I grew up in a society where collective will was at the forefront and it…

The Wall Street-US Treasury Complex

Today I am in Barcelona, Spain after travelling from Trujillo (in the western part of Spain). Today’s blog continues the analysis I have been providing which aims to advance our understanding of why the British government called in the IMF in 1976 and why it fell prey to a growing neo-liberal consensus, largely orchestrated by the Americans. Yesterday, we analysed the way in which the IMF reinvented itself after its raison d’être was terminated with the collapse of the Bretton Woods fixed exchange rate system. Today’s part of the story, is to trace the growing US influence on the IMF and the way it manipulated that institution to further its ‘free market’ agenda on a global scale. We will consider what Jagdish Bhagwati called the “Wall Street-Treasury complex”, which referred to the way in which financial market interests in the US combined with (pressured) the US Treasury Department to advance the myth that liberalisation of global capital flows would deliver massive benefits in the post-1971 period after the convertible currency, fixed exchange rate system collapsed.

We left the discussion last week with the assertion that at the time the IMF was reinventing itself after losing its rationale as a provider of foreign exchange reserves to nations under the fixed exchange rate Bretton Woods system, it was also coming under increasing US influence.

The growing American influence seemed to suggest that the French fears in the 1960s of the IMF becoming a vehicle for US imperial hegemony were not as ill-founded as some might have thought at the time.

Boughton (2004: 16) argues that in the early 1970s, the emerging Monetarism of Milton Friedman “probably had less impact on the IMF than on the economics profession at large” but that “monetarist theory still had a forceful pull when high inflation became a nearly global phenomenon in the late 1970s. Even if the sources of that inflation extended beyond excessive monetary growth, controlling it would require reining in monetary growth through a tightening of monetary policy.” (p.17).

The arguments for “incomes policies had little appeal in the Fund” (p.17) and the IMF eventually found it “hard to resist being swept along” in the Monetarist hype.

He also argues that (2004: 17) that the rational expectations revolution in economics, which began in the mid-1960s and strengthened in the 1970s as a partner to Monetarism “had the biggest post-Keynes impact on the IMF … [and] … seemed to undermine the basis for countercyclical demand management policy”, a basic tenet of Keynesian economics.

He says that the (p.17):

…clearest example of the shift in thinking, however, was in the annual consultations with Germany, where the staff gradually abandoned the view that persistently high unemployment was due to weak demand and increasingly focused on rigid labor markets and other supply-side issues as the source of the problem.

These views eventually would form the core of what became known as the ‘Washington Consensus’, a term introduced into the public lexicon in 1990 by English economist John Williamson, to capture trends in the economic narrative that emerged in the early 1970s.

The consensus referred to the liberalisation policy agenda broadly pursued by Washington based institutions such as the IMF, the World Bank and the economic agencies of the US government, the Federal Reserve Board, and the right wing think tanks (Williamson, 1990).

[Reference: Williamson, J. (1990) ‘What Washington Means by Policy Reform’, in Williamson, J. (ed.) Latin American Readjustment: How Much has Happened, Washington, DC, Peterson Institute for International Economics, Chapter 2.]

According to Williamson there were ten pro-growth policy instruments which these agencies mutually supported and promoted, including the neo-liberal agenda based on free market fundamentalism, fiscal austerity, broad based deregulation of financial and labour markets and privatisation. The narrative suggested that this agenda was responsible for the ‘moderation’.

Williamson’s ‘consensus’ terminology seemed to suggest that the economic policy terrain was uncontested. But, there were other, albeit largely ignored, voices at the time.

For example, Robert Wade (2004) outlined his own ten-point reform agenda based upon the East Asian experience, which emphasised the centrality of government leadership in managing economic growth. Wade opposed the ‘shock therapy’ doctrine that the ‘Washington Consensus’ had advocated and eschewed the use of fiscal austerity. Later, Dani Rodrik (2006) also exposed the failure of the Washington reform agenda.

[Reference: Wade, R. (2004) Governing the Market, 2nd edn, Princeton, NJ, Princeton University Press.]

The underlying neo-liberal narrative that dominated policy making from around the mid-1970s and certainly impacted on the British policy debate in the mid-1970s (including the decision to call on IMF credit to save the nation ‘running out of money’) was that if private markets were left free of regulation and central banks were allowed to concentrate exclusively on price stability, unfettered by any interference from the political (democratic) process, then economies would be able to maintain long periods of stable output and employment growth.

