Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – June 4, 2011 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Start from a situation where the external balance is the equivalent of 2 per cent of GDP and the budget surplus is 2 per cent. If the budget balance stays constant and the external balance rises to the equivalent of 4 per cent of GDP then:

(a) National income rises and the private surplus moves from 4 per cent of GDP to 6 per cent of GDP.

(b) National income remains unchanged and the private surplus moves from 4 per cent of GDP to 6 per cent of GDP.

(c) National income falls and the private surplus moves from 4 per cent of GDP to 6 per cent of GDP.

(d) National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

(e) National income remains unchanged and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP

(f) National income falls and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

The answer is Option (d) National income rises and the private surplus moves from 0 per cent of GDP to 2 per cent of GDP.

First, you need to understand the basic relationship between the sectoral flows and the balances that are derived from them. The flows are derived from the National Accounting relationship between aggregate spending and income. So:

(1) Y = C + I + G + (X – M)

where Y is GDP (income), C is consumption spending, I is investment spending, G is government spending, X is exports and M is imports (so X – M = net exports).

Another perspective on the national income accounting is to note that households can use total income (Y) for the following uses:

(2) Y = C + S + T

where S is total saving and T is total taxation (the other variables are as previously defined).

You than then bring the two perspectives together (because they are both just “views” of Y) to write:

(3) C + S + T = Y = C + I + G + (X – M)

You can then drop the C (common on both sides) and you get:

(4) S + T = I + G + (X – M)

Then you can convert this into the familiar sectoral balances accounting relations which allow us to understand the influence of fiscal policy over private sector indebtedness.

So we can re-arrange Equation (4) to get the accounting identity for the three sectoral balances – private domestic, government budget and external:

(S – I) = (G – T) + (X – M)

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

Another way of saying this is that total private savings (S) is equal to private investment (I) plus the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)), where net exports represent the net savings of non-residents.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

Thus, when an external deficit (X – M < 0) and public surplus (G – T < 0) coincide, there must be a private deficit. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process.

Second, you then have to appreciate the relative sizes of these balances to answer the question correctly.

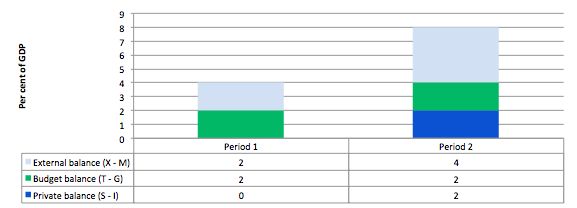

Consider the following graph and accompanying table which depicts two periods outlined in the question.

In Period 1, with an external surplus of 2 per cent of GDP and a budget surplus of 2 per cent of GDP the private domestic balance is zero. The demand injection from the external sector is exactly offset by the demand drain (the fiscal drag) coming from the budget balance and so the private sector can neither net save or spend more than they earn.

In Period 2, with the external sector adding more to demand now – surplus equal to 4 per cent of GDP and the budget balance unchanged (this is stylised – in the real world the budget will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP.

The fiscal drag is overwhelmed by the rising net exports.

This is a highly stylised example and you could tell a myriad of stories that would be different in description but none that could alter the basic point.

If the drain on spending (from the public sector) is more than offset by an external demand injection, then GDP rises and the private sector overall saving increases.

If the drain on spending from the budget outweighs the external injections into the spending stream then GDP falls (or growth is reduced) and the overall private balance would fall into deficit.

You may wish to read the following blogs for more information:

- Back to basics – aggregate demand drives output

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Barnaby, better to walk before we run

- Saturday Quiz – June 19, 2010 – answers and discussion

Question 2:

A rising budget deficit indicates that discretionary fiscal policy is expansionary.

The answer is False.

The actual budget deficit outcome that is reported in the press and by Treasury departments is not a pure measure of the discretionary fiscal policy stance adopted by the government at any point in time. As a result, a straightforward interpretation of

Economists conceptualise the actual budget outcome as being the sum of two components: (a) a discretionary component – that is, the actual fiscal stance intended by the government; and (b) a cyclical component reflecting the sensitivity of certain fiscal items (tax revenue based on activity and welfare payments to name the most sensitive) to changes in the level of activity.

The former component is now called the “structural deficit” and the latter component is sometimes referred to as the automatic stabilisers.

The structural deficit thus conceptually reflects the chosen (discretionary) fiscal stance of the government independent of cyclical factors.

The cyclical factors refer to the automatic stabilisers which operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the budget balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The problem is then how to determine whether the chosen discretionary fiscal stance is adding to demand (expansionary) or reducing demand (contractionary). It is a problem because a government could be run a contractionary policy by choice but the automatic stabilisers are so strong that the budget goes into deficit which might lead people to think the “government” is expanding the economy.

So just because the budget goes into deficit doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this ambiguity, economists decided to measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

As a result, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance.

The Full Employment Budget Balance was a hypothetical construction of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

This framework allowed economists to decompose the actual budget balance into (in modern terminology) the structural (discretionary) and cyclical budget balances with these unseen budget components being adjusted to what they would be at the potential or full capacity level of output.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The question then relates to how the “potential” or benchmark level of output is to be measured. The calculation of the structural deficit spawned a bit of an industry among the profession raising lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s.

As the neo-liberal resurgence gained traction in the 1970s and beyond and governments abandoned their commitment to full employment , the concept of the Non-Accelerating Inflation Rate of Unemployment (the NAIRU) entered the debate – see my blogs – The dreaded NAIRU is still about and Redefing full employment … again!.

