I started my undergraduate studies in economics in the late 1970s after starting out as…

The year ends badly and then …

The year and the decade are rapidly closing out (early evening Thursday AEST). It is been an incredible year to be an economist with some of the swings in aggregates not seen before in most of our lifetimes. The degree to which nation’s have gone backwards has been staggering. For a researcher like me it has opened up so many new lines of enquiry. I always worry that my major research angle – the study of unemployment – gives me a job as long as there are others without them. But someone has to keep the topic at the top of the agenda and that is what I have devoted my academic and public career to doing. I have also been staggered this year by the sheer audacity of the mainstream economists who went to ground when the crisis emerged because their theories were shamefully wrong – but who are now popping up again – in all their arrogance – leading the charge of the deficit terrorists and undermining the capacity of governments to fight the crisis effectively. They should have just stayed in their slime. Anyway, my final post for the year has some sad things to say … and then …

The Guardian published a report today (December 31, 2009) entitled – UK standard of living drops below 2005 level – which paints a grim picture of the Old Dart.

Evidently, “GDP per person is £225 lower than in 2005 and UK living standards trail those in US by 25%” although its unemployment rate is still below the US.

The Guardian reports on a so-called thinktank Oxford Economics who have just released a consulting brief (it is not available to the public although you can see the press release) which says that:

The decline in UK GDP per capita over the last four years contrasts markedly with the improvements seen over the Labour government’s first two terms. Coupled with the tax rises to be implemented over the coming years – starting on 1 January 2010 – this research underlines the new age of austerity facing the UK economy.

Not to mention the savage spending cuts that the British Government is inflicting on its citizens because they have bowed to the conservative pressures to cut their deficit at exactly the time they should be increasing it.

Taking into account the differences in the relative cost of living (that is, adjusting the data for purchasing power parity), the data shows that:

British living standards in 2009 were still higher than in Germany, France, Italy and Japan. But UK living standards still trail those in the US by almost 25% on this measure and the gap is expected to widen in 2010 as the US economy recovers more strongly.

I then noted some tory sympathiser writing in The Times under the guise of an independent journalist. The article – Lipstick and daffodils won’t save Britain now – ran the line that the UK had to get back to the fundamentals of Thatcherism and reject policies that “squeezed the rich till the pips squeaked, ran out of juice anyway” and “propelled Britain’s public debt into the stratosphere”.

According to this article the deficit had to come down much earlier than the government was planning. The journalist said:

… when the Tories berate Gordon Brown for saving nothing while the sun was shining, they are being too kind … It has, in truth, been raining almost throughout new Labour’s interminable parade … Mr Brown broke through the previous Conservative Government’s public spending ceilings … Britain’s finances were in deep structural deficit before the crisis hit – one reason why, even with aggressive fiscal pump-priming, it has taken Britain longer than any other major economy to start emerging from recession.

So you can imagine that I assess that this person knows nothing at all about the way the monetary system operates. The British government budget position prior to the crisis hitting had nothing at all to do with the length of time Britain is taking to record positive growth again.

A sovereign government such as Britain’s faces no financial constraints on its spending. The problem is that it is not spending enough in the right places and it was lax in its supervision of the financial system exactly because it inherited the Thatcherist neo-liberalism and tried to soften it with the ridiculously titled Third Way. Folks we are neither free marketeers nor socialists was their calling sign.

But they took their eyes off the road with respect to its banking and financial sector and are rueing the day. Their fiscal position had nothing to do with that policy failure.

Further, while the journalist wants the conservatives to save Britain and restore its fortunes the reality is the policies they are advocating will worsen the situation.

Anyway, that was long-winded way of introducing a few graphs I made today using data from the IMF World Economic Indicators database, which is becoming more user friendly by the year.

While the UK report was interesting I thought I would check out the performance of a greater number of countries including Australia. One of the stark things to come out of the September National Accounts data in Australia was the continued decline in per capita GDP (that is, on that measure we have become poorer) despite our relatively superior performance on overall growth outcomes.

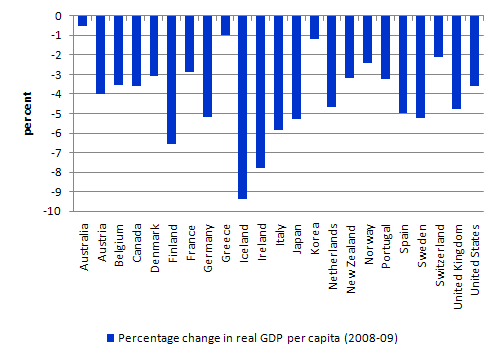

This graph shows the change in Real Gross domestic product per capita valued in local currencies between 2008 and 2009 (2009 is estimated by IMF). The countries shown is a sample of the IMFs advanced economies.

The 2009 data, while estimated, looks fairly good to me when I compare it to the known data up to the third quarter 2009. So all of the advanced countries shown went backwards on this measure with some such as Iceland and Ireland the worst performers. Finland also went backwards significantly.

The best performer is Australia followed by … Greece (that so-called basket case – at least on this measure the rising deficits appear to be looking after its people better) and Korea.

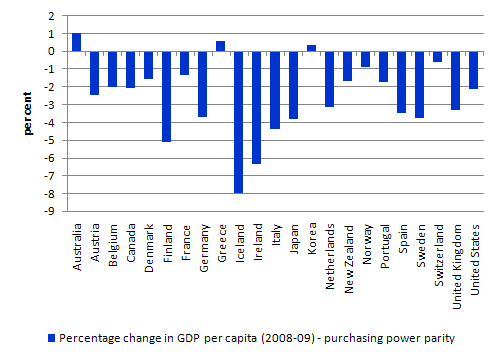

What happens when we take into account the differences in the relative cost of living – so we adjust the data for purchasing power parity?

The following graph shows the change in Gross domestic product per capita adjusted for purchasing power parity (by the IMF) between 2008 and 2009 for the same sample of advanced countries.

The basic idea is that exchange rate movements driven, say, by financial asset speculation can alter the valuation of a nation’s GDP in USD terms (as an example). So if the Australian dollar is depreciating against the USD our GDP measure will be valued downwards in USD terms implying we are now poorer. But in AUD terms, the fall in standards of living (measured imperfectly by GDP per capita) will only reflect the reduced capacity to buy imported goods and services rather than command over non-traded goods and services sold in AUD to the domestic market.

The PPP method overcomes this deficiency by creating a basket of goods and expressing currencies in relation to that basket. Using this measure you can see that Australia, Greece, and Korea have actually increased their income per capita command on a world basket of goods and services.

Australia has experienced an appreciating exchange rate which some say will reach parity with the USD before too long. So this increases our command over the goods and services of the rest of the world. But in time it also undermines the competitiveness of our traded-goods sector (unless it is offset by rising global demand for the goods of that sector).

