Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – May 15, 2010 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

Only one of the following propositions is possible (with all balances expressed as a per cent of GDP):

- A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earning.

- A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

- A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

- None of the above are possible as they all defy the sectoral balances accounting identity.

At the outset I accept Bruce’s point – the government surplus reinforces the demand drain coming from the current account deficit. I more correctly should have written “accompanied by a government sector surplus of equal proportion to GDP”. I don’t think it would have lead you astray though!

This is a question about the sectoral balances – the government budget balance, the external balance and the private domestic balance – that have to always add to zero because they are derived as an accounting identity from the national accounts.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances).

This is also a basic rule derived from the national accounts and has to apply at all times.

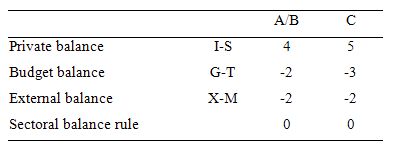

The following Table represents the three options in percent of GDP terms. To aid interpretation remember that (I-S) > 0 means that the private domestic sector is spending more than they are earning; that (G-T) < 0 means that the government is running a surplus because T > G; and (X-M) < 0 means the external position is in deficit because imports are greater than exports.

The first two possibilities we might call A and B:

A: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending less than they are earn

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

So Option A says the private domestic sector is saving overall, whereas Option B say the private domestic sector is dis-saving (and going into increasing indebtedness). These options are captured in the first column of the Table. So the arithmetic example depicts an external sector deficit of 2 per cent of GDP and an offsetting budget surplus of 2 per cent of GDP.

You can see that the private sector balance is positive (that is, the sector is spending more than they are earning – Investment is greater than Saving – and has to be equal to 4 per cent of GDP.

Given that the only proposition that can be true is:

B: A nation can run a current account deficit with an offsetting government sector surplus, while the private domestic sector is spending more than they are earning.

Column 2 in the Table captures Option C:

C: A nation can run a current account deficit with a government sector surplus that is larger, while the private domestic sector is spending less than they are earning.

So the current account deficit is equal to 2 per cent of GDP while the surplus is now larger at 3 per cent of GDP. You can see that the private domestic deficit rises to 5 per cent of GDP to satisfy the accounting rule that the balances sum to zero.

The final option available is:

D: None of the above are possible as they all defy the sectoral balances accounting identity.

It cannot be true because as the Table data shows the rule that the sectoral balances add to zero because they are an accounting identity is satisfied in both cases.

So what is the economics of this result?

If the nation is running an external deficit it means that the contribution to aggregate demand from the external sector is negative – that is net drain of spending – dragging output down.

The external deficit also means that foreigners are increasing financial claims denominated in the local currency. Given that exports represent a real costs and imports a real benefit, the motivation for a nation running a net exports surplus (the exporting nation in this case) must be to accumulate financial claims (assets) denominated in the currency of the nation running the external deficit.

A fiscal surplus also means the government is spending less than it is “earning” and that puts a drag on aggregate demand and constrains the ability of the economy to grow.

In these circumstances, for income to be stable, the private domestic sector has to spend more than they earn.

You can see this by going back to the aggregate demand relations above. For those who like simple algebra we can manipulate the aggregate demand model to see this more clearly.

Y = GDP = C + I + G + (X – M)

which says that the total national income (Y or GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

So if the G is spending less than it is “earning” and the external sector is adding less income (X) than it is absorbing spending (M), then the other spending components must be greater than total income

The following blogs may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

Question 2:

If the Greek government decided to leave the EMU and restore their own currency they would have no solvency problems and could avoid an austerity program.

The answer is False.

The “could avoid an austerity program” dated the question as applying to the current situation rather than some period in the future when all the adjustments associated with a decision to leave the EMU had worked themselves out of the system.

In that context, it is clear that all liabilities that the Greek government holds would immediately be denominated in a foreign currency if it left the Eurozone and introduced its own currency again. This is in a formal sense.

In fact, the liabilities are currently in a “foreign currency” (Euros) in the sense that the Greek government does not issue that currency. But once it left the EMU then this alienation from the Euro would become formal.

As a result, the decision to exit the EMU would have to be accompanied by a default on existing obligations, because the government would be insolvent (unable to meet its Euro liabilities).

