Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – September 25, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

In a fiat monetary system (for example, US or Australia) with an on-going external deficit, if you desire the domestic private sector to reduce its overall debt levels without employment losses, then you have to support the national government continually increasing the budget deficit in line with the private de-leveraging process.

The answer is Maybe.

This question is an application of the sectoral balances framework that can be derived from the National Accounts for any nation.

The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

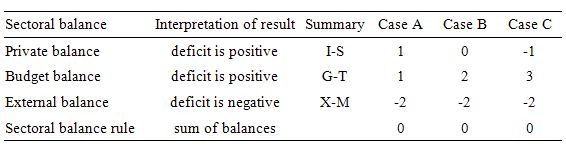

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X – M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. Case A shows the situation where the external deficit exceeds the public deficit and the private domestic sector is in deficit. In this case, there can be no overall private sector de-leveraging.

With the external balance set at a 2 per cent of GDP, as the budget moves into larger deficit, the private domestic balance approaches balance (Case B). Case B also does not permit the private sector to save overall.

Once the budget deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) the private domestic sector can save overall (Case C).

In this situation, the budget deficits are supporting aggregate spending which allows income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save.

For the domestic private sector (households and firms) to reduce their overall levels of debt they have to net save overall. The behavioural implications of this accounting result would manifest as reduced consumption or investment, which, in turn, would reduce overall aggregate demand.

The normal inventory-cycle view of what happens next goes like this. Output and employment are functions of aggregate spending. Firms form expectations of future aggregate demand and produce accordingly. They are uncertain about the actual demand that will be realised as the output emerges from the production process.

The first signal firms get that household consumption is falling is in the unintended build-up of inventories. That signals to firms that they were overly optimistic about the level of demand in that particular period.

Once this realisation becomes consolidated, that is, firms generally realise they have over-produced, output starts to fall. Firms lay-off workers and the loss of income starts to multiply as those workers reduce their spending elsewhere.

At that point, the economy is heading for a recession.

So the only way to avoid these spiralling employment losses would be for an exogenous intervention to occur. Given the question assumes on-going external deficits, the implication is that the exogenous intervention would come from an expanding public deficit. Clearly, if the external sector improved the expansion could come from net exports.

It is possible that at the same time that the households and firms are reducing their consumption in an attempt to lift the saving ratio, net exports boom. A net exports boom adds to aggregate demand (the spending injection via exports is greater than the spending leakage via imports).

So it is possible that the public budget balance could actually go towards surplus and the private domestic sector increase its saving ratio if net exports were strong enough.

The important point is that the three sectors add to demand in their own ways. Total GDP and employment are dependent on aggregate demand. Variations in aggregate demand thus cause variations in output (GDP), incomes and employment. But a variation in spending in one sector can be made up via offsetting changes in the other sectors.

So given that the budget deficit has to be larger than the external deficit, the best answer is maybe.

The following blogs may be of further interest to you:

- Private deleveraging requires fiscal support

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

- Saturday Quiz – May 22, 2010 – answers and discussion

Question 2:

The only time that fiscal surplus represents increased national savings is when the government creates a sovereign fund.

The answer is True.

From the perspective of Modern Monetary Theory (MMT) the national government’s ability to make timely payment of its own currency is never numerically constrained by revenues from taxing and/or borrowing. Therefore the creation of a sovereign fund by purchasing assets in financial markets in no way enhances the government’s ability to meet future obligations. In fact, the entire concept of government pre-funding an unfunded liability in its currency of issue has no application whatsoever in the context of a flexible exchange rate and the modern monetary system.

The misconception that “public saving” is required to fund future public expenditure is often rehearsed in the financial media. In rejecting the notion that public surpluses create a cache of money that can be spent later we note that Government spends by crediting an account held by the commercial banks at the central bank. There is no revenue constraint. Government cheques don’t bounce! Additionally, taxation consists of debiting an account held by the commercial banks at the central bank. The funds debited are “accounted for” but don’t actually “go anywhere” and “accumulate”.

