I don't have much time today as I am travelling a lot in the next…

Money multiplier and other myths

Policies such as Quantitative Easing which has been in the news lately are predicated on a mistaken belief about the way the banking system operates and how the non-government and government sectors interact. One of the hard-core parts of mainstream macroeconomic theory that gets rammed into students early on in their studies, often to their eternal disadvantage, is the concept of the money multiplier. It is a highly damaging concept because it lingers on in the students’ memories forever, or so it seems. It is also not even a slightly accurate depiction of the way banks operate in a modern monetary economy characterised by a fiat currency and a flexible exchange rate. So lets see why!

Allegedly, the money multiplier m transmits changes in the so-called monetary base (MB) (the sum of bank reserves and currency at issue) into changes in the money supply (M). Students then labour through algebra of varying complexity depending on their level of study (they get bombarded with this nonsense several times throughout a typical economics degree) to derive the m, which is most simply expressed as the inverse of the required reserve ratio. So if the central bank told private banks that they had to keep 10 per cent of total deposits as reserves then the required reserve ratio (RRR) would be 0.10 and m would equal 1/0.10 = 10. More complicated formulae are derived when you consider that people also will want to hold some of their deposits as cash. But these complications do not add anything to the story.

The formula for the determination of the money supply is: M = m x MB. So if a $1 is newly deposited in a bank, the money supply will rise (be multiplied) by $10 (if the RRR = 0.10). The way this multiplier is alleged to work is explained as follows (assuming the bank is required to hold 10 per cent of all deposits as reserves):

- A person deposits say $100 in a bank.

- To make money, the bank then loans the remaining $90 to a customer.

- They spend the money and the recipient of the funds deposits it with their bank.

- That bank then lends 0.9 times $90 = $81 (keeping 0.10 in reserve as required).

- And so on until the loans become so small that they dissolve to zero …

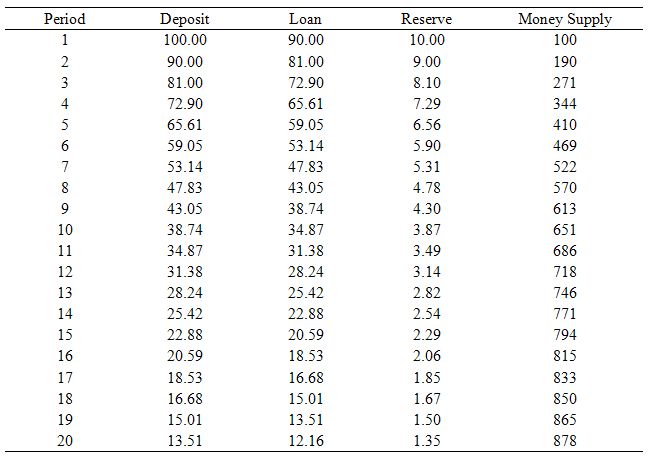

The following table and graphs shows you what the pattern involved is. They are self-explanatory. In this particular case, I have shown only 20 sequences. In fact, this example would resolve at around 94 iterations as you can see on the graphs where the succesive loans, then fractional deposits get smaller and smaller and eventually become zero.

The conception of the money multiplier is really as simple as that. But while simple it is also wrong to the core! What it implies is that banks first of all take deposits to get funds which they can then on-lend. But prudential regulations require they keep a little in reserve. So we get this credit creation process ballooning out due to the fractional reserve requirements.

Well that is not at all like the real world. It is a stylised text-book model which isn’t even close to how things actually operate. The way banks actually operate is to seek to attract credit-worthy customers to which they can loan funds to and thereby make profit. What constitutes credit-worthiness varies over the business cycle and so lending standards become more lax at boom times as banks chase market share.

These loans are made independent of their reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period. They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”. There is typically a penalty for using this source of funds.

At the individual bank level, certainly the “price of reserves” will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend.

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements. The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.

What about open market operations? These are allegedly how the central bank increases or decreases the money supply. So assume the central bank wants to increase the money supply it would purchase bonds in the markets and, accordingly, add reserves to the banking system. The banks in turn will try to lend those reserves out because they don’t want to be stuck with underperforming deposits and competition in the overnight markets will drive the interest rate down. Clearly, if the central bank wants to maintain control over the overnight interest rate it has to then drain the excess reserves which would require it offer the banks an interest-bearing asset commensurate with the overnight rate. That is, it would have to sell bonds in an open market operation. The reverse is true if it tried to reduce the money supply by selling bonds. This drains reserves from the cash system and would probably leave some banks short of required reserves. Given the only remedy for an overall shortage of reserves is intervention from the central bank the attempt to decrease the money supply fails.

It is clear that the central bank then is unable to control the volume of money in the system although it can control the price through its monetary policy settings. The money multiplier is a flawed conception of how things work. The monetary base does not drive the money supply. In fact, the reverse is true. So the reserves at any point in time will be determined by the loans that the banks make independent of their reserve positions.

So when you consider this in the light of the current policy debate you have to wonder what half the commentators are on! For example, it makes no sense to say that the credit crunch is because banks have no money to lend and that Quantitative Easing will provide them with “printed money” that they can then lend. Banks will always lend when a credit-worthy customer walks through the door and the terms are to the bank’s favour.

Endogenous money or Wicksellian myths

Mainstream economists are not the only group who demonstrate a misconception of the way the monetary system operates. Among so-called progressive economists there are many, who while recognising that we use a fiat currency (manifest as worthless tokens) rather than a “commodity money” (where the actual unit has intrinsic value), still fail to consider how the currency gets its value and its role in the non-government sector transactions. So-called Circulation or Wickesellian models of the credit cycle which fail to include a government sector are examples of these flawed approaches. In general, these models reject the money multiplier myth but replace it with another – that you can understand capitalism without understanding the essential role that Government plays in the monetary system.

Accordingly, these models consider economies as being made up of households (who supply productive factors and consume); firms (who produce) and banks (who loan working capital to firms in advance of production). And they then analyse the “circuits of production” whereby firms borrow from banks to hire and pay workers to produce. The workers then use their wages to consume and the firms then are able to pay back the banks. At that point the “credit money” is destroyed (and corresponding and offsetting assets and liabilities). Any household saving is reflected in unpaid bank loans at the end of each circuit unless firms offer “bonds” to the households to soak up their saving.

