In the annals of ruses used to provoke fear in the voting public about government…

British Labour Government is losing the plot or rather is confirming their stripes

At the moment, the UK Chancellor is getting headlines with her tough talk on government spending and her promise to keep an “iron grip on the public finances”, which she defined as “taking an iron fist against waste”. Okay. This tough guy talk (guy being generic) seems to be the flavour of the month with the incoming US administration also talking about creating a Department of Government Efficiency (DOGE) to hack into public sector spending and employment. Once again we see a Labour government consorting with the ideas of the conservatives. And extreme conservatives nonetheless. The British Chancellor has also determined that public officials are incapable of understanding the priorities and means to provide public services and is going to force the department officials to appear before a so-called ‘independent committee’ of bankers and other financial market types who will scrutinise the financial plans with the aim of cutting 15 per cent over three years from each department’s budget. Another example of conforming to neoliberal ideology. The problem with all this talk, which generalises into public discussions about government spending, is that there is an implicit assumption that it is dysfunctional and just goes up in smoke (waste) somewhere. I never hear these politicians acknowledge that if they actually succeed in making these cuts then a spending gap will emerge and that gap has to be filled in some way or the economy moves towards recession. In other words, what a person might deem to be wasteful expenditure, will always be underpinning GDP and employment growth. Clear up the ‘waste’ and there are additional consequences that may not be considered desirable. At least these politicians and their advisors should make that clear to the public.

First, let’s deal with the proposal for government departments to be vetted by some panel of experts from the financial markets.

The Minister for the Cabinet Office released a press statement (December 9, 2024) – Pat McFadden vows to make the state “more like a start up” as he deploys reform teams across country – which announced his “pledge to make the state ‘more like a startup'” and use techniques developed in Silicon Valley to allegedly improve public service delivery.

Business types will be hired by government on “Tours of Duty” to bring an entrepreneurial mindset to the public service.

A relaxation on recruitment rules will help these characters take over government strategy – a sure fire way for ‘mates’ to be imported into lucrative consulting positions with less scrutiny.

Over the last few decades, the higher education sector in Australia, as an example, has been flooded with this sort of entrepreneurial nonsense.

Academics have been subjected to a conga line of consultants being marched into the universities and preaching austerity and KPIs.

The vast majority of these consultants have never worked in a university and clearly have never taken the time to understand the way these institutions function to deliver research and teaching excellence.

Instead, management consultants come up with ridiculous cost-cutting plans, which cut costs in the areas that actually do the work and pad out the senior management areas, with all sorts of new, fancy-titled positions.

I swear that universities could eliminate almost all of the senior management positions and the institutions would function better in delivering their core functions.

I remember one meeting with the so-called ‘external’ consultants where the ‘expert’ announced that they were cutting costs by eliminating the use of laptop computers.

When challenged he said: “Why do academics need portable computers when they have desktops in their offices?”

It was laughable how little he knew about the daily life of a research academic with global networks.

Anyway, the Chancellor thinks that she can sub-contract her ‘iron fist’ out to some characters from the financial markets including from Lloyds and Barclays banks.

Yes, the same Lloyds that was bailed out by the UK government and partially nationalised during the GFC as a result of their appallingly bad loan behaviour.

And, yes, the same Barclays Bank that saw “four former executives … charged with fraud over their actions in the 2008 financial crisis” (Source).

The other aspect of the madness that British Labour is indulging in at present relates to the Chancellor’s plan to force government department officials to submit their spending ‘budgets’ to a so-called ‘independent committee’ of bankers and other financial market types who will scrutinise the financial plans with the aim of cutting 15 per cent over three years from each department’s budget.

More madness.

1. Government is not a business and its objectives and evaluation criteria are not remotely akin to how a profit-seeking business should assess its progress.

What expertise does a Lloyds’ Bank official have in delivering programs to the poor?

Hazard a guess! Mine is none!

We have seen across many jurisdictions how these ‘efficiency’ drives play out.

In a private business, if costs are cut to the point that service delivery is compromised, consumers will soon work out the problem and shift their custom to another business.

Businesses rise and fall on this basis in the private economy.

However, cutting a government service to the bone is a quite different matter.

There are scads of evidence showing how various segments of the public service have been decimated by these ‘efficiency’ cuts, to the point where basic services are no longer provided.

That challenges our conception of what a public service is.

It is a lot of things but one thing it is not – a product for private shareholders to profit from its sale.

2. The whole point of government is that we elect it and hold it responsible and accountable as our agents, for accomplishing outcomes that we, individually cannot achieve.

Decisions taken by said government should always be scrutinised by the public and our voting intentions signalling our own assessments of the outcomes.

