I grew up in a society where collective will was at the forefront and it…

Reducing income inequality

The recent political ructions such as the Brexit outcome in the UK, the popularity of Donald Trump and Bernie Sanders in the US, the growing extremist popularist movements in Europe and elsewhere, and the scrape-in victory of the incumbent conservative government in Australia at the recent federal elections, have been attributed in no small part to a growing resentment against rising income (and wealth) inequality. A ‘progressive manifesto’ has to address this issue and work out ways that the gap between real wages and productivity growth is eliminated so that workers can rely more on wages growth to fund their consumption growth rather than credit. This blog continues to discuss the elements of such a Manifesto and today we focus on the question of income inequality and ways in which productivity growth can be better shared.

The imperative to reduce income inequality

The GFC was the culmination of a long build-up of destructive forces, which resulted from the ideologically-motivated financial market deregulation, that exposed the dysfunctional and unproductive nature of so-called self-regulating financial markets.

There was little ‘self-regulation’ on show. Rather:

1. The incentive structures set up for senior bankers encouraged high risk excess.

2. The ratings agencies were relied on to provide guidance to these investors but were engaging in criminal and incompetent behaviour whereby they were being paid by companies to rate their products favourably – thus providing no sound guidance at all.

3. Various statistical techniques promoted by economists who believed in the ‘efficient markets’ theory to evaluate risk were hopelessly inadequate for the task (as was the theories they advocated).

4. A range of new ‘financial’ products were created that bore no relationship to the real economy (where ordinary people live and work) which were impossible to comprehend and assess (for risk) from the perspective of the investor (individual or institution).

5. Fraud and deception were common in the financial sector.

These systemic failures were crucial in the financial crash that occurred in 2008. But they were only part of the story.

They were part of the neo-liberal mania that dominated the world’s economic and social policy making since the 1980s (before in some nations).

The global nature of the crisis arose because over the last 2-3 decades most Western governments succumbed to the neo-liberal myth of fiscal austerity and introduced policies which allowed the destructive dynamics of the capitalist system to create an economic structure that was ultimately unsustainable.

Once that instability began to manifest it was only a matter of time before the system imploded.

Please read my blog – The origins of the economic crisis – for more discussion on this point.

There were a number of interrelated policy failures. First, the obsessive promotion of fiscal surpluses as virtuous and deficits as a reflection of policy irresponsibility, squeezed the disposable incomes of the non-government sector.

In the US (the Clinton surpluses), Australia (10 out of 11 years of fiscal surpluses between 1996 and 2007) and elsewhere governments were pursuing fiscal policies that in normal times would have created recessions.

But while recessions did follow the period of fiscal surpluses, they were stalled by another major shift that marked the neo-liberal era.

The other characteristic of the neo-liberal era has been the dramatic rise in income inequality in most advanced nations. There are various dimensions of this trend.

The first important point to note is that the so-called ‘wage share’ in national income has fallen in many advanced nations as real income has been increasingly funnelled towards profit recipients.

I have considered this topic in these blogs – There is a class warfare and the workers are not winning and Massive real wage cuts will not improve growth prospects and The origins of the economic crisis.

A 2013 ILO Report written by Englebert Stockhammer – Why have wage shares fallen? A panel analysis of the determinants of functional income distribution – is also worth reading for its analysis of trends in the advanced OECD nations.

[Reference: Stockhammer, E. (2013) Why have wage shares fallen? A panel analysis of the determinants of functional income distribution, International Labour Office, Geneva]

There are two broad facts that are agreed by most analysts in this area.

First, up until the early 1980s, real wages and labour productivity typically moved together. As the attacks on the capacity of workers to secure wage increases intensified, a gap between the two opened and widened.

The wage share in many countries was more or less constant for a long time during the Post Second World War period and this constancy was so marked that Nicholas Kaldor (the Cambridge economist) termed it one of the great “stylised” facts.

It meant that real wages grew in line with productivity growth which was the source of increasing living standards for workers and allowed them to maintain growth in consumption expenditure commensurate with the growing output of the economy.

The productivity growth also provided the ‘room’ in the distribution system for workers to enjoy a greater command over real production and thus higher living standards without threatening inflation.

To understand the relationship between real wages, productivity growth and the wage share, please read my blog – Declining wage shares undermine growth – for more discussion.

Basically, the wage share will be constant if real wages and productivity grow in proportion with each other.

