With an national election approaching in Japan (February 8, 2026), there has been a lot…

Why has Japan avoided the rising inflation – a more solidaristic approach helps

A few years ago, various policy makers, but mostly central bankers were keen to disabuse anyone of the notion that they were ‘doing’ Modern Monetary Theory (MMT). Some were aggressive in denial, such as US Federal Reserve boss Jerome Powell, who on February 26, 2019 announced to the US Senate Banking Committee that MMT was ‘just wrong’. There was a general pile on from other central bankers and commentators. No way, they were doing MMT. Okay, they were right, one doesn’t ‘do’ MMT, given it is an analytical framework (see below). But, curiously, now, the commentators are falling over themselves claiming that MMT is dead in the water given that it has been tried over the course of the pandemic to date and failed because inflation is out of control. Hilarious really. But what is interesting is Japan (as always). And I wonder whether any of these MMT critics now have considered why the Bank of Japan has not followed the lead of the other central banks that are rushing to exacerbate the temporary inflation spike by deliberately creating unemployment. It seems that there are different paths that policy makers can take within a capitalist monetary economy. They can allow corporations to profit gouge at the expense of the workers and then turn on the workers (creating unemployment) or they oversee a system where all parties (workers and corporations) take real income hits as a result of imported price pressures and wait it out. Japan is in the second category to its credit.

On whether one does MMT, I wrote about this misperception in this blog post – The erroneous ‘lets have a little, some or no MMT’ narrative (February 20, 2019).

As regular readers will know, I consider Japan to be the most interesting economy of all to study.

I will be working there for an extended period from the end of September 2022 on a Japanese government fellowship hosted by the University of Kyoto.

I hope to be able to publish the products of that period of working with my Japanese colleagues in the coming months.

There are a lot of interesting issues to explore, not the least being the curious case of low inflation in Japan.

Today, I am offering a starting point to understand this phenomemon.

Why is inflation so low in Japan?

Inflation rates have risen in almost all nations since the supply disruptions arising from the on-going pandemic started to come up against spending growth maintained, in part, by government fiscal policy support.

Those supply pressures were then exacerbated by the price gouging behaviour of the OPEC oil cartel which has pushed energy prices up to ridiculous levels.

Then Mr Putin decided to invade the Ukraine which has put further pressure on supply chains, particularly food commodities and created increased demand for non-Russian energy products.

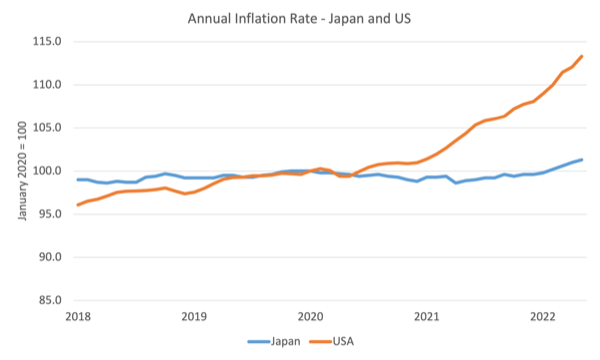

Taken together, the All Items CPI for the US, for example has risen by 13.3 per cent since January 2020, while the Energy component of the US All Items CPI has risen by 48.8 per cent and the Food component has risen by 15.7 per cent.

Taking Food and Energy out still leaves a 10 per cent rise in the US CPI since the onset of the pandemic.

However, for Japan the following has happened since January 2020:

