In the annals of ruses used to provoke fear in the voting public about government…

Central banks are resisting the inflation panic hype from the financial markets – and we are better off as a result

Regular readers will know that I think the current inflationary phenomenon is transitory. They will also know that I see the continual claims by financial market economists that central banks have to increase interest rates now to avoid an accelerating inflationary episode as having little economic content and lots of self interest content. If rates go up, they win their bets and the more they can bully authorities to do their bidding the more certain their bets become profitable. I am glad that central banks around the world are resisting that game of bluff. In previous periods, they have not resisted and have handed the financial speculators (the top-end-of-town) massive and unjustified profits and forced millions of workers to endure joblessness. It is also interesting that the mainstream press is starting to work that out too. Some progress.

Several readers have E-mailed me wondering what we mean when we say the inflationary pressures are emerging from the supply-side, which is different from a demand-side instigation.

Clearly, both the productive and spending sides of the economy interact to create an inflationary episode.

But the important point is to understand how that interaction changes to motivate a shift from stable prices to rising prices and then accelerating prices.

We can start thinking in this way.

The pandemic is a highly unusual event.

It has created a major imbalance in the relationship between spending and production.

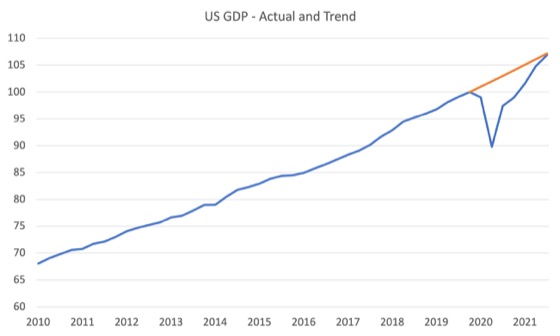

Here is a graph from the latest US national accounts that helps us understand the issue at stake.

It shows the path of nominal GDP from the March-quarter 2010 to the September-quarter 2021.

The red line is the average quarterly growth rate up to the December-quarter 2019 (the peak before the pandemic) extrapolated out to the most recent quarter. It tells us what would have happened if the US economy had have continued growing on that average growth rate trajectory.

You can see that the economy has now just about recovered overall nominal spending levels – by the September-quarter 2021, the trend index was 107.2 points and the actual GDP was 106.9.

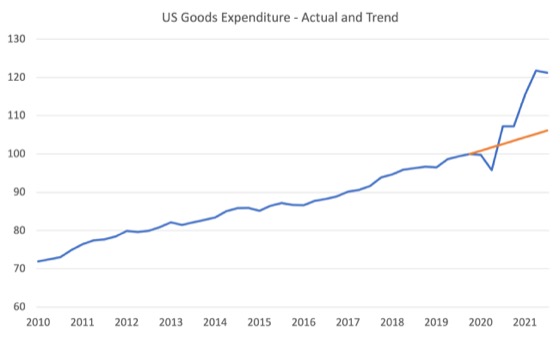

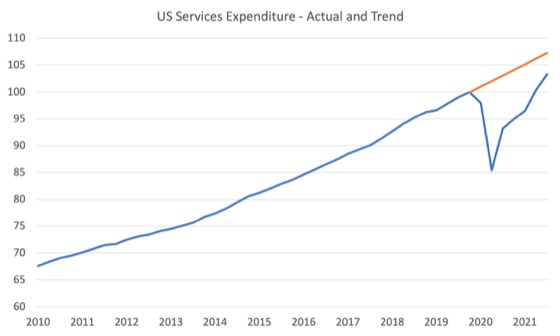

The next two graphs tell what was going on in the goods- and service-producing sectors to deliver this aggregate result.

The pandemic did three things in this context.

First, the government stimulus payments, though imperfect, helped maintain incomes and spending capacity among households.

Second, the lockdowns prevented consumers spending on services by and large – hospitality, entertainment, travel etc.

And with income still intact, the spending shifted to goods-production – renovations, gadgets, flat-screen TVs, you name it.

Households brought forward spending plans on some things while normal spending patterns were short-circuited by the inability to spend on other things.

What better way to assuage the uncertainty and boredom of a lockdown than buying a whole heap of gadgets and devices to start up once and then ignore (-:

Third, the lockdowns and health concerns also reduced the capacity of the goods-producing sector to meet the new demand. This is what we are referring to when we talk about supply-side bottlenecks.

If workers are locked down, getting sick, and ports and freight terminals are disrupted, the normal smooth supply chain is interrupted and so there are inventory shortfalls, delivery delays and the like.

Then overlay market power – which allows producers, wholesalers and retailers to profit gouge the shortages via mark-up increases and you see the problem.

The following graph shows the expenditure on goods in the US – actual and trend (calculated in the same way as before). You can see what happened.

The expenditure on goods has shot up – well above the previous trend, upon which decisions about productive capacity and investment were being made.

The supply-side in the productive goods sector simply cannot adjust that quickly to such rapid (and artificial) shifts in demand and so the conditions for price rises are in place, given the market power held by price setters.

The next graph shows why the total GDP (the first graph shown) has only just recovered to its pre-pandemic level, while expenditure on goods increased so much.

It shows expenditure on services in the US is recovering but still well below where it would have been had the pandemic not hit and the average growth path prior to the pandemic continued smoothly.

So the pandemic has created a combination of supply constraints and rapidly shifting demand patterns.

This is not the 1970s redux.

If the pandemic abates then those conditions will also abate.

That is the basis for my assessment that the current inflationary pressures are transient.

Transient doesn’t necessarily mean short-lived.

The pressures will last as long as the pandemic distorts the supply and demand sides of our systems.

There are signs that the distortions are easing – but then with omicron, things could change again for the worse.

Transient means that there are no structural forces that would see these initial price pressures morphing into an institutionalised wage-price spiral where labour and capital duke it out in distributional struggle to see which one has the power to force the other to bear the real income losses of the rising costs and prices.

That was the 1970s after the OPEC oil shocks imposed real income losses on nations via imported raw material price rises (oil) and both sides of the labour market had the market power to force price and wage rises, respectively onto the other.

Those conditions no longer exist in 2021.

The workers have largely lost that capacity – although, hopefully, the pandemic has altered the balance somewhat and workers will realise – even Amazon workers etc – that there is power in union.

There are signs that is happening – and not before time.

Mainstream press is finally waking up to the scam

For years, we have had to tolerate commentators in the mainstream financial and economic media playing along with the financial market ruses about artificial inflation panic.

The constant hype has been about how governments will lose control of their currencies if they don’t do what the financial markets think is ‘prudent’.

Of course, prudent has nothing to do with prudence in this context.

It is massage code (to keep us in the dark) for doing what the financial markets want so they can make huge profits and minimise their risks of losses.

So appeasement is about the government running the show so that the conditions are ripe for the speculators – the gamblers – to make money and damn the rest of us if they get in the way.

People are told – well, if the ‘markets’ don’t make large profits, we will not enjoy increases in our own wealth via pension/superannuation funds etc.

However, they are not told that the super funds charge massive ‘management’ fees and deliver rotten returns while ‘managing’ the savings of workers.

Our progressive political parties fell prey to the ‘markets’ must be appeased mantra.

Most recently, I wrote about how the British Labour Party leader thought that the priority was business profits because then everyone benefits – a factually false assertion.

Please read my blog post – When wages go up, we all benefit – what Starmer should have said (November 25, 2021) – for more discussion on this point.

All this talk about governments having to be fiscally responsible has nothing to do with them delivering full employment etc but everything to do with keeping a solid flow of risk free assets to the financial markets for them to price their risky products off and to flee to when things get uncertain in the private asset markets.

It has everything to do with ensuring they bail out the gamblers when they overreach.

