The other day I was asked whether I was happy that the US President was…

Bite the bullet and get shot in the mouth

If I was to become the boss of a sovereign government, the first thing I would do would be to introduce a Job Guarantee and immediately set about restoring jobs and a living income to those who are without either. This would immediately boost aggregate demand and give business firms a reason to start investing and producing. The second thing I would do would be to pass legislation outlawing all the international rating agencies. If I was to become the boss of a government within the EMU, the ordering would be similar except that before I introduced the Job Guarantee I would withdraw from the monetary union, default on all Euro-denominated debt, and reintroduce a sovereign currency. Then I would offer a job to anyone who wanted one at a living minimum wage and outlaw the ratings agencies. All that could be done on the first day of my tenure in official office. The recession would be over within a few months and then I would set about nationalising the zombie banks. It would be a fun ride!

I read a speech delivered yesterday (September 20, 2010) by the Governor of Ireland’s central bank Patrick Honohan. The speech was delivered to the SUERF – The European Money and Finance Forum in Dublin. Reading is normally a pleasurable activity and a central part of my enjoyment. But sometimes you choke on the nonsense that is before your eyes.

The speech was extraordinary in one sense because it was from a central banker delivering commentary on fiscal policy. So the so-called central bank independence goes only one way! When it suits, the central bankers feel it is entirely appropriate to make political statements about the democratic choices of an elected government but will scream if the polity interferes with its (unelected and unaccountable) decisions-making powers.

Total hypocrisy.

The Governor claimed that:

As many of you will know, the Government has already taken prompt and painful steps to readjust its spending and tax profile, most conspicuously by effectively cutting public sector pay rates … if the economy stays close to the track originally envisaged, the deficit would come close to 3 per cent by 2014. But as the IMF and others have noted, the real economy, the price level and also interest rates on Government borrowing, have evolved in a less favorable way … Some explicit reprogramming of the budgetary profile for the coming years is clearly necessary soon if debt dynamics are to be convincingly convergent. Recent movements in the yield spread on Government debt – both for Ireland and for some other countries – readily demonstrate the costs that can result unless international lenders remain convinced that the budget is going to be kept on a convergent path, as indeed the Government is committed to ensuring.

This was reported in the press as the central bank governor saying that the Irish government “must bite the bullet “soon” on fresh spending cuts, if it is to bring debt dynamics under control” but that this “message is starting to test political patience. Public wages have already been cut 13pc on average” (Source).

So “bit the bullet” you Irish bastards! Sure and get shot in the mouth! What an example of leadership is that?

It almost beggars belief the audacity that these characters (Honohan and his ilk) have – strutting the conference circuit – presumably drinking and dining well at nice hotels – and then demanding further spending cuts when it is clear that the economy is heading south as a result of the earlier cuts.

When will someone start asking the real questions: Why tolerate the rating agencies holding the welfare of the people to ransom? Why tolerate Europe’s EMU elites holding the welfare of the people to ransom because they refuse to admit their European common currency dream is deeply flawed?

At least, the common currency union is deeply flawed because its design is dominated by neo-liberal precepts which prevented a sensible fiscal capacity being available to meet the challenges of asymmetric demand shocks of the type that has crippled the zone in the last 3 years. But even then the lack of homogeneity between the economies and the relentless German approach to their own needs would suggest the Eurozone is poorly conceived in membership.

But the debate is not heading in the direction at present of dissolution. Indeed, poor Estonia still thinks it is in their best interests to surrender their currency sovereignty entirely and join the sinking ship on January 1, 2011.

It is only a matter of time before debt defaults begin which will bring the logic of the union into even sharper relief and hopefully encourage Greece, Spain, Ireland and Portugal (at least) to bail out.

Which leads to this article in the UK Telegraph (September 19, 2010) – The IMF Itself Has Become the Problem as Europe’s Woes Return – which I found interesting.

The article says that:

Once a quorum of big names says the game is up in a debt crisis, events move fast and furiously. Portugal neared the line on Friday when Diário de Noticias cited three ex-finance ministers warning that the country might have to call in the International Monetary Fund (IMF). One spoke of a “reckless reliance on foreign debt”; another spoke of “runaway public spending”. No matter that all were complicit in euro membership, the policy that incubated this crisis and now traps Portugal in its depression.

I am sure none of the ex-finance ministers are suffering financially yet all should lose all public entitlements for having pushed their nations in the EMU.

Prior to joining the EMU, “Portugal was a net foreign creditor” but now its foreign debt is 109 per cent of GDP as a result of the low Eurozone interest rates and the borrowing boom they engendered.

And, even though Portugal is severely cutting public spending to meet the demands of the Brussel-Frankfurt bullies the financial markets are delivering pain in the form of surging yields on 10-year Portuguese debt.

So it is like blackmail – you pay once, the blackmailer gets greedy and demands more. When do you stop paying? Answer: you have to eliminate the blackmailer by coming clean. In the context of Portugal the only solution that will allow their government to serve the best interests of the people that elected it is to exit the EMU and re-establish their currency sovereignty.

Then who is in charge changes dramatically. What the financial markets think about the quality of sovereign debt becomes irerelevant and what the credit rating agencies think becomes irrelevant.

Then the government stands or falls on whether it delivers financial stability and economic progress. The ballot box sorts that question out. It is a deeply offensive state that we have allowed democratic accountability to be eroded and government policy to be driven by the needs and wishes of amorphous (and unproductive) financial markets.

The Telegraph article says that:

António de Sousa, head of Portugal’s bank lobby, said his members are in dire straits. Banks cannot raise funds abroad, remain “extremely fragile”, and “quite simply” will have nothing more to lend unless foreign capital returns. Portuguese banks cannot survive on local savings. They rely on foreign funding to cover 40pc of assets.

This is the underlying crisis in the EMU. The lack of currency sovereignty means that the national governments are unable to protect their own banking systems in the event of a collapse of the type being signalled here.

In Ireland, the bank bail outs are imposing punishing costs on the standard of living of the citizens. The government chose to “socialise” the losses and restructure the banks (a process that is not complete). The correct thing to do would have been to force the losses onto the shareholders, nationalise all the banks that were insolvent and restructure them within the public sector. So that the socialised losses would lead to socialised benefits.

The extent to which income and wealth has been transferred in most countries from poor to rich by inappropriate government responses to the crisis (and poor policy choices before it) is breathtaking.

The only way the EMU member states can insure their banking systems remain stable is to re-establish their currency sovereignty. That is, exit the monetary union.

But the policy direction in Portugal is distinctly Irish. They are now accelerating their public spending cuts. The Telegraph article challenges the logic of this:

Yet what exactly will austerity achieve? Combined private and public debt is 325pc of GDP (viz 247pc for Greece), so the country already risks a debt compound spiral. Lisbon has been cutting state jobs for several years. This has certainly crimped growth, but not cured the problem. Productivity is stuck at 64pc of the EU average. The brutal truth is that Portugal lost competitiveness on a grand scale on joining EMU and has never been able to get it back. Convergence never came.

Ireland has shown what happens when you grasp the fiscal nettle, slashing public wages by 13pc – to applause from EU elites – without offsetting monetary and exchange stimulus. Irish bonds have spiked even higher to a post-EMU record 6.38pc. Two years into its purge, Ireland has a budget deficit near 20pc of GDP. It is 12pc if you strip out the bank rescues, but the reason why the bad debts of Anglo Irish keep spiralling upwards is that the economy keeps spiralling downwards. House prices have fallen 35pc. Nominal GDP has contracted 19pc.

