The other day I was asked whether I was happy that the US President was…

Europe – bailout or exit?

First, devise a monetary union that is based on flawed notions of how the monetary system operates. Second, within that union invent nonsensical rules that give the system in general or member nations in particular the no capacity to deal with a damaging economic crisis. Third, allow countries within the union to game it to their own advantage at the expense of other member nations (for example, Germany – although the advantage was at the expense of German workers). Fourth, when a crisis hits elevate the nonsensical rules to the level of the sacrosanct and commit innocent citizens to years of unnecessary economic hardship. That is the level of sophistication that Europe has reached in 2010.

At the outset, a primary reason why I would bail out Greece right now is in order to put a short squeeze on all the market speculators who prefer to make money out of the misery of others than to deploy their brains pursuig how to make peoples’ lives better. That would sort a few of the banks out – the very same banks that poured money into Greece prior to the recession – taking advantage of the yields the Greek government was providing them.

With the EMU and Germany, in particular, baying for Athenian blood, if you work out what would be required to make the fiscal adjustments they are calling for it is no wonder everyone is predicting a Greek collapse.

Greece has promised the EMU bullies that it will cut 4 percentage points from its deficit to GDP ratio in 2010 – taking it to 8.7 per cent. They are putting up taxes and cutting public sector wages.

Some back of the envelope calculations suggest that you would have to run a primary budget surplus for a decade of about 6-8 per cent of GDP to get the debt ratio down to 60 per cent of GDP as required by the Maastricht rules. That sort of contraction will be so damaging to the local economy that I suspect that voters will not tolerate the real burdens that would be imposed on them.

At any rate, that is why there is all the sovereign default betting at present by the “genius bankers”.

In Monday’s (February 15, 2010) Financial Times I read that – Europe cannot afford to rescue Greece. The article by one Otmar Issing (a former European Central Bank’s executive board member) claims that if Greece received:

… financial aid from other EU countries or institutions that amounted, directly or indirectly, to a bail-out would violate EU treaties and undermine the foundations of Emu. Such principles do not allow for compromise. Once Greece was helped, the dam would be broken. A bail-out for the country that broke the rules would make it impossible to deny aid to others.

Yes it would do that but the treaties and foundations are going to have to be recast anyway so why allow some citizens of Europe to suffer needlessly. What amazes me is that there are few commentators actually challenging the basis of the treaty (Maastricht) rules. Even progressives are skating around them and advocating all sorts of other improvements without attacking some of the core propositions that the EMU was founded upon.

Further, it is becoming a common assertion that Greece stands alone in Europe as an ill-disciplined nation living beyond its means. A German article I have now lost claimed that Germans resent any assistance being offered to Greece because the latter has an excessively generous retirement age (63). Dear me, slaving for some boss on low wages until your 63 years of age seems like hard work if you ask me.

An article in the Financial Times yesterday (February 15, 2010) from Arminio Fraga, the former president of the Central Bank of Brazil – Greece and the EU at a crossroads – represents the common thread in the “blame Greece” lobby. The author said:

Moving to the present, Greece ran its macro policies in extremely loose fashion since joining the EMU. Markets went along collecting the spread paid by Greek bonds as if it was just a gift. Deficits ballooned and debts piled up.

Issing, in the article cited above is also of this persuasion. He said:

Participation in Emu brings huge advantages. The benefits of joining a stable economic area are greatest for countries that were unable to deliver such conditions before. Thanks to the euro, Greece has enjoyed long-term interest rates at a record low. But instead of delivering on its commitment at the time of entry to reduce public debt levels, the country has wasted potential savings in a spending frenzy. The crisis with which it is now confronted is not the result of an “external shock” such as an earthquake, but the result of bad policies pursued over many years. Bailing out Greece would reward such behaviour and create moral hazard of a dimension hardly seen before.

So a spending frenzy contributed to Greece’s problems not the exogenously imposed global economic crisis that was the handiwork of the “smart-bankers” around the World, the same ones who have enjoyed massive bailouts themselves from governments but who are now leading the deficit-terrorist charge.