With all that in mind, it is pleasing to read an article from the Sydney Morning Heral (December 6, 2021) – Panicking financial markets could stuff up another global recovery – by the economics editor, Ross Gittins that goes some way to recognising this game of bluff.

He notes that with inflationary pressures rising in the US and Britain:

… we’re witnessing a battle between people in the financial markets, who fear inflation is back with a vengeance and want interest rates up to get it back under control, and the central banks.

As you can see he hasn’t completely embraced my position.

The financial markets are not fearing inflation. They are using the inflation threat beat up to pressure for interest rate rises.

Their objective is to get interest rates up.

Why?

Because they have bet they will rise.

They have assumed that the central bankers will just bend over, as they have for the last few decades under this New Keynesian paradigm, and with their ‘forward-looking’ mentality push up rates.

The ‘forward-looking’ idea was that central bankers would hike if they ‘thought’ inflation might emerge down the track, even if there were no current pressures.

Their forecasting models to help them assess that condition were fraught – error-laden – and so we had the situation where monetary policy was always pushing against progress for no real reason.

And with fiscal policy being compliant – that is, not to ‘undermine’ the monetary policy stance – the surplus bias worsened matters.

The damage to economic growth and employment was not so much the elevated interest rates but the fiscal drag in combination with the rate rises.

So the financial markets thought that it would be a shoe-in this time around and bet accordingly.

If rates don’t go up, they will lose millions.

Hence the constant talk of inflation threats (code: put up rates you bastards so we can get our profits).

Gittins notes that:

The central bankers see the higher prices as a transitory consequence of the supply and energy disruptions arising from the pandemic. They fear that, once their economies have rebounded from the government-ordered lockdowns and fear-induced reluctance to venture forth, their economies will soon fall back to into the “secular stagnation” or weak-growth trap that gripped the advanced economies for more than a decade following the 2008 global financial crisis until the arrival of the pandemic early last year.

Exactly, although the low-growth wasn’t a structural matter but rather the consequence of the fiscal drag which was ideological and could have been reversed any time (as it was as the pandemic hit).

Secular stagnation would not be as easily reversed.

You can see from the graphs above, how quickly GDP has got back on trend in the US, which is a familiar story around the globe as governments have relaxed restrictions (for the time being).

So for once, the central bankers are not playing ball with the gamblers.

Gittins also argues (finally) that central bankers should:

… be less pre-emptive. Stop relying on theoretical estimates and just keep allowing the economy to grow until we had proof that wages really were taking off before we applied the interest-rate brakes.

And perhaps we should base decisions to raise rates on actual evidence of a problem with inflation – including, particularly, evidence of excessive growth in real wages – rather than on mere forecasts of rising inflation.

That is the shift that has accompanied the pandemic.

First, the US Federal Reserve decided to abandon the ‘forward-looking’ nonsense and not try to slow the economy while it is adding jobs and reducing unemployment.

In the past, the US Federal Reserve would have hiked rates several times already.

The new thinking – which effectively abandons the NAIRU culture that has hurt workers immeasurably – is welcome.

I wrote about that shift in thinking in more detail in this blog post – US Federal Reserve statement signals a new phase in the paradigm shift in macroeconomics (August 21, 2020).

The Reserve Bank of Australia has followed suit.

And the ECB and the Bank of England have also resisted the demands of the financial markets.

Gittins writes:

This is still what the central banks want to see: a new era of much lower unemployment and, as a consequence, much healthier rises in real wages to power a move to stronger economic growth than we saw in the decade before the pandemic.

But now Wall Street is panicking over the surprisingly big price rises caused by the pandemic’s disruption, and has convinced itself inflation’s taking off like a rocket. If the Fed doesn’t act quickly to jack up interest rates, high and rising inflation will become entrenched.

Wall Street is not panicking about inflation.

It is panicking because it fears that the central banks have actually changed the monetary policy paradigm and the bets they made based on an expectation that the old paradigm would return the moment the CPI ticked up will lose (millions).

Gittins thinks the “financial markets … have joined the inflation panic, betting that, despite all Lowe says to the contrary, our Reserve will be putting up rates continuously through the second half of next year.”

They haven’t joined the panic – they are trying to create that sense of panic because that way their bets win.

At least he understands that the ‘inflation panic’ narrative is all hype – “Apparently, this dramatic reversal in the economy’s fortunes has occurred without workers getting even one decent pay rise.”

The reversal being a return to the 1970s – as the ‘market’ commentators are trying to convince us of.

Gittins knows this is just hype:

There are three obvious weaknesses in this logic. First, globalisation has not made our economy a carbon copy of America’s. Second, there’s a big difference between a lot of one-off price rises and ongoing inflation. If the price rises don’t lead to higher wages, no inflation spiral.

Third, even if the central banks did get a bit worried, they’d start by ending and then reversing “quantitative easing” – creating money from thin air – before they got to raising the official interest rate.

Conclusion

I maintain my position that the inflationary pressures are transitory – how long that lasts depends on how long the pandemic distorts the spending and production systems.

And I hope the central bankers deliver massive losses to the financial markets by resisting the hype to hike rates.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

“People are told – well, if the ‘markets’ don’t make large profits, we will not enjoy increases in our own wealth via pension/superannuation funds etc.”

Except that paper profits for ” the markets” won’t take care of us when we’re old, future production of goods and services will…

There is only inflation news in the media. There is no inflation hype in the markets. If anything, everything looks subdued in the markets because the free markets haven’t existed for a long time.

I am a democratic socialist; Marxian, Veblenian and “CasP-ian” as in Capital as Power theory. In matters of monetary theory I am closer to MMT than any other view. I see MMT as a continuation or development of Chartalism and the ways Lerner and Keynes viewed money. I agree with the Government Job Guarantee approach to setting minimum wages and generating full employment.

Having said all that, I am not quite as sanguine as Bill Mitchell about the thesis that the current inflationary phenomenon is transitory. Nonetheless, his exposition makes sense to me. And I agree that we should not set interest rate policies to suit financial speculators. So on balance, I would agree with Bill and the Reserve Banks on holding fire on interest rates.

Several things still trouble me though. First, I am not happy about asset inflation. That makes home purchase unattainable for young workers and gives windfall gains to real estate and stock market speculators. Hence, I am not happy when with Q.E. which simply gives interest-free loan monies (essentially) to rich people. I am skeptical that governments measure inflation properly. I strongly believe (though admittedly lack the methods and the proofs) that inflation is deliberately under-measured, especially here in Australia. So taking official figures on trust (if people do) seems somewhat dubious to me. Governments have strong political incentives to under-measure inflation. The headlines look better and indexed Government outlays can be trimmed as much as (I assert) the official CPI figure is trimmed below reality. Finally, an inflation rate of 5% is probably fine so long as wages are permitted to inflate at the same rate. That sort of rate lets workers inflate their debts away provided real interest rates are kept relatively low, by legislation if necessary.

Ultimately, I would favor a sovereign money strategy where no-one is permitted to create debt money and the state only creates money (fiat money obviously). I also favor taxing the rich hard even if this is not strictly necessary from MMT principles. Most riches are accumulated by enclosure, inheritance, rent seeking, exploitation, general speculation and “gangster capitalism”. The undeserving rich simply should not be permitted to keep their ill-gotten gains. And asset inflation is far less likely to occur if the rich and super-rich are controlled and indeed abolished as a class since they are, almost entirely, a parasite class.

Re: ‘the super funds charge massive ‘management’ fees and deliver rotten returns while ‘managing’ the savings of workers.’ In the UK, it seems to me, that the downgrading of the state pension at the same time as traditional company pensions were being withdrawn/failing, and the unleashing of the pensions industry to fill the gap, at great profit for terrible service, is one of the most important but least analysed aspects of neo-liberalism: the dominant ideology for at least the last 40 years that the likes of Nick Cohen in the G/Observer tell us doesn’t exist. This parasite industry demands high short term returns from the productive economy, state subsidy and risk reduction from the government (distinguishing neo-liberalism from laissez faire liberalism) and worst, workers financial buy-in in this scam.

