I started my undergraduate studies in economics in the late 1970s after starting out as…

Structural deficits and automatic stabilisers

In the coming period and probably years you should expect to hear, read and be submerged with mainstream economists coming out and assessing the structural budget deficit. Across most economies, these so-called “experts” will be arguing that the structural deficit in the nation is too high and deep cuts are needed to bring it into surplus. The importance of this debate is that they use the structural deficit estimates as an indicator of the fiscal stance being taken by the government and thus separate out the effect of the automatic stabilisers. The problem is that it is an inexact science. The mainstream approach is highly dependent on the NAIRU concept (see below) and thus will err on the side of concluding that the deficit is “too big” and “likely to cause inflation”, whereas it is probable that the deficit will be too small to underpin private savings and high levels of employment.

I wrote a primer on this topic in this blog – Structural deficits – the great con job!. From the title you can glean that this is one area of economic commentary where caution and some knowledge is required. Translated that means – do not accept what the mainstream economists say because they deliberately skew the measurement to suit their ideological pre-occupations.

I was reading an interesting research paper today by the US Congressional Budget Office entitled Measuring the Effects of the Business Cycle on the Federal Budget and says its object is to offer “an alternative measure of the budget that incorporates adjustments for the effects of the business cycle”.

On Page 3 of the CBO document we read:

Calculations of the cyclically adjusted budget attempt to remove the effects of the business cycle on revenues and outlays (that is, the cyclical part of the budget).

So this is about decomposing the impacts of the automatic stabilisers from those attributable to the underlying fiscal stance. Both the revenue and spending side of the budget are adjusted.

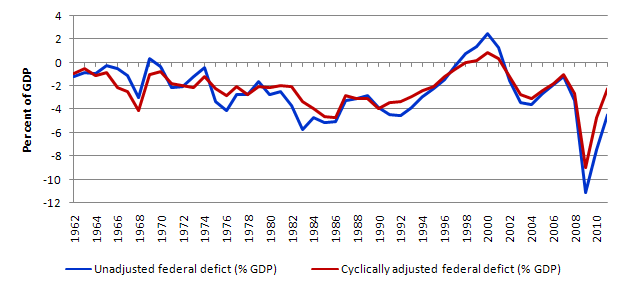

This graph uses CBO data (available from their home page) and depicts the actual US federal deficit and the cyclically-adjusted federal deficit as a percentage of GDP.

They describe the recent history as follows:

CBO estimates that under the laws in place as of March 2009, the cyclically adjusted deficit will climb from 2.6 percent of potential GDP in 2008 to 9.0 percent in 2009 before falling to 4.7 percent in 2010 and 2.2 percent in 2011. The increase from 2008 to 2009 and the decrease in 2010 are the largest on record, reflecting primarily the effects of the TARP legislation, assistance to Fannie Mae and Freddie Mac, and the American Recovery and Reinvestment Act of 2009 (Public Law 111-5), which together will increase the deficit by $812 billion in 2009 and by $445 billion in 2010. (Without those costs, the cyclically adjusted deficit would be about 3.6 percent of potential GDP in 2009 and roughly 1.9 percent in 2010.)

This is the graph uses CBO data for their estimated “cyclical factors” which can be taken to mean the automatic stabiliser component (as a percentage of GDP) of the US federal deficit. The values for 2009-2011 are estimates only.

So they are estimating that 2.1 per cent of GDP in the current deficit (2009) is automatic. This will rise to 2.6 per cent in 2010 and fall back to 2.2 per cent in 2011.

The problem is that these automatic stabilisers are likely to be understated as a result of the estimation technique used by the CBO.

On Page 3 of the CBO document we read:

CBO’s estimates of the cyclical component of revenues and outlays depend on the gap between actual and potential GDP. Thus, different estimates of potential GDP will produce different estimates of the size of the cyclically adjusted deficit or surplus. More specifically, the calculations remove the budgetary effects of the economy’s falling below or rising above its potential level of output and the corresponding rate of unemployment.