It will probably have to default anyway, given that the design of the EMU makes it impossible for a nation to manage a major aggregate demand failure such as the one that has occurred during the current crisis.

So the question is: given that default (they will call it renegotiation or rescheduling) is inevitable, why not go the whole way and insulate your economy from this vulnerability forever.

The general point is that a sovereign government (one that issues its own currency) can never face a solvency risk on liabilities denominated in its own currency. Once it issues debt in a foreign currency then it can face a solvency risk because the nation has to earn that currency via exports or other nations have to be willing to exchange it via currency swaps or whatever. For Greece, neither option is particularly plausible in the current circumstances.

The following blogs may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

- EMU posturing provides no durable solution

Question 3:

The IMF claims that “Greece needs to rely on internal devaluation” and the austerity programs are designed to deflate nominal wages and prices which is claimed will make the economy more competitive as long as real unit labour costs fall faster than their trading partners. However, ignoring whether the logic is correct or not, which of the following propositions must also follow if the IMF logic is to follow:

The EMU countries cannot improve their international competitiveness by exchange rate depreciation, which is the option always available to a fully sovereign nation issuing its own currency and floating it in foreign exchange markets.

Thus, to improve their international competitiveness, the EMU countries have to engage in “internal devaluation” which means they have to cut real unit labour costs – which are the real cost of producing goods and services. Governments setting out on this policy path have to engineer cuts in the wage and price levels (the latter following the former as unit costs fall).

But the question demonstrates that it takes more than just a nominal deflation. The strategy hinges on whether you can also engineer productivity growth (typically).

So given the assumption (wage and prices falling at the same rate), the correct answer is:

If wages and prices fall at the same rate, then labour productivity has to rise and what happens to employment is irrelevant.

Some explanatory notes to accompany the analysis that follows:

- Employment is measured in persons (averaged over the period).

- Labour productivity is the units of output per person employment per period.

- The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

- The wage bill is employment times the wage level and is the total labour costs in production for each period.

- Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

- The wage share is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

- Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays; Real unit labour costs just divide this by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and through algebra I would be able to show you (trust me) that it is equivalent to the Wage share measure (although I have expressed the latter in percentage terms and left the RULC measure in raw units).

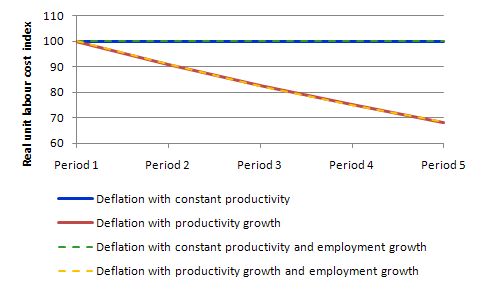

The following table models the constant and growing productivity cases but holds employment constant for five periods. We assume that the nominal wage and the price level deflate by 10 per cent per period over Period 2 to 5. In the productivity growth case, we assume it grows by 10 per cent per period over Period 2 to 5.

It is quite clear that under the assumptions employed, RULC cannot fall without productivity growth. The only other way to accomplish this is to ensure that nominal wages fall faster than the price level falls. In the historical debate, this was a major contention between Keynes and Pigou (an economist in the neo-classical tradition who best represented the so-called “British Treasury View” in the 1930s. The Treasury View thought the cure to the Great Depression was to cut the real wage because according to their erroneous logic, unemployment could only occur if the real wage was too high.

Keynes argued that if you tried to cut nominal wages as a way of cutting the real wage (given there is no such thing as a real wage that policy can directly manipulate), firms will be forced by competition to cut prices to because unit labour costs would be lower. He hypothesised that there is no reason not to believe that the rate of deflation in nominal wage and price level would be similar and so the real wage would be constant over the period of the deflation. So that is the operating assumption here.

The following table models the constant and growing productivity cases as above but allows employment to grow by 10 per cent per period. All four scenarios in the Table are them modelled in the following graph with the Real Unit Labour Costs converted into index number form equal to 100 in Period 1. As you can see what happens to employment makes no difference at all.

I could have also modelled employment falling with the same results.

The following graph shows the four scenarios shown in the last two tables. I have dashed some scenarios to make the lines visible (given that Case A and Case C) are equivalent as are Case B and Case D. What you learn is that if wages and prices fall at the same rate and labour productivity does not rise there can be no reduction in unit or real unit labour costs.