The Wicksellian view then is that “money” is largely created by banks in response to the demand for credit from economic agents. It is clear that the revolving fund of credit finance can expand to accommodate growth in private sector activity, at a rate related proportionately to the product of provisioning rates for capital adequacy requirements and the percentage of retained earnings available for leveraged lending. For this very reason, the private sector can take up some of the slack created through government fiscal conservatism. However, and this is the crux of the modern monetary view, this growth will become unsustainable because net financial assets are either being destroyed or are not being created in sufficient quantity to meet the net saving needs of the private sector. Private sector debt levels will be rising while the stock of net financial assets declines. But back to the main story!

So the “elephant in the room” which is ignored by these analyses is the question of the currency unit. Why would these transactional circuits use the unit that the Government has legally sanctioned? Why would anyone accept the unit of account? You cannot answer these fundamental questions if you have excluded the Government sector from your analysis. Further models that exclude government clearly cannot say anything about the important fiscal effects on bank reserves?

Modern monetary theorists consider the credit creation process to be the “leveraging of high powered money”. The only way you can understand why all this non-government “leveraging activity” (borrowing, repaying etc) can take place is to consider the role of the Government initially – that is, as the centrepiece of the macroeconomic theory. Banks clearly do expand the money supply endogenously – that is, without the ability of the central bank to control it. But all this activity is leveraging the high powered money (HPM) created by the interaction between the government and non-government sectors.

HPM or the monetary base is the sum of the currency issued by the State (notes and coins) and bank reserves (which are liabilities of the central bank). HPM is an IOU of the sovereign government – it promises to pay you $A10 for every $A10 you give them! All Government spending involves the same process – the reserve accounts that the commercial banks keep with the central bank are credited in HPM (an IOU is created). This is why the “printing money” claims are so ignorant. The reverse happens when taxes are paid – the reserves are debited in HPM and the assets are drained from the system (an IOU is destroyed). Keep this in mind.

HPM enters the economy via so-called vertical transactions. Please refer back to Deficit spending 101 – Part 1; Deficit spending 101 – Part 2 and Deficit spending 101 – Part 3 for the details and supporting diagrams.

So HPM enters the system through government spending and exits via taxation. When the government is running a budget deficit, net financial assets (HPM) are entering the banking system. Fiscal policy therefore directly influences the supply of HPM. The central bank also creates and drains HPM through its dealings with the commercial banks which are designed to ensure the reserve positions are commensurate with the interest rate target the central bank desires. They also create and destroy HPM in other ways including foreign exchange transactions and gold sales.

We can think of the accumulated sum of the vertical transactions as being reflected in an accounting sense in the store of wealth that the non-government sector has. When the government runs a deficit there is a build up of wealth (in $A) in the non-government sector and vice-versa. Budget surpluses force the private sector to “run down” the wealth they accumulated from previous deficits.

One we understand the transactions between the government and non-government then we can consider the non-government credit creation process. The important point though is that all transactions at the non-government level balance out – they “net to zero”. For every asset that is created so there is a corresponding liability – $-for-$. So credit expansion always nets to zero! In previous blogs I have called the credit creation process the “horizontal” level of analysis to distinguish it from the vertical transactions that mark the relationship between the government and non-government sectors.

The vertical transactions introduce the currency into the economy while the horizontal transactions “leverage” this vertical component. Private capitalist firms (including banks) try to profit from taking so-called asset positions through the creation of liabilities denominated in the unit of account that defines the HPM ($A for us). So for banks, these activities – the so-called credit creation – is leveraging the HPM created by the vertical transactions because when a bank issues a liability it can readily be exchanged on demand for HPM.

When a bank makes a $A-denominated loan it simultaneously creates an equal $A-denominated deposit. So it buys an asset (the borrower’s IOU) and creates a deposit (bank liability). For the borrower, the IOU is a liability and the deposit is an asset (money). The bank does this in the expectation that the borrower will demand HPM (withdraw the deposit) and spend it. The act of spending then shifts reserves between banks. These bank liabilities (deposits) become “money” within the non-government sector. But you can see that nothing net has been created.

Only vertical transactions create/destroy assets that do not have corresponding liabilities. My friend and sometime co-author Randy Wray puts it this way:

Credit money (say, a bank demand deposit) is an IOU of the issuer (the bank), offset by a loan that is held as an asset. The loan, in turn, represents an IOU of the borrower, while the credit money is held as an asset by a depositor. On this view, money is neither a commodity (such as coined gold), nor is it ‘fiat’ (an asset without a matching liability).

But what gives the unit of account chosen by the Government its primacy. Why do all the banks and customers demand it? The answer is that state money (in our case the $A) is demanded because the Government will only allow it to be used to extinguish tax liabilities. So the tax liability can only be met by getting hold of the Governments own IOU – the $A. Further, the only way that we can get hold of that unit of account is by offering to supply goods and services to the Government in return for their spending. The Government spending provides the funds that allow us to pay our taxes! That is the reverse of what most people think.

This process is how the Government ensures it can get private resources in sufficient quantities to conduct its own socio-economic policy mandate. It buys labour and other resources and creates public infrastructure and services. We are eager to supply our goods and services in return for the spending because we can get hold of $A.

So the private money creation activity that is central to many progressive models misses the essential point – that the credit creation activity is leveraging of the HPM – and is acceptable for clearing private liabilities (repaying loans) only because it is the only vehicle for extinguishing one’s tax liabilities to the state.

References

Graziani, A. (1990) ‘The Theory of the Monetary Circuit’, Economies et Societes.

Mosler, W.B. and Forstater, M. (2002) A General Analytical Framework for the Analysis of Currencies and Other Commodities.

Dear Bill,

brilliant! It clarifies a lot.

Thanks

Graham

Thanks Bill!

Was thinking that one precondition needed for Keen’s hypothosis to be correct would be that the RBA’s accounts should show a fairly strong upsurge in the lending to commercial banks through the discount window, given that the government has been witholding liquidity by running up surpluses for so many years.

Aside: how do we pronounce “fiat”? Is it “fee-at” or “feye-at”?

Further aside: obviously, the shrinking base of credit-worthy customers is squeezing banks profit margins. I don’t understand how home loan interest rates work. It does seem that the banks often ignore the RBA’s lead. Might we expect to see the banks jacking up interest rates to alleviate the falling profits caused by a fall in the number of credit-worth customers?

Dear Lefty

The banks can also borrow from abroad which is what they were doing.

Fiat = fee at

Home loans rates are conditioned by the RBA target rate which is essentially the rate at which funds can be borrowed overnight. But the banks are claiming that the cost of accessing reserves abroad has risen and this is why they cannot pass on the RBA cuts in full. At the same time they are getting lower cost funds because they are being guaranteed by the Federal government.

Thanks Bill.

