I grew up in a society where collective will was at the forefront and it…

The Bacon-Eltis intervention – Britain 1976

This blog continues the discussion of the British currency crisis in 1976. It traces the growing anti-government influence on key players within the British Labour government as the pressures on the exchange rate were mounting in the early part of 1976. While the Chancellor was clearly influenced by the growing dominance of Monetarist thought, he also fell under the influence of the so-called Bacon-Eltis thesis, which argued that the growth of the public sector in the 1960s and early 1970s in Britain had starved the private sector of resources, which had led, directly, to the declining growth, high inflation and elevated unemployment. The conservative mainstream used this thesis to call for harsh cut backs in public spending and the British Labour government were increasingly cowed into submission by the vehemence of this mounting opposition. The problem is that the ‘thesis’ didn’t stand up to critical scrutiny, although that fact didn’t seem to bother those who used it to advance their anti-government ideological agenda. This blog is longer than usual because I felt it important to put this part of the story into one continuous narrative rather than break it up into two or three separate, shorter blogs.

The British government was clearly focused on bringing the inflation rate down in 1975. In a June 1975 briefing note for the Cabinet, the Cabinet Secretary wrote that for “both external and domestic” reasons that it should be “seeking a speedy and convincing deceleration in our rate of inflation” (Hunt, 1975: 2).

[Reference: Hunt, J. (1975a) ‘Pay Options and the Prospect , Note by the Secretary of the Cabinet’, C(75), June 17, 1975, TNA, CAB/129/183/20, LINK]

The concern was two-fold. The external context meant “that there was on-going pressure on sterling and the decline in our standing as a borrower arising from lack of confidence in our control of inflation, as well as the effects on competitiveness” (Hunt, 1975: 2).

The Government also thought the high inflation was eroding domestic investment.

Taken together, the aim was to “reduce the rate of inflation to 10% by the early autumn of 1976” (Hunt, 1975: 3) and that this target would be used to condition the so-called 1975-76 ‘Pay Round’, which would be conducted in an environment of increasing unemployment, from already elevated levels.

The discussions turned to whether establishing an explicit statutory ‘wage norm’ which “would allow less latitude for interpretation” (Hunt, 1975: 5) would be preferable to a bargaining environment where no ‘norm’ was set but the public sector settlement was used as a general target to pressure the outcomes in the private sector.

The balancing act the Government was engaged in was trading off the likely opposition of the trade unions to an enforced, legally-binding wage outcome (the statutory ‘norm’) against the signal to the external financers that the Government was not serious about containing wage increases and thereby significantly reducing inflation.

The Secretary of State for Employment (Michael Foot) favoured the voluntary incomes policy, which had the support of the Trades Union Congress (TUC), although there was “the risk of being ignored in the private sector” (Cabinet, 1975: 1).

[Reference: Cabinet (1975) ‘Conclusions of a Meeting of the Cabinet’, CC(75), June 20, 1975, TNA, CAB/128/56/29 – LINK.]

However, it was clear that tensions within the Cabinet had developed over the issue. The Chancellor (Denis Healey) was intent on elevating the situation to an emergency.

The Cabinet was told on June 20, 1975 that (Cabinet, 1975: 3):

… the economic situation of the country required the Government to be more drastic in its action than had been suggested … the United Kingdom rate of inflation was double that of OECD as a whole, and unit wage costs in Britain were four times

higher than the average in other OECD countries. Foreign funds were still flowing into the country, but this situation could change with dramatic suddenness, and if there were a large-scale outflow of funds later in the summer this would compel the Government to impose drastic emergency measures.

He foreshadowed sharp cuts in government spending, which he acknowledged would “lead to a rise in unemployment that might leave 2 million people out of work in 12 months” and “cuts to real income and investment” (p.3).

It was clear that the Government understood that spending was required to generate economic activity and maintain employment levels. In other words, they did not ascribe to the idea, which is current in the modern policy narrative, that fiscal austerity will promote growth.

The Chancellor also stated that these cuts would not curtail inflation and that tight statutory pay norms would still be necessary, which meant he supported a showdown with the trade unions, who were implacably opposed to an enforced pay settlement in the 1975-76 bargaining round.

Other Cabinet members considered the Chancellor’s timetable for reducing inflation was too lenient and so were in the camp that favoured even tougher cuts in public spending.