The neo-liberal economists believed this ‘stability’ would lead us to understand that there was no further role for governments to use fiscal policy, the hallmark of Keynesianism, to try to ‘stabilise’ total spending in search of low unemployment. They prosecuted that view with zeal and arrogance and funded a plethora of so-called ‘think tanks’ and lobbyists to advance the message and ensure it penetrated the public psyche.

Whether the IMF was specifically influenced by Monetarist ideas and the accompany purge on all things Keynesian is debatable. IMF historians like Boughton and De Vries certainly play it down, which is not surprising given their employment relationship with the institution. One could hardly call them independent analysts.

De Vries, M.G. (1985) The International Monetary Fund 1972-78, Volumes 1 to 3, Washington, D.C., International Monetary Fund.

But the behaviour of the institution in the early 1970s clearly demonstrated its growing neo-liberal credentials. Their role in the Chilean overthrow of democracy was an early manifestation of their willingness to add their name, authority and resources to the development of the neo-liberal attack on the Keynesian orthodoxy.

Harvey (2007) interprets the rise of neo-liberalism as a response to the falling profit rates in the 1960s as income distribution became less skewed towards to the top end and workers enjoyed increasing employment security and prosperity under the full employment framework.

He argues that “the economic threat to the position of the ruling elites and classes was … becoming palpable (emphasis in original)”.

David Harvey (2007: check page number) recounts how:

The US had funded training of Chilean economists at the University of Chicago since the 1950s as part of a Cold War programme to counteract left-wing tendencies in Latin American. Chicago-trained economists came to dominate at the private Catholic University of Santiago. During the early 1970s, business elites organized their opposition to Allende through a group called ‘the Monday Club’ and developed a working relationship with these economists, funding their work through research institutes. After General Gustavo Leigh, Pinochet’s rival for power and a Keynesian, was sidelined in 1975, Pinochet brought these economists into the government, where their first job was to negotiate loans with the International Monetary Fund. Working alongside the IMF, they restructured the economy according to their theories.

Harvey notes that the Chilean coup demonstrated how profit rates could be restored if trade unions were smashed and public assets sold off to the private sector.

The Chicago Boys and their mentors accepted theories, which were, of course, at the extreme end of Monetarism and free market deregulation. They were Milton Friedman’s intellectual soldiers and together with the military soldiers of the Chilean army, co-opted by Pinochet, they destroyed the democratic movement in Chile and wrecked the economy.

[Reference: Harvey, D. (2007) A Brief History of Neoliberalism, Oxford, Oxford University Press.]

There is no doubt that the IMF was keen to do the bidding of the US government, which was prosecuting the neo-liberal agenda with vehemence on behalf of the large Wall Street firms, which provided massive funding to the Congressional members.

Bhagwati (1998: 7) coined the term “Wall Street-Treasury complex” to describe the way in which financial market interests in the US combined with (pressured) the US Treasury Department to advance the “myth” that liberalisation of global capital flows would deliver “enormous benefits” in the post-1971 period.

He argued that the ‘Complex’ was driven by the “obvious self-interest” that “Wall Street financial firms” have in free capital flows which “enlarges the arena in which to make money” (1998: 11). This self-interest, in turn, stimulates Wall Street to “put its powerful oar into the turbulent waters of Washington political lobbying to steer in this direction” (p.11).

This ‘Complex’ had, in turn, used the influence of the US government to bring about a paradigm shift in the thinking of the IMF:

… which has steadily propelled the IMF into its complacement and dangerous moves towards the goal of capital account convertibility …

The ‘Complex’ includes “Wall Street, the Treasury Department, the State Department, the IMF, and the World Bank” and, at the time, Bhagwati was writing, he mentioned some key “like-minded luminaries’ such as the Secretary of the US Treasury Robert Rubin who drove the agenda such that the ‘Complex’ was “unable to look much beyond the interest of Wall Street, which it equates with the good of the world” (p.12).

Please see my blog – Being shamed and disgraced is not enough – for more discussion on the role that Rubin has played in the creation of this neo-liberal dystopia.

With reference to the Asian crisis, Bhagwati recounts how various nations (Indonesia, Thailand, and South Korea) had:

… lost the political independence to run their economic policies as they deem fit. That their independence is lost not directly to foreign nations but to an IMF increasingly extending its agenda, at the behest of the U.S. Congress …

[Reference: Bhagwati, J. (1998) ‘The Capital Myth’, Foreign Affairs, 77(3), 7-12. – LINK]

(see also Wade, 1998; Stiglitz, 2002).

[References: Wade, R. (1998) ‘The Gathering Support for Capital Controls’, Challenge, 41(6), 14-26.