The NAIRU became a central plank in the front-line attack on the use of discretionary fiscal policy by governments. It was argued, erroneously, that full employment did not mean the state where there were enough jobs to satisfy the preferences of the available workforce. Instead full employment occurred when the unemployment rate was at the level where inflation was stable.

The estimated NAIRU (it is not observed) became the standard measure of full capacity utilisation. If the economy is running an unemployment equal to the estimated NAIRU then mainstream economists concluded that the economy is at full capacity. Of-course, they kept changing their estimates of the NAIRU which were in turn accompanied by huge standard errors. These error bands in the estimates meant their calculated NAIRUs might vary between 3 and 13 per cent in some studies which made the concept useless for policy purposes.

Typically, the NAIRU estimates are much higher than any acceptable level of full employment and therefore full capacity. The change of the the name from Full Employment Budget Balance to Structural Balance was to avoid the connotations of the past where full capacity arose when there were enough jobs for all those who wanted to work at the current wage levels.

Now you will only read about structural balances which are benchmarked using the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models. This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending because typically the estimated NAIRU always exceeds a reasonable (non-neo-liberal) definition of full employment.

So the estimates of structural deficits provided by all the international agencies and treasuries etc all conclude that the structural balance is more in deficit (less in surplus) than it actually is – that is, bias the representation of fiscal expansion upwards.

As a result, they systematically understate the degree of discretionary contraction coming from fiscal policy.

The only qualification is if the NAIRU measurement actually represented full employment. Then this source of bias would disappear.

So in terms of the question, a rising budget deficit can accompany a contractionary fiscal position if the cuts in the discretionary net spending leads to a decline in economic growth and the automatic stabilisers then drive the cyclical component higher and more than offset the discretionary component.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 3:

Matching government deficit spending with bond issues is less expansionary than if the government instructed the central bank to buy its bonds to match the deficit.

The answer is False.

There are two dimensions to this question: (a) the impacts in the real economy; and (b) the monetary operations involved.

It is clear that at any point in time, there are finite real resources available for production. New resources can be discovered, produced and the old stock spread better via education and productivity growth. The aim of production is to use these real resources to produce goods and services that people want either via private or public provision.

So by definition any sectoral claim (via spending) on the real resources reduces the availability for other users. There is always an opportunity cost involved in real terms when one component of spending increases relative to another.

However, the notion of opportunity cost relies on the assumption that all available resources are fully utilised.

Unless you subscribe to the extreme end of mainstream economics which espouses concepts such as 100 per cent crowding out via financial markets and/or Ricardian equivalence consumption effects, you will conclude that rising net public spending as percentage of GDP will add to aggregate demand and as long as the economy can produce more real goods and services in response, this increase in public demand will be met with increased public access to real goods and services.

If the economy is already at full capacity, then a rising public share of GDP must squeeze real usage by the non-government sector which might also drive inflation as the economy tries to siphon of the incompatible nominal demands on final real output.

However, the question is focusing on the concept of financial crowding out which is a centrepiece of mainstream macroeconomics textbooks. This concept has nothing to do with “real crowding out” of the type noted in the opening paragraphs.

The financial crowding out assertion is a central plank in the mainstream economics attack on government fiscal intervention. At the heart of this conception is the theory of loanable funds, which is a aggregate construction of the way financial markets are meant to work in mainstream macroeconomic thinking.

The original conception was designed to explain how aggregate demand could never fall short of aggregate supply because interest rate adjustments would always bring investment and saving into equality.

At the heart of this erroneous hypothesis is a flawed viewed of financial markets. The so-called loanable funds market is constructed by the mainstream economists as serving to mediate saving and investment via interest rate variations.

This is pre-Keynesian thinking and was a central part of the so-called classical model where perfectly flexible prices delivered self-adjusting, market-clearing aggregate markets at all times. If consumption fell, then saving would rise and this would not lead to an oversupply of goods because investment (capital goods production) would rise in proportion with saving. So while the composition of output might change (workers would be shifted between the consumption goods sector to the capital goods sector), a full employment equilibrium was always maintained as long as price flexibility was not impeded. The interest rate became the vehicle to mediate saving and investment to ensure that there was never any gluts.

So saving (supply of funds) is conceived of as a positive function of the real interest rate because rising rates increase the opportunity cost of current consumption and thus encourage saving. Investment (demand for funds) declines with the interest rate because the costs of funds to invest in (houses, factories, equipment etc) rises.

Changes in the interest rate thus create continuous equilibrium such that aggregate demand always equals aggregate supply and the composition of final demand (between consumption and investment) changes as interest rates adjust.

According to this theory, if there is a rising budget deficit then there is increased demand is placed on the scarce savings (via the alleged need to borrow by the government) and this pushes interest rates to “clear” the loanable funds market. This chokes off investment spending.

So allegedly, when the government borrows to “finance” its budget deficit, it crowds out private borrowers who are trying to finance investment.

The mainstream economists conceive of this as the government reducing national saving (by running a budget deficit) and pushing up interest rates which damage private investment.

This trilogy of blogs will help you understand this if you are new to my blog – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The basic flaws in the mainstream story are that governments just borrow back the net financial assets that they create when they spend. Its a wash! It is true that the private sector might wish to spread these financial assets across different portfolios. But then the implication is that the private spending component of total demand will rise and there will be a reduced need for net public spending.