But to focus our minds in this last post before 2010, the next graphs look at unemployment rates? The point that is often forgotten as economies start to recover in terms of stock markets and real economic growth is that the tail of the recession is generally very long when we consider the labour market.

It takes years to generate the employment growth that is sufficient to not only absorb the new entrants into the labour force but also to start eating into the pool of jobless left to decay by governments after the recession. In Australia it took some 15 years after the 1991 recession to return to the unemployment low that was recorded in November 1989. And that level that took some 15 years to get back to was still a long way from full employment.

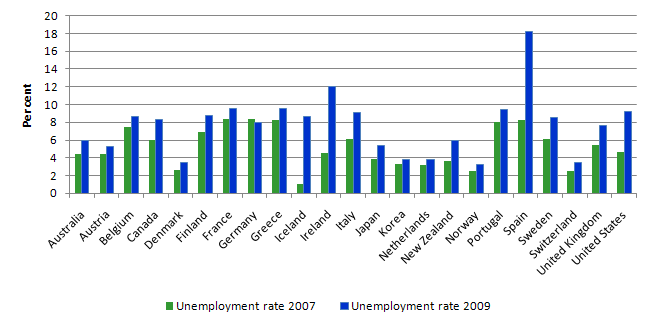

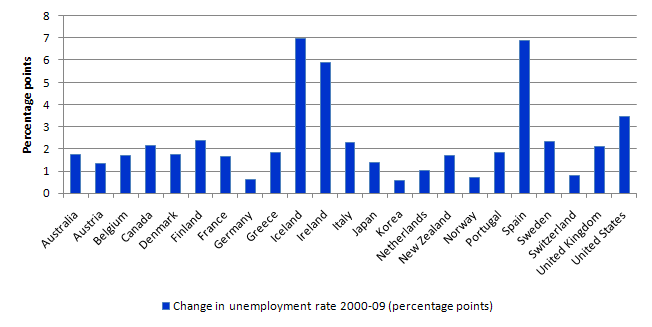

The following graph shows the unemployment rates for the same sample of advanced countries in 2007 and 2009. The average for all countries in the sample between 2000 and 2007 was 5.9 per cent

The decline of Iceland and Ireland and Spain is notable but joblessness is now the greatest problem facing all these nations.

The change in the unemployment rate in the last year (2008-09) is shown next and just makes it easier to see how quickly the labour market contracted in some nations.

In general there is no reason to have any unemployment in excess of so-called frictional unemployment (people in the process of moving between jobs). While aggregate demand failures will lead to private employment falling, the correct role for the public sector should be to absorb all the workers into the public sector.

There is never a shortage of work – just a shortage of someone who is willing to pay the wage. When the private sector is unwilling then the only sector that is left is the public sector.

An efficient solution to the rapid escalation in unemployment that occurs during recessions would be to have a permanent Job Guarantee in place which would provide workers unable to find work elsewhere an immediate minimum wage job in the public sector engaging in productive work that would advance public purpose.

While it is not a perfect solution to the vicissitudes of cyclical swings in aggregate demand it is light-years ahead of what we tolerate now – pushing people into joblessness and in many cases into poverty.

It is a no-brainer and the only reason governments do not do this is because they are blinded by an ideology that says they “cannot afford it” and “it would be unproductive” and “private firms might find it hard employing people again” and all the rest of the wrongful and tedious arguments that get wheeled out by the conservatives.

The bosses don’t want this scheme because they would be forced to restructure their workplaces and eliminate underemployment and poverty wage levels.

The government won’t do it because they are advised by people who have learned their economics from textbooks like Mankiw (and a host that are as bad).

There is no financial constraint on the government introducing an employment buffer stock. Only the political will and good sense is constrained.

Finally … for 2009

So I am taking my annual rest now until 2010.

The macroeconomic scene is likely to be pretty awful as the policy makers stumble around limited by their understandings of how the system we elect them to run actually works and constrained by their own largely conservative ideologies.

In that respect I make special mention of Hugo Chavez’s plan to take over the Toyota factory in Venezuela unless they produce things his country wants. He was quoted as saying (Source):

We’re not interested in these traditional companies that have been here 50 years or more, they’ve never transferred technology … I suggest they gather their things and go, and we’ll bring in the Russians, Belarusians and Chinese who want to make cars here.”

I thought that was pretty solid. If all the less developed governments followed suit things would be much better for their citizens.

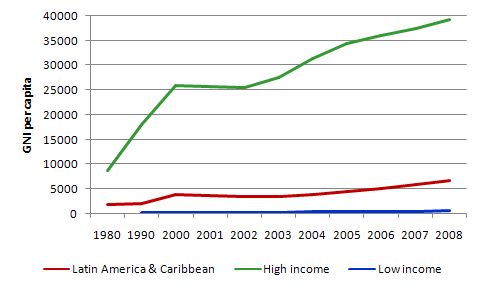

Which brings me to my chart of the year – which I produced for this blog – IMF agreements pro-cyclical in low income countries in October. It uses data from the World Development Indicators, provided by the World Bank. It shows Gross National Income per capita, which, in material terms is an indicator of increasing welfare.

The overwhelming evidence is that these programs increase poverty and hardship rather than the other way around. Latin America and Sub-Saharan Africa (which dominates the low income countries) were the regions that bore the brunt of the IMF structural adjustment progams (SAPs) since the 1980s.

While the high income countries enjoyed strong per capita income growth over the period shown (since 1980), Latin America (and the Caribbean) has experienced modest growth and the low income countries actually became poorer between 1980 and 2006.

The two trends are not unrelated. The SAPs are responsible for transferring income from resource wealth from low income to high income countries.

When I see this sort of data I wonder what the hell we are doing? Well I know what we are doing in fact, but it is not what we say we are doing. A new paradigm for economic and social development in less developing countries is needed. I am working on a book on this topic at present centred around modern monetary theory (MMT) and a domestic-focused development strategy with employment guarantees.

On the topic of “awards”, I could give out awards for the most ridiculous piece of economic commentary for 2009 but I would have to ship a lot of medals to a lot of places and the postage bill would get out of control.

How the public can be so duped on a daily basis by so many so-called experts who only mislead, deceive, dissemble and just show their total ignorance of how a modern monetary system operates is beyond me.

But if we have to have one award then I guess it would go to Mark Thoma’s nonsensical story about banking which I wrote about on November 26 in this blog – An unholy gathering is emerging. His followup reaction when some commentator requested he debate his ideas with a fellow academic (me) was an appalling statement of an arrogant closed mind. But hey, we are dealing with mainstream economics here – so it was no surprise to me.

But I have to force Mark to share this prize with another professor of economics Tony Makin whose rantings I covered on December 15, in this blog – Lost in a macroeconomics textbook again.

