The Japanese government is investing heavily in high productivity sectors and revitalising regions in the process

Last week I noted in my review of the Australian government’s Mid-Year Economic and Financial Outlook (MYEFO) – Australian government announces a small shift in the fiscal deficit and it was if the sky was falling in (December 19., 2024) – that the forward estimates were suggesting the federal government’s fiscal deficit would be 1 per cent of GDP in 2024-25, rising to 1.6 per cent in 2025-26 before falling back to 1 per cent in 2027-28. The average fiscal outcome since 1970-71 has been a deficit of 1 per cent of GDP. I noted that the media went crazy when these estimates were released – ‘deficits as long as the eye can see’ sort of headlines emerged. It was fascinating to see how far divorced from reality the understandings in Australia are of these matters. Meanwhile, the RBA keeps claiming that productivity is the problem and the reason they are maintaining ridiculously high interest rates even though inflation has fallen back to low levels. My advice to all these characters is to take a little trip to Hokkaido (Japan) and see what nation building is all about. The Japanese government has already invested ¥3.9 trillion for semiconductor industry development since 2021 (that is, 0.7 per cent of GDP) and the Ishiba government recently announced a further ¥10 trillion (1.7 per cent of GDP). Meanwhile, the overall deficit is around 4.5 per cent of GDP and no-one really blinks an eyelid. The Japanese government is investing heavily in high productivity sectors and revitalising regions in the process.

Australian government announces a small shift in the fiscal deficit and it was if the sky was falling in

Yesterday (December 19, 2024), the Australian government published their so-called – Mid-Year Economic and Fiscal Outlook 2024-25 (MYEFO) – which basically provides an updated set of projections and statuses of the fiscal position six months after the major fiscal statement was released in May. One would have thought the sky was falling in given the press coverage in the last 24 hours. The standard of media commentary in Australia on fiscal matters is beyond the pail.

The assessment that Greece has been an ‘astonishing success’ beggars belief

Today, I consider the Greek situation, the decision by the UK Chancellor to further deregulate the financial services sector and then to calm everyone down or not, some music. The Financial Times published an article (December 12, 2024) – The astonishing success of Eurozone bailouts – which basically redefines the meaning of English words like ‘success’. Apparently, Greece is now a successful economy and that success is due to the Troika bailouts in 2015 and the imposition of harsh austerity. The data, unfortunately, doesn’t support that assessment. Yes, there is economic growth, albeit from a very low base. But other indicators reveal a parlous state of affairs. At least, this blog post finishes on a high note. Please note there will be no post tomorrow (Wednesday) as I am travelling all day. I will resume on Thursday.

Australian labour market – stronger than October but some statistical artifacts involved

Last Thursday (November 12, 2024), the Australian Bureau of Statistics released the latest – Labour Force, Australia – for November 2024. I was unable to get the data in time due to where I was when it was released so I held over my. usual report until today. The latest data release shows that employment rose in net terms by 35,600 (+0.2 per cent) reversing the weakness that was recorded in October. With the participation rate falling by 0.1 points, the combination of growing employment and shrinking labour force saw unemployment decline by 27,000 and the rate fall by 0.2 points to 3.9 per cent. There was zero growth in monthly hours worked, which was surprising given the strength in full-time employment growth and the declining part-time employment. The improved overall employment growth in November after a fairly weak period in October was, in part, explained by the ABS “In November we saw a higher than usual number of people moving into employment who were unemployed and waiting to start work in October. This contributed to the rise in employment and fall in unemployment.” Underemployment fell by 0.1 point and the overall labour underutilisation rate (the sum of unemployed and underemployed) fell to 10 per cent overall. The mainstream commentators try to equate that level of wastage to a state of full employment but it just makes a mockery of the concept.

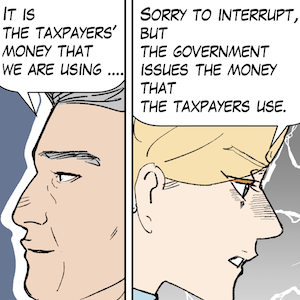

Episode 9 (S2) of the Smith Family Manga is now available – the Prime Minister embarrasses himself

Today (December 13, 2024), MMTed releases Episode 9 in the Second Season of our Manga series – The Smith Family and their Adventures with Money. Have a bit of fun with it while learning Modern Monetary Theory (MMT) and circulate it to those who you think will benefit.

