I started my undergraduate studies in economics in the late 1970s after starting out as…

We are sorry

On Friday (February 12, 2010) as Eurostats released the flash estimates of fourth quarter GDP for the EU (see below), the IMF released a new staff position note entitled – Rethinking Macroeconomic Policy. The bad news is the Europe is looking more like a region that is heading for a double dip recession. The even worse news is that that cretins at the IMF are claiming they know why they messed up in the past and how to address their failure. Stay tuned for a modified version of the same. The fact is that the IMF Report reveals they are as ignorant as ever of the workings of the modern monetary economy. So this revisionist exercise doesn’t signal a major paradigm stage.

I am writing this apology for various IMF officials who are now claiming they were wrong:

- We are sorry, truly sorry for being so arrogant that we forced our beliefs in the primacy of monetary policy and the failings of fiscal policy onto policy makers around the World and we acknowledge that this arrogance has now helped contribute to the current economic crisis which is impoverishing millions of people and severely damaging entire nations. We were wrong.

- We recognise that this ideological obsession we had with monetary policy was a denial of the evidence before us but we were too blind to consider it important. We were wrong.

- We are truly sorry for perpetuating the myth of the Great Moderation and giving credence to the views of blind ideologues such as Lucas, Barro, Sargent, Taylor and others as they strutted the international stage declaring an end to the business cycle. All academic economists who continue to perpetuate that myth should be dismissed from their positions. We were wrong.

- We are sorry for not realising that fiscal policy is an important tool that governments can use to stabilise and support aggregate demand and employment. We now recognise that for years we have been pressuring governments to deliberately create unemployment and the associated poverty because we wrongly believed this would be the most effective way to fight inflation and deliver stable growth and prosperity. We were wrong.

- We are very sorry we supported the ideologues in the economics profession who lied to the World about the NAIRU. We now realise it is unmeasurable and all our own efforts to produce estimates have been built on flaky foundations. We recognise that policy makers have used this misleading estimates to inflict damage on their populations. We were wrong.

- We are sorry that some of us have written textbooks that systematically lie to students about the way the macroeconomy works with particular focus on the way we have misrepresented banking and money markets and the policy interactions. We were wrong and will offer refunds to all the students who used the books (fees and book purchase price).

- We are sorry for being so dim-witted to believe that wide-scale deregulation would enhance the prosperity of the World. We now recognise that we have been imposing blind ideology onto policy makers and allowing the elites to gain greater access to the resources in each nation at the expense of the poor. We were wrong.

- We are sorry for inflicting this dogma on the world, particularly the poorest nations where we have caused children to die because we have bullied governments into cutting back on spending on health. We were wrong.

- We are sorry for holding back the development of many of the poorest nations by bullying their governments to cut back on education and public infrastructure investment while at the same time pressuring them to give cheap access to their natural resources to predatory first-world corporations who have paid very little in return. We were wrong.

I am also preparing resignation letters for all the top officials. They should be ready in the coming days.

We will consider the IMF Report after the grim news from Eurostat.

Europe staring at a double-dip

On Friday (February 12, 2010) Eurostat released its Flash GDP estimates for the fourth quarter of 2009. While the official press released highlighted:

GDP increased by 0.1% in both the euro area1 (EA16) and the EU271 during the fourth quarter of 2009, compared with the previous quarter …

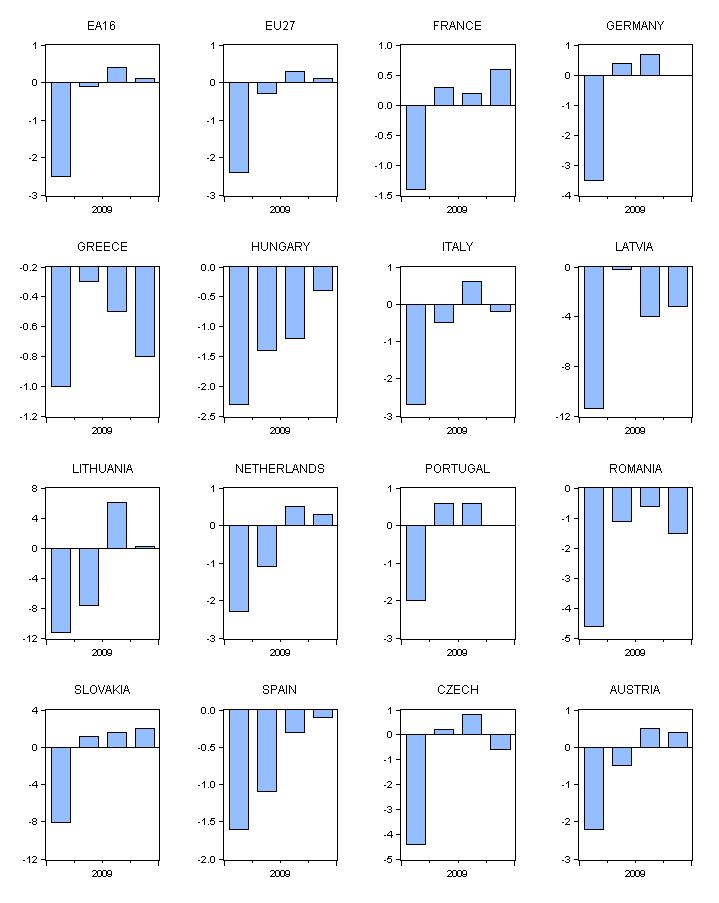

But what the press release didn’t emphasise was the trend towards a double dip recession. The following graph taken from the Flash estimates data shows the quarterly GDP growth over 2009 for all EU nations who have reported December quarter estimates.

The data shows that the overall 16-country eurozone grew by only 0.1 per cent in the December 2009 quarter with Italy sliding back into negative growth and Germany stationary at zero growth. Of the four large EU economies, France was the only to record growth.