The widening gap between real wages and productivity growth manifested as the rising profit share and the wage share in national income has fallen significantly over the last 35 years in most nations.

Second, in the Anglo nations, “a sharp polarisation of personal income distribution has occurred” (Stockhammer, 2013: 2), with the top percentile and decile of the personal income distribution substantially increasing their total shares.

The munificence gained at the expense of lower-income workers manifested, in part, as the excessive executive pay deals that emerged in this period.

It also provided the financial markets with more casino chips to play with.

It has also seen income inequality rise dramatically.

Since the mid-1980s, the neo-liberal assault on workers’ rights (trade union attacks; deregulation; privatisation; persistently high unemployment) has broken the nexus between real wages and labour productivity growth.

So while productivity growth has proceeded, real wages have been stagnant or growing modestly.

As a result, the wage shares in most nations have been falling.

The rising inequality has had two major effects. First, it has undermined the capacity of economies to grow in a stable fashion.

In the C19th, Karl Marx understood that cutting wages not only lowers costs but also cuts income and the likely effect would be to undermine total spending. He was opposed in this view by the Classical economists (Ricardo, Mill, Say etc) who considered that wage cuts would increase supply (lower costs) and sufficient spending (demand) to absorb the extra output would follow naturally.

These debates saw a more modern form during the 1930s when Keynes attacked the conservative Treasury view by emphasising the duality of wages – a cost and an income. The Treasury View dominated in the early days of the Great Depression and inspired wage cuts, which only made the unemployment higher.

The fact is that if the wage share falls and more income is concentrated at the top end of the personal income distribution then we would expect to see a decline in total consumption because the marginal propensity to consume out of wage income is much higher than the similar propensity out of income derived from profits.

There is no evidence that redistributing national income towards profits (or higher income earners) stimulates private investment in productive capacity.

There is strong evidence that it stimulates speculative activity in the financial markets.

New York Times correspondent, Steven Greenhouse interviewed a large number of American workers as part of his research for his 2009 book Big Squeeze Tough Times for the American Worker.

He observed that:

Very simply, corporations, along with their CEOs, are seizing a bigger piece of the nation’s economic pie for themselves, leaving the nation’s workers and their families diminished.

In part, this was accomplished by an increasingly hostile legal climate against trade unions (for example, Ronald Reagan’s 1981 sacking of air traffic controllers) and the rising importance of the “a large industry of union-busting consulting firms has emerged and prospered, often through illegal tactics that draw little scrutiny from the Justice Department” (Source)

He considered the impact of the squeeze on real wages through suppression of nominal wage rises.

He concluded that:

Since 1979, hourly earnings for 80 percent of American workers (those in private-sector, nonsupervisory jobs) have risen by just 1 percent, after inflation. The average was was $17.71 at the end of 2007. For male workers, the average hourly wage actually slid by 5 percent since 1979. Worker productivity, meanwhile, climbed 60 percent. If wages had kept pace with productivity, the average full-time worker would be earning $58,000 a year; $36,000 was the average in 2007. The nations economic pie is growing, but corporations by and large have not given their workers a bigger piece.

The squeeze on the American worker has meant more poverty, more income inequality, more family tensions, more hours at work, more time away from the kids, more families without health insurance, more retirees with inadequate pensions, and more demands on government and taxpayers to provide housing assistance and health coverage.

[Reference: Greenhouse, S. (2009) Big Squeeze Tough Times for the American Worker, New York, Penguin Random House.]

It goes without saying that had American workers been paid in accordance with the increasing productivity over the period 1979 to 2007, the reliance on credit to sustain consumption expenditure would have been diminished and economic growth would have been stronger.

This leads us to the second consequence of the the rising income inequality and falling wage shares was that capitalism faced a ‘realisation’ problem.

The question arises: if the output per unit of labour input (labour productivity) is rising so strongly yet the capacity to purchase (the real wage) is lagging badly behind – how does economic growth which relies on growth in spending sustain itself?

This is especially significant in the context of the fiscal drag coming from the public surpluses or deficient defigits, which squeezed purchasing power in the non-government sector.

In the past, the dilemma of capitalism was that the firms had to keep real wages growing in line with productivity to ensure that the consumption goods produced were sold.

But in the recent period, the financial market deregulation provided capital with ‘all its Christmases at once! – it could have a higher profit share and suppress real wages growth and keep profits high by realising the increased sales and productivity improvements.