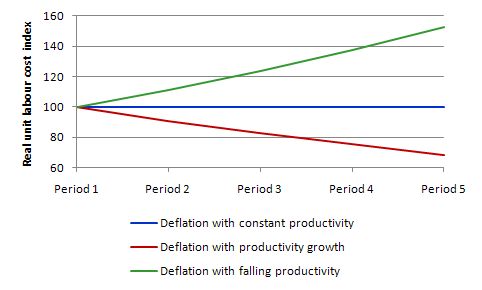

So the internal devaluation strategy relies heavily on productivity growth occurring. The literature on organisational psychology and industrial relations is replete of examples where worker morale is an important ingredient in accomplishing productivity growth. In a climate of austerity characteristic of an internal devaluation strategy it is highly likely that productivity will not grow and may even fall over time. Then the internal devaluation strategy is useless.

This graph compares the two scenarios in the first Table with the more realistic one that labour productivity actually falls as the government ravages the economy in pursuit of its internal devaluation. As you can see real unit labour costs rise as labour productivity falls and the economy’s competitiveness (given the exchange rate is fixed) falls.

Of-course, this “supply-side” scenario does not take into account the overwhelming reality that for an economy to realise this level of output over an extended period aggregate demand would have to be supportive. The internal devaluation strategy relies heavily on the external sector providing the demand impetus.

Given that Greece trade is mostly exposed to developments in the EMU itself, it seems far fetched to assume that the trade impact arising from any successful internal devaluation will be sufficient to overcome the devastating domestic contraction in demand that will almost certainly occur. This is why commentators are calling for a domestic expansion in Germany to boost aggregate demand throughout the EMU, given the dominance of the German economy in the overall European trade.

That is clearly unlikely to happen given Germany has been engaged in a lengthy process of internal devaluation itself and the Government is resistant to any stimulus packages that might improve things within Germany and beyond via the trade impacts.

Further, the recent evidence suggests that tourism, a prime export for Greece, is suffering as a result of the civil disturbances.

The following blogs may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

- EMU posturing provides no durable solution

- Protect your workers for the sake of the nation

- The bullies and the bullied

- Modern monetary theory in an open economy

Question 4:

One possible problem with running continuous budget deficits is that the spending builds up over time and with inflation eventually becoming the risk that has to be managed.

The answer is False.

This question tests whether you understand that budget deficits are just the outcome of two flows which have a finite lifespan. Flows typically feed into stocks (increase or decrease them) and in the case of deficits, under current institutional arrangements, they increase public debt holdings.

So the expenditure impacts of deficit exhaust each period and underpin production and income generation and saving. Aggregate saving is also a flow but can add to stocks of financial assets when stored.

Under current institutional arrangements (where governments unnecessarily issue debt to match its net spending $-for-$) the deficits will also lead to a rise in the stock of public debt outstanding. But of-course, the increase in debt is not a consequence of any “financing” imperative for the government. A sovereign government is never revenue constrained because it is the monopoly issuer of the currency.

The following blogs may be of further interest to you:

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

- Fiscal sustainability 101 – Part 1

- Fiscal sustainability 101 – Part 2

- Fiscal sustainability 101 – Part 3

Question 5:

One of the reasons, mainstream economists argue for lower taxes is that they believe they distort the allocation of resources by changing the rates of return on different uses of capital (and labour). In the 2010-11 Australian Federal Budget, the Australian government introduced a Resource Super Profits Tax on mining companies as a way of sharing the gains made from excess mining profits across all Australians. Leaving aside the arguments that the government does not need revenue to spend, a typical mainstream economist would conclude that this tax will reduce mining investment.

The answer is False.

The question was a trick and doesn’t directly have much to do with Modern Monetary Theory (MMT) at all. It was intended to provide insight into the inconsistencies (doublethink) that mainstream economists get themselves caught up in when they blur their own “pure” theory with political and moral arguments.

Even in mainstream economic theory there are many instances where government intervention is beneficial although you won’t find too many conservatives who continually invoke “competitive text book theory” to make their cases for cutting government intervention etc admitting that.

In fact, most of the commentators who perpetuate “free market” economics do not fully understand it as a body of theory.