While German exports have improved, domestic demand (consumption and investment) fell significantly as the deflationary impacts of unemployment and stagnant real wages growth over the last several years begins to take its toll.

You can see that reversals of the previous quarter’s growth occurred in Austria, Germany, Italy, Lithuania, Netherlands, Portugal, and Czech Republic.

Further, Greece, Hungary, Latvia, Romania, and Spain remained in recession.

The data also shows that over the entire year the Baltic states who are queuing up for Eurozone membership were severely damaged by the crisis. Latvia contracted by a staggering 17.9 per cent; Lithuania by 15 per cent and Estonia by 9.4 per cent.

The worst-performed Eurozone nations over the whole year were Spain (-3.1 per cent decline); Italy (-2.8 per cent); Germany (-2.4 per cent decline); Netherlands (-2.2 per cent); and Austria (-1.8 per cent) although once the full December quarters are available Ireland will be up there (shrinking 7.6 per cent September 2009 to September 2009).

So nothing to cheer about there. The restrictions on EMU members that are now clearly in relief as a result of this crisis expose all the EMU governments to default risk. Without a fiscal redistribution capacity and with the SGP restrictions impeding the capacity of member governments to use fiscal policy to arrest the decline in aggregate demand there was reason to expect that growth would stall in the way the data is now showing.

The problem then will turn to the banking system which is still exposed to failure which the member governments are unable, under current structure and rules, to deal with.

IMF Report

The IMF Staff Position Note entitled – Rethinking Macroeconomic Policy, was written by IMF Chief Economist Olivier Blanchard with co-authors Giovanni Dell’Ariccia and Paolo Mauro.

Blanchard has his own textbook which is as bad as the Mankiw’s book – the so-called Barbeque Lighter.

Section 1 of the IMF paper is entitled What We Thought We Knew, which I would have summarised in advance of the crisis as nothing! Nothing, that is, that is relevant for understanding how a fiat monetary system operates within national borders and what happens when politics and ideology conspires to deny the efficiency of that monetary system and even constrain it by creating common currency areas (Eurozone) or currency pegs (like Latvia) or other deviant ways to stifle government policy.

I would have come to that conclusion well before the crisis based on my reading of Blanchard’s previous work and hearing him speak in the past. He is a mainstream ideologue in the same way as Mankiw.

Section 2 of the IMF paper is entitled What We Have Learned from the Crisis, which after reading the paper I summarise as not much.

The first thing they thought they knew was:

… we thought of monetary policy as having one target, inflation, and one instrument, the policy rate. So long as inflation was stable, the output gap was likely to be small and stable and monetary policy did its job. We thought of fiscal policy as playing a secondary role, with political constraints sharply limiting its de facto usefulness. And we thought of financial regulation as mostly outside the macroeconomic policy framework.

They say the “intellectual support for inflation targeting provided by the New Keynesian model”. Please read this blog – Mainstream macroeconomic fads – just a waste of time – to see what an intellectual desert this model presents.

I justified three major conclusions in that blog:

- The so-called micro-foundations of New Keynesian models are not as robust as the various authors would like to claim;

- The so-called Keynesian content of the models should be taken with a grain of salt;

- The rationale these models provide to justify their claim that tight inflation control leads to minimal labour market disruption is highly contestable. The only reasonable conclusion is that the approach has no credibility in dealing with the issue of unemployment and cannot reasonably be used to justify aggregate policy settings.

There are no saving features of the New Keynesian research program. None of the NK models handle “money” in a way that remotely corresponds to the dynamics and operational realities of a modern monetary economy based around a fiat currency.

The alleged advantage of the New Keynesian approach is the integration of real business cycle theory elements (inter-temporal optimisation, rational expectations, and market clearing) into a stochastic dynamic macroeconomic model. But it is obvious that notwithstanding the air of rigour, the New Keynesian results are always conjunctions of abstract starting assumptions and ad hoc additions to provide a semblance of engagement with reality.

This indicates an important weakness of the New Keynesian approach. The mathematical solution of the dynamic stochastic models as required by the rational expectations approach forces a highly simplified specification in terms of the underlying behavioural assumptions. This severely compromises the models and they are unable to say anything meaningful about the actual operations of central banks.

As a consequence the New Keynesian models have no empirical credibility.

So why would anyone be surprised that conceptual thinking and policy design based on the New Keynesian paradigm would fail badly when the system was in crisis.

On the way banking works, the IMF paper says that they believed the:

… theoretical literature … [where] … bank credit was seen as special, not easily substituted by other types of credit. This led to an emphasis on the “credit channel,” where monetary policy also affects the economy through the quantity of reserves and, in turn, bank credit.

So they believed in the money multiplier and the myth that reserve volumes influence lending. If you read Blanchard’s textbook you will see he deals with this topic is the standard way. So I guess he should apologise for misleading generations of students in this way. Please see my blog – Money multiplier and other myths – for more discussion about the way banking in modern monetary systems works.

On regulation, the IMF note that mainstream economics has long recognised the lender of last resort role of the central bank but:

Little attention was paid, however, to the rest of the financial system from a macro standpoint.

So the self-regulation myth. They believed that financial markets like all markets would achieve the optimal outcomes for all if they were left to pursue risk and return without the fetters of regulation. The geniuses in the markets all were assumed to be able to price risk properly and scale it against return. Sometimes they might get it wrong but the shareholders would pay the price and the market would cleanse itself of this bad capital. More efficient capital would take its place.

The crisis has shown what non-mainstream economists knew all along – this was a pipedream forged by excessive consumption of textbooks and academic literature that bore no resemblance to the real world. Further, the “belief” was always a lie. The “optimal” results they claimed were derived in theory using models that relied on very restrictive assumptions for their conclusions.

