I started my undergraduate studies in economics in the late 1970s after starting out as…

Failed states and ideologies

When I give public lectures about economic policy I often pose the question – how should we judge the effectiveness of public policy? I pose a simple rule of thumb! I judge whether social and economic policy is effective not by how rich it makes society in general but how rich it makes the poor! I see richness in broad terms which embrace both economic and social valuations. Applying this rule of thumb has led me to conclude that the majority of nations in the advanced world are now failed states with run-down and corrupted public institutions. The conclusion is more stark when applied to less developed nations suffering under the neo-liberal yoke imposed on them by institutions like the IMF and the strong donor nations. But the rising poverty in the advanced world as a result of the extended current crisis is making it clear that our economic systems and the policy regimes that are being imposed on them by the neo-liberals are no longer delivering satisfactory outcomes. There needs to paradigm change – urgently.

When fighting a paradigm war it is often very hard to get beyond the conceptual stand-off especially when there is an entrenched and particularly aggressive paradigm that uses all means to defend its power base. In economics this is particularly so and the mainstream body of economic theory (and practice) is very aggressive and ruthless in warding off challenges to its legitimacy.

Thomas Kuhn in his 1962 book – The Structure of Scientific Revolutions – conjectured that scientific activity is not a process of some orderly accumulation of new knowledge. Rather, there are periodic revolutions – which in more recent times have been referred to as paradigm shifts – where the “nature of scientific inquiry within a particular field is abruptly transformed”.

A revolution emerges slowly as the dominant paradigm (Kuhn’s “normal science”) fails to respond to the empirical world and anomalous results accumulate. At some point, the scientific community realises that the new approach is more capable of explaining the phenomena of interest and then the revolution in science occurs.

In the degenerative phase, adherents of the dominant paradigm respond to anomalies in ad hoc ways and rarely alter their world views. There are self-reinforcing institutions within a paradigm to discipline thought and maintain constancy. In the academy, hiring practices (who gets the jobs and promotion), journal editorships (who gets published), funding agencies (which research gets supported) all serve to maintain the “bias” and continuity of the dominant paradigm.

Exceptions emerge – the disciplining institutions are not 100 per cent pervasive and progressive views (defined here as an emerging counter-paradigm) do develop and new ideas emerge and gather pace as the anomalies faced by the dominant paradigm mount and are unconvincingly dismissed.

Please note I am fully aware of the controversy surrounding Kuhn and Polanyi and I make no judgement on the validity of either side’s arguments in that debate in this blog. I have views on it though (as you might expect).

Imre Lakatos built on this work to consider the way in which research programs are built on an ideological core which is never confronted with empirical testing. Instead there is a “protective belt of auxiliary hypotheses and observations” that are constantly being challenged. However, inconvenient facts or failed tests never lead to the scientist abandoning their core belief systems.

As the paradigm becomes degenerative – as it struggles to maintain credibility in terms of its ad hoc response to anomaly – the rival paradigm attracts support and grows in influence in the scientific community. Eventually, the degeneration becomes complete and the revolution occurs.

I also enjoyed reading Austrian philospher Paul Feyerabend when I was a young scholar (particularly his 1975 book Against Method). His writing suggest that knowledge accumulation (“true science”) was stifled by the prevailing scientific establishment – which he considered to be as self-serving, elitist and undemocratic as the Church in the medieval times (see his 1978 book Science in a Free Society).

Here is one beautiful quote from Feyerabend about the academic journal mafia that deliberately filters ideas to ensure that the dominant paradigm remains largely unchallenged:

… almost every journal in the philosophy of science deals with problems that are of no interest to anyone except a small gang of autistic individuals.

The same applies in spades to the economics literature.

So when would it be reasonably assumed that a paradigm was degenerative and had lost all credibility? I have written before that I thought the current crisis would be a significant nail in the neo-liberal coffin when the scale and enormity of it started to be revealed in 2007 into 2008.

I considered the fact that the fiscal policy interventions and the ineffectiveness of the monetary policy initiatives the central banks tried might have been ample evidence that the mainstream macroeconomic approach had categorically failed.

In the early days of the crisis, you didn’t hear much from the mainstream macroeconomists (exceptions were noted). They kept their heads down because there was nothing they could really say. Their textbooks were largely irrelevant and they had been teaching students theory that could not explain what was going on in the world nor what the solution to the crisis might be.

The degeneration of the dominant paradigm was extreme.