I understand that they were borrowing from abroad but they have to exchange it for $AUSD that are already in existence or being created here don’t they? They can’t lend to Australians in yuan or $USD.

The money multiplier is sort of how I was imagining it to work (sort of). I was thinking yesterday that while the banks here lend to domestic customers in $AUSD, there is a constant inflow of deposits straight back to the very same banks in monthly mortgage, car loan, credit card payments etc that are the result of the banks lending in the first place. That this, and the fact that Australians have for years been increasing their debt-to-income ratio means that all the $AUSD being loaned out domestically by our banks are rapidly recycled back to the banks as deposits, giving them access to the $AUSD they need to keep lending in this country (while the government was witholding new $AUSD from entering circulation by running up surpluses) without needing to borrow from the reserve bank at all. While Australians have been digging deeper and deeper into debt.

But this would not create any new net money in the Australian economy and there would have to be limits to how far we could keep accelerating down this road (increasing the ratio of debt-to-income) before we started to drown in personal debt.

Dear Lefty

There was a mountain of new money pouring in each day. Have a look at the following graph (with the explanation of the series below). Remember also that banks don’t need deposits to lend! Loans create deposits. But you are right – the budget surpluses meant that the only way the economy could continue to grow was for the private sector (in our case – mostly households) to become increasingly indebted. It could not go on forever and is now unwinding fast.

M1 = Currency plus bank current deposits of the private non-bank sector

M3 = M1 plus all other ADI deposits of the private non-ADI sector.

Broad Money = M3 plus non-deposit borrowings from the private sector by AFIs, less the holdings of currency and bank deposits by RFCs and cash management trusts

ADI = Australian deposit-taking instutions.

AFI = Australian financial institutions

Non-bank ADIs include Credit Unions, Building Societies and Specialist Credit Card Institutions.

Thanks again Bill

But I’m still not sure I completely understand about the new money pouring in. Even though the banks can raise potentially unlimited amounts of money offshore, isn’t their ability to lend it out here in Australia going to be ultimately limited by how much Australian currency is available here to convert the foreign money they’ve raised into?

If 1 gumball=1 gobstopper (I’m assuming the exchange rate is 1:1), if I have 100 gumballs that I want to exchange for gobstoppers but my mate only has 50 gobstoppers, how can I get 100 gobstoppers from him if his mother (the fed) refuses to issue the other 50 gobstoppers because she wants to make sure that there is a surplus of gobstoppers in the lolly jar? He cannot give me what he does not have.

If the bank lends me $250 000 to build a house, surely that $250 000 must be available for the bank to lend NOW. The Builder must be paid now, the workers must be paid now, the cement company must be paid now.

I understand that the banks are not constrained by any need for reserves when it comes to RAISING money in other currencies but surely their ability to convert that into our currency and lend that out here is dependent upon how much of our currency is available here at that point in time to convert that foreign currency into?

I think what i’m trying to ask is ; how could an unlimited amount of money come pouring in if it must first be exchanged for Australian dollars, the supply of which is limited, especially if the government has a long running obsession for running surpluses? No matter how much money I can raise, whatever can’t be converted into Australian dollars is impossible to lend to people who are unable to spend anything other than Australian dollars.

Thanks for your patience.

While there are simply too many pages of econo-speak fro me to trudge through, a google search seems to suggest very heavy usage of the RBA’s discount window in recent years.

Keen may have a point Bill.

Dear Lefty

The volume going through the discount window tells you that that the money supply is endogenous. It in no way makes the case for ignoring the vertical government and non-government transactions from one’s analysis. Further, it has nothing much to do with the issue I raised – which in this context can be expressed as: why do the commercial banks want this particular unit of account? Why do people borrow this unit of account? Why do transactions occur in this particular unit of account? To understand that and the role of High Powered Money you have to start with the currency monopoly that the Government enjoys. Your blogger ignores those aspects and is therefore left floundering without a true explanation of anything.

You can get data on repos from HERE

You might also like to read the following pages –

Intraday Repos and Overnight Repos

I also graphed it for you just now. Not much sign of it escalating over the recent period.

best wishes

bill

Dear Lefty

So the parity between the gobs and gums changes!

If the bank lends you $250k it gets an operator to make an entry in some accounting ledger and it prints out as yours. You then transfer the amount to the builder and … guess what … a number bounces up on his screen to. Next time you check, your account is less by that amount.

So if you understand that banks are not constrained by any need for reserves when they lend then what is the issue?

Why does the exchange rate change? To mediate changing flows (volumes) of currencies going in and out.

best wishes

bill

Hi Bill.

The graph does show an upward trend towards the end but you’re right, it’s fairly piffling. The absolute amount passing through is expressed in hundreds of millions. If Keen were correct, I would expect to see hundreds of BILLIONS passing through the discount window.

I don’t think Keen’s argument was that government spending was not how new money entered but rather that there was also an alternative channel for money creation.

Though trapsing round the blogs, one common thing I notice is that many economic commentators appear to simply ignore the role of government as though the existence of the currency monopolist is incidental and doesn’t matter.

I will try and explain what I mean re gums and gobs this evening or tomorrow.

cheers

Dear Lefty

Clearly the credit creation process of banks creates new deposits. Loans create deposits. But nothing net is created. That is the crucial difference between the Government creating new net financial assets by crediting private bank accounts (that is, deficit spending) and the banks creating deposits (which are always offset by a matching liability.

That is a huge difference and should be incorporated at the outset in any analysis of the monetary system.

best wishes

bill

Well said, as usual, Bill

I think the last point is the key one . . . financial assets are always two sided in that the creation of a financial asset adds a liability to one entities balance sheet and adds an asset to another’s. For private credit creation, the asset and the liability remain in the private sector, netting to zero. On the other hand, if the government runs a deficit, the government keeps the liability and the private sector gets the asset only. So . . by definition, the government’s deficit creates net financial assets (net worth) for the non-government sector, while a government surplus by definition is the reduction of the private sector’s net financial worth. Private credit creation, also by definition, cannot add to the private sector’s net worth.

Didn’t read Keen’s piece, but from the discussion here and a few days ago, this appears to be what was missing there.

My line of thinking was that when government decided it was fashionable to run nothing but surpluses for years and years, the volume of deposits going into commercial banks stagnated, seeing as the nation’s biggest spender – by running surplus after surplus – was no longer crediting a steadily increasing number of private sector accounts.

The banks realised that if government intended to do this indefinately, profit growth for them might stagnate as well. They found an alternative way of increasing deposit taking – they marketed debt as though there were no tomorrow. By convincing Australians to part with an ever-increasing portion of their income as debt, they continued making motza. But since the currency monopolist was determined to run surpluses, still no new net assets were created.