Stiglitz, J. (2002) Globalization and its Discontents, New York, W.W. Norton.]

With considerable deftness and, in an increasingly neo-liberal milieu, the IMF reinvented itself again and established its mission as being the lender to poor nations who faced currency pressures as a result of foreign debt accumulation.

The neo-liberal ideology came to the fore in the late 1970s when the IMF started to implement their so-called Structural Adjustment Programs (SAPs). These programs were a response to the debt crisis that engulfed the world – a crisis that was significantly related to IMF loans.

The debt crisis was constructed as a crisis for the developing nations but it was really a crisis for the first-world banks. The IMF made sure the poorest nations continued to transfer resources to the richest under these SAPs.

The SAPs were vehicles by which the IMF forced nations to adopt free market policies – the same sort of policy changes that created the conditions for the crisis in the advanced nations.

The poorest nations were forced to privatise state assets, make cuts to education and health services, cut wages, eliminate minimum wages and free up their banking sectors to allow speculative capital to prey on them.

The results in all cases was to increase the inequality in the wealth and income distributions, to increase poverty rates and open the nations to extensive environmental damage.

Nations with subsistence agriculture were forced to convert into cash for trade crops. The impact of the increased supply on world markets was to reduce the price below which was necessary to repay the IMF loans. More repressive conditions were then imposed.

The Americans started flexing their muscles in relation to the British sterling crisis in early 1976.

The US Secretary of the Treasury, William E. Simon wrote an extraordinary memo to the so-called Economic Policy Board on the options facing Britain as the currency crisis worsened in early 1976. The memo is undated but was probably written in March or April 1976.

He argued, on behalf of the US government, that the use of “highly expansionary fiscal and monetary policies have triggered strong and sustained inflationary pressures”, particularly in the case of the United Kingdom, and that “These pressures have been augmented by ‘external shocks’, the most important of which was the quadrupling in the prices of oil” (Simon, undated).

[Reference: William E. Simon (undated) Memorandum From Secretary of the Treasury Simon to the Economic Policy Board, Document 132, Foreign Relations of the United States, 1969-1976, Volume XXXI, Foreign Economic Policy, 1973-1976. LINK]

The growing external deficits in nations such as Britain and Italy that had resulted from these pressures then raised the issues as to whether they “should be financed or be permitted to reflect almost directly the exchange rate of the countries involved” (Simon, undated).

Britain had already floated the pound, and, with no official intervention from the Bank of England, the expectation was that it would find a new lower value. This, in turn, would help improve the international competitiveness of the British economy and form part of the resolution of the external deficit.

The choice was becoming clearer as the capacity of the deficit nations to fund the trade deficits was narrowing. Further, it was clear from the tone of Simon’s Memo that they resented nations such as Italy using external funds to maintain the large external deficits “to avoid adjustment” in the domestic economy.

The ‘adjustment’ the US wanted was in the form of what we now call internal devaluation – maintaining a fixed parity for the currency against other currencies and cutting domestic wage costs and prices. The aim was to increase the international competitiveness of the nation by reducing its unit labour costs.

The problem is that by attacking the working conditions of the workers, there is no guarantee that productivity growth will not fall, which under plausible conditions would not lead to a fall in unit labour costs.

Some would also argue that the attack on the workers’ wages and working conditions was an end in itself as capital sought ways to overcome the profit squeeze of the early 1970s. The Powell Manifesto released in 1971 was very influential in concentrating the efforts of capital on restoring profit rates as the profit squeeze in the late 1960s and early 1970s gave it genuine concern that its hegemony at the apex of the economic system was being challenged.

Please read my blog – The right-wing counter attack – 1971 – for more discussion on this point.

So while the demands that nations such as Italy and the United Kingdom engage in harsh ‘structural adjustments’ were made in the name of improving international competitiveness, the main game was more about shifting power to capital and redistributing national income towards profits at the expense of labour.

The US had particular views about the internal domestic adjustments that nations such as Italy and Britain should take. They eschewed the use of import controls and what they called “competitive depreciation” because they claimed they undermined the fortunes of other nations who were not experiencing the same external deficits.

The opposition to allowing the exchange rate to adjust was curious and reflected a throwback to the 1960s, where a series of competitive devaluations were used to improve the external situation of a number of countries.

After all, it was the US that abandoned the fixed-exchange rate system in August 1971 and the logic of the floating exchange rate system was that the freedom of the exchange rate to float freed domestic policy from having to deal with external imbalances.

The resistance from the Americans to allowing Britain to adjust via exchange depreciation was thus a reflection of gold standard mentality in a period where the world had moved on.

