The other day I was asked whether I was happy that the US President was…

Euro zone’s self-imposed meltdown

I have been looking into underemployment data for Europe today as part of a larger project which I will report on in due course. But whenever I am studying European data I think how stupid the European Monetary Union (EMU) is from a modern monetary theory (MMT) perspective. Then I read the Financial Times this afternoon and saw that Diverging deficits could fracture the eurozone and I thought there is some hope after all although that is not what the journalist was trying to convey. This is an opportune time to answer a lot of questions I get asked about the EMU. Does MMT principles apply there? Why not? Is this a better way of organising a monetary system? So if you are interested in those issues, please read on.

I always like to get back to the things that matter when I am writing about macroeconomic theory especially when I am focusing on financial and banking arrangements. Remember that most often the financial markets just shuffle wealth between casino players. They rarely accomplish anything that we could call productive.

It always bemuses me when I receive negative correspondence from characters who tell me they are working on some bank desk or another (meaning they think that is important – presumably they are staring at computer screens all day watching for numbers to change) that my advocacy of a Job Guarantee is outrageous because it would just create a whole lot of unproductive jobs. I laugh everytime I get one of these nasty E-mails.

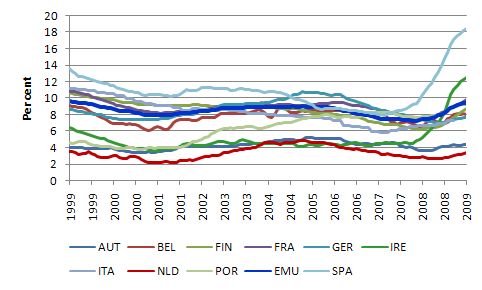

Anyway, the following graph shows the OECD MEI unemployment rates (harmonised) for selected Eurozone countries with the thicker blue line being for the whole EMU area.

Only the Netherlands (NLD) and Austria (AUT) maintained fairly low unemployment rates since the inception of the EMU. In Netherlands case, they have had rising underemployment and a significant portion of their working-age population pensioned off on disability support pensions. Ireland (IRE) went from being a relatively lower unemployment rate EMU country to a hospital-case in the current crisis. Spain (SPA) is also hurting badly in the current downturn having never really recovered from the 1991 recession.

The larger (wealthier) European economies however have never reduced their unemployment rates below 6 per cent and the average for the EMU since inception is 8.5 per cent (as at July 2009) and rising since. The average for the EMU nations from July 1990 to December 1998 (earliest MEI data for the EMU block available) was 9.7 per cent but that included the very drawn out 1991 recession. Underemployment throughout the EMU area is also rising.

So what about these diverging deficits?

Regular FT writer Wolfgang Münchau wrote on October 4 that he is:

… almost despairing … about what is happening at the eurozone level … The underlying problem is a policy divergence between France, Spain, Italy, Portugal and Greece on one side, and Germany, Finland, Austria, and the Netherlands on the other. The policy divide between France and Germany is the most damaging. Paris dropped a bombshell last week when it said it no longer aimed to reduce the French budget deficit to under 3 per cent of gross domestic product by 2012. This is the limit set by the Maastricht treaty. Even on optimistic growth assumptions, France will not hit the target until 2015 at the earliest. By then the country’s debt-to-GDP ratio will have reached more than 90 per cent.

Oh dear, the French government appears to be bowing to domestic political demands and actually using fiscal policy to reduce the damage of the crisis on its citizens. Unemployment in France in August 2009 was at 9.9 per cent having risen from its 2008 average of 7.8 per cent (Source).

Münchau considers this to be tantamount to having “effectively given up on policy co-ordination within the eurozone” which is “a decision President Nicolas Sarkozy will almost certainly regret one day”. Apparently, Spain is heading “into the same neighbourhood” and given Italy will not make serious cuts in the fiscal deficit, Münchau concludes that:

… we are likely to end up with debt-to-GDP ratios in three of the four large eurozone economies settling at levels close to 100 per cent.

Profligacy! This should be outlawed.

Spain’s unemployment rate in August 2009 was 18 per cent having more than doubled since its 2007 low of 8.3 per cent. Italy’s unemployment rate in June 2009 was 7.4 per cent having risen from its 2007 low of 6.1 per cent (Source).

In contradistinction, Münchau says that:

Germany … has committed itself to the virtuous path.