Typically, if one or more of those assumptions failed to hold – then bingo, the overall conclusions were then unfounded. But in their missionary zeal to convince us that the self-regulation route was optimal they forget to tell everyone about that. Obviously they knew they were conning the general public and tilting the playing field to deliver massive returns to the elites. The mainstream economics profession essentially is a tool for the wealthy and powerful.

The IMF paper then articulates how they believed fiscal policy justifiably “took a backseat to monetary policy” and “(t)he reasons were many”:

first was wide skepticism about the effects of fiscal policy, itself largely based on Ricardian equivalence arguments. Second, if monetary policy could maintain a stable output gap, there was little reason to use another instrument. In that context, the abandonment of fiscal policy as a cyclical tool may have been the result of financial market developments that increased the effectiveness of monetary policy. Third, in advanced economies, the priority was to stabilize and possibly decrease typically high debt levels; in emerging market countries, the lack of depth of the domestic bond market limited the scope for countercyclical policy anyway. Fourth, lags in the design and the implementation of fiscal policy, together with the short length of recessions, implied that fiscal measures were likely to come too late. Fifth, fiscal policy, much more than monetary policy, was likely to be distorted by political constraints. The rejection of discretionary fiscal policy as a countercyclical tool was particularly strong in academia.

So the entire litany of mainstream macroeconomic myths in one succinct paragraph. Please read my blog – Deficits should be cut in a recession. Not! – for more discussion on Ricardian equivalence.

This is one of the classic examples that I noted above – when the assumptions are so restrictive that if they fail to hold then the overall conclusion is bunkum.

The modern version of Ricardian equivalence was developed by Robert Barro at Harvard and claims that the government does spends on our behalf and raises money (taxes) to pay for the spending. When government spending exceeds taxation it has to “finance” the gap, which Barro claims is really an implicit commitment to raise taxes in the future to repay the debt (principal and interest). Under these conditions, Barro claims that if each individual will reduce consumption by the amount that they perceive taxes will increases to “pay back” the deficit.

So the government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed”.

Even ignoring the fact that the description of a government raising taxes to pay back a deficit is nonsensical when applied to a fiat currency issuing government like exist in most countries now, the RE models required several assumptions to hold for the conclusions to be made.

Should any of these assumptions not hold (at any point in time), then his model cannot generate his conclusions and any assertions one might make based on this work are groundless – meagre ideological raving.

First, individuals are claimed to be able assess the total stream of income and taxes over their entire lifetime in making consumption decisions in each period.

Second, capital markets have to be “perfect” which means that any household can borrow or save as much as they require at all times at a fixed rate which is the same for all households/individuals at any particular date. So totally equal access to finance for all.

Third, the future time path of government spending is known and fixed. Households/individuals know this with perfect foresight.

Fourth, there is infinite concern for the future generations. This point is crucial because even in the mainstream model there is no optimal prediction about when the debt will be repaid and so the tax rises might come at some very distant time (even next century).

As I am sure you will appreciate none of these assumptions is remotely true in the real world. We do not have perfect knowledge of all these developments. For example, many households have liquidity constraints and cannot borrow or invest whatever and whenever they desire. Further, if the future path of government spending was known why are all the deficit terrorists calling for a “credible exit plan” – they should know it already. Finally, our conduct towards the natural environment is not suggestive of a particular concern for the future generations other than our children and their children.

But the theory doesn’t even stack up in empirical terms. For example, Barro’s sycophants all predicted that consumption would not rise after the US Congress gave out large tax cuts in August 1981. Why? They all said that saving would rise to “pay for the future tax burden”. The data shows that personal saving rate fell between 1982-84. There has never been a successful empirical application of the theory.

So I am sorry that Blanchard still believed this up until the crisis. It was always an ideological construction to make a case against fiscal policy.

The other claims against fiscal policy fall on similar grounds – logical inconsistency and/or empirical failure.

I particularly liked the claim that “monetary policy could maintain a stable output gap, there was little reason to use another instrument”. Yes, and then along came the crisis and monetary policy has failed dramatically to rekindle growth.

Further, the reliance on monetary policy in the 1990s and the abandonment of fiscal policy as a counter-stabilising tool created years of chronic labour underutilisation. Please read my blog – The Great Moderation – where I outline how inflation targetting proponents failed to understand the size of the sacrifice ratios that were involved.

A reliance on deflationary monetary policy, inasmuch as it is effective, leaves policy makers with no encore – the only way to maintain the status quo of low inflation is to maintain high levels of unemployment. That is, the NAIRU approach. It doesn’t allow you to deal with high pressure economies. Fiscal policy is required in that context.

The only criticism of fiscal policy that has some merit is the timing issue and the danger that it can be implemented “too late” and become pro-cyclical. That is one of the reasons I advocate a Job Guarantee which strengthens the automatic stabilisers and provides immediate relief when the labour market starts to contract.

But I actually find mainstream economists who make the “timing” case to be beyond contempt. Many of them are now advocating and hectoring governments in many countries to implement, by choice, pro-cyclical fiscal policy to reduce their deficits.

That is, they are advocating policies which for years they have been claiming exemplify the reason you should not use fiscal policy. One word comes to mind: hypocrites! Several others come to mind to and they would appear as *&#))!!@# – (you can say them out aloud to yourselves).

The IMF paper also claimed that mainstream economists had:

Increased confidence that a coherent macro framework had been achieved was surely reinforced by the “Great moderation,” the steady decline in the variability of output and of inflation over the period in most advanced economies.

Once again refer to the blog – The Great Moderation – where I show why this proposition was never well-established.

The IMF paper then examines “WHAT WE HAVE LEARNED FROM THE CRISIS”. They say that:

Inflation, even core inflation, may be stable, and the output gap may nevertheless vary, leading to an obvious trade-off between the two. (This is hard to prove empirically, as the output gap is not directly observable. What is clear, however, is that the behavior of inflation

is much more complex than is assumed in our simple models and that we understand the relationship between activity and inflation quite poorly, especially at low rates of inflation.)