From a Modern Monetary Theory (MMT) perspective none of this comes as a surprise. It is exactly what happens to an economy when you cut spending in an environment where demand has already collapsed. It is exactly what happens when you insist on tying public debt-issuance $-for-$ to net spending increases. The rising spreads on public debt is exactly what happens when the bond markets know the nation has surrendered currency sovereignty.

But one by one the nations are going down the same path which will systematically undermine the welfare of a vast bulk of their citizens and further transfer wealth and real income to the top-end-of-town, which caused this strife in the first place.

The Telegraph article is interesting because it sheets home the blame, in part, to the IMF. The article quotes former IMF chief economist Simon Johnson who said “Ireland’s debt is ballooning, while its capacity to pay has collapsed” and:

… the country has made a Faustian pact with Europe, able to draw ECB loans worth 75pc of GDP so long as Irish taxpayers shield European creditors.

The problem for EMU nations is that once they surrendered their currency sovereignty they have to “finance” their spending. If debt-issuance becomes problematic the only other option is to raise tax revenue.

The Article concludes that:

In any case, the IMF itself has become the problem, operating as an arm of EU ideology under Dominique Strauss-Kahn. It offers no remedy since it acquiesces in the EU’s ban on debt-restructuring. In Greece it backs a policy that will leave the country with public debt of 150pc of GDP after its ordeal – allowing French and German creditors to shift a big chunk of Greek risk to Asian taxpayers through the IMF, and to EU taxpayers through the eurozone rescue … the Fund has become a font of incoherence, an engine of moral hazard. In August, it abolished its credit ceiling and created a new tool to rush fresh debt to states that need more debt like a hole in the head.

You always have to ask yourself what is the agenda driving these international organisations. Over the last 40 years or more the IMF has not acted to advance the interests of the normal citizens. They have helped protect first-world capital (banks etc), they have helped dictators maintain power and they have been active participants in the transfer of massive quantities of real resources from the developing (poor) world to the top-end-of-town in the rich first world.

Once the Bretton Woods system collapsed in 1971, the IMF lost all purpose. After that time, it has become a haven of neo-liberal thinking and has been one of the principle vehicles engaged in implementing that pernicious program.

The Telegraph say that if “Greece, Portugal, or Ireland restructure debt” then the contagion will spread to Spain and Italy and where will it end given the big French and German banks are so exposed. The point is that the “monetary union has created a monster”.

It is a monster that will not resolve without dissolution. Debt default is inevitable unless the ECB continues to violate the Lisbon rules by bailing out the problem nations. Please read my blogs – Euro zone’s self-imposed meltdown – A Greek tragedy … – España se está muriendo – Exiting the Euro? – Doomed from the start – Europe – bailout or exit? – EMU posturing provides no durable solution – where I discuss the intrinsic design flaws in the Eurozone monetary system.

In this article – Europe’s €440bn rescue fund wins AAA just in time we learn that:

Standard & Poor’s and Fitch have both granted the Eurozone’s rescue fund a AAA credit rating, clearing the way for swift action if needed as the region’s debt crisis threatens to erupt again.

In other words, the non-bailout clause in the EMU treaty is expected to be used again as the European situation worsens.

The EU bosses know full well that their system as designed and implemented has been incapable of meeting its first major challenge. The band-aid remedy is just a way to protect the big French and German banks and the citizens in the southern European states are being punished for sins they didn’t get to enjoy!

The EU bosses know that if they didn’t have this treaty-violating bail-out fund the system would quickly collapse under the weight of the debt default. In my view, all they are doing is forestalling the inevitable. And each day, the social unrest in Southern Europe is increasing which will make it difficult politically to implement continued austerity.

The only short-term solution is for the ECB to continue buying government debt in the secondary markets. But then that rather defeats their purpose. The action manifestly tells the world their system has failed.

Meanwhile, the OECD has put out it latest US Economic Survey and confirms that it has learned nothing from the crisis.

The Survey indicated that the US economy has been growing because it has been “supported by substantial stimulus measures”.

It also suggests that growth will not be strong enough to “put a significant dent in unemployment” which means that long-term unemployment will continue to rise (along with poverty rates).

To see how twisted the logic has become, the OECD claim that:

… support from monetary and fiscal policy is still necessary … [as well as] … the extension of unemployment benefits, job training and tax credits for hiring workers, and the Administration’s target of reducing the deficit to 3% of GDP by 2015 … The establishment of the bipartisan National Commission on Fiscal Responsibility and Reform by President Obama with a mandate to propose additional measures to achieve fiscal consolidation also goes in the right direction … “even if measures are to be implemented only at a later stage, spelling them out now is an important signal”.

Signal to whom? The unemployed? The business firms that will not borrow nor invest because they are haunted by a contraction in public spending that is coming at some point? The consumers who will not spend because they are worried they will lose their job as the fiscal contraction gathers pace? The bond markets who cannot get enough government debt to satisfy their greedy, yet insipidly weak ambitions.

I say insipidly weak because government bonds represent corporate welfare to these unproductive and unnecessary elements in our society. We would all be better off if they got a real job and stopped sponging on the public purse but complaining about it into the bargain.

So the OECD realises that without the fiscal support the US economy and most economies would be in much worse shape than they are now in. The situation in most countries is still very bad given that the fiscal support barely trickled out into the spending stream as the deficit terrorists wages their unrelenting and destructive campaign.

But a far amount of the change in the budget position in each nation has been driven by the cyclical component – that is, the automatic stabilisers. Please read my blog – Structural deficits and automatic stabilisers – for more discussion on this point.

What this means is that the fiscal positions will be reversed when growth returns because tax revenue will rise and welfare support payments will fall. There is very little logic in cutting the structural (discretionary) component of the budget now – just at the time that the recovery process requires the fiscal support.

That will definitely cause the budget to go further into deficit via the automatic stabilisers.

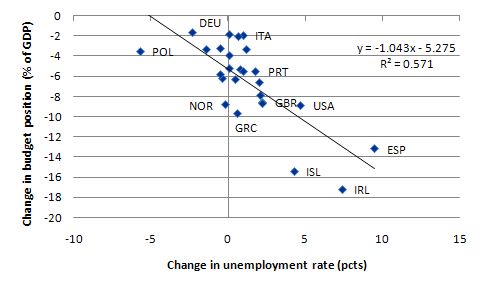

The OECD data accompanying the Survey is used to create the following graph. I also used the harmonised unemployment rates available from the Main Economic Indicators. The graph shows the change in the budget position as a percent of GDP (vertical axis) between 2006 and 2009 (inclusive) and the change in the unemployment rate (horizontal axis) over the same period (percentage points).

The relationship has some statistical veracity (given the R2 shown) which is to be expected given that the deterioration in the labour market prompts the changes in the budget components (as people lose jobs and stop paying taxes etc). I realise that the causality is bi-directional but that is another story. The dominance of the automatic stabilisers is driving the relationship depicted.

The conservatives know that the automatic stabilisers have driven most of the budget change. So how do they justify scorching the earth with fiscal austerity now in the hope that things will get better, rather than maintaining (and even strengthening) the fiscal stimulus to ensure growth gathers pace and reduces the budget deficit in that way?

They introduce another myth – the intergenerational strain on future budgets. According to this logic there is a time bomb ticking within the budget which will explode when we age some more and demand lots more hip replacements and pensions.

I have covered this myth in detail in several blogs – Democracy, accountability and more intergenerational nonsense and Another intergenerational report – another waste of time.

The bottom line is that a sovereign government will always be able to financially afford to buy as many hip replacements that are demanded as long as the titantium is available. It might be that as an outcome of the political debate the younger generations force an anti-aged mandate onto the governments of the day which prevents them from providing first-class health care to the seniors.