Even without the GFC, household debt-to-income ratios could not have continued increasing indefinately. No household can shoulder an increasing level of debt forever, it had to unwind sooner or later. Now if everyone was to reign in their borrowing and the government was to continue to run surpluses, how would economic growth continue? It would have to stagnate.

If the government feels compelled by pressure from the dominant economic paradigm to run endless surpluses, couldn’t they create new net assets by increasing the overall size of the budget but leaving the surplus the same.

Dear Lefty

First, the Government is not the nation’s biggest spender. Even at present the deficit is unlikely to be more than about 1.5 to 2.0 per cent of GDP. In real terms ($m) the following expenditure components were recorded for the December National Accounts:

Household Consumption $152,556

Dwelling investment $16,349

Buildings and structures investment $20,210

Equipment investment $25,147

Private: Other investment $8,555

Public demand $62,339

Exports of goods & services $57,340

Imports of goods & services $64,446

Total GDP $271,567

Second, when the Government runs a surplus there is a continual reduction in the private sector’s net financial worth (other things equal). When the previous Treasurer boasted he was “getting the debt monkey of the taxpayers’ backs” (when public debt was retired) what this really meant was the surpluses were squeezing private liquidity who still had to meet their tax obligations in $A and, in part, they were forced to sell back their bond holdings to the Government to get funds. That is one way their wealth was being eroded (again other things equal).

Third, other things were not equal, and at the same time credit growth accelerated as banks increased lending and deposits. You are correct in concluding that even if the GFC had not been so severe, this growth strategy was doomed because the economy became increasingly sensitive to small changes in economic aggregates (such as interest rates, employment levels, hours of work, wage rates). The household sector became more precariously balanced as a whole between solvency and insolvency. Eventually, households were going to try to make their balance sheets more secure by increasing their saving again. During the surplus period household saving overall became negative. As you rightly point out, once the private sector resumed saving, the fiscal drag represented by the surpluses would have quickly reduced the economy to rubble. The other intervening factor was the mining boom which boosted net exports. We would have had a recession a long time ago in this country had households not have borrowed so much and commodity prices not have risen to record levels. But the pre-conditions were there as a result of the surpluses.

Fourth, the last point is impossible. It can create new assets by increasing the scale of spending but if it is running surpluses it is always destroying net assets and forcing the private sector into increasing deficits which show up as loss of wealth and rising indebtedness.

By the way, did you read Scott’s excellent summary of the difference between a modern monetary account and your other blogger’s flawed representation of things?

best wishes

bill

If you really want to confuse someone who is obsessed with money multipliers and fractional reserve banking, tell them that Australian banks have no reserve ratio requirement. The only requirement imposed on their accounts with the Reserve Bank (so called “Exchange Settlement (ES) Accounts”) are that they cannot go into overdraft. Every day as people conduct financial transactons, banks will settle the net movements between each other through their ES accounts. Since a bank cannot overdraw their account, they may have to borrow from another bank overnight at the so called “overnight cash rate” (a.k.a. the “11am rate” as this is when the rate is determined). The Reserve Bank uses its “open market operations” (buying or selling bonds) to influence this cash rate. Note that the term “discount window” is an American one and is not used in Australia. Anyway, the point of all this is that reserve requirements are completely irrelevant to banking in Australia.

On the topic of “Quantitative Easing”, there is in fact a practical difference between this practice and normal market operation. While bonds are bought and sold in the course of market operations, this is done via a “repurchase agreement”. This means that the while the Reserve Bank may buy the bond today, it will sell it back tomorrow. The prices for the buy and the sell are worked out so that the sell price is just a little bit higher, whereby the Reserve Bank effectively earns one day’s interest. Thus, seeing it as a bond trade is a bit misleading. It is really an overnight loan (or deposit if the Reserve Bank initially sells the bond) with the bond used as collateral. This is why open market operations affect overnight rates not bond prices. In the case of Quantitative Easing, bonds are purchase outright with no agreement to sell. As a result, Quantitative easing tends to push bond prices up (the central bank adds to the market demand) and thus yields down. In the US, where most mortgage rates tend to move in line with long-dated bond yields, unlike Australia where they (usually) move in line with the cash rate, an important reason for conductive Quantitative Easing has been to attempt to lower mortgage rates. Elsewhere, even without the mortgage rate feature, it has been used to improve the liquidty position of banks. The reason for this is that effectively the central bank is giving banks money for longer time periods, while the usual money market operations only provides money overnight.

Another subtlety in the discussion of money mechanics is the difficulty of pinning down exactly what you mean by “money”. While loans can create “money” in the form of deposit balances, they need not. As Scott notes, all this creation of financial assets works by the creation of equal and opposite assets and liabilities on the balance sheet. A $1m loan (asset for the bank) offsets a $1m deposit balance (liability for the bank) creates $1m of “money”. However, since banks also raise liabilities by issuing bonds in the wholesale market, you can also have a $1m loan (asset for the bank) created that offsets $1m of, say, 5 year bonds (liability for the bank). As usually conceived, this bond would not be considered “money”, whereas a shorter borrowing by the bank (say a three month certificate of deposit) may be. All of this goes to show that trying to get to grips with the aggregate amount of “money” in the system is tricky.

Bill,

Anything we can learn about the Eurodollar markets with this analysis ?

Dear Ramanan

What were you thinking off? The banking operations with respect to the Eurodollars work the same way as any horizontal transaction. The main futures contract traded out of the Chicago Mercantile Exchange works like any similar transaction so in that case anything that impacts on the USD LIBOR interest rate will influence the outcome of any particular contract.

I am just unsure what you are looking for.

best wishes

bill

Hi Bill,

I am just talking of the banking operations with respect to the Eurodollars and not much worried about the futures market. When one finds out (for the first time) what these Eurodollars are, he/she is referred to Milton Friedman’s The Euro-dollar Market: Some First Principles which is a Neoclassical treatment which takes the usual approach with “… keeps $10 as reserves and lends the remaining $90. …. this hits another bank and they loan $81 …” However I would expect the “reverse-causality” argument in this post to apply here as well.

For ‘normal’ dollars, there is a cost of reserves due to loans. Is it lower for banks dealing in ‘Eurodollars’?

Dear Ramanan

Eurodollars is a misnomer – they are just USD-denominated deposits held offshore (in foreign banks or foreign branches on US-owned banks). There are no significant operational changes however.