But the Brits were also intolerant to a lower sterling value because they considered it a sign of slipping British greatness.

Simons’ Memo made it clear what the Americans wanted to happen:

Our objectives have been on the following lines:

1. Discourage the use of import controls as a substitute for internal adjustment.

2. Create a climate both in terms of the legal content of the Jamaica Agreements and in terms of world public opinion which makes competitive depreciation policies unacceptable.

3. Facilitate the provision of financing – through the IMF and the Financial Support Fund – that would truly be conditional on tangible progress in the direction of domestic stabilization.

So unless the nations were prepared to impose austerity themselves, the Americans wanted the IMF to impose “truly … conditional” austerity policies in return for providing funding for the external deficits, so that the exchange rates were kept stable.

It is hard to avoid the conclusion that the Republicans in America at the time were locked into gold standard mentality despite them being the ones that ended that system.

Simon was emphatic:

Significantly, we have also issued a clear warning to the British-with the French within hearing-that we will not tolerate deliberate competitive depreciations.

Conclusion

The next instalment in this series will consider the so-called Bacon-Eltis Thesis which argued that the ‘British Disease’ was directly attributable to what they claimed was excessive government spending. The Thesis was very influential on Denis Healey, the Chancellor in James Callaghan’s government.

The Thesis had no credibility but was another arm in the growing neo-liberal attack on state intervention designed to advance general well-being rather than favour the top-end-of-town.

Then we will consider the internal debate within the British Labour Party (Benn versus Healey) and finally the decision to call in the IMF.

By the end of this, I hope we all have a solid understanding of this turning point in Left political fortunes.

The series so far

This is a further part of a series I am writing as background to my next book on globalisation and the capacities of the nation-state. More instalments will come as the research process unfolds.

The series so far:

1. Friday lay day – The Stability Pact didn’t mean much anyway, did it?

2. European Left face a Dystopia of their own making

3. The Eurozone Groupthink and Denial continues …

4. Mitterrand’s turn to austerity was an ideological choice not an inevitability

5. The origins of the ‘leftist’ failure to oppose austerity

6. The European Project is dead

7. The Italian left should hang their heads in shame

8. On the trail of inflation and the fears of the same ….

9. Globalisation and currency arrangements

10. The co-option of government by transnational organisations

11. The Modigliani controversy – the break with Keynesian thinking

12. The capacity of the state and the open economy – Part 1

13. Is exchange rate depreciation inflationary?

14. Balance of payments constraints

15. Ultimately, real resource availability constrains prosperity

16. The impossibility theorem that beguiles the Left.

17. The British Monetarist infestation.

18. The Monetarism Trap snares the second Wilson Labour Government.

19. The Heath government was not Monetarist – that was left to the Labour Party.

20. Britain and the 1970s oil shocks – the failure of Monetarism.

21. The right-wing counter attack – 1971.

22. British trade unions in the early 1970s.

23. Distributional conflict and inflation – Britain in the early 1970s.

24. Rising urban inequality and segregation and the role of the state.

25. The British Labour Party path to Monetarism.

26. Britain approaches the 1976 currency crisis.

28. The Left confuses globalisation with neo-liberalism and gets lost

29. The metamorphosis of the IMF as a neo-liberal attack dog

30. The Wall Street-US Treasury Complex.

The blogs in these series should be considered working notes rather than self-contained topics. Ultimately, they will be edited into the final manuscript of my next book due later in 2016.