The Resource Super Profits Tax proposed by the Australian government is in the class of taxes known as Resource Rent Taxes. What are they?

The Australian government Information Paper is of interest in this regard and the their FAQ site has more information.

The papers available at the Australian Treasury’s Tax Review site are of interest, particularly Chapter C: Land and resource taxes of the final Report.

There you learn what economic rents are and how they arise:

The finite supply of non-renewable resources allows their owners to earn above-normal profits (economic rents) from exploitation. Rents exist where the proceeds from the sale of resources exceed the cost of exploration and extraction, including a required rate of return to compensate factors of production (labour and capital). In most other sectors of the economy, the existence of economic rents would attract new firms, increasing supply and decreasing prices and reducing the value of the rent. However, economic rents can persist in the resource sector because of the finite supply of non-renewable resources. These rents are referred to as resource rent.

So an economic rent arises to a resource where it is in finite supply and demand drives its return above the minimum required for it to be used in the current use. For example, Madonna would probably work for much less than she does but enjoys rents because people seem to like her performances and records etc.

The point about an economic rent is that if you eliminate it you will not alter the supply of resources.

The Treasury Review Chapter tells us that in mainstream theory (derived from a 1931 article by Hotelling).

The optimal rate for exploiting non-renewable resources is, in theory, determined by the required rate of return … The owner of the resource can maximise the value of their resource stock by extracting quantities at a rate such that the expected value of the remaining resources rises over time at the required rate of return.

So even in mainstream economic theory, a resource rent tax will be optimal if it fully taxes the super-normal profits accruing to the companies that have been given the rights to exploit the mineral deposits. In this respect the 40 per cent tax proposed by the Australian government is sub-optimal because it leaves some of the rents in the hands of the rights-owners.

Theory then describes how leaving rents in the system will lead to sup-optimal outcomes. You can read the Treasury Report noted above for more information on that if you are interested.

But the important point is that the tax on the rents will not lead to less investment in mining projects. Firms will still earn more than the competitive return on their capital available elsewhere – 60 per cent of the higher rate of return more!

There are other arguments that can be used to support the tax which are more amenable to MMT. For example, the incidence of the tax (who bears the final burden of it) will most likely fall on high-income investors. In the case of mining this group also involves many foreign interests. Low-wage workers will not bear much if any of the incidence.

The question also of who “owns the resources” is relevant. If the resources are “publicly-owned” by all of us then it appears inequitable to allow foreigners and high-income rights-owners to compile massive wealth arising from exploitation of the resources. These are complex arguments that I will leave alone at the present time.

There are many more arguments that have been used.

From the perspective of Modern Monetary Theory (MMT) the basic fiscal proposition underpinning the government’s justification for the tax, however, is flawed. They say that by raising funds in this way they will be able to improve infrastructure, pay better retirement benefits etc for Australians who do not directly benefit from the “mining boom”.

Well, they can do that whenever they like given they are sovereign in the Australian dollar. The only MMT justification for the introducing the tax or increasing its rate would be if it helped drain demand at a time when the real capacity of the economy was being exhausted and inflation was threatening. The Australian government has suggested this is one of their motivations.

The other point is to consider the overall tax drain on aggregate demand in terms of the composition of the taxes being used to achieve that drain. Of the available taxes, Resource Rent Taxes advance equity; do not have any disincentive effects (strictly speaking) and are relatively easy to administer.

So shifting towards this type of tax as a vehicle to fight inflation would be sensible.

The following blog may be of further interest to you:

Just one observation. In question 1, there could be other possibilities if one includes taxes on capital gains.

Dear Ramanan

You said:

That cannot alter the requirements that the balances have to net to zero. So if you have a current account deficit and a public surplus then it doesn’t matter what you have done the accompanying result has to be a private domestic deficit.

best wishes

bill

Hi Bill,

Thanks for the comment.

It depends on how one defines deficits, surpluses. For example, capital gains or losses are not included in National Income by national accountants. Consider a closed economy for simplicity. So it is possible in a period, where the private sector income is matched by the expenditure, but the budget ends in surplus because part of the taxes was paid on capital gains in the stock market. But yes, it cant last long.

Obviously, you take into account capital gains taxes for purposes of measuring the effect on net financial assets.