Further, they assume that savings are finite and the government spending is financially constrained which means it has to seek “funding” in order to progress their fiscal plans. But government spending by stimulating income also stimulates saving.

Additionally, credit-worthy private borrowers can usually access credit from the banking system. Banks lend independent of their reserve position so government debt issuance does not impede this liquidity creation.

In terms of the monetary operations involved we note that national governments have cash operating accounts with their central bank. The specific arrangements vary by country but the principle remains the same. When the government spends it debits these accounts and credits various bank accounts within the commercial banking system. Deposits thus show up in a number of commercial banks as a reflection of the spending. It may issue a cheque and post it to someone in the private sector whereupon that person will deposit the cheque at their bank. It is the same effect as if it had have all been done electronically.

All federal spending happens like this. You will note that:

- Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.

- There has been no mention of where they get the credits and debits come from! The short answer is that the spending comes from no-where but we will have to wait for another blog soon to fully understand that. Suffice to say that the Federal government, as the monopoly issuer of its own currency is not revenue-constrained. This means it does not have to “finance” its spending unlike a household, which uses the fiat currency.

- Any coincident issuing of government debt (bonds) has nothing to do with “financing” the government spending.

All the commercial banks maintain reserve accounts with the central bank within their system. These accounts permit reserves to be managed and allows the clearing system to operate smoothly. The rules that operate on these accounts in different countries vary (that is, some nations have minimum reserves others do not etc). For financial stability, these reserve accounts always have to have positive balances at the end of each day, although during the day a particular bank might be in surplus or deficit, depending on the pattern of the cash inflows and outflows. There is no reason to assume that these flows will exactly offset themselves for any particular bank at any particular time.

The central bank conducts “operations” to manage the liquidity in the banking system such that short-term interest rates match the official target – which defines the current monetary policy stance. The central bank may: (a) Intervene into the interbank (overnight) money market to manage the daily supply of and demand for reserve funds; (b) buy certain financial assets at discounted rates from commercial banks; and (c) impose penal lending rates on banks who require urgent funds, In practice, most of the liquidity management is achieved through (a). That being said, central bank operations function to offset operating factors in the system by altering the composition of reserves, cash, and securities, and do not alter net financial assets of the non-government sectors.

Fiscal policy impacts on bank reserves – government spending (G) adds to reserves and taxes (T) drains them. So on any particular day, if G > T (a budget deficit) then reserves are rising overall. Any particular bank might be short of reserves but overall the sum of the bank reserves are in excess. It is in the commercial banks interests to try to eliminate any unneeded reserves each night given they usually earn a non-competitive return. Surplus banks will try to loan their excess reserves on the Interbank market. Some deficit banks will clearly be interested in these loans to shore up their position and avoid going to the discount window that the central bank offeres and which is more expensive.

The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the budget deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.

However, the vertical transaction just offers portfolio choice for the non-government sector rather than changing the holding of financial assets.

This is based on the erroneous belief that the banks need deposits and reserves before they can lend. Mainstream macroeconomics wrongly asserts that banks only lend if they have prior reserves. The illusion is that a bank is an institution that accepts deposits to build up reserves and then on-lends them at a margin to make money. The conceptualisation suggests that if it doesn’t have adequate reserves then it cannot lend. So the presupposition is that by adding to bank reserves, quantitative easing will help lending.

But this is a completely incorrect depiction of how banks operate. Bank lending is not “reserve constrained”. Banks lend to any credit worthy customer they can find and then worry about their reserve positions afterwards. If they are short of reserves (their reserve accounts have to be in positive balance each day and in some countries central banks require certain ratios to be maintained) then they borrow from each other in the interbank market or, ultimately, they will borrow from the central bank through the so-called discount window. They are reluctant to use the latter facility because it carries a penalty (higher interest cost).

The point is that building bank reserves will not increase the bank’s capacity to lend. Loans create deposits which generate reserves.

The following blogs may be of further interest to you:

- When a huge pack of lies is barely enough

- Saturday Quiz – April 17, 2010 – answers and discussion

- Quantitative easing 101

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Money multiplier and other myths

- Will we really pay higher interest rates?

- A modern monetary theory lullaby

Question 4:

If private households and firms decide to lift their saving ratio the national government has to increase its net spending (deficit) to fill the spending gap or else economic activity will slow down.

The answer is False.

Please refer to the conceptual explanations in Question 1.

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X - M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

When the private domestic sector (that is, households and firms) decide to lift their overall saving ratio, we normally think of this in terms of households reducing consumption spending or firms reducing investment.

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms layoff workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession. Interestingly, the attempts by households overall to increase their saving ratio may be thwarted because income losses cause loss of saving in aggregate – the is the Paradox of Thrift. While one household can easily increase its saving ratio through discipline, if all households try to do that then they will fail. This is an important statement about why macroeconomics is a separate field of study.

Typically, the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur – in the form of an expanding public deficit or an offsetting increase in net exports.

The budget position of the government would be heading towards, into or into a larger deficit depending on the starting position as a result of the automatic stabilisers anyway.