The Chancellor released a statement on July 1, 1975:

A sharp reduction in the rate of inflation is an over riding priority for millions of our fellow citizens, particularly the housewives and pensioners. It is also a pre-condition for the reduction of unemployment and the increase in investment which the Government, the TUC and the CBI all want to see.

[Reference: Hunt, J. (1975b) ‘Draft White Paper on Inflation’, C(75) 76, July 8, 1975, LINK.]

The Government claimed they rejected “a solution to the problem of inflation which relies on the generation of large-scale unemployment and under-utilisation of our productive equipment” but that there was an imperative for wage settlements to produce moderate growth in wages.

The culmination of these Cabinet discussions was the release of a White Paper on July 11, 1975 ‘The Attack on Inflation’ (Department of Employment, 1975), which outlined the restrictive wages growth that would be tolerated over the course of the next 12 months. The flat-rate increase that was specified favoured low-income earners and compressed relativities across the income distribution, thus engendering the support of the trade unions.

[Reference: Department of Employment: Incomes and Prices Division (1975) The Attack on Inflation White Paper, TNA, LAB 112/154, July 11.]

The impact of the new wage guidelines was immediate with growth in average earnings slowing down appreciably by the end of 1975 and into 1976.

Economic growth returned to Britain in the last quarter of 1975, with real GDP expanding by 1.2 per cent in the December-quarter and then by 1.7 per cent in the first-quarter 1976. On an annualised basis, real GDP growth was 2.3 per cent by the second-quarter 1976, rising to 4 per cent in the third-quarter and 5 per cent by year’s end.

Notably, despite all the talk about a lack of external competitiveness of Britain’s economy, exports played a significant role in the strong return to growth.

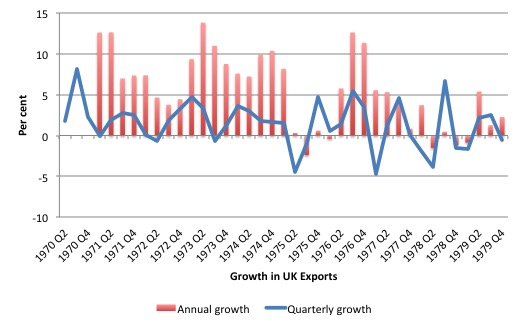

The following graph shows the growth in total British exports (quarterly, blue; annual, red) from the first-quarter 1971 to the fourth-quarter 1979.

The following table shows quarterly real GDP (per cent) and the percentage point contribution of exports to growth.

| Quarter | Real GDP growth | Contribution of Exports |

|---|---|---|

| 1975 Q4 | 1.2 | 0.3 |

| 1976 Q1 | 1.7 | 0.0 |

| 1976 Q2 | -0.2 | 0.1 |

| 1976 Q3 | 1.3 | 0.3 |

| 1976 Q4 | 2.2 | 0.2 |

While the real GDP growth was clearly a welcome relief from the recession that had plagued the British economy since the onset of the OPEC crisis in the third-quarter 1973, it was not strong enough to bring down unemployment, which rose from 4.2 per cent in 1975 to 5.7 per cent by the end of 1976.

The annual inflation rate peaked at 26.6 per cent in the third-quarter 1975 and as the Social Contract held, it steadily fell, so that by the third-quarter 1976, it had fallen to 13.7 per cent.

While the Conservative Heath government was not able to reach an accord with the unions, the Labour government seemed to have found a way to achieve some moderation in wage demands. The fixed rate, £6 annual pay rise that was outlined in the White Paper was clearly helping to bring the inflation rate down.

Significantly, Britain also recorded a current account surplus in the first-quarter of 1976, and although it went back into deficit for the rest of the year, the deficits were no where near the size that had been recorded in response to the oil price hikes in 1973 through 1974.

Britain has appeared to have weathered the OPEC storm and was now adjusting, albeit slowly to its new reality. More significantly, the plans to develop the North Sea oil fields were well underway, which would more than generate funds to allow the external deficits to continue without unsustainable downward pressure being absorbed by the exchange rate.

It was also likely that the prospect of North Sea oil coming on tap in the late 1970s would be enough to allow the exchange rate to stabilise at the level that the British government thought was appropriate, although that perception had, since the 1960s at least, being inflated against the reality of the market.