1. All Items – risen by 1.3 per cent.

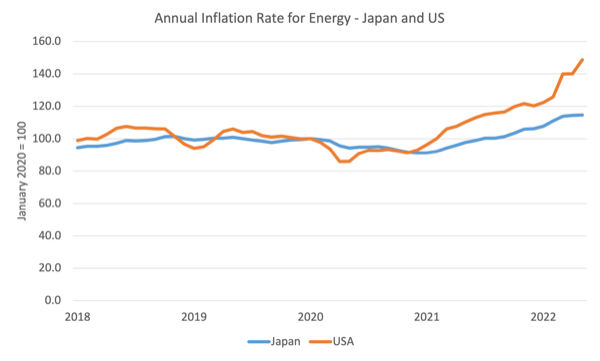

2. Energy – risen by 14.6 per cent.

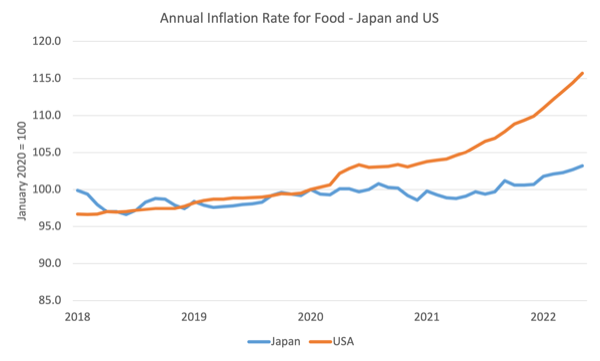

3. Food – risen by 3.2 per cent.

4. All Items less Food and energy – has actually fallen by 0.01 per cent.

The US experience is mirrored around the world, which makes the Japanese experience an outlier.

The following graphs tell the story that has to be explained.

The first graph is the All Items annual inflation rate for Japan and the US (indexed at 100 as at January 2020).

Pre-pandemic – the two indexes were moving more or less in lockstep.

But from mid-2020, the divergence has been stunning.

The next graph shows the Energy component in the respective CPIs.

A fairly similar story for both nations.

The next graph shows the Food component – again divergence.

So with both nations experiencing the energy price shock in a similar manner, why has Japan been able to avoid the high inflation rates of the rest of the world?

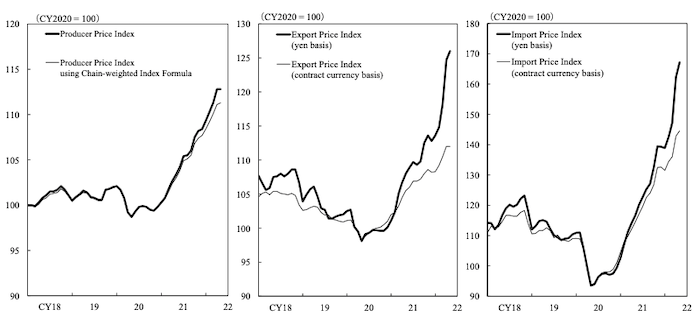

The first thing to note is that producer prices in Japan has followed global trends.

The Bank of Japan produces – Producer Price Indexes – on a monthly basis, and the latest release for May 2022 – Monthly Report on the Corporate Goods Price Index – shows that in the year to May 2022, the index has risen by 9.8 per cent.

The Import price index has risen by 42.2 per cent over the same period (on a yen basis).

The following graph is taken from the latest Bank of Japan release:

So local producer input prices are being largely driven by higher import prices – energy and timber being the most prominent of these imports.

Second, the dramatic drop in Communication costs is a factor.

Further analysis of the CPI sub-groups reveals that the Communication component index has fallen from 99.9 points in January 2020 to 66.2 points by May 2022.

Why has there been such a large decline in communication costs?

The national government has been pressuring the telco carriers to push down mobile phone costs to consumers, which has led to an almost 34 per cent decline in charges.

The Japanese Communications Minister said in October 2020 that they were going to push down mobile phone charges (Source):

… with a sense of urgency … We are confident this will bring fees more in line with international standards.

The campaign to persuade/pressure the telcos worked very well.

The Communications component, though, is a relatively low weight in the overall index, which means other explanations are required.

There are several distinguishing characteristics to explain why Japan has resisted the inflationary surge despite facing large imported cost pressures.

First, there are no wage pressures, which doesn’t really serve as a distinguishing factor because no nation is really experiencing any significant real wage resistance from workers anyway.

Second, there is clearly a different mentality among Japanese companies with respect to pass-through.

In the US and elsewhere, corporations with price setting power do not hesitate to push rising unit costs onto consumers as they defend their real profit margin.

In the 1970s, where trade unions were stronger, this market power set off real wage resistance and a price-wage spiral as worker retaliated against the real wage cuts by pushing for higher nominal wages growth.

Now, the unions are weak and the workers are being forced to take the real income cuts and thus bear the burden of the rising imported price rises.

In Japan, corporations are much more mindful of their reputation and have clearly resisted passing on the imported cost rises.

In part, they are being helped by fiscal initiatives to absorb the cost pressures (see below), but, in general, the corporate mentality is different.

Whether one wants to label the behaviour of US and other firms price gouging is moot. The fact is that these firms will not absorb cost pressures into their profit margins, whereas Japanese firms are clearly doing that (with notable exceptions).

But it is not all down to the socially-minded behaviour of Japanese firms.

