I started my undergraduate studies in economics in the late 1970s after starting out as…

Twin deficits – another mainstream myth

The headline news for today was that the actor Kevin McCarthy died at the age of 96. He was the star of the legendary 1956 science fiction movie the Invasion of the Body Snatchers which was about a doctor who tried to tell the world that it was being invaded by the emotionless alien Pod People. The movie was in the “so bad that it was good” category. Given the ending was open, perhaps we can persuade some of the Pods to return and subsume a few neo-liberals and also some progressives who have neo-liberal tendencies. There has been a lot of noise lately about why Modern Monetary Theory (MMT) is essentially misguided because it ignores the dangers of the external sector. The claim goes that while there is no financial constraint on government spending, expansionary policy leads to an expanding current account deficit and rising foreign debt levels which are unsustainable over any period longer than a few years. Okay, we have heard this all before. Here are some thoughts.

I dealt with the open economy fairly comprehensively in this blog – Modern monetary theory in an open economy – and it surprises me that the issues I dealt with there still cause confusion.

MMT does not say that the economy is not prone to crises or that the behaviour of the private sector cannot cause serious problems.

The orthodox interpretation of a burgeoning Current account deficit is that it indicates that the nation “living beyond its means” – with excessive domestic demand that boosts imports; the excessive demand also fuels inflation that restricts exports. The presumption is that this CAD must be “financed” by flows of foreign reserves, which for the most part must be attracted by high returns and a stable political, economic, and social environment.

So the worsening trade account indicates that local consumption becomes dependent on the whims of foreign lenders. Further, if the nation has a large budget deficit, then its government is said to be increasingly dependent on the foreign purchases of its debt to supplement domestic savers’ purchases of government debt.

If the nation cannot attract these needed reserves, it must slow its growth to reduce imports; lower prices and wages could also encourage exports. The obvious portent of the default on foreign debt obligations then is used to argue in favour of restricting government spending. Thus, both monetary and fiscal policy ought to be tightened to encourage such capital flows even as this reduces the need for them.

Further, the orthodox interpretation of fiscal deficits is that they drive interest rates up (through competition for limited loanable funds) while generating inflation (excess demand). High interest rates, in turn, are argued to squeeze out productive investment, making the nation less competitive internationally. This hinders improvement in the trade balance, and competitiveness is further hurt by inflation.

Thus there is a fairly direct link claimed to follow from budget deficits to trade deficits – the so-called “twin deficits” hypothesis. This is why the mainstream believe it is imperative to reduce budget deficits. According to the logic, that would allow interest rates to fall, inflation to be reduced, lowering pressure on the external balance and exchange rates.

The supposed link between net spending and interest rates is predicated on the notion that sovereign governments have to “finance” any deficit spending, in the same way that a household has to fund spending above income (ignoring asset depletion options).

Such a link is purely voluntary and that it is not required for a sovereign government that wishes to maintain a sustainable fiscal strategy based on deficits.

As we will see in what follows, the “twin deficits” hypothesis is further based on crucial assumptions about the private domestic balance (relationship between saving and investment) which have rarely held in practice.

Finally, the “crowding-out” and “twin deficits” arguments are critically based on a supposed relation between government “borrowing” and interest rates where deficits push interest rates higher.

People think that when there is a CAD, further growth via budget deficit spending will worsen the situation. Robust growth will tend to generate a CAD if there is a relatively low income elasticity of demand for the country’s exports.

From the mainstream perspective the consequences of encountering balance-of-payments problems before short-term capacity utilisation is reached are straightforward. Demand has to be curtailed, unemployment increased, and capital accumulation has to be reduced. This leads, in the long run, to a relative deterioration of the country’s export potential compared with that of its main competitors. This situation tends to lead to a vicious circle with further balance-of-payments problems.

MMT recognises this problem, but doesn’t recommend the mainstream solution.

For a sovereign nation – that is a “modern money regime” – that includes flexible exchange rates, the government has more domestic policy space than the maintream consider.

The government can make use of this space to pursue economic growth and rising living standards even if this means expansion of the CAD and depreciation of the currency.

While there is no such thing as a balance of payments growth constraint in a flexible exchange economy in the same way as exists in a fixed exchange rate world, the external balance still has implications for foreign reserve holdings via the level of external debt held by the public and private sector.

But it is also advisable that a nation facing continual CADs foster conditions that will reduce its dependence on imports. However, the mainstream solution to a CAD will actually make this more difficult.

Fiscal discipline has not helped developing countries to deal with financial crises, unemployment, or poverty even if they have reduced inflation pressures.

There are also inherent conflicts between maintaining a strong currency and promoting exports – a conflict that can only be temporarily resolved by reducing domestic wages, often through fiscal and monetary austerity measures that keep unemployment high. The best way to stabilise the exchange rate is to build sustainable growth through high employment with stable prices and appropriate productivity improvements.

A low wage, export-led growth strategy sacrifices domestic policy independence to the exchange rate – a policy stance that at best favours a small segment of the population.

There is also erroneous claims about who funds whom. We continually read that nations with current account deficits (CAD) are living beyond their means and are being bailed out by foreign savings.

A CAD can only occur if the foreign sector desires to accumulate financial (or other) assets denominated in the currency of issue of the country with the CAD.

This desire leads the foreign country (whichever it is) to deprive their own citizens of the use of their own resources (goods and services) and net ship them to the country that has the CAD, which, in turn, enjoys a net benefit (imports greater than exports). A CAD means that real benefits (imports) exceed real costs (exports) for the nation in question.

So the CAD signifies the willingness of the citizens to “finance” the local currency saving desires of the foreign sector. MMT thus turns the mainstream logic (foreigners finance our CAD) on its head in recognition of the true nature of exports and imports.

