I am late today because I am writing this in London after travelling the last…

The NAIRU should have been buried decades ago

In 1983, I started a PhD at the University of Manchester working within the Phillips curve framework. At the time, all the talk was Monetarist – eschewing the use of fiscal policy to reduce unemployment. Unemployment was high after the OPEC oil shocks and governments were abandoning their responsibilities to reduce it because they had drunk the Monetarist Kool-aide. The Monetarists invented a concept – the Non-Accelerating Inflation Rate of Unemployment (NAIRU) or the ‘natural rate of unemployment’, which became part of the dominant macroeconomic approach and influenced policy makers to pursue microeconomic reform (deregulation, privatisation, outsourcing etc) and obsessing about fiscal surpluses. My work was an attempt to show this shift in thinking – away from a commitment to full employment was based on a lie. The whole NAIRU story was a fraud. I was largely ignored along with other progressive economists who were also producing credible research that refuted the main propositions. Some 40 years later, the ECB has produced a research paper which now supports the position I took back then. Millions of jobless people later!

When I returned to Australia and took up a position at the Flinders University in South Australia (Adelaide) one of my first publications on that work was – The NAIRU, Structural Imbalance and the Macroeconomic Equilibrium Unemployment Rate – which was published in the Australian Economic Papers, June 1987.

It had been in the refereeing process for 2 odd years.

If the referees had have been more efficient, then my paper would have beaten the paper by Summers and Blanchard to press. Their paper is the one everyone references.

Regular readers will know that I have written about the NAIRU before and have done years of work on the topic:

1. My PhD thesis included a lot of technical work (theoretical and econometric) on the topic – beginning in the mid-1980s, when I was just starting out.

2. In my 2008 book with Joan Muysken – Full Employment abandoned – we analysed the technical aspects of the NAIRU in detail.

3. Many refereed academic papers.

4. The following blog posts

(a) The NAIRU/Output gap scam reprise (February 27, 2019).

(b) The NAIRU/Output gap scam (February 26, 2019).

(c) No coherent evidence of a rising US NAIRU (December 10, 2013).

(d) Why we have to learn about the NAIRU (and reject it) (November 19, 2013).

(e) Why did unemployment and inflation fall in the 1990s? (October 3, 2013).

(f) NAIRU mantra prevents good macroeconomic policy (November 19, 2010).

(g) The dreaded NAIRU is still about! (April 6, 2009).

At the time I began this research, the debates were about whether inflationary expectations drove the inflation process independent of the state of the labour market.

The traditional Phillips curve was based on the notion that there was a trade-off between inflation and unemployment, such that when unemployment was low, wage pressures would push up costs and firms, exercising price-setting power through mark-ups, would pass the rising costs on as price rises.

To reduce inflationary pressures, unemployment had to rise.

So governments had to choose between the ‘twin evils’ and a lot of work was done in government departments trying to work out the socially optimal trade-off.

There was never any doubt that governments could reduce unemployment to some irreducible minimum. The only question was how much inflation had to be tolerated.

Then the Monetarists came along and claimed that there was no trade-off really because inflationary expectations drove inflation quite apart from whether unemployment was low or high.

They said that if governments tried to drive unemployment down, there would be some inflationary pressures, which would then become self-fullfilling because wage and price setters would expect higher future inflation and build those expectations into their behaviour.

As a result, the only unemployment rate that was consistent with stable inflation was the so-called ‘natural rate’, later called the NAIRU and governments could not influence that rate using aggregate fiscal and monetary policy.

The ‘market’, so the story ran, would keep the economy at that level of activity and the government should just butt out!

This marked the attack of fiscal intervention and began the era that obsessed with running fiscal surpluses etc.

And so we endured elevated levels of labour underutilisation.