If there are not other changes in the economy, the answer would be true. However, there is also an external sector. It is possible that at the same time that the households are reducing their consumption as an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public budget balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

The following blogs may be of further interest to you:

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 5 – Premium question

In Year 1, the economy plunges into recession with nominal GDP growth falling to minus -1 per cent. The inflation rate is subdued at 2 per cent per annum. The outstanding public debt is equal to the value of the nominal GDP and the nominal interest rate is equal to 2 per cent (and this is the rate the government pays on all outstanding debt). The government’s budget balance net of interest payments goes into deficit equivalent to 1 per cent of GDP and the debt ratio rises by 4 per cent. In Year 2, the government stimulates the economy and pushes the primary budget deficit out to 4 per cent of GDP in recognition of the severity of the recession. In doing so it stimulates aggregate demand and the economy records a 4 per cent nominal GDP growth rate. The central bank holds the nominal interest rate constant but inflation falls to 1 per cent given the slack nature of the economy the previous year. Under these circumstances, the public debt ratio falls even though the budget deficit has risen because of the real growth in the economy.

The answer is False.

This question requires you to understand the key parameters and relationships that determine the dynamics of the public debt ratio. An understanding of these relationships allows you to debunk statements that are made by those who think fiscal austerity will allow a government to reduce its public debt ratio.

While Modern Monetary Theory (MMT) places no particular importance in the public debt to GDP ratio for a sovereign government, given that insolvency is not an issue, the mainstream debate is dominated by the concept.

The unnecessary practice of fiat currency-issuing governments of issuing public debt $-for-$ to match public net spending (deficits) ensures that the debt levels will rise when there are deficits.

Rising deficits usually mean declining economic activity (especially if there is no evidence of accelerating inflation) which suggests that the debt/GDP ratio may be rising because the denominator is also likely to be falling or rising below trend.

Further, historical experience tells us that when economic growth resumes after a major recession, during which the public debt ratio can rise sharply, the latter always declines again.

It is this endogenous nature of the ratio that suggests it is far more important to focus on the underlying economic problems which the public debt ratio just mirrors.

Mainstream economics starts with the flawed analogy between the household and the sovereign government such that any excess in government spending over taxation receipts has to be “financed” in two ways: (a) by borrowing from the public; and/or (b) by “printing money”.

Neither characterisation is remotely representative of what happens in the real world in terms of the operations that define transactions between the government and non-government sector.

Further, the basic analogy is flawed at its most elemental level. The household must work out the financing before it can spend. The household cannot spend first. The government can spend first and ultimately does not have to worry about financing such expenditure.

However, the mainstream framework for analysing these so-called “financing” choices is called the government budget constraint (GBC). The GBC says that the budget deficit in year t is equal to the change in government debt over year t plus the change in high powered money over year t. So in mathematical terms it is written as:

which you can read in English as saying that Budget deficit = Government spending + Government interest payments – Tax receipts must equal (be “financed” by) a change in Bonds (B) and/or a change in high powered money (H). The triangle sign (delta) is just shorthand for the change in a variable.

However, this is merely an accounting statement. In a stock-flow consistent macroeconomics, this statement will always hold. That is, it has to be true if all the transactions between the government and non-government sector have been corrected added and subtracted.

So in terms of MMT, the previous equation is just an ex post accounting identity that has to be true by definition and has not real economic importance.

But for the mainstream economist, the equation represents an ex ante (before the fact) financial constraint that the government is bound by. The difference between these two conceptions is very significant and the second (mainstream) interpretation cannot be correct if governments issue fiat currency (unless they place voluntary constraints on themselves to act as if it is).

Further, in mainstream economics, money creation is erroneously depicted as the government asking the central bank to buy treasury bonds which the central bank in return then prints money. The government then spends this money.

This is called debt monetisation and you can find out why this is typically not a viable option for a central bank by reading the Deficits 101 suite – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3.

The mainstream view claims that if governments increase the money growth rate (they erroneously call this “printing money”) the extra spending will cause accelerating inflation because there will be “too much money chasing too few goods”! Of-course, we know that proposition to be generally preposterous because economies that are constrained by deficient demand (defined as demand below the full employment level) respond to nominal demand increases by expanding real output rather than prices. There is an extensive literature pointing to this result.

So when governments are expanding deficits to offset a collapse in private spending, there is plenty of spare capacity available to ensure output rather than inflation increases.

But not to be daunted by the “facts”, the mainstream claim that because inflation is inevitable if “printing money” occurs, it is unwise to use this option to “finance” net public spending.

Hence they say as a better (but still poor) solution, governments should use debt issuance to “finance” their deficits. Thy also claim this is a poor option because in the short-term it is alleged to increase interest rates and in the longer-term is results in higher future tax rates because the debt has to be “paid back”.

Neither proposition bears scrutiny – you can read these blogs – Will we really pay higher taxes? and Will we really pay higher interest rates? – for further discussion on these points.

The mainstream textbooks are full of elaborate models of debt pay-back, debt stabilisation etc which all claim (falsely) to “prove” that the legacy of past deficits is higher debt and to stabilise the debt, the government must eliminate the deficit which means it must then run a primary surplus equal to interest payments on the existing debt.

A primary budget balance is the difference between government spending (excluding interest rate servicing) and taxation revenue.

The standard mainstream framework, which even the so-called progressives (deficit-doves) use, focuses on the ratio of debt to GDP rather than the level of debt per se. The following equation captures the approach:

So the change in the debt ratio is the sum of two terms on the right-hand side: (a) the difference between the real interest rate (r) and the real GDP growth rate (g) times the initial debt ratio; and (b) the ratio of the primary deficit (G-T) to GDP.

The real interest rate is the difference between the nominal interest rate and the inflation rate. Real GDP is the nominal GDP deflated by the inflation rate. So the real GDP growth rate is equal to the Nominal GDP growth minus the inflation rate.