Note: despite all the academic articles and several nobel prizes in economics on this exact topic, the IMF now say that the relationship between inflation and activity (the real economy) is quite poorly understood. As a senior member of the profession this admission probably resonates more with me than with many non-economists.

This relationship, which I wrote a PhD about and countless academic articles and a book since, has been at the core of the debate about the appropriate design of economic policy.

The mainstream claimed that they knew exactly how this relationship worked and panned out in reality. My work and that of a minority of other economists over the years always told them they had no idea and their models were ideological constructions without empirical foundation. So this admission is particularly galling.

The IMF Report also admits that the crisis has taught them that monetary policy is ineffective at low interest rates and that:

One main implication was the need for more reliance on fiscal policy and for larger deficits than would have been the case absent the binding zero interest rate constraint.

The ineffectiveness of monetary policy, however, is not confined to so-called liquidity trap situations. The reality is that policy makers have very little idea of the speed and magnitude of monetary policy impacts on aggregate demand and consistently have held rates too high for too long before realising they were causing damage. Monetary policy is a blunt instrument that has no targetting (personal, regional etc) capacity.

We always knew that. The reason the mainstream promoted monetary policy to the fore was because they were really advocating smaller government and more free market space. Hence they had to undermine the case for fiscal policy. In doing so, they have created 3 or more decades of persistent underutilisation of labour resources in most nations; virtually zero growth in per capita incomes in the poorest nations; and set the World up for the current crisis.

After detailing problems they now recognise with monetary policy – specifically, the reliance on the manipulating the overnight interest rate and the failure of this policy stance to stimulate demand, the IMF Report then elaborated on fiscal policy:

The crisis has returned fiscal policy to center stage as a macroeconomic tool for two main reasons: first, to the extent that monetary policy, including credit and quantitative easing, had largely reached its limits, policymakers had little choice but to rely on fiscal policy. Second,

from its early stages, the recession was expected to be long lasting, so that it was clear that fiscal stimulus would have ample time to yield a beneficial impact despite implementation lags.

The fact is that policy makers relied, initially on monetary policy, as per the ideological obsession of the times. It failed. They still cannot admit that quantitative easing doesn’t do what they think it does – that is, make it easier for banks to lend. Please read my blog – Quantitative easing 101 for more on that.

In terms of the “Great Moderation”, the IMF Report asks “(i)f the conceptual framework behind macroeconomic policy was so flawed, why did things look so good for so long?”

The truth is that things didn’t look so good. Private sector indebtedness was building as governments pressured by the IMF and other groups to run surpluses squeezed the liquidity in the private sector. Labour underutilisation rates remained persistently high. Third world poverty did not significantly fall. Real wages growth was subdued at best.

What looked “good” was the surge in profit shares around the world. That fed the speculative bubble and led to the crisis.

Finally, the IMF Report addresses the “implications for the design of policy”. I found this section pretty amazing – in terms of how blaise these characters are in the face of admitting they were mostly wrong for at least 2 decades.

The summary of their policy recommendations are covered in this UK Guardian article – More inflation may be better after all, says IMF published February 12, 2010.

The Guardian say that:

IMF’s senior staff break with years of economic orthodoxy by arguing for higher inflation and more state intervention.

After years of lecturing governments on the need for low inflation and minimal intervention, the International Monetary Fund’s top economist has admitted that orthodox policies were powerless to prevent the crisis that swept the global economy.

In a stunning turnaround, Olivier Blanchard, the IMF’s chief economist, now suggests that higher inflation, help for the poor and greater government involvement might do a better job helping protect countries from financial turmoil.

The IMF Report recommends the following policy developments:

1. A higher inflation target rate of 4 percent rather than 2 percent with indexed bonds to protect investors from inflation risk. This is to avoid the “zero interest rate bound”. So you what you understand from this recommendation is that they still do not get anything about the way the system operates. They just want to produce a wider range in which they think monetary policy can work. The problem is the reliance on monetary policy. That is what has to be addressed. Low inflation is possible with fiscal policy being the primary counter-stabilisation tool. They clearly do not get that.

2. The need to expand monetary policy to include tighter regulatory tools to prevent “excess leverage, excessive risk taking, or apparent deviations of asset prices from fundamentals”. I clearly support this recommendation but would go further and outlaw speculation not linked to real activity. Please read my blog – Asset bubbles and the conduct of banks – for more discussion on this point.

3. “Strict inflation targeting is not optimal” when there are external pressures on reserves. The IMF has made it a dogma to force countries facing external pressures to maintain strict inflation targetting. Now they are saying that central banks have to intervene in foreign exchange markets.

4. “Providing liquidity more generally” to non-deposit-taking institutions and “replace private investors” when needed. However, this assumes the current structure of financial markets is retained. I would as noted under 2. above, significantly reform the financial system and rid it off significantly “private investment” which is not investment at all (in the expanding productive capacity sense) but gambling in pursuit of greed. I don’t think gamblers should ever be bailed out by government.

5. “Creating More Fiscal Space in Good Times” – to emphasis how little they understand what has happened they recommend the following:

A key lesson from the crisis is the desirability of fiscal space to run larger fiscal deficits when needed. There is an analogy here between the need for more fiscal space and the need for more nominal interest rate room, argued earlier. Had governments had more room to cut interest rates and to adopt a more expansionary fiscal stance, they would have been better able to fight the crisis. Going forward, the required degree of fiscal adjustment (after the recovery is securely under way) will be formidable, in light of the need to reduce debt against the background of aging-related challenges in pensions and health care. Still, the lesson from the crisis is clearly that target debt levels should be lower than those observed before the crisis.

I will fast track those resignation letters. I suggest interested readers consult the following trilogy of blogs – Fiscal sustainability 101 – Part 1 – Fiscal sustainability 101 – Part 2 and Fiscal sustainability 101 – Part 3. I cover the IMF notion of fiscal sustainability and fiscal space in detail.

