The other day I was asked whether I was happy that the US President was…

The assessment that Greece has been an ‘astonishing success’ beggars belief

Today, I consider the Greek situation, the decision by the UK Chancellor to further deregulate the financial services sector and then to calm everyone down or not, some music. The Financial Times published an article (December 12, 2024) – The astonishing success of Eurozone bailouts – which basically redefines the meaning of English words like ‘success’. Apparently, Greece is now a successful economy and that success is due to the Troika bailouts in 2015 and the imposition of harsh austerity. The data, unfortunately, doesn’t support that assessment. Yes, there is economic growth, albeit from a very low base. But other indicators reveal a parlous state of affairs. At least, this blog post finishes on a high note. Please note there will be no post tomorrow (Wednesday) as I am travelling all day. I will resume on Thursday.

The meaning of the word success

The FT article tells the reader that:

Rather than suffering in “debtors’ prison”, condemned to the permanent austerity and poverty forecast by the 2015 Greek finance minister Yanis Varoufakis, the country’s economy has not only grown much faster than the Eurozone average, it has also been able to run the primary budget surpluses demanded by its creditors under its bailout plans. Just last month, the Greek government repaid part of its debts under an early bailout programme from 2010 because its investment-grade status allowed it to borrow more cheaply in financial markets.

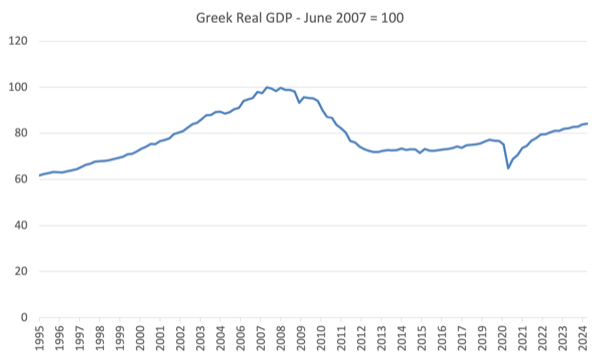

GDP growth is certainly occurring from a very low base.

But the economy remains 15.9 per cent smaller than it was in the June-quarter 2007, before the GFC.

The FT journalist then wrote:

Between the eve of the Covid crisis in 2019 and 2024, IMF data shows GDP per head will have grown more than 11 per cent in Greece …

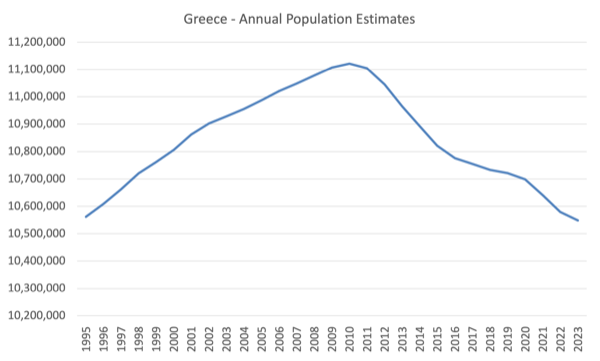

It is not hard to increase GDP per capita when the nation’s population has contracted sharply since the austerity began.

Here is the evolution of the total population.

Since 2010, the Greek population has declined by around 5.2 per cent and a significant proportion of that decline has been driven by younger, educated Greeks leaving for distant shores.

A talent loss that will haunt the nations for decades to come.

Had the Greek population growth pre-GFC continued, the current population would be closer to 11.6 million rather than 10.5 million.

That fact is ignored by the FT article and by all the Eurozone boosters when they talk about the ‘astonishing success’ of the bailouts.

The current GDP figures would look pretty wan if a significant proportion of the population had not been driven out of the nation by the austerity.

In fact, GDP per capita would remain below the peak in 2010 despite the recent GDP growth.

Further, unemployment remains high.

Here is the latest unemployment rate graph (to October 2024) with the dashed line being the moving average given the data is not seasonally adjusted.

In October 2024, there were 9.2 per cent of available workers unemployed.

A nation that cannot generate enough jobs to meet the desires of the workforce can hardly be called a ‘success’.

The last ‘Risk of Poverty’ Report published by the Hellenic Statistical Authority (September 23, 2021) was for the period 2010 to 2020, so we have no more recent data.

At that time, 28.9 per cent of the population were ‘at risk of poverty or social exclusion’, which summed to 3,044 thousand persons

The Hellenic Anti-Poverty Network (EAPN-Greece) released a report – Poverty Watch 2022 Greece – which noted that:

It is well known that during the decade of the crisis 2010-2020 about 25% of incomes were lost but by the end of the decade a recovery had begun. Today, however, the reverse trend has begun and poverty risk indicators are increasing. Indeed, it is estimated that the loss of real income of Greek households due to the energy crisis, which has set fuel and electricity bills on fire, will be more than 10% more in 2022 …

… the risk of poverty and exclusion in the country in 2021 amounted to 29.5% of the population, an increase of 0.6 points from 28.9% in 2020 (based on the indicators of the Europe 2020 programme). Statistically, there are also increases in the rates of income poverty (19.6% of the population in 2021 compared to 17.7% in 2020) and in people living in low-intensity work households (13.6% of the population in 2021 compared to 11.8% in 2020). The increases in all three poverty indicators, the rise in child poverty and the current economic and energy crisis are of particular concern.

Even with the current GDP growth phase, it is estimated that 26 per cent of the population are around the poverty line with 17.4 per cent of the population considered impoverished with 20 per cent of children in poverty (as at September 2023) (Source).

Running primary surpluses when 25 per cent of the population live in poverty does not appear to be an outcome one should boast about.

