Japan’s new proposed national strategy has to overcome the domination of imported neoliberalism – Part 1

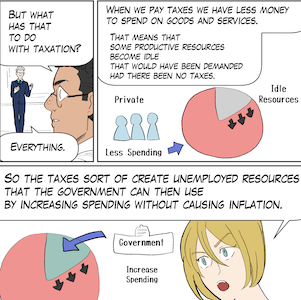

My colleagues and I at Kyoto University met the night before I flew back to Australia this year to discuss the on-going research collaboration, which will define part of my work over the next few years. I hope we can announce a major event in Kyoto or Tokyo in October or November 2025 to disseminate the first stage of the research results. The topic is broadly characterised by the working title – The Future of Japan – Challenges and Opportunities – and aims to articulate the contemporary challenges facing Japan – juxtaposing the mainstream framing (with associated economic narratives) with a framing based on Modern Monetary Theory (MMT). It is a very broad project and we will have to work over the next few months to make it tractable. The Project aims to develop an alternative blueprint for economic development, one that is centred on advancing the needs and aspirations of the people and moving away from a compliance to the corporate needs. My contribution will draw on the current work I am doing on degrowth and delinking (breaking the yoke of Colonialism in poorer nations) and explore the notion that Japan can actually take ‘advantage’ of its shrinking population to demonstrate how key degrowth strategies can actually be implemented. We will also be running at odds to the Japanese government’s recently announced (October 2024) – JIIA platform – which is the government’s major national strategy statement. The fact that the current government thinking is a reflection of its neoliberal leanings, which have not served the nation well, stands in contrast to the ‘opportunities’ we identify once we adopt an MMT lens. Here is a bit about that thinking and, of course, over the next year (at least), I will periodically update readers with the progress of our work.