But when I think about it with some recent memory intact, I think they both have to share the prize with Sydney Morning Herald senior economics commentator Ross Gittins who tried to tell his readers that they could understand all there is to know about economics by rote learning Mankiw’s ridiculous 10 Principles of Economics. I covered that on December 29 in this blog – Do not learn economics from a newspaper.

You will note that most of these articles are of recent origin. That is because my memory about how bad things have been in 2009 on the professional commentary is fading. I know it has been bad but I just haven’t the heart to go back and check the reality.

So in that context and in the true spirit of collectivism I thus invite all readers to send in (via your comments) your own nominations for the worst statements, articles, pictures, etc from the so-called expert commentators. Don’t hold back is my motto. Let them have it! They deserve no better.

As to politicians, the worst comment in my view from a politician has to be the US President’s enlightened declaration that the US government was running short of money. I covered that stunning piece of awareness on December 4 in this blog – The US government has run short of money.

If you disagree with that assessment then please send in your own recommendations for the “worst comment from a politician in 2009” award. I know there were many shockers.

Overall in 2009, we have had holes of all types and magnitudes opening up all over the place and getting bigger so that squirrels, who should have been saving, were falling into catastrophic voids.

I noted each time we discussed a new hole that was looming below our feat or in our garden buckets or wherever the commentator had located them that the discussion always seemed to be about sovereign governments who issue their own currency and never need to finance their spending. Read: never!

But then we did have some holes opening up in Greece and other EMU nations which seemed to be telling me something about the lunacy of their monetary system. Why did the citizens of these countries (especially those on the periphery of European wealth – for example, Greece, Spain, Italy, Portugal) ever let their stupid governments do this to them? My enquiry on that score will continue in 2010.

We have also investigated why sovereign governments (those that issue their own currency with flexible exchange rates) then act as if they have to finance their spending which then forces them to face the public furore about the (totally unnecessary) public debt levels and ratios and all sorts of other meaningless configurations that are wheeled out nightly to scare the bjesus out of us all.

Thankfully, I have never been scared! That must be because I am one of those dinausaurs who still believe that fiscal policy can underpin aggregate demand and employment and should always be used to advance public purpose. Unfortunately most governments do not use the opportunities they have as currency issuers in a fiat monetary system to promote public purpose.

We have also discussed the ins-and-outs of banking – their reserves and all the rest of it and I am sure that this is the first time that many of you have spent your precious evenings sitting squinting in front of a computer screen coming to terms of the ennui of bank accounting and other matters that have previously not been discussed much in public space. But I can assure you – every last one of you is better off for it. (-:

In that respect, my award for “Diligence in Rising to the Challenge” goes to regular commentator – Lefty from Gladstone, Queensland – who told us some time during the year that he had been downloading RBA data in his spare time to analyse it and was also threatening to introduce his own currency (Lefty Units) to prove there were no financial constraints on a government of issue (in his house presumably). Lefty had previously told us he that he works as a school janitor in the Queensland education system who had a passing interest in economics. A very solid performance and deserving of the prestigious award. He knows more about the operations of the modern monetary system than most mainstream economists who have Phds.

Finally, I have run out of time again … it always happens to me … every day in fact.

So if you have other awards you want me to offer this year let us know about them and we can get the Awards Committee to deliberate and get things moving.

While the macroeconomic environment is looking bleak it doesn’t mean necessarily (as long as you have a job) that the personal outlook for 2010 should be compromised by what our stupid governments do in our name. Their time comes around in most countries and hopefully they get their comeuppance from the voters. Although it is rather sad to note that in most countries I am familiar with the political choice is conservative in this corner versus conservative in the other corner. While the voters in the UK will probably go to the tories in 2010 their policies will just make matters worse.

But our personal lives still have lots to offer – friends and family and drug-free cycling and great music and occasionally some surf (its been dreadful the last two weeks!) and nice gardens to hang out in – and who knows what you all find interesting – but on that dimension I wish you all a happy 2010.

Thanks for being part of the billy blog collective and I hope your participation endures into 2010.

I really appreciate all the comments that people take the time to make. I also apologise for not being as timely in my replies. It is not a reflection of my disinterest or disregard of the comment – just that I never have enough time. I will make it my resolution to catch up on the backlog of comments and be better next year. But I really appreciate it also when others take up some of the work and answer questions that have been raised.

I really enjoyed meeting some of the regular billy blog commentators who came from afar (India, USA, Sydney!) to the CofFEE conference in Newcastle this year to meet all the modern monetary theory gang. I hope it becomes an annual intention.

Anway, with that said, my annual leave starts now and it is time to go home. See you tomorrow and best wishes.

PS: where did the last year go to?

Thanks Bill for all the efforts you make.

I have made this my first blog stop of every day. While not an economist I can tell good thinking from bad thinking and on that metric you (and all the other MMTers) have the deficit terrorists beat HANDS DOWN!!

I have made it my …………….reason for being…….. to spread your ideas around the blogosphere. You, Mr Mosler, Mr Wray and Mr Fullwiler need a larger voice and I am doing MY best to get it heard. I go to other econ sites and link to you while trying to get others to see the errors of their “debt a phobe” ways.

I think world events will prove the necessity of facing up to our currently flawed notions about fiscal matters. I hope 2010 brings you, Mr Mosler, Mr Wray and Mr Fullwiler (Im sure there are others but I’m not familiar with them) into the public sphere in a larger way. I’m just going to keep hammering away at others hoping to get inside their brains just a little to get them to see finance and employment in a different light.

I’m no economist but I’m good at seeing strong foundational thinking from poor. The point that needs to be hammered home about most economic models is that their foundations are weak. How can a model be predictive of anything substantial if the major assumptions used to build the model are fallacious? “Don’t listen to predictions of the future from people who don’t understand the present” should be your motto.

Happy New Year – I’m hoping for big things for your ideas in 2010

BTW- I was very disappointed in Mr Thoma’s response to my request to debate your ideas, he definitely dropped a notch or two in my book, but I will not give up. I will stay at his site and others trying to open the minds of others to your ideas on finance and employment.

Bill,

I’m glad you are writing a book. It will make it easier to go back and check your views on many of these topics.

Maybe you saw this in the Economist. It seems to be close to your thinking on reserves. But are there differences?

http://www.economist.com/blogs/freeexchange/2009/12/the_truth_about_all_those_exce

Also, in yesterday’s post on interest rates, you seem to agree with the Fed that the housing bubble had more to do with lax regulation than low rates. But, surely, low rates, stimulate speculation….don’t they?

Happy New Year from Detroit!

