I grew up in a society where collective will was at the forefront and it…

The 1976 currency crisis

Today, I take a further step in advancing our understanding of why the British government called in the IMF in 1976 and why it fell prey to a growing neo-liberal consensus, largely orchestrated by the Americans. The assertion by British Labour Prime Minster James Callaghan on September 28, 1976 that Britain had to end its ‘Keynesian’ inclinations and pursue widespread market deregulation and fiscal austerity has been taken to reflect a situation where the British government had no other alternative. His words have echoed down through the years and constituted one of the major turning points in ‘Left’ history. Successive, so-called progressive governments and politicians have repeated the words in one way or another. The impact has been that they have increasingly imbibed the neo-liberal Kool-Aid and have, seemingly forgotten that their were options at the time that the British government rejected, which would have significantly altered the course of history. The rejections were ideological rather than based on substance. For all intents and purposes, the British Labour Party, in government, had become the first practising neo-liberal government in British history. Britain just became a part of the US-led policy move that aimed to tilt the world economy heavily in favour of the profit-seeking aspirations of the corporate sector and the financial market sector (‘Wall Street’), in particular. The US government became the international political conduit for ‘Wall Street’ influence and the growing influence of the ‘City’ in London, also allowed these neo-liberal ideas to permeate the policy making circles in Britain. But it wasn’t just a permeation that was going on. The US used institutions such as the IMF to conduct brute force attacks on the prosperity of nations to undermine the viability of their public sectors and to shift more of the national income and national assets into the hands of capital. It was a brazen and very determined shift in world affairs. The ‘Left’ should never hold the decisions that were taken by the British government at the time as an inevitability of global capitalism.

February 1976 – the Sterling Crisis

Britain had struggled all through the 1960s with an overvalued pound. It cultural aversion to letting the pound reach its appropriate value given its trade fundamentals and its declining industry base was a major contributor to its poorly performed economy in the 1960s.

It forced the government to deliberately allow unemployment to rise in the latter half of the 1960s and again in the mid-1970s after a brief respite following the ‘Dash for Growth’ under the Heath-Barber administration.

The origins of this aversion is unclear but relates to the past sense that a strong pound is somehow a sign of the greatness of Britain, which presumably is a hangover from the colonial days and the centrality of Britain in the sterling zone.

It has parallels with the French notion of the ‘Franc Fort’ (strong franc), which defined French government economic policy in terms of matching German inflation rates in the late 1970s. The consequence of that misguided policy position – again an expression of national chauvinism – was constrained domestic demand designed to reduce growth in national income and GDP, which led to reduced spending on imports and persistently high unemployment.

The first real sterling crisis in modern history was in November 1967 when the British government was forced to devalue the pound by around 14 per cent, within the system of fixed exchange rates. The devaluation was thus a once-off attempt to quell the speculative attacks on the pound that reflected the overvalued currency.

The depreciation prodded an already rising inflation rate and flowed through fairly quickly to the wage-price spiral.

When President Nixon refused the demands by countries to convert dollars into gold (principally from the UK) on August 15, 1971, the dollar became a non-convertible fiat currency.

If all nations had followed suit and floated at that point the world would have been a better place. The unilateral action by the US gave the other nations in the Bretton Woods system three options: (a) fully float their currencies against the US dollar and all other currencies; (b) jointly float against the US dollar, that is, maintain fixed parities between themselves but allow for flexibility against the dollar; or (c) continue to peg to the now non convertible US dollar.

The European economies, particularly driven by the French wanted to maintain the peg. The French saw danger in anything resembling a float because it would threaten the subsidies they enjoyed from Germany under the Common Agricultural Policy. The Germans were for a joint European float against the dollar.

In November 1971, the G10 Finance Ministers and central bank Governors met in Rome to advance discussions about how to deal with the huge US balance of payments deficits, given that they meant that the capital outflow from the US would continue indefinitely because all speculators would consider the dollar to be overvalued.

The Europeans considered this would compromise their economies and their export lobbies were powerful and feared they would be priced out of their markets as a result of the currency appreciating too far.

The November 1971 meeting led to discussions on December 18, 1971 at the Smithsonian Institute in Washington and the parties signed the so-called Smithsonian Agreement, which was a last gasp attempt to hang on to the old system of fixed exchange rates.