While fiscal policy was still providing stimulus to support growth, the fiscal deficit began to fall from an already modest level of around 0.8 per cent of GDP.

Monetary policy was also easing with interest rates falling throughout the first part of 1976.

As Andrew Brittan noted (1994: 29):

Looking at all these indicators many years after the event it is not at all obvious why this was to be the year of the great sterling crisis.

[Reference: Brittan, A. (1994) Macroeconomic Policy in Britain 1974-1987, Cambridge, Cambridge University Press.]

The internal politics of the Labour government were intense. On the one hand, the Chancellor proposed public spending cuts in 1977-78, despite the elevated unemployment and falling inflation, because he argued that “the economy was growing faster than had previously been assumed” (Cabinet Office, 1976: 1).

[Reference: Cabinet Office (1976) ‘Conclusions of a Meeting of Cabinet held at 10 Dowling Street, July 6, 1976’, CM(76) 13th, TNA, CAB/128/59/13.]

The Chancellor also considered “that domestic demand might be excessive, particularly if the private savings ratio were to fall” (p.2).

He told the Cabinet on July 6, 1976 that (p.2):

… the International Monetary Fund (IMF) and the individual countries from whom we might borrow – were concerned about the growth of the money supply with a high public sector borrowing requirement (PSBR).

It was true that, as economic activity revived, the PSBR should fall … but no other country was planning to continue with as high a Government borrowing requirement. Indeed the United States, France and Germany were all planning to cut or eliminate their deficits.

His emphasis, represented a mix of influences. On the one hand, Healey had clearly been caught up in the Monetarist mantra than cutting the growth of the broad money supply would tame inflation.

On February 5, 1976, he bragged to the Parliament (Hansard Commons, 1976) that:

For those who are interested in controlling the money supply, the fact is that my achievement on M3 was four times superior to that of the Conservative Government, which allowed M3 to increase in their last year of office, 1972 to 1973, Q4 to Q4, by 29 per cent. as against a 13 per cent. increase in money GDP. The figures for Q3 1975 on Q3 1974, showed an 11 per cent. increase in M3 as against a 21 per cent. increase in money GDP over the same period.

When questioned about the reasons for this superior’ performance, Healey said it was due:

Primarily to the far superior fiscal probity of the present Administration.

[Reference: Hansard Commons (1976) ‘Money Supply’, HC Deb 05 February 1976 vol 904 cc1396-8, LINK.]

Healey had clearly fallen under the spell of the increasing Monetarist cabal in the Treasury and the Bank of England. Davies (2012) reports that a group of “unnamed Bank officials” (p.14) issued a paper in October 1975 which expressed an increasing anxiety about the impact of the fiscal deficit on the growth of the money supply. Pure Monetarist rhetoric.

The report also claimed the government had to cut the fiscal deficit “as a means of ensuring confidence within the financial markets” (p.14) and should establish “publicly announced monetary targets” (p.15), despite the Bank having failed to achieve such targets in the failed attempt earlier in the 1970s under the CCC.

This was an extraordinary intervention into the political process by the central bank. It was pure Monetarist dogma.

A letter from a central bank official to a senior Treasury official J.M. Bridgeman argued that “monetarist prescription” (setting a money supply growth target) should be followed “irrespective of what was happening in the economy” (Davies, 2012: 15).

Healey had really walked into a trap of his own making. As Aled Davies (2012, 13-14) noted, in placing so much emphasis on controlling the money supply, Healey had established:

… a situation in which the success or failure of the Government’s counter-inflationary policies could be easily measured according to the behaviour of the monetary indicators.

This is despite the fact that the broad monetary indicators were not a suitable vehicle for assessing the state of the economy or the effectiveness of the anti-inflation policy stance.

But it was clear that the policy makers had convinced themselves that “the markets … had become strongly influenced by monetarist ideas” and the Treasury and Bank of England officials “consciously expressed the view that the influence of ‘monetarist’ ideas amongst investors were a significant limitation on the Government’s policies.” (Davies, 2012: 17).

On the other hand, some of the senior politicians in the Labour Party such as the Chancellor and the Prime Minister James Callaghan were also enamoured with the ideas of British economists Roger Bacon and Walter Eltis, who published a book in 1976 – Britain’s economic problem: Too Few Producers – which followed a series of high profile Op Ed articles.

