With an national election approaching in Japan (February 8, 2026), there has been a lot…

Japan has lower inflation, no currency crisis and its citizens are better off as a result of the monetary-fiscal policy initiatives

The – Washington Consensus – has been out in full force this week with the US Federal Reserve and the RBA increasing interest rates further despite all the indications that inflation peaked months ago and its downward trajectory has had little if anything to do with the ridiculous interest rate rises since early 2022. Both banks, along with most other central banks, are just thumbing through the New Keynesian textbook to get their direction and pretending to be capable of assessing the situation correctly. Neither the textbooks nor the assessments are remotely accurate and unnecessary pain is just being inflicted on low income mortgage holders. But the public barely know that there is a grand global experiment being conducted by central banks which allow us to reflect on the veracity of competing economic theories and approaches. Most central banks are hiking rates at present as a reflection of the dominance of the New Keynesian prioritisation of monetary policy as a counter-stabilising, anti-inflationary policy tool over fiscal policy. One central bank is not following suit – the Bank of Japan. The BOJ has not shifted rates, is maintaining its yield curve control policy and the government is expanding fiscal policy. The diametric opposite to the New Keynesian approach. We now have enough data to assess the relative merits of the two approaches. Japan has lower inflation, no currency crisis and its citizens are better off as a result of the monetary-fiscal policy initiatives.

The Western Consensus

In Australia, interest rates have gone beyond the level that the RBA itself considers can be absorbed by many mortgage holders.

In Chapter 3 of the RBA’s – Financial Stability Review – April 2023 – which focuses on household and business finances, the RBA indicated that around 15 per cent of Australian households will not have sufficient cash reserves or income to remain solvent after the interest rates rose again yesterday.

The RBA noted that:

This risk is highest for those who also have low incomes. This is because low-income households typically have less ability to draw on wealth or cut back on discretionary consumption to free up cash flow for debt servicing.

Further:

Estimates suggest around 16 per cent of existing loans are unable to meet serviceability assessments conducted at current interest rates … If mortgage rates were to increase by a further 1 percentage point, the share of loans unable to refinance with another lender is estimated to increase to around 20 per cent.

So first the RBA set about destroying what saving buffers people had built up, claiming that would allow them to keep spending as their liquidity was being undermined by the interest-rate rises.

Then the RBA admitted it was deliberately seeking to increase unemployment by around 180 thousand workers who will be forced onto unemployment benefits which are way below the poverty line and the federal government refuses to increase the payments.

And finally, the RBA is fully aware that around 20 per cent of mortgage holders will be driven broke by its interest rate rises if not more.

How did we reach a situation where an unelected body that is largely unaccountable to the public can render such damage?

Further, as I also noted yesterday – RBA loses the plot – Treasurer should use powers under the Act to suspend the RBA Board’s decision making discretion (May 3, 2023) – that the RBA decisions are actually pushing inflation up not down via the impacts on business costs and rental prices.

So we have the absurdity that inflation is falling because the factors that created the pressure (the supply-side factors) are in retreat and the RBA is actually prolonging the inflationary period despite claiming its interest rate increases are intended to bring inflation down more quickly.

The joke is on us people!

And, amidst all the outcry, this morning, the National Australia Bank announced that they have recorded a 17 per cent increase in their half-year profits to a “record $A4.1 billion” as a result of the higher interest rates.

I noted last year several times that the private banks were going to generate massive profits as a result of the RBA’s interest rate mania while their customers were increasingly being screwed.

The crazy part is their share price fell because the greed cohort thought that the profits would be even higher than they were reported.

In the US, the Federal Reserve Bank added more mortgage pain yesterday (May 3, 2023) by raising the policy rate a further 0.25 percentage points, which makes it the higher level for 16 years.

Their interest rate increases have redistribute income from poor to rich and created the beginnings of a series of private bank failures.

So much for their charter that requires them to maintain financial stability.