How? The trick was found in the rise of so-called ‘financial engineering’, which pushed ever increasing debt onto the household and corporate sectors.

The capitalists found that they could sustain purchasing power and receive a bonus along the way in the form of interest payments.

This seemed to be a much better strategy than paying higher real wages.

The household sector, already squeezed for liquidity by the move to build increasing national government surpluses were enticed by the lower interest rates and the vehement marketing strategies of the financial engineers.

The financial planning industry fell prey to the urgency of capital to push as much debt as possible to as many people as possible to ensure the ‘profit gap’ grew and the output was sold.

And greed got the better of the industry as they sought to broaden the debt base. Riskier loans were created and eventually the relationship between capacity to pay and the size of the loan was stretched beyond any reasonable limit. This is the origins of the sub-prime crisis.

To return nations to a stable footing requires that these trends be reversed.

In a separate blog I will discuss reforms to the financial markets and banking. In this blog we explore a few options to restore the nexus between productivity growth and real wages growth.

Sharing productivity growth

In Australia, prior to the neo-liberal period, all wage earners were able to participate in the nation’s productivity growth through the aegis of so-called ‘national productivity’ hearings, convened by the judicial courts that used to set wages in this country.

The National Productivity Case would consider submissions from all relevant parties including government, unions and employment groups and make a determination of the quantum of productivity growth to be distributed via an across-the-board wage rise.

There were all sorts of arguments as to how productivity growth was measured, whether it should be discounted for terms of trade changes and the like.

The point is that a national rule that allows the nation’s productivity gains to be shared by all workers would ensure that workers in low-wage sectors with weak trade unions are not disadvantaged because the management of firms cannot invest in better technology or structure their work places to lift productivity standards.

It is a way of redistributing the gains made by the nation to all workers, which would also significantly reduce inequality and provide a more stable platform for sustained economic growth.

Another way of approaching the problem of productivity sharing would be to legislate within some ‘incomes policy’ a sharing arrangement that is applied each year.

All nations have some form of industrial relations legislation or another. The national government could amend the legislation to ensure that productivity gains by firms, sectors etc are shared out to all workers.

An historical example of productivity sharing arrangements was the Treaty of Detroit, which was an agreement between General Motors and the United Auto Workers (UAW) signed in 1950.

David Moberg (2007) wrote that:

The landmark contract helped create mass prosperity and growing equality in America over the next two decades by setting a standard for other unions that even many non-union employers felt pressure to approximate. Workers shared in rising productivity, and unions shifted to employers many of the risks that come from life in a capitalist economy. The UAW won comprehensive health insurance, pensions, cost-of-living adjustments and income protection during economic downturns.

[Reference: Moberg, D. (2007) ‘Treaty of Detroit Repealed’, In These Times, November 13, 2007.]

The Treaty of Detroit became a model for other unions in the high growth period in US history.

The operational details of such a law would be fairly simple. A ruling on the measured productivity growth would be made by some independent authority which would then sanction real wage increases equal to that determined quantum.

The question would arise as to whether this should be a national requirement or a sector-by-sector or firm-by-firm imposition.

If income inequality is to be reduced, the productivity growth in the high wage/high productivity sectors/firms has to be redistributed to allow for similar wages growth in the low-wage/low productivity sectors/firms.

Otherwise, further divergences between the top and bottom of the income distribution will emerge.

This certainly imposes higher costs on the low productivity sectors but would stimulate a dynamic process whereby to stay in business these firms would have to invest in better techniques and work organisation. The behavioural shifts would benefit the entire economy, while reducing income inequality overall.

There is also a body of literature that proposes that the so-called ‘Scandinavian Model (SM)’ of inflation be applied to national wage setting principles, particularly in small economies that are exposed to international trading markets.

It is argued that the SM is applicable if the task of maintaining international competitiveness is a central concern for wages policy.

The SM dichotomises the economy into a competitive sector (C-sector) and a sheltered sector (S-sector).

The C-sector produces products, which are traded on world markets, and its prices follow the general movements in world prices. The C-sector serves as the leader in wage settlements.

The S-sector does not trade its goods externally.

Under stable exchange rates, the C-sector maintains price competitiveness if the growth in money wages in its sector is equal to the rate of change in its labour productivity (assumed to be superior to S-sector productivity) plus the growth in prices of foreign goods.