The so-called ‘Bacon and Eltis Thesis’ posited that explanation for the ‘British disease’ – the demise of British industry and the entrenched inflation in the post Second World War period – was straightforward.

Their account of the ‘British disease’ was straightforward – they argued that the public sector (or in fact, the non-market sector) had become excessively large and has squeeze the productive sector of resources to invest in capital formation and develop exports.

Essentially eighteenth century notions of ‘productive’ and ‘unproductive’ labour to allege that Britain’s economy was being strangled by public sector growth.

Their ‘new’ thesis was really just a recycled version of mainstream (orthodox) free market notions, which had always claimed that if the public state taxed the non-government sector to fund government spending, thereby denying the more productive sector of resources, the result would be stagnating growth.

Why the ‘new’ intervention into the public debate gained any traction is a question in itself given that its antecedent had not established an evidence base to support its contentions.

But the fact that in the 1960s, the ratio of government spending to GDP rose by more than 10 per cent in many nations at a time when growth was slowing, gave the conservatives a door in which to peddle their anti-state ideas again.

Bacon and Eltis argued that the public sector (or in fact, the non-market sector) had become excessively large and has squeeze the productive sector of resources to invest in capital formation and develop exports.

They wrote of Britain (Bacon and Eltis, 1976):

… the shift in employment from industry to services, and public services in particular, had no equal in any other large Western developed economy …

[Reference: Bacon, R. and Eltis, W. (1976) Britain’s economic problem: Too Few Producers, London, Macmillan.]

The ‘crowding out’ proposition was simple. The ‘productive’ market sector (which creates wealth through the production of goods and services) competes for resources with the non-market sector (which they held was funded by taxation).

To generate the income to allow those taxes to be paid (which ‘fund’) the spending (investment and consumption) in the non-market sector, the market sector has to be able to produce enough output and income, to enable it to meet the demands of its workers and capital owners and leave surplus production necessary to provide for the consumption and investment needs of the non-market sector.

In a sense, this was nothing more than rehearsing the insight that Marxian analysis had long understood that in a two-sector economy producing consumption and capital goods, respectively, the workers in the consumption goods sector have to be exploited (produce surplus value) in order for the workers in the capital goods sector to eat!

But Bacon and Eltis went further, of course. They argued that as the non-market sector grew it would claim more output from the market sector, which, in turn, would have less capacity to satisfy those demands.

To apply the ‘thesis’ to the so-called British disease, they noted that as the Welfare State in Britain expanded in the 1960s the non-market sector increased substantially relative to the market sector. They also claimed that

Skildelsky wrote (1996: X) wrote:

The pre-tax share of marketed output claimed by those who did not produce it rose from 41.4 per cent in 1961 to 60.3 per ecnt in 1974; at the same time there was a transfer, through a sequence of recessions, of a third of the market labour force into the non-market sector, in accordance with the pseudo-Keynesian doctrine that the government should be ’employer of last resort’. This left ‘too few producers’ of wealth. Because non-market employment was tax dependent, taxation had to rise substantially. In practice, workers could pass on any taxes aimed at cutting real wages, so profits, industrial investment and net exports were squeezed. The economy was trapped in a vicious circle of slowing growth, rising unemployment, accelerating inflation and deteriorating external balance.

[Reference: Skidelsky, R. (1996) ‘Foreward’, in Bacon, R. and Eltis, W. (19CC) Britain’s Economic Problem Revisited, 3rd Edition, London: Macmillan, I-XVI].

Bacon and Eltis conflated monetary resources and real resources and thus assumed the constraints that the national government faced during the Bretton Woods period, where they had to fund spending with taxes and/or debt issuance, still applied in 1976, four years after Britain had floated its fiat currency.

Quite clearly, the presumption that the British government was relying on the taxation of the market sector to fund its spending in the non-market sector was a reflection of the lack of appreciation that the British treasury officials had of the capcity they had as currency-issuers under the new fiat monetary system.

Further, the maintenance of low unemployment through implicit employment guarantees did not deprive the market sector of resources. Rather it diverted unused or idle resources. The transfer of labour from the market to the non-market sector occurred precisely because the former sector did not bid for their services and had, instead, left them unemployed.

The assumption that they were permanently trapped in low-wage public employment but were supported by the endeavours of the capitalists in the market sector was far fetched.

