In the annals of ruses used to provoke fear in the voting public about government…

Japan about to walk the plank – again

Japan is about to walk the plank again when it follows through on a previous government decision to increase the consumption tax by a further 2 per cent on October 1, 2019. That means it rises from 8 per cent to 10 per cent. The latest fiscal documents suggest the government is hyper-sensitive to the historical experience, which tells us that each time they have fallen prey to the deficit terrorists who have bullied them into believing that their fiscal position is about to collapse, consumption expenditure falls sharply and the government has to respond by increasing the deficit even further to compensate. But, notwithstanding their caution (as evidenced by some permanent and temporary spending measures to offset the significant loss of non-government purchasing power that will follow the consumption tax hike, the fact remains that the policy shift will be undermine non-government spending and growth and is totally unnecessary. Moreover, the main problem in Japan at present is the lack of spending overall – non-government consumption expenditure has not yet recovered from the last consumption tax hike in April 2014. So far from raising taxes, the data on the ground is telling us that they should be increasing the fiscal deficit. This is another example of a few conservative politicians, being told by unaccountable mainstream economists to introduce policies that will damage the material prosperity of the ordinary Japanese worker and their families. And when we consider that the time is approaching when the debt-servicing burden for the government is approaching negative territory, then the consumption tax hike looks even more ridiculous.

The Government has twice delayed this increase because of the push back – which came from within its own ranks as well as more broadly.

Recall, that the tax was first introduced in April 1989 – the rate was 3 per cent. They claimed at the time that the tax was necessary to fund welfare spending – in relation to its ageing society.

So from the outset, the justification for the tax was flawed.

In April 1997, in the face of mounting criticism from conservatives that the rising fiscal deficit, which kept the economy growing after the massive property collapse, the Government pushed the rate up to 5 per cent.

Economic growth fell sharply and the Government was forced to renew its fiscal (deficit) support for the economy. This dislocation sealed the political fate of the Prime Minister at the time.

The same flawed justification (ageing society) was used to propose pushing the rate up to 8 per cent in April 2014 and then 10 per cent in October 2015.

The second proposed rate rise was delayed because of the fear that further retrenchment in the fiscal stimulus would promote recessionary forces.

I have written about that several times – Japan is different, right? Wrong! Fiscal policy works (August 15, 2017).

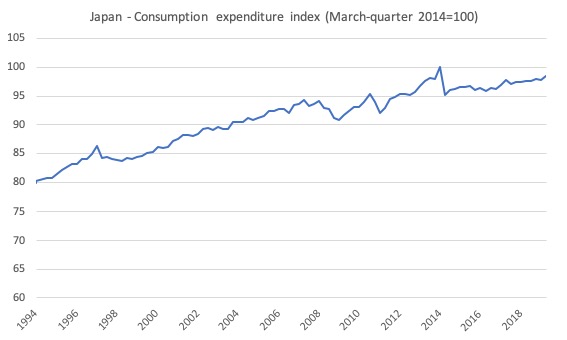

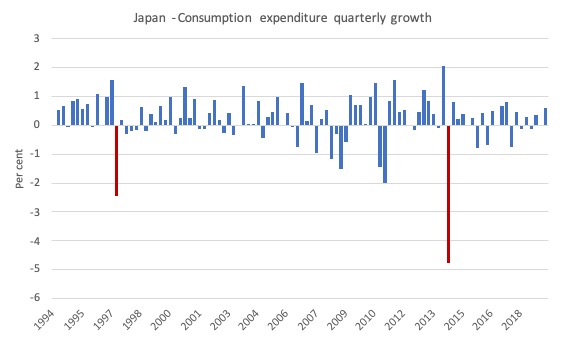

The following graphs show two different perspectives on consumption expenditure in Japan over the period 1994 to the June-quarter 2019. The first indexes the time series at the March-quarter 2014, the quarter before the most recent tax hike was introduced.

The two sharp declines in consumption expenditure followed the tax hikes in 1997 and 2014. There is clear causality here – cut purchasing power and demand for goods and services drops.

The second graph shows the quarterly rate of change in consumption expenditure. The two largest negative spikes (in red) are the quarters after the tax hikes in 1997 and 2014.

If you look at the current period, consumption expenditure has not yet recovered from the last tax hike in April 2014. It is still 1.6 per cent below that previous peak (March-quarter 2014).