As the crisis unfolded I noticed that the mainstream was fighting back. At first it was subtle and measured.

Please read my blogs – The comeback of conservative ideology and An unholy gathering is emerging – where I started to document the growing number of deficit-terrorists who were trying to restore their credibility in the face of the global financial crisis.

Initially, this started out with them trying to re-engage in the policy debate by appearing reasonable – saying that “now we should have deficits” but soon (unspecified) “we will need surpluses” to “pay back the excesses”. That sort of spurious reasoning. Even the IMF announced – We are sorry – in a couched attempt to re-establish their credibility.

I further covered this theme in these blogs – When former politicians and bureaucrats get bored with golf … and Being shamed and disgraced is not enough.

As time progressed, the comeback attempts became outrageous and denial entered the picture – see this blog as an example – Pushing the fantasy barrow. This latter development has now gathered pace and it won’t be long before the mainstream start denying that there was a crisis of any magnitude at all. After all there hard-core models assume constant full employment.

The crisis has delivered empirical blows to the mainstream explanations. Fiscal policy works and do not push up interest rates. Very large central bank balance sheet accumulations (increasing the monetary base) have not caused inflation. Sovereign governments have not defaulted on their debt.

With interest rates low and unchanging and deflation the likely issue the mainstream are struggling for relevance but have been able to maintain their dominance and influence policy directions.

The vehemence of the mainstream stance and their ability to maintain their dominance position is worthy of further research – I am working on a book about this at present (2012 publication date maybe).

In this context, I quite liked this article – Neoliberalism is destroying Europe – which was published in the UK Guardian last week (September 14, 2010). The article said that:

The European sovereign debt crisis, which was caused by member states’ public debt but increased because of the actions taken to rescue the banks after the 2008 crisis, demonstrates at least three things. First, that currency does not exist without a state. Second, that capitalism cannot be managed by the market alone. And third, that the austerity measures will not bring Europe out of the crisis but will in fact continue to make it worse – until the euro crashes.

However, the most important point to emerge from the crisis is that Europe’s political reinvention will depend exclusively on the social struggle against neoliberal politics. Neoliberalism, the absurd idea of economic government based solely on the market and its ability to self-regulate, is at the root of the great illusion of a leaderless Europe supposedly unified by a euro that has controlled the internal economic and social differences according to the logic of the financial markets.

The first paragraph covers the design faults of the Eurozone monetary system which I have covered in the following blogs – Euro zone’s self-imposed meltdown – A Greek tragedy … – España se está muriendo – Exiting the Euro? – Doomed from the start – Europe – bailout or exit? – EMU posturing provides no durable solution.

I liked the point that a “currency does not exist without a state”. This is a central aspect of Modern Monetary Theory (MMT) and is a defining feature of economic sovereignty.

A sovereign government is never revenue constrained because it is the monopoly issuer of the currency. The issuance aligns with the political state. The currency also has to be freely floated to allow that government to use this sovereignty to focus on domestic policy without being compromised by the external position.

Any departure from the alignment of the state with the issuance of a freely-floating currency violates the concept of sovereignty and compromises the state’s capacity to pursue socially useful economic outcomes.

The Eurozone nations should now be learning that lesson although it is clear that the mainstream has high-jacked the lesson and are instead trying to tell the citizens that are having harsh austerity imposed on them that the fault lies with government not the monetary system that is incapable of responding to any economic shock.

The second paragraph resonates well with me. The increasing dominance of the financial markets and the capacity of that sector to expropriate increasing proportions of real income has only been possible because governments abandoned their responsibilities to pursue full employment and to conduct an appropriate balancing role in the market economy. Please read my blog – The origins of the economic crisis – for more discussion on this point.

You might like to read this article in today’s Sydney Morning Herald (September 20, 2010) which documents one appalling case study – Inside the boiler room: ‘Clients are Bambi – we shoot Bambi’.

For there to be any sustainable recovery policy have be developed whereby the distribution of real income is shifted dramatically back into the hands of the workers. The first place to start is to target the reduction of unemployment and to create public sector jobs if the private sector will not create enough.

The Guardian article concludes that:

… the cracks between the economically strong countries and those that are industrially weak, conditioned by the politics of the European Central Bank, can only get worse. In all likelihood, the final outcome of this crisis will be the exit of Germany from the euro – it’s just a matter of time. Greece or Spain’s departure from the eurozone would not heal the cracks inside the central block of the EU or the divide between Germany – which is focusing more on Asian and South American markets – and France, which has been losing economic power and political credibility for some time.