This standard mainstream framework is used to highlight the dangers of running deficits. But even progressives (not me) use it in a perverse way to justify deficits in a downturn balanced by surpluses in the upturn.

MMT does not tell us that a currency-issuing government running a deficit can never reduce the debt ratio. The standard formula above can easily demonstrate that a nation running a primary deficit can reduce its public debt ratio over time.

Furthermore, depending on contributions from the external sector, a nation running a deficit will more likely create the conditions for a reduction in the public debt ratio than a nation that introduces an austerity plan aimed at running primary surpluses.

But if growth is not sufficient then the public debt ratio can rise.

Here is why that is the case.

While a growing economy can absorb more debt and keep the debt ratio constant or falling an increasing real interest rate also means that interest payments on the outstanding stock of debt rise.

From the formula above, if the primary budget balance is zero, public debt increases at a rate r but the public debt ratio increases at r – g.

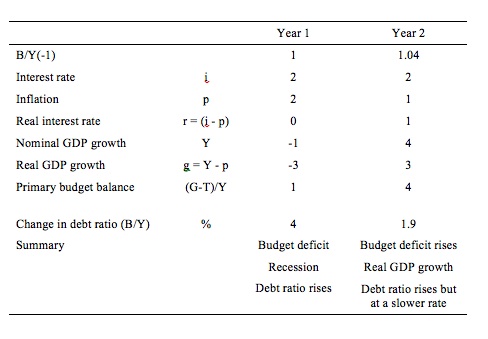

The following Table simulates the two years in question. To make matters simple, assume a public debt ratio at the start of the Year 1 of 100 per cent (so B/Y(-1) = 1) which is equivalent to the statement that “outstanding public debt is equal to the value of the nominal GDP”.

In Year 1, the nominal interest rate is 2 per cent and the inflation rate is 2 per cent then the current real interest rate (r) is 0 per cent.

If the nominal GDP grows at -1 per cent and there is an inflation rate of 2 per cent then real GDP is growing (g) at minus 3 per cent.

Under these conditions, the primary budget surplus would have to be equal to 3 per cent of GDP to stabilise the debt ratio (check it for yourself).

In Year 1, the primary budget deficit is actually 1 per cent of GDP so we know by computation that the public debt ratio rises by 4 per cent.

The calculation (using the formula in the Table) is:

Change in B/Y = (0 – (-3))*1 + 1 = 4 per cent.

The situation gets more complex in Year 2 because the inflation rate falls to 1 per cent while the central bank holds the nominal interest rate constant at 2 per cent. So the real interest rate rises to 1 per cent.

The data in Year 2 is given in the last column in the Table below. Note the public debt ratio at the beginning of the period has risen to 1.04 because of the rise from last year.

You are told that the budget deficit rises to 4 per cent of GDP and nominal GDP growth shoots up to 4 per cent which means real GDP growth (given the inflation rate) is equal to 3 per cent.

The corresponding calculation for the change in the public debt ratio is:

Change in B/Y = (1 – 3)*1.04 + 5 = 1.9 per cent.

That is, the public debt ratio rises but at a slower rate than in the last year. The real growth in the economy has been beneficial and if maintained would start to eat into the primary budget balance (via the rising tax revenues that would occur).

In a few years, the growth would not only reduce the primary budget deficit but the public debt ratio would start to decline as well.

So when the budget deficit is a large percentage of GDP then it might take some years to start reducing the public debt ratio as GDP growth ensures.

The best way to reduce the public debt ratio is to stop issuing debt. A sovereign government doesn’t have to issue debt if the central bank is happy to keep its target interest rate at zero or pay interest on excess reserves.

The discussion also demonstrates why a falling inflation rate makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.

Well, I have some problem with Q5 – or rather – find in unnecessary complicated. While Debt/GDP ratio isn’t really a meaningful measure of the economic health of a country, I can’t realy see (if we have to calculate it at all) why we need REAL factors – like real GDP growth, or real interest rate, to calculate it. Debt is a NOMINAL concept (a defined amount of currency is owed) – as is the interest rate (a defined percentage of nominal debt is owed). So the only factors that matter (in that respect) are: NOMINAL GDP growth, outstanding stock of debt, interest rate, and the primary budget balance. All else beeing equal, debt / GDP ratio will develeop in the same way, irrespective if (say) a 10 % nominal growth is due to 10 % real growht and zero inflation, 5 % real growth and 5 % inflation, zero real growth but 10 % inflation, or even 10 % real contraction and 20 % inflation.

Q1, “In Period 2, with the external sector adding more to demand now – surplus equal to 4 per cent of GDP and the budget balance unchanged (this is stylised – in the real world the budget will certainly change), there is a stimulus to spending and national income would rise.

The rising national income also provides the capacity for the private sector to save overall and so they can now save 2 per cent of GDP.”

Can you expand on that some more? Thanks!

“All federal spending happens like this. You will note that:

» Governments do not spend by “printing money”. They spend by creating deposits in the private banking system. Clearly, some currency is in circulation which is “printed” but that is a separate process from the daily spending and taxing flows.”

I’m not quite getting that.

For example, the gov’t gives me a tax cut of $100,000 with no bond attached.

Case 1, I get $100,000 of currency and then take it to the bank. Don’t I get a demand deposit for $100,000 and the bank gets a reserve markup of $100,000?

Case 2, the gov’t markups my demand deposit account for $100,000 and does the same $100,000 reserve markeup for the bank.

Aren’t those two cases the same?