In fact, British capital had been continuously investing its surpluses abroad instead of maintaining a high productivity strategy within Britain. We will return to the issue of the British capital strike presently.

The solution proposed by Bacon and Eltis was straightforward – reduce public spending and taxation to provide more net income to the market sector or allow the state to assume responsibility for national investment.

Given that the work entered the debate at a time when the free market forces were growing in strength and influence as a result of their organising strategies and funding from the corporate sector, only the first option really entered the public debate.

Roger Middleton (1997: 3) said of the Bacon-Eltis thesis:

Implicit within this work, and the popular and political support that it engendered, was a counterfactual that Britain’s economic problem would have been lessened had their been a smaller public (or non-market) sector.

Skidelsky (1996: XIV) concluded that the intervention of Bacon and Eltis into the policy debate “created an intellectual climate favourable to Thatcher”. But it also had a significant influence on the British Labour government in the mid-1970s.

Apart from the logical difficulties noted above, Middleton (1997) presents comprehensive evidence which undermines the veracity of the Bacon-Eltis thesis.

He notes (997: 20) that:

In rejecting the thesis that in the long-run the growth of the public sector was at the expense of private sector investment we also make appeal to the very long period over which the investment ratio in Britain has been significantly below that of comparators.

[Reference: Middleton, R. (1997) ‘Britain’s economic problem: too small a public sector?’, mimeo, Department of Historical Studies, University of Bristol.]

The propulsion of the Bacon-Eltis thesis as part of the anti-government phalanx being formed by capital in the early 1970s was completely consistent with other developments at the time, including the Powell Manifesto, which outlined a multi-pronged strategy for capital to capture the state and ensure that the capacities of the latter would more closely serve the interests of profits rather than generalised well-being.

Middleton places the Bacon-Eltis intervention within this generalised environment of corporate fightback after several decades of Welfare State spending that forced capital to share out national income more equitably.

He wrote (1997: 22):

It is, therefore, no exaggeration to conclude that the attack on big government launched by agencies such as the IEA rested on very flimsy empirical foundations and a insularity all too typical of public policy debate in Britain.

The IEA were major proponents of the excessive government attacks during the 1970s and Middleton (1997: 22) notes that their published work was “almost wholly literary in approach and contained no empirical research of substance.”

In other words, they were ideological diatribes aimed at skewing the debate in favour of capital.

Middleton’s very deep empirical study concluded that (1997: 24):

British transfers and subsidies, which have been consistently below the average, are distinctive in terms of the importance of producers as against households, one lending credence to the proposition that are actually two ‘welfare states’ in most ACCs – one supporting the incomes of households and the other the profitability of firms.

This is an important empirical insight which still resonates in the modern debates about excessive government spending. Those on the right who attack fiscal deficits never suggest that the public funds they receive in the form of government contracts, subsidies, leveraging of public infrastructure, beneficial regulation are excessive and should be included in austerity strategies.

Many large corporations would not exist if it was not for the government support they receive.

Further, in relation to the claims by Bacon and Eltis that tax burdens on private companies were squeezing profits and undermining their capacity to invest and produce, Middleton (1997: 27) finds that “the majority of large corporations paid no mainstream corporation tax by the late 1970s”.

One might suggest, given the revelations contained in The Panama Papers, that the top-end-of-town pay very little taxes to the state ever.

It is also clear that welfare expenditure in Britain was “below average” against the comparators (Middleton, 1997: 28). He quotes Cameron (1985: 18) who concluded that:

This discrepancy between the level of welfare spending effort and the political rhetoric surrounding this domain of policy suggests that welfare spending in nations such as Britain … provides a convenient political scapegoat for those who wish to attack the scope of government activity – activity which is, by the measure of final consumption expenditure, in fact unusually large.

Middleton (1997: 28) supports this contention by noting that:

Since final consumption expenditure was comparatively large in Britain because of above-average defence expenditures, and since the constituency supporting defence spending correlates – as it also does in America – with those seeking to cut the expenditure ratio, the stage was set for a bitter distributional conflict in the 1980s.

[Reference: Cameron, D.R. (1985) ‘Public expenditure and economic performance in international perspective’, in Klein, R. and O’Higgins, M. (eds) The Future of Welfare, Oxford, Basil Blackwell, 8-21.]

The modern economics debate has been dominated by attacks on welfare but when specifics are assembled, we always find that it is the income support for the most disadvantaged and vulnerable that the elites demand to be cut.