The point is clear – the EMU is based on a flawed design. It is a monetary system that can never consistently align economic outcomes with socially-beneficial outcomes because it has not coherent and effective way to deal with asymmetric demand shocks. The current ad hoc interventions of the ECB to shore up the bond markets and ensure that the large French and German banks remain solvent is not a coherent solution.

There has to be a realignment of currency with the state. That means either a collapse of the individual member states and a single fiscal authority established or, alternatively the entire dissolution of the monetary union. The former is not possible given the historical and cultural differences. That leaves the latter as the way ahead for Europe.

The Guardian article tells us that the:

… austerity measures imposed on all eurozone countries will be impossible to carry out … there will be a stampede away from the plan of European stability – and very soon, as Hungary has shown us – with repercussions on economic and social policy within the member states. We are watching the de-Europeanisation of Europe.

Eventually the people will fight back. All oppressive systems eventually fail under the weight of human suffering.

As the article tells us, the main cause of the crisis is neo-liberalism and so the way out of it is to move away from that paradigm and “resist the reduction of salaries, oppose cuts in public services, redistribute the wealth that financial capitalism has appropriated, and convert economic growth into sustainable development.”

The writer says that “the Europe characterised by its people and its differences will only be saved if neoliberal Europe is destroyed”.

The conclusion generalises. The only sustainable future for the global economy is to reflect not only on the crisis (that is, what has happened in the last couple of year) but also to understand what has been happening over the last 20-30 years – a period over which the neo-liberal has increasingly exerted its dominance.

Have our economies really delivered outcomes that we consider desirable?

The conservatives claim that the under the neo-liberal policy regime – markets were freed and became more flexible and produced substantial new wealth that we have all been able to enjoy.

They characterise this period of alleged stability as being the ultimate victory over the business cycle. I showed in this blog – The Great Moderation myth – how ridiculous the notion that the economics profession had conquered the business cycle is.

But going back to by starting point it is clear to me that the most disadvantaged individuals in our societies have not be well served by this policy approach.

Is rising poverty the sign that we are looking for?

I reviewed some of the economic performance of 2009 in this blog – The year ends badly and then ….

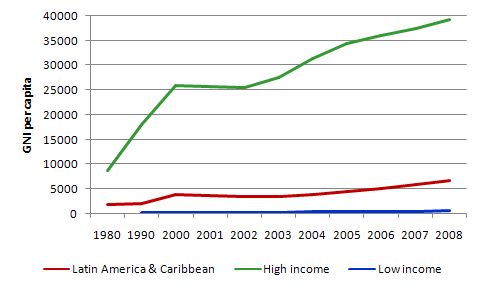

Previously – in this blog – IMF agreements pro-cyclical in low income countries – I used data from the World Development Indicators, provided by the World Bank to track the movements in Gross National Income per capita since the 1980s. Gross National Income per capita is an often used material indicator of increasing welfare.

That blog examined whether the plethora of IMF development programs had made any substantial dent in world poverty. The overwhelming evidence is that these programs increase poverty and hardship rather than the other way around.

Latin America and Sub-Saharan Africa (which dominates the low income countries) were the regions that bore the brunt of the IMF structural adjustment progams (SAPs) since the 1980s.

While the high income countries enjoyed strong per capita income growth over the period shown (since 1980), Latin America (and the Caribbean) has experienced modest growth and the low income countries actually became poorer between 1980 and 2006.

The two trends are not unrelated. The SAPs are responsible for transferring income from resource wealth from low income to high income countries.

That data alone should demand an explanation from the mainstream. It has been clear to me for years now that a new paradigm for economic and social development in less developing countries is needed. If policy makers embraced MMT and implemented suitable policies (starting with a Job Guarantee) they could pursue domestically-focused development strategies with employment security guaranteed.

The problem has been that the poor countries have little bargaining power and their woes are not the focus of the mainstream debate in the advanced nations. So the failure of the IMF and the World Bank to really deal with world poverty has gone unnoticed as the financial engineers have been diverting the attention of the advanced world with an unprecedented debt-fuelled consumption boom.

The major world institutions have been covering their tracks by introducing the Millennium Development Goals (MDGs), which were supposedly going to significantly reduce poverty.