Price inflation in the C-sector is equal to the foreign inflation rate if the above rule is applied. The wage norm established in the C-sector spills over into wages growth throughout the economy.

The S-sector inflation rate thus equals the wage norm less its own productivity growth rate.

Hence, aggregate price inflation is equal to the world inflation rate plus the difference between the productivity growth rates in the C- and S-sectors weighted by the S-sector share in total output.

The domestic inflation rate can be higher than the rate of growth in foreign prices without damaging competitiveness, as long as the rate of C-sector inflation is less than or equal to the world inflation rate.

Under this arrangement, nominal labour costs in the C-sector will grow at a rate equal to the ‘room’ (the sum of the growth in world prices and the C-sector productivity).

The main features of the SM can be summarised as follows:

1) The domestic currency price of C-sector output is exogenously determined by world market prices and the exchange rate;

2) The surplus available for distribution between profits and wages in the C-sector is thus determined by the world inflation rate, the exchange rate and the productivity performance of industries in the C-sector;

3) The wage outcome in the C-sector is spread to the S-sector industries either by design (solidarity) or through competition; and

4) The price of output in the S-sector is determined (usually by a mark-up) by the unit labour costs in that sector. The wage outcome in the C-sector and the productivity performance in the S-sector determine unit labour costs.

Although the SM was originally developed for fixed exchange rates, it can accommodate flexible exchange rates.

Exchange rate movements can compensate for world price changes and local price rises. The domestic price level can be completely insulated from the world inflation rate if the exchange rate continuously appreciates (at a rate equal to the sum of the world inflation rate and C-sector productivity growth).

Similarly, if local price rises occur, a stable domestic inflation rate can still be maintained if a corresponding decrease in C-sector prices occur. An appreciating exchange rate discounts the foreign price in domestic currency terms.

Any number of other productivity sharing arrangements might be conceived. But without them, the dynamics of the unfettered labour market will continue to increase income inequality and the problems that accompany it.

Minumum wages evidence and principles

Another factor that has influenced the rising income inequality is the suppression of minimum wage levels during the last 30 years.

There is a growing trend among the Right (represented by mainstream economists, employer groups, conservative think tanks and the like) to mount arguments against minimum wages in general, or against increases in the existing minimum wage levels.

The claim from mainstream economists is always the same – minimium wages interfere with the free market and lead to lower employment levels among the lowest-paid.

The evidence typically fails to support that ‘textbook’ claim. The main reason that teenagers and low-skill workers do not have enough jobs is because there is inadequate aggregate spending and they are disadvantaged in the shuffling of the jobless queue that results.

But there is a substantial body of evidence generated over a long period of time (including that produced by the OECD itself) that reject the sort of conclusion that economists offer in their opposition to minimum wages.

In Australia, the minimum wage is set annually by the federal judicial body, Fair Work Australia at its so-called ‘Safety Net’ wage hearing.

In the May 2004 Federal National Safety Net decision (minimum wage hearing), the Full Bench of the Australian Industrial Relations Commission (the previous incarnation of Fair Work Australia) noted that:

[163] Professor W Mitchell, Professor of Economics and Director of the Centre of Full Employment and Equity at the University of Newcastle, in a critique included in the ACTU’s reply submissions, raised a number of limitations in the methodology applied in regression analyses …

[166] Based on the material before us, we adhere to the conclusion reached in the May 2003 decision that it has not been demonstrated that there is a negative association between safety net adjustments and productivity growth. There is no necessary association between award coverage, safety net adjustments and productivity growth.

Further, in the June 2005 Reason for Decision theAustralian Industrial Relations Commission rejected the main employer groups claims that a rise in minimum wages is harmful with respect to employment.

The Full Bench noted that:

[275] We do not propose to place any weight on the Commonwealth’s submission based on the data in Chart 14 above. The analysis undertaken by the Commonwealth relies on only a small number of observations. In the May 2004 decision, the Commission referred to the evidence of Professor Mitchell in which he raised a number of limitations in the methodology applied in regression analyses undertaken by the Commonwealth in those proceedings …

[276] It seems to us that at least the first two limitations identified apply with equal force to the Commonwealth’s analyses in these proceedings. Given the technical limitations of the exercise, the material does not allow us to reach any conclusions as to the impact of safety net adjustments on employee hours worked in the three most award-reliant industries …

[278] Based on the material before us, we are not persuaded that there is any necessary association between award coverage, safety net adjustments and employment growth.