The problem is not that the Japanese government has a fiscal crisis on its hands but that overall spending remains weak. A consumption tax rise will exacerbate that problem.

But the pressure for further rate hikes is clear – the conservative forces are continually pushing the Japanese government to cut its fiscal deficit to store up capacity to deal with the future ageing society.

In the annual – OECD Economic Surveys Japan 2019 (released April 2019) – the OECD said that:

Achieving a sufficient primary surplus through the consumption tax alone would require raising the rate to between 20% and 26%, above the 19% OECD average.

Why?

To create a primary fiscal surplus.

Why?

To pay for the welfare demands of the ageing society.

So, once again, a poor economic policy choice is being motivated by an incorrect construction of a problem.

Please read my blog post – Australia – the Fourth Intergenerational Myth Report (March 5, 2015) and the linked blog posts cited therein – for more discussion on this point.

A primary fiscal surplus is an excess of tax revenue over spending net of interest payments. I will return to the question of whether a scale of tax hike of this order is realistic.

But the Japanese government is clearly sensitive to the past sales tax history as it approaches the October 1 deadline.

In the most recent – Highlights of the Draft FY2019 Budget – the Government notes that:

Based on the previous experience with the past consumption tax hike by 3%, mobilize a range of measures and make every effort to ensure that the tax hike will not affect the trend of economic recovery.

So they are cognisant that the last two sales tax hikes caused significant declines in household consumption spending,

The Government provides the following estimates:

1. The consumption tax hike will increase revenue by approximately ¥5.2 trillion. That is, it will reduce current purchasing power in the non-government sector significantly.

2. To offset this negative effect, they propose to implement some compensatory policy changes in the areas of “Free Early Childhood Education” and “Enhancement of Social Security System”.

The social security changes will target “low-income pensioners” and provide “compensation to medical fees” arising from the sales tax rises.

These offsets are estimated to benefit households by around ¥3.2 trillion and will be on-going fiscal changes.

3. So taken together the estimated contraction in spending will be ¥2 trillion, which is around 0.4 per cent of 2018 nominal GDP.

In scale terms, this is significant.

4. They also propose a range of temporary measures which will inject approximately ¥2.3 trillion in the short-run.

So taken together, the Government claims that it will provide ¥5.5 trillion in benefits or offsets to more than compensation for the ¥5.2 trillion in lost purchasing power.

The expectation is that in the short-run, the impact on economic growth will be small. In effect, the proposal just delays the negative impact of the tax rise.

When the temporary measures terminate then the tax hike will bite – as it did in the past.

So the question is whether it is sensible for the Japanese government to entertain the claims that it needs to ‘consolidate’ its fiscal position.

The answer is clearly that it is not sensible.

Japan issues its own currency and does not face a fiscal crisis. There will never be a situation where the Japanese government is unable to meet any financial liabilities issued in its own currency.

What about the OECD claim?

It is here that we see the absurdity of the claims that Japan has to move towards a primary fiscal surplus.

Consider the reality.

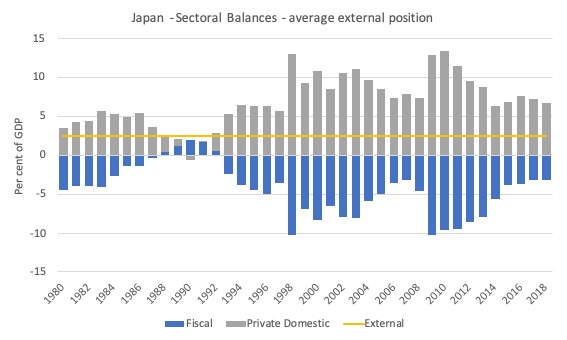

The following two graphs show the sectoral balances for Japan from 1980 to 2018 from two perspectives. The first graph shows the actual balances.

You can see a detailed explanation of the sectoral balances in this blog post – The Weekend Quiz – September 7-8, 2019 – answers and discussion (September 7, 2019).

The second graph shows the balances based on the average external balance (a surplus of 2.51 per cent of GDP) – the yellow line – to give a clearer depiction of the way the private domestic balance (grey) and the fiscal balance (blue) relate to each other.

These graphs don’t tell you about causality but we know that shifts in national income bring the balances into the accounting equality that underpins the relationships between the balances.