Thus is makes no sense to say that a sovereign government is saving in its own currency. Saving is an act that revenue-constrained households do to enhance their future consumption opportunities. The sacrifice of consumption now provides more funds in the future (via compounding). But the government doesn’t have to sacrifice spending now to spend in the future.

The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency. It also applies to non-government users of a currency. Their ability to spend is a function of their revenues and reserves of that currency.

So at the heart of the mis-perceptions about sovereign funds is the false analogy mainstream macroeconomics draws between private household budgets and the government budget. Households, the users of the currency, must finance their spending prior to the fact. However, government, as the issuer of the currency, must spend first (credit private bank accounts) before it can subsequently tax (debit private accounts). Government spending is the source of the funds the private sector requires to pay its taxes and to net save and is not inherently revenue constrained.

However, trying to squeeze the economy to generate these mythical “pools of funds” which are then allocated to the sovereign fund as if they exist is very damaging. You can think of this in two stages.

First, the national government spends less than it taxes and this leads to ever decreasing levels of net private savings (unless there is a strong positive net exports response). The private deficits are manifest in the public surpluses and increasingly leverage the private sector. The deteriorating private debt to income ratios which result will eventually see the system succumb to ongoing demand-draining fiscal drag through a slow-down in real activity.

Second, while that process is going on, the Federal Government is actually spending an equivalent amount that it is draining from the private sector (through tax revenues) in the financial and broader asset markets (domestic and abroad) buying up speculative assets including shares and real estate.

Accordingly, creating a sovereign fund amounts to the government competing in the private equity market to fuel speculation in financial assets and distort allocations of capital.

However, as you can see from pulling it apart, this behaviour has been grossly misrepresented as providing “future savings”. Say the sovereign government ran a $15 billion surplus in the last financial year. It could then purchase that amount of financial assets in the domestic and international capital markets. But from an accounting perspective the Government would no longer have run that surplus because the $15 billion would be recorded as spending and the budget would break even.

In these situations, the public debate should be focused on whether this is the best use of public funds. It would be hard to justify this sort of spending when basic infrastructure provision and employment creation has been ignored for many years by neo-liberal governments.

So all we are talking about is a different portfolio of assets.

The following blog may be of further interest to you:

Question 3:

The massive build-up of Chinese holdings of US government debt has allowed US citizens to enjoy a higher material standard of living overall at the expense of the residents of China.

The answer is True.

The use of the descriptor overall signals that we are considering the macroeconomic outcomes in this question. We might have concerns about the distributional consequences within the US that might arise from an on-going external deficit – that is that some might benefit while others will be losing jobs as manufacturing heads to China. But when we think in macroeconomic terms (which is mostly the case in this blog) we are dealing with aggregates and so the distributional questions, while very important, are abstracted from.

That statement is not entirely accurate because one of the important insights that progressive economists such as Kalecki provided was that distribution of income does impact on aggregate demand. Please read my blog – Michal Kalecki – The Political Aspects of Full Employment – for more discussion on this point.

First, China can only do what the Americans and everyone else it trades with allow them to do. They cannot sell a penny’s worth of output in USD and therefore accumulate the USD which they then use to buy US treasury bonds if the US citizens didn’t buy their stuff. Presumably, people buy imported goods made in China instead of locally-made goods (which are more expensive) because they perceive it is their best interests to do so.

There is often a curious inconsistency among those who advocated free markets. They hate government involvement in the economy yet propose complex regulative structures (for example, tariffs) which would increase government control on resource allocation and, not to mention it, force citizens (against their will) to purchase goods and services they reject in an open comparison (on price and whatever other characteristics).

Many economists do not fully understand how to interpret the balance of payments in a fiat monetary system. For example, most will associate the rise in the current account deficit (exports less than imports plus net invisibles) with an outflow of capital. They then argue that the only way the US (if we use it as an example) can counter this is if US financial institutions borrow from abroad.

They then assume that this is a problem because it means, allegedly, that the US nation is “living beyond its means”. It it true that the higher the level of US foreign debt, the more its economy becomes linked to changing conditions in international credit markets. But the way this situation is usually constructed is dubious.