CBO define Potential GDP as “the level of output that corresponds to a high level of resource-labor and capital-use.” So how do they estimate potential GDP? They explain their methodology in this document.

In 2007 Update they say:

The cyclical contribution to revenues is negative when actual gross domestic product (GDP) is less than potential GDP. The cyclical contribution to mandatory spending is positive when the unemployment rate is higher than the natural rate of unemployment.

While the technicalities are not something I will go into in this blog – see my recent book with Joan Muysken – Full Employment abandoned for the mathematical and econometric chapter and verse, suffice to say that they CBO uses the standard mainstream method.

CBO say that they:

They start with “a Solow growth model, with a neoclassical production function at its core, and estimates trends in the components of GDP using a variant of a tried-and-tested relationship known as Okun’s law. According to that relationship, actual output exceeds its potential level when the rate of unemployment is below the “natural” rate of unemployment) Conversely, when the unemployment rate exceeds its natural rate, output falls short of potential. In models based on Okun’s law, the difference between the natural and actual rates of unemployment is the pivotal indicator of what phase of a business cycle the economy is in.

The resulting estimate of Potential GDP is “an estimate of the level of GDP attainable when the economy is operating at a high rate of resource use” and that if “actual output rises above its potential level, then constraints on capacity begin to bind and inflationary pressures build” (and vice versa).

So despite saying that their estimate of Potential GDP is “the level of output that corresponds to a high level of resource-labor and capital-use” what you really need to understand is that it is the level of GDP where the unemployment rate equals some estimated NAIRU.

Intrinsic to the computation is an estimate of the so-called “natural rate of unemployment” or the Nonaccelerating Inflation Rate of Uunemployment (the dreaded NAIRU). This is the mainstream version of “full employment” but is, in fact, an unemployment rate which is consistent with a stable rate of inflation.

Given the history of estimates of the NAIRU (more below), the “steady-state” unemployment could be as high as 8 per cent or as low as 3 per cent. The former estimate would hardly be considered “”high rate of resource use”. Similarly, underemployment is not factored into these estimates.

The concept of a potential GDP in the CBO parlance is thus not to be taken as a fully employed economy. Rather they use the devious shift in definition in mainstream economics where the the concept of full employment is not constructed as the number of jobs (and working hours) that which satisfy the preferences of the available labour force but rather in terms of the unobservable NAIRU.

Policy makers constrain their economies to achieve this (assumed) cyclically invariant benchmark. The NAIRU is not observed and a range of techniques are used to estimate it. Yet, despite its centrality to policy, the NAIRU evades accurate estimation and the case for its uniqueness and cyclical invariance is weak. Given these vagaries, its use as a policy tool is highly contentious.

CBO say that their estimates of the NAIRU are derived from “historical relationship between the unemployment rate and changes in the rate of inflation”, in other words, a Phillips Curve. Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

In my recent book with Joan Muysken – Full Employment abandoned we provide an extensive critique of the NAIRU concept. You can also read an earlier working paper I wrote – The unemployed cannot find jobs that are not there! which documents the problems that are encountered when relying on the rubbery NAIRU concept for policy advice.

In an interesting article not long before his death Franco Modigliani, who had in 1975 introduced the term NAIRU to the economics profession, said the following (which I read as a recantation):

Unemployment is primarily due to lack of aggregate demand. This is mainly the outcome of erroneous macroeconomic policies …[the decisions of Central Banks] … inspired by an obsessive fear of inflation … coupled with a benign neglect for unemployment … have resulted in systematically over tight monetary policy decisions, apparently based on an objectionable use of the so-called NAIRU approach. The contractive effects of these policies have been reinforced by common, very tight fiscal policies (emphasis in original)

(Reference: Modigliani, Franco (2000) ‘Europe’s Economic Problems’, Carpe Oeconomiam Papers in Economics, 3rd Monetary and Finance Lecture, Freiburg, April 6, page 3).

