In the annals of ruses used to provoke fear in the voting public about government…

The US government view of the 1976 sterling crisis

This blog continues the discussion of the British currency crisis in 1976. Today we discuss the way the US government was constructing the crisis. They had previously seen Europe in terms of military and political threats and had clearly developed a range of interventions in Europe (NATO, military bases etc) in response to their fear of Communism. But, it was clear that the US began to believe that the on-going financial turmoil that accompanied the OPEC oil shocks at a time when the world was trying to adjust to the collapse of the Bretton Woods system (and the Smithsonian agreement reprise), was undermining what they called their “assumptions of political stability” and increasing, in their paranoiac minds, the threat of the spread of communism. They considered that the IMF would have to be ‘steered’ to take a larger role in this period of turmoil to restore financial stability – a precondition for political stability (in their eyes). And if they couldn’t directly order the IMF to act in the perceived interests of the US government, then they would do it informally – through “‘conversations’ rather than meetings”. It is a very interesting period because the US clearly wanted to use the IMF to influence “the future shape of the political economy of Great Britain”. The ‘crisis’ was, in effect, manufactured to give those ambitions ‘ground cover’. At least, that is one plausible perspective of what happened in 1976.

In 1977, the US Senate published a report – US Foreign Economic Policy: the United Kingdom. France, and West Germany – which summarised the “foreign economic issues with respect to the United Kingdom, France and West Germany” which would “likely require consideration” by the US Congress in terms of framing that nation’s external policy.

[Reference: United States Senate (1977) US Foreign Economic Policy: the United Kingdom. France, and West Germany, Washington, US Government Printing Office LINK.]

The pretext for the study, which generated the report, was the belief that the OPEC oil price hikes and the economic dislocation that followed could engender political instability in Europe, which would threaten US interests.

In particular, the US government was worried about, among other things – “that political coalitions may gain power in Italy and France which would include Communist Ministers in the Government” (p.1), the “increasingly unstable international economic environment … [for] … oil importing countries” such as France, West Germany, Italy and Britain.

The report claims that the major problem is the “need for financing of external deficits caused by the oil price hikes” (p.1) and the deflationary impact of the oil price rises, which had cruelled investment and pushed up unemployment.

It also noted that the recycling of the funds generated by the oil surpluses was imperfect and favoured the already stronger nations such as the US, West Germany and Japan.

The report identified Britain as being in “the worst economic situation of any of the major Western European countries” as a result of the recession, “severe external payments pressures”, high unemployment and inflation (p.2).

It correctly noted that as a result of a “quadrupling” of oil prices in 1974, “Britain’s trade deficit jumped to $12 billion, compared to $5.8 billion the year before” (p.3). The trade deficits persisted into 1975, and, although still present in 1976, were almost half the 1974 result.

Further, Britain’s trade deficit through this period was, in part, a reflection of its large investment in the “development of North Sea oil” given that exploration capital was purchased from foreign suppliers (p.3).

The problem was that in 1976, Britain was reaping the consequences of poor decisions taken in 1974.

The British government had tried to attenuate the trade implications of OPEC oil price hike by holding interest rates at higher levels than were available in the US and Europe, in order to attract the sufficient capital inflows (on the capital account) to offset the currency losses on the trade account (purchasing oil at inflated prices).

That is, they tried to postpone the adjustments that were necessary to cope with the real income loss brought on by the oil price rises.

The source of the capital inflow was largely the funds from the booming oil surpluses held by OPEC nations and others.

In fact, the funds were routed to the external deficit nations via the World Bank, the IMF or private banks who raised the cash by offering, mostly, Eurocurrency deposits to the OPEC nations running the large surpluses.

The 1977 IMF Annual Report noted that (p.32):

… during 1974 the inflow of short-term capital into the United Kingdom from the oil exporting countries may have prevented a depreciation that was needed to improve the current account position.

[Reference: IMF (1977) Annual Report 1977, Washington DC.]