Subsequently, a CAD will persist (expand and contract) as long as the foreign sector desires to accumulate local currency-denominated assets. When they lose that desire, the CAD gets squeezed down to zero. This might be painful to a nation that has grown accustomed to enjoying the excess of imports over exports. It might also happen relatively quickly. But at least we should understand why it is happening.

The other implication of the mainstream view is that policy should be focused on eliminating CADs. This would be an unwise strategy.

First, it must be remembered that for an economy as a whole, imports represent a real benefit while exports are a real cost. Net imports means that a nation gets to enjoy a higher living standard by consuming more goods and services than it produces for foreign consumption.

Further, even if a growing trade deficit is accompanied by currency depreciation, the real terms of trade are moving in favour of the trade deficit nation (its net imports are growing so that it is exporting relatively fewer goods relative to its imports).

Second, CADs reflect underlying economic trends, which may be desirable (and therefore not necessarily bad) for a country at a particular point in time. For example, in a nation building phase, countries with insufficient capital equipment must typically run large trade deficits to ensure they gain access to best-practice technology which underpins the development of productive capacity.

To understand this point note that the balance of payments, which records all transactions between local residents and the rest of the world (ROW), is divided into two main accounts:

- Current account – records trade in goods and services, net income payments and net unrequited transfers.

- Capital account – records purchases and sales of assets (shares, bonds, property)and summarise a nation’s net foreign investment and foreign borrowings by government.

The Current Account is thus split into the merchandise trade balance (exports and imports); net income (records of the receipts and payments of interest and dividends; and unrequited transfers – remittances between the local economy and the ROW – including aid etc.

The Current Account can also be seen as equal to what the mainstream call “national saving” less domestic investment.

National saving in mainstream terms is the sum of the budget position plus private domestic saving.

MMT does not consider that concept applicable because the mainstream assumes the household-government analogy is sound.

Given the national government is not revenue-constrained it makes no sense to say it is saving in its own currency when it runs budget surpluses.

So the Current Account is the sum of the budget balance plus private domestic saving less investment (see discussion below).

This just tells us that macroeconomic factors will drive international borrowing and lending behaviour.

The Capital Account is split into official transactions (government transactions) and the unofficial component which records private net investments and offshore borrowing by local financial institutions including banks.

So all foreign direct investment in a nation’s productive capital is recorded in the Capital Account.

Is rising foreign debt unsustainable?

This article – Debt is good when it means investment in the Sydney Morning Herald on September 11, 2010 by Ross Gittins is interesting in this regard.

He is talking about the recent federal election campaign and notes that:

… despite all the feigned concern about the size of federal budget deficit, nothing was said about the current account deficit, which is almost always much bigger.

This just proves politicians carry on about what it suits them to. It hasn’t suited the opposition to bang on about the current account deficit because it was consistently high throughout the Howard government’s 11 years – meaning the net foreign debt just kept getting bigger.

He notes that even though our terms of trade are improving dramatically at present, the “rise in exports leads to a rise in imports” because our national income is higher and our exchange rate appreciates “thus encouraging people to buy more …. [imports] … relative to locally produced goods and services.”

The rising terms of trade also encourages productive investment which requires new capital equipment to be imported.

But the point of his article is that a rising CAD “isn’t as worrying as it sounds”. Gittins says:

… to debunk the Liberals’ dishonest implication that anything labelled “deficit” or “debt” must always be bad … [by switching] … the discussion of our “external imbalance” from the language of exports and imports to the language of saving and investment.

So given “(j)ust as Australia almost always imports more than it exports, so the nation also spends more on investment (in new housing, business equipment and structures, and public infrastructure) than it saves (whether by households, companies or governments)”.

Gittins says:

This is why Australia runs a surplus on the (financial) “capital account” of our “balance of payments” to and from the rest of the world, which exactly matches and finances the deficit on the “current account” of the balance of payments.

While we can take exception to the terminology (finances the CAD) the fact remains that the rising foreign debt may not be unproductive.

A rising CAD allows domestic residents to enjoy the benefits of the imports while providing the capital for investment to increase the potential growth path of the economy. Domestic saving can then remain high.

A budget deficit helps keep the domestic saving desires realised.

So a current account deficit reflects the fact that a country is building up liabilities to the rest of the world that are reflected in flows in the financial account. While it is commonly believed that these must eventually be paid back, this is obviously false.

As the global economy grows, there is no reason to believe that the rest of the world’s desire to diversify portfolios will not mean continued accumulation of claims on any particular country. As long as a nation continues to develop and offers a sufficiently stable economic and political environment so that the rest of the world expects it to continue to service its debts, its assets will remain in demand.

However, if a country’s spending pattern yields no long-term productive gains, then its ability to service debt might come into question.

Therefore, the key is whether the private sector and external account deficits are associated with productive investments that increase ability to service the associated debt. Roughly speaking, this means that growth of GNP and national income exceeds the interest rate (and other debt service costs) that the country has to pay on its foreign-held liabilities. Here we need to distinguish between private sector debts and government debts.

The national government can always service its debts so long as these are denominated in domestic currency. In the case of national government debt it makes no significant difference for solvency whether the debt is held domestically or by foreign holders because it is serviced in the same manner in either case – by crediting bank accounts.

In the case of private sector debt, this must be serviced out of income, asset sales, or by further borrowing. This is why long-term servicing is enhanced by productive investments and by keeping the interest rate below the overall growth rate. These are rough but useful guides.

Note, however, that private sector debts are always subject to default risk – and should they be used to fund unwise investments, or if the interest rate is too high, private bankruptcies are the “market solution”.

Only if the domestic government intervenes to take on the private sector debts does this then become a government problem. Again, however, so long as the debts are in domestic currency (and even if they are not, government can impose this condition before it takes over private debts), government can always service all domestic currency debt.