So you can see there are only two possible constraints – the real resource availability and the political choices that need to be made. There are no financial constraints on the government budget.

Thus, running austerity now and seriously undermining the recovery is unjustifiable on financial grounds. It is an irony that people will be better placed to pay for their own retirements and health needs in the future and be less reliant on public provision if they maintain continuous employment and enjoy real wages growth now. Fiscal austerity jeopardises both of these advantages.

Further, the capacity to cope with a rising dependency ratio comes from productivity growth and technological change. We typically get that from increased skill levels of the workforce and extensive research and development. In turn, strong higher education and public research institutions are crucial for the development of these advantages. Again, fiscal austerity undermines the capacity of an economy to generate these long-term benefits.

Fiscal austerity is about the “race-to-the-bottom” – where low-wages, insecure employment and low productivity are the salient characteristics. It is a mindless and totally unnecessary strategy.

The best the OECD can suggest is that the unemployed should be churned through training programs “to help workers adapt to the post-recession economy” and the government should provide “tax incentives for companies to hire new staff”.

You get the drift – not a job to be created. The business sector will not invest or employ at present because they are pessimistic. Cutting business taxes will not help consumers spend. Progressive policy would put funds into the hands of those who will spend them and then let the business respond with increased production. Firms will not produce just because it is cheaper if no-one will buy the extra production.

And finally, the credit rating agencies have been ticking the UK government because it has signalled it is joining the austerity train despite being fully sovereign in its own currency.

In the UK Independent yesterday (September 21, 2010) we learn that UK keeps triple-A credit rating as Moody’s backs Government cuts. Since when have been allowing criminal organisations to strut the world stage telling democratically-elected governments what to do?

Here is a fact about fiat monetary systems that is clearly overlooked: A sovereign government issuing its own currency is not at all dependent on what the international credit rating agencies or anyone else thinks. Please read this blog – Who is in charge? – to see where the power really lies if it is exercised.

Yes, only the voters matter for such a government. In that context, if governments do fall prey of these criminal organisations then they also have to lie to the voters because the policies that satisfy the latter (the ratings agencies) are never in the best interests of the former (the voters).

As a result, the voters are deceived into thinking that there are no real choices and that the government is actually doing them a favour inflicting harm on them because they are brainwashed into believing that it is lesser of two evils.

The Independent article said:

One of the world’s premier rating agencies yesterday backed the UK’s economy by maintaining its top credit rating, despite fears that the Government’s cuts could send the country into a double-dip recession.

So good fiscal conduct is to drive your economy back into recession just as the conduct of fiscal policy was allowing it to make some sort of recovery. A fine state of affairs.

You realise how scary the whole ratings gig is when you read the comments from the Moody’s so-called “lead analyst for the UK” – they are scary. He said that:

The global financial crisis of 2008 to 2009 caused serious long-term damage to the British Government’s balance sheet. The country’s economic outlook is also more challenging because private sector deleveraging, the uncertain state of the financial sector and slower growth in the UK’s main trading partners are not conducive to allowing GDP growth to return to its pre-crisis trend rate.

There is no such thing as “long-term damage” to a sovereign government’s balance sheet. What does that mean? There is never a solvency issue. The rising debt is rising wealth and the interest-servicing payments are income to the non-government sector.

The increased net public spending stimulates economic growth and the cyclical adjustments that follow reduce the public deficit substantially. What the hell does long-term damage mean? Answer: nothing!

Apparently, Moody’s is banking on an export-led recovery. Please read my blogs – Fiscal austerity – the newest fallacy of composition and Export-led growth strategies will fail – to see why this is misguided.

The Independent article then misinforms its readership:

A credit rating is essentially an indication as to how risky the agency thinks a debt issuer is. The higher the rating, the less likely it believes the issuer is to default.

There is no solvency risk for the British government. This is a totally misleading statement. The credit ratings rely on the public believing that they are an independent and important arbiter of the quality of public debt. They are irrelevant as Japan showed early in the 2000s.

Please read my blogs – Ratings agencies and higher interest rates and Time to outlaw the credit rating agencies – for more discussion on this point.

Conclusion

I cannot say that much of what I read today was enjoyable. I think I will have to read some of my latest Henning Mankell novel tonight to restore some sense of sanity. I am also planning to read up on Acidised multi-track drum loops! That should restore the joy.

That is enough for today!

Bill, is it entirely true to say that a sovereign state can ignore the markets? Imagine the UK were to decide that it needed to tax away some of the wealth from the top end of the economy (so as to do its bit in addressing the global liquidity glut and excessive financial services industry) and also decide to have sufficient fiscal stimulus to optimize employment in the real economy. In such a situation there would surely be capital flight from the UK to other nations that were focussed on favoring asset price inflation. Banks surely are going to lend in whichever country is fostering the most rapid asset price inflation. To my mind this creates the tragic need for countries to constantly transfer wealth from the poorest to the richest so as to keep as large a portion of the global pie as each country can.

Hmmm … in a widely noticed Bloomberg TV interview nobody else than Hans-Olaf Henkel remarked, that he’s already discussing the issue of re-introducing the DM with an elitist non-public exclusive circle. So Europe might soon enough enjoy again the benefits of truly sovereign governments issuing their currencies, but not because of good public policy accountable to voters. My guess: in the coming months conservative elites will hijack the currency agenda and the German public will readily follow. Germany will be the first country to withdraw from the Eurozone.

As for centralbankers like Honohan they should follow the example of their ex-colleague Thilo Sarrazin. Develop some interest in pseudo-science like Eugenics or Geocentrism and devote their time to write lengthy books why there’s overwhelming evidence that Ptolemy was correct and the sun orbits earth.

“This would immediately boost aggregate demand and give business firms a reason to start investing and producing. The second thing I would do would be to pass legislation outlawing all the international rating agencies. If I was to become the boss of a government within the EMU, the ordering would be similar except that before I introduced the Job Guarantee I would withdraw from the monetary union, default on all Euro-denominated debt, and reintroduce a sovereign currency..”

You’d probably want to use some of your newfound savings to build a good defence force for when you get invaded! lol

Question: With aggregate demand boosted and everyone employed and consuming, how would you go about controlling escalating inflation? Traditional monetary policy?

I agree with you about the major ratings agencies. A bullet to the temple would be just rewards for their efforts of the past decade.

Bill, I’m intrigued to know what you consider to be a just level of affluence for the Irish in a global context. Pre-crisis, the Irish were among the wealthiest people in the world and that was largely on the back of the Irish government doing everything it could to ramp up a real estate bubble. To my mind cuts in public sector pay and tax increases are justified to bring Irish affluence more in line with global norms. I totally agree that it is more just if those are aimed at the wealthiest in Ireland but I don’t see how Irish people can expect to be so much better off than those elsewhere in the world. After all someone working full time in Nigeria only gets paid $2 USD per day. Do you think a just level of affluence for any nation should be that determined by how canny its government is at playing the expanding fiat currency global chess game? To my mind that is as bad as saying that individuals deserve as much as they are able to grab.

“A credit rating is essentially an indication as to how risky the agency thinks a debt issuer is. The higher the rating, the less likely it believes the issuer is to default. ”

Is that statement really that misleading? I wonder whether the credit rating agencies are themselves aware that there is no risk of default of sovereign governments. It’s the old “incompetent or evil?” question.

Either the agencies are incompetent and truly believe there is a default risk of sovereign governments and judge accordingly – completely incorrectly of course, but at least their stupidity would be honest in this case.

Or the agencies are evil and they want people to believe that there is a default risk for whatever reason, even though they know for a fact that there is none.

