The other day I was asked whether I was happy that the US President was…

A Greek tragedy …

Today I have a wind in my sails and I am heading for Greece. I am wondering if any modern day Ulysses will find much of their homeland left given current trends. The current situation in Greece exposes the stupidity of the Euro monetary system. The Greek government is running a rising budget deficit in response to the economic crisis that it faces. Much of the budget change is being driven by the automatic stabilisers. Meanwhile the financial markets are playing their usual (unproductive) tricks and making matters worse. Sitting in the middle is the undemocratic ECB which is insisting on fiscal consolidation. Pity the poor Greeks who are increasingly without work. The solution is not straightforward but I would abandon the Euro and restore currency sovereignty.

Greece is currently facing on-going street riots as so-called anarchists prompt widespread protests against government policy. The situation is sure to get worse if the Greek government actually starts cutting its budget deficit.

As an amusing aside, the Greek Kathimerini English Edition carried the following headline – Deputy parliamentary speaker insists children not anarchists. One wishes they were. It would be every parents dream that their children bucked corrupt croneyism. For your own amusement, the report said that:

… deputy Parliament Speaker Grigoris Niotis, whose two children were taken into custody following a police raid in Keratsini near Piraeus on Saturday, insisted yesterday that the property known as “Resalto” where they were arrested was a “political and cultural, self-managed cafe” and not “a hideout for the manufacture of illegal explosives”. Niotos’s 30-year-old daughter, a lawyer, and 28-year-old son, a postgraduate student, were among 22 people arrested at Resalto after officers discovered materials they believe were going to be used to make Molotov cocktails … A group of 41 protesters briefly took over Keratsini Town Hall yesterday demanding the release of those arrested on Saturday but eventually gave themselves up to police.

I loved the description of a political and cultural, self-managed cafe rather than a hideout with bombs.

Meanwhile the first-world (US, UK, Denmark, Australia it seems, and others) have been sprung trying to stitch up a dirty (excuse the pun) deal in Copenhagen that the Guardian unveiled overnight. The Guardian reports that the contents of the deal would:

– Force developing countries to agree to specific emission cuts and measures that were not part of the original UN agreement;

– Divide poor countries further by creating a new category of developing countries called “the most vulnerable”;

– Weaken the UN’s role in handling climate finance;

– Not allow poor countries to emit more than 1.44 tonnes of carbon per person by 2050, while allowing rich countries to emit 2.67 tonnes.

That seems straight-forward. Hatched by our Nobel Peace Prize winner and his other first-world mates (Australian PM Rudd has not denounced it I note) to maintain the hegemony that our rich nations enjoy. The only problem for the existing wealthy nations is China. Deals aside, when it starts to spread its wealth internally and there are increased claims on energy the rest of us who have been enjoying cheap energy will get a shock. We saw some of it in the recent oil price hike that preceeded the financial collapse.

Anyway, Greece is my focus today. This is in response to several E-mails I have received asking me to explain what is going on. As background you may like to read this blog – Euro zone’s self-imposed meltdown.

In summary – when you decide to voluntarily choke yourself you may as well do a good job of it. Is there any short and easy solution: stop voluntarily choking yourself.

The Euro monetary system

To understand the workings of the EMU system you might like to read this 2008 ECB paper. You will read that:

With the launch of the euro in January 1999, responsibility for the single monetary policy in the euro area was transferred to a supranational central banking system: the Eurosystem. It comprises the European Central Bank (ECB) and the national central banks (NCBs) of those EU Member States that have adopted the euro.

Within the Eurosystem, almost all of the operational matters pertaining to the monetary system are conducted by the NCBs except under the unified “federal” role of the ECB, where the “centralised agreement by the Governing Council of the ECB on monetary policy and other Eurosystem-wide matters ensures that decisions are timely and efficient”.

It is the Governing Council that “sets interest rates based on consensus”.

I laughed when I read (on page 13) that:

Modern central banks have chosen to be accountable to citizens for their monetary policy. This helps monetary policy to better anchor inflation expectations and enhance its credibility. Accountability is the legal and political obligation of a central bank to explain and justify its decisions to citizens and their elected representatives.

So when do we get to vote out the RBA (or the ECB) board of governors? Never. Even changing the government doesn’t allow us to particularly influence who sits on the boards of the central bank.

