The other day I was asked whether I was happy that the US President was…

Protect your workers for the sake of the nation

I am currently researching the way in which the labour market functions to discipline the inflationary process has fundamentally changed over the last 20 years as underemployment has risen. I will have more to say on that at another time as the work advances. But today it led me into considering research that demonstrates that different employment protection (higher dismissal costs etc) standards across the EMU have been instrumental in explaining the differentials in unemployment that are now evident. So nations with more protection have fared better in the crisis than nations which more vigorously pursued the neo-liberal flexibility agenda (that is, creating rising proportions of precarious employment). This type of research puts the debate now raging in the Eurozone that nations have to adjust by drastically cutting wages and conditions into a different light.

I read an interesting paper today entitled – Unemployment and Temporary Jobs in the Crisis: Comparing France and Spain – which was presented at the 2009 FEDEA Annual Policy Conference in Spain. FEDEA is a research institute in Spain.

The premise of the paper is simple:

- There has been a “strikingly different response of Spanish unemployment relative to other European economies, in particular France, during the ongoing recession”.

- France and Spain “share similar labor market institutions (employment protection legislation, unemployment benefits, wage bargaining, etc.)”.

- “However, while French unemployment has remained relatively subdued during the current recession, the Spanish unemployment rate, which fell from 22% in 1994 to 8% in 2007 – when Spain was creating a large share of jobs in the European Union (EU) – has reached almost 19% by the end of 2009.”

- “Our basic conjecture is that this very different behavior is partly due to the large gap between dismissal costs of workers with permanent and temporary contracts in Spain …”

They point out that both France and Spain have exploited the move to “fixed-term contracts” (casual, short-term, etc) as the neo-liberal push for more labour market flexibility gained favour among policy makers. The way the Europeans have been pursuing this agenda in the light of the difficult politics is to cerate two-sector labour markets. Protect most workers and let a secondary segment emerge which is largely precarious.

The authors say that Spain has led the way with temporary work (now around 1/3 of all employment) while France’s share of fixed-term work in total employment is “slightly below 15%”. Further, severance pay is much higher for all workers in France than in Spain as a result of their push for flexibility.

They seek to see whether these differences explain the different unemployment trajectories over the crisis.

While the empirical methodology is tricky and I am not fully convinced (given I am working on this sort of research myself at present) they find that if Spain had have retained the French proportions their unemployment rate would be around 8 percentage points below its current levels.

They interpret their results as saying that the trend to temporary contracts have been detrimental to employment. They also argue that severance pay should be linked to seniority. Their results and conclusions have been supported by other papers recently. The neo-liberal tide is somewhat in recess.

Over the last 20 years or so, many academic studies sought to establish the empirical veracity of the orthodox view that unemployment rose when real wages and workplace protections increased. This has been a particularly European and English obsession. There has been a bevy of research material coming out of the OECD itself, the European Central Bank and various national agencies, in addition to academic studies. The overwhelming conclusion to be drawn from this literature is that there is no conclusion.

These various econometric studies, which have constructed their analyses in ways that are most favourable to finding the null that the orthodox line of reasoning is valid, provide no consensus view as Baker et al (2004) show convincingly.

In the last 10 years, partly in response to the reality that active labour market policies have not solved unemployment and have instead created problems of poverty and urban inequality, some notable shifts in perspectives are evident among those who had wholly supported (and motivated) the orthodox approach which was exemplified in the 1994 OECD Jobs Study.

In the face of the mounting criticism and empirical argument, the OECD began to back away from its hardline Jobs Study position. In the 2004 Employment Outlook, OECD (2004: 81, 165) admitted that “the evidence of the role played by employment protection legislation on aggregate employment and unemployment remains mixed” and that the evidence supporting their Jobs Study view that high real wages cause unemployment “is somewhat fragile”.