The financial and economic crisis has seriously undermined this agenda although it was off track well before the crisis began. The reality is that with five years to go (the targets were defined out to 2015), there is no hope that the MDGs will be met.

You might like to read the Gap report which documents how far away the major countries are in meeting their stated commitments to the MDGs.

For example, $US272.2 billion was committed under an agreement to increase aid as share of national income of donor countries to 0.7 per cent. The outcome has been $US119.6 billion, leaving a shortfall of $US152.6 billion.

The neo-liberals also mounted campaigns over the last decade which sought to disabuse us of the notion that aid to poor countries worked. Increasingly, articles and books are appearing that try to tell us that advanced nations should not extend aid and that free markets will deliver the essential growth needed to expunge poverty.

While a lot of aid has not been effective, this is largely because the domestic policies pursued by the governments have been dominated by the same neo-liberal tendencies that have dominated policy making in the advanced world and which led us into this crisis.

Outcomes would be superior, if governments in developing countries focused on advancing domestic well-being and eschewed the export-led growth strategy pushed on them by the IMF and the World Bank (with the backing of the large donor countries). Aid is essential to development but government policy must be freed from the neo-liberal yoke.

Anyway, the topic of the MDGs will be considered again this week with the Summit on the Millennium Development Goals starting today in New York. I will report separately on the outcomes of that Summit once I had read some of the papers that will be delivered.

The point is that the neo-liberal approach has not reduced poverty in the developing world. That fact alone should have been the basis of a scientific revolution in economics.

But it is clear that the persistence misfortune and poverty in the developing world has not had much impact on the policy debate and the possibility of social action against the neo-liberal in the advanced world.

For a time, the neo-liberal agenda – with the increasing financialisation of the world economy and the decline in the belief that fiscal policy was an effective way to improve socio-economic outcomes – has spawned rising consumption levels in the advanced world.

This is despite rising inequality and entrenched disadvantage arising from the persistently high unemployment delivered by this policy approach. The increasing disadvantage in the advanced world has been blurred and the victims of the policy failures have been vilified and divided from mainstream society. A new nomenclature was introduced – dole bludgers, job snobs, and more recently in the UK we have heard about “lifestyle unemployment”. This nomenclature reinforced the divide and rule strategy that the neo-liberals implemented to obscure what was going on.

The middle- and beyond-classes were then anaesthetised by the availability of debt which allowed consumption (and asset accumulation) to boom even though real wages growth was being tightly constrained and labour productivity was growing much faster. The gap between the real wages growth and productivity growth was the real product that provided the largesse for the largely unproductive financial sector to make their “fortunes”.

This expropriation was facilitated by supportive government policy – financial market deregulation and attacks on trade unions and welfare institutions.

The plan came unstuck when the greedy recipients of this redistributed real income over-extended themselves. It was obvious the growth strategy could not continue indefinitely. It was always only a matter of time before the whole house of cards collapsed.

The collapse came in 2007 and the financial crisis quickly became a real crisis that has created a surge in unemployment and income loss. Poverty is closely tied to unemployment and so it is no surprise to see rising poverty in the richest nations.

Last week, the US Census Bureau released its Income, Poverty, and Health Insurance Coverage in the United States: 2009 which shows that:

The poverty rate increased between 2008 and 2009 … [and] … The uninsured rate and number of people without health insurance increased between 2008 and 2009 … In 2009, 43.6 million people were in poverty, up from 39.8 million in 2008 – the third consecutive annual increase in the number of people in poverty … The number of people in poverty in 2009 (43.6 million) is the largest number in the 51 years for which poverty estimates have been published …

So there are now a record number of Americans living in poverty and it is spreading among Non-Hispanic whites and families in the US.

Real Median Household Income for all races is now around 1997 levels. So the crisis wiped out 13 years of gains overall.

In 2009, there were 51 million Americans with no health insurance a rise of 4.7 million since 2008. The Census Bureau noted that it is “the highest number of uninsured since 1987, the first year comparable health insurance data were collected.”

The Report also says that:

… comparing the change in household income between 1999, the year that household income peaked before the 2001 recession, and 2009 suggests income inequality is increasing.

So while we might ignore the plight of the extremely poor in the developing world, it remains to be seen if we will ignore the increasing poverty in the richest nation in the world.

The failings of the neo-liberal policy agenda are now spreading into the advanced world. If I analysed the situation in some of the EMU nations the same conclusion would be forthcoming. Poverty rates is rising and income security is being trashed by neo-liberal complicit governments desperately acting under orders from the IMF, the ECB, etc.

