Well my holiday is over. Not that I had one! This morning we submitted the…

European Union – business as usual as the madness continues

At the weekend, the German Social Democratic Party elected a new leadership from the Left of the Party, in the hope of resurrecting their disastrous political standings (Source), In rejecting the other main contender, current Finance Minister Olaf Scholz, the decision has apparently threatened the GroKo (Große Koalition), the coalition between Merkel’s CDU/CSU union and the SPD, which, arguably, has been the reason for the declining fortunes of the SPD. They have, in effect, abandoned their charter and become part of the neoliberal, austerity machine. The new leadership rejects the basis for the GroKo. At present, the SPD is only marginally ahead of the far-right AfD with the Union and Greens ahead of them. The same political dislocations are happening throughout Europe although the antagonism to the neoliberal austerity orthodoxy is more manifesting in chaos than a defined direction away from the major political parties (Britain is currently a good example of that). Meanwhile, the orthodoxy continues in the European Commission and in its – Autumn 2019 Economic Forecast: A challenging road ahead – they are requiring the majority of Member States to inflict more austerity on their nations even though a recession is looming. That is, business as usual as the madness continues.

European Commission Autumn 2019 Forecasts

On November 7, 2019, the European Commission released its – Autumn 2019 Economic Forecast: A challenging road ahead – where it acknowledged that:

… the European economy looks to be heading towards a protracted period of more subdued growth and muted inflation.

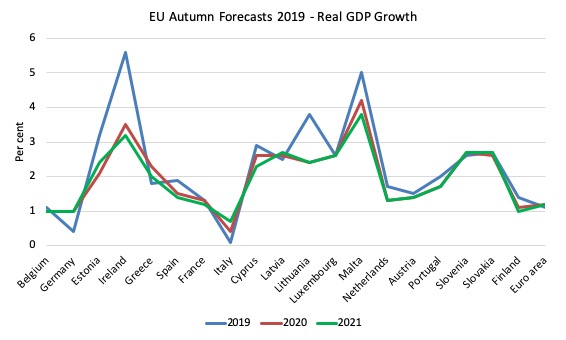

The following graphs document the key economic forecasts.

Real GDP

Italy is forecast to barely grow this year, then only achieve sluggish growth for the next two years.

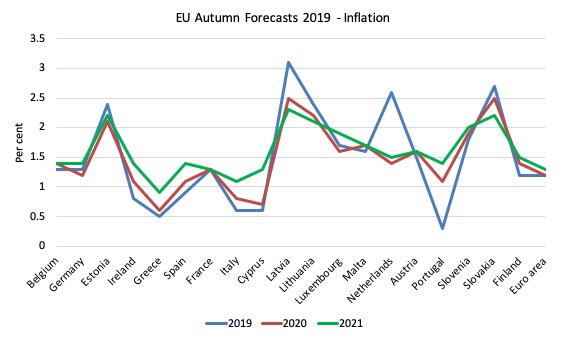

Inflation

So inflation in almost all Member States is forecast to be well below the ECB’s definition of price stability and for the Euro area as a whole the departure is massive.

Which tells you that the EU is considering the ECB will continue to fail to deliver on its so-called primary mission under the new leadership even with all the expected monetary policy gymnastics.

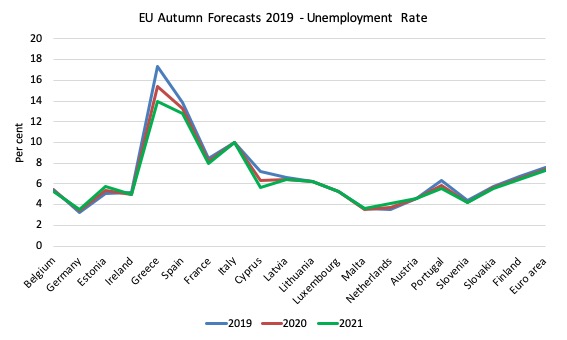

Unemployment Rate

A total acceptance that there is little movement expected on the unemployment front over the next two or more years. This is a disgraceful admission.