Bill,

I see your area of economic specialization is unemployment and “disadvantaged workers”. What are disadvantaged workers other than workers NOT PRODUCTIVE ENOUGH to generate a level of nominal income (profit) high enough to fund BOTH new investments AND sunk costs? Government “aid”, both in the form of money creation and deficit spending, functions as a net driver of economic growth ONLY when it refuses to throw good money after bad in the form of funding sunk costs. Of course, by definition politicians are ALL ABOUT defending entrenched interests and funding sunk costs. This is what they do. It is therefore the very rare dollar of govt expenditure which does any real economic good. WHAT IS THE ENTIRETY OF THE BAILOUTS THUS FAR OTHER THAN FUNDING SUNK COSTS?

In a properly functioning banking system, bankers would not be hoarding phantom cash (so called “reserves”) to continuously fund bad investments in the form of legacy SIVs being brought back on balance sheet. Even a simpleton can see there are NO RESERVES! If they do exist, just how might a member bank draw them down? You’re a student of the balance sheet…how does a Federal Reserve bank account for the actual drawing down of these “reserves”? As a member bank, ask yourself this question: If we all took our so called “reserves” on deposit at the Fed down to near zero, what would we be given to pay us off? There are only two legal choices. Both are practically absurd from the traditional view of a cash or equivalent. Obviously, assuming enough currency was on hand, you could be provided with Federal Reserve Notes. This is patently ridiculous, because $1 trillion of FRNs is a non-starter in the present banking system. The other solution is that the Federal Reserve Banks SELL their mortgage backed securities, plus some other assets and utilize the proceeds to wire funds to the banks. In this instance, the Federal Reserve banks would need to find a buyer for over $800 billion of junk mortgage-backed securities which they carry at (or near) par. Even a small loss would destroy the Federal Reserve Banks meager equity of a little over $50 billion! My point here is that the present total of Reserve Deposits of member banks at the Fed is really VERY MUCH ILLIQUID, and only technically a cash equivalent. Again, THERE ARE NO RESERVES, and this is why lending (AND THE ECONOMY) will stagnate until the real value of these junk mortgage securities is determined and they are removed from the books. The banks should write these loans off, take the losses and either go out of business or begin lending again. There would be no need for fake reserves. Instead, we kick the can down the road.

The core problem in a deflationary economy is the inability of the existing stock of investments to create enough nominal income to fund debt service costs on investments made previously. For a market economy to begin functioning normally (growing) again, the existing stock of (mal)investments MUST be written down to a level capable of being funded by the newly deflated economy. If this writedown is forestalled or postponed (see current U.S. fiscal and monetary policy), economic stagnation and crony capitalism are two inevitable results. In simple terms, the economic narrative becomes more about “who knows WHO” rather than “who knows WHAT” because the capital allocation function of the markets is circumvented by political fiat.

Happy New Year!

“What are disadvantaged workers other than workers NOT PRODUCTIVE ENOUGH to generate a level of nominal income (profit) high enough to fund BOTH new investments AND sunk costs?”

I love comments by someone who has apparently never worked in business. I guess workers are responsible for: corporate strategy, business partnerships, capitalization and finance, product direction and value proposition, pricing, branding and marketing, in addition to sales, engineering, purchasing, manufacturing, distribution, and customer support.

I am relieved that workers are fully responsible for the success of individual enterprises – as well as responsible for relaxed regulation of labor and environment laws, financial regulations, reduced government oversight, ad nauseam

Of course, politicians defend entrenched interests – that why they we elect them – the fact that the public does not organize itself into a better entrenched interest is a different matter than why we have politicians to get their hands dirty and to make the sausage.

I cannot believe people who think that “It is therefore the very rare dollar of govt expenditures which does any economic good.” So, Social Security payments do no good, federal research and development does no good, farm programs do no good, etc.

What is “phantom” cash? It sounds like some concept of fake currency – so why would anyone intelligent want to hoard fake currency? Reserves are there for two reasons, 1) to provide liquidity – in the event of another money market seize up, banks are in a quicker position to respond than Congress and the Fed, 2) risk-free interest earning opportunity (not usually, but now in the crisis). Reserves do not represent “extra” money available for lending. Reserves do nothing to change the solvency position of banks (except now they generate some income). Reserves do not generate lending. I wouldn’t worry too much about them being drawn down.

I agree that the existing stock of poor investments must be written off before private lending will recover. This means general industry consolidation – for example, over 3,000 US auto dealerships are being closed by GM and Chrysler. This is being done over the course of about one year. Do you think that would occur faster if GM and Chrysler had gone bankrupt and let the lawyers and courts figure it out? Hundreds of small banks have been or are being closed in the US – again over the course of a year, and lets not forget Washington Mutual and Wachovia – a couple of decent sized institutions.

My argument isn’t that we live in the best of all possible worlds, but that there is real restructuring going on the financial economy. With less players in the future, the value of poor investments go up simply due to less competition (the increased possibility of monopoly pricing power). The same thing is happening in retail and in commercial real estate.

IMHO, What Bill advocates is that workers (who have little responsibility in producing this situation and have NO say in how the big boys want to parcel out their spoils) should not suffer and there is no economic reason for them TO suffer. The government can provide jobs – there is lots of valuable work to be done TODAY – and pay workers a livable but not extravagant wage – and not be concerned about inflation. I can’t imagine the government providing jobs less productive than the loan officers, real estate agents and refinance consultants that private industry generated very recently.

Of course there is a limit as to how much money can be injected into the economy – but if a large part of it is provided to workers then there is that much less available for bank bailouts , this would hasten the financial losses and we would get cleaned up that much faster, with less damage to the real economy. If you really want the bankers and fraud artists to be identified and their ill-gotten gains returned to the public treasury, you would be advocating a fully-funded job guarantee.

Happy New Year!

Of course individual line employees are not responsible for the success or failure of large organizations. Organizations which are not well managed often fail, and employees suffer as a result. My point is that in a properly functioning economy, the least productive workers and organizations AS A GROUP suffer first. In the U.S. today we instead see some of the least productive (and politically connected) labor suffering LAST. This is detrimental to the long term health of the economy.

Politicians defend entrenched economic interests to the detriment of productivity and economic progress. Government spending is demonstrably less efficient than private spending because incentives to economize disappear when one person spends a second person’s money on a third person. This wastes resources. Yes, a minimal safety net may be necessary for those who cannot manage for themselves, but certain expenditures (such as farm price supports) have done nothing more than keep prices artificially high over time, benefitting politically favored industries (see the U.S. sugar lobby).

My point on bank reserves was that the people waiting for commercial banks to begin lending supposed mountains of cash stashed in their vaults are misinformed on how the banking system works. They need to focus instead on removing the detritus of the last cycle (junk mortgage bonds held by the Fed) from the system before the economy can exhibit sustainable growth. I understand that the classic money-multiplier definition of money creation is bunk, but I also understand that the Japanese have suffered 20 years of stagnation due to their lack of political will in addressing the rot within their banking system. I do not want the U.S. to suffer the same fate.

Why does the economic rationalization process have to be “slowed down” so that certain well-connected groups (bankers, government employees, homeowners) can reap extaordinary benefits?