To put these flows into perspective, the IMF (1977) report that the current account deficit for Britain was -$US7.8 billion in 1974 (after the oil shock), -$U2.8 billion in 1975, -$U1.1 billion in 1976 and $U0.5 billion (surplus) in 1977.

At the time, the Bank of England even “provided the OPEC depositors with a guarantee against depreciation of their sterling assets by agreeing to intervene in foreign exchange markets if the pound was in danger of falling below a certain level” (p.3).

So the capital account surpluses Britain was experiencing were providing investment opportunities for non-residents, and were mirrored in the current account deficits.

Modern Monetary Theory (MMT) says that the fact that Britain was able to continue running the large current account deficits was evidence of the how attractive the nation was to international investors. If Britain was not an attractive investment port, then the current account adjustment would have come much more quickly.

Another way of thinking about this is that Britain was able to avoid paying the OPEC oil exporters in real resources for the deteriorating terms of trade after the oil price hikes.

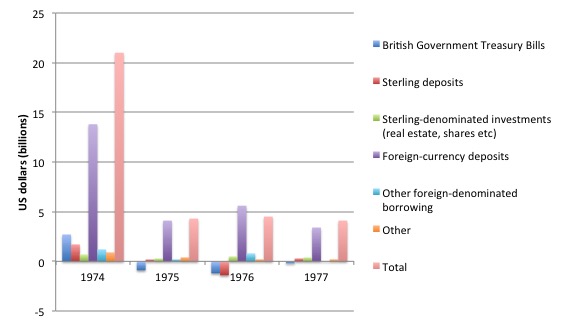

The following graph shows the the extent to which OPEC external surpluses were recycled into Britain through the UK capital account. The unit of measure is $US billions. The data comes from the IMF.

However, as the graph shows, by 1975, the flow of funds into sterling assets was drying up. The data shows that in 1975 most of the oil surplus recycling that found its way into Britain took the form of Eurocurrency deposits (foreign-currency), which clearly didn’t help prop up the pound (Bank of England, 1975).

[Reference: Bank of England (1975) Quarterly Bulletin, September.]

The reason I said that the 1974 policy decision – to avoid the adjustment required by the current account increase – was poor relates to the domestic impacts of the Bank of England’s strategy.

1. The high interest rates that were necessary to induce the capital inflow dampened domestic investment opportunities.

2. The Bank’s support for the pound (as a guarantee against depreciation) meant that the exchange rate remained ‘over-valued’ relative to the trade fundamentals and suppressed export competitiveness.

3. Britain had put its economic policy in the “hands of a handful of non-resident sterling depositors, that largest of whom were … the central monetary authorities of Nigeria, Kuwait, Saudi Arabia and the United Arab Emirates (US Congress, 1977: 4).

The US government clearly took the view that (p.4):

Britain became a victim of its own success, its economy a hostage to those OPEC deposits. When it tried to free itself, Britain discovered that it could not afford the ransom.

The currency slide started in mid-1975, when the Bank of England reduced its official intervention – buying up pounds to prevent depreciation.

The pound fell from 2.3218 against the US dollar on June 6, 1975 to 2.0231 by December 17, 1975 – the day that the British Chancellor formally sent a letter of request to the IMF to establish a ‘stand-by’ arrangement (credit line).

The US government noted that the Bank of England wanted the pound to fall even further (p.4) but was not prepared to let it float cleanly.

In fact, in the post Bretton Woods period, Britain never really allowed the exchange rate to float cleanly. The Bretton Woods mentality was still in play during the 1976 crisis and in the following years.

The IMF data (International Financial Statistics) show that Britain had foreign-exchange reserves of $US6 billion in 1974, falling to $US4.6 billion in 1975 and to $US3.4 billion in 1976, the year of the crisis.

However, in 1977, the reserves jumped to $US20.1 billion as the Bank of England fought against an appreciating pound, partly driven by the newly reported external surplus.