From the mid-1970s to the present day very few countries have enjoyed full employment. Most countries have suffered a lengthy period of deficient aggregate demand which corresponded with the regime shift in macroeconomic policy making that accompanied the OPEC oil price hikes in the 1970s.

Unemployment rates in almost all OECD economies rose and persisted at higher levels since the first OPEC shocks in the 1970s. The mainstream response has been to argue that the persistently high unemployment is sourced in institutional arrangements in the labour market (wage setting mechanisms and trade unions) and government welfare policies (encouraging people to engage in inefficient search).

But in fact the major reason for the unemployment lies in demand shifts, which have reflected the unwillingness of policy makers to use fiscal and monetary policy in an appropriate manner.

The rapid inflation of the mid-1970s left an indelible impression on policy makers, which became captive of the resurging new labour economics and its macroeconomic counterpart, monetarism.

The goal of low inflation replaced other policy targets, including low unemployment. The result has been that GDP growth in OECD countries has generally being below that required to absorb the labour force growth and the growth in labour productivity.

Consistent with this new ruling economic paradigm, the available policy instruments have narrowed with Governments reluctant to use taxation and spending to provide stimuli to their economies, and have instead placed an excessive reliance on tight monetary policy to control inflation. The upshot has been deflated economies with stifled economic activity.

The experience of the OECD economies has been replicated, but with harsher consequences, in the nations that have been subjected to the disastrous IMF and World Bank structural adjustment programs.

The dominant concept over this whole period of persistently high unemployment has been the NAIRU.

There is also mounting evidence against the dynamics implied by the NAIRU approach (if you source the papers/book I linked to above you can find the primary sources of these claims).

The NAIRU literature began with the position that the NAIRU was constant and cyclically-invariant (not sensitive or able to be manipulated by fiscal or monetary policy). On this basis, the NAIRU advocates pressured governments to deflate their economies and push unemployment up. Most of the reasonable econometric studies have found that the estimated NAIRU, as originally conceived is anything but constant.

Early conceptual challenges from the theories of hysteresis. This is one of the topics I examined for my PhD thesis. The point here is that estimated NAIRUs were highly dependent on the level of the actual unemployment rate – and followed the path of the actual rate very closely. In other words, it made the concept meaningless.

The reason for this cyclical sensitivity in the estimates is that the business cycle invokes structural shifts that are reversable. For example, in a downturn workers lose their jobs and those working on marginal capital (that is shed) lose their productive skills. In the upturn, they are typically offered chances to retrain and so what looks like a structural impediment at the bottom of the cycle is eliminated by policies that stimulate aggregate demand.

These structural adjustments in the labour market are thus driven by aggregate demand changes which killed the mainstream insistence on a structurally-invariant natural rate.

Faced with mounting criticism, the NAIRU theorists progressively moved to a position where time variation in the steady-state was allowed but this variation is seemingly not driven by the state of demand – the so-called TV-NAIRUs estimated by Robert Gordon and others.

So this meant that the inflation-stable equilibrium defined by the NAIRU was tenuous because the NAIRU itself was not invariant. But they salvaged their theory that aggregate demand policy was ineffective in real terms and would only be inflationary by claiming that that variation over time in the NAIRU was due to other (supply) factors.

No convincing story or ratification with data exists to establish the TV-NAIRU.

But the TV-NAIRU phase spawned a frenetic period of estimation using a range of technical methodologies including state space techniques (Kalman filter); univariate extrapolation methods (filters and smoothers), and spline estimation.

Like the original concept, the attempts to model the time variation have been based on shaky theoretical grounds. The theory that generated the NAIRU in the first place provides no guidance about its evolution.

Presumably, the evolution of unspecified structural factors have played a role, if we are to be faithful to the original (flawed) idea. In this theoretical void, econometricians have assumed that a smooth evolution is plausible but these slowly evolving NAIRUs bear little relation to actual economic factors.