The mainstream economists said that the only way the nation could reduce its ‘natural rate’ of unemployment would be through structural reforms and so we had the array of neoliberal policies emerging – attacks on pensions, minimum wages, unemployment benefits etc and the introduction of harsh work tests – all designed to divert attention away from the fact that the government had abandoned its macroeconomic responsibility to create enough jobs.

At the time, all the econometric work was targetting the sensitivity of inflation to inflationary expectations and the mainstream claimed that a one per cent rise in expected inflation would be fully passed through to the inflation rate, which seemed to support the Monetarist assertion.

Heterodox Keynesian economists tried to estimate a sensitivity of below 100 per cent.

All sorts of econometric papers were published debating this issue.

For me, the issue was unresolvable within that framework.

As a young researcher, I came up with the idea that it was better to target the relationship with the Phillips curve between the actual unemployment and the so-called steady-state rate (which they called the NAIRU).

The point of my work was that even if expectations were passed on fully into the inflation rate, there could still be a trade-off, if the steady-state unemployment rate was related to the actual unemployment rate.

My 1987 paper showed that demand deficient unemployment occurs when the number of people wanting gainful employment exceeds the number of vacancies being offered.

The composition of the unemployed relative to the skills demanded is not the binding constraint.

Structuralists suggest that structural imbalances can originate from both the demand and supply sides of the economy.

Technological changes, changes in the pattern of consumption, compositional movements in the labour force and welfare programme distortions are among the pot-pourri of influences listed as promoting the structural shifts.

The distinction between demand deficient and structural unemployment is usually considered important at the policy level.

Macro policy will alleviate demand deficient unemployment, while micro policies are needed to redress the demand and supply mismatching characteristic of structural unemployment.

In the latter case, macro expansion may be futile and inflationary.

But my PhD work was part of a new research agenda that was able to show that structural changes were in fact cyclical in nature – this was called the hysteresis effect.

Where the economy is at today, is a function of where it has been in the past!

Accordingly, a prolonged recession may create conditions in the labour market which mimic structural imbalance but which can be redressed through aggregate policy without fuelling inflation.

I produced a theoretical model which showed that any structural constraints that emerge during a large recession can be wound back by strong fiscal policy stimulation. This was my main PhD contention. I also produced several empirical articles during that period to verify the claims.

In other words, recessions cause unemployment to rise and due to their prolonged nature the short-term joblessness becomes entrenched long-term unemployment.

The unemployment rate behaves asymmetrically with respect to the economic cycle which means that it jumps up quickly but takes a long time to fall again.

But this behaviour has to be seen in the context of the policy position that the national government takes at the time of the recession and the early recovery period.

It is true that once unemployment reaches high levels it takes a long time to eat into it again because labour force growth is on-going and labour productivity picks up in the recovery phase.

You need to run GDP growth very strongly at first to absorb the pool of idle labour created during the recession unless you provide a strong public employment capacity that is accessible to the most disadvantaged (for example, this is what the Job Guarantee is about!).

It is also the case that if GDP growth remains deficient then the idle labour queue will remain long and employers will use all sorts of screening devices to shuffle the workers in the queue.

They increase hiring standards and engage in petty prejudice.

A common screen is called statistical discrimination whereby the firms will conclude, for example, that because on average a particular demographic cohort is unreliable, every person from that group must therefore be unreliable.

So gender, age, race and other forms of discrimination are used to shuffle the disadvantaged from the top of the queue.

Enter the hysteresis effect.

The hysteresis effect describes the interaction between the actual and equilibrium unemployment rates.

The significance of hysteresis is that the unemployment rate associated with stable prices, at any point in time should not be conceived of as a rigid non-inflationary constraint on expansionary macro policy.

The mainstream theories of the natural rate (NAIRU) all began by assuming that the rate was invariant to the state of the economy.

That only microeconomic reform could reduce it.

But this was really just a ruse to argue against macroeconomic policy interventions (and the use of fiscal deficits) and to justify the raft of neoliberal policies that gathered pace in the 1980s – privatisation, outsourcing, deregulation, attacks on unions, attacks on income support schemes, and the rest.