Meanwhile, the land of the rising sun

The mainstream economics media has hardly commented on the global experiment that is now clearly underway.

The RBA and the Federal Reserve are just part of the gaggle of central banks pushing up interest rates at present, pretending they are ‘winning’ the war against inflation, when the latter has already peaked and is falling for reasons quite apart from what the central banks are doing.

Gaggle by the way can mean a ‘flock of geese’ or ‘a disorderly group of people’.

Either meaning might apply, given that the term ‘goose’ is an informal insult in English!

However, there is one central bank that is not playing along with this agenda – the Bank of Japan – and, in that sense, provides a direct comparison to the New Keynesian consensus approach.

I have commented on this experiment before:

1. Former Bank of Japan governor challenges the current monetary policy consensus (March 22, 2023).

2. Bank of Japan continues to show who has the power (January 26, 2023).

3. Bank of Japan has not shifted direction on monetary policy (December 22, 2022).

4. The monetary institutions are the same – but culture dictates the choices we make (December 8, 2022).

5. Two diametrically-opposed approaches to dealing with inflation – stupidity versus the Japanese way (October 6, 2022).

6. Why has Japan avoided the rising inflation – a more solidaristic approach helps (July 4, 2022).

7. We have an experiment under way as the Bank of Japan holds its cool (March 31, 2022).

Japan has experienced all the global supply shocks that other nations have endured that imparted the inflationary pressures.

Japan imports almost everything!

Yet, the Bank of Japan has not increased its policy interest rate and has held the line on the yield targetting for the 10-year Japanese Government Bond.

The Japanese government also relaxed fiscal policy further to deal with the cost-of-living crisis – provided fiscal transfers to households and subsidies to business as part of a deal to compress profit margins.

Meanwhile the corporations elsewhere are gouging profits to their hearts’ content because our governments refuse to pressure the corporate sector into the same sort of behaviour that the Japanese government has succeeded to extract from its price setters.

As a result of its policy stance, the Japanese currency has been attacked relentlessly by the ‘short-sellers’ in the financial markets who think they can bluff the Bank into changing policy and delivering massive profits to the speculators.

The Bank has refused to be bluffed and, has instead, inflicted large losses on the short-sellers.

I discuss that issue in the 2. blog post cited above.

The progressives in the UK might have taken note of the way the Bank of Japan stares down the financial markets – there has been no yen currency crisis and the government has not had to ask the IMF for money.

Instead the likes of Starmer and his gang (who have conducted a major purge of the Left in the British Labour Party) are now backtracking on policy promises – such as to nationalise the dysfunctional privatised utilities and rail, among other promise reneges, because they have to be fiscally responsible – which is code for appeasing the financial markets.

Why? Because they have a pathological fear of the City, which goes back to the 1970s when Callaghan and Healey used the ‘run out money, currency crisis, IMF bailout’ ruse to purge Tony Benn and his socialist mates within the Party.

The Left has never recovered really.

They should look to the East and see how Japan deals with the financial market speculators.

Anyway, how is Japan going in the inflation ‘fight’ given that it hasn’t shifted its monetary policy stance?

Well, the answer is they are demonstrating that the interest rate hikes that other central banks have inflicted on their citizens were not necessary in bringing the supply-side inflation down.

Here is an update.