First, even though overseas branches of a US bank may keep separate books for accounting purposes they are really just part of the parent bank which keeps only one reserve acccount at the Fed for all its operations (wherever).

Second, there is a statement in the trade that “Eurodollars never really leave the US”. That is, it doesn’t matter wheere the dollars are deposited or who owns these deposits, the transactions that might arise never change the reserves held by the banks at the Fed (US central bank).

For example, imagine an Australian company gets a cheque for $1 million USD drawn on a major US Bank in Los Angeles and then deposits in Sydney at their bank, which has agreed to maintain a US dollar deposit facility. This is a Eurodollar deposit. So now the Sydney bank owns the $US1 million and the Australian company has a Eurodollar deposit at that bank. No new net financial assets have been created because the Sydney bank has the asset which is offset exactly by the liability – the Eurodollar deposit.

We could then have a multitude of transactions involving that $1 million USD between various banks all of which could involve changes to individual reserve accounts at the Fed by various banks involved in these transactions.

But at the end of it all the overall reserves irrespective of who has them will be unchanged. It doesn’t matter who owns the Eurodollars.

Third, there are differences in banking regulations however between the Euromarket and US domestic banking. For example, in the Eurodollar scene, deposits are time-restricted (that is, have fixed maturity) and interest is paid on them. So liability accounting is different.

Another major difference is that there are no reserve requirements of FDIC insurance costs on Eurodollar deposits. A money multiplier view of the world might take this to mean that these deposits can be lent out at a higher rate (100 per cent) than the USD deposits in US domestic banks. But it remains true that loans create deposits. Most banks with Eurodollar deposits have what are called standby lines with US-based banks. Further, central banks around the world will offer lender of last resort facilities to their “own” banks. So the RBA will ensure an Australian bank abroad doesn’t go broke through lack of reserves.

best wishes

bill

Bill,

Thanks. Yes its a misnomer and I just wanted to confirm my understanding about reserves and various transactions it can bring about in a scenario. Thanks for the comment – the bonus I got were facts about insurance costs and the standby lines.

Neoclassicals wouldn’t recognize the endogenity when someone is talking of just one currency even with the complication of Euro$, but they may accept it when one is talking of two currencies. Lets consider a US bank involved in an FX transaction – the $ and the £ with a corporation in the UK and that some “hot money” flows into the US from the UK. The US bank gets more £s and in return has endogenously created $s and has to look for reserves.

Hi Bill,

Quoting you:

However, and this is the crux of the modern monetary view, this growth will become unsustainable because net financial assets are either being destroyed or are not being created in insufficient quantity to meet the net saving needs of the private sector. Private sector debt levels will be rising while the stock of net financial assets declines.

I was looking at this from Godley’s book and looking at how this happens. Maybe we can have a blog on this from you ? I think some people will like the logic of deficits saving the world but would argue deficits are bad in good times (e.g., Krugman). You have emphasised the power of the identity G – T = S – I. Maybe you can try to debunk critics by directly showing the instability of the model without the government ? Doing it on a blog might not be the easiest thing – but hey I learned many stuff about Modern Monetary Theory of Economics here.

The fractional reserve banking system has been described incorrectly. So naturaly the statement that is made, that the bank does not operate like that, is true.

If the money multiplier is m, and if a customer deposits X dollars, a bank is not required to keep X/m on hand and permited to loan out the other X/(m-1). What realy happens is that if a customer deposits X dollars, a bank is permited to loan out mX. Or in other words the bank is permitted to create (m-1)X of money supply from thin air. In other words X is the reserve for the mX loan. I like to call X real money.

Of course a bank will try and loan out this mX of cash to reputable customers. But try to loan it all out it certainly will, because a bank makes money from interest on its loans.

The figure m is set by the government or perhaps by the reserve bank, I don’t know that part.

Banks do borrow “reserves” from each other, in order to fullfill their reserve requirements but if the net amount of reserves available does not cover the required reserve rate, banks are forced to borrow extra reserves from the central bank. Once again this is not real money, it is intended to be a temporary loan for which banks pay dearly for. This loan may be negotiated via bonds sold to the reserve bank or via the “discount window”, which is pretty much a direct loan.

It seems that banks can loan out more than mX buy artificialy bulstering their reserves by borrowing extra reserves from the central bank, on a permanent basis. All this means is that the practical reserve rate is dependent on the actual reserve rate plus the degree to which banks are discouraged from loaning out extra artificial reserves from the central bank.

reserves don’t “finance” bank balance sheet expansion, they are simply a requirement imposed by government to limit credit expansion to a perceived safe level. A bank’s ability to expand its balance sheet IS primarily constrained by the quantity of reserves it holds AND by the fractional reserve requirement. However, it may increase this limit somewhat, beyond the actual reserve rate by borrowing from the central bank. And an individual bank may not always be at its loan limit. It depends on how many customers it can find to loan money to. But as stated earlier, the sum of all loans from all banks at any one time is very close to the total reserve limit, if not over, due to loans from the central bank.

A bank does expand its balance sheet by lending, but loans DO NOT create deposits. There are 2 cases here. If the money is loan out to customer A who pays customer B using the same bank. Then that bank has not had to produce that loan in cash and the total money supply has not changed. If however customer B is with another bank, then the first bank must pay customer B real cash so that he may cary that with him to his own bank. In this case, the reserve at the first bank has gone down but the reserve at the second bank has gone up, and all other things being equal, the first bank would then have to borrow back that lost reserve from the second bank, in order to maintain the reserve rate for the money it has already loan out, if it was at its limit. Overall, deposits can only be real money. Deposits ARE the reserves.

The need to borrow reserves from the central bank may not impede making the loan, but it certainly descourages a bank from going over the reserve rate. As indicated a bank will settle at some comfortable level of central bank loans. But non the less, this level of comfort begins with no central bank loans at the reserve rate making it less and less atractive to go over the reserve rate.

When a bank loans X dollars from the central bank, by selling bonds or whatever, these X dollars are the same as a deposit in terms of reserve. That is they add to a banks reserve. If a bank loans X dollars from the central bank. It does not try to loan out X dollars, it tries to loan out mX dollars.

The paragraph on “overnight rates” simply shows how it is in fact reserves that govern to a large extent, what banks decide to do with their loans / interest rates etc, even more so than the rate at which the central bank loans out reserves. That is, if the central bank buys bonds, it injects reserves into the system, money flows freely and interest rates go down as banks try to flog some of this artifical money off.