I personally prefer to err in the direction of incompetence as an explanation, combined perhaps with the lesser evil of refusing to listen to anything that falls outside their comfort zone. This is not to excuse the credit rating agencies, of course, but it changes the way that MMT advocates should approach the situation for improvement.

“The correct thing to do would have been to force the losses onto the shareholders, nationalise all the banks that were insolvent and restructure them within the public sector. So that the socialised losses would lead to socialised benefits.”

That’s a very good point, and somehow forgotten or ignored in the maelstrom of criticism of governments (like the US, for example) for being “socialist”, when they are nothing of the sort, and have demonstrably averted a major economic catastrophe…for now. The banks and right wing market fundamentalists have been more than happy to socialise losses, haven’t they…..which reminds me of a recent Krugman article, “The Angry Rich”, which encapsulates this contradiction brilliantly – http://www.nytimes.com/2010/09/20/opinion/20krugman.html.

I am a recent MMT convert, now working on my disciple badge.

For every valid MMT proposal that contradicts mainstream thought, there is a reflexive response.

e.g. Sovereign government XYZ should default on it’s foreign debt.

FAQ’s

How exactly will you do that?

Won’t that collapse the currency?

Will the nasty bank creditors pull all their money out of the country?

etc.

I don’t know if there is an organised MMT movement, actively trying to influence policy. I think there should be!

Is anyone working on a website to list the key tenets of MMT in Layman language?

If so, I’d like to see an FAQ section. For starters, I’d love to see a summary of key policies and a generalised transition plan.

Austrian Von Miserly institute has a fancy website and a lot of the stuff there is bird swill. MMT stuff is gold and deserves a wide audience outside academia.

Stone:

I think the main underlying message of MMT is: don’t be fooled by the numbers game! The only thing that matters is the real economy – actual human labor and physical goods. Money is just a metaphor, a way of making labor liquid.

I don’t think you can disagree that the first priority of the state is to make sure that all it’s citizens are working and producing to their full potential. No one wants people sitting around twiddling their thumbs all day – especially when they would rather work!

From that perspective, who cares about capital? Capital – by itself – is meaningless. Just numbers in a spreadsheet. If UK pounds get shipped offshore, then the UK government can just provide more to fill the gap and ensure everyone in the UK is employed. If the pound depreciates against other currencies, then export until imports are affordable enough again.

After all – it’s not fair that countries like the US and UK import so much of the product of other people’s labor without exporting an equivalent amount of their labor. Trade is trade – X amount of Japanese cars for Y amount of US microchips or whatever.

The point is, if every country had low to no unemployment, the world would be a richer and more productive place. Even if the UK went at it alone, UK citizens would be better off. There is no excuse to deliberately waste willing human labor!

Dear Nicolai Hähnle (at 2010/09/21 at 22:04)

You just have to read what the credit agencies admitted to the US Congress enquiry a couple of years ago to realise they will do anything to make a profit including lying. That should answer your dilemma as to whether they are ignorant or evil.

best wishes

bill

Grigory Graborenko, you say “If UK pounds get shipped offshore, then the UK government can just provide more to fill the gap and ensure everyone in the UK is employed. ” what I am saying is what if the UK electorate decide that they don’t want to fuel the global liquidity glut that comes from that kind of action? MMTers seem to not care about adding to the liquidity glut but then wring their hands about the symptoms ( a volatile, speculative and bloated financial system). On this bog I feel in a minority of one in thinking that it does any global harm having trillions of USD in excess savings but the impression I get is that elsewhere it is seen as a critical driver of the derangement of the global economy eg: http://www.ecb.int/pub/pdf/scpwps/ecbwp911.pdf

or http://blogmaverick.com/2010/08/20/the-stock-market-is-still-for-suckers-and-why-you-should-put-your-money-in-the-bank/

I think that we should all get together and raise some money to bribe one of the credit ratings agencies – pay them to give MMT a AAA rating, then promptly tell the world that we got our rating by paying for it (like everyone else!).

I agree that that we need to start/continue a campaign to convince EU citizens to become soverign nations once more.

I also think we need to target those countries that are considering joining the EU. In addition to the Baltic tragedy, Poland needs to avoid joining.

Why anyone would listen to the rating agencies is beyond me – they rated private mortgage derivative bonds AAA in return for fees, I don’t call that incompetence – it’s fraud yet no one has been indicted. But we are supposed to believe these Ponzi rating agencies when it comes to evaluating public debt?

Andrew:

Take a look at how Argentina restructured its debt and introduced a job guarantee (Jefes) program. A default doesn’t mean complete repudiation, but a renegotiation of terms and creditor haircuts. Yes, the rating agencies get mad and stomp their feet, and the country goes through a period of sharp cutbacks, but they have proven it can be managed.

So let me see … The Weimar government falls because of the austerity imposed to service a crushing external debt load. A new government merely re-establishes the sovereignty of the German currency, and the German economy springs back to life. The German people, greatful for their new-found prosperity, look up to their new leader as something akin to a god, and the rest, as they say, is history.

Did I get that right?

“government bonds represent corporate welfare to these unproductive and unnecessary elements in our society”

I understand why Bill uses the “welfare” label for government bonds, but given that the market sets government bond prices for the various durations offered by the treasury at roughly the expectations for future consumer price inflation (right?), couldn’t we instead label government bond dividends as “fiscal policy aimed at purchasing power preservation and market stability”?

Unless the private debt markets and banking system would somehow adjust to compensate and offer a positive yield anyway (?), the “natural rate of interest is zero” suggests a larger chunk of private sector savings held in the form of zero nominal yield assets (thus negative real yield) that ALSO have zero possibility of capital gain… a unique combination. People view inflation as a wealth tax (whether or not such tax would be justified) and try to avoid it by bidding up other asset classes instead (real estate, gold, private bonds, stocks, foreign currencies, etc). Given momentum-chasing, non-rational market participants, I see this magnifying asset price volatility (bubbles and busts when momentum goes to far), which has messy impacts on the real economy even if you mitigate them partially with sound fiscal policy.

I know negative real rates on overnight deposits have occurred plenty of times (and even when the real rate is slightly negative commentators do suggest it has this effect), but perhaps degree is relevant… i.e., 0% nominal yield with 3%-5% YoY CPI might have even larger impacts, unless I and other observers are just wrong on this connection. Also I know there is always some demand for short duration assets (cash in hand, checking accounts, etc) but will the markets automatically adjust without asset price inflation if the ENTIRE stock of government liabilities is only offered at overnight duration and with no yield?

Note I am not arguing that negative real interest rates cause consumer price inflation or cause excess loan growth, this is simply a question of behavioral dynamics, portfolio preferences, and the effect on asset markets and volatility.

This is far from a novel thought but I seem to have missed it being discussed on Bill’s blog, so please direct me to any past conclusions reached… thanks!

How exactly you do you guarantee jobs for everyone?

Stone & Grigory,

The Russian ruble crisis of 1998 might give some kind of clue what could happen to a sovereign currency issuer with large foreign debts (public and private).

Prior to the crisis Russia was running a persistent budget deficit, and persistent current account deficit, meaning foreign investors were funding the budget deficit. They also tried to run a pegged exchange rate.

Pressure on the exchange rate grew until the Russian government was forced to abandon the peg. The ruble went from around 6 rubles per USD to over 20 rubles per dollar, as foreign capital poured out of the country.

Inflation went up to over 80% as a result.

Andrew Wilkins: you want to know if there is an organised MMT movement trying to influence policy. There is certainly a loose association of like-minded individuals with Bill Mitchell and Warren Mosler being two of the “ringleaders”.

Plus there is a “mini” or “sub” organisation running at the moment: Warren Mosler is currently running a contest to see who can place the most pro-MMT comments on blogs before October 31st. First prize is a trip to the U.S.Virgin Islands.