While the US refused to re-enter a fixed exchange, convertible currency system, it did agree to devalue the dollar to stifle the growing speculative attacks. Most other nations agreed to revalue their currencies and the average upward revision was around 10 per cent, a significant realignment.

Britain (and France) were passive and their parities altered in line with the US devaluation (about 1 per cent). This was a further example of the determination of the British to resist reducing the relative value of the pound in any significant (and necessary) manner.

By early 1972, the currency traders clearly were not convinced and the revaluations led to further speculative attacks on the US dollar, which pushed several currencies (mark, guilder, Belgian franc and yen) to their upper limits within the allowable, but widened range under the Smithsonian Agreement.

It soon became obvious that the system was not viable.

Facing an election, the US government was keeping interest rates low, which led to inflationary pressures in Europe. The latter were enduring very strong balance of payments surpluses as a result of their higher interest rates attracting massive capital inflows from the US. It was a case of 1971 revisited.

With renewed currency instability in early 1972, currency traders formed the view that the Smithsonian Agreement was unsustainable.

There had to be massive central bank intervention in the form of US dollar purchases in the foreign exchange markets to keep it functioning.

The Bank of International Settlements (1973: 20) said the developments:

… in the rather battered international monetary system may be said to come under the heading of unfinished business left over from the upheaval of 1971. In broader perspective, they constituted a further instalment of the more or less permanent crisis which has prevailed since 1967.

The European currencies under the ‘Snake in the Tunnel’ system, an eccentric derivative of the Smithsonian arrangement, started to unravel by mid-1972.

The increased volatility began in February 1972, as speculators renewed the bets against ‘weak’ currencies.

It was generally considered that the US dollar remained overvalued even though it had been devalued by 7.9 per cent against gold, and other nations had revalued as part of the Smithsonian Agreement.

This was in the context of the ongoing US balance of payments deficits and the unwillingness of the US government to drive unemployment up through domestic monetary and fiscal restraint.

The speculative activity saw significant fund movements out of the US dollar into marks, the Benelux currencies and the yen (BIS, 1973: 22).

In the case of the European currencies, the upward pressure pushed them to the upper limits renegotiated as part of the Smithsonian process and forced their respective central banks to sell their currencies and buy US dollars to soak up the strong demand.

The speculative attacks reached a peak in June-July 1972, and the British pound was particularly targeted as a result of the widening British balance of payments deficit.

While the so-called ‘sterling crisis’ led to massive Bank of England and Banque de France intervention in an attempt to halt the sale of the pound in international currency markets.

Following this period of massive instability in international currency markets, the British government was ultimately forced to float on June 23, 1972 as they exited the arrangement. They had lasted a full 7.5 weeks in the ‘snake’.

When the dam broke and the pound floated, there was massive buying of the other European currencies, which pushed them up to the upper limits against the US dollar.

In mid-July 1972, the European Finance Ministers were forced to reaffirm “their determination to adhere to the existing rate structure” (BIS, 1973: 23).

The US balance of payments deficits, which were undermining confidence in the US dollar were not abating quickly; German and Japanese trade surpluses continued to grow; the higher European interest rate persisted; all of which meant that large currency flows were undermining the capacity of the central banks to maintain parities within the agreed limits.

There was no doubt that investors were coming to the realisation that the Smithsonian attempt to shore up the failed Bretton Woods fixed exchange rate system was doomed.

The international currency crisis intensified in January 1973, when Italy was forced to partially float the lira to stem the capital outflow.

In February 1973, the US published a massive trade deficit for 1972 and this prompted a renewed speculative selling of the US dollar of greater volumes than in the previous attacks. The central banks of other nations (Germany, Japan etc) could no longer keep buying US dollars in volumes that were sensible.

The upshot of further instability and contrived devaluations forced the currency markets to close more than once in the next few months and the BIS wrote that “the market was in disarray” (BIS, 1973: 24) and the only course of action was to abandon the fixed exchange rate regime and float the US dollar, which occurred when the currency markets opened again on March 19, 1973.

This instability would return in 1976 to plague Britain and once again it was the result of the British government hanging on to an overvalued pound and giving the speculators a target on which to profit. And the speculators didn’t disappoint.

The troubles started in earnest in April 1975 with speculative activity against the pound increasingly in the face of a strengthening US dollar.

Over 1975, the only two floating major European currencies – the pound and the lira – depreciated significantly against the US dollar, the pound by around 28 per cent against the value agreed at the onset of the Smithsonian Agreement and the lira by some 23 per cent.