This is one of the problems of the neo-liberal era which has created these so-called independent central banks. There is not accountablility that matters despite them telling us that some releases of minutes (which just mouth motherhood statements) etc allow us to be part of the decision-making process.

The rules under which the Euro monetary system operates were laid down in the Maastricht Treaty, which was signed on February 7, 1992.

Article 105(1) of the Treaty defines the main mission of the ECB to maintain price stability – that is, “safeguarding the value of the euro”. Further, and “without prejudice to the objective of price stability” that ECB will support “general economic policies in the Community” as laid down in Article 2 which includes: “a high level of employment, sustainable and non-inflationary growth, a high degree of competitiveness and convergence of economic performance”.

Note the real things – employment and GDP growth – are not to prejudice the price stability goal.

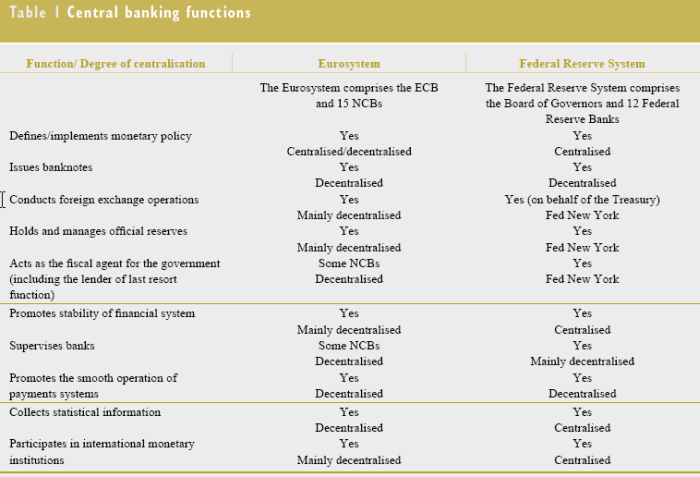

The following Table (which is Table 1 in the ECB information paper) provides a comparison between the way the ECB and its decentralised NCBs work in relation to the Federal Reserve system in the US. The model is very similar in fact, except and significantly, the nations of Europe conduct fiscal policy individually whereas the US government has its fiscal policy aligned with the monetary domain. That is, of-course, crucial.

To understand how they conduct monetary policy you might like to read this very long 2006 ECB document.

On page 31 you read:

Unlike monetary and exchange rate policy, the responsibility for economic policy has largely remained with the Member States.

Further member states are required under the Treaty to conduct their economic policies (that is, fiscal policies) “with a view to contributing to the achievement of the objectives of the Community” and under the Stability and Growth Pact guidelines or Broad Economic Policy Guidelines.

Pages 32 and 33 provide some interesting insights into the constraints on fiscal policy. The ECB recognises the “asymmetry between the monetary and economic aspects of EMU” which “implies that there is no “EU government” in the same way as there are national governments”. But they claim the constraints on fiscal policy at the national level “ensure macroeconomic stability, provided that the policy-makers respect them.”

The reality is that until now the system has not really been stress-tested. Fiscal rules that prevent a national government from using its fiscal capacity to protect its citizens from the vicissitudes of recession are liable to breakdown politically when times get tough.

The Greek situation is a case in point, although there are always stories circulating that the Greek government is corrupt and there is a lot of waste in its public spending. Whatever waste there is the situation is still poor.

So what can a Euro national government do? The Maastricht Treaty “contains several provisions aimed at ensuring sound government finances”.

First, the SGP requires that “Member States shall avoid excessive government deficits” (Article 104), which are defined as a “reference value for the government deficit-to-GDP ratio of 3%, and a reference value for the government debt-to-GDP ratio of 60%.” There is an “excessive deficits procedure” which sounds like the Spanish Inquisition that is invoked should there be a failing by a member state.

There is some tolerance for ratios above this if GDP falls by at least 2 per cent in any year. A fall of 2 per cent is very large and would result in very significant increases in unemployment. So the Treaty will allow significant rises in unemployment before it tolerates governments doing something about it.

Second, the Treaty contains provisions that prohibit any:

… monetary financing of budget deficits and of any form of privileged access for the public sector to financial institutions. Article 101 of the Treaty forbids the ECB and the NCBs to provide monetary financing for public deficits using “overdraft facilities or any other type of credit facility with the ECB or with the central banks of the Member States”. Article 102 of the Treaty prohibits any measure that may establish privileged access to financial institutions for governments and Community institutions or bodies.