Finally, we appear to differ fundamentally on the most efficient system for creating economic value over time. I believe that maximum economic progress is the product of a framework in which people earn their livelihoods by adding value for their employers, which in turn adds value for consumers. “Fully funded job guarantees” are nothing more than a state sanctioned process for stealing from one group in order to buy votes from another.

Why do you use terms like “stealing” when describing a job guarantee program? There is no theft going on when a govt wishes to keep its electorate consuming at a most basic level by providing minimum financial support in return for a needed service. Keeping people busy, earning something, able to maintain some dignity and NOT seeking antisocial activities is something any GOOD government should desire and provide.

That person will maintain his hireability for the private sector if he is not left to rot after his previous brilliant boss had to make mass layoffs to maintain profitability.

Your use of the term efficient in comparing govt to private spending needs some fleshing out. Your use of it is quite vague and assumes everyone has the same measure of it…………………………. we dont. Please give me some examples so I can see if I think your idea of efficient is “correct”.

Dear CSmith

You ask:

This is a very narrow view of human capacity and potential. I reject the notion that the calculus of a private firm dealing with its market place can define for us what value is. They can determine what value is for them but not society overall. In the 1930s Depression, government job creation schemes put men who had no work onto major public works schemes around the world. In Australia, one project, for example, was the Great Ocean Road in Victoria. The private calculus of a firm would have never seen that road built – it could never have made a profit. But now some 80 years later it generates billions in tourist revenue and provides livelihoods for tourist towns all the way along it. I would think the national parks in California are of similar benefit. We need to think broadly about value and worth.

I think pebird has dealt with the bank reserves argument satisfactorily. However, you seem to think that banks lend from reserves. They do not and that is a common misperception among those who do not understand fully how banks operate.

I have no quarrels with your view that there are toxic assets in the system that need to be dealt with. However, even in good times there is a need for governments to support the saving intentions of the non-government sector. Unless net exports can provide the injection needed to support income levels sufficiently to allow private domestic agents to save then the only other injection that can is net public spending. Every time a nation has run a surplus (unless supported by strong net exports) the economy goes into recession soon afterwards because of the fiscal drag. Check your history out. It is certainly the case in the US.

In another comment you say:

I choose not to take a view that people should be punished by poverty for making errors. We all make errors and society is large enough to allow people to reflect on those errors without imposing unemployment and poverty onto them. So surely the greed or lack of understanding of some got them into personal crises. But is that a reason for us to sit back and let them sink. I don’t share a value system that would suggest that.

Further, I doubt whether there are many who bought large homes with huge mortgages are the ones who are persistently suffering from unemployment and poverty. The families that live in the slums of Pittsburgh or Baltimore or wherever never were in this category.

Finally your other comment that:

Is emotional to say the least. Where is the theft involved here? I suppose you are thinking about taxation as theft and then the taxation being used to fund the Job Guarantee scheme. Whether taxation is theft has been a topic of debate for eons and my view is that we elect governments to serve us knowing that they are going to raise taxes when they want us to have less purchasing power or want us to not do something bad (like smoke cigarettes). I don’t consider that fits any reasonable definition of stealing.

But that aside, the most important mistake you are making is to assume the taxation funds anything. National governments who issue their own currency do not need to fund anything. They don’t raise taxes to get revenue. They raise them to control the growth rate of aggregate demand. So in that sense a Job Guarantee is not taking resources from anyone but rather allowing idle resources a chance to contribute to society in a productive way rather than be confined to the waste bin. That seems to be a good thing for all of us.

best wishes

bill

Dear Mike

I did see the blog in the Economist. They are largely correct but still toy with the erroneous notion that banks lend out reserves.

Further, I do agree largely with the Federal Reserve’s conclusion. Remember while low interest rates make it easier to borrow it also cuts incomes for many people. These distributional effects are difficult to net out but you cannot simply conclude that spending will rise because interest rates fall.

In addition to the lax regulation, I think the real problem in the US was the 2003 fiscal changes that Bush brought in with retrospective tax cuts and sharp spending increases.

best wishes

bill

“What are disadvantaged workers other than workers NOT PRODUCTIVE ENOUGH to generate a level of nominal income (profit) high enough to fund BOTH new investments AND sunk costs?”

Just curious which economic theory it is that explains how somewhere around 10% of the labor force that was not unemployed, underemployed, etc., just 2 years ago and thus apparently “PRODUCTIVE ENOUGH to generate a level of nominal income (profit) high enough to fund BOTH new investments AND sunk costs” so quickly saw their skills and/or effort deteriorate to the degree that they became far less productive? Please enlighten me.

Greg:

…keep its electorate consuming at a most basic level by providing minimum financial support…

I do not oppose a basic social safety net. The entire system fails, however, when the raison d’etre of both the political party advocating and the bureaucracy implementing that safety net is keeping people dependent upon that safety net. According to the Bureau of Economic Analysis (an organization within the Department of Commerce), the average U.S. federal employee now makes $79,197 annually, not including benefits. And, when benefits are added in, this compensation averages $119,982, based on 2008 figures. Average compensation per private sector worker is LESS THAN HALF these amounts.

The oft quoted line: “The problem with capitalism is capitalists” applies here as well. The problem with socialism is that it is full of people looking to take advantage of both the beneficence of their fellow man AND THE TAXPAYER. Capitalists are just so much more practical than socialists. They understand that channeling both the higher and lower human instincts (greed included) into a free system of production benefits the greatest number over time. Discourage sloth with the proper incentives, and you will get less of it.

My definition of “efficient” is very simple. An efficient system encourages maximum labor with minimum resources to produce maximum output AS DEFINED BY PEOPLE FREE TO CHOOSE how they consume that output. Notice I said “encourages”. Incentives are what matter. When you set up a system that taxes entrepreneural effort to the point of discouragement in order to fund bureacracy and make-work, you are wasting both human potential and natural resources. Supposedly Milton Friedman once told a Chinese bureacrat at a construction site that if he really wanted to maximize employment he should provide each of his minions with a spoon rather than a shovel. Reductio ad absurdum, but it proves the point.

Scott:

…curious which economic theory it is…

That’s an easy one. First, the inefficiencies did not arise over a one or two year period, but go back to the beginning of the decade. US GDP data show that the ENTIRETY of the nominal growth in the period 2003 to 2007 can be attributed to mortgage equity withdrawal. Basically, the only reason we had any recovery at all from the 2001-2002 recession was because people could use their houses as ATMs. IOW, the recovery in the first half of the decade was a mirage, driven by securitization and massive overleveraging, which in turn had been driven by cheap money. This overleveraging drove a massive asset inflation, the deflation of which now hangs like a millstone over U.S. consumers. We’re struggling to pay principal and interest on (primarily) real estate assets which have collapsed in value. Thousands of real estate agents, builders, appraisers, laborers etc had built their livelihoods on this bubble, and lost their jobs, apparently overnight. The seeds of the collapse had been planted 6, 7 or 8 years ago, however. To sum it up, the incentives and policies of “Kick the can down the road” (derivatives, Fannie & Freddie, mortgage interest deduction, CRA, bank CEO pay without limits, credit default swaps, etc. etc. etc.) all came a cropper in the summer of 2008, but the problem had been building for years.

