In the annals of ruses used to provoke fear in the voting public about government…

Zero trading in 10-year Japanese government bonds signals Bank of Japan supremacy

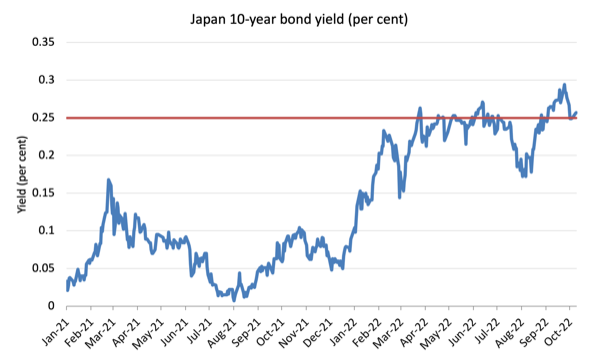

On July 21, 2022, the Bank of Japan issued this – Statement on Monetary Policy – which outlined that it would continue to use its capacities to implement ‘Yield curve control’, whereby the “Bank will apply a negative interest rate of minus 0.1 percent to the Policy-Rate Balances in current accounts held by financial institutions at the Bank” and “will purchase a necessary amount of Japanese government bonds (JGBs) without setting an upper limit so that 10-year JGB yields will remain at around zero percent”. Further, the Statement noted that “the Bank will offer to purchase 10-year JGBs at 0.25 percent every business day through fixed-rate purchase operations, unless it is highly likely that no bids will be submitted”. The only dissenter on an 8 to 1 vote, wanted even more easing of monetary policy! The BOJ has been implementing its yield curve control since March 2021. In the light of global trends in central banking, the Bank of Japan’s decisions are a standout and show how a sophisticated understanding of the monetary economy coupled with a desire by the Government to improve the lives of ordinary citizens expose the fictions of mainstream economics, which dominates policy making elsewhere.

Recently, various hedge funds thought they were smarter than the Bank and started to place bets in the 10-year Japanese government bond that were based on their belief that they could force the Bank of Japan to relent and abandon its yield curve control policy.

The hedge funds started short selling the bonds, meaning they were entering contracts to sell the bonds down the track in the hope they would buy them at the contracted time of deliver at a lower price in the spot market and make profits.

Their behaviour was predicated on their view that they could drive yields beyond the Bank’ target of 0.25 per cent on the 10-year JGB and restore their yield determining power in the bond market, which the Bank, through its policy had denied them.

The implication is that as the so-called ‘yield gap’ between Japanese financial assets and US assets increased, because the US Federal Reserve was tightening while the Bank of Japan was maintaining its low interest rate approach, the yen would plummet in value and the Bank of Japan would have to give up.

If you read the briefing notes issued by various investment banks in August and September, you will find that hubris was not in short supply.

Claims such as that the Bank would “move quickly to shift” were prominent.

Suffice to say the Bank of Japan held its ground.

History repeats.

Many players in the financial markets – particularly younger traders who are full of their own self-importance and have probably been indoctrinated by mainstream macroeconomics programs in one way or another – have been betting against the JGB market and the Bank of Japan for years – to their detriment.

The short-sell strategy on Japanese government bonds was called the ‘widow maker’ trade for good reason, give the money that has been lost in trying to force the Bank of Japan’s hand.

Chasing higher yields via these ‘widowmaker’ trades has led to massive losses because the investment banks etc are engaged in a battle against the Bank of Japan, which is a battle they can never win.

A Modern Monetary Theory (MMT) understanding shows that the sovereign government (central bank and treasury) typically calls the shots over the financial markets.

It sets the rules, has the currency capacity to set yields and volume, and can stop issuing debt altogether if it chooses.

The financial markets are supplicants.

As the hedge funds pushed their strategy, the Bank of Japan’s response was to increase its bond purchases to record levels.

The result – the short selling had pushed yields over the 0.25 per cent target and the Bank then showed how they could easily bring it back under the threshold.

They can do that whenever they choose.

The following graph shows the history of the 10-year JGB yield since the beginning of 2021, noting that yield curve control began formally in March 2021. The red line is just the yield control target of 0.25 per cent.

This week we observed something extraordinary in Japan – news of which the mainstream press has mostly left alone because it is too damaging to the Western view of central banking.

If you follow the Japanese bond market, you will realise that yesterday (October 12, 2022) resulted in the fourth successive trading session in the bond markets, there were no 10-year JGBs traded between investors.

There have been zero trading days before but this is the longest succession of sessions since data was available.

The reason?

The Bank of Japan, is showing the investors who is in charge.

They are offering prices for the bonds above the price that the hedge funds and other investors are willing to pay.

As a consequence no trading occurs between the private investors.

The Bank of Japan’s stated aim that it will buy as much debt as is necessary to maintain yield curve control means that it can maintain prices above what the investors will pay and thus keep yields at the desired target level.

The private bond speculators think that the underlying yield on the 10-year JGBs is much higher than 0.25 per cent, which means they think the current price is also inflated.

And while the Bank of Japan is paying prices in the secondary markets to maintain the yield control target, there is no speculator willing to buy the bonds.

And the most recent – Statement on Monetary Policy – September 2022 (published September 22, 2022) – noted that:

The Bank will continue with Quantitative and Qualitative Monetary Easing (QQE) with Yield Curve Control, aiming to achieve the price stability target of 2 percent, as long as it is necessary for maintaining that target in a stable manner. It will continue expanding the monetary base until the year-on-year rate of increase in the observed CPI (all items less fresh food) exceeds 2 percent and stays above the target in a stable manner.

And if the economic situation deteriorates due to the “impact of COVID-19” and global trends, the Bank “will not hesitate to take additional easing measures if necessary”.