The extensive corporate welfare provision that we find occurs in most advanced countries is never questioned. Austerity really is about one rule for the top-end-of-town that reinforces their wealth accumulation and another rule for the rest of us that seeks to repress our real wages growth and any accumulation of wealth that we might be able to achieve.

Middleton (1997: 29) also disabuses us of thought that the British government was running ever increasing fiscal deficits during the 1960s into the 1970s. He concluded after an exhaustive empirical investigation that:

… apart from 1951-5, which was much affected by the Korean War, and the 1970s, the adjustment to OPEC I, Britain’s budget deficit was consistently and significantly below the OECD average.

And further, Artis (1978) found no evidence in his exhaustive summary of the research efforts designed to test the ‘crowding out’ hypothesis that the British fiscal deficits had starved the market sector of real resources.

[Reference: Artis, M.J. (1978) ‘Fiscal policy and crowding out’, in M.V. Posner (ed.) (1978) Demand management. London: Heinemann, pp. 174- 9.]

The other strand of the ‘crowding out’ thesis that was paraded in the 1970s was an explicitly financial version of the Bacon-Eltis thesis, which asserted that the rising public borrowing to fund the rising fiscal deficits had put pressure on scarce private savings and, as a consequence, pushed up interest rates, driving productive private spending out of the market.

The corollary of the thesis was that public spending was always unproductive and private sector spending was always efficient and productive. This was an assertion that was also applicable to the Bacon-Eltis Thesis.

The ‘financial crowding out’ assertion seemed to be another case of denial that the monetary system had changed irrevocably when the fixed-exchange rate system was abandoned.

The vehemence of those pushing the argument against fiscal deficits coincided with a period when international capital flows were growing significantly and the domestic banking system was undergoing a freeing up of lending practices.

As Tomlinson (2010) concluded:

Yet, paradoxically, the 1970s was the decade of great strides towards free international movement of capital, so that the pool of resources available to a country like Britain was no longer restricted by national boundaries. Governments and the private sector could freely borrow in international markets and for a small country like Britain borrowings were such a limited proportion of the total world supply that they would have no impact on interest rates.

[Reference: Tomlinson, J. (2010) ‘Crowding Out’, History & Policy, December 5.]

The ‘financial crowding out’ thesis is also in denial of other characteristics of the modern monetary system. This thesis dates back to the so-called ‘Loanable Funds’ theory from the C19th, which was thoroughly discredited by Keynes and his accomplices in the 1930s.

The old Classical theory of loanable funds underpins the modern financial crowding out hypothesis.

Mainstream textbook writers assume that it is reasonable to represent the financial system as a market for loanable funds with banks as the principal institutions mediating the desires of savers and investors through deposit and loan rates.

The ‘loanable funds’ market is where savers deposit their savings and borrowers access loans. The ‘market’ allegedly sets an interest rate which provides a the reward for saving and the penalty for borrowing.

The original conception was designed to explain how aggregate spending could never fall short of the total supply of goods and services because interest rate adjustments would always bring investment and saving into equality. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving.

So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

The supply of funds comes from those people who have some extra income they want to save and loan out. The demand for funds comes from households and firms who wish to borrow to invest (houses, factories, equipment etc).

This framework is then used to analyse fiscal policy impacts and the alleged negative consequences of fiscal deficits. The resulting financial crowding out thesis was a dominant narrative in the mid-1970s (and remains so today).

The mainstream logic claims that private investment (which is more productive than public spending) falls if the government borrows to match its fiscal deficit.

The reason is that the public borrowing allegedly increases competition for scarce (finite) private savings and thus via the loanable funds market pushes up interest rates.

The demand for loans in this market is the sum of the public and private desire to borrow.

The higher cost of funds thus ‘crowds out’ private borrowers who are trying to finance investment.

This leads to the conclusion that given investment is important for long-run economic growth, government fiscal deficits reduce the economy’s growth rate.

The UK government at the time had already broken with the fixed exchange rate system and was issuing its own currency. So, in fact, it didn’t need to borrow from the private bond markets at all.

But that point aside, the conception that fiscal deficits drive up interest rates and that savings are finite is erroneous.

Two questions arise:

1. Does public sector borrowing increase the claim on saving and reduce the ‘loanable funds’ available for investors?

2. Doesn’t the competition for saving push up the interest rates?

The answer to both questions is no!