The following facts help frame the following conclusions:

1. Japan has run an average external surplus of 2.5 per cent of GDP since 1980.

2. On average, the private domestic sector has had an overall saving rate of 6.9 per cent of GDP since 1980.

3. The debt-servicing ‘burden’ in Japan is very low now.

It is also becoming clear that the debt-servicing ‘burden’ is likely to turn negative in coming years.

This is because as older debt issues mature, the negative yield issues will become more dominant in the overall debt servicing calculation, such that, at some point, the burden will become negative.

Think about that in relation to the Project Fear claims that it has to cut its fiscal deficit and hike its consumption tax.

Think about that in relation to the fact that Japan has the largest gross public debt to GDP ratio among advanced nations.

Which mainstream macroeconomics textbook could explain this?

Answer: None.

Further, what do you expect will happen if the Japanese government followed the advice of the OECD and tried to run a primary fiscal surplus, given that the most recent fiscal deficit was around 3.2 per cent of GDP (in 2018) and is now slightly lower again?

1. The higher consumption tax will damage growth – that is undoubted. At a time where growth is being constrained by inadequate spending, a policy that exacerbated that problem doesn’t make any sense.

2. With a debt servicing heading into negative territory that will represent a further contractionary force (lost interest income).

3. With the non-government sector saving around 6.9 per cent of GDP and an external surplus of around 2.5 per cent the government has to run a fiscal deficit of around 3 per cent to 3.5 per cent for the current GDP level to be sustained.

There is actually a need for an increased fiscal deficit given the stagnating private consumption expenditure.

4. Pushing towards a primary fiscal surplus would be catastrophic given the related historical parameters.

Where anyone would think that would be a reasonable idea?

It demonstrates the way in which mainstream macroeconomics just blindly applies its dogma without regard for institutional reality.

Conclusion

The major problem in Japan is stagnating non-government spending.

There is no government funding problem. It issues its own currency.

And the non-government sector is now facing an overall loss of income coming from the public debt.

The Government should learn that its stop-go stimulus behaviour – where the ‘stop’ is generated by these repeating sales tax hikes – is not conducive to stable growth or the advancement of prosperity in Japan

I will be in Japan at the end of October and will be keen to discuss these issues further with government officials and activists.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Is it true to say that ‘servicing’ the debt is never a problem if interest is paid in yen? Ditto here in UK.

Hi Carol. A currency issuing government is never revenue constrained in the issue of its own currency, done on its central bank’s computer. Paying out interest is putting currency into the economy which is resource constrained (at full employment) so that is the limiter, though as Bill often points out, bond interest is corporate welfare, much of which goes into the pockets/savings of the already wealthy rather than being circulated. With regard to the large percentage of ‘debt’ on the Central Bank’s books, having been bought back at some time in the past, of course interest doesn’t even enter the economy. It would appear to me that this debt is still included in debt figures purely to mislead the public even further.

Hi Prof Mitchell, given that unemployment in Japan is 2.2% and youth unemployment is 3.4% – low, but above historical lows – and there is no sign of inflation (probably never will be!), is your prescription aimed at simply moving the economy to its productive potential so as to optimise economic welfare? Are the Japanese doing “OK” in a low growth environment? Kind regards.

This sentence needs to be edited.

“In April 1987 [1997??], in the face of mounting criticism from conservatives that the rising fiscal deficit, which kept the economy growing after the massive property collapse, the Government pushed the rate up to 5 per cent in 1997.”

Also search for “bit” that ought to be “bite”.

” though as Bill often points out, bond interest is corporate welfare, much of which goes into the pockets/savings of the already wealthy rather than being circulated. ” Patrick B

More precisely it is welfare proportional to account balance and that would apply to individuals, pension funds and any other bond holder, not just corporations.

Otoh, an equal Citizen’s Dividend would be a great help to the non-rich and arguably should replace ALL fiat creation beyond that created by deficit spending for the general welfare as a simple matter of equal protection under the law.

As an alternative to more fiscal spending, they could of course reduce, rather than increase, the consumption tax. (It might actually be more popular with the electorate than more fiscal spending, which is somewhat “behind the scenes”, and takes some time to work its way through. But if prices fall due to reduced consumption tax, then that’s an immediate bonus).

(Of course, the consumption tax reductions are not necessarily always passed on to the end customer. This is always a potential problem, but they are still a benefit to the non-government sector overall).