There is also a “no bail out” clause such that “neither the Community nor any Member State is liable for or can assume the debts incurred by another Member State (Article 103)”.

I thought that background might help you understand the dilemma that a national state faces in the Euro system. In joining the EMU they surrendered their currency sovereignty in the same way that a nation with a fixed exchange rate and fiscal rules foregoes their currency options.

The introduction of the EMU was in in three stages with the “third and final stage” commencing in January 1, 1999 with the:

… irrevocable fixing of the exchange rates of the currencies of the 11 Member States initially participating in Monetary Union and with the conduct of a single monetary policy under the responsibility of the ECB.

Greece and the Euro monetary system

Greece joined the EMU two years later on January 1, 2001 and threatens to undermine the stability of the entire system.

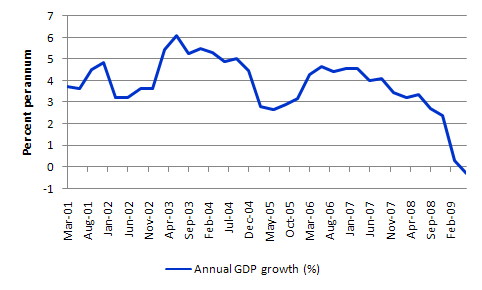

The following graph shows the recent history for annualised Greek GDP growth. All data is available from the National Statistical Service of Greece, although I used a combination of OECD MEI data and the Greek Statistical Office data (for most recent observations). The European Commission is forecasting the Greek economy to contract by 1.1 percent this year and 0.3 percent next year, before growing 0.7 percent in 2011. If there is no major fiscal intervention, then this will have serious labour market consequences.

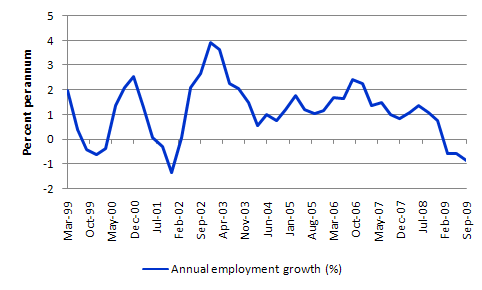

The next graph shows annual Greek employment growth from March 1999 to September 2009. The plunging real output level is having a clear impact.

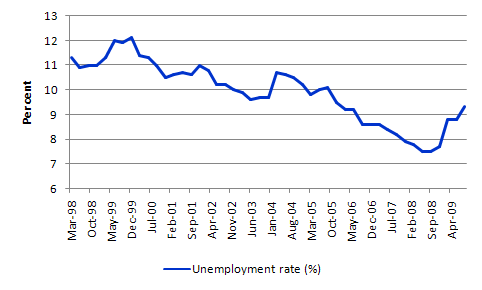

Finally, Greece has endured a persistently high unemployment rate for many years. In recent years, it fell to a decade low of 7.5 per cent but this was in part a reflection of a declining labour force growth rate.

Clearly, unemployment is now rising again and in September 2009 it stood at 9.3 per cent and rising. Underemployment is also rising. Taken together, the real data is not encouraging. If the EC GDP growth forecasts are correct then the official unemployment rate will rise substantially given that labour force growth in the year to September 2009 was around 1.1 per cent and has averaged around 0.9 per cent per annum over the last decade.

With modest productivity growth combinined with the new entrants, GDP growth has to be over 1.5 per cent and closer to 2 per cent per annum to produce enough jobs such that the unemployment rate starts falling. That is a long way off on present trends.

The problem is this. The Greek government facing a major worsening of its economic situation has done what any reasonable fiscal authority would do and that is to expand its budget deficit. A significant proportion of the rising deficit is being driven by its automatic stabilisers which is normal and sensible.

The financial market reaction is also being conditioned by the fact that after the October election, the incoming PASOK socialist government in Greece, which smashed the conservative New Democracy into opposition, revealed that the budget deficit was in fact 12.5 percent of GDP rather than around 6.0 per cent as had been held out by the conservatives.

Clearly it is also about 4 times higher than the Eurozones’s SGP and because GDP growth has not collapsed completely (below 2 per cent) the outcome will be classified as an “excessive deficit”.