Then in 2006, the OECD Employment Outlook entitled Boosting Jobs and Incomes, which claimed to be a comprehensive econometric analysis of employment outcomes across 20 OECD countries between 1983 and 2003 went further. The study sample for the econometric modelling included those who adopted the Jobs Study as a policy template and those who resisted labour market deregulation. The Report revealed a significant shift in the OECD position. OECD (2006) finds that:

- There is no significant correlation between unemployment and employment protection legislation;

- The level of the minimum wage has no significant direct impact on unemployment; and

- Highly centralised wage bargaining significantly reduces unemployment.

These conclusions from the OECD in 2006 confounds those who have relied on its previous work including the Jobs Study, to push through harsh labour market reforms, retrenched welfare entitlements; and attacked trade unions.

It makes a mockery of the arguments that minimum wage increases and comprehensive employment protection will undermine the employment prospects of the least skilled workers.

OECD (2006) found that unfair dismissal laws and related employment protection do not impact on the level of unemployment but merely redistribute it towards the most disadvantaged – including the youth who have not yet developed skills and have little work experience.

But this point is obvious. In my own work (references are available on request) I have consistently pointed this point out. In a job-rationed economy, supply-side characteristics will always serve to only shuffle the queue.

But you cannot say that the unfair dismissal laws and related employment protection have caused the unemployment!

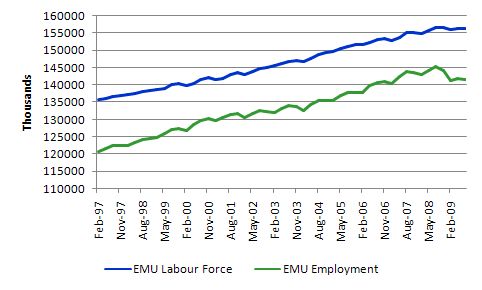

The problem is that there are not enough jobs as the following graph which shows the relationship between the labour force (blue line) and total employment (green line) for the entire Eurozone since first quarter 1997 to the third quarter 2009. The data is from Eurostat.

This is the relationship between the labour force (blue line) and total employment (green line) for the entire Eurozone since first quarter 1997 to the third quarter 2009. The difference between the lines is total unemployment. The diagram also understates the degree of slack in the labour market because it doesn’t consider full-time equivalent employment. Given the massive rise in underemployment in some parts of the EMU over the last 20 years or so, the “full-time equivalent” or “hours” gap would be significantly larger than depicted by the comparison in persons.

Then you consider Martin Wolf’s latest FT column (March 23, 2010) entitled – Excessive virtue can be a vice for the world economy.

In general, I agree with his position that the EMU is a wreck and should never have been created. The EU yes, the EMU no. But it is his comments on adjustment that are interesting in this regard.

He notes the Germans want the Eurozone to be an extension of Germany and that they will not concede and inch to undermine their competitive position. This is in the context of a rising call for Germany to stop suppressing wages and working conditions and to allow domestic consumption to rise as a means of reducing the trade deficits that its trading partners are running against it.

But the Germans counter this and claim that “wages even in Germany are still too high, given the elevated unemployment”. On this claim, Wolf responds:

I find it hard to disagree. Many countries entered the currency union without recognising the implications for labour markets. Rather than the reforms membership requires, they enjoyed a once-in-a-lifetime party. The party is over. With German unit labour costs stagnant and the euro still strong, labour costs in peripheral European countries must fall sharply. These countries have no alternative, within the currency union they chose to join.

Well at this point I depart company with Mr Wolf. The idea is that unit labour cost deflation (that is, shifting the aggregate supply curve out) will generate increased output and employment.

This is an old debate in economics and was the classical response to Keynes who demonstrated (following Marx) that effective demand determined employment and output and if that was deficient supply would contract. The classical economists believed unemployment was because real wages were too high relative to productivity and argued that cutting wages was the solution.

Keynes noted this would further reduce aggregate demand because wages were both a cost (supply-side) and an income (demand-side). The classics assumed independence between the demand and supply sides of the economy so cutting wages would not impair the demand side. Their other line of response was that even if cutting wages caused demand to fall, it was likely that prices would also fall.

The lower prices would invoke wealth effects which stimulated consumption and investment demand and QED Say’s Law rules. Please read the blogs that are found via this search string for more discussion on this point.