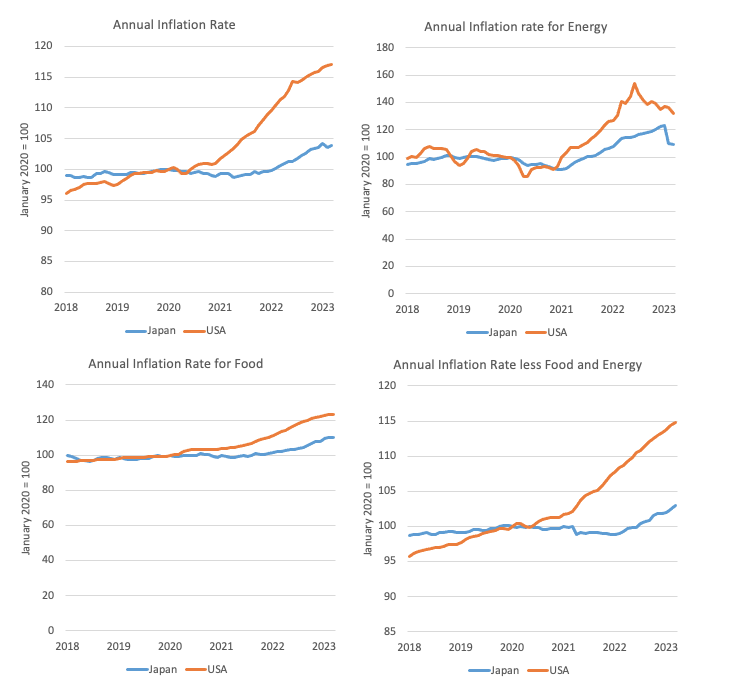

The current annual inflation rate in Japan (All Items) (March 2023) is 3.3 per cent down from the peak of 4.4 per cent in January 2023.

For the US, the peak was 8.3 per cent in August 2022 and the current rate is 4.98 per cent.

The following four-panel graph captures the key aggregates from January 2018 to March 2023.

The indexes are set to 100 in January 2020.

The question that should be asked is why has Japan been able to resist the high inflation while also refusing to hike rates and contract fiscal policy?

We know the answer.

Further, the ‘currency-crisis’ lot always claim that if the financial markets are upset by a national government policy then they will destroy the currency.

Well, the evidence is not supportive of that paranoia, as long as the government and the central bank understand their own capacity to resist the speculators.

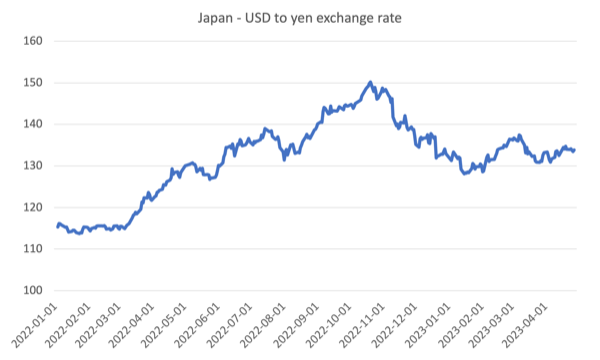

Initially, as the interest rate differential between the US and Japan emerged after the US Federal Reserve started hiking rates, the yen depreciated somewhat.

‘Currency-crisis here we come’ said the ignorant.

The following graph shows the USD-yen exchange rate from the start of 2022.

A modest depreciation followed by several months of appreciation and a stabilisation at slightly lower rate relative to before all the hiking began.

Conclusion: no currency crisis.

Conclusion

The question I have is why are the mainstream financial media not reporting all this?

We all hear about the US Federal Reserve pushing up rates and the boss is widely quoted in the Australian media.

The RBA governor gets blanket coverage for his asinine commentary trying to justify the interest rate rises.

But I guarantee that the Australian public will have no idea that the Bank of Japan has defied this western consensus and it is actually doing much better than the hikers!

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

Doesn’t Japan have a current account surplus?

Could this be an advantage to Japan compared to a deficit country like New Zealand?

Comment?

@William.

If Current Account is in surplus, then the capital and financial account is in deficit.

Therefore, If NZ has a Current Account Deficit, they must have a Capital and financial account surplus.

It doesn’t impact the ability of the NZ government to buy goods and services denominated in NZ dollars.

The same as the massive Capital and financial account deficit in Japan doesn’t negatively impact their government’s ability to buy goods and services denominated in the Yen.

The Professor’s companion pieces of yesterday and today neatly encapsulate where we are at vis-a-vis the choices made by central banks to continue with interest rate rises.