First, exports are a cost – a nation has to give something real to foreigners that it we could use domestically – so there is an opportunity cost involved in exports.

Second, imports are a benefit – they represent foreigners giving a nation something real that they could use themselves but which the local economy will benefit from having. The opportunity cost is all theirs!

Thus, on balance, if a nation can persuade foreigners to send more ships filled with things than it has to send in return (net export deficit) then that is a net benefit to the local economy. I am abstracting from all the arguments (valid mostly!) that says we cannot measure welfare in a material way. I know all the arguments that support that position and largely agree with them.

So how can we have a situation where foreigners are giving up more real things than they get from the local economy (in a macroeconommic sense)? The answer lies in the fact that the local nation’s current account deficit “finances” the desire of foreigners to accumulate net financial claims denominated in $AUDs.

Think about that carefully. The standard conception is exactly the opposite – that the foreigners finance the local economy’s profligate spending patterns.

In fact, the local trade deficit allows the foreigners to accumulate these financial assets (claims on the local economy). The local economy gains in real terms – more ships full coming in than leave! – and foreigners achieve their desired financial portfolio. So in general that seems like a good outcome for all.

The problem is that if the foreigners change their desire to accumulate financial assets in the local currency then they will become unwilling to allow the “real terms of trade” (ships going and coming with real things) to remain in the local nation’s favour. Then the local econmy has to adjust its export and import behaviour accordingly. If this transition is sudden then some disruptions can occur. In general, these adjustments are not sudden.

So if you understand this then you will be able to appreciate the following juxtaposition:

- Neo-liberal myth: US consumers have to borrow $billions from foreigners to keep consuming.

- MMT reality: US consumers are funding $billions in foreign savings (accumulation of $US-denominated financial assets by foreigners).

Here is a transactional account of how this works which starts off with a US citizen buying a Chinese product.

- US citizen buys a nice little Chinese car.

- If the US consumer pays cash, then his/her bank account is debited and the Chinese car dealer’s account is credited – this has the impact of increasing foreign savings of US dollar-denominated financial assets. Total deposits in the US banking system, so far, are unchanged.

- If the US consumer takes out a loan to buy the car, then his/her bank’s balance sheet now records the loan as an asset and creates a deposit (the loan) on the liability side. When the US consumer then hands the cheque over to the car dealer (representing the Chinese firm – ignore intervening transactions) the Chinese car company has a new asset (bank deposit) and my loan boosts overall bank deposits (loans create deposits). Foreign savings in US dollars rise by the amount of the loan.

- So the trade deficit (1 car in this case) results from the Chinese car firm’s desire to net save US dollar-denominated financial assets and sell goods and services to the US in order to get those assets – it is the only way they can accumulate financial assets in a foreign currency.

What if the Chinese car company then decided to buy US Government debt instead of holding the US dollar-denominated bank deposits?

Some more accounting transactions would occur.

- The Chinese company would put in an order for the bonds which would transfer the bank deposit into the hands of the central bank (Federal Reserve) who is selling the bond (ignore the specifics of which particular account in the Government is relevant) and in return hand over a bit of paper called a bond to the Chinese car maker’s lawyers or representative.

- The US Government’s foreign debt rises by that amount.

- But this merely means that the US Government promises, on maturity of the bond, to credit the Chinese car firm’s bank account (add reserves to the commercial bank the car firm deals with) with the face value of the bond plus interest and debit some account at the central bank (or whatever specific accounting structure deals with bond sales and purchases).

If you understand all of that then you will clearly understand that this merely amounts to substituting a non-interest bearing reserve balance for an interest-bearing Government bond. That transaction can never present any problems of solvency for a sovereign government.

The US consumers get all the real goods and services and the Chinese have bits of paper.

I know some so-called progressives worry about the stock of debt that the Chinese are holding. But the US government holds all the cards. The debt is in US dollars and they never leave the US system.