The latest article in the smear MMT campaign got print space in the G last week (I think an Aussie author), with pretty much a lie per sentence, associating MMT with a UBI (and the G keeps asking me to donate!). Thanks always to Prof. Mitchell for providing an alternative reading to the propaganda.

“First, I am not happy about asset inflation.”

Then stop seeing it as asset inflation, and see it for what it actually is – removal of artificial asset price suppression.

Assets have been too cheap for too long because we try to artificially constrain the amount of lending banks undertake in a desperate attempt to ‘control inflation’. That channels huge sums of public money to financiers via the interest rate mechanism.

During the pandemic the price of used cars started to go up. Nobody sat there and said that was delivering windfalls to car sellers and that it made the price of cars unsustainable. Therefore we should tax the rich and stop banks lending to buy cars.

What we said is what needed to happen – get the car production system back up and running, and get it to start producing cars. That way they go back to depreciating – as they should do because cars wear out. Then the financial anomaly sorts itself out – banks realise they are lending on depreciating assets and cut their cloth accordingly.

Now apply the same thinking to housing. Houses should depreciate because they wear out. Therefore we are simply not making enough of them.

The whole issue with land prices and housing prices started not just with the deregulation of banking, but with the elimination of the supply-side production of housing services by the state. Demonstrably the private sector is either incapable or unwilling to produce enough houses so that they depreciate properly. That is therefore a market failure that needs correcting. We need to redeploy capacity to produce more houses and we need to do that until old ones start to depreciate. Once they start to depreciate the disfunction in the financing industry will correct itself.

The last fifty years has been a historical record of the failure to control monetary quantity, and that’s because people will always find a way around it. Trying to prohibit liquidity is like trying to prohibit alcohol sales – a fools game. There is always a way around it.

@ Neil

Besides housing, assets also include stocks and shares plus the land that housing is built on. We can all have our own opinion on whether the stock market represents the true value of shares or if they are inflated due to a bubble effect.

Housing does indeed depreciate in value in Australia. Unlike in the UK it is quite normal for an older property, depending on the method of construction, to be physically moved from an expensive urban plot to a much less expensive rural location at an ultra cheap price.

It is only cheap, of course, because the land is no longer included with it. That doesn’t wear out with time.

Peter is right. Land is the only asset price which matters because it is the main component of the cost of a home – a basic human need. As I said in previous post: “The extremely variable cost of housing (rent, mortgage, council tax) is a problem when setting a Job Guarantee rate and benefits.” Land value tax is the only measure which can address this – it should not be considered as just another tax.

Neil

“Houses should depreciate because they wear out.”

But the land they stand on doesn’t. It’s the land that appreciates in value, not the actual bricks and mortar. Which is why I’m seeing houses torn down by developers all around me and replaced with swanky new ones. And why I have sympathy with LVT proponents.

There’s more to it than the gamblers placing bets,

You just have to listen to Elon Musk recently when he said it is all about capital allocation. Which means it is just not about the gamblers and their bets it is about the FIRE sector in general and Steve Keen’s work on bank lending and private sector debt.

Musk would rather the unelected banks allocated capital via loans rather than elected governments. Government should act as a household and balance their budgets and not increased its debt by running a budget deficit, by spending money into the economy for infrastructure, education and public services.

Musk supports the paradigm that economy has to depend on banks to create the money to expand. Stop the government from spending and the banks will take their place. Why the financial sector attacks budget deficits so much . Get people like Osborne and Hammond to destroy household savings to the lowest household saving ratio on record since 1963. Push households and businesses into the arms of the banks.

Just look at your TV sets since the 1990’s

a) The number of bank lending advertising has increased a 100 fold. Along with credit score adverts and pay day lenders and insurance companies. Sky and channel 4 and channel 5 opened it all up.

b) Charity porn – how many adverts are now charity that used to be provided by government spending.

The advantage of governments creating money is you they don’t have to pay interest, because the spending is self-financing and If the government do a bad job they get voted out. Banks in the other hand can’t be held to account if they do a bad job You get 2008.

I call it the Skye bridge economy. If the government had simply instructed the BOE to credit the accounts of all the private sector companies they could hire to build the Skye bridge then the bridge would have been built for free by simply increasing the deficit.

As it was built on the back of a bank loan the American bank that provided the loan then charged a toll to cross the Skye Bridge and There was nothing the locals could do about it.

The battle for Skye Bridge

https://www.bbc.co.uk/programmes/m0009qln

George Monbiot book captive state – showed how New Labour under Blair used the Skye Bridge model for the whole of the UK economy. Rather than deficit spending. This idea that governments should not create money implies that they shouldn’t act like governments. Instead, the de facto government should be Wall Street and the City of London. Instead of governments allocating resources to help the economy grow, banks should be the allocator of resources – and should starve the government to “save taxpayers” (or at least the wealthy). Scream for smaller governments.

They scream for a balanced budget, saying, We don’t want the government to fund public infrastructure. We want it to be privatised in a way that will generate profits for the new owners, along with interest for the bondholders and the banks that fund it; and also, management fees. Most of all, the privatised enterprises should generate capital gains for the stockholders as they jack up prices for public services. Create a big 3 or 4 that manipulate the prices and call it competition.

That’s the rent seeking, financial capitalism, Skye bridge model that Musk supports in a nut shell. They use the myth of affordability and tax payers money narrative to achieve it. Every privatisation is done because they say we can’t afford the public sector and your taxes will have to rise to pay for it and attack the national debt for the fun of it.

The real theft of course is how much they take from your disposable income every month as the big 3 or 4 increase their prices. After the rent seekers turned the whole public sector into a monopoly. Try and grow the economy on the back of household and business debt. More and more are forced to turn to.pay day lenders.

You also have take into account how the smaller and other countries borrow in $ and what it means for them when interest rates rise. There’s a lot of control in that so that the neoliberal globalists can get their structural reforms and privatisations pushed through. What I have described above gets amplified 100 fold as countries can’t pay back their $ debt. A strong $ always hurts these smaller countries and why sometimes they offer swaps as long as you have passed the ideological test. If you pass the ideological test you will get the funds if you don’t you will be asset stripped or taken over by a coup de tat.

Why the very first thing a neoliberal globalist puppet does when they win a rigged election is borrow in $’s – See Argentina and other South American for details and why the EU was set up the way it was. For US geopolitical and foreign policy purposes.

There’s a lot more to it than just gamblers and in the same way they have eased the fiscal rules in the EU and provided $ swap lines during the pandemic. I don’t share the view they have learned something here and moving forward they will be less ruthless. My view is that will reintroduce the fiscal rules across the EU as soon as posdible. Nothing new has been learned as they know how it really works anyway. Just read George Monbiot book captive state they knew exactly what they were doing.

I do believe they will try and weaken the $ to help the smaller countries as they have always tried to do that under neoliberal globalism. That’s it, that’s where it stops, as we get return to normal it will be business as usual because geopolitics and foreign policy demands it.

I hope I am wrong and hope I am not even close to the truth. In 3 years time I fully expect an article from Bill with the heading ” They learned nothing from the pandemic ” in the exact same way they learned nothing from the financial crises. That we have seen written down many times since 2008.

Just listen to the noises coming out of every Western Parliament. Just listen to them debating budgets and spending plans now today. They have already reintroduced every myth under the sun and asked you to completely ignore how the funds were created to fight the pandemic. Listen to them it is already business as usual. They know exactly what they are doing and will continue to lie to the voters to keep super imperialism alive.