Bill,

“I reject the notion that the calculus of a private firm dealing with its market place can define for us what value is.”

I never said that. CONSUMERS, free to choose what they believe is in their best interest, determine value. Those institutions capable of serving the greatest number of consumers at the lowest cost create the most value. Some of it accrues to capital as profit. Some goes to labor as wages. A free polity can choose to allot a portion of these earnings for creating public assets, as you state.

Wow, I read what Thoma wrote. That was really insulting. Not surprising though after reading how he treated his neighbor here: http://economistsview.typepad.com/markthoma/2009/06/the-dog-that-did-did-bark.html It is inline with most students say about him on ratemyprofessors.com. Beware friends, success can change hormone levels in your body which often has the effect of causing a person to become more insensitive than they would be otherwise.

Csmith . . . agree with you for the most part on the overleveraging driving employment. Of course, prior to that expansion, unemployment rates were still much lower than now, particularly during the 1990s expansion (also bubble driven).

That wasn’t my point. You suggested that when people are unemployed, that is evidence they aren’t productive enough to be employed. That is, you were giving a supply side explanation of unemployment. Then, when I asked for further elaboration, you provide a demand-driven (via over-leveraging by households) of employment during the expansion. So, as the over-leveraging ends, we would by extension have a demand-side reason for the unemployment. But this contradicts your original argument. Either they are unemployed because firms can’t sell regardless of how productive they are, or they are unemployed because they aren’t productive enough. Which one is it?

Best,

Scott

Scott,

You’ve set up a false dichotomy. There is absolutely no reason it has to be an either/or proposition instead of a blend of causes. If demand for retail real estate brokerage services collapses, for example, the least experienced and/or highest cost agents (i.e. the least productive) will be unemployed first. The cause is both a falloff in demand and lack of productivity on the part of the weakest agents. In some cases, even some of the most productive agents may be very briefly out of work if their employer’s agencies fail, but would likely quickly find employment elsewhere.

OK, I figured that was where you were going with it.

Of course, this also means that when demand is adequate, even less productive workers as you’ve defined them are productive enough “to generate a level of nominal income (profit) high enough to fund BOTH new investments AND sunk costs.” And when demand is reduced, as now, making them more productive won’t necessarily help them get jobs.

Best,

Scott

Scott,

You seem to be trying to force the supply/demand dynamic of a freely functioning labor market into a Keynesian aggregate demand model. Demand for labor is “adequate” when profit seeking employers meet a great enough supply of labor to create a wage equilibrium. Periods of reduced demand will drive wages lower and vice versa. IOW, even when demand is reduced, if you define “making them more productive” as reducing nominal wages, increased hiring could result. This is in fact what we are seeing in many markets around the U.S. currently, as nominal wages are declining moderately.

Dear c smith

Where exactly is a freely functioning labour market other than in the mainstream text books that you seem to be quoting from?

Further, when there is a shortage of jobs arising from a macroeconomic spending gap cutting real wages (via nominal cuts or inflation rising faster than nominal wages) will do nothing to resolve the demand constraint no matter how “competitive” the labour market is unless it also reduces the private desire to save. There is no empirical evidence that falling real wages to reduce private saving desires (Read: none!) and the evidence points to the opposite impact – which in a demand-rationed economy will only make matters worse. At the micro levels when there is a demand ration overall operating, you will only be shuffling the unemployment queue by trying to manipulate wages downwards in some areas of the economy.

Further, when did you last read the literature on workplace productivity? It is a team event! Trying to define individual productivity in isolation from the work process is fraught and you run the danger of making very serious assessments. For example, even in a one-on-one situation what is a worker component and what is the management component?.

Further, while I disagree with your characterisation of the labour market even in your own country (US) I think you would benefit from travelling to some of the countries around the World where I have worked as a development economist to see what goes for a “freely functioning labour market”. To even get these places up to the point where private entrepreneurs will start investing requires massive investment in public infrastructure – roads, housing, basic education, health, personal care services and a range of other areas. There are a massive number of “productive” jobs that can be funded by government at low wages in these pursuits which will benefit the nations immeasurably. The alternative for many is starvation and disease.

Employment guarantees in these situations have been very beneficial.

I see similar conditions in advanced countries when I examine the bottom end of the income distribution. Not as stark true. But in relative terms definitely.

And … you evaded the replies from myself and others questioning your characterisation of employment guarantees as “theft” and your seeming mis-understanding that taxation funds spending in a fiat currency system such as your own.

best wishes

bill

Agree with Bill.

I’m not trying to “force” anything into Keynesian AD. The typical Keynesian model you are probably familiar with isn’t a very good one, in my opinion. There’s tons of empirical evidence I could cite showing that sales drive production and hiring, while the correlation you now see between reduced nominal wages and hiring may be nothing more than that (good luck isolating the effect statistically in the current environment). My employer certainly won’t hire more productive or (equivalently, in your example) less expensive workers if there’s no demand for what they would produce.

Scott,

Scott,

Your employer (I see you are an academic economist) may not hire labor willing to work for less, but in today’s deflationary world there are plenty of examples of this sort of demand elasticity. Lots of businesses are willing to expand as prices fall. The example I gave previously of the U.S. residential real estate market is one. Distressed sales have exploded over the past 2 years, and the volume of transactions intermediated by more efficient (i.e. cheaper) realtors (mostly internet related) has expanded as well. This phenomonenon has particularly benefitted low-end home buyers. There’s plenty of demand for bargain properties, and businesses willing to respond to this new reality are gaining market share.

Bill,

Where exactly is a freely functioning labor market…

Hear! Hear! You’re absolutely correct that within the U.S. it exists only in the more entrepreneurial and flexible segments of the economy. Up until the past year or so, the ability to source both manufactured goods and services overseas has rendered DOMESTIC labor demand elasticity moot. It functions beautifully elsewhere, however. Just look for the most rapid rates of GDP growth – China, Brazil, India – and you’ll find it! The Vietnamese have experienced such an inflationary boom they’ve been forced to shut down the gold market. There is no reluctance on the part of savers and PLENTY of investment capital in places where cheaper labor is plentiful. Fifteen years of double-digit growth and unprecedented levels of capital investment in China are all the evidence you need of the ridiculousness of the following statement:

There is no empirical evidence that falling real wages to reduce private saving desires (Read: none!)