Bill –

I think you have made a mistake in your answer to question 5. You say:

“But the important point is that the tax on the rents will not lead to less investment in mining projects. Firms will still earn more than the competitive return on their capital available elsewhere – 60 per cent of the higher rate of return more!”

There are two problems with this statement. Firstly there is a difference between potential and actual returns. Not all mining activity turns out to be profitable, so investors are likely to seek a higher return to reflect the risk.

The second (related) problem is that the “elsewhere” you refer to is the bond market. But there are other elsewheres, including other shares and mining operations overseas.

I am in favour of resource rent taxes, but I think the RPST as it currently stands would be a disincentive to mining investment – though not to the ridiculous extent that the opposition are trying to claim.

If you still don’t think it is, can you tell me how high you think the rate would have to be before it becomes a disincentive?

You said it was going to be a harder quiz – I thought it was a trick question. The “offsetting” deficit is a negative deficit, or IOW a surplus, and when they offset, the private sector is spending what it receives in income.

In the spirit of presenting the principles of functional finance simply, Ralph Musgrave has posted a summary here and has asked for feedback.

Anon,

My comment was merely footnoteish. My tax accountant may ask me to include capital gains in income but national accountants do not. There is some reasons for it. If capital gains are not taxed, some identities are simpler. However, they are taxed and reported in the government’s revenue.

In the spirit of turning MMT theory into rational practice, what is the general feeling amongst readers about replacing/augmenting standard monetary policy with a Land Value Tax linked to an Inflation measure (say RPI)?

Therefore if stimulus did start to cause inflation, then an ‘automatic stabiliser’ would kick in recovering value from landowvners – the fundamental monopoly resource underlying all production.

@Neil

Before discussing any precautionary measurements against inflation I’ve another question. Where does this inflation paranoia come from? Listening to the debates about upcoming inflation there must be a lot of people still around with living memories about pushing wheel-barrows of worthless paper money to purchase an egg on the market. There must be some cultural or social explanation for that?

Now in regard to your proposal. I think it’s counter-productive. It’s like saying I’ve a rational policy but unfortunately irrational citizens won’t understand it. Thus I’ve to provide an additional placebo Vodoo concept to placate all the idiots out there. And I think it won’t make any big difference anyway. You can’t use the T-word to relax people who freak about the D-word.

BruceMcF: “You said it was going to be a harder quiz – I thought it was a trick question. The “offsetting” deficit is a negative deficit, or IOW a surplus, and when they offset, the private sector is spending what it receives in income.”

I, too, interpreted “offsetting” to mean “equalizing”, but offsetting can be partial.

Stephan: “Where does this inflation paranoia come from?”

1) History. Andrew Jackson took a lesson from the hyperinflation of the Continental, which was, they said, finally used for wallpaper. The hyperinflations in Germany and Zimbabwe are ominous specters, even if people realize that they are special cases. Economists may offer reassurances, but who believes economists? It was not hyperinflation, but the stagflation of the 1970s was, and is, troubling. Are we immune to it if we get another oil shock?

2) Fear of poverty in old age. You can work and save all your life and see it go up in smoke if your savings become worthless. One reason people put their savings into a house is as an inflation hedge. And even if you are OK, what about your parents? One reason Prop 13 passed in California was the fear that retired people might own their own homes but be unable to pay their property taxes.

The public sector can have surplus if there is a surplus to the rest of the world and the private sector will be in good shape on an aggregated level. Everything looks fine and in a healthy balance.

This is the key thing to be a good EUro member. But as I guess it is in Germany as some other highly developed industrial nations that the export industry have high productivity growth and produce more and more with less and less employees. And with less and less employees in the export industry it will probably hamper the spread of export gains to the whole domestic economy, alas the “capitalists” is pocketing more and more and engage in financial speculation. Moreover, they have a conflict of interest to make real investments in the domestic economy, they would probably prefer to make real investments in export sector. A thriving domestic economy would raise wages and general costs that could inflict on export sectors profits.

It could also be that the export growth orientated politicians deliberately engage in fiscal surplus to restrain domestic economy to promote export surplus. In that case, the balance could see healthy and sustainable but still large parts of private domestic sector are in distress.

Last year in Sweden the large GDP decline was almost entirely due to export caused by the global crisis, considerable reduction in primarily investment, inventories and net export, but the net export as percent of GDP did stay roughly the same. The export sector is also the absolutely largest importer.