You’ll lucky to win because this has been going for some time. But if you’re interested, see:

http://moslereconomics.com/action/

Dear Elizabeth (at 2010/09/22 at 2:39)

You asked:

The national government announces on national TV and radio and in the news media that they will pay a living minimum wage to anyone who wants to work and turns up at nominated work sites next day.

Meanwhile the government has done extensive analysis of unmet community and environmental need by local regions and designed an almost infinite number of productive jobs. You might like to read a report that was the result of a three-year study we did on the operational details of implementing a Job Guarantee – Creating effective local labour markets: a new framework for regional employment policy. It is not the only way to do it but one way that would work.

best wishes

bill

Dear Gamma (at 2010/09/22 at 2:56)

Your usage of the term “a sovereign currency issuer” to describe Russia in 1998 is inaccurate.

The Russian currency (ruble) was not sovereign because as you acknowledge it was pegged. That is the reason they got themselves into trouble when the foreign-currency denominated debt became a burden.

best wishes

bill

Dear Bill,

Thanks for your response. The peg was a voluntary policy of the Russian government which they could at any stage choose to revise or abandon, which of course they eventually did.

In much the same way, the Australian government chooses to match all deficit expenditure with bond issuance.

So if you hold that Russia was not a sovereign currency issuer, you would also have to argue that Australia (and all other nations which have a similar constraint on deficit expenditure) are similarly not sovereign issuers.

In reality, Australia is a sovereign issuer , just like Russia was in 1998. All nations have voluntary restrictions on what the government of the day can and can’t do with the currency.

The notion that there is a hard and fast distinction between a government which is a sovereign issuer and one which is not is a fiction. In reality, all governments are subject to some restrictions, all of which are to a greater or lesser extent voluntary. Even during the gold standard era, nations could and frequently did choose to suspend conversion of the currency into specie. So were these governments sovereign or not?

Regardless of this, when Russia finally abandoned their peg (and became a true sovereign issuer in your estimation), the currency was dumped with the result that the price of goods for the average Russian almost doubled over the next year. The foreign currency denominate debt was a problem, but so was the ruble denominated debt, as shown by the fact that the ruble eventually lost 80% of it’s value.

How is this advancing the public purpose? It decimated the savings of the Russian people.

Stephan” Germany will be the first country to withdraw from the Eurozone.

My take, too. And the banks will want their outstanding loans converted to DM.

Andrew: I don’t know if there is an organised MMT movement, actively trying to influence policy. I think there should be!

I’ve been agitating about the need for this. Bill has kindly offered space on his server for it. What is required now is a competent webmaster/designer that can volunteer some time to set up the site. There are content people willing to contribute (including me).

Benedict@Large, you got that right, and FDR, Churchill, and Keynes realized it. Even though they were blue-bloods and basically conservative by upbringing, they knew at that time bad economic policy could lead to social unrest with the threat of extreme nationalistic demagoguery, on one hand, and revolutionary Marxism, on the other, so they acted accordingly to avoid it.

Lessons From The Great Depression by Kevin O’Rourke

Billionaire Charlie Munger has some advice for the 17% of the american workforce that are unemployed: “There’s danger in just shoveling out money to people who say, ‘My life is a little harder than it used to be…At a certain place you’ve got to say to the people, ‘Suck it in and cope, buddy. Suck it in and cope'”. He then praises the bank bailouts by using the rise of Hitler example to justify the bailout of companies Berkshire Hathaway has an interest in like Wells Fargo, Goldman Sachs, and GE: Germany was unable to stabilize its financial system in the 1920s, and, Munger said, “We ended up with Adolf Hitler.” The entire article is filled with quotes like these, and to think I used to respect this guys opinion. I can’t help wondering why the media listens to rich people’s opinions so much? I think the biggest threat facing America is politically influential rich people who only care about themselves and how much power they have.

Like the Koch brothers, http://www.newyorker.com/reporting/2010/08/30/100830fa_fact_mayer

http://www.bloomberg.com/news/2010-09-20/berkshire-s-munger-says-cash-strapped-should-suck-it-in-not-get-bailout.html

Elizabeth: How exactly you do you guarantee jobs for everyone?

In the left column, click on “Job Guarantee” under the archive, CorFEE in the links, and MY LATEST for Bill’s tome on the subject. This is Bill’s specialty, and he has written a ton on it.

There is also a good Wikipedia summary of Job Guarantee, with good links to other sources – Randy Wray, for instance.

hbl, the building blocks of MMT also includes Minsky’s influence. The problem in asset inflation is usually leverage and its excessive use over the financial cycle. which culminates in Ponzi finance. At this stage, mispricing risk due to moral hazard, predatory practices and fraud also become endemic. This needs to be addressed through financial reform. Warren Mosler has offered specific proposals for financial reform in the US in conjunction with his senatorial campaign.

Another issue is taxing away economic rent – land rent, monopoly rent, and financial rent. Michael Hudson has written a great deal on this matter.

According to this analysis a well-run economy should be based on a balance of productive investment (supply) and income (demand). This requires reducing or eliminating parasitical activity. Much of the imbalance that accrues under neoliberalism is the result of parasitism. Neoliberalism tilts the playing field so that money runs to the top. The playing field needs to be leveled, and MMT acknowledges this.

Gamma, see Bill’s Hyperbole and outright lies for Argentina and Russia, and more.

Dear Gamma (at 2010/09/22 at 8:00)

Yes it is correct that Russia voluntarily pegged its currency. But the fact that they did that and then tried to hang onto the peg when it was clear the situation was becoming untenable and that they had borrowed in foreign currencies meant they had (voluntarily) lost their sovereignty.

The analogy with Australia voluntarily issuing public debt is not sound. The fact we do that does not expose us the government to the same risks that the Russian practices did.

Further, some restrictions on government open it to the risk of insolvency while others do not. The demarcation is what defines the threshold of currency sovereignty.

best wishes

bill

Re Portugal

Portugal actually has one of the largest gold reserves in the world. They are certainly a nation that should withdraw from the Euro. What amuses me is however is the quote from the Portugese banker “Banks cannot raise funds abroad, remain “extremely fragile”, and “quite simply” will have nothing more to lend unless foreign capital returns. Portuguese banks cannot survive on local savings. They rely on foreign funding to cover 40pc of assets”.

Sounds just like the CBA, only difference is Australia prints its own currency.

bill says:

“The national government announces on national TV and radio and in the news media that they will pay a living minimum wage to anyone who wants to work and turns up at nominated work sites next day.

Meanwhile the government has done extensive analysis of unmet community and environmental need by local regions and designed an almost infinite number of productive jobs”

I see. So what of all the productive jobs that involve treating sewerage, sweeping streets, digging holes at midnight and picking fruit in the tropics?

What if no one wants to do these but are happy to turn up to your designated work sites to collect their minimum wage?

What if all these people think they ought to be astronauts, brain surgeons and politicians but have no such qualifications?

All of a sudden you have headline unemployment of zero (all happily collecting their minimum wage) and underemployment of 20% because these people are unproductive, don’t want to do what the government has designated they ought to do and are not incentivised to work harder as there is little marginal reward. Key areas of employment are untended.

Japan is the closest example of a society offering a job for life and that was via the corporate sector (the electronics firms and car makers). Nobody will be interested in having a nanny state decide how their life ought be run. Your ideas are grand but really haven’t been thought through.

Andrew Wilkins says:

Tuesday, September 21, 2010 at 22:10

“I am a recent MMT convert, now working on my disciple badge.

I don’t know if there is an organised MMT movement, actively trying to influence policy. I think there should be!”

I think you’re onto something Andrew. Great idea.