Q3, “The upshot, however, is that the competition between the surplus banks to shed their excess reserves drives the short-term interest rate down. These transactions net to zero (a equal liability and asset are created each time) and so non-government banking system cannot by itself (conducting horizontal transactions between commercial banks – that is, borrowing and lending on the interbank market) eliminate a system-wide excess of reserves that the budget deficit created.

What is needed is a vertical transaction – that is, an interaction between the government and non-government sector. So bond sales can drain reserves by offering the banks an attractive interest-bearing security (government debt) which it can purchase to eliminate its excess reserves.”

Does it have to be that way? For example, there is a reserve requirement of 10% and enforced. The gov’t markups someone’s demand deposit account by $100,000 and markups the bank’s reserve account by $100,000 (no bond attached). The fed funds rate falls. Next, $1,000,000 in demand deposits from debt is created by borrowing. Doesn’t that get the reserve balance/fed funds rate back to where it was?

Q5, “The discussion also demonstrates why a falling inflation rate makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.”

If Q supplied is near or above Q demanded in most markets so that the economy has gone from mostly real aggregate supply constrained to real aggregate demand constrained, does that mean people should stop trying to create more medium of exchange from the demand deposits from debt (whether private or gov’t) because at least one of the major economic entities has been experiencing negative real earnings growth?

In other words, stop trying to grow real AS more than real AD and using debt (whether private or gov’t) to make up the difference.

Q5, “The discussion also demonstrates why a falling inflation rate makes it harder for the government to reduce the public debt ratio – which, of-course, is one of the more subtle mainstream ways to force the government to run surpluses.”

IMO, The Great Depression, Japan, and the “Great Recession” are nothing more than medium of exchange problems caused by the spoiled and rich, the bankers, and the economists.

Fed up “IMO, The Great Depression, Japan, and the “Great Recession” are nothing more than medium of exchange problems caused by the spoiled and rich, the bankers, and the economists.”

-Can you expand on what you mean by “medium of exchange problems”. To my mind a big part of MMT is that it is championing an indefinate expansion of net financial assets. Supposidly inflation and GDP growth means that this is a stable situation that can endlessly proceed harmlessly. BUT if you look around people are harnessing this tide of expansion to redistribute power to a parasitic financial elite. The only point of it all is to counteract net saving. Why is net saving so sacrosanct?

Q3 reminds me of a probably elementary accounting question I’ve long had about U.S. government spending, having seen it illustrated with T accounts. If the federal government consistently runs a deficit, then it seems to me the balance in the Treasury’s account at the Fed would eventually fall to zero. Yet I understand that can’t be correct because the federal government is not revenue constrained. Since it’s the Fed and not the Treasury that creates new dollars, how exactly is the Treasury’s account replenished as necessary?

Stone’s post said: “Fed up “IMO, The Great Depression, Japan, and the “Great Recession” are nothing more than medium of exchange problems caused by the spoiled and rich, the bankers, and the economists.”

-Can you expand on what you mean by “medium of exchange problems”.”

I’ll try.

The medium of exchange is a commodity like any other. If the amount of medium of exchange is about correct and then an economy starts producing more goods and services, more medium of exchange needs to be created to keep it from rising in value and being used as a savings vehicle.

Right before the Great Depression there was a big increase in private debt (demand deposits, a medium of exchange) with little price inflation and an asset bubble.

Same with the “Great Recession”, and I am pretty sure the same with Japan.

If there were more currency with no bond attached created (present spending in the present) instead of the demand deposits from debt (future demand brought to the present), debt defaults leading to an decrease in the amount of medium of exchange would not have happened. Of course, the spoiled and rich would have hated it if workers would have been paid more and asset bubbles would probably not have happened.

It should have been:

savings of the rich plus savings of the lower and middle class = dissavings of the currency printing entity with currency and no bond attached plus the balanced budget(s) of the various level(s) of gov’t NOT

savings of the rich = dissavings of the gov’t (with debt) plus dissavings of the lower and middle class (with debt)

stone said: “To my mind a big part of MMT is that it is championing an indefinate expansion of net financial assets.”

I think the difference between net financial assets and medium of exchange needs to be explained.

To me, medium of exchange is currency plus the demand deposits from debt.

I not completely sure how MMT defines net financial assets.

Lex, by create new dollars, do you mean currency only?

Can you give some more detail about your accounts question?

The posters here at billy blog have told me that when the gov’t spends/”tax cuts” a demand deposit account is marked up and the target bank’s reserve account is marked up. That mark up is 1 to 1.

bill, can some kind of alert be given when someone presses the preview button, but has not answered the anti-spam math question? Thanks!

stone said: “Why is net saving so sacrosanct?”

1) The spoiled and rich like the power it gives them.

2) Way too many economists (if not almost all of them) think real aggregate demand is unlimited or think real aggregate supply can never reach real aggregate demand. That leads them to believe the economy will grow by the amount real aggregate supply grows. Now they can say we need to spoil the rich because the more saving they do, the more investing they will do to increase real aggregate supply. They can also say debt that does not produce price inflation (more like wage inflation) doesn’t matter so don’t worry about the bankers being enriched. Along the same line of thinking, asset bubbles don’t matter either.