The 50s and 60s is here considered the golden age and considered something to emulate, we did stand strong and got rich by selling to the rest of the world. Then labor got lazy and we did lose this advantage. So goes the story. Albeit industrial employment as share of total did peak in those decades export relative to GDP was no more than about 20% and export-import balance hovered around zero, now we are well over 50% of GDP and have the last 15 years had very large export surplus every year and a domestic economy that has grown poorly and we have never had so many people on subsidy and off real labor market.

And actually the real pension age is not that much higher here in Sweden than in Greece, albeit the official pension age is among the highest in Europe. But when so called early retirement pension is included it do decrees, early retirement pension have been of the major way to get official unemployment to “acceptable” levels.

@Min

I don’t buy these arguments anymore 😉 Because:

(1) Most people can’t even spell Weimar. They can’t locate it on a map and they can’t recall the history. And even the most outlandish gun loving hilly billy will not subscribe to any comparison between the US and Zimbabwe with the hint Zimbabwe = Africa.

(2) Most financial damage in recent history does not stem from inflation but from financial speculation. If common folks would be so alert to long-term threads to the value of their financial assets they would have long ago send troops to Wall Street.

I think these inflation fears stem from simple propaganda and are not grounded in any reasonable assessment.

@Min

While typing my previous comment I was and am watching the main political talk show of Germany. Subject today: Inflation 😉 And a Claus Vogt, Chefanalyst of Quirin Bank just announced, that Germany will face a Zimbabwe style inflation in the next 4-6 years. Sorry, but I would not worry so much about inflation but more about entrusting my savings a bank which employs such idiots as chefanalyst.

José María Aznar

Moreover, the EU should encourage national stability pacts for all member states. Spain does, however, need to comply once again with the original stability and growth pact. It needs sharp cuts in public spending in a return to budgetary discipline, and a complete structural reform package allowing the Spanish economy to regain its lost flexibility and competitiveness.

Wolfgang Schäuble

Germany last year enshrined in its constitution a law that prohibits the federal government from running a deficit of more than 0.35 per cent of gross domestic product by 2016. German states will not be allowed to run any deficit after 2020. Wolfgang Schäuble, the German finance minister, is working on a set of sweeping reforms for the stricken eurozone, which he will present on Friday at the first meeting of a working group set up to consider closer economic policy co-operation.

These two geniuses draw the wrong conclusions rom the GFC and are going to scorch Europe over the next few years, well what’s left of it. Spain, with a CAD of 10% of GDP the last time I checked will be in a terrible state. And Germany trying to replicate Andrew Jackson by eliminating the national debt. And when it all goes pear shaped they will blame someone else for it.

How can Wolfgang Münchau and Paul Krugman who attended the Annual Minsky Conference in the last few years come away from it and learn nothing. Why is that? What is the point in going to these conferences if your not going to learn anything. What is it about Economics that there is very little introspection, every other discipline would go back and research were they went wrong. All this talk, that no one could foresee it, is clearly bullshit.

It would be interesting to have a poll to see if most of Bill’s readers are from an economic background.

BFG says:

Monday, May 17, 2010 at 10:02

dear BFG,

to start the ball rolling –

I am not from an economics background but from maths/computer science.

graham,

I’m not from an economics background either but from an electronic engineering one.

@Graham, Electrical Engineering, and i play guitar (I wouldnt be surprised if musicianship is another common denominator here).

Matt Franko says:

Monday, May 17, 2010 at 12:15

Dear Matt,

I play a keyboard. Looks like we might be able to get a band or even an orchestra together – Bill can take lead guitar!

Stephan, Weimar and Zimbabwe are hardly the only areas to have had hyperinflation in the twentieth century. Most of South America and post-soviet Eastern Europe, and many African countries, have gone through periods of hyperinflation within the last 20-30 years or so. Check this Wikipedia page: http://en.wikipedia.org/wiki/Hyperinflation#Examples_of_hyperinflation. So yes, there are people who remember pushing wheelbarrows around, and how to avoid hyperinflation is a question MMT needs to be able to answer at the drop of a hat – certainly I haven’t gleaned the answer yet from what I’ve read so far.

Dear JamesH

You said:

I wonder how much you have read.