Let’s make it 2 years before Bill does an article headed – ” They learned nothing from the pandemic “

The “Skye bridge ” economic model just makes any country

1. An expensive place to live

2. An expensive place to actually do any business.

Why China is winning. China would have created a 1000 bridges for free the time it takes the West to build 50 bridges they put a toll on that seeks rent from the serfs and their disposable income.

It’s not the land that appreciates in value. The land stays exactly the same. If it appears to appreciate in value, then what you have is a hoarding problem. So solve the hoarding problem.

Government allocates the land onto which houses are built until everything starts to depreciate. Then the problem solves itself, because the demand for land drops away. You’ll no longer want to hold land near existing housing areas, because it is very likely to be reallocated and you’ll be left with land commanding a peppercorn ground rent.

It really is time for progressive people to stop obsessing about taxation and start taking direct action to solve problem instead of falling for the nudge nonsense.

“If the pandemic abates then those conditions will also abate.”

IMF was warning of a slowdown in late 2019, and no amount of money supply expansion will resolve that.

We’ve screwed things up for our grandkids and beyond I believe, with sorrow.

I would also add, regarding the continued supply-side issues, that if the private sector is genuinely innovative in the way the preachers believe, then keep the demand-side intact and force them to innovate. Both in the short and long-term, the focus should always be on improving weaknesses in supply, not curbing growth in demand, which for more than a decade has been in the gutter.

All UK land should be nationalised, with each occupant paying the appropriate rent (call it Land Tax, whatever…) to the State for its occupancy – the cost of which would depend on its legally permitted use.

Farmland or land in designated industrial zones to be cheaper than high-end residential or retail, for example.

You want the use of 500,000 acres in Gloucestershire, or Stirlingshire, to yourself, or the entire area of Belgravia or Knightsbridge to sublet to the luxury housing or retail sector?

Fine – then pay the State for the use of it!

See how much is then freed up for affordable housing!

MrShigemitsu spot on once again. Until the hoarding problem is addressed then Neil’s only ‘appears to appreciate’ is actual. Agree that in many cases of market failure, legal enforcement is required rather than taxation. Don’t want another tax? Then call Land Tax, Land Rent.

‘Assets have been too cheap for too long’. Have to disagree. Foodstuffs, clothes and lots of other stuff has been cheap for too long. It’s had to be that way to be affordable for many who don’t have much left from their wage or pension after paying housing, utilities and tax, and this stuff can be provided at profit on the back of low wages.

‘Houses should depreciate because they wear out’. Fortunate for the mortgage lenders, many householders spend significant sums on keeping the asset up to scratch and governments on so ordering things as to increase land value in certain areas.

Neil says: “It’s not the land that appreciates in value. The land stays exactly the same.”

This is not true. The value of land changes: if its natural attributes change (through a natural disaster or pollution); if the local authority changes the permitted use; if a local facility, either public or private, is removed or added; with changes in ‘fashion’.

The ‘hoarding problem’ affects the market price not the value.

Nationalising the land required for new homes (which is what Neil is proposing) cannot solve the problem, even if it could get past the legislative hurdle. New builds are a tiny fraction of the housing total stock. The effect on prices would be minimal.

LVT would bring down the price of land (but not the value). It nationalises the rent of land – no need for government to allocate. The market needs correction not abolition. Planning consent is most of land value and that is in the hands of elected councillors here (except where national government overrides) and, of course, some councillors use the power they have in the planning system for personal gain.

I believe I know the reason for the prejudice against LVT of some MMTers. I have been called a georgist to my face. It was meant as an insult and I took it as an insult as I am not a georgist, although I probably was when I first got into the movement. LVT proponents have encountered similar professional prejudice as MMTers (‘The Corruption of Economics’ explains).

I don’t see anything about a land value tax as conflicting with MMT. After all, the MMT primers use the ‘hut tax’ as an example of how governments drive demand for the currency and monetize economies. And I probably would not be insulted if someone called me a ‘Georgist’ any more than I would to be called ‘Keynesian’. I prefer to be described as an MMTer though.

I think property taxes can be quite fair even though they are the largest taxes I personally pay. And it is not like I own acres of property. Or even one acre for that matter. Stick to your guns Carol. But those tax costs are easily passed along to tenants, so imagining that they just tax the people who own and rent out apartments or houses is not very accurate in my opinion.

Just out of curiosity- what are the property tax rates like over there where you are? Here in my city it usually hovers around 2 to 3% of the market value of the property annually. But supposedly I live in a high tax city in a high tax state with high priced real estate and high incomes in general. It can be onerous at the times they are due I will admit.

Not against nationalising land but whilst the majority still own simply incompatible

With winning an election.

@Jerry, there’s more to georgism than LVT. Henry George was a free trader and a capitalist. I didn’t know that till later – I’ve only read Progress & Poverty. So an insult it is.

The UK domestic property tax (council tax) is highly regressive. The owner of a mansion in Westminster pays not much more than the tenant of a bedsit in Weymouth (near me). Not so long ago he actually paid less. Tenants are responsible for paying the tax on a property they do not own because its short-lived predecessor (Community Charge or ‘Poll Tax’) was a payment for services provided by the local authority (municipality) and that principle has been maintained. The tory objective is for local authority expenditure to be funded primarily from council tax and business rates. A few years ago half came from central government.

I would charge a high LVT rate on land which is, or is potentially, income-generating and a lower rate for that under principal homes, but still proportional to value.

Sorry, Bill, to take up your space. I’ll say no more.

Thanks Carol. I had no idea. Seems like a strange idea to me to levy a property tax on a person that doesn’t own the property. Certainly sounds quite regressive from your description of it.

I will have to read up on George- I really don’t know all that much about him. Of course, Keynes was quite the capitalist and trader as well from all accounts. I don’t really hold that against him.

Inflationary pressures by investors are predatory and the abusers should be prosecuted. Until a bunch of guys do the perp walk this behavior will only increase.

” There’s no real economic discussion of how economies actually work. Instead, you have a parallel universe of how a hypothetical economy would work in a completely different world – a world in which governments don’t exist, in which bankers are very productive and help the economy grow. The bankers, landlords and monopolists are depicted as the most productive organizers of society, trying to protect labour and industry from intrusive governments and taxes.”

” Neoliberalism is really not individualism, because it ends up destroying individual choice. It’s an anti-government policy. What they call individualism is getting rid of government controls. They don’t want governments to have the power to tax rentiers. They don’t want government to have the power to regulate the banks. Let the banks decide what to make money on, and let them decide who’s going to administer the Federal Reserve or the European Central Bank and other government agencies. This is a travesty of individualism. It’s dictatorialism. That used to be called fascism a century ago. ”

Living with Price Above Value

https://michael-hudson.com/2021/07/living-with-price-above-value/

This is the problem of not having – ” What MMT can do for you” a manifesto.

It’s alright saying set the interest rate to zero and bingo we have cheap mortgages for all. We also have to say okay we know this could help the rent seekers and monopolists more than the one house owner. So this is what we are going to do about that.

So the question then becomes if we introduce the following ….

eliminating government bonds (that provide interest income to rentiers), banning stock ownership by pension funds backed by the government, and regulations to constrain and narrow permitted banking activities-all of which remove most of the highest incomes in question at the source.

The only bonds Brexit Britain needs are Granny Bonds

https://new-wayland.com/blog/the-only-bonds-we-need-are-granny-bonds/

But we also need to put the City Of London back in its box at the same time. Show them who is in charge of they won’t get a banking licence.

The job of a bank is to promote the capital development of the economy. That is its public purpose; the job it is licensed to do. All other activities that conflicts with that purpose must be prevented.