Last 2 paragraphs of money multiplier are complete bullshit. There are always credit worthy customers at a price. Banks are always at or beyond their credit limit. If what Bill says is true then we are in even deeper shit because of our banking system then I first thought, because it means that banks are not effectively prevented from loaning out more than what the reserve rate dictates. Which means there is no limit on banks. Which is what cuases them to sometimes go belly up do to stretching the elastic band just a bit too far.

The reason there are no credit worthy customers, if that statement is in any way true is because a lot of them have had to tap into their savings to make up for the lack of revenue from customers who went broke because somewhere down the track a bank pulled in its loan, triggering a colaps in credit like a deck of cards.

The fewer the restrictions on what banks can do, the more extravagent they get, the more we depend on them, the more autonomy banks have to do whatever the blody hell they please, including paying their executives whatever the blody hell they want and the more the whole society gets focussed on banks and what they are doing, rather than on what banks were set up to do in the first place, which was keep people’s money safe. That’s were we are at now. That’s why Obama came up with the statement that young people should want to be engineers rather than bankers.

Did you know that when you make a deposit, your money is in effect no longer yours. Your money is for all intents and purposes and investment in the bank with which the bank has complete freedome about what to do with it. The bank owes you the money, but if for some reason they can’t pay, it is treated as a bad investment, rather than a debt.

So let me say this very bluntly: the money multiplier is, according to your MMT analysis, an *accurate* description of the way banks work under a system with *no central bank* but *with* reserve requirements? However, this is not the current system.

Is this correct, bilbo?

Paul Alves:

“If what Bill says is true then we are in even deeper shit because of our banking system then I first thought, because it means that banks are not effectively prevented from loaning out more than what the reserve rate dictates. Which means there is no limit on banks. Which is what cuases them to sometimes go belly up do to stretching the elastic band just a bit too far.”

Unfortunately, from what I know of the crash of 2008, that is *exactly what happened*.

“The important point though is that all transactions at the non-government level balance out – they “net to zero”. For every asset that is created so there is a corresponding liability – $-for-$. So credit expansion always nets to zero! I”

No no no, and you know this. This is fundamentally dependent on totally honest accounting, and Enron is merely the most famous example of it not being true. For the grossest example, any bank can start using phony accounting and crediting people with money just by changing the entries on their books. This will work until the bank is “caught” and liquidated by the FDIC.

I can give you less illegal examples — the classics include using long-term loans against houses as the “asset” while misvaluing the houses.. For the sake of simplicity, consider someone borrowing against an already built, already paid off house. The house is an “asset”, but it’s not money! The money provided in exchange for the house *IS* money. Assume again for simplicity that the borrower takes the money off and starts spending it. The bank records a liability (cash paid out, money) and an asset (the illiquid, unmoveable house collateral and speculative future income streams from loan repayment). So far the bank has not created money, but when it proceeds to resell the mortgage as a “AAA mortgage-backed security backing an SPV which is financed by commercial paper”, it has just created money.

But the point is, you can accurately say that the other transactions do not create or destroy “high powered money” (for the most part). But they DO create and destroy money. Be very clear about when you are talking about HPM and when you are talking about “money” plain and simple, because you’re causing confusion.

I will point out finally that the government here in the US will accept a check on pretty much any bank in payment of taxes. So the only constraint on HPM manufacture by banks is the accounting audits of the banks. If the banks choose to alter their accounts in various ways, they are quite capable of manufacturing money which *the government will accept*.

Nominally there is a matching of assets and liabilities, but this can be done “Enron style” if the regulations are weak enough. Then the phenomenon of money creation becomes very simple: banks declare that some people have money and other people don’t. Put it this way: I can write a check to the US government backed by my “money market account”. The bank simply debits my money market account and credits the US government. Does it have to sell the money market securities for cash? I don’t think so. I think the bank transfers money from its federal reserve account to the Treasury’s federal reserve account, while transferring ownership of the money market securities from me to the bank (on paper). It only has to sell the money market securities if its reserves at the Federal Reserve get below regulatory minimums (or its capital fell below regulatory minimums), *and it gets caught*. This means that the ability of banks to create money is limited *only* by regulation, and only by the *enforcement* of said regulation.

The blind acceptance of fraudulent accounting by banks in the United States is seriously frightening, but it would render even MMT insufficiently accurate. I’m more looking at the bubble period here, where fraudulent accounting was used to enable banks to create as much money as they could get away with, before a massive loss of faith in the private money issuers threatened to blow up the shadow banking system; currently after the crash we are plainly limited by unwillingness of banks to lend, period.

You say:

[…] When a bank makes a $A-denominated loan it simultaneously creates an equal $A-denominated deposit. So it buys an asset (the borrower’s IOU) and creates a deposit (bank liability). For the borrower, the IOU is a liability and the deposit is an asset (money). The bank does this in the expectation that the borrower will demand HPM (withdraw the deposit) and spend it. The act of spending then shifts reserves between banks. These bank liabilities (deposits) become “money” within the non-government sector. But you can see that nothing net has been created.[…]

—-

but the individual bank when makes a loan, consider this loans a new deposit for himself, or you are talking about the entire system?

I mean, the deposit is a deposit for another bank, or for the same bank?

thanks

Hi Bill,

Your central position in this article is that the money multiplier is a myth. To my understanding the essence of the money multiplier is that a bank can multiply cash by 10 in a FR system of 10% and end up in a variety of ways into the following extremely leveraged balance sheet.

Assets: 1,000 cash / 10,000 loans

Liabilities: 1,000 capital / 10,000 deposits

This bank basically multiplied the community’s money supply by 10. The contrived textbook example assumes physical money being withdrawn each time. I agree that that is not how modern banking operate. In practice most loans are not withdrawn in cash, but credited on a bank account and transfered to another bank account.

However your comment does not deny the inevitable outcome that banks end up multiplying the money base. Shockingly, you seem to suggest that reserve is of no consequence in modern banking, but let’s put that aside. You only succeed to convince that the scenario described by the ‘textbook multiplier’ is a contrived path to multiplying the money supply. You failed to convince that the outcome of multiplication is false. Was that not your intention?

Dear Maxhill (at 2011/10/27 at 21:29)

Please reflect on your comments and consider the causality that links reserves to broad money. Which comes first? The central bank will always add reserves to meet the requirements of the commercial banks. The causality central to the money multiplier narrative is false. Sorry.

best wishes

bill

If we imagine a cashless society with all transactions being settled digitally/electronically and with no reserve requirements except for BANKS’SIGHT DEPOSITS (at Central banks) for the purpose of interbank clearance/compensation, HPM would reduce to a minimum. So more government spending will lead to increasing the sight deposits held by banks. How do the latter deal with deposits surplus to their daily requirements if interest is not paid by Central Banks?