The extrapolation and smoothing approaches are particularly blighted here. Some authors have the temerity to merely run a smoothing filter through the actual series and assert that this captures the NAIRU.

Most of the research output confidently asserted that the NAIRU had changed over time but very few authors dared to publish the confidence intervals around their point estimates.

One study that did (Staiger,D., Stock, J.H., and M.W. Watson (1997) ‘The NAIRU, Unemployment and Monetary Policy’, Journal of Economic Perspectives, 11(1), 33-49) provided shattering evidence for the viability of the NAIRU as a policy construct.

Staiger, Stock and Watson (page 46) use what they call “state-of-the-art” estimation techniques to compute the NAIRU and conclude that:

… these estimates are imprecise; the tightest of the 95 percent confidence intervals for 1994 is 4.8 to 6.6 percentage points. If one acknowledges that additional uncertainty surrounds model selection and that no one model is necessarily ‘right’, the sampling uncertainty is prudently considered greater than suggest by the best-fitting of these models.

They found that some of their models yield 95 percent confidence intervals of 2.9 percent to 8.3 percent. So while the concept is seemingly precise in theory, the empirical estimates are so variable and subject to such large standard errors that the NAIRU is too imprecise to be useful.

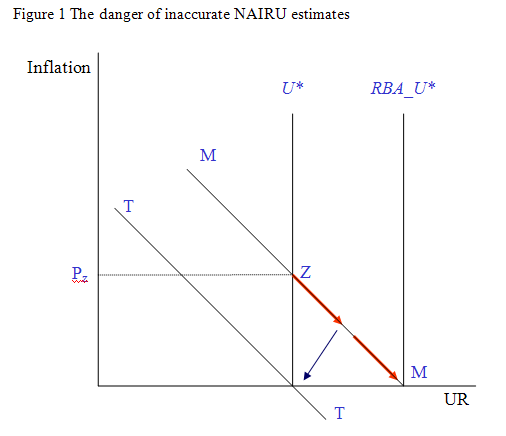

Here is a diagram that shows you the dangers of using this concept at an empirical level, quite apart from its flawed theoretical perspective. Figure 1 examines the case where a cost shock (Z) is misinterpreted by the Central Bank as a demand shock. We are assuming here that a linear short-run Phillips curve exists (which plots the relationship between inflation and unemployment). I have shown two of them in this diagram.

The point where the Phillips curve cuts the horizontal axis is deemed the NAIRU – so again assuming it exists for the sake of argument – we draw the “true” NAIRU as the vertical line (U*).

The central bank (in this case the RBA) believes on the basis of its econometric estimates that the NAIRU is RBA_U* whereas the true U* is at the bottom of the standard error band. This example is to highlight the fact that in econometric studies the standard errors tell you the range within which the “true” value will lie. True doesn’t mean truth in this context.

As a consequence they contract monetary policy (increase interest rates) which pushes unemployment up (it will after some large rise in interest rates). They are targetting an UR at M whereas the actual U* is at T (again playing along with their framework for the sake of exposition).

Without going into the full Expectations-augmented Phillips Curve story, the RBA would be maintaining higher unemployment rates for longer because their estimates of the NAIRU were inaccurate (even if it existed at all). This is Modigliani’s point above.

There was (and it is simmering at present – being held in check by the massive downturn) an obsession with NAIRU’s and their importance for policy. It is no wonder that fiscal policy was relegated and monetary policy elevated to policy prominence during this very sorry period in the history of ideas.

A further problem is that the modern studies include a host of other variables, which can influence the inflation rate independently of the unemployment gap. In this case, the NAIRU hypothesis, if valid at all, loses policy relevance. But, unfortunately, the losses from a deflationary strategy are higher under these conditions and this reinforces the points made earlier.