Some early work on twin deficits

Some time ago (1996), I considered the financial implications of MMT in the context of a small open economy. I presented the paper in New York at a conference organised by the New School and it was subsequently published as:

W.F. Mitchell (2003) ‘The Job Guarantee model – financial considerations in an open economy’, in E.J. Nell (ed.), Functional Finance and Full Employment, Edward Elgar, New York, 278-295, June.

You may be able to find a copy of the paper. I have an older working paper version that I can E-mail as long as 15 thousand people do not ask for it (current readership)!

I noted that in addition to the normal arguments that monetarists and others use to justify their case against fiscal activism (crowding out, inefficient resource usage), it is often argued that increased globalisation imposes further restrictions on the ability of governments to pursue independent fiscal and monetary policy.

In Australia’s case, it is alleged that budget deficits only result in growing current account deficits and rising debt levels. This is the so-called Twin Deficits hypothesis. Reacting to the growing debt levels, it is alleged that external funds managers can enforce higher interest rates and thus even lower growth and higher unemployment in the domestic economy.

In that paper I noted that there were several testable hypotheses included in the monetarist case, which are rarely confronted with empirical scrutiny.

These include:

- 1. Is there evidence of a relationship between budget deficits and short-term and long-term interest rates? If there is no discernable statistical relationship found it is difficult to argue against fiscal activism based on financial crowding out arguments.

- 2. Is there evidence of a relationship between long-term interest rates across countries in globalised financial markets? If there is no relationship detected then the view that financial traders in the large markets like Japan and the United States can render domestic monetary policy ineffective is problematic.

- 3. Is there any evidence that the relationship between domestic long-term and short-term interest rates is unstable? Stability implies that the cash rate, which is set as a policy instrument, and the longer-term interest rates, which are influenced by market considerations, move together in a proportional manner over the long-run and that therefore the determinant is the officially controlled cash rate.

- 4. Is there any evidence to support the twin-deficits hypothesis that imposes causality from the fiscal deficit changes to changes in the current account deficit? A lack of such a direct relationship also provides further support for the use of budget deficits to implement a Job Guarantee.

MMT tells us that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency. It makes no statements about the sagacity of the private sector absolutely or relatively to the government sector.

What MMT tells us that if the exchange rate is floating the government can always use fiscal policy to maximise domestic potential subject to real resource constraints. There is no attempt to deny that fluctuations in private spending or imprudent financial investment decisions can go haywire and get the economy into serious trouble.

Clearly, private sector solvency is at risk if there is foreign currency-denominated debt involved and export performance fails.

But even in that situation (unless there is an absolute shortage of food or other resources – see this blog – Bad luck if you are poor! – for more on that – a sovereign government can keep everyone employed and economic activity high if it so chooses.

It can also orient spending to domestic activities which substitute for traded-goods and thus take the pressure of the external situation that the failing private sector behaviour has generated.

To have maximum fiscal discretion the government has to be able to implement an independent monetary and fiscal policy. In this section we examine the effects of budget deficits on interest rates and current account performance and also seek to establish causality within the term structure of interest rates.

The critics of MMT point to financial constraints they allege would arise from the higher budget deficits. The willingness of government to allow the budget deficit to increase and decrease as is necessary is essential to running a Job Guarantee and maintaining full employment.

MMT tells us that rising budget deficits that may be required to make Job Guarantee operational (depending on what else is happening in the non-government sector) are not a cost and should be ignored.

MMT tells us that the size of the budget deficit necessary to maintain the policy is irrelevant. One of the most damaging analogies in economics is the supposed equivalence between the household budget and the government budget. This immediately leads to what we might call “backward” reasoning. For example, Barro (1993, p.367) says “we can think of the government’s saving and dissaving just as we thought of households’ saving and dissaving.”

The analogy is flawed at the most fundamental level. The household must work out the financing before it can spend. Whatever sources are available, the household cannot spend first. Moreover, by definition a household must spend to survive.

A sovereign government is totally the opposite. It spends first and does not have to worry about financing even if it puts in place institutional arrangements (such as debt-issuance machinery that obscures this fact).

The important difference is that the government spending is desired by the private sector because it brings with it the resources (fiat money) which the private sector requires to fulfill its legal taxation obligations. The household cannot impose any such obligations.

The government has to spend to provide the money to the private sector to pay its taxes, to allow the private sector to save, and to maintain transaction balances. Taxation is the method by which the government transfers real resources from the private to the public sector. A budget deficit is necessary if people want to save.

The logic according to those who draw the household analogy follows like this. Debt would have to be issued to finance the deficit. Accordingly, bond sales finance government, which will accumulate as debt.

Like a household, the rising debt cannot be sustained indefinitely and so spending must be curbed and brought in line with the financial reality. In the meantime, the demands that the debt places on available savings pushes interest rates up and crowds out “more efficient” sources of private spending.

The backward logicians divide into two camps. The orthodox monetarists who eschew government debt and advocate balanced budgets. Their wrong-minded logic has imposed extremely high macroeconomic costs in terms of lost growth and high unemployment on the western economies since the mid-1970s.

The other camp is the group, which includes some Post Keynesians, who while comfortable with using deficit spending to increase economic activity, couch their recommendations in conservative logic bounded by appropriate movements in the debt to GDP ratio. As long as the ratio is stable there is no problem. These are the deficit doves!

On the latter, Andrew Glyn a well-known “progressive” and advocate of expansionary fiscal policy to reduce unemployment, has used the mainstream government budget constraint framework in his work to claim that the higher is the public debt ratio the higher sustainable deficit as long as the real interest rate is below the GDP growth rate.

He also argues that “financial markets, the ultimate arbiters of such matters, may look simply at the size of the deficit.”