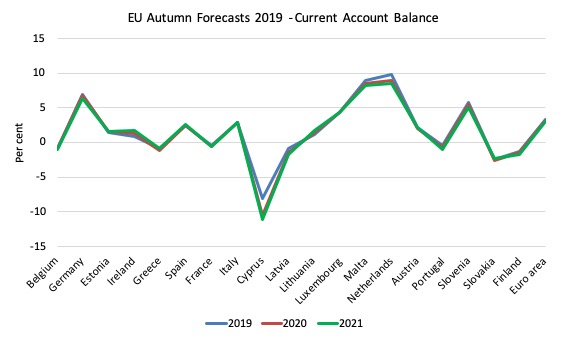

Current Account Balance

Almost all nations running growth-draining external surpluses with Germany, Luxembourg and the Netherlands expected to violate the Macroeconomic Imbalance rules out to (at least) 2021 – with no punitive action taken – just a lot of hot air.

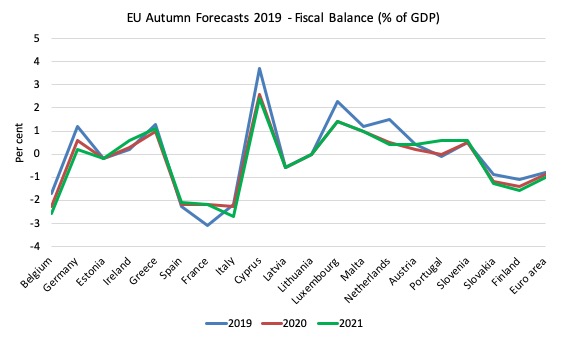

Fiscal Balance

Surpluses predominate with no sign of any significant fiscal stimulus being anticipated despite the elevated unemployment levels and moderating growth rates.

I don’t want to comment on whether these forecasts will be realised or not in this blog post.

Rather, I want to comment on the logic and the implications of the relationships implied between the variables.

The EU logic or illogic

If you then dig a bit further into these forecasts, you realise that the European Commission is basically eliminating fiscal policy intervention for almost all the Member States as a means of addressing any likely decline in growth and the rising unemployment that would follow.

The predictions from a number of different sources are that a recession in the coming period is not out of the question for the Eurozone.

There are widespread calls for Germany, among other Member States to spend more to offset the likelihood of recession (Source).

When nations are confronted with this sort of outlook, the responsible thing for them to do, is use their currency capacity to head of the decline in non-government spending by increasing net government spending, and, as a consequence, head of any chance of a recession.

Recessions are incredibly damaging and have long-lived consequences.

The ECB has already signalled, as Mario Draghi was handing over the Presidency, that there is very little scope for further monetary policy support for growth.

The fact that the policy rate is at -0.5 and the ECB’s balance sheet has expanded dramatically since the GFC, with little impact on the inflation trajectory or real GDP growth, should be sufficient for anyone to know that monetary policy isn’t very effective anyway as a counter-stabilising force over the economic cycle.

In the case of Australia, which is also heading into a similar funk, the RBA has been begging the Federal government to increase its net spending and abandon its obsessive pursuit of a fiscal surplus.

The RBA hasn’t penetrated the thick ideology that is driving the Government in this direction and on Wednesday, when the ABS releases the latest national accounts data, we will see the damage that the fiscal strategy is delivering.

Include all meanings of thick in your understanding here.

But the point is that the Australian government could make a U-tune at any time it chooses – as it did in late 2008, when, with a few weeks, it went from relentlessly pushing a narrative that inflation was the big problem and surpluses were necessary, to, overseeing a fairly large and immediate fiscal stimulus which saved Australia from recording an official recession during the GFC.

The crash of Lehman’s was the trigger in this shift.

The problem for the Eurozone is that it has tied its Member States in such a complex technical web of fiscal rules that it is unlikely any individual state (bar Germany and the Netherlands) will be allowed to engage any fiscal discretion if its economy melts down into recession.