There are no wage pressures and real growth in expenditure is subdued to say the least.

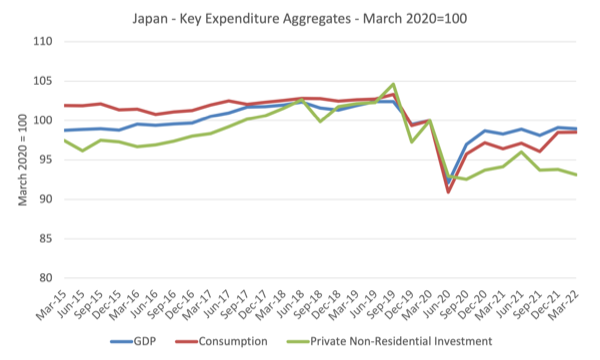

The following graph shows the key expenditure aggregates from the March-quarter 2015 to the March-quarter 2022.

Real GDP is still 1 per cent below the pre-pandemic level and household consumption expenditure is 1.5 per cent below.

Private non-residential investment is 6.9 per cent below the pre-pandemic level and that gap is widening.

So one can argue that the product market environment is very soft, which discourages firms from pushing up prices for fear they will lose market share.

The situation in the US, for example, is that the product market is stronger and firms have more scope to pass on the price rises.

The interesting fact though is that the unemployment rate in Japan continues to fall and in May 2022 was 2.6 per cent, well below the levels in most nations.

We often hear Anglo commentators talking about the low growth (the ‘lost decades’) in Japan in a pejorative way but they fail to mention that Japan consistently outperforms the world in terms of its unemployment status.

A nation doesn’t need strong growth if its unemployment rate remains low (and public services are excellent).

The point here is that the Anglo nations (with Europe following) are intent on creating ‘soft’ product markets through monetary policy interest rate hikes.

They think that will suppress the inflationary pressures and to some extent they will provide a disincentive for firms to pass-through cost rises.

That disincentive will be relative weak at first until firms start going broke in large numbers.

But the difference with Japan, which has much lower growth trajectories than say the US, is that the US Federal Reserve’s approach will only work (if it works at all) via substantial increases in mass unemployment.

Japan will get through the transitory import price hikes without the recourse to the destructive increases in unemployment.

And while fiscal and monetary policy is now contractionary almost everywhere, the situation is markedly different in Japan – a point I go to next.

Meanwhile back at the Bank of Japan and the Ministry of Finance

Life goes on without the obsessive fearmongering that the rest of our governments are facing from commentators intent on pressuring them to kill off the inflation by increasing unemployment and suppressing demand.

The Bank of Japan continues to target a zero yield on 10-year government bonds through its daily bond-buying program.

The Bank has accepted some depreciation in the yen as a result of the increasing differential between US (and other nation) interest rates and the on-going zero rate policy in Japan.

The Bank has clearly not fallen into the trap that many other central banks have – refusing to believe the narrative that interest rate rises will stifle the inflationary pressures without creating significant increases in unemployment.

It understands that once these transitory imported price pressures are absorbed the inflationary pressures will subside rather quickly.

Which remains my view.

Fiscal policy in Japan is also being tweaked to deal with what they consider to be temporary cost-of-living pressures.

On April 21, 2022, the Government announced a ‘supplementary’ fiscal initiative designed to support low-income households and small business firms struggling with the imported price rises.

This document (May 17, 2022) – Overview of the Supplementary Budget for FY2022 – details the stimulus measures the Government will introduce, which will total 2,700.9 billion yen.

Quite a stimulus.

1. 1,173.9 billion to address soaring crude oil prices.

2. 1,520.0 billion for a future contingency to deal with oil prices rises.

These injections include one-off 50k yen cash transfers per child for low-income families and subsidies to petrol wholesalers to help them contain pass-through to consumer prices.

The Government also indicated it preferred to use the direct action of fiscal policy to deal with these problems rather that try to hike interest rates or manipulate the yen.

You can be sure they will also not deliberately create rising unemployment to address the inflation pressures.

This really sets Japan apart from the English-speaking West.

The Anglo nations really have lost respect for the continuity of employment and workers.

Conclusion

I will write more about Japan in the coming months.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

I wonder how much of the inflation surge we are experiencing right now, is just the acknowledgment of the utter incompetence of (most) western governments?