The reality is that these wealth effects have been estimated to be very small if positive and not nearly sufficient in volume to reduce a major aggregate demand failure.

The point is that employment could easily be increased within the Eurozone through appropriate domestic expansion. However they are now in such a fiscal straitjacket that this is being voluntarily foregone for ideological reasons.

Please read my blogs – Euro zone’s self-imposed meltdown and Doomed from the start – for more discussion on this point.

So the logic that Wolf is advancing is that the Eurozone has to become an export powerhouse – all nations – by cutting their standards of living significantly.

To some extent that is the logic of the EMU – if you don’t want to use domestic fiscal expansion and fiscal redistribution policies then the only source of demand is from outside the region.

But do the citizens of the EMU nations really understand what their governments are doing to them. All of it is totally unnecessary – that is the point.

Wolf writes that the Germans want all nations to depress their living standards so that they can collectively increase their exports. At this point he recognises the demand issue:

I find it impossible to agree. What is fascinating about these remarks is that there is no mention of demand. Mr Wilhelm is inviting everybody to join a zero-sum world of beggar-my-neighbour policies in which every country tries to grab market share from the rest. At a time of global weakness, this is a self-defeating recommendation for both the eurozone and the world.

More precisely, what Germany wants to see is a sharp cutback in fiscal deficits throughout the eurozone. With the fiscal deficit contracting and output weakening, the way out for each country would be via falling relative unit labour costs and higher net exports. If successful, this would shift each country’s economic weakness to other eurozone countries or, more likely, to the world, via a bigger eurozone net export surplus.

Exactly. So by pursuing fiscal austerity policies to get their ratios back in line with the nonsensical Maastricht rules, the EMU governments are imposing a very harsh and long road for the citizens to traverse – with declining living standards and restricted purchasing power.

The more obvious solution would be for Germany to stop trashing the wages and working conditions of their own workers and getting consumption and public infrastructure development moving in that country. They should recall how they managed the unification of the two Germany’s. That would have been much harder if they had tied themselves to Maastricht rules during the early stages of that process.

Trade wars only end up with depressed domestic conditions and rising poverty rates. Not everyone can be in trade surplus!

Wolf finishes on a good note:

In short, economic policy is about more than competitiveness. When the world is trying to struggle out of a deep recession, demand matters, too. As the world’s fourth-largest economy and the core of the eurozone, Germany has a role to play in rebalancing global demand. I appreciate that this is a difficult challenge. It must be met, all the same.

Meanwhile, with all that said, Germany is now suggesting the IMF should fix up Greece. And the following snippet will help to put all of this in a different light. The word hypocrites comes to mind.

This Reuters report comes via the India Times which reported yesterday (March 23, 2010) – that if you are – Broke? Buy a few warships, France tells Greece.

I wrote last week about how the Germans had been pushing Leopard tanks and other weapons onto Greece at the same time as claiming the Greeks were lazy and were spending too much. Please read my blog – Hyperdeflation, followed by rampant inflation – for more discussion on this point.

Yesterday’s story reports that:

In a bizarre twist to the Greek debt crisis, France and Germany are pressing Greece to buy their gunboats and warplanes, even as they urge it to cut public spending and curb its deficit.

Further, the blackmail element is being hinted at – the “buy our weapons and we will be more amenable towards you” angle.

Apparently, when the Greek prime minister was negotiating recently about fiscal austerity, the French we pressuring them to go ahead with billions of euros of military ships and helicopters. They agreed!

Germany is also trying to flog submarines to the Greeks.

The Report also says that Greece has the highest military spending as a percent of GDP than any EU country because it is so paranoid about Turkey. Perhaps some diplomacy might allow them to cut all their military contracts with other EMU nations (largely France, Germany and Belgium) and ease their fiscal position.