3. In the UK, around 60 per cent of businesses (‘start ups’) fail, for various reasons, in the first three years of operation.

There is considerable ‘waste’ incurred in the startup Merry-Go-Round.

Capital is abandoned, people’s lives are disrupted, and services disappear as quickly as they emerge.

That sort of model is clearly not suitable to government which must run stable departments that deliver secure services to the citizens over long periods of time.

The other point I want to make today relates to the macroeconomic reality of government spending.

Whether one likes where the spending is going is one thing.

And different value systems will clearly have different preferred patterns of spending.

I would defund the military and the support for financial markets and ramp up spending on climate policies and education, health and the arts.

And I might argue vehemently in the public domain for governments to shift their spending priorities.

I might also say that the billions governments spend on making bombs to kill people with is a classic spending ‘waste’.

And I might want to eliminate all such waste from the public sector.

So at that stage I am in agreement with the Chancellor – waste is bad and should be eliminated – even if I readily understand that what might be considered waste is in the eyes of the beholder and I certainly wouldn’t trust private bank officials who come from a culture that landed them in so much trouble during the GFC to be the best set of eyes to make those judgements.

But then there is the macroeconomic issue that is always sidestepped or ignored in these ‘efficiency’ drive discussions.

Every $ or £ or ¥ that constitutes government spending goes somewhere even if we consider the somewhere to be a waste.

At the macroeconomic level of analysis, ‘waste’ has no real meaning.

What has meaning is that spending drives output which drives income generation and employment.

That is the basic rule of macroeconomics.

The government spending also sets of the expenditure multiplier process which simply means that the first recipient of the extra spending from government then is induced to spend some of that extra income elsewhere and that multiplies throughout the economy such that the initial $ spent by government produces a much larger multiple in total income change.

Please read this blog post for more on that – Spending multipliers (December 28, 2009).

Which means that if you start hacking into government spending then the current spending equilibrium will be disturbed and GDP will decline because the spending gap that is created leads to falling sales, rising inventories, production and employment cutbacks and the rest.

The point is that the government spending whether one calls it wasteful or not is contributing to income generation and employment growth.

Take it away and there is a shortfall.

Now the British government might think that the gap will be suddenly filled by non-government sector spending increases.

That is the standard ‘growth friendly austerity’ nonsense that the IMF and its ilk have been trying to convince us of for years.

The facts are the opposite.

When the government imposes cutbacks and GDP starts to tank, households in fear of the rising unemployment cut back too, which then leads to businesses cutting back on investment spending.

It is a vicious cycle.

And if we reflect on the current British National Accounts situation then the government sector is playing a significant role in keeping GDP growth above water.