And with Britain still likely to exit in January 2020, the bean counters in Brussels will further claim there are limited structural funds in their ‘budget’ available to help in the case of a recession.

The current fiscal rules that comprise the Stability and Growth Pact and its amendments in Europe are a sight to behold:

1. A maximum fiscal deficit of 3 per cent of GDP – which invokes austerity adjustments if exceeded.

2. A debt reduction rule – any Member State over the allowable 60 per cent threshold must impose austerity to reduce the gap by 5 per cent per year.

3. A so-called – expenditure benchmark rule – which was introduced as part of the “six pack” in 2011, requires that:

… spending increases which go beyond a country’s medium-term potential economic growth rate must be matched by additional discretionary revenue measures.

This means that allowable spending is then determined by the medium-term growth rate, which as we will see is such a loaded term that it ensures an austerity bias.

I will come back to the MTOs (medium-term budgetary objectives) soon.

4. The so-called ‘structural balance’ rule, which was introduced as part of the amended SGP, known as the Fiscal Compact.

The EU define the “structural budget balance” as the:

… nominal budget balance adjusted by the cyclical component, excluding one-off and temporary policy measures. The cyclical component is calculated as the product of the output gap (difference between actual and potential GDP as percent of potential GDP) and a parameter reflecting the automatic reaction of the government balance to an output gap change.

This cyclically adjusted budget balance corresponds to a budget balance prevailing if the economy was running at its full potential.

I have discussed this concept on a number of times (including):

1. Beware of structural explanations of cyclical events (June 11, 2014).

2. Structural fiscal balance is about full employment not ‘normality’ (February 3, 2014).

3. Structural deficits and automatic stabilisers (November 29, 2009).

4. Structural deficits – the great con job! (May 15, 2009).

Conceiving the structural balance at a conceptual level is hard enough – for example, what is full potential? full employment? what is that? Only frictional unemployment with no underemployment or hidden unemployment? etc.

But then trying to compute the unobservable full capacity state using proxy variables can generate considerable variations in the estimates.

Such that the concept becomes too inexact for policy setting purposes.

For example, the typical methods try to relate an estimate of the Non-Accelerating-Inflation-Rate-of-Unemployment (NAIRU) to a measure of the output gap.

The NAIRU is unobservable and is highly sensitive to the estimation techniques used.

See my 2008 book with Joan Muysken – Full Employment abandoned – for detailed discussions of all this.

The problem is that the output gap estimates are usually biased downwards because the NAIRU estimates are biased upwards. So we get situations where nations are assumed to be operating at over-full capacity when they still have elevated levels of unemployment – I will return to this below.

I have discussed this issue on a number of times (including):

1. The NAIRU/Output gap scam reprise (February 27, 2019).

2. The NAIRU/Output gap scam (February 26, 2019).

3. Why we have to learn about the NAIRU (and reject it) (November 19, 2013).

4. NAIRU mantra prevents good macroeconomic policy (November 19, 2010).

5. The dreaded NAIRU is still about! (April 16, 2009).

The issues raised in those blog posts render the practice of estimating structural balances fraught and typically the estimates err on the side of concluding that the structural balance is too expansionary (excessive deficit or insufficient surplus).

However, the concept of the ‘structural budget position’ in the EU is pivotal in determining:

– The medium term objectives (MTO) and related fiscal efforts (and assessments) under the preventive arm of the SGP;

– The fiscal effort recommendations and assessments under the Excessive Deficit Procedure (EDP);

– The balanced budget rule included in the so- called “Fiscal Compact” …

See the latest – Structural Budget Balances in EU Member States – November 2019 – for more information.

Each Member State prepares their fiscal position each year within the contraints imposed by these rules.