FedUP, thanks for your explanations. But when you say “Way too many economists (if not almost all of them) think real aggregate demand is unlimited or think real aggregate supply can never reach real aggregate demand. That leads them to believe the economy will grow by the amount real aggregate supply grows. Now they can say we need to spoil the rich because the more saving they do, the more investing they will do to increase real aggregate supply”

-do you class economists such as MMTers like Bill as proclaiming such a view point? I got the impression that MMTers were very aware of aggregate demand problems and yet MMTers are as wedded to facilitating net saving as anyone. The irony is that it obviously will never be possible for people to own more than 100% of planet Earth. As such “net saving” will always be a phoney delusion BUT the attempts to reach for it do have real consequences. The price volatility that those attempts create is a bumper harvest for sophisticated speculators.

stone, check back again soon.

“Way too many economists (if not almost all of them) think real aggregate demand is unlimited or think real aggregate supply can never reach real aggregate demand. ”

This would be the usual point of view of the supply-side crowd, and not of MMT, of course…

stone said: “The irony is that it obviously will never be possible for people to own more than 100% of planet Earth.” But …

can a very small number of people own 100% of planet Earth while the rest own none of it?

Here is the simple version of Michael Hudson’s neofeudalism:

The very few experience extremely positive real earnings growth, accumulate all the assets, and accumulate all the retirement. Everybody else experiences negative real earnings growth, lose all their assets, and lose all their retirement.

stone said: “I got the impression that MMTers were very aware of aggregate demand problems and yet MMTers are as wedded to facilitating net saving as anyone.”

Good Habit’s post said: “”Way too many economists (if not almost all of them) think real aggregate demand is unlimited or think real aggregate supply can never reach real aggregate demand. ” [Fed Up]

This would be the usual point of view of the supply-side crowd, and not of MMT, of course…”

What should happen if real aggregate supply is growing 2.5% to 3% per year, real aggregate demand is growing 1% per year (about population growth), and there is already enough real aggregate supply? IMO, there should be more retirement.

stone said: “-do you class economists such as MMTers like Bill as proclaiming such a view point?”

Very partially because of the jobs guarantee but nowhere near as bad as most economists.

Here is what I normally see and from:

http://www.thefiscaltimes.com/Columns/2011/05/25/Unemployment-Why-Stimulus-Hasnt-Created-More-Jobs.aspx

“Supply-side policies, which almost always involve tax cuts and tax credits, attempt to stimulate the three factors that determine economic growth: technological innovation, growth in the capital stock, and growth in the labor force. Examples of these policies include tax credits for R&D; capital gains and dividend tax cuts to increase investment; and income tax reductions to boost both labor supply and entrepreneurial activity.

Demand-side polices are used when the economy strays off of its optimal long-run growth path. In recent decades we have relied mainly on monetary policy– and secondarily on changes in tax rates–to offset business-cycle fluctuations and stabilize the economy. But in the Great Recession, government spending has played a more prominent role.”

Notice the “optimal long-run growth path.” I take that to mean real GDP should grow by the amount real aggregate supply grows. No clue that real GDP could grow by less (real aggregate demand). Notice monetary policy and changes in tax rates. IMO, that is mostly about more private debt (medium of exchange) and more gov’t debt (medium of exchange) to attempt to stabilize and grow an economy (the so called great moderation).

“There are still 11 million people who need jobs, and we are doing very little to help with this problem.”

And, “Those who promote supply-side policies above all else might be surprised at how much growth will be helped nonetheless by policies that avoid the long-term problems associated with high and persistent unemployment.”

Jobs, jobs, jobs. No mention of retirement, retirement, retirement.

Fed Up, I take your point about the Job Guarentee being supply side leaning. I think what you’re saying fits in with my anxieties about MMT too. From what I can see demand side problems are just a symptom of wealth inequality. I agree that supply is best pulled up by demand with demand being limited to what is -demanded- on the basis of wealth equality. If demand and supply are lower because people want to spend more time on activities that don’t “make money” and want to throw away less stuff- then that is what is wanted and why is that a problem? It only becomes a problem if there is wealth inequality. I think the basis for supply side economics is that “development” is the goal. Supply side policies are hoped to chivy people into forcing ‘development”. The irony is that they chivy people into speculation and waste.

Fed up “What should happen if real aggregate supply is growing 2.5% to 3% per year, real aggregate demand is growing 1% per year (about population growth), and there is already enough real aggregate supply? IMO, there should be more retirement.”

-It is questionable whether there is enough of the “right kind” of aggreagate supply (even in the UK there is a shortage of basic palliative care for the terminally ill etc). But I totally think that facilitating supply of what the current distorted economy is demanding will only make things worse. The current demand is for “wealth management services” and gulfstream jets. What the world would demand were it not for wealth inequality is things like safe water supplies etc.

Fed up “Jobs, jobs, jobs. No mention of retirement, retirement, retirement.”

Of course we could lower the retirment age to 50 – or even less. Or have a Job Guarantee that gives everyone a minimum wage – of say $ 100 a day for work – and a citizens (or resident) bonus of $ 70 a day (for doing nothing). So even those without the desire for work could choose to retire early, at a time of their choice…

As a monetary sovereign government can always pay for a Job Guarantee and for retirement, trough deficit spending, there is no reason why their should be unemployment (ever), and why retires should not have a decent standard of living and good healt care.

stone said: “If demand and supply are lower because people want to spend more time on activities that don’t “make money” and want to throw away less stuff- then that is what is wanted and why is that a problem? It only becomes a problem if there is wealth inequality.”

There is also the “problem” for the rich that stock prices won’t be as high as they want and budget/balance sheet problems by insisting that all new medium of exchange has to be the demand deposits from debt (future demand brought to the present). That also ties into my claim that real aggregate demand only grows by the population growth at some point. If real AD grows by 1%, real AS grows by 1%, and real AS could grow by 2.5% to 3%, then the real AS part (mostly corporations) will need fewer workers.