Glyn (1997, p.227) concludes that:

Given the experience of the past twenty years it would be difficult to convince that increased deficits at the beginning of the expansionary programme would be rapidly scaled down as the private sector took up the main thrust of expansion. There seems little alternative to financing through taxation most of an expansionary programme.

Further, Glyn (1997, p.224) says “it is misleading to treat them (interest rates) as entirely exogenous. It is likely that beyond a certain level, a higher deficit will lead financial markets to exact a higher real-interest rate.”

The two camps however fail to understand the relationship between fiat currency, public debt and taxation in a monetary capitalist economy. The proponents of MMT have written extensively about these relationships over the last 15 years.

They show the priority of spending and argue that debt issue is not essential for governments to spend beyond tax revenue.

Bond issues are essential only to support the cash rates set by the Central Bank in the absence of a support rate. Deficit spending without Treasury bond sales would generate excess reserves in the banking system, so that government debt helps to maintain a positive overnight interest rate for private banks. The idea of crowding out in this environment is as meaningless as debates about the term maturity of the debt.

To fine-tune this point further, the spending would still have occurred if there were no bond issues. The excess reserves would be held somewhere in the banking system earning zero return.

If the Treasury offers too few or too many bonds relative to the holders of reserve balances at the Central Bank, the Central Banks “offsets” those operations to balance the system. In any case, the ‘money’ is in one account or another at the Central Bank.

Why should government care if the holders of the excess balances chose the one that doesn’t pay interest as opposed to the ones that do (buying bonds)? The answer is simple – they would be indifferent.

Deficits add to the net disposable income of households in the economy and the income provides markets for private production. An endogenous credit economy then serves to provide the deposits necessary to make payments, which facilitate production. The higher demand stimulates investment that creates capacity as a legacy to the future. The higher is current demand, the higher is productive capacity in the future. Spending brings forth its own savings. Savings are not required to exist as a prior pool for spending to occur.

The Nobel Prize winner William Vickrey (1996, p.10) argued that:

… the ‘deficit’ is not an economic sin but an economic necessity. Its most important function is to be the means whereby purchasing power not spent on consumption, nor recycled into income by the private creation of net capital, is recycled into purchasing power by government borrowing and spending. Purchasing power not so recycled becomes non-purchase, non-sales, non-production, and unemployment.

In an endogenous money world, there can be no crowding out unless the monetary authority stops lending.

In the late 1990s, the Asian financial troubles and subsequent IMF interventions gave credence to the view that increasing levels of public debt will eventually lead to lenders refusing to take up further public borrowing.

Usually this is cast in terms of countries with low levels of capital that have major private debt denominated in a foreign currency which is used to finance imports. Crises occur when the export revenue, which services the debt, falls for one reason or another.

However, what is ignored is that none of these countries would have any trouble issuing debt in its own currency.

In terms of the hypotheses I noted above I employed a range of “best practice” econometric modelling techniques in the paper mentioned and found that:

… none of the principal claims used against fiscal activism are empirically sustainable. The evidence is supportive of the conceptual basis of monetary theory that underpins the … (MMT) … model.

In terms of interest rate effects, the crowding out notions of monetarism are well known. It is claimed that whenever there is an exogenous planned rise in demand there is a concomitant rise in demand for money to meet the extra contractual commitments. If the banking system does not meet the demand for credit the rate of interest will rise before any additional output is sold. Accordingly, a budget deficit which “draws” on scarce savings via debt issue will push interest rates up in the domestic markets.

However, if the extra public spending is paid out of deposit-balances held by the Treasury at the Central Bank then there are no short-term interest rate effects. The demand for credit is not independent of the level of real activity, irrespective of whether this is a demand for loans from private entrepreneurs from the commercial banks, or whether it is a demand by the Treasury for balances at the Central Bank. Either route to increased money are consistent with an overdraft system.

So in a credit money economy we should expect to find no relationship between changes interest rates and the changes in the budget deficit.

Do short-and long-run interest rates converge?

While the measurement of real long-term interest rates is open to question there appeared to be a convergence among real long term interest rates in the major economies during the mid-1990s despite what appeared to be different domestic situations in each country.

Real long-term interest rates in Europe and Japan seemed to rise in response to American monetary conditions. So were rates truly determined domestically?

The issue bears on the ability of a sovereign government to implement policy, which is likely to be suspected by global financial markets. So how much do external factors constrain the freedom of long-term interest rates to vary with domestic fundamentals and to what extent has globalisation reduced the ability of monetary authorities to influence long-term interest rates?

With flexible exchange rates we expect that domestic long-term real interest rates will reflect domestic economic conditions. The budget deficit is usually included because it is seen as a major factor determining domestic saving.

However, this reflects a view of saving as a finite pool, which can be made available either to finance the budget deficit or to finance private spending.

MMT tells us that public spending creates its own saving and so no such influence is expected.

What factors might lead to international conditions dominating domestic influences on a country’s long-term interest rates?

First, when portfolio diversification is possible, risk premia may be determined by conditions in world markets. The argument is that large financial traders can impose their view on a nation’s interest rates. If, for example, it is thought that inflation is rising a higher risk premium will be imposed. There is very little evidence in the literature to support this view for sovereign governments.

Further, the antagonism towards large budget deficits is usually in terms of higher expected inflation rates. However, there is no systematic relationship between public deficits and inflation outcomes.

Second, in 1986, Larry Summers proposed that noise trading could provide the linkage. Allegedly expectations rather than economic fundamentals drive speculation. Traders who are unable to determine exact equilibrium information will use price information derived from large bond markets (such as the US bond market) to guide their trading behaviour. However, it is hard to argue that these effects which are likely to impact on short-term rates will be influential on long-term rates. Further, no evidence supports the claim.