If the monetary authority responds to shifts in the Phillips curve independent of the unemployment rate with higher interest rates, the eventual losses from rising unemployment (and in a hysteretic world rising steady-state unemployment) will be larger.

One might conjecture that the authorities should only react to endogenous factors (the unemployment gap). But then if it cannot measure that accurately and cannot decompose the different sources of inflation impulse, then this strategy will also fail. The safest strategy is to avoid the use of monetary policy in this way.

There are several Non-NAIRU stylised facts, which have always posed considerable challenges at both the both the theoretical and empirical levels for those who adhere to the NAIRU hypothesis (these are all covered in Full Employment abandoned):

- Unemployment rates exhibit high degrees of persistence to shocks.

- The dynamics of the unemployment rate exhibit sharp asymmetries over the business cycle.

- The models developed by LNJ (1991), which have motivated a large amount of NAIRU research, are misspecified because they exclude capital by artificially imposing a unity elasticity of substitution on the technology.

- Inflation dynamics do not seem to accord with those specified in the NAIRU hypothesis.

- Close relationships exist between employment and vacancies growth and the inverse of the unemployment rate, and between investment to GDP ratios and the unemployment rate across many countries. They are difficult to interpret as being driven from the supply-side.

- High real interest rates seem to cause high unemployment.

- The constant NAIRU has been abandoned and replaced by TV-NAIRUs, which have such large standard errors. The NAIRU-concept is now all but meaningless for policy analysis.

- Estimates of steady-state unemployment rates are cyclically-sensitive (hysteretic) and thus the previously eschewed use of fiscal and monetary policy to attenuate the rise in unemployment has no conceptual foundation.

- There is no clear correlation between changes in the inflation rate and the level of unemployment, such that inflation rises and falls at many different unemployment rates without system.

- The use of univariate filters (Hodrick-Prescott filters) with no economic content and Kalman Filters with little or no economic content has rendered the NAIRU concept relatively arbitrary. Kalman Filter estimates are extremely sensitive to underlying assumptions about the variance components in the measurement and state equations. Small signal to noise ratio changes can have major impacts on the measurement of the NAIRU. Spline estimation is similarly arbitrary in the choice of knots and the order of the polynomials.

But undaunted by the facts which might get in the road of their preferred theories, the NAIRU camp continue to be influential. We have seen in recent days (I refer to Mark Thoma’s response to a billy blog reader to engage in a debate) how blinkered the mainstream is when it comes to facts.

Their response is (and always has been) along the lines of “I think that alternative theory is funny” (funny ha ha!) or “It is obvious there is a NAIRU and we can estimate it reasonably accurately. Anyone who doesn’t believe that is not worth debating”. Or, they just ignore the evidence and the reality and proceed as normal protected by their academic tenure and/or the political masters they serve.

Automatic stabilisers and fiscal rules

Once you understand how the automatic stablisers work then you will realise that governments that pursue fiscal rules like a balanced budget or in the case of German’s constitutional amendment recently the illegality of any budget deficit in a few year’s time are actually denying the operation of the automatic stablisers.

So the variance of economic activity is increased – the booms are bigger (probably more inflationary) and the recessions deeper – because the attenuating effect of the automatic stabilisers on aggregate demand are negated. I cover those issues in this blog – Fiscal rules going mad … for further information.

The imposition of fiscal rules is the anathema of modern monetary theory (MMT), which instead sees virtue in bolstering the strength of the automatic stabilisers via the introduction of an employment guarantee. This would strengthen the automatic (endogenous) component of the budget by offering and unconditional job to anyone who wanted one at the minimum wage.

So when private demand fell (and hence aggregate demand fell) more people would seek a Job Guarantee position and government outlays would rise as tax revenue falls.

It it true that the expenditure side is already endogenous in most countries. In Australia, the Federal government pays unemployment benefits to qualified applicants. In the US, for example, the Federal government makes outlays under its Supplemental Nutrition Assistance Program (the old food stamps program). Other less obvious public outlays rise as a result of recession. For example, health care and criminal justice costs rise as the costs of unemployment impacts extend beyond the loss of income.