The Chinese may decide they have accumulated enough and will seek to alter the real terms of trade (that is, reduce its desire to export to the US). In that situation the US will no longer be able to exploit the material advantages and the adjustment might be sharp and painful. But that doesn’t negate that while the situation is as described the material benefits are flowing in favour of the US citizens (overall).

The following blogs may be of further interest to you:

- Twin deficits – another mainstream myth

- Export-led growth strategies will fail

- What you consume or what you produce?

- Modern monetary theory in an open economy

- Debt is not debt!

- The piper will call if surpluses are pursued …

Question 4:

Short-term interest rates are set by the central bank while the fiscal strategy manifests in tax and spending decisions by the government. Whereas the private sector cannot directly influence the interest rate target being set the budget outcome at any point is not something the government can control.

The answer is True.

The fundamental principles that arise in a fiat monetary system are as follows.

- The central bank sets the short-term interest rate based on its policy aspirations.

- Government spending is independent of borrowing which the latter best thought of as coming after spending.

- Government spending provides the net financial assets (bank reserves) which ultimately represent the funds used by the non-government agents to purchase the debt.

- Budget deficits put downward pressure on interest rates contrary to the myths that appear in macroeconomic textbooks about ‘crowding out’.

- The “penalty for not borrowing” is that the interest rate will fall to the bottom of the “corridor” prevailing in the country which may be zero if the central bank does not offer a return on reserves.

- Government debt-issuance is a “monetary policy” operation rather than being intrinsic to fiscal policy, although in a modern monetary paradigm the distinctions between monetary and fiscal policy as traditionally defined are moot.

Accordingly, debt is issued as an interest-maintenance strategy by the central bank. It has no correspondence with any need to fund government spending. Debt might also be issued if the government wants the private sector to have less purchasing power.

Further, the idea that governments would simply get the central bank to “monetise” treasury debt (which is seen orthodox economists as the alternative “financing” method for government spending) is highly misleading. Debt monetisation is usually referred to as a process whereby the central bank buys government bonds directly from the treasury.

In other words, the national government borrows money from the central bank rather than the public. Debt monetisation is the process usually implied when a government is said to be printing money. Debt monetisation, all else equal, is said to increase the money supply and can lead to severe inflation.

However, as long as the central bank has a mandate to maintain a target short-term interest rate, the size of its purchases and sales of government debt are not discretionary. Once the central bank sets a short-term interest rate target, its portfolio of government securities changes only because of the transactions that are required to support the target interest rate.

The central bank’s lack of control over the quantity of reserves underscores the impossibility of debt monetisation. The central bank is unable to monetise the federal debt by purchasing government securities at will because to do so would cause the short-term target rate to fall to zero or to the support rate. If the central bank purchased securities directly from the treasury and the treasury then spent the money, its expenditures would be excess reserves in the banking system. The central bank would be forced to sell an equal amount of securities to support the target interest rate.

The central bank would act only as an intermediary. The central bank would be buying securities from the treasury and selling them to the public. No monetisation would occur.

However, the central bank may agree to pay the short-term interest rate to banks who hold excess overnight reserves. This would eliminate the need by the commercial banks to access the interbank market to get rid of any excess reserves and would allow the central bank to maintain its target interest rate without issuing debt.

So the private sector cannot directly influence the central bank’s capacity to set interest rates. Clearly the central bank considers developments in the private sector but that is a different matter.

However, the private sector does ultimately determine the budget balance associated with fiscal policy.

The budget balance has two conceptual components. First, the part that is associated with the chosen (discretionary) fiscal stance of the government independent of cyclical factors. So this component is chosen by the government.

Second, the cyclical component which refer to the automatic stabilisers that operate in a counter-cyclical fashion. When economic growth is strong, tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this decreases during growth.

In times of economic decline, the automatic stabilisers work in the opposite direction and push the budget balance towards deficit, into deficit, or into a larger deficit. These automatic movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments).

When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

The cyclical component is not insignificant and if the swings in private spending are significant then there will be significant swings in the budget balance.

The importance of this component is that the government cannot reliably target a particular deficit outcome with any certainty. This is why adherence to fiscal rules are fraught and normally lead to pro-cyclical fiscal policy which is usually undesirable, especially when the economy is in recession.