Go a step further and form your own political party to get your policy into mainstream society.

The nutty ultra rightwingers of Qld did it with One Nation.

I am sure you can garner enough loony-left supporters from universities, unions and the docklands to win a couple seats in parliament. Even the stupid in Australia have to vote; that’s your ticket to success.

Why be a disciple when you can be the Messiah?

Ralph and Tom,

I like the counter insurgency incentive scheme. I am active (under alias), but my knowledge is still thin. I already live on a tropical island, so I don’t need the prize.

It’s a shame there is a lack of web building knowledge. Sorry, I can’t help much in that department. I know there are Wiki pages which can be self edited. That would be a start, if funds and resources are thin.

I would donate to a worthy cause. Donations could pay for professional web services.

Ray:

“Your ideas are grand but really haven’t been thought through”

The thing is, Bill spent 3 years thinking out the details. He included them in this hefty document:

http://e1.newcastle.edu.au/coffee/pubs/reports/2008/CofFEE_JA/CofFEE_JA_final_report_November_2008.pdf

Page 237 in particular is where it starts to addresses JG implementation details.

When you criticize him for not providing concrete details after failing to read his concrete details, it appears, at least on the surface of things, as if the lack of “thinking things through” is mostly on your part.

Ray,

[BILL EDITED OUT UNNECESSARY INVECTIVE]

There is an optimum balance for every policy. We should search for a balance that optimises the benefits to society in general. Policy should not unfairly reward or punish a demographic segment.

You still don’t get it…. yet another bitter and twisted personal attack…. Epic fail.

[BILL EDITED OUT UNNECESSARY INVECTIVE]

Dear Ray (at 2010/09/22 at 10:24)

You assert:

I am not sure you see at all. In a market system the minimum wage becomes the floor. Any employer (public or otherwise) can offer other productive jobs at wages and conditions above that to suitably attract labour.

You ask:

How is this relevant? If they want to work in the Job Guarantee the job offer is unconditional. If they don’t they better find a job as a brain surgeon because they will need to find an income somehow. The offer of a JG job becomes the ultimate work test. I do not advocate paying unemployment benefits.

You note:

If people are happy then that is progress. The major candidates for JG jobs are low-skill workers who are at the back of the job queue. Why would these people be unproductive? There are hundreds of thousands of socially-useful (that is, productive) jobs that can be performed in Australia which would be inclusive for low-skill workers. The Great Ocean Road in Victoria was constructed during the Great Depression by low-skill work gangs – it now delivers millions of dollars a year through tourism. Examples like that are everywhere in the world. Key areas of employment will not be unintended if the market offers the right wages to bid workers out of the JG pool.

You assert:

The ultimate test of whether anyone is interested is to offer the jobs. See how many turn up. If you are correct then the introduction of a Job Guarantee will have zero impact anyway because no-one will be interested. I suspect I am right and millions of workers around the world will be interested. The work I have done in South Africa evaluating their national public works program tells me categorically that there were many more interested in working than the government was prepared to offer vacancies.

Further, I have been working on this stuff since 1978. That is a long time to be stupid and continue to offer “thoughtless” ideas.

I wonder what you are scared off here.

best wishes

bill

Dear Ray and Andrew and all

Please read the Comments policy which among other things suggests that we do not engage in personal insults here. Ideas are contestable to the maximum but when the attacks become personal I think it is time to go and sit in the sun and relax.

Please keep our vehemence and attacks at the ideas-level.

best wishes

bill

Ray,

Before you lashed out with the usual vitriol. I was going to agree with you.

“What if no one wants to do these but are happy to turn up to your designated work sites to collect their minimum wage?

What if all these people think they ought to be astronauts, brain surgeons and politicians but have no such qualifications?”

That’s a really good point. In the UK in the 80’s they had a youth job gaurantee scheme. The problems with it, were more or less along the lines you state in your comment.

While I am absolutely in agreement with Bill on deficit spending to get us out of the current mess. I agree with his methods to reign in the Banks. I still have reservation on the JG. Any direct Government sponsored JG has to be designed very well. It would have to be managed by effective trained managers.

I am comfortable with spending Government money wisely into the Private sector. Building useful infrastructre, providing day care and nursing services etc. These schemes still have to be administered wisely.

To me JG is a last resort option. The JG jobs have to match the aspirations of the underemployed.

Then again I shouldn’t waste my time talking to people who don’t listen.

ok, apologies @ bill and @ andrew for getting a little too excited.

Your description of JG sounds similar to ‘Work for the Dole’. By definition JG only applies to those who have not found themselves a job. WftD was intended to remove the need to pay unemployment benefits based on the assumption that everyone who could work, should work. Are the two schemes not dissimilar?

WftD went down like a lead balloon because of the perception that the Govt was trying to force people to work and that the right to remain unemployed was just as important a civil liberty as the right to work.

Being the compassionate society that Australia is, unemployment benefits are available to all, even those who refuse to work (with a minimum amount of chicanery).

However you add; “I do not advocate paying unemployment benefits.”

Therefore are you not moving our society in the wrong direction? The Government will find you a job but if you decide not to accept that position you will earn naught?

It sounds that you are really advocating the creation of a Govt employment bureau which finds available work within society and attempts to place the unemployed. Much more than that does not seem practical.

Would not the best solution to unemployment be to maintain economic growth as high as is possible within inflation parameters and allow both the market and government to attract the unemployed with the goal of personal achievement and reward while simply maintaining a safety net for the unemployed?

We have tabloid economists spruiking the RBA to immediately hike several times because of ‘full employment’ in now what we are supposed to believe is a one-speed economy which will in time put pressure on further reducing unemployment. It seems there are still ample positions for those you describe as underemployed if there is a willingness to do such work.

Dear Bill,

I think, what we really need, is an evolution in human consciousness. ‘Think globally and act locally’ does not work globally: it should be think globally and act globally – then locally. One has to lift one’s eyes always to the bigger picture. It is pointless for example worrying about a definition of a ‘failed State’ when the whole human species could be given an ‘F” on current behaviour. David Attenborough on SBS last night addressed some of the fundamental concerns in: ‘How Many People Can Live On Planet Earth’

For those who missed this essential viewing David Attenborough talked about how earth’s population was steady around 2 billion up until somewhere in the 1800’s, then went into exponential overdrive up to 6.8 billion today (9 billion by 2050) as medical science prolonged life and food production increased with technology advances. All land available for agriculture is already under cultivation, all water available already tapped – most of it consumed by agriculture. Demand for oil energy and materials use is escalating and the environmental effects of all of this increasing, as the human species races towards unsustainable consumption of real resources and increasing conflict. Unconsciousness and greed eclipse the logical, moral and physical necessity for the species to cooperate and share, if they are to survive with dignity and prosper as a species, and stand a chance to live fulfilling lives: (let alone fulfil their inherent dharma to the planet as a whole, to each other, and to the planet’s other life forms). For this the first and essential requirement is Peace. When human beings are happy, they cooperate with each other and look after each other! Prosperity without peace ends in chaos!

To this end, may I link to the efforts of the United Nations and their ‘2010 Peace Day Global Broadcast’ to remind ourselves that there are many people in the world who recognise the fundamental problems, and work tirelessly despite considerable headwinds; and in particular ‘A Message of Peace’ from Prem Rawat, whom I consider after more than forty years of relentless work, to be the foremost advocate of the demand for and possibility of peace on the planet today.

Warm regards,

jrbarch

Ray:

When I first mentioned the idea of a JG to a liberal voter (my dad), the first thing he said was how it was pretty much like work for the dole – I struggled to find a difference between them other than just the level of the wage. Naturally, that is an important distinction – the dole is barely enough to live on.