Twin deficits hypothesis

The Twin Deficits Hypothesis (TDH) was used by monetarists to justify restrictive fiscal policy stances in the OECD economies during the 1980s and 1990s. The hypothesis is based on sectoral flow relationships which hold in an accounting sense in the national accounts.

So at the macroeconomic level, the final expenditure components of aggregate demand are consumption (C), investment (I), government spending (G), and net exports (exports minus imports) (NX).

The basic aggregate demand equation in terms of the sources of spending is:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

In terms of the uses that national income (GDP) can be put too, we say:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume, save (S) or pay taxes (T) with it once all the distributions are made.

So if we equate these two ideas sources of GDP and uses of GDP, we get:

C + S + T = C + I + G + (X – M)

Which we then can simplify by cancelling out the C from both sides and re-arranging (shifting things around but still satisfying the rules of algebra) into

what we call the sectoral balances view of the national accounts.

There are three sectoral balances derived – the Budget Deficit (G – T), the Current Account balance (X – M) and the private domestic balance (S – I).

The Twin Deficits Hypothesis writes the balances in this way:

(X – M) = (S – I) + (T – G)

So the External balance (X – M) equals the sum of the private domestic balance (S – I) plus the budget balance (T – G), where private savings is S, private investment is I; public spending is G, taxes, T) and exports (X) minus imports (M) is the net savings of non-residents.

You can then manipulate these balances to tell stories about what is going on in a country.

For example, when an external deficit (X – M < 0) and a public surplus (G – T < 0) coincide, there must be a private deficit. So if X = 10 and M = 20, X – M = -10 (a current account deficit). Also if G = 20 and T = 30, G – T = -10 (a budget surplus). So the right-hand side of the sectoral balances equation will equal (20 – 30) + (10 – 20) = -20.

As a matter of accounting then (S – I) = -20 which means that the domestic private sector is spending more than they are earning because I > S by 20 (whatever $ units we like). So the fiscal drag from the public sector is coinciding with an influx of net savings from the external sector. While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process. It is an unsustainable growth path.

So if a nation usually has a current account deficit (X – M < 0) then if the private domestic sector is to net save (S – I) > 0, then the public budget deficit has to be large enough to offset the current account deficit. Say, (X – M) = -20 (as above). Then a balanced budget (G – T = 0) will force the domestic private sector to spend more than they are earning (S – I) = -20. But a government deficit of 25 (for example, G = 55 and T = 30) will give a right-hand solution of (55 – 30) + (10 – 20) = 15. The domestic private sector can net save.

For further discussion please read the following blogs – Barnaby, better to walk before we run – Stock-flow consistent macro models – Norway and sectoral balances and The OECD is at it again!.

The Twin Deficits Hypothesis, however, imputes a strict causality between the sectoral flows where the private sector savings and investment gap is zero or stable, and changes in the budget deficit translate directly into current account deficit.

In my empirical work, I have never found any robust statistical causality between the budget deficit and the external balance.

Noting that in these circumstances the current account deficit represents a nation “spending more than it is earning”, the budget deficits are then considered to “cause” a rising external debt.

Accordingly, the risk of foreign financial market retribution via downgrading by international ratings agencies and the like is related to rising budget deficits. The cure for a chronic current account deficit then is logically to be found in increased domestic savings emanating from budget surpluses.

The problem is that the causality is not guaranteed. The evidence in Australia is that the private savings gap is not stable.

Further, the current account position at any point in time can be driven by international factors like imperfect competition, barriers to entry, economies of scale and general conditions of world trade.

All these factors may constrain export revenue. A world recession may cause a trading economy with automatic stabilisers to experience a current account deficit, which then drives a rising budget deficit.

Further, a rising budget deficit can increase domestic income and reduce the private savings gap.

The TDH which says that budget deficits are the driving source of Balance of Payments problems emerged in the 1980s as part of the overall neo-liberal attack on the use of expansionary fiscal policy (that is, budget deficits).

The claim is that the government’s budget deficit leads to an increase in the trade deficits (the twins) emerged initially from the use of the highly flawed Mundell-Fleming IS-LM macroeconomic models.

It was claimed that that expansionary fiscal policy drove up domestic interest rates – yes the TDH is in the same camp as the crowding out hypothesis – which pushes up the exchange rate and crowds out exports.

The appreciated exchange rate also is conducive to higher imports because for constant foreign prices they are now cheaper in the local currency.

Interestingly, the followers of Ricardian Equivalence deny any fiscal influence on the trade balance because they claim households and firms automatically adjust their spending down when government net spending increases – so there is no real output (aggregate demand effect).

As I have pointed out previously in this blog – Pushing the fantasy barrow – and others, Ricardian Equivalence is a nonsensical description of the real world.

That is not a path I ever tread however.

Some economists have recently considered this hypothesis again for the US (Kim and Roubini, 2008) give that a lot of the work was previously done on data that applied to the fixed exchange rate period.

They found that expansionary fiscal policy actually improves the current account and depreciates the real exchange rate (indicator of competitiveness) – which they call the twin divergence hypothesis.

They show that the budget deficits allow for higher private savings (because of their stimulatory impact on national income). They also claim that investment falls because the real interest rate is higher but I don’t find that part of their analysis compelling at all.

Other models suggest that rising domestic absorption (as aggregate demand rises and income rise) links the deficits to the current account balance rather than any interest rate or real exchange rate effect.

The overall conclusion that you draw from the literature, however, is confusion. No robust findings are a systematically available and many complicating factors are evident.

Overall, the methods used in the empirical studies are questionable and the results highly ambiguous.