For banking to be effective it must be boring - bowler hat boring. The job of a bank is to provide capital development loans to the economy based solely upon credit analysis. All other activities deflecting from that purpose are banned.

1. Banks can only lend directly to borrowers for capital development purposes (i.e. business credit lines and household loans), and the banks keep those loans on their books until cleared.

2. Banks must operate on a single balance sheet. No hiving things off into ‘off balance sheet’ subsidiaries to try and hide them.

3. Banks cannot accept collateral. Collateral is a fixed charge over an asset as an insurance policy and aligns the incentives of banks with those possessing assets, not ideas. It stops banks being capital developers and turns them into pawn shops. That is the wrong alignment of incentives. We want loan officers with skin in the game. Their success should depend upon the success of the borrower. Banks should line up in insolvency with the other unsecured creditors (and importantly behind the remaining preferential creditors - employees).

4. Depositors are protected 100% at all amounts. A depositor in a commercial bank is holding nothing more than an outsourced central bank account. They are not investors in the bank and should never be treated as such.

5. The job of the bank resolution agency is to ensure the banks are properly capitalised given their loan book and declare them solvent. If they are not, they take the bank over and resolve it with any excess losses absorbed by government. This aligns the incentives of the regulator. If they get the solvency calculation wrong and the capital buffers exhaust, the regulator stands the cost.

6. The Central Bank provides unlimited, unsecured lending to regulated banks at zero interest rates. Collateral serves no purpose since the bank has been declared solvent (and therefore there is no reason for it to be illiquid), and collateralised Central Bank lending just shifts the losses to depositors who are protected 100% anyway.

7. Once you get rid of interbank collateral and funding requirements, you get rid of one of the final excuses for keeping Government Bonds. National Savings annuities for pensions (allowing retiring individuals to receive a secure lifetime income) would get rid of the final one. Transferable instruments that confer government welfare on the owners do not serve the public purpose. Government welfare receipt is a social decision, not a market driven one.

See Granny bonds above for more details on number 7

8. As the asset side is now heavily regulated because of 1-7, you want the liability side to be as cheap as possible. Unlimited central bank access ensures liquidity for depositors and allows lending-only banks to arise. It gets rid of the Interbank overnight market and replaces it with central bank overnight accounts. It puts the Central Bank ‘in the bank’ as a major investor - with open access to the commercial bank’s loan book via the work of the solvency regulator.

9. All levies, liquidity ratios, reserve requirements and the like are eliminated. The cost of maintaining the collateral system is eliminated. The result is loans at a low price with the quantity restricted solely by credit quality. As an economy heats up, credit quality declines and loans become restricted - systemically preventing the Ponzi stages of finance that lead to a Minsky Moment.

10. Proscribed banks, forced to rely on credit analysis for profit, help prevent a boom by issuing less credit as project quality declines.You get a natural and steady withdrawal of funding that is far more surgically targeted and responsive to local conditions, than the carpet bombing approach of interest rate adjustments.

Banks are currently too complicated, too large, too impersonal, too intertwined and systemically dangerous. They need to be simpler, smaller, more local and relationship oriented in scope. All of which are easy to achieve once you adopt steps 1 to 10

And if we ramp up the number of social housing being built and change planning laws is that enough ?

That’s the question – if we change the banks or nationalise the banking system and build more social housing do we still need a land value tax ?

Until we get ” What MMT can do for you” a manifesto. Then everything is just noise and we can talk about it for another 20 years in below the line comments sections and keep standing still.

Of course the elephant in the room which is always the elephant in the room when it comes to these debates is geopolitics and foreign policy. If you are going to fix these things within your own borders then it is impossible to ignore the geopolitical landscape.

You have to understand why the system we have was set up in the first place. Michael Hudson in the link above paints the picture of what has been going on globally. Bill and Thomas expanded on that in reclaim the state.

So if you support a LVT or when you write the ” What MMT can do for you” a global manifesto. How or what is the plan to make 800 US military bases ” stand down” and accept your proposals. How are you going to do it by changing the culture of America ?

Good luck with that ! The civil war in that country never ended rain just stopped play.

You cannot keep treating the geopolitics and foreign policy agenda as if it does not exist. It is real and the elephant sits on your lap every room you go into. It is a mistake just to look at the problem from within your own border. If the 800 US military bases do not like a LVT tax or what we propose you will be Corbynised and forced to sit on a chair and wear Bernie’s mittens. Boris will tell you all about it and how utter ruthless these super imperialists and their media are.

History shows what needs to be done. The battle for Skye bridge further up the comment section showed what needs to be done. How many people sacrificed their lives and were jailed for the cause. As they tried to clog up the courts and jails on the mainland. so that the system couldn’t cope with the sheer numbers that were arrested. Why the leisure class have turned their police forces into armies and they will shoot you if you try if ketteling you does not work.

Derek I agree wholeheartedly with your long insightful comment and also believe the common man and woman is being scammed by rich speculators and rent seekers otherwise known collectively as the FIRE sector. Elon Musk and Jeff Bezos can go fuck themselves.

All commenters are making worthy contributions even if differing solutions are suggested.

Michael Hudson’s many books cover these issues very well and Bill has also covered these issues in his blog many times and his book Reclaiming the State.

The West is collectively fucked unless the voters can gain the necessary understanding and reclaim our democracies, mass media and the state. If anything the ignorant slaves of neoliberalism are gaining in numbers and demanding stupid and counter productive solutions for example Trump’s racist base who support big tax cuts for the rich and poverty for themselves. The Australian working class right is very similar.

China is primarily overtaking the West because of the nation building approach of the CCP and the harnessing of the fiscal power of the state despite some shared policy failures such as excessive real estate speculation.

The FIRE sector in the West is creating geopolitical shifts to the detriment of the West and will destroy the West just as surely as the Roman Empire was destroyed by internal decay.

My industry the car manufacturing industry was also destroyed by the FIRE sector in Australia but as it turns out this is just one symptom of the malignant cancer of neoliberalism.

It is time for mass insurrection because of this dangerous and destructive greed and also for the failure to adequately address the global warming challenge. However on current trends any political unrest is more likely to be misdirected at scientists, intellectuals or other innocent minority ethnic or social groups.

@ Neil

“It is not the land that appreciates in value”

Not sure about that! It’s not just about how land is allocated for use by govt, it is where people want to live. In many UK cities, especially in London, we’ve seen a process of ‘gentrification ‘. What were working class areas become unaffordabe to those on typical incomes. Workers can’t afford to live even in the East End any longer. The new East End is actually Essex!

If cities become more prosperous and cleaner then more people will want to live in them. Price will be the rationing mechanism. A LVT won’t change that on its own. There needs to be laws and tax disincentives to prevent properties being kept empty which will help but not be a complete solution .

“It’s not just about how land is allocated for use by govt, it is where people want to live.”

If I offer new towns with work and cheap housing people will move to them. And those who want to live in the ‘des-res’ parts of the country then get to pay the price for them. That’s then their choice.

However the cheap servants they rely upon will be moving in the opposite direction. The Keynesian plans of the social climbers will meet reality of the cost of living. Is see that as a transfer from the rich to the poor.

Few want to live in cities at present, because there is a far higher chance of dying from a certain respiratory virus if you live there. The desire is to get out of town and into the country. Just as people did in the 17th century when the plague was in town.

In fact we might get some sense if Parliament moved to Oxford.

Once again we have people obsessed with taxation as a solution. That is never a solution. It is brain capture by neo-liberal belief systems that price is the sole allocator.

Once you can get a job anywhere, and you have a planning system that forces leases from landowners at a peppercorn rent (which is precisely the same mechanism Treasury uses to force loans from the central bank at a set price), then housing can be created cheaply. Once you create housing and jobs publicly, then the marginal demand is neutralised and the price starts to fall. Embed depreciation and the calculations made by lenders change direction – to the ones they generally use to fund inventory and cars.

