were 35.55 million ‘regular employees’ and 20.64 million ‘non-regular employees’.

The non-regular employees accounted for 36.7 per cent of total employees.

The sex breakdown of the latter category in 2021 was 6.52 million males and 14.13 million females.

In terms of the type of non-regular employment, “the number of ‘part-time workers and arbeits (temporary workers)’ was 14.55 million” or 70 per cent of the total.

In 1990, non-regular employment stood at 8.81 million, while regular employment was a little under 35 million.

The non-regular employees accounted for 20 per cent of total employees.

And the ratio of non-regular to regular has grown from 21 per cent to 59 per cent.

Part of the shift is the rise of students also undertaking part-time work.

But the majority of the shift is the increasing degradation of work.

The National Statistics Office indicates that one of the reasons for this increase is the shortage of regular work, which has precipitated a rise in underemployment – workers wanting to work more hours but unable to find the opportunities.

This document – Overview of Non-regular Employment in Japan – from the Japanese Institute for Labour Policy and Training provides a detailed account of non-regular employment in Japan.

A regular employee is hired directly by the firm of employ and works scheduled full-time hours. They are “covered by public insurance schemes including workers’ compensation, unemployment, health care and retirement pension”.

A non-regular employee “is one who does not meet one of the conditions for regular employment.”

They might be part-time workers, or have no fixed hours, or be sold through a labour hire company, or not be covered by the standard non-wage protections.

The capacity of non-regular employees to gain pay rises is extremely limited and is a major factor why wages growth has been so low in Japan.

Conclusion

In another post, I will explain how the Nenkō joretsu wage system also creates conditions where firms are not pressured to award wage increases.

Trade unions are stronger in the regular labour market and they have prioritised employment security and promotional certainty over wages growth.

The annual annual spring wage offensive or – Shuntō – where unions and firms bargain wage increases has failed to protect the real wages of workers for reasons I will explain.

But while I often hold out Japan as an example of why pushing fiscal and monetary policy beyond their typical limits has not had the negative consequences predicted by mainstream New Keynesian economists, there is still a massive wages problem that needs to be addressed.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

It is commonly said that gov. should tax what they don’t want the people to do. Like smoke or drink whiskey.

Why is it off the table to increase the tax rate of corps that increase their percentage of profits? Why is it off the table to tax corps progressively, like the US does with people? Why is it off the table to tax huge corps at a much higher rate, to stop them from growing larger (often by buying the competition).

If international corps use bookkeeping tricks to move profits to low tax nations, why is it off the table to just tax revenues collected in a nation, with few deductions? The main allowed deduction could be wages paid to people living in that nation.

“It is commonly said that gov. should tax what they don’t want the people to do.”

And that’s a commonly wrong attitude for a sustainable tax system, and why we have so much problem with it.

Tax has to be continuous and predictable so that it permanently suppresses the private activity that needs to be suppressed so there is physical space for the public activity government was elected to undertake.

It’s time to stop thinking we can change the world by tinkering with tax. Either ban it or leave it alone.

In Europe and the US, I’m not so sure about Japan, part of the problem with wages, as highlighted in Wednesday’s post, is wage inequality.

Minimum wages is one way to address this, by pushing up low wages, but it doesn’t help at the top end. Perhaps we also need to reduce high wages so that companies choose to redistribute this lower down the scale.

Could there be a progressive employers tax? Obviously employers tax already exists. But it tends not to apply at high remuneration. Instead governments tend to try to impose progressive income tax (William Pitt and Abraham Lincoln have a lot to answer for), which is politically difficult at high rates and is, obviously, limited to 100%.

An employers tax could start at a low rate at few times median wage and then increase progressively. The difference from income tax is that employers tax could exceed 100%. Perhaps if a company had to pay 1000% tax on excessive CEO salaries they might find they could find a CEO for a lower salary?

@Neil Wilson,

Sometimes the problem with banning it (that is a ‘something’) is, that it can be hard to define legally

My proposal to tax corp revenue over (say) 1/3 of Amazons current revenue less wages paid to Americans in America at a 90% tax rate will make Amazon do something to not earn that much. Like sell off parts of their operation. They can’t easily hide revenue. Maybe they would pay more because that reduces their tax bill.

I recently saw a graph plotting wages against company profits in Japan – just recapitulating the situation here and in the US but worse as detailed above.

But I disagree that this has been to benefit shareholders. If anything shareholders in Japan have been treated worse than the salaryman. Over the last 30 years the S&P up 600% – so yes shareholders in the US have been taking their share and more. The Nikkei has increased ~ 16% in 30 years over a period of large increases in company profits. Plot the S&P and Nikkei over the last 30 years and you get the picture, yes dividends up from a very low level but can hardly account for all the cash – so were has it gone – largely wasted by profitless expansion, cash just sitting on the books with companies run by elderly men unresponsive to anyone but themselves (not the shareholders or the salarymen). Maybe slowly changing and perhaps management have been shielded by persistently low interest rates (no incentive to manage capital efficiently).

“My proposal to tax corp revenue over (say) 1/3 of Amazons current revenue less wages paid to Americans in America at a 90% tax rate will make Amazon do something to not earn that much.”

Your proposal to tax anybody anything will result in more unemployment, because that is the purpose of taxes – as MMT makes clear.

Tax imposition has little to do with tax incidence, the entity who is forced by systemic effects to actually stand the loss. The loss changes hands until the power relations stop the next person down the chain passing on the loss.

Corporations don’t really exist. They are owned by people, sell to people, and employ people. If you take money from them they pass the costs onto one of those three people – and it won’t be the owners. The net result is less employment and higher prices.

That’s why we classify corporations as intermediate spending, not final spending in the national accounts.

Taxes cause unemployment. Tax incidence causes the tax loss to change hands from where it is legally applied. It appears the more times the tax loss is forced to change hands the more impact on prices before we end up with the unemployment. Therefore we want to use the insights of tax salience to get the unemployment we’re after as directly as possible – to maintain stable prices.

If you want to impact owners then you need higher competition, not higher taxes.

Hi Dr. Mitchell, in the third graph on trends in Japan`s large corporations, I am curious whether you looked into the Depreciation and Amortization or accumulated tax credit data for the same 2000-2020 period. It seems as if–even by the standards of large corporations–Japanese large corporations don`t pay very much tax. The change in ordinary profits (pre-tax) is almost equal to dividend payouts. The cash buildup could be the result of a sizeable D&A tax-shield or a sizeable D&A plus tax reduction benefits coupled with the slightly decreasing CapEx. The FY20 in Japan runs up to March 2020, so Covid would not have played a factor in skewing the numbers.