The US Fed being the conductor and the vassal states, in accordance with the neoliberal project/Washington Consensus, following its lead. The April meeting of treasurers, treasury secretaries and central bankers at the G20 meeting plus concomitant meetings of global central bank governors (oh, to be a fly on the wall) in the US was plainly for the New Keynesian orchestra to receive its instructions to maintain some steel in the spine against the proles.

As Bill exclaims, what about Japan? Is anyone paying attention? It seems so, at last, but slowly. Recently, more of those interested in economics are being alerted to the goings on outside of the anglosphere, which has unreasonably dominated the propagandised output via western MSM for far too long.

From https://billmitchell.org/blog/?p=60809: “I have been exploring new data which shows that rising interest rates create a vicious circle of higher inflation which then precipitate further higher interest rates.” . Seems to have come from looking at the thesis that raising interest rates leads/trails rising inflation.

The fact that inflation is primarily continuing via price gouging is demonstrating the constancy of demand for the unavoidable essentials (utilities) that support today’s way of life coupled with the unfettered greed of suppliers of those essentials – so easily summed up by the word “greedflation”. The inelasticity of such demands captures consumers and locks them in to bearing the added costs (wealth redistribution) because TINA. Price rises >inflation (real or fearmongering) >interest rate hikes >price rises: rinse, repeat. Noone has ever heard of the benefits of price controls being invoked, of course.

Japan shows us what works and how we should be going, but those who are in charge of the monetary and fiscal levers are not interested while ever they are in thrall to the US empire and its controllers of capital markets. Stumbling across a mention of research from The International Institute for Strategic Leadership which long-predicted that Coordinated Market Economies like Japan would be ‘canaries in the coal mine’ for surviving in the slowing economic growth environment of the 21st century – metaphorical ‘camels’ in the metaphorical economic ‘desert’”. Maybe, perhaps the penny is finally dropping.

What the RBA are doing with interest rates is working perfectly.

They just happen to have a completely different set of objectives than the average household does.

Like the government the RBA works for the elites not the other 99.9% of the population.

I wonder how many comercial banks need to fail in the US, before the FDIC fails.

In fact, the Federal Deposit Insurance Corporation is just another bank.

The Fed (the only private central bank in the whole world) keeps shifting wealth from the 99% to the 1% – its shareholders!

Banks keep failing and the FDIC bears the brunt.

The rest of the herd follows suit – but not Japan.

So there is an alternative, after all.

Japan in not TINA!

Thatcher is just a rotten patch beneath a tombstone.

Maybe we should bring a new “May 1968” and send the TINAs to where they belong – oblivion!

I want to ask a question (to anyone) about Bill’s comment: “Their interest rate increases have redistribute[d] income from poor to rich…”

When we had ZIRP and QE, there was said to be a massive increase in inequality via inflating asset prices, which undeniably was disproportionately beneficial to the rich. And now that policy rates have normalised, Bill’s comment identifies a further redistribution in favour of the wealthy. Presumably through additional interest income on more substantial cash holdings.

If the above statements hold true, then any change in monetary policy increases inequality. Logic tells me that this cannot be the case. Even within today’s brand of crony-capitalism, there must be some way to implement monetary policy settings that reduces inequality. To be clear, I am not trying to misrepresent Bill’s view.

I would suggest that further increases in official interest rates would hurt almost everyone, but especially those in the upper echelons. This is because a collapse in asset prices would assuredly outweigh the gains in interest income. There is no chance everyone is quick enough to go to cash (or gold or short term bonds, etc.). Virtually everyone would be worse off, but perversely, the gaping chasm between the rich and the poor would narrow.

I am not arguing for higher rates (far from it). I’m simply making a point about changing wealth distribution. Perhaps this is another illustration of second best solutions in a second best world.

@ESP. The elites are dictating the terms. It’s a rigged game.

Peak intetest rate equals price floor of bonds.

Time to buy.

Interest rate floor equals maximum bond price.

Time to sell.

The government / RBA will always accomodate them.