It said it:

… also expects short- and long-term policy interest rates to remain at their present or lower levels.

Bank Governor, Haruhiko Kuroda, reiterated that message during an address in Washington D.C. yesterday (October 12, 2022).

He also told an audience that the BOJ would continue to intervene in the currency markets to attenuate so-called ‘one-sided’ yen depreciation even though he said:

Yen depreciation may have a good impact on the macro-economy as a whole, but there are some sectors which are suffering. If the currency’s movement is so fast and (one-sided in) direction, probably caused by speculation, that would be bad for the economy because that would make corporate planning more difficult.

He also reaffirmed the Bank’s policy stance on wages and inflation:

Wages are certainly rising now but insufficient to guarantee 2% inflation in a sustainable and stable manner … ou cannot simply jump to the conclusion that we will be able to achieve 2% inflation in two years, or one year’s time, so that we can change monetary policy now. That is not correct.

Conclusion

So the lack of trading in the 10-year JGB is a sign that the gamblers in the investment banks have given up their power play against the Bank of Japan.

They have finally got the message – for the time being – that the Bank will continue to run the show and trying to bet against that is just a loss-making activity.

Now the private bond traders are bleating about how ‘price discovery’ is being compromised by the Bank.

What does that mean?

It means that the private market isn’t really sure what the bonds would trade at in the absence of the central bank.

They need not worry.

The Bank of Japan isn’t about to hand control over to the gamblers any time soon – if ever.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Indeed, Japan is a world apart.

A proof that you can have a right-wing government that works for the whole Japanese people.

In the west, right-wing (and the so-called “credible” progressive) governments turned into fiefdoms of the elites, and work only in their behalf.

What brings the question if the neoliberal dogmas are, in fact, right-wing ideology, or we should call it something else, like “theft ideology”…

“He also told an audience that the BOJ would continue to intervene in the currency markets to attenuate so-called ‘one-sided’ yen depreciation”

That’s a problem because they can definitely run out of capacity to do that.

@Neil, in absolute terms, Japan is by far the world’s biggest creditor. They have no shortage of foreign currency income, certainly enough to break some rogue currency speculators. In any case, the absolute level of a currency doesn’t matter. It is only rapid/erratic/unpredictable changes that make life difficult for import/export businesses, and capital controls can sort that.

Japan is to be applauded! Yes the central banks call the shots unless the CB is in bed with and being shaken down by the hedge fund elites

Japan still exports value added goods so a bit of currency deval is not the end of the world. For Australia on the other hand devaluation would mostly benefit miners and farmers exporting raw materials while driving up costs for most people as we are so imort reliant.

Interesting that the Yen has held its value against the USD for a long time now. Convetional wisdom had it that ‘traders’ would have crashed the currency by now as payback for being cut out of controlling Japanese deficit financing.

More detail on why their currency is holding up would be useful, as the threat of having the markets crash your exchange rate is held up as a peril of adopting MMT.

Thanks for all your writing. Big help in interpreting what’s going on in the Australian and global economies.

@ Bradley Schott,

“In any case, the absolute level of a currency doesn’t matter. ”

The bigger the economy, and the lower the level of international trade in percentage of GDP terms, the more likely this is to be true.

On the other hand, the smaller the economy………

This may work for Japan and the BoJ, but it doesn’t work in the U.S. with the Fed, which has proven itself under Jerome Powell to be a follower of the markets (i.e. hedge funds, market commentators, etc.) There is no “widow maker” trade in the U.S. bond market because the hedge funds do force the Fed to make moves aligned with their trades.

Michael….How does that work that ‘hedge funds force the Fed’?

Don’t know how this works so am curious.

@Andrew, what I think Michael mean is that, in the US Jerome lets the market have a big say in the bond markets by moving interest rates up (and down) to their expectations, whereas in Japan, like bill wrote and Mike hinted, BOJ is the one who is calling the shot on bond yields. This is why we see their yield is steady at around 0.1 percent (BOJ might intervene in the foreign exchange markets at times, but not really to prop it up or down, but to ease volatility).

Here, in a way, one can see the ideology of the US and UK monetary policy are similar, the market have large influence, whereas in Japan, it is different, that is why it is called the ‘widow trades’.

Who is right or wrong? It depends on your end goals and how you manage it. In any case, MMT helps us to see how it plays out, as well as how to manage it clearly.

Example, as we have seen in the UK pension margin calls, as bond yields keep rising according the bond markets, mainly via the LDI and their derivative bets, resulting in DV turning very sour, prompting gilts selling to cover the margin calls, which has become, as they say the ‘doom loop’.

In sum, ‘who will pay for it’ is the ideology in the US and UK (in this case), against the MMT and BOJ who say – we will pay for it!

Thanks vorapot.

Tho u say Powell ‘lets’ the market have a say in moving rates to their expectations. Whereas M Norman says hedge funds ‘force’ the Fed to make moves in line w their expectations.

Is this a distinction that should matter?

@Andrew, in my opinion, this shouldn’t matter because I think it is just a choice of word or rhetorical. Also, in reality, and at times, macroeconomic misalignment occurs in which they can become a big part of the markets quickly. A case in point is the pension funds fiasco sponsored by Liz Truss et al (but not the widow trade). The business model is the same – to speculate on the bond price movements but with different results.

In short, when these funds see that if there is a misalignment between fiscal policy, fiscal balance and interest rates, as in the UK, they know a window of opportunity is formed.

But again, this hypothesis must also be contextualized. The tragedy is that these hedge fund managers never learned all these while, when the secret is only just to go ask ‘who will be for it’ when they is a big stimulus package being offered on the table from the policy makers. It can be a sure win.

That is why MMT posits that there shouldn’t be independence between the treasury and the CBs. Otherwise, you see what you see in the land of fish and chips and not seen in the land of the sun rise.