Not that they are likely to do this, by the sound of it.

ppffft…

If they know that the tax hike will hurt the economy enough to implement a temporary offset, whats stopping the economy from tanking once those temp things wear off.

Can one argue that they know it? Maybe they just want to discipline labor to show who is boss?

Isn’t the implementation a sneaky tricky?

I don’t think its economics as your book laid out. Its politics first and economics is just public relations propaganda.

“Can one argue that they know it?”

I believe that there is enough evidence to support the claim that no, they don’t know it. They are completely ignorant.

Of course, it is even easier to be ignorant if you are not the one suffering from unemployment or other effects from slow growth. But nonetheless, they are ignorant.

I think that claiming that there is some kind of global conspiracy to discipline labor undermines MMT. It also seems the wrong framing of the issue (ignorance is one thing, malevolence is another). But that is just my opinion.

Andre,

I don’t think that claim undermines MMT. Instead, it shows us clearly what we are up against. In Reclaiming the state, its laid out pretty clearly that capital in 1970 gained much upper hand against labor.

Do you think a lot of top people from elite institutions never really tasted unemployment themselves?

One of the reasons why I chose to study MMT was because of my experience being out of work with no idea what I was into after college.

Tom,

Most people, including many left-wing politicians who claim to be progressive, do still believe that the government works like a household and that money is like gold. Bill himself criticizes those people a lot (for example, in his two-part post “Is the British Labour Party aboard the fiscal dominance train?”). But this is also applicable to most people in the world, including the common people: when voting, many do believe that the government works like a household and cannot overspend or something like that.

I don’t think that they do now better and are just pretending that they don’t, in a covert plan against labor. I believe this sort of stuff is just more evidence that they are ignorant.

If you tell people “hey, you are in a plot against capital”, they will probably just think you are crazy, and if a lot of MMTers do claim that, they would inevitably think “MMT is for crazies”, and that is why I believe it undermines MMT. Just saying my opinion here, I may be wrong

Yes, I can see that it can make us look like cranks if we say that.

André,

You wrote, ‘ “hey, you are in a plot against capital”…’ .

This is unclear, maybe?

It would be better as “Hey, I’m in a plot against capital.” OR

“Hey, you seem to be part of a plot against labor.”

Steve_American,

I don’t know if I could understand what you said (asked?)… I was just saying that I think that telling people “Hey, you seem to be part of a plot against labor” is a non-starter and may undermine MMT, in my opinion.

@Andre:

“Hey, you seem to be part of a plot against labor”

The confusion arose because in the original post you [mistakenly?] wrote, “hey, you are in a plot against capital”.

I was also momentarily thrown by that first comment, but I agree with the thrust of your argument, that it’s a better look to accuse our opponents of ignorance rather than malice (although I think Denis Healey in 1976 and George Osborne from 2010 to 2016 knew exactly what they were doing, and did it anyway… with relish).

I have thought for some time that the financial and political elite (sorry for the conspiracy theory language, but it’s useful shorthand) know perfectly well the facts that Bill and the other pillars of MMT teach, even though they would use different language to describe it – as we know, framing is all-important. Healey was definitely of a high intellect. I don’t know much about Osborne (other than always finding him a very shallow politician, compared to giants like Healey), but I think he knew enough to have known exactly what he was doing, i.e. austerity was a political choice, in line with the modern conservative agenda of shrinking the state (at least as far as public utility goes – defence, intelligence & policing might be a different matter). And by modern, I mean post-Thatcher/Reagan era, i.e. when the post-war consensus broke down.

As for the Lib Dems who took part in the UK 2010-2015 coalition, I assume that people like David Laws (former investment banker) and Danny Alexander (who wasn’t originally a banker, but is one now, apparently) also pretty much knew what they were doing. David Laws (co-author of the “Orange Book” and one of the main negotiators in the Coalition agreement), is described in Wikipedia by one of his former colleagues as ” “an unreconstructed 19th-century Liberal. He believes in free trade and small government…”. With views like those, he was perfectly comfortable with the Tory austerity policy and the “urgent need to get the deficit down” after all that “rash spending by the previous profligate Labour government” (not quoting anyone there, just putting it in quotes to make it clear that those are not my own views!). For these and similar reasons, I’ve never trusted the Lib Dems, and their recent attitude and actions regarding Brexit have only confirmed me in that view.