That will solve the problem. No Lincoln Green required.

Agglomeration as a concept has suffered a nuclear strike from Covid. Getting lots of people into the same space is going to be increasingly difficult. Which means that plans that allow people to live in other parts of the country and world have greater traction at present.

@ Neil,

“In fact we might get some sense if Parliament moved to Oxford.”

Totally agree that Parliament should be moved out of London but why Oxford? I’d suggest Middlesbrough which is a more central geographical location for the UK as a whole. Geography should be more a part of economics than it is. Additional Govt spending in Middlesbrough will be far less inflationary than in either Oxford or London.

Economic policy should also be more directed towards keeping people where they are rather than allowing a steady population drift to the more prosperous areas. Many of London’s problem are caused by an influx of people from elsewhere. People aren’t just economic units. They do have attachments to their place of birth. If they wish to move to new towns like Milton Keynes that’s fine but equally, if they don’t, they shouldn’t be economically coerced. That’s already started to happen with reports of “social cleansing” in some London boroughs.

https://www.politics.co.uk/news/2017/09/14/social-cleansing-hundreds-of-families-moved-out-of-london-boroughs-immediately-after-grenfell/

“A LVT won’t change that on its own. There needs to be laws and tax disincentives to prevent properties being kept empty which will help but not be a complete solution .”

Peter, why would you keep your property empty if you are paying a hefty LVT, receiving no rent and the price of your asset is falling?

I’ve never said that LVT is a panacea. It is the key to fix the housing crisis (in the real world where there are markets – that includes China), reduce wealth inequality and encourage businesses to invest in good working environments. MMT, of course, works at a higher level, but it shows how LVT could be introduced without frightening ‘homeys’. I believe that ignorance of what land is in its economic sense still thrives even in a progressive group like this – part of the corruption of economics. Michael Hudson knows this well.

@ Carol,

There is a LVTs in many parts of the world. Can you give any examples of where they have the effect you might wish for? I’m not saying we shouldn’t have them. I’d go along with them if they had a social validity, but land is just one example of wealth ownership which may or may not need to be taxed according to our political preference.

We, in the UK, have property taxes at local level which are highly regressive. We need to have a better and fairer system and a LVT could be a part of that but we’d also need other assets to be included too. Like the value of the buildings standing on the land.

@ Neil,

“Once again we have people obsessed with taxation as a solution. That is never a solution. It is brain capture by neo-liberal belief systems that price is the sole allocator”

We have high taxes on tobacco and alcohol to discourage harmful behaviours. Are you saying we shouldn’t? There’s nothing neo-liberal in saying we should, even if you’d personally prefer them to be lower. My “captured brain” seems to be working reasonably well, and probably better than it would be if I had been able to better afford more alcohol in my younger and more reckless days!

Peter, rather than take up space here, why don’t you contact me direct. See https://www.labourland.org/become-a-member/

100% Andreas

The leisure class have taken the book 1984 and Nazi propaganda to a whole new different level. Every day they take another little bit more of our freedoms away. Destroy our democracy.

There has to be at least 50% of voters on both the left and right who have nobody to vote for. Everyone else who suffer from Stockholm syndrome or battered wife syndrome keep turning up at the polling booth serving their masters thinking they will make a difference.

The Guardian, Independent and the Daily Mirror is full of them no wonder they get called the Looney left. That’s the liberals for you. I can’t stand them they are complete and utter poison. They seep into every political party and divide it. See SNP , Labour and Tories for details. They are the most divisive aspect in UK politics. Try to divide the nation at every turn.

SNP has divided into Alba party. Labour is divided and the Tories all because of the liberals poisoning the parties with their neoliberal globalist view of the world.

Why large swathes of the country now no longer even bother to vote. Apart from Brexit I’ve never voted since 1979. I simply refuse to play their games and take part in the charade.

The left and right are going to have to unite one way or another to get our democracy back. That’s what it boils down to. Starmer has had the easiest ride of any Labour leader since I was born he needs to be stopped he is the establishment, neoliberal globalist, war monger. The Olaf Schultz. Hillary Clinton. Macron of UK politics.

Starmer has to be stopped at all costs. The left and right have to unite somehow or eventually we’ll end up with far right wing gov across the West as it will be the only place the legitimate grievances of the masses disenfranchised, marginalised, impoverished, and dispossessed by the 40-year-long neoliberal class war waged from above will get a voice.

I can see evidence that because of the success of Brexit the left and right wing voters (not political parties) are uniting on other issues and just maybe starting to realise this is what needs to happen to level the playing field.

Here’s Ken telling it as it is….

https://m.youtube.com/watch?v=PVP6PlX_UUA

As there are two sources of pumping money into people’s hands and creating demand for real resources, bank loans and government deficit spending, more financial regulation, limiting bank loans, would enable the federal government to run larger deficits without them being inflationary. This would be especially true to lending to hedge funds, etc., as the top-paid-hedge-fund managers make over $1 billion a year. Even though the managers would save a large portion of this, they would also spend a large portion buying yachts, buying mansions to tear down and build new mansions on the lots, etc., driving up demand on real resources. I believe that any bank with a government charter should be prohibited from lending to any hedge fund, private-equity firm, venture-capital firm, company that buys its own stocks, company that engages in mergers and acquisitions, company that buys cryptos, or company that buys NFTs (non-fungible tokens).

I don’t agree with the people (above) who say asset inflation doesn’t matter. It does matter, as does almost all inflation. However, before people misconstrue me, there are many things which can matter and inflation is just one of them. In all cases, what matters is relativities – sizes of differences and changes of sizes of differences. Let me explain, using inflation as the topic.

Inflation is not an absolute phenomenon, it is a relative phenomenon. Another way of saying this is that inflation differentials matter. If the things that I spend my wage or pension on inflate at 5% per annum and my wage or pension inflates at 5% per annum, then I am fine if I was fine before. Real inflation of my typical basket of goods measured against my income is zero.

The co-developer of Capital as Power theory writes:

“Inflation is the average rate of change of individual money prices. In this narrow sense, Milton Friedman’s claim that inflation is always and everywhere a monetary phenomenon is correct. But underlying the average rate of inflation, individual prices change at different rates. And in this broader sense, inflation is always and everywhere a re-distributional phenomenon.” – Jonathan Nitzan.

The key concept here is “Inflation is always and everywhere a re-distributional phenomenon”. If my typical basket of purchases of good and services inflates at 5% per annum but my wage is limited to 2% per annum wage rises (this sort of thing has been typical in the neoliberal era) then I am poorer every year in the real resources, real good and services that I can purchase.

If the typical house in Australia cost 3.5 times the median annual gross wage in 1980 and now costs 7 times the median annual gross wage in 2021, then all else being equal, it is much harder for the average or median worker to buy a house these days. Now, it is true that all else is not necessarily equal. The interest rates are certainly much lower currently. Even so, the current situation presents young people with new problems and risks for domicile acquisition and household formation. Saving the minimum deposit for the house becomes much harder, delaying house acquisition. A loan becomes a higher risk proposition in some senses, in that the ability to repay the loan depends heavily on the very low interest regime being maintained. Empirically, the acquisition of dwellings by young people has dropped and household formation has also dropped. These are real negative economic and social outcomes.

To return to the point about differential inflation, Jonathan Nitzan states “Inflation has no true magnitude to start with.” What he means is that there is no objective, true and absolute measure of overall or aggregated inflation. To believe so is to believe in a constructed fallacy of classical economics (my words there). The problem is that inflation is measured in the numeraire (the dollar in our case) which itself has a sliding (expanding and contracting) value both against other currencies and against all goods and services priced in it. The measurement instrument is itself not a constant standard. An aggregated inflation rate involves an aggregation of unlike goods and services AND the aggregating them in a common (and fictitious) dimension.