If hysteresis is present, then policies that reduce the actual unemployment rate, also can be shown to reduce the equilibrium rate itself – which means in theoretical terms, the so-called inflation constraint is pushed away by the expansionary fiscal policy.

That was what my PhD work was about.

The idea is that structural imbalance increases in a recession due to the cyclical labour market adjustments commonly observed in downturns, and decreases at higher levels of demand as the adjustments are reversed.

Structural imbalance refers to the inability of the actual unemployed to present themselves as an effective excess supply.

I documented the non-wage labour market adjustments that accompany a low-pressure economy, which could lead to hysteresis.

For example, training opportunities are provided with entry-level jobs and so the (average) skill of the labour force declines as vacancies fall.

New entrants are denied relevant skills (and socialisation associated with stable work patterns) and redundant workers face skill obsolescence. Both groups need jobs in order to update and/or acquire relevant skills.

Skill (experience) upgrading also occurs through mobility, which is restricted during a downturn.

If wage demands are inversely related to the actual number of unemployed who are potential substitutes for those currently employed, then increasing structural imbalance (via cyclical non-wage labour market adjustment noted above) drives a wedge between potential and actual excess labour supply, and to some degree, insulates the wage demands of the employed from the cycle.

The more rapid the cyclical adjustment, the higher is the unemployment rate associated with price stability.

The importance of hysteresis is that stimulating job growth can decrease the wedge because the unemployed develop new and relevant skills and experience.

These upgrading effects provide an opportunity for real growth to occur as the cycle reduces the unemployment rate that might be associated with stable inflation.

In my PhD thesis I called this the Macroeconomic Equilibrium Unemployment Rate to distinguish it from the conservative NAIRU concept (which at the time was claimed to be cyclically invariant).

Why will firms employ those without skills?

An important reason is that hiring standards drop as the upturn begins.

The faster is the recovery the more quickly the hiring screens are taken away as firms are forced to compete for available labour resources.

Rather than disturb wage structures firms offer entry-level jobs as training positions.

So the imbalances that arise as the economy goes under are stripped away in the new growth period. New jobs, new technologies emerge but a strongly growing economy forces firms to offer training and capacity building. If the recovery is tepid, then these upgrading effects are lost or a very slow to emerge.

What this research showed was that the whole NAIRU industry, which had been used to argue against the use of fiscal policy to reduce unemployment, was based on a lie.

That was the point of my work then.

The research, however, disappointingly, was ignored as the mainstream became obsessed with the NAIRU.

And so the dominance of Monetarism, which morphed finally into the current dominant New Keynesian macroeconomic paradigm, eschewed the use of fiscal policy, prioritised the ‘inflation-first’ monetary policy dominance, and tolerated elevated levels of unemployment and underemployment as a result.

Billions of dollars of lost income has been the result.

The lives of individuals and their families who have endured unemployment have been significantly compromised as a result.

If I was wrong, okay.

But it seems I was right all along.

In the last week (December , 2021), the ECB has put out Working Paper 2625 – Hysteresis in unemployment: evidence from OECD estimates of the natural rate (it was actually published as an NBER working paper in October 2021).

You might reasonably ask what is this research being published for now, when we knew all the results back in the 1980s when I was one of the leading researchers in this field and publishing my work.

I even discussed these concepts with one of the authors of the ECB Working Paper (Laurence Ball) at a European Commission workshop in Florence in 1996, when I was invited to present the sceptic viewpoint regarding the creation of the Eurozone.

But that is the nature of paradigm dominance – suppress conflicting research until it is convenient to claim it as your own.

The ECB Working Paper uses OECD data for 29 countries to “the dynamics of unemployment (u) and its natural rate (u*)”.

u* is, of course, unobservable, being a theoretical construct in mainstream macroeconomics.