If Japan escapes the CPI surge, doesn’t that means that people still trust the Japanese government that they are capable of tackling the causes of inflation?

We can compare Japan with the EU, the anti-democratic contraption, ruled by bankers, hidden behind curtains.

Can we trust the Van der Leyen woman that the EU won’t start a major recession, trying to curb inflation?

Does she cares about the poor Germans, that will suffer?

What about the Greeks?

No way!

What’s the chance that she even rules anything?

In 2012, I saw the right-wing Portuguese gorvenment imposing brutal austerity on the Portuguese people and brag about it. They were ovejoyed and didn’t even tried to disguise it.

The IMF had an employee in government, acting as finance minister, who went to TV to announce the “brutal hike of taxes” (his words), with undisguised satisfaction.

‘A nation doesn’t need strong growth if its unemployment rate remains low (and public services are excellent).’ I am always reminded of the questioning of a British politician by an astute worker who saw his real wages fall at a time when politicians were boasting (as they still try to do) of rising GDP, along the lines of, who is benefiting, because it certainly isn’t me.

@Paulo Rodrigues, I share your view, but I’m confident you wouldn’t refer to ‘the despised politician/banker man’

Very interested to see more from Bill in Japan. The MoF and BoJ don’t always see things the same – the MoF was behind the lift in consumption tax in 2019 to ‘pay for’ the pension. That move plunged Japan back into deflation and was the beginning of the end for Shinzo Abe. Meanwhile the BoJ was buying bonds, corporate paper, index funds and listed real estate investment trusts!

They’re still doing it now. Keeping the private sector well funded in yen means there is bugger-all foreign currency borrowing. Because all of this debt is in yen, the BoJ can do whatever they need to and they know it. Whenever “the market” tries to push things around the BoJ breaks them.

It’s an interesting lesson. Overseas borrowing by the private sector can stuff a country just as surely as a government doing it, and the BoJ *seems* to be making sure that does not happen. Not that I can find that explicitly stated in any of their reports or minutes, but then they don’t explicitly talk about MMT either, they are just doing what works.

When you look at loans to the private sector

Japan, US, UK, Euro Area

Firstly, You can see which 2 out of the 4 have fiscal rules in place. Who target their deficits and replace them with bank lending.

Secondly, when their central banks do what they do. It can quickly turn into a credit risk story and can cause default risk. Some businesses would have taken on loans to get them through the pandemic and now paying them back in this current environment is not going to be easy.

So they are going to have to keep rolling the loans over if they are allowed to and try and give these businesses some breathing room to get through this period. Or some businesses will go out of business.

Bankruptcies

Japan, US, UK, Euro Area

Again you can see the 2 out of the 4 that targets their deficits and replaces them with bank lending. It is just going to get worse as interest rate risk starts evolving into credit risk. Wouldn’t be that surprising really If they had to go back to 0% rates within 2 years and start cutting rates again. After crushing the housing markets.

Insanity!

Monetarism is a mental illness. That has infected the financial press because of their sheer paranoia of government spending and who prefer bank lending instead. From which rent seekers can kill competition and form monopolies from which to extract rent. The owners of the press are on the side of the rent seekers and why they refuse to let Monetarism die. A full scale punch and Judy show wrapped into a circus.

Will be a comedy sketch when they have to change their framing and narrative again when they have to cut rates so quickly again. As they keep pointing to an imaginary squirrel and calling it different things. That is always hidden just over the horizon that nobody can see. The slash government spending and cut taxes on the wealthy squirrel that is their fall back position decade after decade, that they say trickles down to the serfs and “WILL” this time create full employment. Even though it never has after 50 years of pushing that squirrel at people dumb enough to listen to what these psychopaths have to say at their central bank meetings.

A class war is all it is and ever has been. Monetarism is their version of the 10 commandments. Their real power and control over the rest of us. A fake geopolitical rules based order that has replaced the UN charter of international law by stealth, lies and deceit and who has the largest military presence.

Nothing wrong with bank lending – as long as the bank’s investors are truly on the hook when the loans go bad. Then bank bankruptcy will control lending behaviour.

The challenge is stopping depositors being held hostage by the banking system, while at the same time ensuring lending is cheap enough that businesses will use it to expand.

Remember that bank lending is about providing liquidity against existing collateral, not new assets. Banks allow you to spend your house or your inventory without having to sell the items first.

The essence of the problem with MMT is the University of Chicago where the Econ Dept. still tries to graduate little Milton Friedmans.