The basic point is that all sovereign governments were equally able to deal with the crisis using expansionary fiscal policy irrespective of the fiscal position they had been following in the past. The crisis required an immediate demand injection and all currency-issuing governments were capable of delivering that through expansionary fiscal policy.

Making “room” for monetary policy is a flawed notion. Monetary policy should be reduced in importance (see this blog – The natural rate of interest is zero!) and made subservient to fiscal policy – not the other way around.

Further, pursuing surpluses in periods of growth will lead to increased private sector indebtedness unless the nation enjoys a strong net exports positions.

Finally, the intergenerational statements about fiscal policy reveal how little these characters understand about the actual policy contraints – please see Democracy, accountability and more intergenerational nonsense and Another intergenerational report – another waste of time – for more on that topic.

So after reading the IMF Report you are left with the impression that they do not really understand what went wrong and why.

Whether the mainstream has learned anything is questionable. Certainly Joseph Stiglitz is pessimistic and thinks another crisis will be required to really hammer home to policy makers the need to make fundamental changes in the way they address their economies.

The UK Guardian interviewed Joseph Stiglitz in the article (February 12, 2010) – Lesson of credit crunch hasn’t been learned on this topic.

The article noted that Stiglitz “was euphoric at the response to the credit crunch – but he believes the plans have been derailed”. He lists the demolition of Greece by the ideologues of the EU, the bankers “behaving as if nothing has changed since August 2007”, and the fact that the two main political parties in the US are devoid of answers and the “political running … is being made by the right-wing anti-state Tea Party”.

He was quoted as saying:

There was a moment of euphoria when we were all Keynesians … Those ideas were working and every government stood behind them. It was not just Keynesian macro-economic policies, it was the need for regulation and the recognition that economics had failed … [but] … Plans to re-regulate the financial markets have run into a political quagmire and there has been a resurgence of deficit fetishism … [and given how fast the forces in favour of the pre-2007 status quo have re-grouped] … The optimist in me is hopeful we won’t need another crisis to finally motivate the political process … The pessimist in me says it may need to happen.

The article recounts the lobbying by one Larry Summers to get Stiglitz removed as World Bank chief economist when he strongly objected to the “deflationary policies imposed on Asian countries by the International Monetary Fund in the late 1990s”.

In terms of the recent trends he does not think “the pick-up in growth across the global economy in the latter half of 2009 will” last.

His recent focus has been on Greece where the speculators are are driving the country into ruin and Brussels and Franfurt are largely standing idle:

If the central bank is prepared to provide liquidity support for banks it should be able to provide it for countries … Governments had to come in after the banks mismanaged what they were supposed to do. The financial markets are now criticising countries for picking up the pieces after the financial markets failed. They are demanding the wages of workers be cut but bonuses be allowed to continue. This is an absurd situation.

I thought that last comment was excellent. It could be re-phrased in the following way. The dirty bastards got to smart for their own greed and brought the global financial system to the point of collapse. Their own organisations were insolvent including GS. They had their hands out very quickly for public support to bail their failed organisations out. Once their positions were secure again on the back of the public money they are now against the other casualities of their incompetence being assisted.

Given the article was in a UK newspaper, Stiglitz noted that the opposition treasury spokesperson (George Osborne) was a great example of a “deficit fetishist” and was “(i)ncredulous at the idea that the Conservatives would cut spending when the economy is barely out of recession”.

Conclusion

I will send them the mea culpa script once I have finished drafting their resignation letters.

Also does anyone have a mailing list for all the economics departments around the World? They will get the draft resignation letters too 🙂

It is quite amazing how arrogant these characters are.

Quote of the day

I received incoming traffic overnight from some site where lunatics on the Austrian school fringe (gold standard liberatarians) were talking about Warren Mosler’s recent TV appearance. One of them said:

As Hugh Hendry told another Keynesian economist the other day, “Um, hello? Can I tell you aboot the reel world?…” Every conversation with Keynesian crackpots should begin like that.

I immediately realised this moron hadn’t enjoyed the benefits of the Keynesian period being obviously deprived of a solid, well-funded by government, primary school education where they taught us to spell correctly.

That is enough for today!

Dear Bill,

“I … would go further and outlaw speculation not linked to real activity.”

Could you explain how this can be achieved? I believe this is a crucial element of any attempt to implement MMT because unconstrained deficit spending targeting unemployment may in my opinion lead to adverse reaction of the “markets” (investors or speculators).

However the only successful attempt to outlaw speculation I am aware of was implemented with the help of (former) Polish aristocrat Feliks Dzierzynski.

A recent interview of Blanchard in Les Echos: http://www.lesechos.fr/info/inter/300407227-olivier-blanchard-il-est-indispensable-que-les-banques-centrales-laissent-leur-taux-d-interet-tres-bas-.htm

I am absolutely loving this Bill. Keep on laying the boot into the bastards.

Hi Bill,

Post-Keynesian monetary economist can be classified into two main groups:

1) Chartalist such as your-self and Randall Wray 2) debt-deflationist/circuit theorist, such as Fisher, Graziani, Minsky and Keen.

Can you educate us about the main differences between these two schools of thought. The other day I was watching Steve Keen on TV saying that both neo-classicals and chartalist have got it wrong and debt-deflationist were the only minority economists who successfully predicted the current grobal financial crisis. Is this true in your opinion ? If not, can you briefly comment why not ?

I would very much appreciate your comments.

Cheers,

Sriram

To comment on Sriram, these labels seem much confusing. Quite recently, in Modern Theories of Money, a book edited by Rossi and Rochon, Parguez, a well-known circuitist, attacked Minsky -and indirecty, thus, the works of both Keen and Fisher. So it is unclear how they would form a unified corpus of thought.

Whether Minsky himself was a Post Keynesian is debated, since Davidson has not been too willing to let him use the label -or rather, as his disputes with Dow or Lavoie seem to show, does he enjoy anyone else having it.