So it has to be proxied – estimated – from real world data using a range of estimation techniques, all of them deeply flawed.

The ECB paper ostensibly studies the concept of hysteresis – so “short-run fluctuations cause the natural rate to change”.

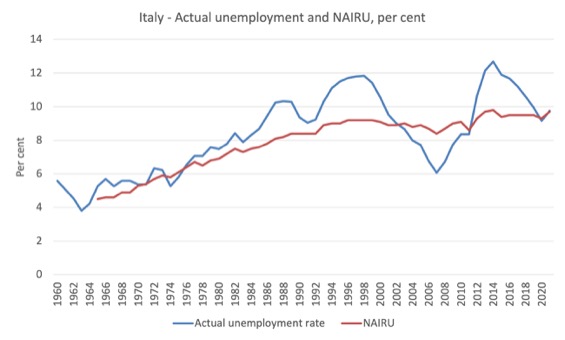

Take a look at this graph for Italy.

I could produce similar graphs for any number of countries.

It shows the European Commission estimate of the NAIRU and the actual unemployment rate.

See the point?

The NAIRU estimate really is just a filtered replication of the actual unemployment rate.

It provides no independent information.

Given the way the estimates are achieved, the NAIRU time series will always just track the unemployment rate up and down (with some lags)

It is meaningless.

It was obvious that the NAIRU concept that has dominated economic policy debates since the mid-1970s and persists today was a fraud.

The ECB paper now find that:

1. Aggregate demand shocks (rises and falls in spending) have “permanent effects” – so when the economy goes into a slump and the unemployment rate rises, so does the estimate of the natural rate.

2. These hysteresis effects are symmetric – which is what I found in 1987.

In other words, expansionary fiscal policy drives the unemployment rate down and pushes any inflation constraint arising from structural impediments out.

3. The paper “finds strong evidence of hysteresis …”

Which means the mainstream are finally catching up.

These findings reject core New Keynesian propositions.

They should be abandoned.

But then the whole house of cards would fall.

We are waiting for that.

The decision in 2020 by the Federal Reserve Bank to abandon the NAIRU approach, which other central banks have followed really marks a decision by policy makers to move on after they have seen the adherence to the NAIRU nonsense has left millions of people without work – quite unnecessarily.

Well, it served the purpose of redistributing income to profits by suppressing wages growth.

But society is becoming fed up with that corruption and the role economists have played in perpetuating it.

So the central bankers have resisted buying into the inflation mania because they know that the current price pressures are temporary and they will only worsen the unemployment if they acted as they did in the past.

This shift away from a ‘forward looking’ anti-inflation stance where they would hike interest rates if someone ‘thought’ there were future inflationary pressures is causing havoc for the speculators who are demanding interest rates rise (as they would have in the past).

Why these demands? Because the gamblers have bets on that the rates will rise and they lose money if they don’t.

When commentators say that rate rises are already ‘priced into the market’, all they are saying is that the financial market speculators have made these bets.

The real economy will not be affected one way or another if they lose their cash.

And central bankers are now wiser to that con.

As an aside, another interesting aspect of the ECB paper, which is common in this ‘we knew it all along’ world as the mainstream economists work hard to salvage their reputations, is that the ECB paper doesn’t reference any of my work, even though I was one of the earliest researchers to develop the concept of hysteresis and present econometric modelling to examine the validity of the concept.

There is a sort of club – that gets the platform. It becomes a self-reinforcing cycle – to never reference work that is awkward so as to control the debate and make it look as if the mainstream were on top of all this all along.

They weren’t.

Conclusion

So when you hear an economist rave on about the NAIRU and the need for fiscal constraint – disregard them.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

N.eglecting A.vailability I.nstead of R.ewarding U.sefulness

We deriously need to start a petition for you to be on Q&A, 60minutes…even Ahn Do’s brush with fame…

No economist, or rather I should say social scientist, is as passionate, knowledgeable, articulate, and quick witted as you are. Truely one of a kind!