The MTO for each Member State must “fulfill the following criteria”:

– ensure safety margin so that the nominal 3% of GDP deficit target would not be triggered in bad economic times;

– ensure the sustainability of public finances (taking into account among other issues any increase in age related expenditure), while allowing room for budgetary manoeuvre, in particular for public investment; it also means that it should be consistent with the so-called debt reduction benchmark, if the debt ratio is higher than 60% of GDP;

– be close to balance or in surplus (Euro Area and ERM2 Member States must have a MTO that corresponds to at least – 1% of potential GDP and signatories of the TSCG of a least -0,5 % of potential GDP …

Within this framework, then, the discretionary fiscal position must be such that in the case of a damaging recession, the automatic stabilisers should still not push the deficit beyond the 3 per cent limit.

In my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – I showed that for most Member States, the automatic stabilisers alone were deficit-inducing beyond the 3 per cent threshold.

Which made a mockery of the EU claims in the “Fiscal Compact” that:

… the main objective is to ensure that the underlying fiscal position of Member States is conducive to fiscal sustainability, while allowing for the free operation of the automatic stabilisers over the economic cycle …

In the GFC, the “free operation of the automatic stabilisers” led quickly to rule violation and the austerity that followed made matters worse.

In April 2019, The European Commission released the Institutional Paper 101 – Vade Mecum on the Stability & Growth Pact (2019 Edition) – which “brings together all the relevant procedures and methodologies involved in the implementation of the EU’s rules-based fiscal policy framework” – the technical detail of how MTOs are computed is outlined.

So if you are struggling to get your head around the way the fiscal rules in the Eurozone are constructed and the current standings of the Member States then this ‘Vade Mecum’ is your ready reference book (as the title denotes).

How intelligent people can put out 108-pages like this and think that it is reasonable is anyone’s guess.

It is a technocracy that is so out of touch with the purpose of government that it is hard to see how any sensible dialogue can occur outside of the straitjacket set out in the manual.

The reason I was consulting the handbook was to see how the EU was constructing, in a technical sense, the scope for fiscal action, in the light of a slowing economy and, still, elevated levels of underutilisation.

The latest – Structural Budget Balances in EU Member States – November 2019 – provides recent updates of the “MTO structural budget position (sbp)”.

So essentially, the EU monitors Member State fiscal positions by:

1. “setting a budgetary target in structural terms (i.e. in relation to a MTO) …”

2. “Member States, which have not yet achieved their MTO, should improve their structural balance by 0.5% of potential GDP per year as a benchmark (more in ‘good times’ and less in ‘bad times’).

3. “A significant deviation is defined as a deviation of at least 0.5% of GDP in a single year or at least 0.25% of GDP on average per year in two consecutive years …”

4. “when assessing expenditure developments net of discretionary revenue measures: The deviation is significant if it has a total impact on the government balance of at least 0.5% of GDP in a single year or cumulatively in two consecutive years.”

If a Member State is found to be deviating then it “triggers a Significant Deviation Procedure”, which involves the European Commission bullying the nation and moving to demand “an interest-bearing deposit” as a surety against not imposing austerity as required.

The whole thing has the air of big brother, bossing elected governments around with threats of sanctions that are rarely invoked (think Germany and the macroeconomic imbalance procedure) unless the nation is to weak to fight back (think Greece).

Table A2.2 in the 2019 Vade Mecum (cited above) provides the latest Minimum MTOs while Table A2.1 provides the latest Minimum benchmarks for 2019 and 2020 for the Medium-term Budgetary Objectives.