Italian wages and prices were also rising to offset the rising import prices.

The pound depreciated significantly between April and July 1975 as the domestic inflation rate rose to 30 per cent, which forced the British government to, once again, try a new incomes policy, which gave the nation a temporary reprieve.

By November 1975, the pressures on the pound had resumed.

The instability that would define 1976, kicked off against the Italian lira, which recorded a substantial current account deficit in the last quarter of 1975 and the coalition government between Aldo Moro’s Democrazia Cristiana (DC) party and the Partito Repubblicano Italiano (PRI) resigned on January 9, 1976 after the Partito Socialista Italiano (PSI) withdrew their support.

The Christian Democrats continued in minority government for a short time but general elections took place in June 1976. The political instability, however, sparked a renewed bout of speculation against the Italian currency.

In the two weeks after the government resigned, the Banca d’Italia nearly exchausted its foreign exchange reserves in a futile attempt to defend the lira. It suspended official interventions at that point for several weeks (BIS, 1976: 98). While trying to stem the free fall, the lira still depreciated by around 35 per cent.

Once the official intervention was suspended, the lira recorded “a record depreciation of about 43 per cent” (BIS, 1976: 98). Levies were then introduced on all foreign currency payments soon after which halted the worst of the free fall.

In early March 1976, the pound followed the lira’s path downwards and the BIS (1976: 98) reported that:

Between then and the end of April the trade-weighted depreciation widened from 30 to about 37 per cent., despite official intervention totalling nearly $3 milliard. Although it became clear in early May that the incomes policy introduced in August 1975 would be strengthened and continued for a second year, pressure on sterling persisted and by the end of the month the depreciation had almost reached 40 per cent.

The weakening pound did not help the French franc which was the second currency to experience sustained speculative attacks. The French economy had partially recovered after the OPEC shock under the support of a substantial fiscal stimulus and by the end of 1975, the current account had returned to deficit.

The speculators bet on increased inflation occurring and a French government under pressure to maintain the agreed parity within the ‘snake’ given its dwindling stock of foreign reserves. The resulting depreciation staggered over the course of 1976 amounted to around 13 per cent but was contained.

The pound didn’t fare so well, however. On March 4, 1976, the pound stood at 2.019 per US dollar, having already depreciated by around 14 per cent since the beginning of 1975.

Next day, it depreciated by a further 1.48 per cent and went below the 2 per US dollar mark for the first time since the end of the Second World War. By March 8, 1976 it had depreciated a further 2.1 per cent.

The BIS reported (1977: 123) that:

Between then and early June, under the combined influence of the current payments deficit, leading and lagging by traders and very large reductions of official sterling balances in the hands of OPEC countries, it plunged to $1.70, the trade-weighted depreciation widening from 31 to nearly 42 per cent. At that point the negotiation of a $5.3 billion six-month credit facility from the central banks of the Group of Ten countries, Switzerland and the BIS, together with improved prospects for a second year of incomes policy, temporarily improved the situation.

The credit facility was not to provide foreign reserves to allow the Bank of England to conduct official interventions (buying the pound) to stabilise the rout.

Over the period March to November 1976, the Bank of England lost reserves and the British government borrowed the equivalent of around $US7 billion (BIS, 1977: 130), a staggering amount in context.

But the volatility returned as speculators continued to sell off the pound and on October 28, 1976, the pound had reached the level of 1.5669 per US dollar and in trade-weighted terms had endured “a depreciation of nearly 49 per cent” (BIS, 1977: 124).

By this time, the British government had announced they were applying to the IMF for $US3.9 billion stand-by credit and the Bank of England had raised the short-term interest rate from 11.5 per cent to 15 per cent. Neither move stemmed the speculative tide.

It was clear that the Bank of England was short of reserves. The IMF didn’t help matters when it let it be known that the “appropriate rate for the pound” (BIS, 1977: 124) was $1.50.

The flukey nature of these speculative attacks saw them abate by early November 1976. The British government entered a multi-lateral arrangement to create a ‘central-bank facility’ to shore up the pound in the face of any further major withdrawals of sterling balances in the British financial system.

Some claim the ‘markets’ were also appeased by the threat of IMF conditionality which would see the British government cut its discretionary deficit in return for the stand-by credit facility. Interest rates were also sustained at record levels.