Always a blessing to read this blog, learn new new things, and see more clearly.

Thank you for your patience, persistence, perseverance, and productivity.

@FT “No economist, or rather I should say social scientist, is as passionate, knowledgeable, articulate, and quick witted as you are. Truely one of a kind!”

There are some great economists in Aus (and elsewhere) that meet all of those attributes. Bill, to his credit, goes above and beyond by putting together this amazing blog. It is very generous of him and in decades to comes many budding economists will find this fabulous and accessible body of important knowledge (and well backed up opinions) in the internet archives.

Great post again, Bill. Thanks.

Morning,

One more of many examples of how the intellectual debate was by passed years ago and completely ignored.

While the leisure class funded and changed dramatically the universities which passed the ideological test to produce propaganda that would provide cover for the class war that was taking place.

1. Privatisation, outsourcing, deregulation, attacks on unions, attacks on income support schemes, and the rest.

2. Allow the West to expand its borders and take the iron curtain countries after the Berlin wall collapsed and asset strip them. Or any country that stood in their way.

What they did to South American countries and the likes of Greece was a crime against humanity. You will never see them standing in a court at the Hague to answer for their crimes. That trial is only for people who oppose and fight against financial capitalism. That trial is only for their enemies.

The most disturbing part of all of it and a complete and utter disgrace is the corruption and the role economists have played in perpetuating it. The dominant paradigm is not educational it is political all you need to do is listen to Wren Lewis and Portes when they speak. They are playing the part the church did for the king and preach from the national security pulpit. The chosen newspaper journalists play the exact same trick.

It doesn’t matter if they have stolen another MMT economists work. This economic paper will be ignored, completely ignored like all the rest. The neoliberal narratives and framing will continue because they own the media. It doesn’t matter what you show them because they control the narrative and framing every time you switch on your TV or radio or pick up a newspaper. They don’t care about the intellectual debate they have no interest in it. It is a sideshow for them and only the voice of the universities and business schools that pass the ideological test will be heard.

The economics profession isn’t even a science. It is a test match, a wrestling match, a football match, bread and circuses to keep you entertained. An advertising agency for business implanted in every fictional book and movie that made Oprah Winfrey top 10 chart. That replaces government spending with charity. The days of Ken Loach are coming to an end.

Putting yourself into the shoes of the leisure class. Surely they can see they have had a good run at deceiving and conning and killing to get their spoils and now is the time to stop and share the spoils more equally. They must realise by now that countries can see through their scam ? They must realise they have to change course or poison democracy to the point of no return ? After the attack on Washington itself by Trump supporters surely the next President would be more FDR than Bush ?

Nope, not even on their rader not even a little bit. Looking at the fights over the Biden plans they have not learned a thing. The people they are supposed to represent are not even given a second thought nothing more than shit on their shoes. It is still all about power and nothing else power for powers sake. Their duty is to serve the leisure class.

Nope, not even on their rader not even a little bit . Rather than stop and reflect on the damage and war mongering they have inflicted around the world. They have doubled down on everything and removed the democratic process from most countries by making sure who you can vote for are hand picked from the right or far right. If that doesn’t work they use one of their 800 military bases to perform a coup de tat with funds provided by Wall Street.

The fact that they can’t even see any of this at all and not even willing to share their spoils even a little bit with the people they are supposed to represent. Or figure out that they are actually the problem instead of doubling down, is why Louis XVI was executed and the Roman empire and British empire crumbled. We are nothing to them they fear and loathe us in equal measure.

Any sane leisure class would change their ways and could probably buy us off by letting go of 10% of their takings as the taxes fund government spending brigade would probably fall for it. stop interfering in the democratic process. Not even on their rader, not even a little bit. They want it all propped up by the liberal middle class who want to be part of the leisure class. Poisoned by groupthink and would sell their souls to achieve it.