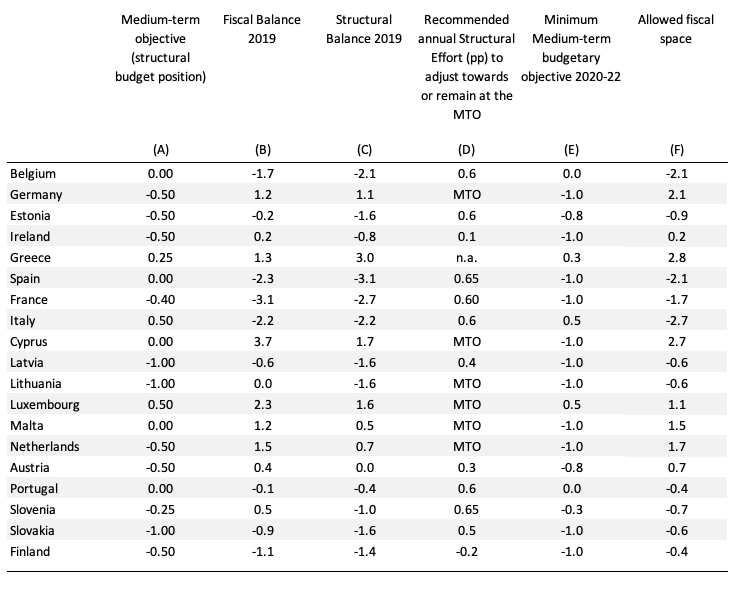

The following Table shows my calculations that bring together the relevant aspects of the European fiscal rules and concepts.

Column (A) is the estimated Medium-term objective for the structural budget in percentage points.

Column (B) is the estimated fiscal balance for 2019, while Column (c) is the estimated structural balance for 2019.

Column (D) is taken from the Structural Budget Balances in EU Member States – November 2019 Annex 1 table and shows the Recommended annual Structural Effort (pp) to adjust towards or remain at the MTO.

Where the element is signified MTO it means: “(1) where the actual structural budget balance is above the target or (2) below the target due to temporary flexibility or (3) only with a minor deviation below the target).”

So in most cases, austerity is required as a transition towards realignment of the estimated structural balance and the MTO.

Column (E) shows the minimum MTO from the 2019 Vade Mecum, which is the “the lowest MTO that fulfils all the criteria defined above”.

The EU claim that in some situations “the minimum MTO does not fulfil the forward-looking debt-reduction benchmark by the end of the next MTO three year cycle” and suggest that nations adopt “a more demanding MTO”, that is, harsher austerity than the minimum requires.

The EU say that the “achievement of the MTO is assessed by verifying whether the Member State’s structural balance is planned and forecast to be at least at the level of the MTO.”

So subtracting Column (E) from Column (C) gives the allowed fiscal space under the EU rules notwithstanding the recommended adjustments shown in Column (D).

A negative number signifies there is no fiscal space under the rules and the larger the negative number means that the nation is required to engage in further austerity no matter what the situation they encounter (except for some flexibility in the face of a “severe” recession.

Greece is a special case (hence the n.a.) and would not be permitted any space for stimulus despite the gap between the huge structural balance (massive austerity) and the MTO.

If you put all that together, and realise that a recession is highly likely in the Eurozone, then only a few nations would be allowed to use any fiscal stimulus to ward of an economic downturn.

That is the nonsensical state of the Eurozone.

The MTOs (medium-term budgetary objectives) considers a balanced fiscal position over the cycle to be the definition of fiscal sustainability. The concept of balance over the cycle is problematic enough.

It suggests that the non-government sector will also maintain a balance over the cycle, which, historically, doesn’t typically apply to any nations.

External deficit nations achieving such an outcome will ensure their private domestic sectors increasingly run deficits and accumulate increasing levels of debt over each cycle.

That is an unsustainable trajectory for most nations.

But the EU took this further and defined an upper MTO limit for ‘structural deficits’ to be 1 per cent of GDP

Max. 1.0% of GDP in structural deficit if the state had a combination of low debt and high potential growth, and if the opposite was the case – or if the state suffered from increased age-related sustainability risks in the long term, then the upper MTO limit should move up to be in “balance or in surplus”.

And according to the European Commission most Member States are at over full-employment

The nonsense doesn’t stop there though.

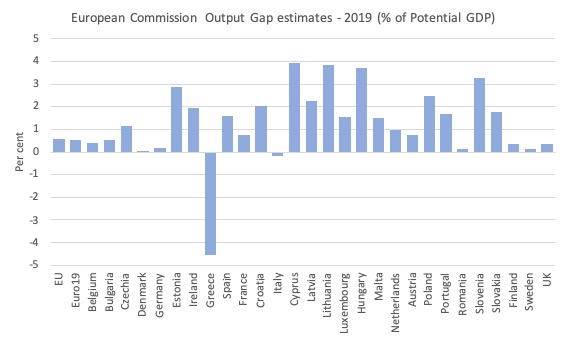

Digging further we find that the latest Output Gap estimates for the EU shown in the following graph indicate that all but two Member States – Italy and Greece – are considered to be operating at over full employment.