Some evidence from Australia

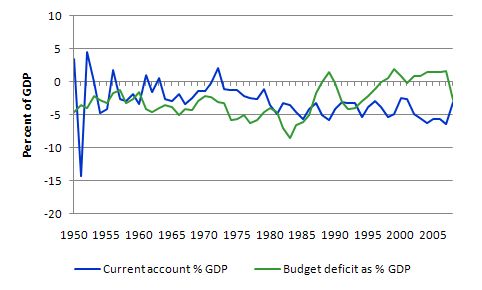

The following graph is taken from Reserve Bank of Australia data and shows the movement in the national budget deficit as a per cent of GDP (green line) and the Current Account deficit as a percent of GDP (blue line) from 1950 to 2009. From 1983 exchange rate was floated. There is no systematic relationship between the two as implied by the TDH. The CAD continues to widen as the budget balance went into surplus.

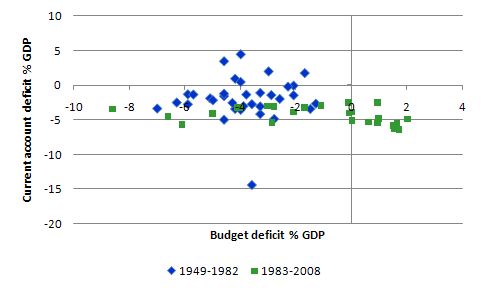

Here is a scatter plot of the same data with the budget deficit on the horizontal axis and the CAD on the vertical axis. The different coloured markets indicate the period before (blue) and after (green) the exchange rate was floated. The green line is a simple regression line and the R2 suggests zero relationship between the two variables. I could get very involved statistically (using VARs, Cointegration, Causality analysis etc) and I would come up with the same result.

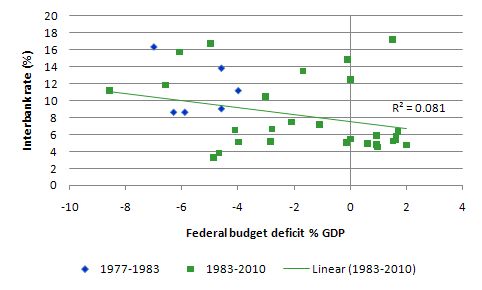

The following graph is taken from Reserve Bank of Australia data and shows the relationship between the federal budget deficit and the overnight interest rate from 1977 to now. The different colours indicate the period before (blue) and after (green) the exchange rate was floated.

You will appreciate clearly – there is no relationship. This graph could be reproduced for the advanced world and you wouldn’t find a robust relationship. So that avenue for the TDH is missing.

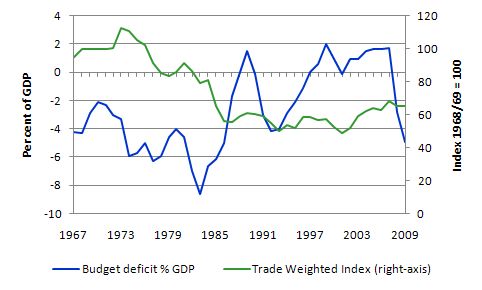

What about the impact of the budget deficit on the exchange rate? The following graph uses RBA data and shows the evolution of the budget deficit as a per cent of GDP and the Trade Weighted Index measure of the exchange rate (right-axis) from 1967 to 2009.

Again nothing systematic can be found between these two aggregates. When the budget was moving into surplus the TWI reached its lowest point.

Further, floating the exchange rate (after 1983) has been associated with muchless volatility rather than more.

Conclusion

I have run out of “blog time” today. But that should give some of you some more ammunition.

Remember when considering these issues what MMT says and don’t impute things to it that are not part of the body of work.

Clearly a nation that has failed to invest in productive capacity and used foreign debt to sustain consumption can face serious problems. But the national government can never be insolvent in terms of obligations made that are denominated in its own currency.

That is enough for today!

Billy, granted that a government can endlessly print it’s own currency to support same currency debt but how do private institutions go? Our banks carry way more mortgaged backed debt as a percentage of balance sheets than other corresponding institute. This debt is not used in a productive capacity other than the sheer hope that things will remain good and the punters can repay their loans so in 20 years they’ve made $600k out of a $200k loan. So what happens when things turn bad? Banks create money out of the fractional system and leverage but can’t ‘print’ money so how do they cover these debts? Also, at what point in a crook economy and “over indebtedness” does the government endlessly print money in order to support their own debt that could have otherwise been used for productive means?

“This desire leads the foreign country (whichever it is) to deprive their own citizens of the use of their own resources (goods and services) and net ship them to the country that has the CAD, which, in turn, enjoys a net benefit (imports greater than exports). A CAD means that real benefits (imports) exceed real costs (exports) for the nation in question.”

This sounds pretty much like China’s relationship with the US all over. Trade surplus being used to buy foreign currency assets (around usd800mm of US Treasuries and a bunch of mining assets around the world) supposedly in lieu of building out local infrastructure which would benefit Chinese living standards and productivity.

Is China’s sole strength over the rest of the world a result of miniscule wages it pays its workers in relation to its trading partners? Has Bill done a piece on China and these issues, I’d be most interested to read his viewpoint.

Johnno: you ask “What happens when things turn bad” in the case of private or commercial banks. Answer: they go bust. But governments (suckers for moral hazard that they are), nearly always print money and bail out private banks. The U.K.’s finance minister, Alistair Darling, created £60bn at the press of a PC mouse button, for the benefit of the ailing HBOS and RBS banks at the end of 2008.

Even more hilarious, was the fact that various so called “financial journalists” who clearly didn’t understand MMT went pouring through the Bank of England’s accounts to work out where this £60bn had “come from”.

As for the U.S., Citibank has been living on what is effectively social security for twenty years. I’d like to live in a world where competence is rewarded. Unfortunately, sucking up to the politicians who have access to a nation’s till is what really pays.

I have a similar problem to Johnno.