When science proceeds, it aggregates items in a common real dimension. It may aggregate them by mass, for example, or by one of the other real dimensions given in the SI table (International System of Units). (See Blair Fix, another CasP practitioner for details on this.) Economics and economic activities does not have this kind of “luxury of objectivity” (except perhaps at the level of quantity surveying). Economics is “condemned” (in part) to operate at the level of “aggregated subjective evaluation and valuation”. That is what prices are. We could also call “aggregated subjective evaluation and valuation” rank dependent expected utility (RDEU). That is what modern micro-economists call it. Certain macro economists do not place much or any store in microeconomics. Steve Keen is one. I suspect Bill Mitchell (MMT) may be another but I am not sure.

I think such macro-economic and Keynesian thinkers (but not post- or neo- Keynesian) are correct in placing little to no store in RDEU (or Utils or SNALTs) as theories of value. A “theorem” or at least heuristic derivable from that position of skepticism about such value theories is that the idea of aggregated inflation and its use in macroeconomics is one which should be applied with great care.

Aggregated or averaged inflation values tell us little to nothing about relative or differential inflations in detail in the system and this is a situation where the devil very much is in the detail. Asset inflation (as inflation of asset values relative to average or median income) can be a very dangerous phenomenon leading to the impoverishment, indigence and even homelessness of not only the unemployed but also of lower waged workers plus leading to the shrinking of the middle class.

High asset inflation, relative to unemployed and worker incomes, also permits the holders of assets to become differentially richer and, if the process continues long enough to its logical conclusion, to become the holders of almost ALL assets in the economy with workers reduced to being perennial renters feeding the incomes and wealth of the slumlords and rentiers.

Thus, in summary, I do not agree at all that asset inflation (relative to median incomes) does not count. It is an extremely dangerous process by which the middle class and working class are impoverished and dispossessed and it will lead to, is leading to, extreme inequality, extreme economic inefficiency and probably the necessity for (very messy and violent) revolution if social democracy is not permitted or able to set matters right.

Ikonoclast,

Asset price inflation would tend to exacerbate inequality since it will disproportionately benefit those who owns assets. This makes sense. But inequality is a policy failure, not a market failure. After all, a capitalist economy will always veer towards monopolistic behaviour if we allow it to. The extent to which we allow that to happen is not a failure of capitalism, it is a failure of policy makers to contain capitalism.

MMT’rs have listed many ways to stop in inequality at source. That “predistribution” rather than “redistribution” works better. Once you’ve let the rich become super rich, they have the incentive and probably the power to defeat the effort to tax them. We have enough taxes already.

The debate above is about is that enough of do we also need LVT?

If the central banks are driving investors to irrationally bid up asset prices then that must mean that prices are inflated in the short-run and likely to mean revert in the long-run. But if this is your view then what do you care?

It simply means that prices are temporarily higher than they otherwise would be and will eventually crash when markets come to their senses. Unless of course you believe that asset prices are perpetually manipulated in which case you also shouldn’t care because you don’t think they can ever collapse which means “everybody” should just be an owner and “don’t fight the Fed”

It’s very hard to believe that markets are so inefficient that they would never sniff out a complete manipulation of the entire system. In short the markets will sniff it out it just a matter of time. Stocks don’t keep going up forever.

The strangest contradiction here is that the asset inflation narrative always seems to come from people who are bearish about these assets. So, they’re certain that the Fed is manipulating prices and they’re certain that asset prices will go up because they claim these policies can never end, but they’re bearish about these assets at the same time. This doesn’t even make any sense.

One could argue that most of the asset price appreciation of the last 10+ years appears largely rational in the sense that it is supported by corporate fundamentals (record profits, record GDP, etc) and other robust economic data that is consistent with a growing economy. It isn’t just a fictitious boom as many “asset price inflation” narratives like to imply.

Ikonoclast,

On top of this to stop inflation happening in the future. MMT’rs say when governments spend you do the following to fight it …….

Fadhel Kaboul and Scott Fullwiler- MMT Insights on Inflation and Central Bank Policies.

https://m.youtube.com/watch?v=ggcsd08LXFA

What would happen if 30 million new social type housing were built and the government built them ? What would happen to house prices ? What would happen to rents?

Inequality is a policy failure, not a market failure.

Ikonoclast,

Brian Romanchuk has been writing about asset inflation and housing for over a decade ( yup 10 years) and just about to bring an excellent book out about it. Here’s 2 articles under the heading housing on his blog.

Principles Of Canadian Municipal Finance (And Why A Land Value Tax Is Inferior)

http://www.bondeconomics.com/2018/05/principles-of-canadian-municipal.html#more

Housing Bubbles And Their Financing

http://www.bondeconomics.com/2018/05/housing-bubbles-and-their-financing.html#more

If you haven’t read any of his books you should they are excellent!

MMT’rs understand LVT . Debates about it are all well and good and Why we need a ” What MMT can do for you ” handbook. So the debate starts from the correct starting point. Show we can fix it without a LVT.

Brian will cover it all in his book. Check both the inflation heading and housing heading on his blog and buy the book when it comes out they are normally under a fiver.

“Totally agree that Parliament should be moved out of London but why Oxford?”

There were several Oxford parliaments during the time of the plague in the 17th century, which was also the time that several financial innovations happened in England.

Paying interest of sovereign debt for example

“We have high taxes on tobacco and alcohol to discourage harmful behaviours. Are you saying we shouldn’t?”

And is it working? Have people stopped drinking and smoking?

If they are harmful why not ban them? Because banning them then gives us the problems we have with those drugs we have already banned.

People’s behaviour is rather more difficult to deal with in practice than naive taxation theory suggests.

They are not taxes. They are duties and levies – political impositions based upon a political belief that will cease to exist if the belief happens. They don’t release resources required by the public sector and keep them released. Any system that operates on duties and excise is unstable (again as the 17th and 18th century English tax system demonstrated – which was based upon land taxation and excise, not taxation of income).

This post has provoked a lot of comment – great!.

I love the data driven first part – very clear and straight forward.

I am mystified by the 2nd part that asserts the “financial markets” (what ever that is) wants high inflation.

I cant imagine there is a unified body of people with a common purpose and motivation that can be considered as a singular force in the media and in economics and labelled as financial markets.

As I am sure Bill knows there are plenty of products available that allow bets on interest rates irrespective of the anticipated direction and the risks and rewards are highest for those brave enough to take a contrary view to the majority opinion.

In my view Wall St and down town Sydney love low interest rates.

Macquarie bank is the only local investment bank here of any substance. Share price up about 50% in last 2 years and currently 203$. recent capital raising at $191 and knocked over in the stampede to get more stock. They dont seem to mind low interest rates. Low interest rates and asset price inflation is a bonanza for those able to borrow and who hold a lot of assets (like MQG). Central banks raising interest rates would bring the music to an end. The discount rate would go up, future prices devalued, borrowing costs up. Why would they they advocate for this? the only reason would be fear of even higher interest rates and a recession. But sensible investment bankers dont think like that – they have a view like Charlie Munger who I saw interviewed recently – who simply said he has no interest in predicting interest rates (he doesnt think its possible). They just try and make money with whatever is put in front of them.

Just like workers who will get a wage rise when they have the power to do so – not based on an abstract notion of future inflation rates.

The current situation of low interest rates and rising prices for essential items like food and fuel, along with extreme asset price inflation is driving further social inequity and i think the underlying force behind the demonstrations we see around the world. Ok lets keep interest rates low but how do this and provide a more equitable economic environment?

Derek, Michael Hudson is an MMTer, I suggest you ask him about LVT – he’s been studying the issue for longer than 10 years.