First, why focus on extreme events which are rare in history and the analysis suggest are always the result of abject policy failures coupled with unusual circumstances? Most advanced nations enjoyed strong growth and full employment for years in the Post War II period as a result of private saving bein supported adequately by discretionary fiscal policy. Why not focus on that historical stability?

Second, if you are worried about inflation that arises from nominal demand outstripping the real capacity of the economy to respond to it in output terms, then MMT says (and I have written this countless times and devoted whole blogs to the topic) – reduce aggregate demand. Increase taxes and/or cut public spending. It is not rocket science.

Third, in the last 35 years nations have been mostly we are dealing with “extreme” events of the persistently high unemployment, rising underemployment category. Why not focus on that as the pathology and the continual risk of policy failure?

best wishes

bill

“2) Fear of poverty in old age. You can work and save all your life and see it go up in smoke if your savings become worthless.”

That is probably an valid point, especially applied to Europe that is an aging continent and a declining population. But the old people cant eat money, however “sound” they may be. The only way old people are going to get what they need is from the active generations’ production. And to have as in Spain and other places staggering numbers of unemployment especially among young people is not a very good prospect for the aging people of Europe.

In the Baltic’s and in many other Eastern European neo-liberal poster countries there have been emigration and declining populations. The other year there was a poll in Latvia with staggering numbers of people in working age that thought they might try to emigrate in the next five years. Some years ago, there was poll in Bosnia that showed that +60% of young people wanted to emigrate if they just could.

And now the politicians of Europe is going to put the entire continent in the austerity baptism of fire and reduce europes productive capacity, no price seems to be to high to implement their loony ideas of “sound” money. IMF and EU bosses declare without the slightest shiver that they ordain Greece the “healing” recipe of 15% unemployment the next five years, real prospect is probably much worse if they make Greece obey. Moreover, not only Greece, it’s a recipe for many other countries around EU. Entire countries are to be baptized in the healing austerity fire. And they not even promised a bright future on the other side, at least normal religions always promise an upside on the other side.

For young people in Europe joining some Jim Jones fellow would look like a brighter prospect for the future than participate in the collective sustainable suicide of Europe in the quest for “sound” money.

Bill, I have only recently learned about MMT and probably haven’t read enough yet 🙂 I have arrived by way of archaeology and anthropology, in that chartalism seems to provide the best explanation of how money was first created and is introduced into “traditional” societies. Having been studying in SE Asia during the financial crises of the late 90s I am also very skeptical of IMF and Washington Consensus style economics. I agree that unemployment and underemployment is a disgrace and its persistence is driven by a desire by power holders to redistribute wealth upwards.

My concern is that if a MMT inspired program were enacted, that politicians would interpret the insight that there is no “hard”, gold-standard limit on spending as saying there is no limit at all. After all, full employment is not the only socially worthwhile goal. Other socially worthwhile goals might include mental health for all, raising the average education level, rescuscitating the environment, etc; and non-socially worthwhile but likely goals would include funding programs which claim to do these things but actually send money to marginal electorates with minimal results. I guess from what I have read so far that you would classify me as a post-keynesian deficit dove.

Having been inspired to google around, this widely cited paper by fischer and easterley: http://ideas.repec.org/p/wbk/wbrwps/224.html which also talks in terms of accounting identities, suggests on empirical grounds that governments can create between 1 and 2.5% of GDP through seigneurage without risking accelerating inflation. Beyond that, if I understand correctly, a process of diminishing returns sets in as the value of money and real business activity declines to such an extent between the time of govt creating/spending money and withdrawing money through taxes that taxes are no longer withdrawing enough from the economy; in effect the tax code and budget office can’t keep up with the repricing of resources. But 1 to 2.5% of GDP would not, I think, be enough to create full employment. Is this (the Olivera-Tanzi effect) a problem that MMT has addressed?

Matt Franko

@Graham, Electrical Engineering, and i play guitar (I wouldnt be surprised if musicianship is another common denominator here).

I don’t play an instrument but I have designed and built Pre/High Powered Amplifiers.

JamesH: “My concern is that if a MMT inspired program were enacted, that politicians would interpret the insight that there is no “hard”, gold-standard limit on spending as saying there is no limit at all.”