In Australia’s case, the bulk of the foreign debt is used to finance domestic house purchases. Houses do not produce an output of goods and services. Rental income either services a loan or is a left pocket to right pocket financial transaction within the economy.

As credit has expanded and house prices have risen there is some leakage of sales profits to the wider economy. This has boosted the economy and enhanced Australia’s ability to service the loans. Should house prices stagnate or fall, surely foreigners would question Australia’s ability to further service the debt. After all, few economically useful assets have been developed with the credit provided.

In this scenario, I perceive the foreign held debt to be a grave risk to the economy. Credit terms can be withdrawn faster than any Government could deficit spend to pick up the slack. Good credit terms with foreigners are predicated on continued rises in house prices, which are ultimately restricted by legislated lending criteria.

Should foreigners withdraw credit sharply, the Government will be forced to use it’s fiat monopoly powers to keep the banks solvent.

Can it be wise to foster continued economic growth through a process of House asset appreciation? Logically it can be done, all we have to do is relax lending criteria until borrowers can obtain infinite loans at zero interest. Did I miss some vital point?

Interesting how independent blogs can take up a similar topic at the same time. Different perspectives providing a great education in real time: http://mpettis.com/2010/09/what-do-the-good-trade-numbers-tell-us/

One of Prof. Pettis’ conclusions: “No matter what US consumers might choose to do, the US trade defcit will continue rising as an automatic consequence of events and policies abroad, and as they do, the US fiscal deficit will probably need to rise even faster to minimize the employment impact.”

Ray: Trade surplus being used to buy foreign currency assets (around usd800mm of US Treasuries and a bunch of mining assets around the world) supposedly in lieu of building out local infrastructure which would benefit Chinese living standards and productivity.

Not so. China is building like mad and has enormous excess capacity. Their problem is essentially that consumer demand is to small a part of GDP (estimated at about 35%). Wealth is accumulating at the top.

Marshall Auerback on China here.

And now, in other economic news…

15 000 people read billy blog!!

Congrats! We have to keep growing!

Dear Andrew (at 2010/09/13 at 23:43) and Johnno (at 2010/09/13 at 19:58)

Your points are sound and I agree with them. The majority of the rise in foreign debt (privately held) in the last decade has been via banks borrowing to lend for (unproductive) housing. The fact that the banks nearly collapsed in the early days of the crisis and were salvaged by the federal government guarantee is not well understood.

The point of the blog is not that the foreign debt is something we should ignore but that we should not worry about budget deficits that are well spent. Private deficits that are incurred and bolstered by foreign-currency denominated obligations are something that we should worry about if the funds are not being used to build productive capacity. In part, the growth of the Australian economy from the mid-1990s was driven by a consumption and housing boom on the back of increasing private indebtedness.

The budget surpluses that the conservatives were running exacerbated that but also were only possible because of that. It was unsustainable because the private sector cannot increasingly accumulate debt obligations indefinitely – that are not backed by productive capacity augmentation.

We agree.

best wishes

bill

Thanks for the response Bill. The blog is full of useful takeaways. It takes a bit of reading 🙂 but it does provide a valuable education.

I would be happier if the legislative powers followed economic advice from this blog. It seems they are all too easily led by the profit motives of (conventional) bank economists.

bill says:

Tuesday, September 14, 2010 at 7:27

“The fact that the banks nearly collapsed in the early days of the crisis and were salvaged by the federal government guarantee is not well understood.”

You seriously believe this?

‘the banks’ I take you to mean the big 4? At no time were they technically insolvent or even close to it, nor were problem loans particularly high. They had little exposure to US housing and held very few CDO and other synthetic securities in portfolio. Yes their share prices fell but so did every company on the planet.

So if you are referring to the period where the debt markets froze then I think you will find that deposit balances rose even before the deposit guarantee was applied, given there has always been an implicit RBA lender of last resort guarantee.

As for the wholesale bank guarantee, this was charged according to credit rating and the Aust taxpayer did very well thank you very much.

If you are referring to Macquarie then yes, at $16 it did look a bit shaky but hey, apart from a few millionaires at the Factory, who was it going to affect?

The Govt was timely in stepping in, no doubt, and probably lost an opportunity to keep the banks on the rack by dictating lending policy but you are dreaming if you think they were anywhere near collapse. Fewer banks in the world were as safe as the big 4, as subsequent performance has shown.

While the reserve ratio’s and lending practices of the big 4 are relatively stronger than many banks worldwide. They cannot “technically” remain solvent should domestic housing prices fall significantly. I wouldn’t put too much faith in their self conducted “stress tests” .

The banks lending practices are only sustainable with the implicit guarantee of the RBA. They wouldn’t be so cock sure of themselves, if they felt their companies and jobs were actually at risk in the event of a severe house price correction.

AW, what are you actually talking about? It sounds like you are reading from a text book (or Biil’s previous writings).

For a start domestic housing prices did not fall significantly (probably because migration and housing shortage keeps a floor under demand).

Secondly, it was the US and EU banks that conducted stress testing, not the Aussies (unless you count APRA’s independent tests which found them to be solid. You can google that if you wish).

‘The banks lending practices are only sustainable with the implicit guarantee of the RBA.’

There has always been an implicit guarantee from the RBA as lender of last resort so what is your point exactly?

I repeat, given the facts, the Aussie banks were never in danger of failure.

Dear Ray (at 2010/09/14 at 14:40) and Andrew (at 2010/09/14 at 12:59)

Apart from Allco and Babcock & Brown failing, the major banks benefited greatly from the guarantee.

Before the Australian government introduced the guarantee for the deposits and wholesale funding of Authorised Deposit-taking Institutions (ADIs) there was a major outflow of deposits from the smaller banks into the Big 4. That drain stopped soon after the guarantee was announced in October 2008 and probably saved several of them (for example, BankWest ?).