You can easily appreciate the nonsensical nature of the SGP fiscal rules in this situation. With GDP growth falling and unemployment rising the deficit will continue to increase as a result of the automatic stabilisers. In this environment prudent government fiscal policy will increase the deficit even more especially given the inflation rate is falling sharply and at November was 1.2 per cent per annum.

Initially, the government said that it would make cuts and the financial markets assumed that the ECB would provide liquidity if needed. However, in recent days the financial markets have shifted gear by increasing the spreads on 10-year Greek government bonds compared to the German Bunds, which are the benchmark asset in the Eurozone. The spread is now above 221 basis points (Monday) whereas in early October it was around 130 basis points.

Credit default swaps covering Greek government debt has also risen from 124 (October 5) to 191 basis points (December 7).

The major reason for the spreads widening is that the ECB has revealed that the Greek central bank (an integral part of the Eurosystem) has:

… tried to discourage local banks from receiving 12-month funds at the ECB’s facility on December 16. Local banks are major buyers of Greek government bonds, using the ECB’s facilities …

Note: this claim was in the financial press (Source). I have not been able to find anything at the Bank of Greece or the ECB to verify it. I am still searching. If anyone can point to an official communiqué it would be helpful.

But what it means is that the local banks will now find it “more difficult to bid for large sums of Greek government bonds” (Source) which will force the Greek government into international capitla markets for funds.

The Greek central bank is thus forcing higher borrowing charges on the Greek government in some misguided attempt to impose “market discipline” on them.

This means that to satisfy the ECB, the government will have to further reduce spending (or raise taxes) to pay for the rising interest service payments and pursue significant fiscal contraction. The ECB President has been making bullying-type statements about the need for Greek fiscal consolidation.

All this fits in with the desires of the conservative press. In terms of solutions, the Kathimerini English Edition (Monday November 23, 2009), says that:

… the answer is clear: First, it will have to reduce the 2010 budget deficit by including more spending restraint, i.e. by eliminating all subsidies to the railways and Athens transport companies as well as the privatization of some state companies.

Secondly and more important, it will have to come up with a credible medium-term plan to control primary spending and do away with public sector waste, while broadening the tax base by tackling tax evasion. To be credible, the plan has to be binding and this will require the consent of the two major political parties at least. In such a plan, the reform of the social security system will have to take a prominent role.

In addition, all this will have to be done within the next six to eight months.

The Greek finance minister however is clearly bowing to the pressure from the financial markets. The Government is claiming it will shave some 2.6 per cent of GDP off the deficit in 2010. Their first attack appears to be public sector pay and employment. The finance minister told the media yesterday (Source) that:

The government is proceeding with a plan … We will do all that’s needed to bring the deficit down in the medium- term. We will submit a supplementary budget if needed … [there will be] … fair fiscal consolidation …

This statement follows the decision by Fitch Ratings to downgrade Greek government debt to BBB+. S&P have already downgraded their rating and are threatening a further downgrading in the coming weeks.

So what does that mean? In previous blogs I have written that the ratings agencies are irrelevant to sovereign debt. Please read my blog – Ratings agencies and higher interest rates – for more discussion on this point. So for Japan, which has been regularly downgraded by the cretinous agencies, some of whom have now been found to have given favourable ratings in return for payment, the ratings are irrelevant.

But for a member state of the EMU the situation is different. First, they are not sovereign, having surrendered that status when they entered the union and agreed to the Treaty with its oppressive rules that were designed to hamper the reasonable conduct of fiscal policy.

Second, the one avenue for funding within the community may be closed to Greece as a result of the downgrading. What am I referring to here? Like all agreements, flexibility to bend rules always seems to be in there somewhere. The EMU Treaty is no exception.

The ECB responded to the crisis by relaxing its quality conditions on loans to member governments. Previously, its minimum required rating was A- but it relaxed this last year to BBB-. The ECB has said it will revert back to A- by the end of 2010.

As an aside, in my recent book with Joan Muysken – Full Employment abandoned, we show how this loan facility effectively means that the ECB guarantees national government debt as long as it is of a sufficient “quality”. I suspect the ECB will always guarantee it anyway if push comes to shove.

The way this loan facility works is that the banks can pledge bonds issued by their government to get loans from the ECB. If the ratings agencies downgrade the Greek sovereign debt further, then the ECB may cut off this source of funding.