Furthermore, I am not sure if Bill, for instance, would consider himself more of a heir to Keynes or to Marx.

This is to say that I do no think labels provide any good guide to the understanding of theoretical paradigms and its subtleties: direct reading of the works of the authors you quote, irrespective of their claims to academic niches, may be a better way to acquaint yourself with the topics under discussions.

K and Sririam

Chartalists/MMT’ers are most definitely Minskyans. Randy Wray is Minsky’s best known former student, after all. The sector financial balances approach based on income accounting identities is very Minskyan, even though Keen doesn’t use it. Aside from that, Keen is quite Minskyan, but it’s a pretty big difference and Minskyans like Wray/Tymoigne/Papadimitriou would argue that it’s really central to understanding Minsky’s approach to policy.

The other day I was watching Steve Keen on TV saying that both neo-classicals and chartalist have got it wrong and debt-deflationist were the only minority economists who successfully predicted the current grobal financial crisis. Is this true in your opinion ?

Sriram, check out James K. Galbraith, Who Are These Economists, Anyway?. He answers Krugman about who got it and why, naming five groups. Interesting paper. The first are the Marxists, and the second Dean Baker, et al. Chartalists are a subgroup under his third category, people that not only got it right but explained it theoretically, namely, those influenced by Wynne Godley’s stock-flow consistent macro modeling. Minsky’s followers are his fourth group, and people influenced by his father are the fifth.

Chartalists make the vertical-horizontal distinction between government money and bank/credit money. Debt-deflation belongs to the horizontal level. It often becomes confused when government debt is lumped in with private debt. MMT fully agrees with debt-deflation in the private sector and shows who it relates to government fiscal policy when the government runs surpluses, depleting non-government net financial assets and causing consumers to go into debt in order to maintain their lifestyle.

Circuitism is chiefly concerned with credit money created at the horizontal level, and MMT is in agreement that money supply is endogenous and under the control of banks through lending, in which the CB plays little role in influencing other than through the interbank overnight rate that affects spreads in the commercial banking sector. What Chartalism adds is the fiscal understanding necessary for government to break the fall, limit the damage, and recover.

K: “Furthermore, I am not sure if Bill, for instance, would consider himself more of a heir to Keynes or to Marx.”

K-Marx?

😉

(For non-U.S. readers, K-Mart is a rival to Walmart.)

This is an anachronism, I believe. Keynes learned from Marx. Marx’s classical analysis was already outdated in Keynes’s time, but Keynes assimilated elements of Marx’s critique to challenge the prevailing New Classical model. The fundamental debate was and continues to be over Say’s law, that is supply side vs. demand side in modern terms.

Simply speaking, surplus value is what is created in excess of what would be produced with everyone growing their own beans. Historians agree that civilization began with surpluses, and all economics is based on the production and distribution of surplus value. Since the marginal revolution, modern economics focuses on marginal effects. Technology greatly increases the marginal effects through increased productivity.

Capitalists claim the bulk of the marginal effect of technology rightfully belong to them because innovation comes through investment and the risk involved. However, this influences distribution of income and wealth in a way that leads to greater and greater inequality. One could say that this is one of the key contemporary challenges for modern society, as common people are driven increasingly toward debt peonage to support a middle class lifestyle, while the growing number of poor is written off.

Marx was undoubtedly correct about this fundamental historical step, and this was a fundamental insight. Demand side pays particular attention to surplus value and its distribution because that affects demand, and supply adjusts to demand. How that surplus is distributed marginally affects the velocity of money as a measure of the number and size of transactions. It also affects the level of private indebtedness. Hoarded profit and rent-seeking sap demand at the bottom, unless debt increases or fiscal policy intervenes to adjust distribution, e.g, through progressive taxation, social programs, and transfer payments to the needy.

Keynes recognized that laissez-faire systems result in money flowing to the top, with consequent pressure at the bottom. Keynes took Marx’s revolutionary program seriously as a threat to capitalism, and it was seriousa serious threat at the time of the Great Depression, with the growing power and influence of Marxism-Leninism in the world. FDR is called a “socialist,” but he like Keynes, realized that a compromised was required. FDR was actually a centrist in his time. Both realized that a more equitable system was required to avoid social unrest, and this would involve a demand-side solution such as the New Deal. Keynes did not just spin the General Theory out of his head. He had a purpose, and this purpose was very much influenced by Marx, both positively and negatively. History, including economic history, is dialectical.

Post Keynesian economists have been more influenced by Polish Marxist Michał Kalecki (1899-1970) than Marx himself.

Interesting post and comments on Keynes and Marx today at Robert Vinneau’s place for those interested in this stuff.

Steve obviously wasn’t reading any chartalist literature since the late 1990s or he wouldn’t have said such a silly thing. Again, Charatalists/MMT’ers are Minskyans and I don’t understand why he won’t acknowledge that, and, again, his lack of understanding of Chartalism leads him to think somehow Chartalists aren’t utilizing the horizontalist/debt deflation/Minskyan framework he uses, but with the vertical component added in as Tom notes. Go and read the Strategic Analysis reports every 3-4 months or so at http://www.levy.org since the late 1990s and you will see the financial sector balances approach espoused by Bill frequently here at work.

This is off topic, but the Atlanta Fed seems to think that boosting bank reserves will boost lending. See

http://macroblog.typepad.com/macroblog/2010/02/the-punch-bowl-the-party-the-exit.html

Everyone send them a message explaining MMT!

“Both” in the Keen’s video link posted here referred not to Neoclassicals and Chartalists but his points (a) and (b) about Neoclassicals. The points (a) and (b) were that Neoclassicals thought a crisis cannot occur and that the government cannot simulate the economy. In fact he said that the only people who have “come out of this smell like roses” were the group associated with Bill Mitchell and that he (Steve) was halfway between the rose and the thorn and that the government did manage to simulate the economy.