Moreover, the Bank of England banned sterling loans provided by UK banks to “finance trade between third countries” (BIS, 1977: 124), which further stemmed the drain of pound reserves.

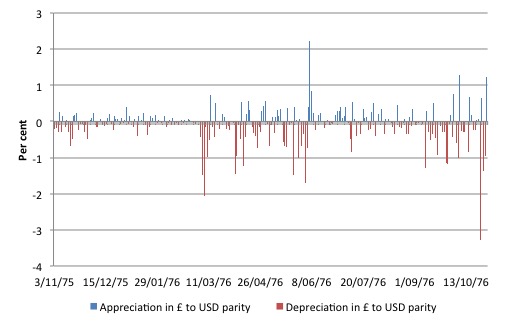

The following graph shows the history of the £ to US dollar exchange parity from November 3, 1975 to November 30, 1976 expressed in terms of the daily percentage change. The red bars shows the days on which the pound depreciated (and the extent) and the blue bars the days on which the pound appreciated (and the extent).

The strong daily movements (mostly down) between March 1976 and June 1976 are evident. Further volatility occurred later in the year in November 1976.

The experience of nations during this period highlighted the tensions that were still evident surrounding the notion of floating exchange rates and the extent to which central banks should conduct official intervention in foreign exchange markets to ‘manage’ the float.

In the case of the European members of the ‘snake’, the experience reaffirmed the impossibility of maintained fixed exchange rates between economies with quite disparate trade structures without resort to damaging domestic policies (with the attendant high unemployment and high interest rates).

The US were clearly leading the charge towards unmanaged floating exchange rates. They argued at the time that intervention to prevent the exchange parities from reaching their ‘market’ levels contributed “to the perpetuation of payments imbalances – as well as transmitting inflation from weak-currency countries to the rest of the world.” (BIS, 1977: 131).

They argued that the inflation arising from pass-through of a depreciating currency (rising import prices in local currencies) was a reflection of poor domestic policies rather than a reason not to allow the currency to ‘find its value’.

On the other hand, it was argued that speculative movements in currency flows and preferences for holding financial assets in one currency or another were liable to “produce rapid modifications of exchange-market conditions” (BIS, 1977: 132), which can distort where the exchange rate levels move relative to the value that the trade fundamentals would dictate.

This ‘overshooting’ behaviour could then become a motivator for further, large speculative movements for or against a currency, which further distorted the situation and impacted on the domestic price level.

The BIS said (1977: 132) that “overshooting can set in motion ‘vicious’ and ‘virtuous’ circles of exchange rate and price movements.”

The reality, though, was that the nations that were facing downward pressure on their exchange rates, could do little to maintain some higher parity over any period of time. They quickly would run out of foreign currency reserves and/or exhaust lines of international credit and, at that point, the exchange rate would follow the market preferences.

In that situation, it is better that the nation in question embraces the logic of the floating currency and takes other decisions to improve the domestic economy.

For example, speculative attacks can be moderated through capital controls, which were powerful tools for nations during the Bretton Woods era.

Nations could also impose targetted import controls to reduce pressures on the exchange rate emanating from trade imbalances, while they sort out their domestic inflation issues.

As we will see, the changing ideological climate in the early 1970s – the Powell Manifesto in the US, the rising Monetarist influences in government and central banks, the rise of the neo-liberal think tanks, and the rise of free market dogma within the large multi-lateral organisations (IMF, World Bank) were not conducive to these ‘market’ restrictions, which is an important part of the story.

But the situation the British economy was facing in 1976 required some deft economic management. It had high inflation relative to its trading partners. Its unemployment rate had risen after the ‘Dash for Growth’ was terminated. The Bank of England had hiked short-term interest rates to record levels, which exacerbated the domestic downturn.

And, it was up against a growing international consensus, largely orchestrated by the Americans, to finally end its ‘Keynesian’ inclinations and pursue widespread market deregulation and fiscal austerity.

As we know, on September 28, 1976, the British Labour Prime Minster James Callaghan made an historic speech to the – Labour Party Conference – held at Blackpool.

Callaghan’s famous declaration went like this:

We used to think that you could spend your way out of a recession, and increase employment by cutting taxes and boosting Government spending. I tell you in all candour that that option no longer exists, and that in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step. Higher inflation followed by higher unemployment. We have just escaped from the highest rate of inflation this country has known; we have not yet escaped from the consequences: high unemployment.