While the short-term interest rate is exogenously set by the central bank, economists consider the budget outcome to be endogenous – that is, it is determined by private spending (saving) decisions. The government can set its discretionary net spending at some target to target a particular budget deficit outcome but it cannot control private spending fluctuations which will ultimately determine the final actual budget balance.

So the best answer is true.

The following blogs may be of further interest to you:

- Saturday Quiz – May 1, 2010 – answers and discussion

- Understanding central bank operations

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 5:

If employment growth matches the pace of growth in the civilian population (people above 15 years of age) then the economy will experience a constant unemployment rate as long as participation rates do not change.

The answer is True.

The Civilian Population is shorthand for the working age population and can be defined as all people between 15 and 65 years of age or persons above 15 years of age, depending on rules governing retirement. The working age population is then decomposed within the Labour Force Framework (used to collect and disseminate labour force data) into two categories: (a) the Labour Force; and (b) Not in the Labour Force. This demarcation is based on activity principles (willingness, availability and seeking work or being in work).

The participation rate is defined as the proportion of the working age population that is in the labour force. So if the working age population was 1000 and the participation rate was 65 per cent, then the labour force would be 650 persons. So the labour force can vary for two reasons: (a) growth in the working age population – demographic trends; and (b) changes in the participation rate.

The labour force is decomposed into employment and unemployment. To be employed you typically only have to work one hour in the survey week. To be unemployed you have to affirm that you are available, willing and seeking employment if you are not working one hour or more in the survey week. Otherwise, you will be classified as not being in the labour force.

So the hidden unemployed are those who give up looking for work (they become discouraged) yet are willing and available to work. They are classified by the statistician as being not in the labour force. But if they were offered a job today they would immediately accept it and so are in no functional way different from the unemployed.

When economic growth wanes, participation rates typically fall as the hidden unemployed exit the labour force. This cyclical phenomenon acts to reduce the official unemployment rate.

So clearly, the working age population is a much larger aggregate than the labour force and, in turn, employment. Clearly if the participation rate is constant then the labour force will grow at the same rate as the civilian population. And if employment grows at that rate too then while the gap between the labour force and employment will increase in absolute terms (which means that unemployment will be rising), that gap in percentage terms will be constant (that is the unemployment rate will be constant).

The following Table simulates a simple labour market. You can see that while unemployment rises steadily over time the unemployment rate is constant. So as long as employment growth is equal to the growth in the underlying population and the participation rate doesn’t change, the unemployment rate will be constant although more people will be unemployed.

Understanding these aggregates is very important because as we often see when Labour Force data is released by national statisticians the public debate becomes distorted by the incorrect way in which employment growth is represented in the media.

In situations where employment growth keeps pace with the underlying population but the participation rate falls then the unemployment rate will also fall. By focusing on the link between the positive employment growth and the declining unemployment there is a tendency for the uninformed reader to conclude that the economy is in good shape. The reality, of-course, is very different.

The following blog may be of further interest to you:

For Q1, I still think it easier to describe it this way:

(X-M) = (T-G) plus (S-I) that is:

trade deficit = gov’t deficit plus private deficit

That makes all negative numbers deficits.

The other thing to consider is whether the gov’t deficit is with currency or debt.

Is Q2 not quite right from yesterday. I thought the question was:

“2. The only time that a budget surplus represents increased national savings is when the government creates a sovereign fund.”

For Q3,

“The use of the descriptor overall signals that we are considering the macroeconomic outcomes in this question. We might have concerns about the distributional consequences within the US that might arise from an on-going external deficit – that is that some might benefit while others will be losing jobs as manufacturing heads to China. But when we think in macroeconomic terms (which is mostly the case in this blog) we are dealing with aggregates and so the distributional questions, while very important, are abstracted from.

That statement is not entirely accurate because one of the important insights that progressive economists such as Kalecki provided was that distribution of income does impact on aggregate demand. Please read my blog – Michal Kalecki – The Political Aspects of Full Employment – for more discussion on this point.”