The mainstream paradigm has failed. That is the only conclusion you can reach. The crisis has amplified what has been going on for the last few decades. More people are being exposed to economic insecurity and are being left idle by the production system.

The solution is simple but would require governments to abandon their complicity with the neo-liberal power bases in the world’s institutions like the IMF and also in the financial sector. I don’t hold out much hope of this occurring smoothly any time soon.

I see my role as an academic to continually point out the degenerative nature of the neo-liberal paradigm and to expose its empirical anomalies. Eventually, the overwhelming evidence that is there for all to see will become obvious to an increasing number of people. Only then will mainstream economics face its Waterloo.

It cannot come too soon.

Conclusion

The conduct of governments in the advanced world over the last 20 years has not typified what sophisticated and rich societies should be doing to enhance the prospects of the weakest among us.

In that sense, I judge all these governments to be ruling over a failed state. The failure is sourced on the complicity that these governments have demonstrated by introducing policies that have surely undermined the economic fortunes of an increasing number of their citizens.

The crisis has been the ultimate manifestation of that complicity and progressives should be continually hammering the anomaly and pushing for paradigm change. The only problem is that the alternatives other than MMT are likely to deliver equally poor outcomes by failing to align the capacities of the monetary system (and the production economy) with desirable social and environmental goals.

That is enough for today!

Oh yes! Politely said Bill.

As my teenage kids would say. Neo liberalism ….. Fail.

In the Neo Liberal spawning ponds of the 1980’s US fraternities. They would have to describe themselves as losers, making the shape of an L on their own foreheads.

Did anyone see Hank Paulsons body language as he announced the bank bailouts? Knowing he was hoisting the entire Neo Liberal movement on their own glorious Petard. The mans lip was quivering and he could hardly speak. Good times 🙂

Bill

Just wondering whether you read this paper from Treasury- seems to be picking up on a lot of things you have been writing about on the blog:

http://www.treasury.gov.au/contentitem.asp?NavId=035&ContentID=1869

Abstract:

“This paper examines the empirical relationship between government debt and the real interest margin between Australian and US 10 year government bond yields. Results for the period 1990 to 2009 suggest that Australian general government net debt has no impact on the short run real interest margin, and has only a small effect in the long run [3 basis points!]. Further, the estimates suggest that movements in US general government net debt have a considerably larger effect than Australian general government net debt – implying that US influences take greater prominence in explaining the real interest margin.”

I want to thank you for the work you are doing. I found your site about three months ago and have read every blog since. I am not an economist, but I have yet to find anything you have said that I disagree with. I only hope that people in high places soon begin to learn about your ideas, since I think that they could be the basis for a real recovery for people everywhere, not just rich bankers.

Dear Timothy (at 2010/09/20 at 18:47)

I did read it last week and it is on my list to talk about. Thanks though for bringing it up. I have a very long list and things get sidetracked.

best wishes

bill

Bill,

just curious, there are plenty of examples cited of failed societies (just about all Western, developed nations). Are there any that are in your eyes demonstrative of a fair, fully employed and just society? About the closest I can think of that might fit your bill would be in Scandinavia.

One other question; can you please point me to a previous article (I’m sure you have written many) of how you would manage wealth being redistributed across society? Practicalities, difficulties etc.

thank you.

Bill, for fairness could you please show the graph above on a log scale?

Slightly off topic but here’s an interesting piece on the struggle for a Living Wage

http://www.tuc.org.uk/extras/living-wage-rep-sep-2010.pdf

Interestingly London’s liberal Conservative Mayour, Boris Johnson signed up to a lot of the principles in London, so there’s hope cross-party support and a lasting consensus is achievable.

One of my questions is how and at what level should the minimum wage be set, this seems to be in that ball park!

“Applying this rule of thumb has led me to conclude that the majority of nations in the advanced world are now failed states with run-down and corrupted public institutions.”

So Bill, has your “rule of thumb” led you to conclude that is Australia a failed state?

Bill Mitchell:

“I see my role as an academic to continually point out the degenerative nature of the neo-liberal paradigm and to expose its empirical anomalies. Eventually, the overwhelming evidence that is there for all to see will become obvious to an increasing number of people. Only then will mainstream economics face its Waterloo.”