In that country, suffering a major decline in its manufacturing base and with unemployment now lapping up around 8 per cent. You might like to read this blog – Fiscal rules going mad … – where I outline the recent constitutional developments in Germany that aimed to outlaw budget deficits in the coming years.

The constitution changes finally agreed in Germany will restrict federal deficits to a maximum of 0.35 per cent of GDP averaged over the business cycle after 2016. The Germans are now on a course of self-destruction as it tries to meet this legal constraint by the cut in date. Münchau estimates that this “deficit target implies a debt-to-GDP ratio of about 10 per cent in the long run”.

In that context, Münchau concludes that:

The fiscal divergence inside the eurozone will then become intolerable.

This is not the first time, the EMU has been strained. In 2005, France, Germany and Portugal all struggling to keep a lid on unemployment pushed their deficits beyond the 3 per cent deficit to GDP rule imposed as part of the Stability and Growth Pact (SGP) that arose out of the Maastricht treaty.

The upshot was that the SGP was made “more flexible” and temporary departures from the rule in recognition of specific economic conditions in individual countries were allowed.

Münchau considers that the ECB will push up interest rates to deal with this “sustained divergence”. He also thinks that:

France will use tax cuts to strengthen the economy’s supply side, which in an out-of-control monetary union can give rise to a race of competitive real devaluations … [and that] … the perception of sovereign default risk within the eurozone will rise dramatically.

Sarkozy has been thinking about lowering tax burdens on employers in France since he came to ofifice. The plan mostly mooted as to incrase the VAT and reduce the employers’ contributions by one percent of GDP. This would be equivalent to a real devaluation without requiring any change in the nominal exchange rate, which of-course is impossible in the EMU.

French companies would enjoy lower domestic labour costs and their products become more competitive against the products of their foreign competitiors. On the other side, imports become more expensive because a higher VAT is imposed. In fact, this sort of strategy doesn’t change the local post-tax-price of labour because the higher VAT tends to offset the lower unemployment insurance contributions. But the traded-goods price of labour falls (exports do not attract the VAT) and this is seen to be beneficial. Further, imports are discouraged by the higher VAT. Germany did exactly this in early 2006 when it increased its VAT by 3 percentage points and lowered its federal unemployment insurance.

This is exactly the type of “beggar-thy-neighbour” policies that undermined the Bretton Woods system of fixed exchange rates although then the nations tried to gain traction against their rivals via competitive nominal currency devaluations.

But “beggar-thy-neighbour” policies essentially will undermine a monetary union.

Other nations will buy into it and the end result will be lower payroll taxes and higher VAT rates without any basic improvement in the underlying economic challenges.

Also note the use of the word perception – there is very little chance that any of the current EMU members would default.

In relation to this, in my recent book with Joan Muysken – Full Employment abandoned we wrote:

The situation in the EMU is slightly different. The member states voluntarily agreed to legally constraining the ECB from providing credit positions to its EMU member governments (which is one of the reasons the UK declined to join the EMU). However, EMU member governments can issue treasury bills to finance their expenditure, which the ECB has to accept eventually since it has to maintain its interest rate target …

Münchau thinks that within ten years people will “start making the case that Germany would be better off outside the eurozone” although he thinks that “politics may well prevent it”.

The problems are related to the fundamentals of the system which, by construction, cannot handle a major downturn and the internal political consequences that arise from that.

The fiscal austerity that accompanied the period of transition into the EMU as governments struggled to reach the entry criteria established under the SGP manifest now as persistently high unemployment and rising underemployment; vaporising social safety nets; decaying public infrastructure and rising political extremism.

Some 10 years after the introduction of the EMU, these problems are increasing rather than decreasing, as the proponents of the system claimed.

Prior to the creation of the EMU, each of the member states were sovereign in their own currencies and had their own central banks. That means they were not revenue-constrained and could conduct fiscal policy and monetary policy in a co-ordinated way to best serve the socio-economic interests of their citizens.

Of-course, in this guise, they succumbed to the growing neo-liberal take-over of macroeconomic policy and typically worried about the size of budget deficits and the public debt. All the usual spurious arguments were used by the conservatives to politically constrain their use of fiscal policy – for example, crowding out arguments (higher deficits cause higher interest rates) and Eurosclerosis that engendered privatisations and deregulation.

Leading up to the unification, the interest rate argument was played to the full. Neo-liberal supporters of the EMU claimed that lower interest rates would emerge throughout Europe. Not only didn’t that happen but it begged the reality – the nations could have unilaterally maintained zero interest rates as sovereign economies by just managing their central bank operations along the lines followed by Japan, for example.