It seems to me that a lot of the “aggregates” are in the present or near present while the medium of exchange is actually future demand brought to the present. IMO, this is where a lot of the problems in macroeconomics are.

“Presumably, people buy imported goods made in China instead of locally-made goods (which are more expensive) because they perceive it is their best interests to do so.”

I don’t think that is correct.

Can I buy a router made in the USA? I’m thinking that > 90 percent are foreign made.

The other problem is that real and/or nominal wages can be falling and people have to buy cheaper items because of budget problems.

The discussion here about the future fund highlights some of the points raised in the previous blog dicussion. Just like a household may purchase financial assets with his surplus, the government may decide to do so. The fact that the latter is silly is a different question. A government running a surplus in an accounting period does not go into a nonsurplus just because it has bought some financial assets. Just like a household 🙂 National accountants will still record a surplus.

Second, why is the US called a debtor nation even though it pays in its own currency? That’s because it has to pay back in goods and services to reduce its indebtedness. It shows how dangerous it is to speak of the government not borrowing. If Indians keep importing stuff, the Indian banking system will face funding pressures and the Reserve Bank Of India may have to raise interest rates to attract flows into purchases of Government Of India Securities. Else it may take comfort on the fact that capital inflows are high. Even in that case, Indians are paying the foreigners. Deficits have to be financed.

At some level, there is no difference between the gold standard era and the present institutional arrangements. Money cannot but be endogenous. In the former, international debt was settled in gold and now in complicated ways. Even earlier it used to be much more complicated rather than simply by gold shipment. If debtor nations do not make attempts to achieve surpluses on their balance of payments, they are doomed to fail.

Bill –

Regarding your answer to what you misidentified as question 2, I think you need to precisely define what you mean by national savings.

Dear Ramanan (at 2010/09/26 at 21:35)

You claim:

Sorry, in an operational sense this is not a correct statement. How the neo-liberal-influenced reporting agencies decide to disclose the operations is one thing. But the purchase of private assets by the government is no different to the purchase of a hospital. It is equivalent to government spending and thus the impact on the non-government is similar (in liquidity terms). The major difference of-course is that it is unproductive expenditure rather than adding to productive capacity as would be the case if they built a new school or hospital.

best wishes

bill

Hi Bill,

Unproductive or not is one matter. How national accountants treat it is different. I agree purchasing financial assets is not productive.

The identity involving G, T, deltaB (assuming little Treasury balances at the central bank) is for a “model” or a story which does not involve purchases of financial assets. If the government decides to purchase financial assets, it does not change its deficit position. It changes its borrowing requirement.

For example, the TARP involved purchases of newly issued equities by banks and the size was around 700b but it didn’t add 700b to the deficit. It added only 200b for reasons that the Treasury thought it may take a loss.

I do not think that the flow of funds accountants are neoliberal.

Dear Bill,

Re q2.

“The concept of pre-funding future liabilities does apply to fixed exchange rate regimes, as sufficient reserves must be held to facilitate guaranteed conversion features of the currency.”

I don’t see why a government which is sovereign in its currency wouldn’t be able to generate the sufficient funds. Can you elaborate a little more, please?

Thanks

Graham

Ramanan: or example, the TARP involved purchases of newly issued equities by banks and the size was around 700b but it didn’t add 700b to the deficit. It added only 200b for reasons that the Treasury thought it may take a loss.

Right. Paulson wanted Bernanke to take the assets on the Fed’s balance sheet and Bernanke refused, saying it was properly fiscal. So Congress had to appropriate the funding, creating a huge political stink that continues and is influencing the coming election. Most of the public was furious about it, and a lot of people aren’t forgetting it. They are also aware that there was virtually no accountability.

The accounting was based on an estimate at the time, and it is being reported that the government fared better than expected, although that is contested.

Ramanan,

I agree. The purchase of private sector assets properly accounted for is not a deficit spending operation and does not alter private sector net saving.

It DOES alter the gross asset liability profile of non government with government (assuming the purchase is funded with government debt), but that is a different beast.