In that regard, the ‘moral hazard of a dimension hardly seen before” has already been created when the US Government saved Goldman Sachs and other large investment banks from failure. Saving a government from a stupid system that is set up to fail in a crisis, and a governemnt which represents ordinary people is not even in the same league as the debauchery that we have seen in the “Wall Street bailouts”.

Even Paul Krugman in his current NYT column (February 15, 2010) – is buying into the Greeks were spendthrifts. He began by saying that:

For the truth is that lack of fiscal discipline isn’t the whole, or even the main, source of Europe’s troubles … the real story behind the euromess lies not in the profligacy of politicians but in the arrogance of elites – specifically, the policy elites who pushed Europe into adopting a single currency well before the continent was ready for such an experiment.

I totally agree with that statement and I have covered the issue in detail on several occasions. Please read the blogs available – HERE for more discussion.

To make his case, Krugman then noted that Spain had been “a model fiscal citizen” with low debts and surpluses but that:

Greece, of course, is in even deeper trouble, because the Greeks, unlike the Spaniards, actually were fiscally irresponsible.

Of-course, we all know that … everybody is saying it everyday. Those Greeks were over the top! I wonder how much we know in fact.

I don’t seek to defend the Greek government at all. I also accept that they probably bodgied up the data to get through the stupid hurdles that the EMU treaty imposed on nations (debt ratios etc). Of-course, the latter behaviour it seems was aided and abetted by those who do God’s work (GS).

But when evaluating whether fiscal policy is lax or not I start with two things – and they are not deficit to GDP ratios or public debt to GDP ratios. I look at: (a) the unemployment rate as a proxy for capacity utilisation – that is, the capacity of the real economy to expand and create income and saving; and (b) the moverments in the inflation rate – which generally tells me how high the pressure in the economy is.

These are the basics if you like which tell me how hot the economy is. While they can concur (stagflation) they usually do not. When they do it is because of a cost-shock (supply shock) which standard macroeconomic policy measures struggle to deal with anyway.

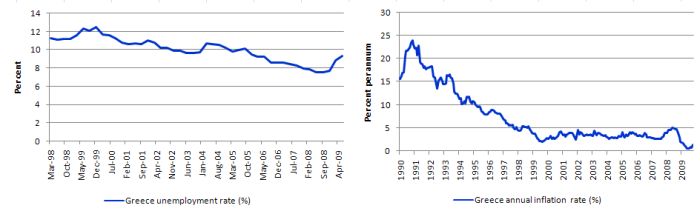

The following graph shows the unemployment rate on the left-panel and the annual inflation rate on the right-panel. The unemployment rate is shown from March 1998 and the annual inflation series starts in January 1990. All data is from the OECD Main Economic Indicators.

The average unemployment rate since Greece entered the EMU is 9.5 per cent and the average annual inflation rate is 3.2 per cent. So this is not an economy with an out of control price level and is one which had significant underutilised labour resources over the entire period these commentators are claiming it to be fiscally responsible.

What would Krugman recommend for the US if its unemployment rate was averaging 9.5 per cent? The answer is obvious – more fiscal expansion. So on the face of it, given the purpose of fiscal policy is to reduce unemployment without triggering off accelerating inflation, Greece still had a long way to go before it could say it was being “fiscally irresponsible”.

The problem of the EMU overall is that the nonsensical fiscal rules that it has imposed on member nations bias unemployment upwards and distort our perceptions of what are reasonable fiscal policy settings. When judged against the Maastricht criteria of 3 per cent of GDP then of-course Greece is way over the top with a primary deficit of around 8 per cent and debt-servicing costs of about 4 per cent of GDP and rising.

But these rules are just imposed ideological constructs that have no relation to the labour market circumstances that an individual nation might find itself in. They are based on no fundamental economic theory. They are the whims of the arrogant European elites (as Krugman calls them) and are designed to suppress public purpose.