Dear Bill,

Your blog is an excellent piece of work – product of great thought and efforts. We – the readers and MMT supporters – should take this example and do our best to spread the word as much as we can. The more readers you and your colleagues have, the better chance MMT principles have to reach the political levels where national economic decisions are made.

IMO, it would be good idea if billy blog had something like a clock constantly showing the number of billy blog’s readers.

Dear Gamma (at 2010/09/21 at 2:35)

You asked:

Any nation that keeps 13 per cent of its available labour force idle (unemployed and/or underemployed); forces its indigenous population to live in absolute poverty, and leaves its 25 per cent of its active teenagers idle while at the same time claiming we are close to full employment and thus need to run budget surpluses is a failed state. Australia fits the category perfectly. Our economy does not advance social purpose.

best wishes

bill

I don’t want to give you a big head or anthing but, I love you Bill!

I think that the neo-liberals will never admit they were wrong and will pusue their fantasy into senility. I think though, that after their rediculous experiment we will eventually recover, though, who knows how much life will be wasted in the process. Let’s just hope that when it ends, it will be the last of this rubbish.

Kind Regards

Charlie

Ray:

Here’s a recent blog I found on the subject:

https://billmitchell.org/blog/?p=11245

It would be good to see reported, any remarks from those in power that their views are changing. But please consider the possibility that they may go the wrong way! Change now, unlike in the past, will be dependent on the media, both for its timing and direction. MMT might seem the only solution that works to readers of Bill’s great blog, but it is possible for yet another unholy and worse mess to be visited upon us. Many in UK are convinced that ‘this is the only way’. Try talking about lternatives and eyes glaze over. The education and publicity job that needs to be done is huge.

Bill,

“Any nation that keeps 13 per cent of its available labour force idle (unemployed and/or underemployed); forces its indigenous population to live in absolute poverty, and leaves its 25 per cent of its active teenagers idle while at the same time claiming we are close to full employment and thus need to run budget surpluses is a failed state. Australia fits the category perfectly. Our economy does not advance social purpose.”

Australia is probably about as far from being a failed state as any nation on earth. I have travelled extensively and there is as much or more social cohesion in Australia as anywhere I have seen. I was in Thailand earlier this year and saw some of the protests there…this is a country that is in danger of failing, not Australia.

You claim we are a failed state, where are the protests from the people at our state of affairs? The only time you’re likely to see masses of people marching in the street, is on their way to the football grand finals over the next 2 weekends.

Clearly Australia is not failing, and is not likely to anytime soon.

This is not to say that there are not problems or room for improvement (I do agree with your idea of a job guarantee), but there is more to a successful society than the level of unemployment and underemployment.

Inflation is looming as a greater problem than unemployment for Australia at the moment. The average person is more concerned about the cost of living rising than getting the unemployment rate down from 5% to 2%. You may not like this attitude, you may despise it, but it is the reality.

Thanks for this post Bill. If only people like the Polanyis (both Michael and Karl) were listened to more. But that would require some intelligence…

On the topic of the controversy surrounding Kuhn and Michael Polanyi; could you not say that both men stole the idea from the older Karl Polanyi, who emphasized the way economies are embedded in society and culture?? So in a scientific framework, this becomes science’s subjective experiences make science a relativistic discipline…

Steve

Sydney, Australia

Prof. Mitchell,

Your comments on Kuhn, Lakatos and Feyerabend are accurate, and account well for these philosophers’ points of view.

I am ready to admit that, to some degree these views are applicable to the current situation, where followers of the neoclassical paradigm by all means refuse to acknowledge any evidence that their paradigm is dead.

The problem I can see with this account is that Kuhn’s, Lakatos’ and Feyerabend’s views addressed primarily the natural sciences, but we are talking about economics, which is not a natural science.

These accounts fail to address what I consider the elephant in the room. As I like irony, I’ll use a term coined by George Stigler: capture. Economics, as a profession, has been captured by private interests, because economic theories (unlike, say, the Copernican system) are immediately relevant to social life.

The idea that neoclassical economists will realize that their theories are wrong, provided enough negative evidence has accumulated, assumes that they are willing to “realize it”, even if it costs them well-paid positions, and prestige and influence.

And it further assumes capitalists and politicians will accept neoclassical economists’ realization.

Spot on. I am currently reading ‘ How Rich Countries Got Rich … and Why Poor Countries Stay Poor’ by Erik S Reinert which comes to the same conclusion about the immense damage done by neo-liberalism. Very readable, highly recommended.