The access to funds to allow banks to roll-over their foreign debt commitments was severely reduced as the crisis emerged. The guarantee immediately solved that problem and not only did borrowing volumes increase but the costs of raising wholesale funding backed by the Government Guarantee fell sharply.

Macquarie Bank would have failed without it.

We know that before the guarantee ANZ and Westpac paid 1 percentage point above swap on three-year bonds whereas National Australia Bank (NAB) was able to raise twice as much as each of those banks (in US dollars) for three-year bonds at 0.85 percentage point above swap.

Further, in July 2008, NAB (one of the big four) was forced to cut is bond sale by more than 66 per cent because investors would not oblige. They completely wrote off a bundle of “senior strips” of AAA-rated CDOs worth A$900 million as a result.

I can catalogue more of this but haven’t the time. The fact was that the exposure problems of the big 4 banks to international debt and the drying up of the markets during the early days of the crisis were resolved by the guarantee. It was very important in ensuring bank profits were strong during this period.

best wishes

bill

Bill,

I don’t disagree that both guarantees greatly served the banks; the deposit guarantee to ensure people didn’t take out money and stash it under the mattress (helping the smaller banks) and more importantly the wholesale funding guarantee for reasons you mentioned.

However, while there was the odd synthetic on the banks’ books, these were tiny in comparison to those in the US and EU and overall bank assets.

Furthermore, and probably more importantly, almost all their exposure was to Australian housing and business lending. The housing market had a blip but with no highly leveraged securities linked to housing, the banks could have endured a significant housing price fall.

Importantly also is that Australian bank lending practices are far more conservative to those in the US. Loans here are full recourse to a borrowers’ assets whereas in the US you can simply walk away when there is negative equity. This tends to make borrowers focused on their obligations.

Who would have failed though? Bankwest? Doubt it, they were unlisted and a wholly owned sub of HBOS so would have shared their fate. Adelaide/Bendigo, Suncorp and the minors? Hard to say. Again they were not leveraged to synthetics.

It all comes down to market liquidity. Could a lack of funding for a period have brought down the banks? Given most major corporations had less access to credit markets than the banks and still managed to survive without guarantees I suspect our banks would have been just fine but the big 4 were never in danger, guarantees or not.

Macquarie Bank was not a deposit taking bank but rather an investment bank. Their CMT was a trust and funding was not able to be applied to their balance sheet. Some smart cookies over there ended up using the guarantee to convert the trust to deposit accounts, paid more interest and this helped save their bacon. But I agree, we would be without MB now without the guarantee.

I find this debate very interesting. People think that rebates, pink batts and building the education revolution that spared Australia much of the GFC pain but I rather suspect it was quick thinking with these 2 guarantees and no small input from the mining industry who fed China’s furnaces.

Cheers

and thank you Bill for taking the time out of your busy schedule to discuss this.

Appreciated.

Ray,

Because of the emotive tones you used. I feel obliged to rebutt your comments. Point by point.

I would happily leave you in a world of your own understanding, but I cannot let you twist my words.

Ray said. “AW, what are you actually talking about? It sounds like you are reading from a text book (or Biil’s previous writings).

AW says. Thanks for the insult, I’ll take it as a compliment.

R. “For a start domestic housing prices did not fall significantly ”

AW. It depends what you call significant. They did fall at first. After the first time buyers stimulus they recovered.

R. “(probably because migration and housing shortage keeps a floor under demand).”

AW. That’s your viewpoint and part of the overall picture. Credit availability, competition for loans, FTB grant and growth in the investment property sector are also factors affecting house prices.

R. “Secondly, it was the US and EU banks that conducted stress testing, not the Aussies (unless you count APRA’s independent tests which found them to be solid. You can google that if you wish).”

AW. No need Ray, I was referring to investor relation slides produced by some of the banks, giving a risk assessment of their exposure to falls in real estate prices. I take your point. They were not official stress tests.

R. “‘The banks lending practices are only sustainable with the implicit guarantee of the RBA.’

There has always been an implicit guarantee from the RBA as lender of last resort so what is your point exactly?”

AW. Point 1. Lender of last resort does not imply the Government is a Bank rescuer of last resort. The Big 4 Banks could have been left to go under and the Government could have taken over the loans portfolio.

AW. Point 2. Ask yourself why do the Banks require Government intervention? I say, because Bank lending practices are not sustainable.

R. “I repeat, given the facts, the Aussie banks were never in danger of failure.”

AW. I disagree. They were in grave danger but the risks were mitigated by Government intervention. Your statement may read better if you said “after the facts” instead of “given the facts”.

Bill,

You say:

A CAD can only occur if the foreign sector desires to accumulate financial (or other) assets denominated in the currency of issue of the country with the CAD.

Agreed.

Then:

This desire leads the foreign country (whichever it is) to deprive their own citizens of the use of their own resources (goods and services) and net ship them to the country that has the CAD, which, in turn, enjoys a net benefit (imports greater than exports).

But surely, just because country x has citizens sending money to country y (that create part of country y’s capital account surplus), it does not mean country x has to ship goods to country y. Can’t country y use all the foreign exchange (US dollars) from country x to buy goods from other countries? The US dollar is the global reserve country. Therefore it is a potential claim on any country’s resources.

I enjoyed this post very much.

Thanks Bill…

Andrew @ Tuesday, September 14, 2010 at 17:56:

“…But surely, just because country x has citizens sending money to country y (that create part of country y’s capital account surplus), it does not mean country x has to ship goods to country y. Can’t country y use all the foreign exchange (US dollars) from country x to buy goods from other countries?”

Yes, country y can do it, but then it won’t have any current account surplus – the balance would go back to 0 or even in deficit depending on how much it bought for from other countries. Why do you ask that question?