If you accumulate the labour slack that implementation of these rules generate over the life of the EMU to date you would be staggered by the foregone income (deadweight) losses that they have imposed on citizens of all the member countries.

Somehow we forget that there is still a major crisis going on with the real possibility, notwithstanding the excellent GDP growth result that Japan posted yesterday, that the major nations will plunge back into recession in the coming months.

Last week I reported the latest Eurostat data in this blog – We are sorry which pointed to the real possibility that Europe is teetering on the edge of a double-dip recession.

Let’s be absolutely clear about this – a recession only can occur when aggregte demand falls below the level (at any point in time) that keeps firms production levels steady or growing. Aggregate demand is made up on consumption spending, investment spending, government spending and net exports. It is not magic.

At present there is very little evidence in Europe or elsewhere (such as the US, UK) that private demand, which collapsed significantly in the last few years, is showing any robust signs of recovery.

To keep unemployment from rising, real GDP growth has to absorb the labour force growth plus productivity growth. Fortunately in Europe, with such low labour force growth rates, they can get by with lower GDP growth rates and still hold unemployment constant than nations such as Australia (and the US) which have younger populations and therefore faster labour force growth rates.

None of this is magic.

A leading article in this week’s Economist Magazine (February 11, 2010) noted that “(t)he picture on global growth is increasingly split” with the BRICS showing strong growth but the “rich world” looking very weak.

The last thing almost any nation should be considering at present is implementing a fiscal austerity program of any kind much less the scale that is being imposed on Greece by the EU bullies. While there is high unemployment the budget deficits should be expanding not contracting.

Which is context for considering the German hardline. I note that Germany recorded zero GDP growth in the December quarter with no sign of any private demand growth emerging.

Issing (who I cited above) expresses the hardline German opposition to any assistance to Greece. He wants to point out “what Emu is, and what it is not”. In that regard he says:

The monetary union is based on two pillars. One is the stability of the euro, guaranteed by an independent central bank with a clear mandate to maintain price stability. The other is fiscal solidity, which has to be delivered by individual member states. Member countries are still sovereign. Emu does not represent a state; it is an institutional arrangement unique in history.

This is not correct. Member states are not sovereign in the sense that they issue their own currency and float it on foreign exchange markets. Further, the Maastricht rules limit the scope that the member states can expand their fiscal positions within.

Further, they have to accept the monetary stance of the ECB independent of their own circumstances. That is not the arrangement that accompanies sovereignty.

Issing acknowledges, almost as a badge of honour, that:

By its construction, Emu is a “no transfers” community of sovereign states. Transferring taxpayers’ money from countries that obeyed the rules to those that violated them would create hostility towards Brussels and between euro area countries. Among ordinary people, it would undermine a badly needed sense of identification with the great project of European integration.

First, the ECB could create the euros necessary to help out Greece or any other member state on the brink of a real catastrophe (real = threat of a major reduction in the standard of living of the citizens). The fact they want all spending “funded” by higher taxes in this case is based in ideology not financial constraints.

Second, no reasonable federal system would not have a fiscal redistibution mechanism, a point I have made before in the posts I refer to above.

Third, the fact that hostility would emerge as one nation “helps out” another demonstrates that the member states do not really see themselves as part of a broader social community, which is another reason for disbanding the failed exercise.

Issing then says that:

For Emu, the crisis represents a final test of whether such an institutional arrangement – a monetary union without a political union – is viable for an extended period of time. Lax monitoring and compromises when it comes to observing implementation of rules have to stop. Emu is a club of states with firm rules accepted by entrants. These rules must not be changed ex-post. Governments should not forget what they promised their citizens when they gave up their national currencies.

The governments that led their citizens into this stupidity come and go and the ideological persuasions change. Democracy is about the people having the voice and the ability to change things if they don’t like them.

Claiming that the countries are locked into a dys-functional arrangement that will crucify the living standards of those who do not mix in the Brussels elites forever is as nonsensical as defending the initial design of the system.

Which brings me to the options.