TARP was not in substance a deficit spending operation. The massive PR problem was due to a general lack of understanding between flow of funds and income statements.

Coincidentally today, from Bloomberg:

Sept. 27 (Bloomberg) — The U.S. Treasury Department may announce plans as early as this week to return American International Group Inc. to independence and recoup taxpayer money from the insurer’s bailout …

Dear Bill,

I think I get it now. I guess one has to interpret “reserves” as “foreign currency reserves”.

Cheers

Graham

Dear anon (at 2010/09/27 at 10:35)

You said:

The fact is that the squeeze on the non-government sector as a result of a true surplus is not evident and that bank reserves increases when the government “spends” its “recorded” surplus in this way.

I understand what TARP was.

I find some of the quips coming from the comments lately which attempt to obscure the underlying monetary movements to be relatively unhelpful.

best wishes

bill

Bill,

“attempt to obscure”

If my contribution has the effect of obscuring, that is unintended and unfortunate, but accusing me of attempting to obscure is not necessary. I’ll end it there, except for this last point regarding your comment:

“The fact is that the squeeze on the non-government sector as a result of a true surplus is not evident and that bank reserves increase when the government “spends” its “recorded” surplus in this way.”

I’m not clear on where the disagreement is.

I said that asset acquisition doesn’t change a properly accounted for deficit (or surplus by implication). Asset acquisition increases reserves in the first instance, but that just begs the question. An increase in reserves can reflect deficit spending or financial intermediation. It doesn’t necessarily reflect (properly accounted) deficit spending.

On the other hand, if a government has surplus, it can adjust its balance sheet in two ways – by eliminating a liability (e.g. reserves) or by increasing an asset. The latter option is consistent with what Ramanan wrote, at least in the way I interpreted it. It amounts to the combined effect of a surplus (reduction in reserves) and financial intermediation (asset plus increase in reserves). Financial intermediation has no effect on the surplus, so the net result of the surplus is an asset.

“Case A shows the situation where the external deficit exceeds the public deficit and the private domestic sector is in deficit. In this case, there can be no overall private sector de-leveraging.

With the external balance set at a 2 per cent of GDP, as the budget moves into larger deficit, the private domestic balance approaches balance (Case B). Case B also does not permit the private sector to save overall.”

Bill, the phrasing here seems to be equating “private sector deleveraging” with “private sector net saving”. These surely aren’t equivalent? The private sector can leverage or deleverage regardless of whether it is net dissaving or saving, no?

I think I’m just a little confused because I’m viewing deleveraging as a contractionary balance sheet change, but net saving as an income event..

Quote from Billy: “Question 3:

The massive build-up of Chinese holdings of US government debt has allowed US citizens to enjoy a higher material standard of living overall at the expense of the residents of China.

The answer is True.”

The use of the descriptor overall signals that we are considering the macroeconomic outcomes in this question. We might have concerns about the distributional consequences within the US that might arise from an on-going external deficit – that is that some might benefit while others will be losing jobs as manufacturing heads to China. But when we think in macroeconomic terms (which is mostly the case in this blog) we are dealing with aggregates and so the distributional questions, while very important, are abstracted from.”

In short, you will ignore the entire reality of stagnate wages and destruction of entire internal sectors. You are talking theoretical la la land.

Quote: “First, China can only do what the Americans and everyone else it trades with allow them to do. They cannot sell a penny’s worth of output in USD and therefore accumulate the USD which they then use to buy US treasury bonds if the US citizens didn’t buy their stuff. Presumably, people buy imported goods made in China instead of locally-made goods (which are more expensive) because they perceive it is their best interests to do so.”

First, this statement makes no sense as one can find holders of USDs outside the United States. As long someone not necessarily US Citizens is selling stuff to Americans or have saved signification USDs Chine can sell to them. Trans-nationals have signification amount of USDs and many times the majority of sell are outside the USA and are not to US citizens. American Trans-nationals don’t need physical sells as they generate USD via trading financial products and financing for inter company markets. To confirm this fact one just have to look at USD denominated sells for major US corps outside of the USA something I suppose a professional economist couldn’t be bothered to check.