His words have echoed down through the years and constituted one of the major turning points in ‘Left’ history. Successive, so-called progressive governments and politicians have repeated the words in one way or another.

The impact has been that they have increasingly imbibed the neo-liberal Kool-Aid and have, seemingly forgotten that their were options at the time that the British government rejected, which would have significantly altered the course of history. The rejections were ideological rather than based on substance.

For all intents and purposes, the British Labour Party, in government, had become the first practising neo-liberal government in British history.

How did it get into this situation and what alternatives were there?

Before we get that we need to further understand the international context and the contest of ideas that was going on at the time.

We have already considered the Powell Manifesto. Please read my blog – The right-wing counter attack – 1971 – for more discussion on this point.

The US was turning to the right and further emphasising its ‘free market’ predilections, which should not be taken to mean it was running a textbook-style competitive market economy.

The reality was that it was tilting the economy heavily towards the corporate sector and the financial market sector (‘Wall Street’), in particular.

The US government became the international political conduit for ‘Wall Street’ influence and the growing influence of the ‘City’ in London, also allowed these neo-liberal ideas to permeate the policy making circles in Britain.

But it wasn’t just a permeation that was going on. The US used institutions such as the IMF to conduct brute force attacks on the prosperity of nations to undermine the viability of their public sectors and to shift more of the national income and national assets into the hands of capital.

It was a brazen and very determined shift in world affairs.

Conclusion

The next instalment – which will get us close to the end of this sequence – considers the changing role of the IMF, the growing US influence, and the bitter debate within the British government (within the Labour Party) following the proposal by Callaghan and Healey to call in the IMF.

We will challenge the notion that the IMF option was the only alternative. We will see that Britain did not ‘run out of money’. Rather it obstinately refused to accept the logic of its floating currency and refused to use other options available to it to stem the speculative attacks against the pound.

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

Upcoming Spanish Speaking Tour and Book Presentations – May 5-13, 2016

Here are the details of my upcoming Spanish speaking tour which will coincide with the release of the Spanish translation of my my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published in English May 2015).

You can save the flyer below to keep the details handy if you are interested. All events are open to the public who are encouraged to attend.

Incredibly important work you do. Thanks so much!

“For example, speculative attacks can be moderated through capital controls, which were powerful tools for nations during the Bretton Woods era.”

The one that gets missed is to stop regulated banks from creating money by taking the other side of a currency trade.

When you sell, say, USD in a currency market, a bank can take that USD as an asset and create the matching liability deposit – taking on the currency risk as it does so. Where the USD is rising against the local currency it makes sense for the bank to do that, but because they are creating local currency rather than exchanging existing local currency you get a trend reinforcement effect.

This gets even more entertaining when you have a multi-national bank than can create money on either side and can shift the risk around with intra-group loans between the internal currency areas.

Missing graph?

Dear dnm (at 2016/04/26 at 7:03 pm)

Thanks for picking that up. I was going to include a complete history graph but decided it didn’t really add much to the argument. And then I forgot to take the reference out.

best wishes

bill

Very good piece. But not sure I get this:

“Facing an election, the US government was keeping interest rates low, which led to inflationary pressures in Europe. The latter were enduring very strong balance of payments surpluses as a result of their higher interest rates attracting massive capital inflows from the US.”

TYpically countries will raise their interest rates to attract inflows into their capital account. This is usually a response to a trade deficit — i.e. they try to attract the inflows to ensure that the currency’s value doesn’t fall.

I’ve never heard of a current account surplus being run through higher interest rates. Surely higher interest rates would have the opposite effect. No?

Dear Bill

You wrote that after Bretton Woods the other countries had the option (b) of fixing their exchange rates among themselves but letting them float against the dollar. Isn’t that impractical considering that there about 200 currencies in the world? Or would they all peg their currency to something other than the dollar?

Regards. James

US economic policy ; for more detail on how they enmesh countries read

Confessions of an Economic Hit Man

isbn 0091909104

Bill,

I’m enjoying this series and will buy the book. Thanks.

It seems that the end of Breton Woods was a spur for the rise of neo liberalism.

Was the fear of falling currency rates ,national pride,inflationary risks or the loss of people’s

international spending power.

This is still a fear today it must be the driving force behind the Greeks fear of losing the euro.

Great post!looking forward to the next installment. Which will now doubt be a resource and equip us to explain the 70’s,whenever Austerians point to 70’s inflation.