Maybe the biggest difference besides income would be intended consequences – Howard’s scheme I suspect was aimed to force people off the dole, so the administrators would probably pick jobs for their unpleasantness rather than social usefulness.

I completely agree with you though on keeping unemployment benefits. I personally suspect most people would switch immediately to the JG. There would be very few true parasites, most people would prefer the dignity and higher pay of the JG. So really any drag on society would be small (much smaller than current neo-liberal policies), and I can’t imagine any amount of hassling will turn them into productive members of society anyway. So let them eat instant noodles and watch Oprah all day – someone has to!

“Therefore are you not moving our society in the wrong direction? The Government will find you a job but if you decide not to accept that position you will earn naught?”

If that is the wrong direction, then why isn’t there a universal pension payable to all simply for being a citizen?

Why should you lose ‘unemployment benefits’ simply because you were unfortunate enough to get a job?

Alternatively why should you pay people to do nothing? Why is it so unreasonable for a society to say that you must contribute if you want any money?

Bill,

Would it be correct to say (as the Wikipedia Job Guarantee article implies) that the JG is analytically seperable from the non-constrained sovereign budget of MMT? That is, it would make sense and be fiscally possible even if the government was revenue-constrained (say, we had a gold standard or were using the Euro?)

Hi Bill,

Thanks for the reply. As you can tell, I’m new to this and don’t have all the background.

What you describe sounds similar to what happened in the Depression in NZ.

Unemployed men went out in gangs to lay railway tracks etc.

Separately — have you commented elsewhere on the UK govts’ plans

to cut back spending drastically?

I still feel this seems the right thing to do. We have here a big part of society which does not

work and subsists on state benefits. Feckless.

Best wishes,

Elizabeth

Grigory Graborenko says:

Wednesday, September 22, 2010 at 15:56

GG, I agree. Perhaps the stigma associated with WftD name was enough to get the hackles up on the civil libertarians which helped kill the idea.

However, a modified scheme seems something that could work (or go part way to utilising the underemployed) if it was apparent the government was not trying to nanny its citizens.

Unlike many of the fairly extreme policies which are discussed here, this is certainly something which the current system could certainly seriously debate.

“What is required now is a competent webmaster/designer that can volunteer some time to set up the site.”

We’d be better off just using one of the blog sites/forums out there and tying it together as a mash up. I do think a forum is required to get discussion going – blogs are all very well but they are centred around an individual.

Ray,

I apologise for any personal comments I made. Past and present.

Luckily Bill is a swift editor and I have learned a new word Invective. Let’s move on.

James H, to me the MMT points about fiscal stimulus such as the job guarantee make perfect sense but the MMT points advocating having an indefinately accumulating pool of savings (ie indefinately worsening liquidity glut) are extremely dangerous nonsense.

Elizabeth,

You’ve no evidence for that a ‘big part of society’ are Feckless. That’s the sort of stuff the Daily Mail comes out with to give the poor sods who buy it their daily dose of fire and brimstone.

In the UK the distribution of taxation means that those at the low ends lose over 90% of their marginal income (ie with no expenses) if they work more, and those at the top end about 18% (or 0% if your wife happens to live in Monaco) of their *profit* (ie after expenses). Given the incentives is it any wonder that the low end see little value in a job?

If the state guaranteed a job to everyone rather than an income, then the ‘Feckless’ (which are few in number IMHO) will discover the joys of starvation and/or prison.

@stone

I’ve no idea where you get the idea that savings are somehow bad. They are just currency savings, they have to be changed into flows before they can do anything real. And flows can be levied if they have inappropriate outcomes.

Ray,

“I see. So what of all the productive jobs that involve treating sewerage, sweeping streets, digging holes at midnight and picking fruit in the tropics?

What if no one wants to do these but are happy to turn up to your designated work sites to collect their minimum wage?”

Some people have more ambition than what the minimum wage can offer. In fact some people will change jobs for less pay because it is more rewarding in non-financial terms.

If these sources of industry, such as sewerage and fruit picking require labour, then they can offer incentives greater than the job guarantee, commensurate to the task at hands. Incentives do not have to be the size of the income, but working conditions and defined career paths.

“What if all these people think they ought to be astronauts, brain surgeons and politicians but have no such qualifications?”

Then the employers won’t be incentivised to hire them given these people can’t produce the desired product.

A job guarantee could be very green but first a story.

I was in Bahrain a few years ago. I looked out the hotel window and watched 12 fellows digging huge holes with pick and shovel to plant date palm on the median road strip. I asked the accountant I was visiting if there was a market for second hand excavators in the Gulf. He said someone had imported second hand excavators and gone bust because it was cheaper to dig the holes by hand.

I would love to see the JGers painting and cleaning and gardening and helping the oldies in the garden. We could even stop importing Indian taxi drivers (Australians didnt want to drive taxi’s so the Gov let in a heap of Indian fellows that are now learning English as they drive!) and have JGers do it instead.

I have being wondering why we dont just outlaw people working more than say 50 hours a week or make say 3.5 day working week and share the jobs around. There will be plenty of work left when we are gone, there is no need to do it all!

I am really surprised that so many people so harshly oppose even an idea of JG when the real life gives so many examples of the opposite. I know a family (close friends) where a partner really wants to work even for free (they have enough income) and her motivation to work is driven mainly by the need to socialize with other people and do something good. She tried Red Cross / Caritas and similar organisations. But this was without much success beyond occasional things which finally all dried out. So now she once in a while goes to a public library to read books to children whose parents are busy at work. I do not know whether she gets paid for that or not. And btw she has a masters degree.

So why do you think that everybody is so selfish out there? There are a lot of honest people which have motives other than money. Moreover such people have dignity which is higher than those of any arbitrary banker. And even without any desperate need for income such people also suffer because neither private sector wants to employ them nor government.

The irony is that because of the fiscal stimulus measures in the developed world, unemployment has not gotten high enough for people to see the value of Job Guarantee yet. I suspect that in the UK, even wihout a double-dip recession, unemployment will start increasing relentlessly as the austerity measures kick-in. When this happens, those ‘feckless’ unemployed people will demand something like a Job Guarantee.

Hi Tom Hickey,

Yes, I understand and agree with your points regarding Minsky’s leverage-driven asset bubbles and the problems of excessive economic rent. My point was intended as a separate one and is a variant form of it is widely made by many commentators (e.g., Edward Harrison who sometimes covers MMT and believes the #1 policy goal of QE was to reinflate asset prices).

To reiterate… if the pool of short duration assets within an economy significantly exceeds the non-government sector’s aggregate portfolio preference for holding short duration assets, then those assets will be a bit like “hot potatoes”, with their holders having a higher propensity to generate bids for other assets, driving up prices. Prices might not climb quite as quickly without leverage, but markets are worth whatever market participants in aggregate price them at (the common “fund flow” discussion is more misleading than helpful when used at the macro level).

The more negative the real interest rates (and thus the larger the perceived tax on one’s savings), the more powerful this “hot potato” effect is likely to be. And I don’t see it causing only a one time adjustment of asset prices, as most asset prices are [over the medium term] a function of underlying earnings flows that may not improve in line with the rising asset prices. I think it would lead asset prices to be more unstable (ups and downs), but I could be wrong on that. I’m not sure there’s any historical example of a country with all government liabilities as overnight reserves / currency (with negative real yield) and no longer duration bonds etc, is there?

While I admit I haven’t been able to follow every comment here and at Mosler Economics, I’m just surprised not to have seen this point addressed directly before, despite the topic of “no sovereign bonds” coming up frequently. But I probably missed it.