Not defending Steve Keen here – I try to pounce on every opportunity to criticize him and try to get him on the right track on his blog 🙂

OK . . . I saw that in the video, too, but thought Sririam was referring to something else. I’ll retract if not. Steve does at least get right what we are predicting, but I think he’s a bit too hard on himself in that video . . . I think his “mistaken prediction” according to his detractors is taken out of context and that most everything that’s happened there with housing prices falls into his framework fairly well (which, again, is the same framework we use when we are discussing the “horizontal component,” so there should be no surprise I agree with him on that score). I’m no expert on housing in Oz, though, so Bill or someone can correct me if I’m wrong.

Off topic –

My Sisyphus weekend:

http://macromarketmusings.blogspot.com/2010/02/feds-exit-strategy.html

including, among about 100 other things, an indirect response to the Atlanta Fed piece

I noticed the following comment in LR Wray’s blog today:

http://neweconomicperspectives.blogspot.com/2010/02/why-do-progressives-claim-that-deficits_5168.html

Anonymous said…

Thanks for the comments. Let me briefly organize some responses to a couple of common themes expressed in them

1. The politics. Of course, I purposely was a bit over the top. Many progressives simply do not know enough about macroeconomics and especially accounting to understand the issues. So they extrapolate from personal household finance to the govt as a whole. That is why I wrote the first piece. However, there was also a decision made to push the deficit mania, specifically as a response to the Republican attack on SocSec. With regard to the public perception–exactly why does the public hate deficits so much? Because both parties and all recent Presidents wail about the deficits. At any time the Dems could stop playing that game. It would disappear from polite conversation. It is not a real issue. Unemployment is a real issue. Refocus.

2. MMT: where does it work? Are there limits? First what many do not understand is at the most basic level, MMT is not really a theory (note I called my book Understanding Modern Money–and others came up with the MMT designation, somewhat misleading). It is a description of how sovereign currencies work. It is not a proposal, it is an explanation. Sovereign govts spend by crediting bank accts, tax by debiting them, sell bonds to offer interest earning alternative to reserves. Period. Not a theory. Not a proposal. It really works that way. In the US, in Japan, in the UK, in Turkey, in Brazil, in Canada–the list goes on and on. It is not limited to the biggest countries, nor to the country that issues the reserve currency.

Now, yes, we do use this understanding to make policy proposals–a different issue. So “where does MMT work best”–is not the right question. Rather, “which sovereign nations use their monetary system to the greatest effect in serving the public purpose?”. Yes, Scandanavia is probably the best example. Many european nations before the Euro would also qualify. However let me be clear: the US has also achieved great things, especially since WWII. We have often used the monetary system in the public interest.

3. Greece, Zimbabwe, Germany 1920s, Argetina 1990s–all examples of the problems faced by countries that are not sovereign–that is that do not issue a sovereign currency. Hence are not counterexamples at all–indeed they prove the point of MMT: adopting a sovereign currency and taking advantage of the benefits it provides is by far the best strategy. LRWRAY

FEBRUARY 12, 2010 9:36 AM’

It appears that LR Wray’s definition of MMT (‘it is not a theory’) is at odds with the definition employed by B Mitchell. Would appreciate clarification.

What Wray apparently meant is that MMT is different from typical economic theories based on assumptions. It is not purely hypothetical, in the sense of theory as opposed to fact, that is, or something unproven in contrast to something empirically established.

MMT is descriptive, or “naturalistic.” It describes how the modern monetary system functions operationally, and it does this in terms of national income accounting and stock-flow consistent models. See Bill’s post, Stock-flow consistent macro models.

However, modern monetary theory is correctly called a theory in the scientific sense of being both descriptive and predictive. Understanding how the system functions operationally allows generating conditional propositions (hypotheses) that predict future outcomes, and these hypotheses can be corroborated based on the expected outcomes. The reason MMT is not based on assumptions is that it is based instead on accounting identities and standards, and available data, e.g., reported by governments.

In contrast, neoliberals like Milton Friedman neither pretend that their models are predictive, nor that their assumptions are empirically-based. They are said to be merely heuristic and meant to be taken as such. For example, a great deal of economic reasoning is based on static models and certeris paribus, when it is not possible to hold all things equal in a dynamic system in which complexity rules. Of course, the reality is that these models pass for gospel, and they are used as dogma in policy-making.

MMT shows that many of these models are based on an erroneous conception of the monetary system, so they are not effective even heuristically. Bill is pretty deft at this.

JKH, awesome. I had picked up the link from Winterspeak, but thanks for providing it here. I always like to keep abreast of what you are saying about the workings of the banking system. Very clear and totally operational.

Interesting how the economists keep thinking (and insisting) that abstract theory trumps actual operations. What can one do with that? What ever happened to reality-based?

Dear William

Thanks for your question – I think it is a good one.

My view is as follows.

MMT is certainly built on national accounting insights with a robust adherence to stock-flow consistency using proper accounting conventions. In that context it is a description of how sovereign currencies work as per Randy’s point. Mainstream analysis and pure credit models fail this accounting tests in my view.

But behavioural elements also have to developed to explain why the flows are what they are. For example, you have to theorise about the nature of aggregate supply so that you can make statements about the inflationary potential of an expansionary fiscal policy. You have to theorise about the likely impacts of monetary policy changes to motivate sound empirical research that can establish that it is so bound up in distributional complexities that it is unlikely to be effective in normal bounds of interest rate adjustments.

Other examples might be the fact that you have to understand labour supply behaviour to really appreciate the labour market dynamics that follow a slowdown or increase in aggregate demand. You also need social theories of the impacts of joblessness and the way in which training effectiveness is maximised to design effective job creation programs under the general heading of a Job Guarantee. I could go on but I think the point is made.