These swings in reserve balances were clear evidence that the Bank was conducting a ‘dirty’ or ‘managed’ float. The pound would have depreciated by more in 1976 and appreciated by more in 1977, had not the Bank conducted the official intervention in the foreign exchange markets (buying the pound in 1976 and selling it in 1977).

From the perspective of the Americans, it was clear that they thought that the on-going financial turmoil that accompanied the OPEC oil shocks at a time when the world was trying to adjust to the collapse of the Bretton Woods system (and the Smithsonian agreement reprise), was undermining their “assumptions of political stability” and increasing, in their paranoiac minds, the threat of the spread of communism (US Congress, 1977: 1).

Their old obsessions with military security (“the strength of NATO forces” (p.1) etc) was giving way to new fears based on economic instability.

Their response? To ensure the IMF became involved.

As we will learn, the US government fully supported the IMF involvement in the British policy making as long as the conditions under which the credit was extended were consistent with US policy.

The US Congress report says (p.11):

From the beginning of the IMF negotiations, U.S. policy with respect to the conditions that Britain would have to meet was effectively devised at the Under Secretary level in the Treasury and State Departments. Technically, the U.S. Executive Director reports to the Treasury. Traditionally, Treasury has primary responsibility for developing the U.S. position and, although the IMF negotiating team does not directly take orders or direction from the U.S. Executive Director of the Fund, the U.S. Director, through a series of informal consultations with the Executive Secretary of the Fund, and, in other ways, can make the views of the Treasury known to the IMF team. Since the Fund is a multilateral institution, however, there is great sensitivity within the Fund and within the Government with which the Fund is negotiationg with respect to any charges that the “strong” countries, the U.S. and West Germany, are “dictating” the position of the Fund during the course of a negotiation. Thus the exact means by which the U.S. position is communicated to the Fund officials is often more “informal” than official, “conversations” rather than meetings.

Initially, the US Government took a “relatively ‘hard’ line of demanding tough conditions on the Labour Government” (p.12) in return for IMF aid although it ultimately recognised that there is an “inability of outside technical ‘experts’ to impose conditions which involve basic social and political decisions when there is no consensus within the society – and Government – on these decisions” (p.12).

This is an important insight. The US government concluded that (p.12):

What was at issue in the IMF/British negotiations was the future shape of the political economy of Great Britain. That decision could only be made within the British political system. Outside influence, in the end, was at best, marginal.

The point is that even though the Americans were intent on advancing the sort of shifts in political thinking encapsulated in the Powell Manifesto (advancing neo-liberalism and breaking up the Welfare State in Britain) they knew full well, just as the major corporations and lobby groups have always known, that the government of the nation in question has to be ‘got at’.

This, in turn, is recognition that the ‘state’ has never gone away and retains the legislative power to do largely what it wants subject to the will of the people.

That opens up two fronts for the neo-liberals: (a) to reconstruct the ‘will’ of the people; and (b) to corrupt the political process to ensure it uses the legislative and currency-issuing capacities for the advantage of the elites.

Conclusion

We will analyse what happened throughout 1976 in the next instalment and discuss the alternative path that the British government could have been taken had it not become infested with neo-liberal economic thinking.

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

28. The Left confuses globalisation with neo-liberalism and gets lost

29. The metamorphosis of the IMF as a neo-liberal attack dog

30. The Wall Street-US Treasury Complex.

31. The Bacon-Eltis intervention – Britain 1976.

32. British Left reject fiscal strategy – speculation mounts, March 1976

33. The US government view of the British/IMF bailout 1976

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

I thought the IMF loan was put in place to help discharge the us dollar swap facility agreed in June 1976 with the US Secretary of State to the Treasury.

page 5 of the June 1976 cabinet minutes

So they signed the Brits up to a swap facility on the understanding they would go to the IMF to repay it.

Seems to be confirmed as drawn on page 6 here

So the UK was already up to its eyeballs in debt in a foreign currency before the IMF was even spoken to.