Once again, had they understood MMT and argued the case politically, these nations would now be in much better shape than they are now.

This is why Europe has been sustained very high unemployment rates since the mid-1970s.

So some might say going into the EMU was moot because they were acting as individual non-sovereign governments anyway. True enough. But now they are legally bound rather than politically bound. The political climate can change whereas it will be much harder to unravel the EMU to restore sovereignty to each of the member states.

So in entering the EMU, all those previously sovereign states surrendered this capacity and became users of the currency issued under the auspices of the ECB rather than monopoly issuers of their own currency. In effect, they became states of a federation (like an Australian or a US state).

Some might also say that this transition doesn’t really alter much because the EMU created new sovereign institutions – the European Parliament and the ECB. But this misses the point that these two institutions are not a consolidated entity serving the same politial ambitions. They also act anything but like a sovereign currency-issuing government.

The EMU, instead, tied itself up in a strait-jacket (SGP) to ensure that individual member state governments who are still accountable politically to their own citizens could not pursue their own agendas very easily.

One danger I see at present is the rising nationalistic political movements throughout Europe which have appealed to the disadvantaged and alienated youth will spawn a political dissolution of the EMU. Clearly, the domestic policies that would follow would be alien to my values.

The other solution would be to create a properly function sovereign state at the EMU level by giving the European Parliament fiscal responsibilities that are currently borne by the individual member states and making it more representative. To make this work even better, the ECB should come under the responsibility and direction of the European Parliament so that macroeconomic policy is enacted by elected officials.

But by far the best option in my view would be to dismantle the EMU and restore currency sovereignty to the now neutered member states.

While I visit Europe often and have stopped throwing away the myriad of small coins I used to pick up as I went across borders (especially those stupid 10 cent Dutch coins) – I now only throw Euro cents the welfare collection bins at airports – the benefits of avoiding all those currency conversions appear to be small relative to the costs of not remaining sovereign.

I realise that the EMU agenda (unification) was to stop another European World War but surely other methods could have been found to achieve that without creating a system that prevents governments from actually doing what they are voted in to do – increase welfare of their citizens.

Instead of outlaying budget deficts that underpin private saving and sustain higher levels of aggregate demand and employment, I would outlaw unemployment (above some minimum rate to allow for frictions – moving between jobs).

I would invoke a new SGP whereby the officials in the ECB would start losing pay the moment the unemployment rate went above 2 per cent in any member state. That might invoke some rapid institutional changes and allow fiscal policy to work more usefully. Its late in the day and I am dreaming!

UK Government plans to transfer public wealth to top-end-of-town

While I said the blog “was off to Europe today” I don’t consider that to include Britain. But I read today that just across the Channel from Europe, the UK Government is going to transfer a massive amount of publicly-owned wealth to cashed-up private interests just because it has forgotten it is a sovereign nation. It doesn’t get much more stupid than this.

Picture it – A sovereign government with no solvency issues but self-imposed constraints on its fiscal policy such that it needs to issue public debt when it net spends. Over a million 16-24 year olds unemployed in Britain. Integrated fiscal and monetary policy (unlike the EMU) … a flat assets market.

Then the Government announces it need money to pay off its debts [read: they are wanting to look tory-like with the national election coming up] – and so they announce that they will try to raise £16bn by selling public assets including the Channel tunnel rail link, the Dartford bridge and tunnel and other assets.

The Guardian reports that the PM is meeting “with business leaders today to fully itemise the assets, earmarking infrastructure for sale …”

It doesn’t get that much easier than that for the top-end-of-town. They just offer the PM a cup of tea and he outlines the specification of the sale.

The Guardian says the plan is designed to meet the Government’s:

… pledge of cutting the deficit in half over the next four years.

Bad luck for Britain … it seems political wisdom is fairly thin on the ground. The tories want “to start paying down the deficit immediately” more or less in inverse proportion to the rise in youth unemployment one might conjecture. The Guardian quoted their spokesperson as saying:

… [the sale was] … probably necessary … Given the state the country … [finances] … is in is probably necessary but it is no substitute for a long-term plan to get the country to live within its means.

Then there is the Liberal Democrats. Their Treasury spokesman is quoted in the Guardian as saying:

Given the state of the public finances, asset sales, at least in principle, make sense.