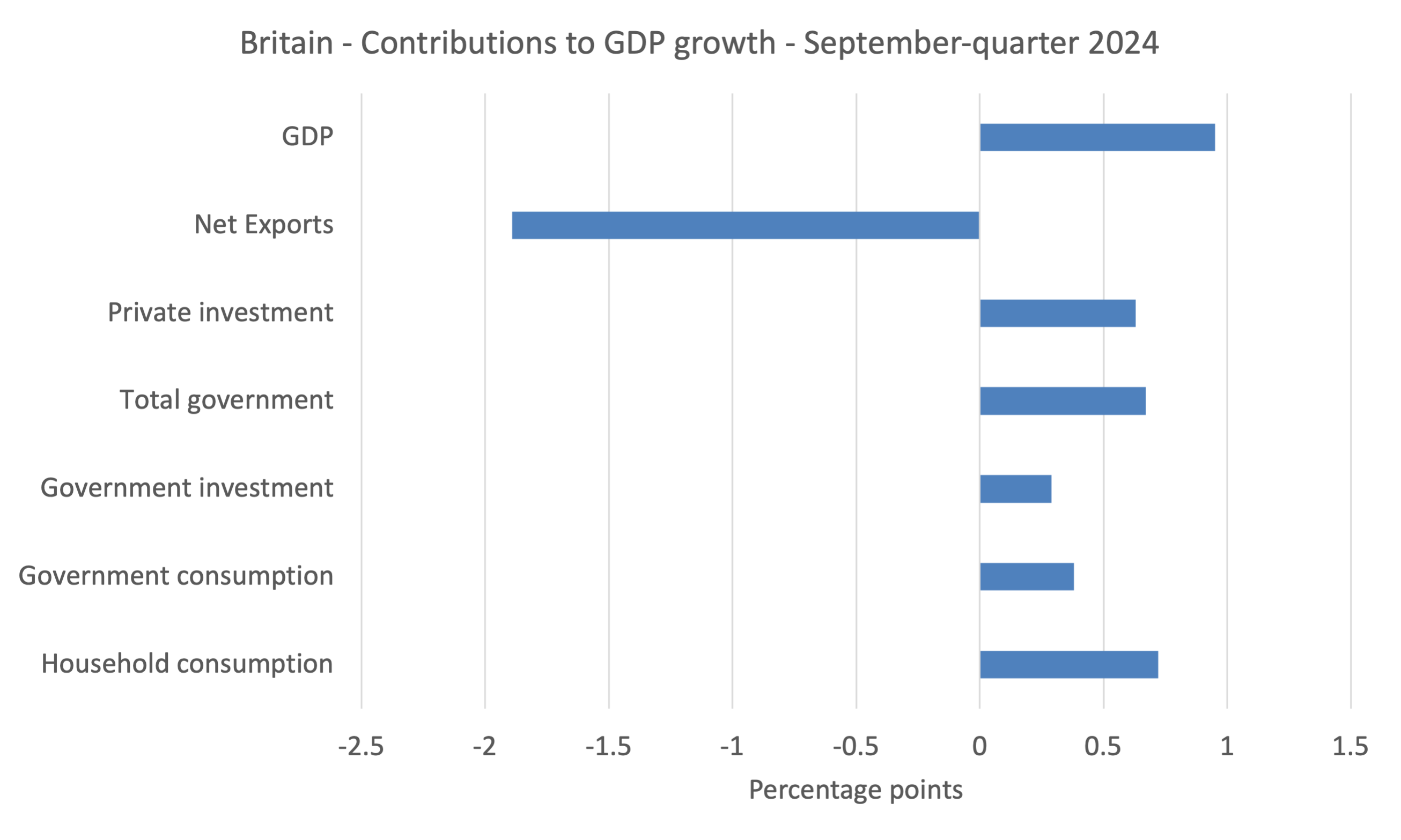

The following graph shows the contributions to GDP growth by major spending aggregate for the September-quarter 2024 – in percentage points.

GDP growth was estimated by the Office of National Statistics to be 0.95 per cent in the September-quarter 2024.

Take out the government contribution (both recurrent spending and capital formation) and that growth rate drops to 0.2 per cent.

At that lower rate, unemployment would be rising fairly sharply.

In the June-quarter it was even more clear what the contribution of government spending was: GDP grew by 0.7 per cent and the contribution of government equalled 0.66 per cent – that is nearly all of the overall growth.

Without that contribution the UK growth would have effectively been zero.

So the question that the journalists should be asking of government is which alternative spending source is going to fill the gap left by the 15 per cent cut in government department expenditure over the next three years.

Conclusion

Silly people.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

How is 15% cut to budgets supposedly not austerity?

Thanks Bill for writing some worth reading analysis on my sorry island. According to another sorry opinion piece in the G, ‘Starmer’s Labour knows the kind of Britain it wants.’ Seems to me what it mainly wants is to preserve the relative wealth and accustomed lifestyle of the home-owning middle class: those who have paid off the mortgage, with money to spare to indulge their whims to do whatever they want, at the expense of society and the environment, and to also set their offspring above the struggling class.

There are several overlapping problems within the UK, that the current lot in charge haven’t the first idea how to fix.

There is indeed a problem within the Civil Service and the wider public sector. There has been a lot of surprise amongst civil servants that they have to justify what public funds are spent on and that the spending must align with the government’s current goals. It’s come as a shock to quite a lot of them, and there has been a remarkable amount of explaining of this concept during the spending round. Requiring that civil servants keep to the agreed budgets and deliver their agreed outputs has come as another shock. This demonstrates how poor the Tories were at controlling government expenditure, and why the supplementary estimates were always way over book during their term in office.

Bringing in people from big business won’t help here, because their organisations suffer from very similar issues – particularly the banks. I’ve seen waste in banks that even the most spendthrift public sector worker would baulk at.

Then we have the increase in taxes which are starting to have an expectational effect anecdotally even if that hasn’t yet appeared in the data. It’s likely offset somewhat by the small increase in lending that has arisen due to the interest rate reductions.

What’s scary is that it looks like the new government really does believe in fiscal crowding out and that if they just stick to their ‘rules’ a rush of money will appear from somewhere to do something. Quite where from and to achieve what is yet to be revealed.

And as for where the demand is coming from to justify the investment, I too can’t see anybody considering that point anywhere. It’s all “build it and they will come”. There’s going to be a lot of head scratching going on when nobody turns up.

And really we need to be ready for that moment with an alternative proposition.

It’s a good thing the Labour government that brought in the NHS, was not led by Starmer and Reeves. The war debts would have been too much for them.