@ Neil,

“And is it working?”

Yes it is. Not perfectly but well enough. The high price of cigarettes was the reason I, and many others, gave up smoking years ago. I do admit if I’d had more sense it would have been for entirely health reasons! They are even more expensive now and in the range of £10 – £12 for a pack of 20. They are even more expensive in Australia and New Zealand.

Alcohol taxes, or duties and levies if you prefer, aren’t quite as severe but they do have a moderating effect. The object isn’t to stop anyone enjoying a pint or a glass of wine now and again but to deter drinking to excess. There is a problem in some parts of the country with youngsters drinking, to excess, cheap but high strength cider. Scotland has imposed a minimum price law. It would be simpler to just raise the rate of duty on it.

Taxes on motor vehicles, and the fuel they consume, are another form of levies and duties. The object is to prevent gridlock on the roads, reduce CO2 emissions, and improve air quality in cities. It that working? It could be much better but the situation would be much worse without them.

I’m grateful for many of the insights you’ve shared on MMT which I largely agree with. However, I have to say not this time. The primary purpose of taxation may well be to provide fiscal space for Govts to spend without causing inflation but there are secondary purposes too.

@ Carol,

” Michael Hudson is an MMTer”

He certainly seems to have moved in the right direction as his career has progressed. However, I’m struggling to reconcile the central theme of his most well known book “Super Imperialism: The Origin and Fundamentals of U.S. World Dominance” with standard MMT theory. He’s critical that the USA has allowed its gold reserves to dwindle and become a “debtor nation ”

There are good reasons to be critical of US Imperialism but the accumulation of debts isn’t one of them. Many countries have adapted a policy of exporting more to the USA than they import from them. If the USA runs a trade deficit it will accumulate foreign debt. But , no-one in the USA is refusing requests from countries such as Germany, Singapore, China, etc to sell to them their goods and services. It is entirely their choice that they hold large amounts of US debt.

The US will have plenty to say to however threatens to change how their banks operate and lend. Whoever threatens monetarism and wants to set interest rates to zero permanently.

Their name will not be On the ballot paper. They’ll be Corbynised wearing Bernie’s mittens.

Carol, I’ve read all his books and website from cover to cover several times. We understand LVT it is not a knowledge gap as it is not rocket science. Maybe you have to learn when others criticise LVT to stop treating it like a god and address their criticisms. Listen to other people’s point of view.

You can leave comments on Brian’s blog if you disagree with him. He will answer any questions you have.

We’ve known about LVT for years it is not something you can teach us, as if we have missed it and made a mistake. Warren has used as an example knows all about it.

Debating is healthy but I would wait until a ” What MMT can do for you ” handbook is published then start the debate from that point and if you still feel as if LVT is needed then say so. Then point out why and what we have missed.

Jim,

” The current situation of low interest rates and rising prices for essential items like food and fuel, along with extreme asset price inflation is driving further social inequity and i think the underlying force behind the demonstrations we see around the world. Ok lets keep interest rates low but how do this and provide a more equitable economic environment? ”

Are you sure you are not being ” nudged ” by the same faces in the media after 2008 ?

For example the Financial Times op ed from Rana Foroohar entitled

“The left’s low-rate fantasy makes inequality worse”.

She is trying to brainwash readers to believe that debt fueled bouts of asset price increases have NEVER happened when interest rates have been high. That it is simply a low rate phenomenon.

Which is a huge myth of course. The Federal Reserve raised interest rates from August 2004 to August 2006 did very little to cool the U.S. housing market.

Asset prices can increase under any rate environment because Inequality is a policy failure, not a market failure.

Here’s what a MMT’r has to say about it.

https://www.crisesnotes.com/rana-foroohars-strange-case-for-raising-interest-rates-does-stringent-monetary-policy-really-produce-equality/

You have to be very careful not to allow yourself to be ” nudged” to believe that asset price inflation only happens when rates are low. It is a myth and the banks want you to believe that narrative and framing for a reason.

Hi guys, has anyone commented on Powell’s announcement that the FED will raise rates 3 times next year, double the taper speed, and that he believes inflation may be persistently high? Is he wrong to say that?

Dereck

You know a lot more than me about the causes of asset price inflation.

but in this uncontrolled experiment causality very difficult to infer.

the main point of my comment was that many in high street, contrary to Bills assertion, love low interest rates and the last thing they want is to advocate for an interest rate rise.

Article in Ruperts rag today about how the current economic conditions are ideal for MQG – maybe some want an interest rate rise but I would suggest that the majority of the investing class like them just as they are!

Morning Joan,

Follow Mike Norman Twitter feed

Mike covers all of this On a daily basis

https://mobile.twitter.com/mikenorman

He did a taper video on the 9th December.

Jim,

Yes, but the key is by using the MMT lens it allows everybody to see the Orwellian trap. Learn how to look out for it.

1. That alarm bells should be ringing from the very start because it is the financial times.

2. They use the same Orwellian trap when attacking the government budget deficit when talking about interest rates and only concentrate on one side of the coin. The side of the coin that will benefit the banks and their political donors and the leisure class.

3. Ignore the side of the coin that hurts households, the poor and small to medium size businesses.

4. Link their work to academic fairy tales that were produced by the ideological universities that they funded.

Nathan done a fantastic job at highlighting how they tried to nudge the reader to believe asset price inflation only happens in a low rate environment. Completely ignored the part fiscal policy played to save the economy and ignored the effects of high interest rates on wages and unemployment. The terrible record monetary policy has at achieving full employment.

If the general populace was better educated in these matters – that is, understood the actual operational capabilities of the national government it would be very difficult for the politicians to conflate their own ideological desires with the concept of a financial constraint. In that context, telling us that we had to have 5 or 8 per cent unemployment and rising underemployment because the government cannot afford to purchase all the labour and even if it did it would be inflationary, takes on a different slant.

We would know that they could afford to fully employ the available workforce as long as their were sufficient real resources available to provide the extra food and other things the higher employment levels would invoke. This would then require a higher level of sophistication in the public debate. Are there the extra resources? How close to real capacity are we? That would then promote new research that focused on the nub of the problem rather than the array of dishonesty that parades as knowledge out there in the form of academic papers – which say the government has a financial constraint and will cause higher interest rates, higher taxes, higher inflation if it fails to follow the neoliberal globalist ideology.

Businesses would also have to justify their opposition to true full employment in more sophisticated ways because we would all know that the usual reasons they give – again relating to government budget constraints and interest rate manipulation – are all deeply flawed.

How many voters have been taken in by these Orwellian traps Jim ? The narrative and framing has been relentless 24/7 by the mainstream media that they own and control.

How many voters take into account that Chinese regulations that actually affected coal mines in China. They increased the safety standards in mining that scared the hell out of some mining companies to the point that many closed down.

That flowed into the Chinese economy as 70% of electricity is by coal in China. Caused major shutdowns in industrial activity in China. So producing the real resources the West needs to complete their spending plans slowed significantly.

When it comes to shipping what they did manage to produce. In normal times shipping a container from China to the US is $2000 because of lockdown that is now $20,000. It is first come first served a bidding war.

Once they actually get to the ports in the west. Because they have not been upgraded in decades as government spending is seen as the devil and austerity is the bank lobby god. The ports can’t cope and are struggling to find the people who are sitting at home.

Once they get loaded on to the trucks what happens there is we have a driver’s shortage. Because drivers left as the free markets demanded poor working conditions combined with low pay. We Uberised the trucking industry on the back of the free market tooth fairy. Truckers were treated like Uber drivers. When you are paid by the load instead of by the hour. Sitting at a port for 8 hours suddenly turns it into a loss making exercise to deliver the containers so they don’t bother.