In Australia, it is likely that the introduction of a JG and the abolition of unemployment benefits would increase the endogenous outlays associate with a downturn because the JG wage would exceed the benefit. But once you take into account the other factors – for example, the JG workers would be paying tax whereas if they remained unemployed they would not – and the fact that the accompanying social costs of unemployment are likely to be lower – then the introduction of a JG would constitute a relatively small net outlay. We have done extensive modelling on this question and you can find it in a recent report we published last year (after a 3-year project) – Creating effective local labour markets: a new framework for regional employment policy.

I cannot comment on the net effects for other countries at the empirical level but it would be an interesting exercise. Randy Wray and Philip Harvey, among others have done work like this for the US and show a modest net impact.

But this doesn’t mean that aggregate demand has to increase overall. The government could make discretionary changes to the taxes and outlays to negate any impact of the JG via the automatic stabilisers. Randy Wray and myself wrote a couple of papers on that issue which appeared in the Journal of Economic Issues a few years ago. You can read the Working Paper version the 2005 paper here.

Conclusion

Most economists (not me) estimate the structural balance by basing it on the NAIRU or some derivation of it – which is, in turn, estimated using very spurious models.

This allows them to compute the tax and spending that would occur at this so-called full employment point. But it severely underestimates the tax revenue and overestimates the spending and thus concludes the structural balance is more in deficit (less in surplus) than it actually is.

They thus systematically understate the degree of discretionary contraction coming from fiscal policy.

So they are trying to tell us that the business cycle moves around a fixed point and above that the economy is operating with spare capacity and below it the economy is operating over full capacity.

Overall message: beware of any discussions about structural budget positions that use the NAIRU as the means to estimate potential GDP.

CofFEE Conference

It is a big week coming up in Newcastle. MMT-types are already arriving for this week’s Path to Full Employment Conference/16th National Unemployment Conference, which my research centre CofFEE runs each year. It starts on Thursday. You can visit the Conference Home Page for details. The final program is now released and you will see several MMT themes including a special MMT workshop.

It is a large annual gathering of MMT types from all over the World and several billy blog commentators have registered which will give us all a chance to meet face to face.

So if you are interested it is not too late to register. Hope to see some of you there. The weather by Thursday will be 30 odd degrees and the ocean temperature is at a (warm) 20.

I just recently found your blog and find it highly stimulating. Thanks for your insights!

I wonder how significant a JG program would really be. Minimum wage pay (at least here in the US) is truly minimal- hardly better then being on the dole, really. And if people underemployed in JG were spending most of their time looking for other better-paying work, the work product would end up being about as useful. On the whole, such a program would be marginally beneficial, while not creating any inflationary problems, as you indicate, so I would be all for it. The public sector certainly needs the extra injection of labor for parks, beautification, and countless other needs that are neglected most of the time (though with plenty of opposition from regular public employees, of course).

Professor Mitchell, are you saying that the job-guarantee scheme would involve the abolition of unemployment benefits? For some reason I was under the impression that there would still be an unemployment benefit.

I think it would be better to have the minimum-wage job guarantee as well as a lower unemployment benefit for those who opt not to take a job-guarantee position. Otherwise, I would be worried that: (i) a government might decide to introduce a job guarantee but at the same pay as the old unemployment benefit (work for the dole); or (ii) a government could introduce de facto conscription by making all the job-guarantee positions military related.

I think an unemployment benefit should still exist as a safeguard against these developments. If a government followed path (ii), an unemployed person without an independent income would have no real choice, because they could not survive without taking the guaranteed position. There would still be a strong incentive to take a job-guarantee position, because the minimum wage is above the unemployment benefit.

Actually, personally I would prefer a minimal – but universal – basic-income guarantee combined with the job-guarantee scheme.