Fortunately Atlee and Bevan were weaned on other economic theories.

At Flinders Uni, where I worked for twenty years, I once asked “why am I not issued with a laptop computer (I had to constantly borrow one from the IT department, which was a nuisance) when I do almost all my writing at home and I’m away a lot on research projects or conferences?” I was told that the university could not afford to give every academic a desktop and laptop computer, to which I gave the obvious response, “why do I have a desktop computer?”

I ended up quitting Flinders for other reasons, although they were all related to changes in university culture and management, which has been driven by the funding models of universities imposed by successive neo-liberal Federal Governments starting with the Hawke/Keating so-called ‘Labor’ Governments of the 1980s. I’m usually a reserved sort of person, but I don’t hesitate to tell some Labor Party supporter who worships those Hawke/Keating years what I think about Hawke and Keating, in particular the latter, who’s still got ‘tickets on himself’ (Australian slang) and knows nothing about economics because he’s a Treasury Dept ‘graduate’. I gave a piece of my mind about this to someone just the other day.

You learn a lot when you spend many years at universities, and one is that most academics are a waste of space, especially in the social sciences, an oxymoron a lot of the time if ever there was one. Overall, academia is not at all objective – most academics are more interested in furthering their own interests rather than the interests of society and will do almost anything to protect some of the nonsense they write. All academics write something that wasn’t 100% correct at the time (academic writing is a record of one’s ‘work in progress’), and the good ones alter how they say things over time to reflect their increased knowledge and understanding of matters. It’s not a sign of weakness or inadequacy – backing down is increasingly seen these days as a sign of failure – but a sign of strength, objectivity, and a commitment to an evidence-based accumulation of knowledge. If we were still in the Middle Ages, mainstream economists would be burned at the stake for practicing witchcraft. Politicians would be thrown in with them.

The neoliberal era of capitalism, that was ushered into Australia prior to but then strongly promoted by the Hawke-Keating years, as Philip mentions, saw the privatisation of various elements of the commons. As I like to explain it, Keating opened the door to neoliberalism and Howard-Costello kicked it off its hinges.

That trampling of the public good was sold to the masses on the basis of trickle-down economics via the lies that privatisation filled the government coffers (with its own monopoly issued currency!) and reduced the public debt while privatised former public services would be operated “more efficiently” and at a lesser cost/greater saving to the consumer. A win-win which wasn’t and never is.

And then, as time passes, it becomes all too late to reverse the process, or so it is again sold to the masses, because the government cannot afford the cost of reversal. Just think how much it would add to the public deficit! Again a massive lie and deception perpetrated on the electors by private capital and neoliberal governments. All of the Australian governments of today are now well and truly captured by big capital. Neoliberal or slightly lighter neoliberal is the choice.

With the advance of the neoliberal project we saw the transition of public bureaucracies from being knowledgeable and skilled and having an internal history in service delivery to becoming top heavy with middle managers having hollowed out capacities, lacking those former skills and knowledge. In fact, they became outsourcing contract managers, with such management done extremely poorly or almost non-existent. We end up with the likes of Robodebt driven by a seeming amorality and unforgivable incompetence from a bureaucracy captured by the government of the day and with, at a minimum, a fear of speaking truth to power.

All of this can be reversed. It will take elected politicians of real character and strength to make that happen. Those politicians must be armed with the truth of the operations of public money and banking within the bounds of macroeconomics as it actually is and not how it is currently propagandised to the masses. So far I’ve seen no evidence of any of the current crop of elected politicians breaking ranks with the status quo.

… [Bill EDITED OUT REFERENCE TO A SITE THAT HE DOES WISH TO PROMOTE] …

We remain the USA’s Deputy Sheriff down in the S-W Pacific. A strategic stationary aircraft carrier and quarry being a vital link for listening and communications for Australia’s master.

In my view Britain needs a pouring of transport infrastructure investment across the country

Targeted R&D investment outside of just oxbridge/London

Reform to planning law; so as to allow private investment in housing/energy infrastructure

Cutting national insurance tax obligations

Increase in defence spending to bolster Naval/airforce capabilities for home island

defence

Removal from Asylum system /echr and immediate deportation of asylum seekers and illegal migrants and foreign criminals

Remigration programme for mirpuiri communities involved in targeting working class white communities

Britain could pursue this but central bank independence needs to be removed ; yield curve control openly pursued to reduce interest costs; fiscal deficits spending to support infrastructure/R&D investment and national insurance tax cuts.

Growth in the UK is really hampered by lack of transport infrastructure outside of south east.

Tom Forth has written about this.we urgently need government investment in this area.