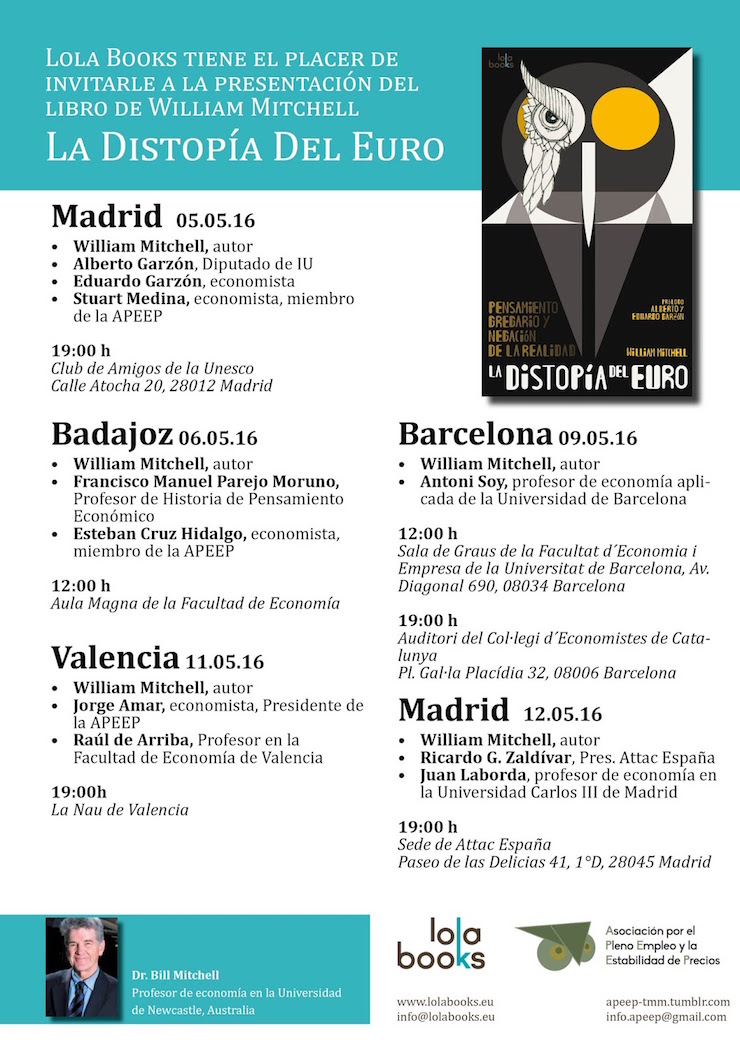

Spanish Speaking Tour and Book Presentations – May 5-13, 2016

Today I am in Barcelona for two speaking events (as below). If you are around it would be great to see you.

Here are the details of my upcoming Spanish speaking tour which will coincide with the release of the Spanish translation of my my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published in English May 2015).

You can purchase the Spanish version of the book – La Distopía del Euro – for 27.54 euros from Amazon.

You can save the flyer below to keep the details handy if you are interested. All events are open to the public who are encouraged to attend.

That is enough for today!

(c) Copyright 2016 William Mitchell. All Rights Reserved.

Professor, the U.K. is no Latin American banana republic. It is not right to place blame for decisions made by the U.K. government on the United States.

Dear Jerry Brown (at 2016/05/09 at 3:14)

You underestimate the power and hold that the emerging neo-liberal Groupthink was having on central bankers and treasury officials around the world at the time.

It was a virulent virus.

best wishes

bill

Fine. Blame it on the neo-liberal central bankers and treasury officials around the world for taking the path of least resistance. They were installed by their own governments and should have answered to their own people. The U.S. has had a lot of responsibility for what has happened in the world over the last 75 years. Good and bad. But U.K. policy should be considered U.K. policy. Please don’t blame extra things on my country.

I know corruption can be insidious but for the right wing counter attack to be so successful there must

have been some poor governance ,some failure of political leadership on the other side.Yes the general

direction of travel was good and the quadrupling of oil prices an external shock but for the centre left to

embrace monetarism cannot come out of the blue there must have been the seeds of corruption to

begin with alongside just dumb governance.

After a generation of acceptance of neoliberalsm much of the old social democractic parties of Europe

have collapsed even in countries like Sweden. We live in scary times where populist right parties have

as much appeal as the non neoliberal ‘left’.The real potential of Trump in the White house is a

powerful testament to the ongoing failure of the political class,the useless technocrats .The next US

recession could yet be manged by austerians the the proverbial might fly.

For reasons unknown, the UK along with many other countries have increasingly been behaving as though vassal states in service to the US. This much is clear.

It’s unlikely this or the overwhelming dominance of nonsense neo liberal economic ideology have happened by mere chance; and, it’s unlikely that most US citizens have been any more than vaguely aware of some of the un democratic machinations occurring behind the scenes under the guidance of a relatively small group of neo conservatives, neo liberals and their hybrids who have wood worked their way into positions of strong influence over both economic policy and foreign policy.

The visible part of the political process, seems to have little to do with influencing the general directions this “coalition of the willing” wish to take the world, and increasing numbers of US people share the resultant suffering along with other unfortunate victims of this disease that is traversing the globe.

Very few would have voted for this state of affairs.

The US and the apparent “vassals” appear to have become mere instruments in the service of some cabal united by a set of special interests rather than a point source of emergence for the driving ideologies.

This is a new situation for our times and it’s difficult to see what can be done about it. No one runs for election on the promise of removing the un-admitted (and often unelected) neo cons and neo libs from the drivers seats on policy.

I look forward to the next instalment regarding Benn’s resistance. I’ve often wondered how much understanding he may have had at the time about what was going on.