So Neil Wilson, are you in favor of rules to make banks have to retain at least 50% of every loan they make, or not let them sell the loan paper they have created by making loans?

The GFC demonstrated the risk in letting banks sell all of the loans they have made.

.

Stev is me, Steve_American.

.

Patrick B. Thank you for commenting on Paulo Rodrigues ‘ Van der Leyen woman’ statement. As a woman who gets so tired of such statements it is much appreciated.

Economist and former Bank of England adviser Tony Yates all those questions about QE (and its seldom-seen friend QT) that you always wanted the answer to but never dared put.

https://the-blindspot.com/alitf-transcripts-quantitative-easing-the-shocking-truth/

An insight on how these people think.

What risk?

As I said bankruptcy will limit what lending is done. If you let those purchasing liar loans go to the wall, then they learn their lesson and stop buying them, which will then force originators to be more honest, and rating agencies to be more realistic.

The problem wasn’t financial firms collapsing in a heap, any more than dot-com “it’s all about the clicks, never mind the profit” businesses collapsing in a heap was a problem.

The problem was that it affected the payment system, and depositors. Take those out of the line of fire and we can just let the losers go bust in the usual fashion.

There is a reason in history why private mints were nationalised and the state issued the money. Once you do that digitally then the accounting requires the central bank to be the biggest investor in banks. They can then use their power as the main source of free funding to require banks to originate loans in an appropriate manner.

Those who don’t want to do that can issue equity at 100%, which will make such loans very much more expensive.

From a ‘Thatcherite monetarist’.

“Why is Switzerland’s rate of inflation so much lower than that of Britain and the USA? . . .

Switzerland’s record is that it has a central bank which believes in the importance of monetary control to inflation. “

Hi Bill.

I have always been fascinated with Japan myself, mostly as a society. Its interesting to know that firms are also mindful or participate as part of society.

The Princes of the Yen was really informative and your works I want to read everyday. Is there anything else you would recommend?

@Neil, as the prime loan collateral for banks is land, what do you think would happen if we extracted most land rent via LVT which would reduce the market price of land to almost zero? I wonder whether your co-author Josh Ryan Collins has considered this. Many years ago when I was trying to convince a young farmer about LVT she said it would mean they couldn’t borrow to invest.

Bill says you don’t “do” MMT; but I think it is vital that Philip Lowe does “do” MMT – is there a semantics problem here?

Eg Lowe has said he will resist any assertion the central bank is directly funding government (for the covid rescue package), he claims the government rescue money is “borrowed and must be repaid”.

Surely MMT teaches us Lowe’s assertion is BS?

Neil Halliday,

Of course it is BS.

Ray Dalio has recently said it out load. That is, that every time a nation has tried to pay off the national debt it has caused a depression.

I keep saying that it is impossible for most nations to ever pay off their debt. Only nations with a huge trade surplus can attempt it.

The early US was unique. It “owned” a huge area of vacant land, after it moved the natives off it. It tried to pay off the war/national debt with revenue from selling that land. Even this caused 1 of the 2 worst depressions in US history in about 1830. It lasted until the War with Mexico.

So, paying down all of the debt increase from covid is going to cause a depression. It is a dumb idea.

Taxing the poor and middle class to convert the bonds held by the rich into cash dollars is a dumb idea. Taxing the rich to do it seems unfair to the rich, and so they will not allow it.

.

“And there is suddenly a lot of inflation in Japan, and it’s a big issue in Japan, and people hate it, and BOJ head Kuroda has come under withering fire for making tone-deaf comments about the benefits of inflation, after core CPI rose to 2.1%, above the BOJ’s target.

Wholesale inflation in Japan has been over 9% for 5 months. The government is subsidizing certain wholesalers so that they would not pass on the price increases, which helped hold down retail inflation. In addition, the entire healthcare system is under the government (insurance and what healthcare providers can charge patients), and the government has pushed some rates down, with further helped lower CPI.” ?

Interesting that Japan’s GDP (c $6 trillion) has more or less remained the same since its 1990 property and share-market crash; before that time many people though Japan was set to overtake the US.

Since that time (1990), GDP of China and the US have grown more or less continuously , and when China’s GDP appeared to be on course to overtake the US, the latter has pulled out all the stops to prevent that from happening…….

We live in interesting times. Has Abe paid a very high price for overturning Japan’s pacifist (US-written) constitution?

Abe has been assassinated