Fraga (cited above) notes that in the Argentine crisis in 2001:

The consequences were quite straightforward: a populist government, having to decide between its suffering people and the greedy bondholders, opted for the people. The rest of Argentina’s experience is well known.

The popular revolt is enhanced by the growing awareness in many countries that the bankers who are now baying for Greek blood and leading the deficit-terrorist charge generally were the same characters that were bailed out by fiscal policy expansion not more than 2 years ago.

So in my judgement this makes the option that the Germans want – to impose a harsh real income cut for Greeks over the next 10-15 years or so – not viable. Not only will this drive the public debt up further given the stupid so-called “funding” pretences most governments go through to pander to the erroneous mainstream economics beliefs but at least a generation of citizens will suffer very significant losses of wealth and life-time prospects.

This is why I would exit the EMU now. I would reinstate the local currency and renegotiate with all debtors in that currency. I would offer all Greek citizens sensible conversions of their Euro holdings back into the local currency (on a voluntary basis) and allow the currency to float on international markets.

While this option would have significant short-term costs I would judge that the adjustment period would be shorter and the real costs less damaging by far. In this way, the Greek government could at least stimulate real activity locally. In the adjustment period, all externally sourced goods would become more expensive and so real income losses would accrue. But this would be the quickest and least painful to restore competitiveness in the traded-goods sector.

A long drawn-out process of wage cutting is the other way and that will have to be a decade long adjustment, which in my judgement, would be too costly and would not be tolerated by the citizens.

I cover the exit option in this blog – Exiting the Euro?.

The other approach that some are talking about it to allow the IMF to provide external financing – that is, pretend the ECB and Brussels is sticking to its rules – as long as the fiscal contraction is severe.

Any fiscal contraction under current circumstances in Europe is madness.

Paul Krugman (in the column referred to at the outset) doesn’t agree with the exit option. He claims that:

… an attempt to reintroduce a national currency would trigger “the mother of all financial crises.” So the only way out is forward: to make the euro work, Europe needs to move much further toward political union, so that European nations start to function more like American states.

It is easy to dismiss the exit option with general statements like “the mother of all financial crises” without actually specifying what that means. I suspect the financial markets would settle down fairly soon as they did in the Argentine case – although the rhetoric didn’t match the reality.

It is true that the EMU could make it work if they abandoned their ideological obsession of being, as Issing puts it, a “”no transfers” community of sovereign states”. If they truly ceded fiscal authority to an elected European body and allowed sensible fiscal transfers to occur within the union then things would improve somewhat. They would also have to abandon the Maastricht rules that limit the allowable budget swings.

But with labour mobility weak, no common language and years of hostility between member states dating back to historical atrocities from the past, they still wouldn’t have a functional optimal currency area.

In my view the EMU experiment is a failure and structural reforms don’t cure the basic issues that will always arise when economic crisis occurs but are blurred when there is economic growth.

But in the short-term, if Greece doesn’t make the best decision it has available and exit – then they have to be bailed out without harsh fiscal conditions being imposed.

Finally, given all the discussions in recent weeks about how bad the Greek government is I wonder how many of you knew how persistently high Greece’s unemployment rate has been and how low its inflation rate has been during this period of so-called “fiscal profligacy”?

Certainly the articles I read never mention either indicator of capacity utilisation.

Local nonsense

Last Thursday (February 11, 2010), the Federal Treasurer Ken Henry appeared before the Commonwealth Sentate Estimates Economic Committee. These hearings are a chance for the politicians to grill the government on detail and I recall a person I knew who worked close to an Opposition Shadow minister in some former time used to contact me and ask me whether I had any questions I wanted them to put before the government to get data or other information that was not typically published. We got some good data that way.

Anyway, Henry was grilled by the Opposition Finance spokesperson Barnaby Joyce about debt and interest rates. Recall Joyce is the person that I recommended the most simple business card model to (the one before the neighbours arrived even!) because he had been making nonsenscial statements about Australia being about to default on its national debt.