Hi Bill,

Thanks for the explanations. I don’t have a background in economics and am trying to understand how this all works so please bear with me on two questions:

1. I notice you didn’t reply to Nathaneal does that mean what he is saying is accurate?

2. You mention horizontal money is net zero and I can understand that on the day the credit is issued where deposits match debt but what about the interest? I’m trying to understand how money can be created as debt and yet the debt plus interest can be repaid? For example, let’s say credit of $100k is extended resulting in the balance sheet showing the $100k deposit as a liability plus the debt of $100k as an asset. For the sake of simplicity lets assume 1% interest is charged, meaning assets should rise to $101k but liabilities still equal $100k. Where does the extra $1k come from to repay the interest on the loan? I understand:

– The bank will spend money on operations, which will get recycled into the economy some of which will be used to repay interest but for it to repay all the interest would require the banks to operate at break-even, which of course isn’t the case or their mandate

– The government is going to spend money in vertical transactions, which increases the quantity of HPM (does all government spending increase the amount of HPM or at least all government deficit spending? Isn’t that money also created as debt? If it is then where does the money come from to repay the interest on that debt?) some of which can be recycled through the system to repay interest but this would also seemingly exhaust itself especially with the ratios depicted in the graph of money supplies (M3, M1, etc.) and the corresponding interest on the much larger horizontal credit as compared with the in flow of vertical money

Any explanation you can offer to help explain this process is greatly appreciated.

Michael

Hi,

I am entirely a layman. I really appreciate your work. I am learning a lot.

However, I must pick you up on one point. You say:

“Banks will always lend when a credit-worthy customer walks through the door and the terms are to the bank’s favour.”

I have personal experience that this is not the case. I have assets which I want to borrow less than 12%. An excellent credit rating. The bank will not loan. I am not the only one that I know has this problem. Currently, the only interest of all banks is to reduce all loans of almost any kind, regardless of benefit. There are other forces at work here.

” I have assets which I want to borrow less than 12%. An excellent credit rating. The bank will not loan.”

Then you are not credit-worthy from the point of view of the bank.

‘Credit-worthy’ is defined by the bank’s risk management processes. Whether you think you are credit-worthy or not is irrelevant.

The Myth of the Money-Multiplier Myth

One advantage of not being an economist is not learning what is taught in economics schools. As will soon, and often, be obvious.

So I learned about the money system by reading, and from my Dad’s teaching, and he was self-taught, so this is potentially a really dangerous outcome.

We are both modern monetary reformers, sometimes ungraciously referred to as ‘cranks’.

I learned about the fractional-reserve banking system for what it is: a private debt-based system of creation of the nation’s circulating medium, a system by which economic ‘purchasing-power’ is extended by those granted a special privilege to do so from the government, those ‘bankers’ s to speak who do not possess that purchasing power in the first-place. It is basically a scheme of renting the national money system to the people who own it in the first place. I was an early reader of Adams’ The Legalized Crime of Banking.

My Dad’s basic tool for teaching me and others about fractional-reserve banking was not Adams’ book, but the Fed’s publication titled, in all irony, Modern Money Mechanics.

I first read the publication in the early 70s and I believe the printing was from the late 60s. I want to make a distinction here about the money-multiplier as I learned it. It is not the “myth” outlined here by Bill and by other MMTers.

The MMM publication NEVER stated that the monetary authority controlled, or attempted to control, the money supply(M1) by controlling the quantity of some base, or high-powered, or any kind of monetary factor under its control.

The amount of M1 money created under the MMM money multiplier was ALWAYS whatever the bankers created and lent at interest to borrowers.

The function of the monetary authority(Fed) was ALWAYS to provide the required reserves needed to maintain the reserve requirements that the Fed itself set.

So, any ‘controlling’ mechanism of the money supply was always outside the relationship of deposit amounts to reserves, or whatever; i.e. interest rates and open market operations.

According to MMM, banks did not multiply their required holdings of reserves or HPM or any other base in order to achieve the targeted M1 money supply.

Banks just lent purchasing power to anyone who had an asset to secure the lending.

The Fed was ALWAYS required to then provide the banking system with reserves needed to achieve the requirements for reserve management next Wednesday.

In other words, from what I learned, without learning about the endogenous nature of the modern money system, the banks were always free to create as much money as they wanted, working within the feeble efforts of the Fed to actually control those amounts, given the Fed’s anti-inflation policy goal.

Learning about the money system by using the Fed’s publication from 50 years ago was to learn about the “potential” for the private bankers to create the nation’s purchasing power by slim reference to something called reserves or HPM, words that really never had any meaning.

The ‘money-multiplier’ according the MMM was not a myth.

It was exactly how the system worked.

After 50 years of financial deregulation, culminating in the central bank paying interest on both required and excess “reserves”, which still mean nothing, the truth of that relationship still stands.

Banks still need to come up with “something” every second Wednesday that represents a relationship to its deposits and hold that amount of that something either in its vault or regional Fed account.

We DO have a fractional-reserve banking system.

That is not a myth.

Far as I can see.

It may help skeptics to think of “money” — that is Assets and Liabilities created by Loans — as a contract or a pair of contracts.

One is a contract of terms for the borrower to pay the bank a sum every month for X months. This contract is created out of words, a legal agreement and a signature of acceptance.

The other is a contract that consists of numbers added to an account balance, the borrower’s checking account, ultimately usually a party designated by the borrower, so a transfer from account to account within the banking system.

Normally, none of that money is withdrawn as paper cash, like $1000 notes. Credits of $10000 and upwards are created frequently, usually backed by some insured collateral, a house or automobile. Therefore, the account of the seller receives the deposit amount.

None of this is illegal or fraudulent — as it may seem according to ‘cranks’ — because all this amounts to is a pair of IOUs or Liabilities, created by this partnering of two counter-parties to a legal agreement. The most basic concept of capitalism cannot make it outright illegal for people (or corporations) to willingly exchange liabilities.

The pejorative (negative) term “Debt-based money” is also “Asset-based money” at the same time. One party’s financial Liabilities are the financial Assets of the Counter-party and vice versa. Physical assets — collateral — are a separate issue, and are based on an estimated future sale price of the collateral at auction. In other words, besides creating Assets and Liabilities, the bank firm also creates and accepts Risk.

This process is not per se a “privilege” provided by the Government. Any two parties can choose to do transactions or agreements such as these. Derivatives contracts tend to be a shadow market that is not supervised or not sufficiently supervised. If two people shake hands over a lawn mowing contract for future performance, the contract is not supervised by the govt (unless one party sues in court), and a degree of risk is created.