Bucket item 1: China about to record first trade deficit in 70 months

This is my new segment – the Bucket. It the bucket full of sxxxx that you dump on someone that deserves it! I know it isn’t charitable to do it literally, but conceptually involves little hurt. So occasionally I will fill the bucket. As time goes by the neo-liberals and deficit clowns will have to face humuliation for the sort of excessive verbiage they have been indulging in over the course of this crisis. They will obviously reinvent what has happened to save face but we will all know that they didn’t have a clue.

Haven’t we been continually hearing how the Chinese exchange rate is killing the US economy and allowing it to accumulate huge trade surpluses? Sometimes things are not as they seem.

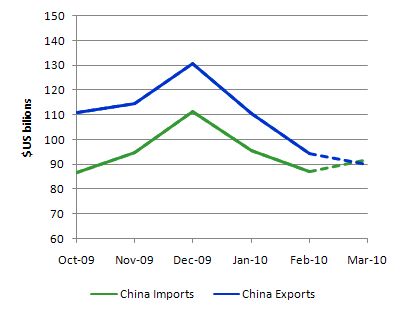

Have a look at this graph. The data comes from the Ministry of Commerce of the People’s Republic of China and shows the most recent balance of trade results with the dotted lines forecasts based on preliminary data.

Minister of Commerce Chen Deming told the China Development Forum in Beijing last Sunday that China will probably record a (Source):

record trade deficit … [in March] … I believe there will be a trade deficit in March” – which will be the first since May 2004.

The Minister said that the economy had recovered from the crisis as a result of fast and significant fiscal stimulus and imports were rising because domestic demand was now much stronger than demand in the rest of the world. The import growth is in investment goods and primary commodities.

Whether the trade deficit persists is another matter and one would expect that once world demand improves then Chinese exports will rise again. But with rising domestic incomes import growth will remain stronger than in the past.

Further, nothing is what is seems at first glimpse. The other angle on China’s trade with the US which the Chinese are publicising is that the US (presumably for ideological reasons) blocks the export of certain US made goods to China. The reports are that “computers, aerospace technology and digital machine tools” have been restricted.

The Chinese claim that the surplus with the US would be lower if the US was more open in its trade with China. Clearly, you would be mad to believe a word that the official Chinese press produces. But even Joseph Stiglitz is now running this line. He was reported as saying at the Development Forum that :

restrictions on high-tech products, rather than the exchange rate contribute to the US deficit with China … [and that] … Washington … [should] … relax the curbs to balance trade.

Another interesting China Daily news story (March 16, 2010) claims that China’s trade surplus with US misread.

It claimed that:

… most US officials ignore a very important fact: a majority of China’s exports to the US are produced by US-funded companies and huge profits go back into American pockets … half of China’s exports came from the processing trade — where imported components were assembled at factories in China and 60 percent were made by foreign-funded companies or joint ventures with foreign partners.

You might be skeptical about this.

But the topic is being studied by US researchers at UC Irvine. In a 2009 study entitled – Innovation and Job Creation in a Global Economy: The Case of Apple’s iPod – they examined who benefits when there are large investments in new technologies and infrastructure in a global economy. They were seeking to see whether investment in the US (perhaps as a fiscal stimulus measure):

… will create more jobs outside the U.S., because many high-tech products currently are manufactured offshore … The same could turn out to be true of alternative energy, hybrid/electric cars, and other new technologies. While these investments have other merits beyond their job-creation potential, it is worth looking at how innovation in a global economy creates jobs in the U.S. and elsewhere.

They used the iPod as a case study and “looked at which companies and countries capture financial value” from their production. They found that in 2006, iPod’s “accounted for about 41,000 jobs worldwide” (27,000 outside the US). The “offshore jobs are mostly in lowwage manufacturing, while the jobs in the U.S. are more evenly divided between high wage engineers and managers and lower wage retail and non-professional workers”. China had the largest share of off-shore jobs.

They found that “the iPod supports nearly twice as many jobs offshore as in the U.S., yet wages paid in the U.S. are over twice as much as those paid overseas.”