There is also significant international evidence that rejects the claims that minimum wages undermine employment and productivity growth.

In the face of the mounting criticism and empirical argument, the OECD began to back away from its hardline 1994 Jobs Study position (that labour market deregulation, including minimum wage cuts, was essential).

In the 2004 Employment Outlook, the OECD (pages 81 and 165) admits that “the evidence of the role played by employment protection legislation on aggregate employment and unemployment remains mixed” and that the evidence supporting their Jobs Study view that high real wages cause unemployment “is somewhat fragile.”

In the 2006 OECD Employment Outlook entitled “Boosting Jobs and Incomes”, which is based on a comprehensive econometric analysis of employment outcomes across 20 OECD countries between 1983 and 2003. The sample includes those who have adopted the Jobs Study as a policy template and those who have resisted labour market deregulation. The report provides an assessment of the Jobs Study strategy to date and reveals significant shifts in the OECD position.

The OECD found that:

- There is no significant correlation between unemployment and employment protection legislation;

- The level of the minimum wage has no significant direct impact on unemployment; and

- Highly centralised wage bargaining significantly reduces unemployment.

In a job-rationed economy, supply-side characteristics will always serve to shuffle the queue.

The evidence from the United Kingdom is also unsupportive of the mainstream argument.

An interesting study from Stephen Machin entitled – Setting minimum wages in the UK: an example of evidence-based policy – is significant because Machin is on ‘orthodox’ economist who has avoided the neo-liberal Groupthink and uses evidence to make his case.

He holds a number of prestigious appointments at various universities.

He examined the impact of the creation of the UK Low Pay Commission, which the Blair Labour Government established to try to remedy some of the worst excesses that the neo-liberal era had delivered to low wage workers.

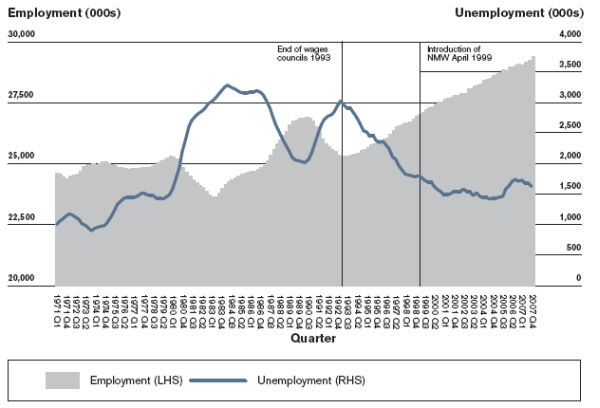

The UK Low Pay Commission (LPC) was established in 1997 and was given the task to define an effective National Minimum Wage (NMW). The following graph is taken from his Figure 1 (page 15) and is self explanatory.

Machin’s commentary is as follows:

The NMW was introduced in April 1999 at an hourly rate of £3.60 for those people over 21 years of age, with a development rate of £3.00 for those aged 18 to 21 years. The key economic question has been the impact of minimum wages on employment …

Over the period 1999 to 2007, the macroeconomic picture indicates that employment continued to grow as minimum wages rose (Figure 1).

What about effects on specific age cohorts?

Machin concluded that:

Across all workers, there was no evidence of an adverse effect on employment resulting from the introduction of the NMW.

What about the effects in the most disadvantaged sectors? Machin reports on research that “searched for minimum wage effects in one of the sectors most vulnerable to employment losses induced by minimum wage introduction, the labour market for care assistants”.

He concluded that:

Even in this most vulnerable sector, it was hard to find employment losses due to the introduction of the minimum wage.

How should a nation following a progressive agenda set minimum wages? Should private profit, capacity to pay arguments be used to set the level or should minimum principles go beyond this type of consideration?

In a progressive world, the minimum wage should be a statement on what a sophisticated society determines to be the minimum social and economic living standards that are acceptable.

The minimum wage level thus should define the lowest material standard of wage income that the Society is prepared to tolerate and will reflect physical factors such as nutritional and housing standards as well as social standards (ability to participate in society, etc).

Accordingly, it should be a wage that allows a person (and family) to participate in society in a meaningful way and not suffer social exclusion or alienation through lack of income. It should be tied in with employment guarantees (more about which another time).