You can read the interchange in the official Hansard – the discussion starts around page E18.

Here is what was said:

JOYCE: Is it a fair statement that, if we keep borrowing money and our debt keeps getting larger, we would be putting upward pressure on interest rates?

HENRY: No disrespect, Senator, but that is a gross oversimplification of economic understanding of these matters. To illustrate, you will recall that during the early years of this decade, as debt was being repaid, interest rates were steadily climbing. So I think we should be careful not to rush into simplistic relationships between levels of debt and interest rates. In Australia since the early to mid-1990s – it is not necessarily true in other countries – it has been the case that, as government debt has been repaid, interest rates have increased, not fallen. That is not altogether surprising because governments have an enhanced ability to repay debt as their fiscal positions improve, which is fairly obvious, and their fiscal circumstances improve as the economy strengthens, which is also fairly obvious. As the economy strengthens, other things being equal, there is increasing upward pressure on prices and monetary policy responds to that. So it is not terribly surprising that we should see, as you would see if you were to have a look at the data, that since the early to mid-1990s the repayment of debt has actually been associated with increasing interest rates.

That is enough for today!

Bill, you will be chagrined to hear that I gave a colleague your Job Guarantee paper to read, after which they went out at lunchtime and returned with a freshly-purchased copy of Mankiw’s textbook to find out more about economics!

Get on with writing that textbook!

Patrice

Please do the humane thing and put that friend out of their misery. If you cant get your self to do that, at least laugh and point (the pointing is the most effective) whenever he/she talks economics.

Professor Mankiw has yet another editorial in the New York Times today about the budget and “sustainability.” It’s too bad the NYT doesn’t enable comments on articles written by contributing authors. Too much of this nonsense is left unchallenged.

Third, the fact that hostility would emerge as one nation “helps out” another demonstrates that the member states do not really see themselves as part of a broader social community, which is another reason for disbanding the failed exercise.

I think that is is key. We see from US history how difficult it is to maintain a federal system even when there is a strong central government and the possibility of democratic change. Without such cohesiveness, a “union” exists only is wishful thinking. There is no democratic means of addressing this, so exiting seems to be the only rational option for a sovereign nation, since Europe seems a long way from becoming the United States of Europe.

As Greeks on aggregate supposedly substantially underpay on taxes (by not reporting full income, I assume), I understand that some effort is being made to enforce existing tax rules, for example by banning cash transactions over a certain size threshold. I suppose with increased enforcement one might advocate a tax cut or spending increase to offset the resulting reduced demand.

And this has probably been discussed before, but it seems to me that if everyone in a country thought of their taxes in MMT terms, there would be even more tax cheating than occurs now. (“What? My taxes aren’t funding anything useful, they are just reducing my demand? Forget that!”) But I guess you could create a lot of job guarantee jobs to assist with doing increased tax audits, at risk of a bit more “government is watching me” paranoia…

hbl, there’s a reason the most hated institution in the US is the IRS. No one likes paying taxes, and the IRS makes sure that they do. They have the power to do so, and they often demonstrate it. A credible economy has to have an effective tax authority in order to function properly, without massive cheating. That pretty basic to Chartalism.

Dear BILLY?

I am a loyal supporter of MMT. But Bussells requires us to reason with concepts from the days of goldsmiths.

For Greece, I am outraged ty measures imposed on the people

and the impunity of leaders

At last report, it is envisaged an increase in VAT, but nothing

for the tax capital revenue ( 9.5% against 19% inFinland and Sweden).

By a correspondent in Athens, I could obtain an unofficial estimate of the rate

of Savings in Greece: it is no more provided by the Government since 1006 (secret d’etat!)

and is estimated between 1 and 2%

Taking back the retirement age, is a absurdity: if we want to increase the workforce,

it is cheaper to recruit younger than pay a retiree.

When is a textbook of MMT?. It is essential for our work washing brain.

You can read my past Chronic on my personal site:

http://www.kybermath.com/economics

Sincerly yours

R0BERT PALLU DE LA BARRIERE