But BECAUSE any Capitalist economy with Property Rights and Rules is managed by Govt, and because the widespread use of unregulated Credit Creation by private firms created huge problems of fraud and excessive Risk throughout the entire economy, economic destabilization, including speculative credit-driven asset-inflation bubbles that inevitably burst, the Government has taken a large role in overseeing these operations and setting terms for what is permitted and not permitted. Therefore, proper banks do operations “with permission” of the Govt. It’s not like the Govt chose certain people or institutions and just granted these permissions like the King of England. It’s that these powers already exist, subject to restrictions by the Govt to comply with terms.

The Bubble of the 00’s and the Great Financial Crash when credit creation hit a peak and reversed, this is evidence that the Govt should NOT have relaxed all the rules on Risk vs Capital (and on lowering standards on defining what is risk-based Assets, vs Liabilities, and what is the size of the real Capital base in flux), such that banking firms were allowed to create excessive Risk and excessively bad Risk, but highly profitable Risk, which far exceeded their Capital base to cover losses as the Risks across the spectrum, Systemic Risks, grew quickly out of proportion of the entire reserved Capital.

A bank’s Capital Reserves — plus the Law — and this is necessarily an estimated value — determine how much additional Risk and the types of Risk a bank is able to create. (For example, banks used to be forbidden from creating Risk to join in on Speculative Forex gambles and derivatives bets which now make up over 90% of all financial transactions).

This is not banks lending out their Capital, but creating Risk off their Capital, just like any business takes certain Risks, such as that their inventory may burn in a fire or their product may flop, limited by the depth of their Capital base to pay bills and/or acquire more credit to keep solvent.

This is not banks lending out funds in the Reserve accounts at the Fed.

Banks simply create Assets & Liabilities up to the limits set and overseen by Govt Regulators.

It’s not hard to see why the argument to De-Regulate Big Finance is utterly stupid and economically reckless to the entire economic and financial system, but “free market” so called “experts” INSIST that the less regulations the better everything will be, and will come to a healthy balance all by themselves, not even considering the bank CEOs are not taking risks with their own personal money yet personally profit greatly from bonuses based on short-term profits of the institutions they manage.

‘…are not being created in insufficient quantity to meet the net saving needs of the private sector..’

I believe this should read, ‘…are not being created in SUFFICIENT quantity to meet the net saving needs of the private sector.”

your top statement, a quirk of Australian grammar, or am I just a dense?

I had a couple (perhaps basic) questions:

1. You mention that when the government runs a deficit, money is created, but I was always under the impression that the government had to borrow from existing money to run a deficit, i.e. that the branch of government that determines fiscal policy was totally separate from the central bank. This is why it has always puzzled me that fiscal policy could be “expansionary,” since every dollar borrowed by the government is a dollar not borrowed by a private entity. Does the Australian system work differently than here in the U.S. perhaps, or am I missing something?

[Bill notes: I edited out a link that was unnecessary]

2. I don’t understand how reserve requirements, discount rates, etc. don’t constrain a bank’s ability to lend. Assuming you agree that such things do have an effect on the interest rate banks must charge to be profitable, then why wouldn’t higher interest rates lower the quantity of loans demanded?

Thanks for any insight

Bill,

I am on the endogenous money side, more or less. But still have a few basic questions, not totally independent of each other.

1. There are some academic textbook authors who were governors of the Fed (Mishkin, Bernanke). They have the money multiplier story in their texts. Given that they have had direct experience with this stuff, why do you think they still push the exogenous money theory?

2. There are some empirical evidence on endogenous money (like VAR regressions, Kydland and Prescott). But it seems that the evidence is weak. Also, there are a few papers here and there in fringe journals. The “endogenous people” have not been able to sway the profession to their side, eve though they have strong views on the subject–almost like religion. What makes you believe that endogenous money theory is the right one?

3. As to the money multiple. I don’t believe it is correct with the mathematical precision it is stated in the textbooks. However, it seems that there are elements of truth to it. Assume that RRR = 0%. If you deposit $100 in my bank, $100 of reserves will be created in my Fed account. It is true that I will not lend that $100 to a borrower–it is just a number in a computer. And, retail depositors don’t have access to the Fed Funds market. But still, that $100 of reserves will enable me to lend more money safely. This is because I already have the reserves and, so, I don’t need to look for some after I lend. So money will multiply, it seems. But perhaps not by the exact formula. Your insght?

Moreover:

You write, “What it implies is that banks first of all take deposits to get funds which they can then on-lend. …Well that is not at all like the real world. It is a stylised text-book model which isn’t even close to how things actually operate.”

But it seems that it is very close to how banks operate in the real world. On a daily (and nightly) basis banks advertise in the media to attract our money. Banks must spend a lot of money on those commercials. Why do they want our money so badly? It is because we are the cheapest source of funds for them (even including the costs of the TV commercials). They give us less than 1 percent interest and lend to borrowers at say 10 percent. Even though they do not lend to the borrowers exactly the money that we have deposited in their banks, having our money in their banks makes it easier, safer, and cheaper for them to lend.

Banks may lend first and then look for reserves. But they have to look for reserves at some point because they have to transfer reserves to the borrowers’ banks. So, having our money in their banks reduces the cost of obtaining the reserves. These loans therefore are not totally made independent of their reserve positions.

Now, if I am swayed by the commercials and deposit some money in Bank A, the aggregate money supply in the economy will not change. This is because that money will come from my account at Bank B. However, Bank A will find it easier to lend due to these newfound reserves. And Bank B will find it harder to lend. By implication, if the Fed injects some reserves into the banking system, both banks will find it easier to lend. Money will multiply.

Your point about open market operations is also hard to understand. If the Fed targets the federal funds rate (FFR), then the supply of reserves become endogenous. In that case active open market operations will be meaningless, as you describe. However, OMO will not be meaningless if the Fed does not target the FFR (like prior to 1980). In that case, an open market purchase by the Fed would reduce FFR and increase money supply due to the injection of reserves. But the Fed later does not need to drain the reserves to stabilizes the FFR. This issue is different from that of whether or not the Fed had tight control on money supply. Money supply will increase, but perhaps not by the amount the Fed wanted.

Finally, all these arguments apply to the era in which there were not ample reserves in the US banking system. Now at close to zero lower bound, OMO have lost their effectiveness. The policy tool seems to be the interest on reserves. By changing the opportunity cost of holding reserves, the Fed can affect the supply of money.