The Right argue that private capacity to pay should be the determining factor. But, in the absence of regulation it is almost certain that the ‘market’ would drive the wage below that level in every nation.

A progressive world would require the business firms to adjust to the minimum standard required by Society rather than the workers.

An inability to pay a socially-acceptable minimum wage says more about management skills and business ethics than anything else.

The minimum wage becomes a statement of national aspiration. Capacity to pay considerations then have to be conditioned by these social objectives.

If small businesses or any businesses for that matter consider they do not have the ‘capacity to pay’ that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy.

Such firms would have to restructure by investment to raise their productivity levels sufficient to have the capacity to pay or disappear.

This approach establishes a dynamic efficiency whereby the economy is continually pushing productivity growth forward and allowing material standards of living to rise.

No worker should be paid below what is considered the lowest tolerable material standard of living just because some low wage-low productivity operator wants to produce in a country and make ‘cheap’ profits.

For a progressive, the private ‘market’ should never be an arbiter of the values that a society should aspire to or maintain.

The employers always want the wages system to be totally deregulated so that the ‘market can work’ without fetters. This will apparently tell us what workers are ‘worth’.

The problem is that the so-called ‘market” in its pure conceptual form is an amoral, ahistorical construct and cannot project the societal values that bind communities and peoples to higher order considerations.

The minimum wage is a values-based concept and should not be determined by a market.

All of that is in addition to the usual disclaimers that the pure ‘competitive market, cannot exist for labour given the imbalances between workers and employers and the fact that the use value of the labour power is derived within the transaction (that is, the worker has to be forced to work). This is unlike other exchanges where the parties make the deal and go their separate ways to enjoy the fruits of their trade.

Conclusion

We will continue this discussion when we consider employment strategies that a progressive government should introduce.

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

28. The Left confuses globalisation with neo-liberalism and gets lost.

29. The metamorphosis of the IMF as a neo-liberal attack dog.

30. The Wall Street-US Treasury Complex.

31. The Bacon-Eltis intervention – Britain 1976.

32. British Left reject fiscal strategy – speculation mounts, March 1976.

33. The US government view of the 1976 sterling crisis.

34. Iceland proves the nation state is alive and well.

35. The British Cabinet divides over the IMF negotiations in 1976.

36. The conspiracy to bring British Labour to heel 1976.

37. The 1976 British austerity shift – a triumph of perception over reality.

38. The British Left is usurped and IMF austerity begins 1976.

39. Why capital controls should be part of a progressive policy.

40. Brexit signals that a new policy paradigm is required including re-nationalisation.

41. Towards a progressive concept of efficiency – Part 1.

42. Towards a progressive concept of efficiency – Part 2.

43. The case for re-nationalisation – Part 2.

44. Brainbelts – only a part of a progressive future.

45. Reforming the international institutional framework – Part 1.

46. Reforming the international institutional framework – Part 2.

47. Reducing income inequality.

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

Alternative Olympic Games Medal Tally

Every four years (since 2000) I have computed what I have called my Alternative Olympic Games Medal Tally based on GDP, GDP per capita and population sizes to better scale the official Olympic Tally.

If you are interested, please go to – Alternative Olympic Games Medal Tally

. It is updated each day and provides an interesting perspective on the Games. That is enough for today! (c) Copyright 2016 William Mitchell. All Rights Reserved.

Hi Bill, looking at the alternative Olympics medal tally, is the UK GDP out by an order of magnitude or so? I don’t think Brexit has hit that hard!

Some claim that the declining wage share has been made up for by increasing wage/salary supplements.

http://taxfoundation.org/article/walkthrough-gross-domestic-income

Might be worth dealing with this argument in the book.

Dear Bill

In all modern countries, the market distribution of income is much more unequal than the post-market distribution, that is, the distribution after taxes have been paid and transfer payments and government services have been received. Especially the poorest 20% would be far poorer without direct government measures to reduce poverty. Sure, let’s make the market distribution more equal, but we still need progressive taxation coupled with transfer payments and government services such as education and health care. The welfare state is also a transfer state and an effective economic equalizer.

Regards. James

I don’t have time to finish the piece and I will get back to it soon but I didn’t see that you mentioned one of the biggest problems with Reaganomics which is that he cut the progressive income tax twice which moved money from the middle class to his wealthy benefactors. Then, Reagan raised taxes for the rest of us sixteen times during his eight years in order to “balance the budget,” something he never achieved and was never publicized. Do you not call for another progressive income tax and especially one that will include taxes on economic rent and that would really affect the financial sector and the natural resources sector?