You monetary economists don’t know anything about trade mechanics outside of banking.

Second, it is also false that locally made goods are more expensive in terms of shelf price which is the point of final sell. That is a lie. America prices are competitive but shelf access is not afforded to America goods because various tax reasons and purchase contracts with Chinese manufacture allow cheaper prices on the wholesale end due to lower labor cost.

However, since wholesale price is simply marked to the American manufacture price the only people who benefit are the major shareholders of American companies. They don’t spend it they “save” the money or gamble it.

The result is the “profit” created by buy the cheaper foreign good is shifted from investment into local production some of which goes into wages. By robbing wages from local workers, aggregate demand must drop and therefore people buy less not more.

I’m ignoring the issues of consumer credit as that will only results in Ponzi finance schemes because the under lying support for demand i.e. high private wages is absent.

Trade with China was made the average American materially poorer not richer. Dani Rodrik has refuted this nonsense about material advantages years ago by looking at the empirical facts than “presuming.”

Quote: “First, exports are a cost – a nation has to give something real to foreigners that it we could use domestically – so there is an opportunity cost involved in exports.”

False. Opportunity cost can be canceled by capital improvement. Increasing sells into foreign markets increases revenue which must be reinvesting into capital investment. Capital investment leads to productivity gains that lead to cost savings above opportunity cost. Saying exports are a cost is saying efficiency is a cost (by efficiency I don’t the new Greenspan method of dollars per hour bull but rather old traditional physical units per hour and I mean capital work speed up not worker speed up).

The proof of this fact that wages rose and the middle class increased prior to the opening up of China-US trade and under the floating rate system real wages have stagnated and based on the old models for inflation and purchasing power (as the evil economists keep changing models to deceive people) American living standards have declined by 60%.

Quote: “Second, imports are a benefit – they represent foreigners giving a nation something real that they could use themselves but which the local economy will benefit from having. The opportunity cost is all theirs”

False. Short terms benefit but long term cost depending on scale. Efficiency gains all theirs. You must balance out cost and gains sector by sector based on physical input-output. Simple accounting formulations based on immediate monetary gains ignores long term physical effects.

Quote: “Thus, on balance, if a nation can persuade foreigners to send more ships filled with things than it has to send in return (net export deficit) then that is a net benefit to the local economy.”

OMG! By that logic US corn dumping must have been a boom to the Mexican farmer. You cannot assume that all net export deficit is a long term net benefit. Let’s say those ships are filled with Tulips in 1636. I suppose MMTers would say exporters are real losers…snicker. After all value is what you consume like a mindless beast.

We MMT loving Oligarchs, wouldn’t wants the lower classes to have to use minds to make stuff because that might mean they would start using their now trained imaginations for outside of the narrow pursuit beast-like consumerism and might starting think about social justice, beauty, science. Stuff like human progress and the value of the human spirit. Halt all progress and call it sustainability. Ha! More like sustainable Oligarchy.

Reason tells us that not all purchases are equal and neither are all sells. MMT Monetarism tells to ignore the physical properties of transactions like irrational crazy people.

ALL Modern Monetary Economists are paid to lie for Banks and they know nothing about economics.

A nation importing cars is getting cars but a nation exporting cars is not just getting paper but a car industry. What is more valuable? Having Cars or a Car Industry?

MMT is lunacy on trade. All you do look at meaningless balance sheets but you ignore rotting factories and capital. You understand nothing about the properties of capital outside of the balance sheet which in the real world isn’t very important.

As an American, I am tired of having to live with imports. But I most tired of imported Imperial British Economic ideology whether it be Keynes, the Austrian School, Neoliberalism, Marxism, Anarcharism, Libertarianism, Liberalism, Free Trade, MMT etc…

Bring back Hamilton, John Quincy Adams, Henry Clay, and Abe Lincoln. Viva the American System, National Banking, Internal Improvements, High Wages, Manufacturing and the Protective Tariff. -Septeus7 the Whig Conservative because the Rs and Ds suck.