Modern Monetary Theory (MMT) does not claim that central bank interest rate hikes are not possible. There is also the possibility that rising interest rates reduce aggregate spending via the balance between expectations of future returns on investments and the cost of implementing the projects being changed by the rising interest rates.

But the Classical claims about financial crowding out (draining finite saving) are not based on these mechanisms. In fact, they assume that savings are finite and the government spending is financially constrained which means it has to seek ‘funding’ in order to progress their fiscal plans.

The result competition for the ‘finite’ saving pool drives interest rates up and damages private spending.

From a macroeconomic flow of funds perspective, the funds that are used by the non-government sector to purchase the public debt come from past net government spending, which introduce new net financial assets (bank reserves) into the system.

Astute financial market players call this a ‘wash’ – the funds used to buy the government bonds come from the past government deficits!

Further, there is no finite pool of saving that the government and non-government compete for in a loanable fnuds market.

First, public deficit spending generates income growth which generates higher saving. It is this way that MMT shows that deficit spending supports or ‘finances’ non-government saving rather than the other way around.

Second, the loanable funds doctrine is in denial of the way modern banking operates. When a bank extends a loan it simultaneously creates a deposit and any credit-worthy customer can typically get funds (although the hurdles that such a person has to jump through can range from not many to several depending on the risk averseness of the banks).

Reserves to support these loans are added later – that is, loans are never constrained in an aggregate sense by a lack of reserves.

Acknowledging the point that increased aggregate demand, in general, generates income and saving, Polish economists Michał Kalecki showed us clearly that – investment brings forth its own savings – an insight that demolished Classical loanable funds theory.

Closer examination of the period spanning the 1960s and mid-1970s suggests that a better explanation for the slowdown in productivity and poor performance of the British economy was the ‘capital strike’ that the elites pursued as a way of bringing down the Labour government, which they regarded as being too close to the trade unions.

Consistent with the strategies outlined in the Powell Manifesto, the financial media was relentless in its criticism of the British government.

On April 29, 1975, the Wall Street Journal published an editorial – Goodbye, Great Britain – which openly called for investors to sell their sterling-denominated financial assets.

The editorial credited to its arch conservative editor Jude Wanniski, who was championed the ridiculous Laffer Curve, presented a blistering US-centric, right-wing attack on the 1975 ‘Budget’ delivered by the Chancellor Denis Healey.

As an aside, Jordan Ellenberg (2014) notes that:

Arthur Laffer, then an economics professor at the University of Chicago, had dinner one night in 1974 with Dick Cheney, Donald Rumsfeld, and Jude Wanniski at an upscale hotel restaurant in Washington, DC. They were tussling over President Ford’s tax plan, and eventually, as intellectuals do when the tussling gets heavy, Laffer commandeered a napkin and drew a picture.

The picture suggested that if the government cuts taxes it actually increases its tax take. The evidence has not supported the assertion. But characters such as Wanniski are never much bothered by those sorts of anomalies.

[Reference: Ellenberg, J. (2014) ‘Math vs. Reaganomics: Why GOP’s anti-tax hysteria falls flat’, Salon, June 9, 2014. LINK.]

Wanniski considered the fiscal policy stance announced by Healey to be deeply flawed because it increased spending and failed to bring down what he believed to be the existing, excessive tax rates on higher income recipients.

He wrote that “Britain … always seems to somehow “muddle through” despite the best efforts of its government” because “in their imperfect understanding of economics, the income redistributors have always overlooked a few opportunities to confiscate wealth.”

In his view, “these tiny cracks in the tax laws” had always provided the entrepreneurs with “enough incentive to keep producing”.

The problem with the 1975 ‘Budget’ was that, in an effort to reduce the fiscal deficit to respond to external pressures concerned with the persistently high inflation rate, “the Labor government made a determined search for these tiny cracks and has found most of them.”

He claimed that the British government was engaged in “a policy of total confiscation” of private wealth and he suggested this was the motivation for wealth holders “discounting furiously at any chance to get it out of the country”.

The message was clear – move financial wealth out of sterling to avoid losing it to the government.

The Wall Street Journal intervention was hardly isolated but it was extraordinary nonetheless. It was one of the more explicit examples of the growing unity among those working in the interests of capital to destroy the Welfare State and co-opt government to work in their favour.