Once they sell they buy real assets like property and essental services/ infrastructure – and the cycle continues until they bleed us all dry.

Thanks Alan that was a very concise description.

However it might go over the head of someone who believes that ‘there must be some way to implement monetary policy settings that reduces inequality’.

And the belief that the financial capitalist elites care whether or not some millionaire can sell his securities before he is fleeced, is endearing.

ESP – Monetarism and financial deregulation (monetary policy) is a blunt tool designed to limit social spending, keep unemployment above 10%, reduce wages and feed all the surplus profits up to the controllers.

There is no way to change these ‘settings’. TINA the casino owners run the show. Maybe you are confusing monetary policy with a socially responsible regulated fiscal policy not seen for over 40 years due to political corruption.

Here is how money works for the wealthy, when the asset value rises, I make money, when the asset value falls, I make more money. Why, becuz I have the capital necessary to wait out the impatient. The table is rigged so that no matter how it tilts, the ones with capital are advantaged. Its the poor without capital, or little capital, or not enuff capital who eventially will have to succumb to the tables tilting. It also helps that the more capital, the more influence one has over the table tilting mechanism. We see this thrill in the current US banking system. Yesterday, treasuries were secure, not so today and who swoops in to clean up the mess at sub bargain prices, why the wealthy of course. This blog post and Professor B. Mitchell are encouraging.

@Ucumist I just reread what I posted in case it was replaced with is a ‘parallel universe’ version. Your response speaks volumes about your own biases and the ones you wish to impute on others.

@Alan, thanks for your response. That makes sense.

“there was said to be a massive increase in inequality via inflating asset prices”

Was that due to inflating asset prices, or excessive restrictions on the production of new assets?

Particularly housing.

During Covid, the car market started to behave like the housing market. We didn’t say put interest rates up to stop it. We said we need to get back to producing cars.

If there are high asset prices, we need to produce more of those assets – which may mean the state intervening to produce those assets if the market gets stuck in a bad equilibrium.

Neil,

That’s not where we are in housing, in general. Everywhere I hear about, there’s plenty of vacant houses, or at least properties to be rebuilt, but they are owned by big groups (especially finance) moderating available supply to control prices. Georgists have a bit of a point, not all locations are the same either, although even suburbs (and further on) prices are rising prohibitively as well.

I don’t think overbuilding and wasting more resources is a silver bullet even where it can help… even if states would accept lower property prices, which they don’t want because it has been the carrot for the middle/upper-middle class vote – the economy is great, your “investment” is making you wealthier!

“That’s not where we are in housing, in general. ”

It is. That is what the price is telling us. So build the houses until they start to depreciate in price – at which point the ‘investments’ will flood onto the market.

Just as happened with cars.

Once the environmental slums drop sufficiently in price it will then become worth refurbishing them, and the rest can be cleared to make way for newer buildings with more modern designs.

The Geologists have very little – once you take control of producing housing and producing jobs *near* housing.

The problem with housing is we have two people living in houses that could accommodate ten or more people, and houses with ten or more people that can barely accommodate two people comfortably.

There is an area of Bristol (UK) already cleared for new buildings. The city council has recently approved building 196 homes, including 40 ‘affordable’ homes, on land vacated by the zoo’s move. How lucky Bristolians are to get 20%, 40 homes which may just about be affordable for an average working person. Elsewhere slum areas are likely to remain as such because they are a cash cow in rent for owners who themselves live in mansions that stand on land that could house thousands. Meanwhile houses are compulsorily purchased to make way for HS2 to bring people down from Birmingham to London through the Shires through acres of concreted over underused land.

Yes I always try to hold up Japan as proof there is an alternative

One quick question .I know historically japans inequality statistics are relatively low.

What has been happening to those measurements this century.

Dear Kevin Harding (at 2023/04/11 at 7:30 am)

Inequality in Japan is rising but hardly at all and hardly relative to the increases elsewhere.

best wishes

bill