Isn’t outsourcing merely a fancy word for attempts on the part of private savers to reduce their savings (i.e.; import stuff and invest overseas) in response to lower wages? What am I missing here. The elascticiy function for labor works fine, just not here in the U.S..

Now, as far as the U.S. is concerned, wages are legislated to be sticky upward to such a great extent that it takes a collapse in asset values to wring out even a hint of labor efficiency, but it is happening (see my post above to Scott). Worldwide labor arbitrage is a FACT. There is no getting around it. Attempting to shield more highly paid workers anywhere from this fact simply breeds greater imbalances and leads to crises. Asset bubble after asset bubble will result if we here in the U.S. continue to attempt to channel the savings generated by high earners overseas into investments our leaders decide are “politically correct”.The next question we in the U.S. need to answer is: When do we let our competitors with the savings begin to recycle their earnings into real assets? So far we’ve limited them to lower-yielding and quasi-public assets (Treasury and mortgage bonds). This must change if we are to properly integrate the world economy.

CSmith,

You said,

“I do not oppose a basic social safety net. The entire system fails, however, when the raison d’etre of both the political party advocating and the bureaucracy implementing that safety net is keeping people dependent upon that safety net. According to the Bureau of Economic Analysis (an organization within the Department of Commerce), the average U.S. federal employee now makes $79,197 annually, not including benefits. And, when benefits are added in, this compensation averages $119,982, based on 2008 figures. Average compensation per private sector worker is LESS THAN HALF these amounts.”

You are assuming here that people dont “want” or “desire” this safety net. That they are somehow being duped into believing they can have this at “No cost”. I think that is patently untrue. Most are willing to pay the cost, you however want people to believe that it is unsustainable that “their” govt (not yours, you didnt vote for him) will run out of money. The only economic decision is how to distribute scarce resources. Money in this fiat system is not scarce so we can put as many zeros on somebody’s check as we want. Does this solve the distribution problem? Absolutely not but it does redefine the problem to one of economics and not one of govt bankruptcy. Lets engage in economic discussions not ones that are red herrings. I would have to see the numbers you are quoting for private sector workers. Do the numbers include management? Often times they are not lumped in with “workers”.

“The oft quoted line: “The problem with capitalism is capitalists” applies here as well. The problem with socialism is that it is full of people looking to take advantage of both the beneficence of their fellow man AND THE TAXPAYER. Capitalists are just so much more practical than socialists. They understand that channeling both the higher and lower human instincts (greed included) into a free system of production benefits the greatest number over time. Discourage sloth with the proper incentives, and you will get less of it.”

I laughed out loud at your “discouraging sloth” comment. You obviously dont find, trust fund boys or rentseeking investors who complain about increases in their “capital gains” tax slothful. I do. Just because they wear nice clothes and speak good English doesnt mean they are “working”.

Dont respond with ” you’re a communist” either. I happen to believe that distribution of income(and work) do matter. It is you and your cohorts who chortle at distribution discussions, until of course you can criticize “equal” distribution. I happen to want neither equal distribution (as if that is ever possible) nor the current situation. You seem to believe in equal opportunity (as if THATS ever possible or definable), more accurately maybe, you believe we HAVE equal opportunity (laughable) unless the govt gets in the way of course.

“My definition of “efficient” is very simple. An efficient system encourages maximum labor with minimum resources to produce maximum output AS DEFINED BY PEOPLE FREE TO CHOOSE how they consume that output. Notice I said “encourages”. Incentives are what matter. When you set up a system that taxes entrepreneural effort to the point of discouragement in order to fund bureacracy and make-work, you are wasting both human potential and natural resources. Supposedly Milton Friedman once told a Chinese bureacrat at a construction site that if he really wanted to maximize employment he should provide each of his minions with a spoon rather than a shovel. Reductio ad absurdum, but it proves the point.”

You’re right about your definition of efficiency being simple, so simple it means nothing. Your definition does not allow you to measure the efficiency of any govt program because by your own definition a govt program cant be efficient, efficiency involves entrepeneurial effort. I dont have a definition of efficiency in regards to he discussion we are having because I think its meaningless. How can anything be efficient that has over 10% of its people desiring employment and not being able to find it? Why should such a person have to rely on the cunningness or efficiency mindedness of some entrepeneur to determine that they are valuable enough to employ? Does this entrepeneur have flawless insights that the rest of us lack?

Why should we allow people to rot their job skills because some entrepeneur failed (happens all the time) and now this person is left with debt and joblessness. They need training maybe (can they get it without additional crushing debt?) They need new to refine some of their skills maybe but first off they need income to continue to live and be a productive citizen. Having a job guarantee program would provide the needed bridge. Would these people desire to “stay” got employees….maybe, but it would be their “choice”. MMT shows us their is no “financial reason” it is unsustainable.

I get the impression that you think “deflation” is okay, in fact maybe helpful. I disagree. Deflation reduces peoples nominal wages but doesn’t reduce their nominal debt. Yes some things are cheaper but the debtor is much worse off and most of us are debtors.

Greg,

So many of the above statements are detached from reality that I don’t know where to begin, so I’ll just end with this whopper:

Money in this fiat system is not scarce so we can put as many zeros on somebody’s check as we want.

Yes, fiat money allows us to float as many zeros as we wish. Weimar Germany, Argentina and (most recently) Zimbabwe proved it. In no case did it work out real well. This is your solution to a so-called “distribution” problem? Wow.

Well Mr Smith

You obviously did not bother to read my post, or comprehend it in any way, I most assuredly did NOT say adding zeros was a solution to the distribution problem. I explicitly said that it was NOT! Please try to limit your critiques to things I actually did say. I was simply separating finance (we can NOT run out of money) from economics.

Your example of Weimar Germany and Zimbabwe show you have no clue as to the nature of their hyperinflationary spirals. You simply like to throw out those names to scare people. Mr Mitchell has an excellent post on just that topic. Read it and learn something

https://billmitchell.org/blog/?p=3773

Would you like to actually address the statements you think are “detached from reality”? Think of it as teaching me something.

Good day

I have read through some of the comments, and I particularly like the way that Bill used the example of how jobs were created in the Depression to demonstrate how the productivity of workers should not be looked at with a narrow perspective. This gives me a deeper understanding and a differen’t perspective on the need for the Job Guarantee. I certainly agree that this system would benefit developing countries. I must admit I haven’t all the reading to give me the depth of knowledge to fully understand your concept, but how does it benefit those that are not classified as in the labour market for whatever reason.

Greg,

re detached from reality

Lets’ start with the idea that the preeminent problem in any economy is one of distribution. Wrong. Wealth must be created before it can be distributed, a concept which redistributionists conveniently forget. In turn, both wealth creation and distribution can be done either efficiently or inefficiently (see above comments).