But if the central bank is choking off this facility as above, the ratings assessments are irrelevant anyway.

Conclusion

Is the Greek government close to default? Answer: not even near it. The ECB will not allow that to happen. It would destabilise the Euromonetary system. The financial crisis has exposed the cracks in the arrangement. But as long as the citizens do not revolt as the real sector is squeezed the ECB will keep funding the Greek government.

The reality is with the real economy heading south at a rate of knots, the budget deficit will prove difficult to cut. If the Greek government actually succeeds in making discretionary cuts it faces a backlash from the automatic stabilisers.

It is possible that there is so much waste in the system – that is, spending that is in some way phantom. My take is that all spending is probably adding to aggregate demand whether it is corrupt, wasteful or otherwise. So it will be difficult to cut the deficit without seriously damaging the real economy even further.

The alternative is to leave the EMU and restore currency sovereignty. Even though this would be a difficult transition back to the Drachma it would be a path worth taking in my assessment.

I would also relieve all voluntary constraints which force debt-issuance and restore domestic demand and employment. But that will not be an option the Greek government takes. Their northern neighbours will make it very difficult for them to do that even if it means compromising the rules of the EMU.

They know that if Greece leaves, the next cab on the ranks looks like being Portugal.

That is enough for today.

I would agree the problem is “solved” if currency sovereigncy is restored. The problem for greece has been its failure to weaken its real exchange rate. Infact a nice chart in the ft on 8/12/2009 (http://www.ft.com/cms/s/3/2e50a720-e314-11de-b965-00144feab49a.html) highlighting the strength of the real exchange rate in greece and spain. These countries have failed to do what Germany did in the early 2000s. Keep wages and that improves competitiveness. I suspect it is difficult to do that when you have real interest rates too low for an economy because monetary policy set for the mature Euro area is unsuitable for an “immature” euro area.

Ultimately though, the solution is not via fiscal policy as the other Euro states will stop fiscal laxitutde eventually (or the bond market will), but via domestic prices falling. Starting to see that in ireland, both with CPI and wages

I, myself residing in euro-zone, see current developments as positive for euro. The situation to-date is a clear sign of no-moral-hazard policy from ECB and spread differentials (i.e. financial responsibility) is something governments will always have to deal with. So this is fair.

Should Brussels exert enough political pressure on ECB to tackle the situation, then be sure to deal not just with riots in Athens but also in Berlin (disclosure: I am not German and do not live in Germany). There is close to zero financial and political tolerance to financial largesses in Greece from Germany and beyond. EU net-donors will have hard times justifying to their electorates bail-outs of net-recipients. In particular, if those recipients are outside of the direct sphere of interests of said electorates. And Greece is very much outside of everybody’s sphere of interests.

Surely, Greece can try to leave Euro-zone. However, do you think that a risk of sovereign default (in CDS sense) is a good reason to leave euro-zone? It rather looks like a clear reason to stay all-in euro-zone. In such times of stress euro provides a very good shelter. Euro-banks are big holders of Greek bonds and Greek government should be completely nuts to cuts this source of money. It is also good to ask Slovaks who joined euro-zone right ahead of the crisis. Despite all the immediate complaints consensus at the moment is that they feel very happy and lucky to have managed to jump on the wagon.

I think ECB will and should stick to its policy, and this in fact is good for euro. Greece will find a solution (with or without help from Brussels) and it will be better for them in the long-term. The problems they have now come from before-euro times. There will never be a better time to solve them. As for ECB their current collateral policy still gives Greece two notches of rating downgrades meaning at the moment their should be no issue holding Greek bonds which prove a healthy 2.5%+ yield compared to 1%+ ECB base rate.

Dear Bill,

I’ve been reading your blog for quite a while, and although I disagree with some of your points, I have found it mostly both very informative and, of course, refreshing.

Today, however, I am not very sure about the soundness of the policy recipe you suggest for Greece. I believe the country’s net foreign assets are in the red, and mostly libelled in euros. I very much doubt that breaking away from the euro would lead to anything but a sharp devaluation of the currency, and thus, possibly default on most obligations, even if I expect most of it is not to be paid in the short-run… I am not sure than the probable following intervention of the IMF might be a preferable relief (think of Mexico in 1994, for instance) to EU-“discipline”.

As regards the possibility that EU will not let “one of theirs” fall… well, in all frankness, I don’t think the Comission cares much about the periphery (be it Letonia, Hungary or Portugal).