“Shrink the state” is just a slogan they chant.

They want the state to get bigger on their terms (military, force people to buy private insurance, raise and shift taxes onto labor, force the state to perform huge bailouts).

I have been thinking:

People often justify shrinking the state because the state is inefficient.

Well, for me, my landlord, fed taxes, insurance paid for healthcare and vehicle, and family’s unemployment are much bigger inefficiencies than the state.

Economy will be much more efficient with the correct state intervention.

Ops, sorry, yes, I made a mistake and wrote “plot against capital” instead of “plot against labor”

Mike Ellwood and Tom,

I believe that the discussion about the size of government is different from the discussion about how government finance works. No matter if you call for a big or small government, you should be aware that government debts and deficits are not like a household deficit or debt.

The fact, it seems, is that no one but the few MMT economists/community (and maybe some few others) seem to understand how government finance works. People in all the political spectrum, including so called left-wing progressives (and the right-wing and the center too, etc) are legitimately ignorant. It seems to me that people are not actually plotting against labor. They are ignorant, but not ill-intentioned.

I cannot discuss specifics about UK politics, but I know that all around the world there are those progressives (or whatever name they call themselves, that varies a lot around the world) that, on one hand, indeed actively support worker rights, social security, economic equality, low unemployment, government investment and the green agenda, but on the other hand believe that the budget should be balanced and rich people should be taxed to fund government spending etc.

I don’t think they actually know the truth and are just pretending they don’t to curb labor in favor of capital. I believe they do legitimately think a balanced budget is a good thing.

When we say that the elites are plotting against capital, we invite critics to write things like this: https://economia.estadao.com.br/noticias/geral,o-econocoach,70003031766

This is an article in the biggest newspaper in the country (Brazil), against MMT: “The econocoach: in the econocoach’s view, the elites prefer the fiscal consolidation because they are evil”. The article is really awful, with no substance at all, but I don’t blame him for claiming that left-wingers or the MMT community are conspiracy theorists. Sometimes we do look like exactly that.

Okay, i will keep that in mind.

Interesting, that remark about Denis Healey.

He was unquestionably highly intelligent. So was Margaret Thatcher. But being so doesn’t make a person any more *perceptive* – which has much more to do with empathy, native wisdom, insight, humility, etc than with intelligence as such – than many of their “perfectly ordinary” less well-educated and/or privileged fellow human beings. Some highly-intelligent individuals become besotted with crazy. and dangerous, ideas precisely because they combine that intelligence with an almost complete lack of real perceptiveness. And maybe with other crucial character-flaws too but which of us is without those?

Thatcher without the shadow of a doubt *believed* in every fibre of her being that running a country’s economy was no different from running a household’s, or a business’s. Just like her father’s grocery-shop. For that very reason she chose as her guru an economist (Alan Walters) who fully subscribed to neoliberal ideology, who fortified her beliefs.

Did Denis Healey believe that too (absent the grocery-shop analogy)? If so, he can’t be accused of “lying to the British public” (which Bill repeatedly charges him with).

FWIW I think that accusation is unwarranted: to me it seems that Healey had become genuinely convinced of the validity of monetarist doctrine. I think he actually *believed* that the country had “run out of money”, and had no other choice than to go cap-in-hand to the IMF for a loan to tide it over – while strict monetarist measures, in line both with IMF prescriptions (though he succeeded in significantly watering them down) and his own genuine convictions, were brought in. And he was by no means isolated in those beliefs (indeed it was those who opposed them who were isolated).

After all, the intelligence of most of those among the most vehement critics and deniers of MMT today can scarcely be questioned. It’s their perceptiveness which is lacking; their stubborn refusal to accept or even give a hearing to a set of ideas diametrically opposed to those to which they’ve adhered all their adult lives.

Is that because they’re malign, or just unperceptive (wrongheaded, if you prefer)? Was Healey? I doubt it. And I do sometime wonder whether when opponents bad-mouth MMT it’s entirely wise to respond in kind – to swap insult for insult.

Those two final graphs confuse me a bit. In the second the private domestic balance looks about 7% but in the first looks more like 10%. In the second graph the government deficit is the sum of the private surplus minus the export surplus. But in the first I can’t see how the equation works. It looks like the government deficit is about 3 but the private domestic balance is 10 and the export surplus is about 3.