All those theoretical elements are integrated within the accounting elements. That is why I call it MMT and I do not consider it to be a misleading terminology.

best wishes

bill

Tom,

Thanks.

I’ve now gone through a very similar process with three monetary economists – Scott Sumner, Nick Rowe, and David Beckworth – with very similar results. It is impossible. It’s as if they are surrounded by deflecting barriers. (Paul McCulley of PIMCO sent me a nice email compliment once about trying to convert “high church monetarists”, but then said it was hopeless – i.e. conversion to a state of knowledge about basic monetary operations and accounting, which he also understands very well.)

I’m reading your comments as well. I’m quite astonished actually about how quickly your MMT knowledge has become so comprehensive and impressive. Your background and your interest in it must have allowed you to zero in and simply absorb it in context of your broader economic knowledge. But that makes me wonder why some of these others are so reflexive in their rejection of stuff they clearly haven’t thought about.

BTW, I viewed Mosler’s CNBC video a second time and thought it was excellent as is. Now I don’t know why I had any critique about his presentation at all. Strange – there must be a name for it in psychology.

E.g. “The government doesn’t have or not have money” – superb.

JKH

I followed your conversation over at that link from Winterspeak as well, followed as in “read it”, not totally able to understand it ( I KNOW you are correct though). I think you made some headway with them. Their story is much less coherent and I think they realize it. They’re just not sure (yet) that your view answers all their questions.

Regarding Warren on CNBC, I had my wife watch him and tell me what she thought. She would be an example of an intelligent voter who has no marriage to any of the economic ideologies who is pretty common sense (when I talk to her about the fact that we cannot “run out of money” that it is merely a distribution issue she totally gets it). Her response was luke warm, because he is not persuasive enough. He didnt APPEAR to believe in his own view strong enough to convince anyone that might be in the “convinceable” camp. Now this is just one persons opinion but I think he does need to work on his delivery. Like it or not we need emotional attachments to ideas. It is the emotional attachments to gold standard thinking we are trying to overcome. So we need to create a new emotional anchor regarding money. It will not be easy but once it happens it will be difficult to unhitch as well. Somehow Warren needs to convey passion and conviction without being wild eyed and crazy. We also need more than Warren as well. Randall, Marshall and Scott need to get into more venues besides comment sections so they can be seen and create a bond with those that can be persuaded. There is that 20-30% that will never be persuaded but the rest are up for grabs

Greg,

I agree. First impressions are important, and the fact it appealed more on replay may be false comfort. The technical message needs a different lead in and context, somehow.

Greg, JKH, First impressions are important, and the fact it appealed more on replay may be false comfort. The technical message needs a different lead in and context, somehow.

Agreed. A good start, but needs sharpening up.

(We’ve all comment at Warren’s place here.)

JKH: I’ve now gone through a very similar process with three monetary economists – Scott Sumner, Nick Rowe, and David Beckworth – with very similar results

I’ve read the latter two, but I don’t have the Scott Summer link. Do you have it still?

I’ve interacted with him, too, not always on MMT specifically. He has his agenda and admits it. He is writing a book on the Great Depression so I asked him if he had integrated Fisher’s theory of debt-deflation and Minsky’s financial instability hypothesis. He said he was aware of Fisher but hadn’t read Minsky and wasn’t about to. He just didn’t want to go there, even though this is central to any discussion of that era in terms of monetary policy. For someone coming from another field where doing this would pretty much disqualify one’s work from being considered serious, it makes me wonder about the standards of scholarship in mainstream economics. You can’t just decide to ignore major contributions to the literature that impact your work.

I’m quite astonished actually about how quickly your MMT knowledge has become so comprehensive and impressive.

Thanks for the kudos. I owe it all to my teachers. 🙂

Seriously, as a kid I made it a practice to hang out with people who knew more than I did, as well as to try to find the people who really knew the most. This has served me well, and I learned that people who really know what they are talking about can explain it clearly, precisely and concisely. Once you get the key fundamentals of a subject, you can build quickly on that solid foundation. A word to the wise.

Very inetresting conversation. Several issues concern me that I try to address in my work although many find difficult to understand; my mistake. Surprise is not involved in the discussion! Dialectical analysis is needed using reality as a non-monotonic reaction to occurence, whether we address economic or other issues. Reality is reaction(vertical,horozontal) to occurence and its surprise brings an impact whose feedback consists of recovery and impression. Reaction incorporates behavior which is not independent but a response to occurence operation bounded by imperfection, friction and complexity. The “curse” of complexity as an entropy of reduction brings excessive behavior motivation or speculation which occurence attampts to moderate with policy. However, surprise impact complexity brings entropies of inertia and illusion that feedback upon behavior and policy as shortfall of operations and exclusion of behavior and policy. Examples of shortfall will be discouragement issues, of behavior(decision, praxis) will be rationing and policing rationing (ie., tax evasion by speculators) and corruption by policy agents. Impact variation is not a single process but displays a private (interest,competition) in a market domain and a public(duty,solidarity) in a community orientation. Private orientation tends to amplify excessive behavior, market power and the shortfall and exclusion effects. The discovery of surprise is only gradual and staggered as we solve enigmas and that is what makes living possible.(For the Greek philosophers this is called “vioma”, the essence of being). Most ideas are not new and the significance of any framework of analysis is the taxonomy of the concepts it uses. And something in the news; AUSTERITY is wrong and POSTKEYNESIANs are right! Keep the faith alive!

Good analysis, Panayotis. There’s a lot there to unpack and articulate. In referring to your work, I assume you have done this or are doing it. Link?

Thank you for your interest Tom. There is a long manuscript which circulates among friends for comments. I have also sent it to Bill. Please send me an email note at takiecon@hotmail.com and I will send it to you with pleasure.

“Blanchard has his own textbook which is as bad as the Mankiw’s book – the so-called Barbeque Lighter.”

Agreed. So what textbooks are you recommending? Thanks.