Andrew Wilkins/Tom Hickey:

I design, build, administer, and moderate web sites professionally, or at least for money 😉 — I’m a drupal jockey. (Drupal is a very powerful open-source content management/social networking platform.) And with Joe Firestone and others, I helped two organize the Fiscal Sustainability Counter Conference in DC, and so I’m familiar with the cause. I could certainly build a professional-looking web site. My email is above.

hbl, by “tax” on savings you refer to holdings of bank reserves where all budget deficits will end up. This is different from deposit accounts of commercial banks (commercial bank monies vs. central bank monies). Both types of monies have pretty much independent demand/supply functions. The former is driven by funding needs of the banking system which will bid up the prices to attract extra funding. The latter is driven by the demand for interbank settlement. The existence of central bank and prudential regulation is justified by the need to ensure on par convertibility between commercial bank monies and central bank monies.

Banks will bid up prices for funding to the level which correlates with the interest rates on loans. This tells you that rates on deposits move pretty much in line with rates on loans. So claiming that banks will pay zero rate on deposits but still charge some positive and increasing rates on loans means that the differences fully accrues to bank profits. Valid point, I will say, but it has nothing to do with inflation and savings tax.

bill @ Wednesday, September 22, 2010 at 9:35

“Further, some restrictions on government open it to the risk of insolvency while others do not. The demarcation is what defines the threshold of currency sovereignty.”

This depends on what your definition of insolvency is. If you are only considering outright default as the only form of insolvency, then yes, however many people also consider the sort of high inflation which was seen in Russia as a form of default.

In the case of Russia, if they had abandoned their currency peg earlier, they may have avoided explicit default, and they would have introduced inflation earlier. Either way holders of the currency end up with less wealth than they started with.

So what about the MMT preferred currency arrangements? That is, a floating currency, no bond issuance, 0% interest rates on reserve funds.

I would be willing to guess that under these sort of arrangements, the people would end up subjecting the government to an even more stringent inflation constraint than is currently the case.

If not, then there would be nothing preventing a government from funding all spending through currency issuance and not levying any taxes. This would obviously produce rampant inflation. I am not saying MMT is advocating this, but what would prevent this from happening?

Hi Sergei,

Thanks for sharing your thoughts, as they get into my earlier question of whether “the private debt markets and banking system would somehow adjust to compensate and offer a positive yield anyway.”

One of your core points is: “This tells you that rates on deposits move pretty much in line with rates on loans.” That makes sense to me under normal banking conditions, but let’s look at the current macro numbers for the US:

– MZM (money zero maturity): about $9.6 trillion

– current Fed reserves and currency: about $2 trillion

– Total loans and leases at commercial banks: about $6.8 trillion

– Total Federal government debt held by the public: about $9 trillion

Let’s say the Federal government replaced all the treasury liabilities with Fed liabilities (reserves and currency) in a massive QE-like operation. A portion of this asset swap would occur on the asset side of bank balance sheets, but the majority of the swap would happen with households and businesses. Their treasuries held as assets would be gone and instead they would have bank deposits as assets. The creation of these bank deposits would add corresponding deposit liabilities in the banking system, matched with new reserve assets (also in the banking system). So bank assets and liabilities would expand together in line with the amount of treasury debt being replaced by central bank liabilities.

Now the asset side of bank balance sheets would jump from $6.8 trillion in loan assets plus $2 trillion in reserve/currency assets (total $8.8 trillion) to $6.8 trillion in loan assets plus around $11 trillion in reserves/currency (total $17.8 trillion). (Admittedly this is simplified to exclude other types of assets held by modern banks).

At this point, what rate would banks pay on deposits? Surely it must be a function of the combined yield (and expected loan loss rates) of their total assets, not just their loan assets? Loan assets would have fallen from 77% (6.8/8.8) of assets to 38% (6.8/17.8) of assets, so this must cause a large reduction in the rates banks could pay on deposits, right? But consistent with what I understand of your point, the customer deposit rate would likely be dragged somewhere above zero by the presence of loan assets on bank balance sheets (but probably still below the rate of inflation given historical deposit rates), so perhaps my original concern was quantitatively exaggerated, even if [I think] qualitatively accurate. And once again, I’m far from the only one (most are more market savvy than I) who has suggested this driver of asset prices, so I’d love to hear what’s wrong with the logic?

hbl, I’ve certainly been carping on on here about the folly of MMT ideas of dumping an ever ballooning mountain of cash into the non-government sector. MMTers apparently do not care at all about asset prices becoming vastly inflated in relation to earnings nor about the increasing liquidity glut leading to increasingly volatile speculative markets. Basically my impression is that they are so wedded to an ideology they can’t bear to step back and think about what it amounts to.

Oh dearie me,

Ireland as an economy shoots itself in the foot again!

Being Irish, I am pretty sure that the last thing the Ireland understands is economics

When we get around to understanding that current banking arrangements are a form of colonialism all hell will break loose.

But it is not going to happen while my Mammy is alive.

There is a whole generation in Ireland in retirement dependent on that, while ‘living the life of Riley’ carry an ‘Angel

stone, you might be interested in this article by Michael Hudson.

Where is the World Economy Headed?

(sorry for the interruption)’Angela’s Ashes’ conciousness

For Stone @Sept23 3:17

I don’t understand what you’re on about re a liquidity glut and asset prices. If government spending creates too much demand somewhere taxes need to rise in an appropriate way to reduce demand or targetted regulations need to be implemented to reduce credit. Big deal. If you have a prior belief against taxes and regulation I understand your problem.

Stone:

Perhaps it might be productive to examine what you mean by liquidity glut and why it’s harmful. Forgive me if I misunderstand your concerns, or stuff up the economics – I’m still just a layman!

Asset price bubbles are only harmful because they burst; so why are they so destructive when they do? In the case of the GFC it was because it was almost entirely debt-fueled. The money supply was heavily over-levereged, and shrank very rapidly, *withdrawing* liquidity from the system. People had debt they couldn’t pay back, so consumption was dropped heavily to repair balance sheets.

In the case of an asset bubble in an MMT context, the liquidity would not be debt-based, but currency based. You have savings, you invest the savings, the asset goes bust and you lose your savings. But you don’t have a debt to pay off; you weren’t gambling with loans. So the money supply doesn’t shrink, and people will probably continue saving at a similar rate rather than cutting consumption drastically. (this may not be true on an individual level, but macroeconomically it will be)

Of course, there are policy settings you can use to prevent asset bubbles, such as taxation and regulation. But even if they still occurred, the harm would be confined to the foolish investors, not to the entire economy. Just the way it should according to free marketeers.

Please keep asking questions; I personally enjoy discussing stuff. I do try to listen to new ideas – MMT itself was a very radical new idea to me just recently. Don’t get frustrated by disagreements – good things come of them!

hbl: While I admit I haven’t been able to follow every comment here and at Mosler Economics, I’m just surprised not to have seen this point addressed directly before, despite the topic of “no sovereign bonds” coming up frequently. But I probably missed it.

It’s come up quite a bit in relation to the no-bonds notion, but I would say it remains unresolved. None of the MMT economists have jumped in on it, so I don’t know what they think about it. I think it can be handled since it is a flow and flow can be directed through fiscal policy. In any case, even without no-bonds, flows into assets are a problem even with tsy issuance, as recent events have shown. This needs to be addressed, as stone has been shouting for some time now, although I would not agree with his limiting quantity solution. Better to redirect the flow into productive use instead incentivizing excessive acquisitiveness.

Lambert, I’m getting a “Site is moving. DNS migration is in progress” response. I’ll try later.

Lambert,

I registered at your site, I couldn’t find your personal e-mail.

Try to contact me through my registration details.