It seems the euro was some kind of path-dependent trap. Once you resign sovereignity, getting it back is just too painful.

As regards deflation as a policy recipe, as suggested in the preceding comment, I’d think we (I am from Spain, excuses for my English) are in some sort of trilema… Either you depress effective demand, further aggravating unemployment (and although a Job’s program may not require higher demand levels, I am not sure it is politically feasible, insofar as unemployment is “normal in a market economy”, as even our “socialist” minister admits by placing our NAIRU at 8%) and probably letting your financial system crash as unpaid mortgages amount; or you raise it with public deficits which are unsustainable because of self-imposed EU-rules, at the expense, probably, of an ever-worsening balance of payments (which finally I believe is as real a constraint as any, all the most since EU and WTO rules would forbid us to use import restrictions of any kind to make it less pressing). Or else, you break away from the EU… but then, we are back to the above.

I am not sure which of the 3 is best…

Monster-great article, especially this:

“The alternative is to leave the EMU and restore currency sovereignty. Even though this would be a difficult transition back to the Drachma it would be a path worth taking in my assessment.

I would also relieve all voluntary constraints which force debt-issuance and restore domestic demand and employment.”

Amen, to that. The Greek finance Minister should start with salvo aimed directly at Brussels, that is, start leaking stories to the press that Greece is serious about leaving the EU. That will put the markets in a tailspin and send global central bankers on overnight flights to Brussels to save them from another Lehman Bros fiasco.

Think Greece is not just as TBTF as G-Sax?

Let’s find out, and take down the capital markets in the process. Wheeeeeee.

Two can play at this game, if the Greek finance minister wakes up and summons his courage.

Keep in mind, the Lisbon treaty just passed last month. The EU corporate state is already in place. They’ll never let little Greece ruin their plans.

Dear Ramon

Welcome to my blog.

Your comments resonate strongly and are not as far from my views as you might think. I especially liked your reference to a “path-dependent trap”. I agree totally with that. I would be very hard to exit the Eurozone for any member country. The Community will do what they can to keep it together – an exit would be an admission of failure and the consequences for a member country with such an entwined economy (debt in Euro’s as you note) would probably be harsh. But the interesting thing is the Greek GDP decline (around 1.1 per cent) is much less than the decline for the Eurozone overall (about 4 per cent). Further, about 30 per cent of its export revenue comes from shipping (transport) which was severely hit as world trade collapsed. That is now recovering.

The major problem facing Greece is the risk of a liquidity crisis prompted by a bank run. Although the Greek banks by and large have solid domestic deposit bases and they have been reducing their use of ECB liquidity since June (and will continue to do that), the problem is that if depositers fear that the government is not in a position to guarantee them, then a run could occur which would lead to a liquidity crisis. Under current Euro arrangements, I doubt any Euro nation could withstand that sort of event. There would have to be a rapid and strong ECB response to prevent that. The ECB would have to fund the entire Eurozone banking system by extending the “collateral” it accepts to any bank assets rather than the narrow financial assets it is currently accepting in return for loans. Such an event will bring the system to its knees and it is questionable whether Frankfurt can act quickly enough to stop some damage. Greek Government spending capacity would quickly evaporate if the ECB didn’t fund it immediately under such circumstances.

So it is a very big issue for the Eurosystem which is why I think the ECB will act in advance to head the problem off. But it exposes the structural absurdity of the system.

You forgot to mention Argentina. That is the non-IMF model that Greece could use to restore its sovereignty. Definitely not painless and simple. But it could do it and if I was a Greek citizen I would support that move.

By the way depreciation would further stimulate its transport exports. I do not see Greek’s external accounts in structural deterioration as you hint. Their trade fundamentals are not that unsound.

best wishes

bill

Dear Nic

I agree with you about fiscal policy … as long as Greece remain in the Eurosystem. As a member they will have to solve the problem with some ECB liquidity and some nasty domestic changes along the lines you suggest. But if I was a Greek citizen I would be questioning why a country which is not a “basket case” was being driven into the ground by a voluntary arrangement that the nation entered into which inhibits the ability of its democratically-elected government to act in the best interests of its citizens.