In relation to who benefits overall, they found that:

We found that the largest share of financial value (defined as gross margin) went to Apple, which captures a large margin on each iPod. Although the iPod is assembled in China, the value added in China is very low … So it appears that innovation by a U.S. company can benefit both the company and U.S. workers, even if production is offshore and foreign suppliers provide most of the inputs. However, there is no guarantee that U.S. firms will keep engineering and other white collar jobs in the U.S. in the future.

The computations on a $US300 iPod suggests that China retains $US4 of value-added yet the whole value is billed against China’s exports.

So the real debate in the US might be about a fairer distribution of income rather than worrying about exchange rates. I plan to write a blog some day about industry policy and protection.

Bucket item 2: inflation falling in the UK

Yesterday (March 23, 2010), the UK Office for National Statistics (ONS) released the February inflation data and said:

CPI annual inflation – the Government’s target measure – was 3.0 per cent in February, down from 3.5 per cent in January.

The data release provides a context for recent anxiety – you know the baseless stories that circulate around financial markets etc – that the Bank of England was soon going to have raise interest rates – because that is what mindless central bankers have been doing over the last 15 or more years while at the same erasing financial market regulations which kept bankers and investment funds in check.

The UK (non-financial) business lobby seems to know what is going on (Source):

The main industry trade bodies – the Confederation of British Industry, the British Chamber of Commerce and Institute of Directors – warned that despite factory closures and 2.6 million unemployed workers spare capacity in the economy remained a significant factor and meant underlying inflation growth would remain low.

Conclusion

My band is playing tonight so …

That is enough for today.

I agree that U.S. needs to focus more on income inequality but there are clearly some benefits to China for manipulating its currency. Chinese ruling class has made the calculation that benefits to doing so outweigh the costs. The major benefit, IMO, is the survival of ruling class. Manufacturing and industry is more than just products such as ipods – there is steel (kind that goes into tractors or bridges), steel pipes and tires. Nobody has clean hands in this mess.

I think someone commented in an earlier blog about a Michael Pettis article about Chinese revaluation – anyway here it is – another good long post by M.Pettis with interesting commentary:

http://mpettis.com/2010/03/how-will-an-rmb-revaluation-affect-china-the-us-and-the-world/

A moment of reflection (2 minutes) from Spain. Because sometimes art captures reality better…

http://www.bbc.co.uk/mundo/cultura_sociedad/2010/03/100319_video_myworld_espana_dc.shtml

China GDP, GNI Exp-Imp

World Bank numbers, GNI, Atlas method (current US$), GDP (current US$)

Computing the available numbers on WB it seems like Chinas GDP-GNI difference 2008 was larger than the exp-imp surplus.

It looks like a trend, even the Germans are in increasing degree working for foreign masters. At least the GDP is larger than GNI.

World Bank Data Profie

The Export import percent numbers was in integers so it’s a approximate figures. There was no numbers for Germany export 2008.

Two points.

1. Greece mantains a strong defense budget because the threat from Turkey is real as daily violations of Greek water/air space continue, Turkey has a casus belli against Greece and part of Cyprus is occupied against international law by Turkish military forces. Diplomacy is not working because Turkey has this dream of reintoducing the Ottoman empire. Turkish decision makers claim that joining the EU will be a way to refight the battle of Vienna and win! They even claim that if they join, Europe will shift towards their culture and muslim values and away from the Grecoroman civilization paradigm!

2. A mercantilist/external policy whether successful or not, is an involuntary means to surpress real wages, dismissal costs and raise the profit share. Greece also has a high cost of dismissal and low employment flexibility terms and apart from the high underemployment it has a lower unemployment than Spain. Of course, all this will change because the second stage of austerity programs are the so called stuctural changes that include higher employment flexibility, fixed term contracts, temporary employment and low dismissal costs.

Of course, all this will change because the second stage of austerity programs are the so called stuctural changes that include higher employment flexibility, fixed term contracts, temporary employment and low dismissal costs.

In my observation, this has been the trend in the US for some time. If fact, it began with the “downsizing” of the 80’s. I believe it was also the strategy behind Donald Rumsfeld’s restructuring of the military away from a civilian force toward a mercenary force under G. W. Bush/Dick Cheney.