Dick Cheney said, “Deficits don’t matter.” The supposedly small government Republicans have been spending like drunken sailors for a generation. The supposedly large government Democrats have been restraining spending. The tragedy is that now, when the economy is limping along and millions of people in the U. S. are out of work, both parties are under the sway of debt/deficit fear mongering. I agree that fiscal discipline is required, but this ain’t it, folks. This is like scaring your kids with the boogeyman.

“Increase taxes and/or cut public spending. It is not rocket science.”

That is easier said than done. The UK government is getting a hard time for suggesting stripping £6bn out of a near £700bn annual budget. Much easier to talk about a 0.5% increase in interest rates than the equivalent amount on income tax, or slashed off the public sector budget (which is always cast as hitting doctors, nurses and teachers rather than the army of ‘hole diggers’ hiding under stones).

“Most advanced nations enjoyed strong growth and full employment for years in the Post War II period as a result of private saving bein supported adequately by discretionary fiscal policy. Why not focus on that historical stability?”

But it broke down didn’t it. Have you an adequate explanation of why it broke down, and also why it worked during a period of fixed exchange rates.

And there is still the elephant in the room – what would really happen to the currency exchange rate if you did pass a policy stating that you would create the necessary finance to fund a Job Guarantee scheme.

Min, as a good post-Keynesian you’ll get no argument from me that Republicans are dishonest idiots, Dems are clueless, and running big deficits during recessions is vital. My concern, which I have not yet found an answer for in what I have read of MMT, is what is to stop people elected on an MMT program from running big deficits during booms? Accepting that there is no hard budget constraint in a sovereign currency, what are the guidelines or rules that should be followed to provide both full employment and stable prices?

Accepting that there is no hard budget constraint in a sovereign currency, what are the guidelines or rules that should be followed to provide both full employment and stable prices?

Full employment and stable prices are the criteria for assessing policy success operationally. If employment-prices destabilize, then this indicates that operational adjustments have to be made using the principles of functional finance:

1) Use fiscal policy to adjust nominal aggregate demand to real output capacity by increasing NAD with increased discretionary spending and decreased taxation to correct an output gap, and vice versa in case of inflation.

2) Use monetary policy to adjust interest rates.

Hey Bill,

@Sunday, May 16, 2010 at 23:37

I realize now that the balances will continue to hold as you mentioned. I was thinking of a situation where there is a small economy but where statisticians are able to catch data instantly and that someone makes capital gains at the last moment of the recording period. When he/she makes the gains, assume that taxes are immediately paid. This causes disposable income (recorded) of that period to come down by the amount of taxes paid. Seemed somewhat counter-intuitive (for me), but more clear now.

Dear Ramanan

Yes, the tyranny of accounting!

best wishes

bill

Link to similar discussion:

https://billmitchell.org/blog/?p=13206

“Fed Up says:

Sunday, January 23, 2011 at 9:48

“However, if the real wage is falling we cannot conclude that the wage share is also falling. Given the nature of ratios, if the numerator (in this case, the real wage) is falling but not by as much as the denominator (in this case, labour productivity) then the overall ratio can actually be rising.”

I want to go over some possibilities.

Real wage -2% and productivity +2% means falling wage share.

Real wage -2% and productivity 0% means falling wage share.

Real wage -2% and productivity -1% means falling wage share.

Real wage -2% and productivity -2% means constant wage share.

Real wage -2% and productivity -3% means rising wage share.

Are all those correct?”

************

And, “bill says:

Sunday, January 23, 2011 at 9:55

Dear Fed Up (at 2011/01/23 at 9:48)

All your possibilities are correct.

best wishes

bill”

I’m still struggling with this:

“The private domestic balance (I – S)”

If S=I — another inviolable, given identity — doesn’t that balance always equal zero?

Dear Steve Roth (at 2011/06/19 at 1:17)

You asked:

Only in a simple macroeconomic model with no government sector and no trade (external) sector.

Then S must always equal I although desired saving might not equal planned investment. In that case, unplanned investment (via undesired inventory run-down or accumulation) will occur and firms will alter production and employment levels.

In a closed economy with government sector the following must hold:

(S – I) + (T – G) = 0

And then adding the external sector gives you:

(S – I) + (T – G) – (X – M) = 0

Hope that helps.

best wishes

bill