The crisis is exposing the structural flaws in the Eurosystem and the imposition of fiscal rules that constrain the standards of living of member states … and impose harder adjustments on some relative to others. It is the fixed exchange rate system all over again. The deficit nations face harsh adjustment paths while the surplus nations do better. It is unsustainable in the long-run.

best wishes

bill

Bill,

These are the figures for Ireland, and today we had our 3rd Budget this year. And our “dear leaders” just cut another €4 billion from the budget but sought to offer one boost to public morale by cutting taxes on beer and wine. A marvellous boost to public health.

http://www.cso.ie/releasespublications/documents/economy/current/qna.pdf

* › CPI down 6.6% (Oct 2009 compared to Oct 2008)

* › Retail Sales Index down 10% (September 2009 compared to September 2008)

* › Standardised Unemployment Rate 12.5% (November 2009)

* › GDP down 7.4% (Q2 2009 compared to Q2 2008)

* › Population Estimate 4.5 million (April 2009)

To put that GDP in perspective Iceland’s drop in GDP was -7.2%. Total GDP decline has shrunk by 10.5 % from its peak in 2007. Those figures just scream deflation. And I don’t see any bright spots out there, our exports are doing well but because of the strength of the euro especially against the british pound everybody is heading across the border to do their shopping. With a shopping centre in Dundalk empty a mile up the road in Newry the car parks are filled with southern shoppers. And the government have the cheek to call people unpatriotic.

Are you putting up the presenations from last weeks conference. I would like to read the following from Mr. Watts if you have the time. The role of macroeconomic policy in Euroland: a case study of Ireland.

Ireland: a perfect example of what not to do.

Many thanks,

BFG

Hi Bill,

A few basic questions. I understand that the whole Euro system has a lot of self imposed constraints. So it is not like the case of the US. On top of that there are these NCBs in addition to the ECB. My questions are:

1. Who conducts the open market operations ? The ECB does them but do the NCBs do them as well ? How do they work together in achieving the overnight interest rate target ? At a less detailed level, it must be the same as other central banks – just needed to get into details. Plus I need to know how interbank settlement works.

2. When a government X spends it credits bank accounts, but where are the reserves created ? I can understand a system with just the ECB – the NCBs are confusing me and I don’t see their role.

3. How do the flow matrix and the balance sheet matrix of the ECB and the NCBs look like ? Is there something like an ECB bond which the NCBs hold ?

4. How does accounting of the “fines” work ? If a government breaks the rules of the Maastricht treaty, what are the flows ? It seems to me that a government can just walk away by paying the “fines”.

The major reason for the spreads widening is that the ECB has revealed that the Greek central bank (an integral part of the Eurosystem) has:

… tried to discourage local banks from receiving 12-month funds at the ECB’s facility on December 16. Local banks are major buyers of Greek government bonds, using the ECB’s facilities …

Note: this claim was in the financial press (Source). I have not been able to find anything at the Bank of Greece or the ECB to verify it. I am still searching. If anyone can point to an official communiqué it would be helpful.

Bill,

This was released on November 16, a bit of a delayed reaction from the markets.

http://eng.bankofgreece.gr/en/announcements/text_release.asp?relid=1839

16 November 2009

The Bank of Greece has recommended to a number of Greek banks that they show restraint with regard to their participation in the twelve month Eurosystem liquidity providing operation in December, in order to facilitate their exit from the extraordinary and temporary measures of the Eurosystem when these measures are withdrawn.

Under no circumstance does this recommendation constitute a prohibition. Moreover, it is not connected with the Greek government bonds which banks are holding or are wiling to purchase.

“1. Who conducts the open market operations ? The ECB does them but do the NCBs do them as well ? How do they work together in achieving the overnight interest rate target ? At a less detailed level, it must be the same as other central banks – just needed to get into details. Plus I need to know how interbank settlement works.

2. When a government X spends it credits bank accounts, but where are the reserves created ? I can understand a system with just the ECB – the NCBs are confusing me and I don’t see their role”

hi bill,

same here,

im assumming that governments spend in euros and create credits in their domestic banking system in euros. the ecb i assume sets the price of money, but its upto the ncb’s to conduct open market ops to reach the interest rate target set by the ecb

“Europe [EU] is a monument to the vanity of intellectuals, a programme whose inevitable destiny is failure: only the scale of the final damage is in doubt”

Mrs Thatcher

I love you. I’m making a presentation about the current situation in Greece and extremely need data. Your graphs are soooo useful.