So how do we get rid of the 800 US military bases around the world that keeps this system in place ? How do we get rid of them so countries stand a chance of getting their democracies back ?

How do we explain to Louis XVI that he is the problem before every one else turns their backs and Unites against him ? Or do we let him hang? So we all stand a chance at fighting against and beating our own leisure class?

Because you are kidding yourselves if you think a Corbyn or Bernie will ever be on the ballot to alter the scales of this injustice. That will never be tolerated with King Louis in charge.

As Robin Macalpine said recently – ” Is there anything of our history or tradition or culture which is beyond the destructive reach of the dead hand of our ruling class? If you find it, take great care of it, because it’s probably only a matter of time before they come for that too.”

“But then the whole house of cards would fall. We are waiting for that.” Yes, the fall not only of NAIRU but of neoliberalism in its entirety. And many of us wait scared as hell about both the collapse and what comes after. Yet fall it must, like that house built upon sand in the old parable, that we might construct a better house in which people and all living things can peacefully co-exist. Push economics far enough, and does it not blend into eschatology?

Typo?

The idea is that structural imbalance increases in a recession due to the cyclical labour market adjustments commonly observed in downturns, and decreases at higher levels of demand as the adjustments are reserved.

sb reversed.

The sheep are still demanding that national governments balance their budgets and pay back all previous deficits. Neoliberalism may celebrate it’s centenary?

A random Financier Satyajit Das can get a piece in the Guardian no problem at all. No problem at all for the financial sector to get a voice on the liberal globalist soap box that they call a left wing newspaper.

Just look at this nonsense today.

Spending without taxing: now we’re all guinea pigs in an endless money experiment

https://www.theguardian.com/commentisfree/2021/dec/10/spending-without-taxing-now-were-all-guinea-pigs-in-an-endless-money-experiment

It’s that bad you would think the Guardian Editor is using the article for polling purposes. Data mine below the line comments to see how many believe MMT. Using this article like the politicians use a focus group.

Click bait with a purpose but call it an opinion.

I saw that article Derek. I also saw in the comments below that someone said they hoped Bill Mitchell would be given a right of reply!

It was the usual collection of misrepresentations and lies, combined with a wilful mis-understanding of what MMT is. From a banker of course.

Loved the mention of Japan though, of course written off as a “unique circumstances” just like anything else that contradicts the dogma. Also loved that most of the *questions* raised about MMT are actually questions that the mainstream has itself failed to answer for the last 50 years, such as:

– the source of useful, well-compensated work is unclear

– who decides the target employment rate or UBI payment level?

– Unemployment, inflation and output gaps are difficult to accurately measure

– Effects on employment incentives, workforce participation and productivity are untested

There is also a total absence of explanation or understanding of sectoral balances, exemplified by this statement of the obvious:

“…while available to nation states able to issue their own fiat currencies, it is unavailable to state governments, private businesses or households…”

The final paragraph is the clincher – “While the current game can and will continue for a time, the bill will eventually arrive.” Indeed it will. But not the way he thinks.

Bradley, I think you mean “Bill will eventually arrive’.

Derek, there’s a guy we know at Guardian who must have wept into his cornflakes over that.

A LP friend who lives in his constituency told me last week that he gave them a talk recently but it was about politics not MMT.

“They don’t care about the intellectual debate they have no interest in it”

They have a great deal of interest in it. It’s just a different intellectual debate – one about marketing, advertising and the power of persuasion.

As MMTers what we have to do is stop talking about the bad ideas of the mainstream, and start talking about the good ones we have.

It’s time to ignore the mainstream, and stop referencing their work. We need to get people to join our tribe because we offer better food for the soul, understand them more and can offer solutions to their problems.

That means stopping talking about obscure banking transactions or which set of people you don’t like you’re going to tax to oblivion next week and start talking about the promised land.

Haruki Murakami(2015), “Colorless Tsukuru Tazaki”

There is a reason Hamas runs soup kitchens in Gaza. It’s difficult to hate somebody who will share their food with you.