Of course we can’t run out of money, but we can run out of the most basic incentive to produce when we debase the currency to the point where producers give up and the economy collapses. I don’t need to read an apologia on why various failed regimes resorted to the printing press, the FACT is that they did, and the results were disastrous for their citizens.

Dear c smith

It is sad that you have by your own admission, “closed your mind”. You don’t even know what the argument in the blog that Greg suggested you read is.

best wishes

bill

bill,

Not at all. Enlighten me. What is the “nature” of the Zimbabwaean hyperinflation? I know the outcome for the citizens of Zimbabwae. Boil down several thousand words of academic gobbledygook into the core proposition in 300 words. My guess is it came down to a choice on the part of a corrupt regime (as hyperinflations do) in an effort to save themselves.

In case you haven’t noticed, simple declarative sentences are the currency of my realm. Any argument which can’t be stated in a straightforward way is a waste of your time and mine. I promise to chase down whatever supporting evidence you might reference later if the core concept has merit.

Mr Smith

Bill will probably not take the time to boil his previous post to 300 words and I dont blame him at all. He’s made a much more substantial effort already and you choose to ignore it.

I will however give you an overview. I cant guarantee a word limit however. I will consider this a test of my retentive powers because I will not look back at it and I hope Bill will correct me if I have misrepresented anything.

The hyperinflationary situations that are constantly brought up as the dangers of simply printing money go much deeper than the printing press.

Germany in the post WWI era was an example of, among many things, harsh retributions. German manufacturing and mining operations in the areas bordering France were in fact taken over by the French ( after Germany defaulted on their obscene war reparations)and German workers left.

This caused an abrupt choking off of the supply chain leading to increased prices since Germany continued to pay the German workers in the local currency and when the lost manufacturing and mining output caused exports to fall, the only way they could pay the reparations was with more currency. So the seminal event was a supply shock which was a result of a confiscatory move by a hostile neighbor.

Zimbabwes was similar in that the govt decided to take productive land from productive white farmers and give it to black native farmers who could not produce at near the levels. This supply shock and other political and economic decisions completely trashed production. The money printing was secondary.

Both cases were the result of small countries, one in the aftermath of a war it was being punished for another in the midst of terrible racial inequality and trying to do something about it, with very limited production chains that became disrupted. The loss of production was the primary

cause not the money printing.

Neither of these dynamics is operating in the US, Britain, Japan, Aust or China today. The hyperinflation cries are not credible in the least.

Now Mr Smith to our previous discussion.

The preeminent issue in any economy is “Who gets what and how do they get it”. That is what ALL economies start with. We are in modern economies at the point of answering these questions in various ways but that is STILL the central economic problem. There are things we all need, things we all want (but dont need) and things only sought by certain types of people. How are claims to these things made?

I would argue that our most basic incentive is to CONSUME not produce. It is always better (in an economic sense) to receive than to give.

Money is NOT wealth. It is a claim to goods which CAN be wealth but may also be WASTE. You may see something as wealth (gold) where I see it as superfluous.

I cant figure what efficiency in your argument really means. There can be seven middle men between field and your plate and you might call it efficient where as one entity can take it from the field to everyones plate but because it was a “government” you see it as inefficient. Even if the “cost” in scenario two was less you would see it as inefficient.

Sorry Greg; you’re still stuck on distribution as the central tenet, when the fact is that the “what” which you refer to doesn’t exist until someone makes it.

How can you say that consumpution is primary and production secondary, when what is NOT FIRST PRODUCED cannot be consumed? The propensity to consume may drive the production imperative, but the actual consumption doesn’t happen UNLESS SOMEONE TAKES THE INITIATIVE TO PRODUCE IT.

Money can most certainly be a store of wealth, but ONLY if it is impervious to the inflationary propensities of politicians. Gold is not superfluous, but instead represents a sort of last refuge from debasement. I regard holding gold as a necessary evil (it has relatively little productive value) in a world run by human beings.

Finally, there can be a thousand intermediaries between producer and final consumer, but if the final consumer is free to choose what is best for him or her (rather than dealing with a monopoloy provider, government or otherwise) all are better off as a result of the competition.

Mr Smith

I talked about consumption being a more basic desire. You act as if we were born to “produce” we actually are born to consume……food mostly. Thats our need. Once we created societies with people who did not need to gather their own food(because of farming and animal domestication) then we had tinkerers who invented stuff but only the stuff that was desired by consumers actually sold. Demand drives supply ……ALL DAY LONG!

Again, Gold is superfluous TO ME. I do not desire it at all and I will also fight tooth and nail (though I dont think it will be necessary) to keep our currency off any kind of gold standard. You can already buy as much gold as you want for the right price.

I think you contradict your own point when you first claim that productive value is paramount and later when discussing your desire to hold gold you admit it has no productive value. Sounds to me like YOU simply like pretty shiny metal, but it has no value TO ME.

I dont disagree about the virtues of competition in the market place, unfortunately not every “commodity” is better distributed using ONLY market dynamics. Its just a plain truth. Some things, that every one deserves equal access to, are better not left to market dynamics. You are evading the efficiency question again. Is efficiency about keeping costs down or keeping governments out?

Dear Mr Smith,

why do you assume that government has a genuine reason to keep “disadvantaged workers” unemployed without having asked them whether they want to have a job which would provide them reasonable living and social standing or not? What is the purpose of YOUR government? Is it to tax and distribute?

Why do you make an assumption that inflation is not a desired outcome versus giving jobs to “disadvantaged workers”? Is there any research on this topic? And this goes without saying that inflation is the result of imbalance between real demand and real supply and not quantity of money as you seem to think and it is the task of governments to fix imbalances either via demand or via supply. And now since most of the supply in the US was outsourced to China, the moment they revalue US will face inflation big time. But textbook professors will link it to FED and their “printing” and not supply/demand imbalance.

And speaking about “disadvantaged workers”. My wife can not find a job even for ZERO pay. That is right. We do not starve on cash-flow basis but she wants to do something useful in this society and she CAN NOT. In my company, which employs about 50000 in Europe, there is an absolute hiring freeze to the extent that any new position should approved by the Board (this issue is very widespread). And government does not hire people because deficits are scaring some people off. But all that my wife NEEDS is a JOB. Even for FREE (though it is not possible in the minimum wage settings but lets call this free).

Dear Bill,

this is my first try to make a reasonable comment. Hope it is not too far off 😉

Thanks for your efforts. I think I am slowing freeing myself from textbook dogmas.

One last thought Mr Smith

What do you call production without a consumer……………..WASTE!

How is something produced……..by labor not by capital. You need capital to pay(incentivize) the labor if you want something produced but no labor no production.

It also seems to me from your statement about gold that you do not hold human beings in very high regard. You regard holding non productive commodity a necessary evil because of humans, whom you must find more evil…………………….. maybe thats your problem. Learn to see the good in other people…………. there’s plenty to see.

Good day