The Lib Dems are trying to sound sensible by arguing that the time is not right given the appalling state of the British economy.

The whole notion is absurd. I would imagine there are some investors who cannot wait to get hold of the so-called “non-core” assets at bargain-basement prices. And what is a “non-core” asset anyway?

The whole privatisation movement which has transferred massive volumes of public wealth to a relatively small number of private sector investors over the last 20-30 years is based on the nonsensical notions that: (a) sovereign governments are revenue-constrained and cannot afford to maintain assets (even if they are turning a commercial profit); (b) even if they are turning a commercial profit, the private sector will manage them more efficienty (we have seen how well this has played out in the current crisis!); and (c) the government should not be involved in making profit anyway. By whose rule?

None of this had any basis in anything other than the ideology that drove it. The top-end-of-town saw it as a way of grabbing valuable assets at cheap prices and earning massive commissions by managing the sales on behalf of governments. With real wages fairly flat and average unemployment rates excessive over this whole period it was clear that the lower-income workers didn’t benefit very much at all from the sales.

How did they ever win the Ashes?

Digression

How can you win a Nobel Peace Prize when you are the commander in chief of forces that are systematically killing people in various countries that you have invaded?

In a system where countries have free floating exchange rates and a liberalized capital account, monetizing government deficit spending will just lead to massive capital flight and a collapse in the exchange rate (possibly even hyperinflation as the cost of imports surges).

How does a country using neo-chartalist methods of government spending overcome this problem?

Dear Andrew

You already asked this question elsewhere. You might like to consult that answer.

best wishes

bill

“How can you win a Nobel Peace Prize when you are the commander in chief of forces that are systematically killing people in various countries that you have invaded?”

I used to ask that question regarding Theodore Roosevelt, one of the most invasion-happy presidents the USA ever had, and regarding Woodrow “he kept us out of war” (until 1917) Wilson. I guess War is Peace, Freedom is Slavery, etc.

I was bemused to hear about Brown’s plan to sell public assets in order to reduce future deficits on the radio this morning.

Can you please enlighten me if I’m wrong, but according to my understanding of macroeconomics (gained almost entirely from this blog):

1: A deficit is not a stock, it is a flow (i.e. a transfer of money from the Government to the non-government sector over a period of time).

2: Public assets may contribute to the Governments income stream if they operate at a commercial profit.

Given this, how on Earth does selling assets decrease a future deficit? Doesn’t it just serve to decrease the Government’s income, there-by increasing future deficits?

Am I missing something, or is this propositon of selling assets to reduce a deficit simply nonsense?

So deficit hysteria reasserts itself once the well-connected have been bailed out, and is now being used to justify transfers of real assets to the private sector so that the government can make a simple accounting entry? The tyranny of neoliberal accounting continues..

Bill,

I notice that the Netherlands unemployment rate has been unaffected by the global downturn (one of only two Euro countries on the chart) and remains very low, not that far above full employment. Most other Euro countries have been hammered.

I speculated on possible reasons on another blog…

“Referring back to the Netherlands – I really don’t know, I would need to ask a professional researcher (or a number of them) but just off the cuff it looks to me as though their unemployment benefits system functions as a kind of an automatic stabaliser or automatic stimulus.

If you become unemployed and are eligable for benefits, the system will replace up to 75% of the wage you were earning – we have nothing like that here. The dole would not come close to this.

lose at least five working hours per week;

It looks like the system will replace lost working hours as well – that could encourage employers to keep more part-time staff. It would also mean that losing hours would be largely irrelivent to the worker who lost them – the money would be replaced.

Depending on how long you have been employed before becoming unemployed, you are eligable for a minimum of 6 months worth of that deal. I would be eligable for a full year’s worth (I guess after that it reverts to a lower, dole-like payment).

A big spike in unemployment and/or underemployment here can destroy a hell of a lot of consumer spending power through lost wages. When a large number of resource sector workers lost their jobs here, other businesses around town were starting to shut shop or cut back staff/hours – the big spenders had lost their spending ability. But if most of those lost wages are quickly replaced by goverment spending directly into the average Joe’s bank account – similar to our first two stimulus injections here – then the spending that drives demand (and the jobs that exist because of it) may not be overly affected.

I really don’t know if this is greatly different from other Euro countries but it is interesting contrast with what we have”

http://www.easyexpat.com/en/amsterdam/work/unemployment-benefits.htm

Is this anything to do with the reason?

P.S I am still a daily reader of Billyblog.