British Labour Government is losing the plot or rather is confirming their stripes

At the moment, the UK Chancellor is getting headlines with her tough talk on government spending and her promise to keep an “iron grip on the public finances”, which she defined as “taking an iron fist against waste”. Okay. This tough guy talk (guy being generic) seems to be the flavour of the month with the incoming US administration also talking about creating a Department of Government Efficiency (DOGE) to hack into public sector spending and employment. Once again we see a Labour government consorting with the ideas of the conservatives. And extreme conservatives nonetheless. The British Chancellor has also determined that public officials are incapable of understanding the priorities and means to provide public services and is going to force the department officials to appear before a so-called ‘independent committee’ of bankers and other financial market types who will scrutinise the financial plans with the aim of cutting 15 per cent over three years from each department’s budget. Another example of conforming to neoliberal ideology. The problem with all this talk, which generalises into public discussions about government spending, is that there is an implicit assumption that it is dysfunctional and just goes up in smoke (waste) somewhere. I never hear these politicians acknowledge that if they actually succeed in making these cuts then a spending gap will emerge and that gap has to be filled in some way or the economy moves towards recession. In other words, what a person might deem to be wasteful expenditure, will always be underpinning GDP and employment growth. Clear up the ‘waste’ and there are additional consequences that may not be considered desirable. At least these politicians and their advisors should make that clear to the public.

The federal government would sack the RBA Board and Governor except it is too busy jumping at its own shadow

It’s Wednesday and as usual I cover a few topics briefly rather than provide a deeper analysis of a single issue. Today, I consider yesterday’s RBA monetary policy decision which held interest rates at elevated levels despite the inflation rate dropping towards the lower range of its targetting band. The RBA has lost credibility and the federal government should sack the RBA Board and Governor. The problem is that the federal government is too busy jumping at its own shadow to actually take any meaningful decisions about almost anything. I also reflect on the recent decision by the Nobel Committee to award the Peace Prize to the – Hibakusha – which reminds us of the devastation that nuclear arms can (and did) cause. Some other matters then precede today’s great music segment.

The demise of trade unions as a countervailing power to civilise Capitalism

One of the striking characteristics of the neoliberal era has been the dramatic decline in trade union membership across the world. The decline has also been associated with depressed wages growth for workers overall, increased income inequality, reduced job security, and the rising domination of the ‘gig’ job phenomena. Related trends include rising household indebtedness (as wage suppression has led to use of credit to maintain consumption levels) and reduced housing affordability, etc. Today (December 9, 2024), the Australian Bureau of Statistics (ABS) released the latest edition of biannual – Trade union membership – for August 2024 (the latest data available), which shows that trade union membership has grown from 12.5 per cent in August 2022 to 13.1 per cent now. But that modest rise doesn’t hide the fact that trade unions are no longer serving the role as a – Countervailing power – in the labour market. The decline has many drivers and many consequences and I consider that topic a bit in this post.

The concept of degrowth remains underspecified – reform or revolution?

I have done quite a number of podcast interviews with various hosts over the last few weeks and the discussions often turn to issues relating to the environment and what Modern Monetary Theory (MMT) has to say about those issues. Inevitably, the discussions then meandered into debates about what is possible given that we humans are estimated to be using 1.7 times the regenerative capacity of our biosphere at present. At some unknown point, but sometime, that overuse will have to come to an end as the biosphere asserts its capacity constraints in one way or another. The question that seems to interest people now is whether the existing mode of production (Capitalism) is at all compatible with reducing that ratio. My answer is always the same. Those progressives who promote the notion of ‘green growth’, which is embedded in ‘green new deal’ proposals or their ilk, seem to think that we can make the shift away from fossil fuels and reduce the claim on the biosphere within a growth paradigm while retaining the Capitalist ownership relations. For me, a system where the logic is ever accumulation of capital via the creation and expropriation of surplus value and realisation of that value as profit, is incompatible with being able to live within the limits imposed by the biosphere. If we are to have any long-term future as a race, then we will have to embrace a degrowth strategy and radically alter the way we allocate resources and our patterns of production and consumption. In a sense, Marx’s long discredited notion of the – Tendency of the rate of profit to fall – as an intrinsic feature of Capitalism, which he believed would eventually bring the system asunder, is likely to be realised as the environmental constraints impinge on the accumulation system. Simply put, the logic of Capitalism requires growth and degrowth is the anathema of that logic.