“This blog continues to discuss the elements of such a Manifesto and today we focus on the question of income inequality and ways in which productivity growth can be better shared.” Bill Mitchell

Government privileges for private credit creation mean that those with equity need not share it via, say, common stock (shares in equity) but may instead use that equity as the basis for loans of what is, in essence, the legally stolen purchasing power of the less and non so-called creditworthy.

Monday musings…

“He was opposed in this view by the Classical economists (Ricardo, Mill, Say etc) who considered that wage cuts would increase supply (lower costs) and sufficient spending (demand) to absorb the extra output would follow naturally.”

How could economists believe spending would remain constant while wages are cut? That makes no sense. At best, the volume of goods and services purchased would remain a constant, but at lower prices, yielding deflation.

Moreover, unless wages are cut at the bottom and top both, does it really cut costs?

It seems to me people are too obsessed with the value of a dollar. Probably because the dollar is our reference point for the value of everything we buy or sell.

We also fail at thinking of economics as a closed system. Low wage earners spend nearly every dollar they earn, often more than they earn, funneling the earnings straight back into the economy, fueling more growth. The more they make the more they spend.

In a way I’m glad the GFC happened. It woke me up to the reality of our economic system and reversed polarity on my political/economic views. I hope it did for others. For most of they money changers out there, sadly, it is just back to business as usual.

Yes a progressive tax system is important in regards to transfer payments and equality.

Wage gains that match productivity gains are just as important. Otherwise total wages decline as a % of GDP and those productivity gains are delivered as profit and to the wealthy. Our tax and transfer systems are distributing less if our incomes were otherwise more.

The way I think of it is….wage gains then redistribution.

“the use value of the labour power is derived within the transaction (that is, the worker has to be forced to work)”

Could somebody please elaborate on or rephrase this concept? I would like to understand it clearly.

Nicholas,

The use-value of labour power is labour. Wages pay for labour power, which is only the potential to work. That potential must be realised through extracting its use-value (labour). That is the reason workers are directly supervised, to ensure they do enough work to not only account for their wages (necessary labour), but to provide a surplus of labour. It is the surplus labour, and the value produced from it, that capitalists are interested.

In other transactions, the purchaser of a commodity extracts its use-value after the exchange has taken place. With employment, the use-value is extracted during the transaction.

Bill, I totally agree with all you have written but one argument some economists including some “progressives” use are that the 80’s was when women entered the workforce hence the bigger shift in productivity sharing in wages as a link. I don’t agree with that at all but I didn’t have a good argument. I’ve seen news articles in fairfax about it (I think) but can’t find any links right now. Just wanted to mention it and how we can simply counter that argument.

Unfortunately this issue seems to have a lot of resistance with even members of the lower middle and working class.

My young barber who started his own trendy barber shop nearly threw a fit when I said that wages were too low,

he didn’t see why people who were too “lazy” to develop a skill should receive as much as they do on the current minimum wage.And that his business wouldn’t be able to make as much profit.A lot of vitriolic rhetoric.

Hey Bill, I don’t wanna be rude, since you write so prolifically, but you said you would update the alternative medal count daily. With Fiji’s win in the sevens competition, surely that puts them on top of the list, ahead of Kosovo, even?

Dear Thomas Bergbusch (at 2016/08/12 at 4:09 pm)

And so I have. Last update was at 17:18 August 11, 2016 (Australian Time) – End of Day 5. In Australia, it is just gone 17:16 August 12. I still have 7 hours about to update to keep the daily routine going.

Not everyone lives in North America!

best wishes

bill

Again no mention of the significant changes to the progressive tax system of the post war period.

When the middle class were growing the spending power of the wealthy was severley curtailed by

high income tax rates especially in the US post war period.

Reagonomics ,trickle down economics ,put an end to that there was a similar story in the Uk rises in flat rate

taxes Natinal Insurance and Vat and cuts in income tax especially at the higher rates.The middle classes

ability to compete with the rich for resources has been degraded.

ALthough I agree with all the other elements of your narrative,seeking government surpluses,

targeting low inflation as opposed to low unemployment ,union bashing, financial deregulation

why the silence on the fundamental changes to the post war progressive tax regimes?