And global capital clearly responded. Tomlinson argues that rather than a shortage of funds being available it was the choices that global capital made that mattered:

In 1976 this was very evident in the ‘gilt-strike’, when financial markets simply refused to buy government debt until, in their view, the government had ‘put its house in order’. This, of course, is exactly where we are today, with international financial markets acting as the key players in determining what is an ‘acceptable’ level of public borrowing.

However, once again, this is gold standard type thinking. It doesn’t matter a toss whether international capital wants to buy the debt issued by a currency-issuing government. The latter can always fund its spending through the central bank under a flexible exchange rate system and maintain whatever yields on outstanding debt that it chooses.

So while it is true that there was a ‘gilt-strike’ in 1976, the British government did not have to ‘obey’ the choices made by the the capital markets. It failed to understand what its floating fiat currency meant.

Conclusion

Next up in this series will be the discussion of the internal struggles within the Cabinet as they strove to deal with the currency crisis that really reared around April 1976.

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

28. The Left confuses globalisation with neo-liberalism and gets lost

29. The metamorphosis of the IMF as a neo-liberal attack dog

30. The Wall Street-US Treasury Complex.

31. The Bacon-Eltis intervention – Britain 1976.

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

Spanish Speaking Tour and Book Presentations – May 5-13, 2016

Today, I am in Valencia and have two presentations – one at midday and the other tonight. The first talk is closed to the public (it is at the University) but details for the second public talk are below.

The speaking tour coincides with the release of the Spanish translation of my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published in English May 2015).

You can purchase the Spanish version of the book – La Distopía del Euro – for 27.54 euros from Amazon.

You can save the flyer below to keep the details handy if you are interested. All events are open to the public who are encouraged to attend.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Bill,

Sentence on North Sea oil and exchange rate incomplete.

Regards

Dear Chrislongs (at 2016/05/11 at 7.53 PM)

Thanks for that. I was rushing. I have fixed it now.

best wishes

bill

“Second, the loanable funds doctrine is in denial of the way modern banking operates. When a bank extends a loan it simultaneously creates a deposit and any credit-worthy customer can typically get funds (although the hurdles that such a person has to jump through can range from not many to several depending on the risk averseness of the banks).”

I need some help with something. Does the price inflation target have anything to do with the lender of last resort function of the central bank to the commercial banks?

It is actually an important question. Thanks in advance!

Dear Fed Up,

Take a look at Bill’s blog “The natural rate of interest is zero,” https://billmitchell.org/blog/?p=4656

It may help.

Justin, I think here is the key part:

“It was obvious that the stock of money could not be controlled by the central bank given it was endogenously determined by the demand for credit. Modern monetary theory never considered money to be exogenously determined – which is the main presumption in mainstream macroeconomics textbooks.”

I believe the term “money” should not be used in economics.

Here is what I am seeing. One side says the monetary base is the medium of account (MOA). Demand deposits are a (emphasis on a) medium of exchange (MOE). The exchange rate is not unconditionally fixed. Demand deposits can always go up with the monetary base so demand deposits do not rise in value against the monetary base. Monetary base may not always go up with demand deposits so monetary base may rise in value against demand deposits. In other words, the price inflation target applies to lender of last resort. Demand deposits cannot cause price inflation to rise above target because if the demand deposits did, then entities would rush to exchange demand deposits for monetary base. The central bank would not allow this exchange to completely happen so something has to happen to get demand deposits down so the price inflation does not happen.

Another side says currency and demand deposits are both MOA and MOE. For that to happen, the exchange rate between currency and demand deposits is unconditionally fixed as long as the commercial bank(s) is/are solvent. Currency and demand deposits can both go up so they stay at the same value against each other. In other words, the price inflation target does not apply to lender of last resort. Demand deposits can cause price inflation can rise above target. If price inflation rises above target, the central bank hopes interest rates rise enough to lower price inflation. If not, the central bank can raise the fed funds rates and even invert the yield curve.

Which side is correct?

Does the price inflation target have anything to do with the lender of last resort function of the central bank to the commercial banks?

The answer to that question matters.

No, means the system works one way.

Yes, means the system works a different way.

“Demand deposits can cause price inflation can rise above target.”

That should be “Demand deposits can cause price inflation to rise above target.”