Neil is right, we have to make an offer.

I posted something yesterday where I asked who would vote for: free health/social/childcare, free tertiary education, free public transport, free dentistry + a tax system which seeks to minimise unearned income. I could have added a non-contributory state pension and benefits tailored to need. I’m working on a complementary tax system which would reduce wealth inequality and consumption of non-renewables, but I need lots of help with that. I’ve already done a lot of work on how to solve the housing crisis here, but still much to do. The extremely variable cost of housing (rent, mortgage, council tax) is a problem when setting a Job Guarantee rate and benefits.

Not deluded enough to think this can be sold to Labour Party at any time soon.

I wish it was as easy as just winning the argument then we will reach the promised land. I really do. I’ve believe it for many years but not anymore.

Ken Loach has just brought out a new film – The War on Journalism: The Case of Julian Assange.

https://labourheartlands.com/exclusive-ken-loach-calls-out-sir-keir-starmer-what-was-his-dealings-in-the-julian-assange-case/

Ken examines the Role Starmer played in the whole affair. Ken asks the questions the media have buried in a media blackout. The role Starmer played as head of prosecution service.

Boris Johnson is being Corbynised doesn’t matter if it happens to Corbyn or Bernie or somebody on the right. When you see it you have to call it out. The attacking has been relentless and they even sat on the Xmas video for a year. A lot of things that have been used to Corbynise Boris would never have seen the light of day if he was playing the neoliberal globalist role they expect from him.

The globalists can find as much dirt as they like when they need it and when it suits their cause. It’s been used time and time again. Most of the dirt found has been aimed directly at the Brexiteers not the liberal conservatives.

Meanwhile Starmer the establishment man continues to get a free ride and is now 9 points ahead in the latest poll. No Labour leader has ever had such an easy ride by the press. It amazes me that the left never even saw him coming and how they could let him anywhere near the party. Never mind let him run the party all within 5 years. Starmer will play the neoliberal globalist war mongering role full of pride and conviction.

That’s the country we live in. Not one built on simply winning the argument.

If Assange had been Chinese reporting on Chinese war crimes he would have won the noble prize. He Would have been the poster boy for Bidens meeting of democracy event. As the war criminals walk free, what they have done to Assange is outrageous and broken every human rights law ever written.

Democracy and Journalism is dead Neil. I simply can’t see how winning the argument will make any difference. If the country can’t even come out and support Assange what are the chances they will ever the come out and support MMT. There’s a very good chance they are going to come out for a humans right lawyer who trampled all over Assange humans rights with impunity.

That’s the country we live in. Not one built on simply winning the argument.

The fact that 90% of the country still believe taxes are needed for revenue after 20 years of MMT. Tells you everything you need to know and how arguement is kept out of any serious debate. Out of any debate that can actually change things. How narrative and framing rules everything by those who own the narrative and framing tools.

It’s even in full view at 5 years old they take you to give you an education. An education in what ? GROUPTHINK ? They know how things work, but did and do everything they can to hide it from the people they are supposed to represent.

That’s the country we live in. Not one built on simply winning the argument.

The injustice of everything I’ve written above gets amplified 100 fold when you get to the heart of geopolitics and foreign policy. Always has been from the very early days in Greece, as they tried to expand their borders from Athens and always will be moving forward. Winning the argument will not stop the West trying to turn every other country into one of their slaves. We are living in a modern day crusade with financial capitalism playing the role of the Christians. The US being their god and Starmer as one of their many Bishops.

That’s the world we live in. Not one built on simply winning the argument.

The only thing that would give me any hope is If on election day the majority stayed at home. When you added up the total share of the vote for the Greens, SNP, Tories, Liberals and Labour the whole lot came to 3% of the vote. 97% of the vote stayed at home and never voted.

Then for me the progressives will have made some serious progress.