Hardly the stuff of an ‘astonishing success’ story.

More ‘light touch’ regulation coming

Remember Gordon Brown’s character-defining – Speech – to the Confederation of British Industry (CBI) on November 28, 2005, where he laid out his approach to the financial markets:

The better, and in my opinion the correct, modern model of regulation – the risk based approach – is based on trust in the responsible company, the engaged employee and the educated consumer, leading government to focus its attention where it should: no inspection without justification, no form filling without justification, and no information requirements without justification, not just a light touch but a limited touch.

The new model of regulation can be applied not just to regulation of environment, health and safety and social standards but is being applied to other areas vital to the success of British business: to the regulation of financial services and indeed to the administration of tax. And more than that, we should not only apply the concept of risk to the enforcement of regulation, but also to the design and indeed to the decision as to whether to regulate at all.

Those words – “not just a light touch but a limited touch” – should be etched on his headstone.

History shows that the risk-based approach badly failed and it was always going to fail.

I wrote more about Brown’s attempt to reinvent himself after the disaster leading to the GFC in this blog post – A former UK Chancellor attempts to save face and just becomes confused (October 3, 2017).

But the British Labour Party has a long-history of being stooges for the ‘City’.

A succession of Chancellors have come to office on a story line that unless the new Labour Government seeks ways to appease the financial speculators it will be game over for the country.

They never really outline how the ‘game’ might end.

They just leave that but out and the imagination of the citizens is left to weave some lurid and desperate tale.

Brown failed badly because he put in place a system of oversight that allowed the financial markets to elevate their pursuit of greed to new levels unfettered by appropriate regulative controls.

Then the Government rewarded the failure with bailouts and very few banksters faced prosecution, let alone prison sentences for their fraudulent and incompetent behaviour.

All under Gordon Brown’s watch.

The new Labour Chancellor Rachel Reeves is apparently planning to further deregulate the financial markets in the UK.

In her – Mansion House 2024 speech ((November 14, 2024) – she told the audience:

Before we came into government…

… I was clear that financial services must play a central part in our economic vision…

… and our plans for economic growth.

Because I know that this sector is the crown jewel in our economy.

It employs 1.2m people, from London to Edinburgh, and from Manchester to Belfast.

It is one of the country’s largest and most productive sectors, accounting for 9% of our economic output.

And it is a global success story, as the Lord Mayor has said: we are the second largest exporter of financial services in the G7.

But we cannot take the UK’s status as a global financial centre for granted.

There is another example of how the English language has been rendered meaningless.

“Productive” is not a word I would associate with the daily operations of the financial markets.

In fact, I would describe the financial services sector as the most unproductive sector in the economy.

It does little more than provide gambling opportunities for speculators who bet against each other to see who can shuffle wealth the most.

It distorts the labour market by attracting very bright characters at exorbitant salaries and thus diverting this talent away from more socially useful pursuits.

It encourages wealth holders to shift their funds from potentially useful investment opportunities which would actually increase material benefits to the broader society into wealth shuffling exercises.

And in doing so it creates asset bubbles, which deprive low income earners of the opportunity to access, for example, affordable housing.

And as it builds momentum over a cycle, the speculators abandon more conservative options and ramp up the risk, to the point where there is failure.

Then they put their hands out to government to bail them out and ensure the top-end-of-town maintain their status.

A progressive government would be working on policies that shut down much of this sector rather than opening the door for further greed.

Music – White Room

This is what I have been listening to while working this morning.

The song – White Room – was released on the 1968 double album – Wheels of Fire – by British band – Cream.

I was at high school by then and starting to play in bands and the band was on my favourites iist.

I only really liked the playing of – Jack Bruce – and I preferred other British guitar players to – Eric Clapton.

But while they were together they produced some magnificent music.

This song was written by Jack Bruce and the lyrics were provided by English performance poet – Pete Brown – who contributed lyrics for many of the Cream’s songs.

The story goes that Jack Bruce wrote the music as his tribute to Jimi Hendrix who was suitably impressed.

Whatever, it remains a classic.

As kids we tried to play this and while we achieved the intensity and enthusiasm the music craft in those days was lacking.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Concur wholeheartedly!

“Welcome to the meaningless words club!” – Says democracy to success.

Thank you neoliberalism!

Well, excuse me for being an MMT nerd, but Bill’s railing against the parasitic financial sector was better music to my inner ear than the music selection.

On my side of the pond, due to a brief encounter between a health insurance CEO and an independent claims adjuster, a meme has gone viral: there is no longer right or left, only up or down. It remains to be seen whether a new George Floyd moment has arrived, this time not about race but class. Are similar memes circulating in other countries like Greece or the UK or Australia, also long subject to the oppressive rule of the rich euphemistically called neoliberalism?

@Newton Finn I have to say I find this recent ‘no longer right or left’ quite troubling. It seems to be an extension (or reaction to but without any intellectual vigour) to the Third Way politics of the usurpers of the Left Political Parties who infested them with neo-liberalism and deny the reality of class conflict, having continued the work of the right to reduce the power of organised labour. If there is no viable left politics, then we see that people who are not content with neo-liberalism find a populist home, which is manipulated by the wealthy right. I see Americans dissatisfied with their health sector but I don’t see them getting behind a less individualist, less capitalist alternative. Black Lives matter, MeToo movement, Occupy, Palestinian Lives Matter, have all been shrugged off by the system, the last two with more violence as they really challenged vested interests.

“[Financial services are] the crown jewel in our economy.”

Finance must exist in service to the production of real goods and services, and not be allowed to serve its own purposes.