Good Habit said: “Of course we could lower the retirment age to 50 – or even less. Or have a Job Guarantee that gives everyone a minimum wage – of say $ 100 a day for work – and a citizens (or resident) bonus of $ 70 a day (for doing nothing). So even those without the desire for work could choose to retire early, at a time of their choice…”

My idea is to fund retirement from savings and guaranteed interest (currency printing with no bond attached) so that no other entity has to pay/earn the interest. IMO, that should be separate from the gov’t budget(s). If the number of retirees is near correct, then hopefully no job guarantee(s) would be necessary (the labor market is tight enough).

stone, about income/wealth inequality. IMO, an economy only needs enough income/wealth inequality to function well. For example, skilled jobs (like a doctor) should make more than unskilled jobs. Wages might need to adjust based on shortages. Maybe there is a need for more housekeepers at hotels vs. more waiters/waitresses in a restaurant.

FedUp “stone, about income/wealth inequality. IMO, an economy only needs enough income/wealth inequality to function well. For example, skilled jobs (like a doctor) should make more than unskilled jobs. Wages might need to adjust based on shortages. Maybe there is a need for more housekeepers at hotels vs. more waiters/waitresses in a restaurant.”

-I think that that is the big distinction between wealth inequality and wage inequality. Currently there is a real return on capital for the most wealthy so the more wealthy people are the more wealthy they become just on the basis of being wealthy. The expansion of medium of exchange as you put it allows that process to continue to become more extreme. If it were not for that, crisis would be reached quickly and sharply rather than ballooning over decades. I’m just saying that an asset tax is needed to keep things from distorting off track.

stone said: “-I think that that is the big distinction between wealth inequality and wage inequality. Currently there is a real return on capital for the most wealthy so the more wealthy people are the more wealthy they become just on the basis of being wealthy.”

What about wages for upper management?

And, “The expansion of medium of exchange as you put it allows that process to continue to become more extreme. If it were not for that, crisis would be reached quickly and sharply rather than ballooning over decades.”

Now I say that depends on the type of medium of exchange. If the new medium of exchange does not have a bond attached then the rich don’t get a new asset. It is the debt/loan (asset) that allows the time differences between spending and earning to “balloon over decades”.

And, “I’m just saying that an asset tax is needed to keep things from distorting off track.”

I’d rather go with a progressive (100% if necessary) tax that treats all income (wage, dividend, capital gain, etc.) the same.

FedUp ‘It is the debt/loan (asset) that allows the time differences between spending and earning to “balloon over decades”.”

-I see your point about the very nature of debt being that it is expansionary and that is a root to the problem. But I also think even without debt, if tax does not mop up the goverment spending you can get a ponzi asset bubble effect that is much the same.

“I’d rather go with a progressive (100% if necessary) tax that treats all income (wage, dividend, capital gain, etc.) the same.”

-The big problem is “unrealised capital gains”. That is where most wealth is. An asset tax is so basic it can not be dodged.”

FedUp “If the new medium of exchange does not have a bond attached then the rich don’t get a new asset.”

-I really think it is vital to scrutinize the idea that having a bond attached leads to more rather than less wealth transferance to the richest. If taxation does not mop up goverment spending and no new goverment bonds are issued, the rich do not revert to holding 100% cash portfolios. They employ their money to drive the prices of existing assets and to induce others to take on private debts. If extra money is constantly brought in to bid for a fixed collection of assets then the effect on the price of those assets is extremely dramatic. It is more complex to speculate in commodities etc than to hold goverment bonds but that actually works in the favour of the very richest. Increasingly the very rich are actually the same people as the expert speculators. Rennaissance Technologies is probably the most lucrative speculating outfit there is and they largely speculate on the employees’ account rather than for outside clients. Pension funds etc can hold goverment bonds to maturity as an idiot proof store of value. When pension funds are induced into more speculative strategies they become the suckers at the poker table -transfering pension contributions to the likes of Rennaissance Technologies, Goldman Sachs etc.

stone, define for me your asset tax.

FedUp, what I was meaning by an asset tax was to move the tax burden so that it was a fixed percentage of the value of all the gross assets of each citizen of the country irrespective of where they were held or in what form. So cash, land, bonds, shares, collectables etc etc would all be taxed at the same rate as each other every year. In order to legally own anything you would have to be up to date on the asset tax for it.

stone, I don’t want an asset tax on the medium of exchange (cash and other). That can mess up its supply.

I need to think about the others, but at first glance I would want them to be progressive too because the tax is a cost which can lower living standards.

FedUp “stone, I don’t want an asset tax on the medium of exchange (cash and other). That can mess up its supply. I need to think about the others, but at first glance I would want them to be progressive too because the tax is a cost which can lower living standards.”

-I think the key thing is that government spending constantly replenishes the medium of exchange so that the supply is never reduced. A citizens’ dividend could be used to recyle it out to the population. Inflation/deflation also acts to align the value of the cash supply with what the economy requires. I think it is stunning just how much more “progressive” a flat asset tax is than other forms of tax. In 2007 Warren Buffet owned $52B and had an income/realised capital gains of $46M. He paid 17.7% tax on that $46M of income ie $8M. For him, even if income/capital gains tax was 100%; an asset tax of just 0.1% would be greater! If the entire current tax burden was transfered to being a flat asset tax then it would transform the way profits get distributed through the economy.