This is why the MTOs are advocating austerity in most cases even though a recession is approaching.

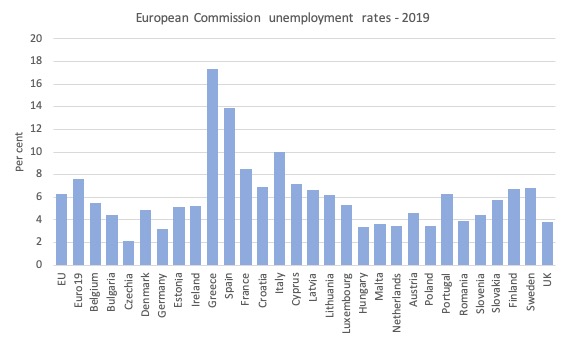

But the next graph shows that the unemployment rate estimates for 2019 that fed into the Autumn forecasts.

Juxtapose the two sets of estimates, for example, for Spain. Its unemployment rate is estimated to be 13.9 per cent while the output gap is +1.6 per cent.

In other words, the European Commission is claiming that Spain is at full employment when the unemployment is some level above 13.9 per cent.

For the Eurozone, the unemployment rate is estimated at 7.6 per cent for 2019, whereas the output gap is +0.54 per cent. So, again, the Commission is trying to tell us that the full employment unemployment rate is in excess of 7.6 per cent.

And so it goes.

The perversity has Germany with a small positive output gap but an unemployment rate of 3.2 per cent.

Then compare all that with the inflation figures.

There is no sense to any of it.

Conclusion

With another cyclical downturn approaching, the European Commission continues to conduct its affairs in a sort of time warp, divorced from reality.

The basic design flaws have only been made worse by the additional fiscal rules they have introduced since the crisis.

And, the only way the monetary union was saved during the crisis and since was as a result of the ECB breaking the Treaty laws with respect to bailouts (even though the claim has been otherwise).

With the Commission pressuring the majority of Member States to implement more austerity, and the nations that have some fiscal latitude within the mad rules (for example, Germany and the Netherlands) being resistant to using any fiscal stimulus, Europe has a right royal mess on our hands … again!

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

This policy will lock us in recession forever. Where will this end? Probably in some far-right government blaming immigrants.

Thanks Bill, I’ve struggled to understand the fiscal “strangle” that the EU has over the euro area and your analysis is spot on as usual.

One of your regular themes is the chronically misinformed output of our media and the UK Guardian often comes (rightly) under fire for this. The extract below is from an editorial on the 28th November commenting on the spending promises recently made by the two parties manifestos.

It poses the question:

“Is this election turning out to be a Lutheran moment for the Church of Economics?”

“The answer is that most governments run fiscal deficits most of the time. Labour is right to signal that its fiscal balance will be allowed to move to the level required to maintain the shape of the society it desires – after taking into account the spending decisions of the private sector. Since the late 1970s it has been heresy to suggest that governments ought to put social objectives at least on a par with fiscal ones. But Mr Corbyn is right to put forward a programme that challenges this orthodoxy, whether or not one agrees with every element of it.

Governments over the last nine years have congratulated themselves on fiscal discipline and sound management, even while the economy is evolving in a highly unsustainable manner, with private households taking on record amounts of debt.”

Title;

The Guardian view on Labour and Tories: radical economics now the norm

The link is;

https://www.theguardian.com/commentisfree/2019/nov/28/the-guardian-view-on-labour-and-tories-radical-economics-now-the-norm?

Exponentially increasing climate change demands emergency levels of national investment in transition to sustainable non polluting energy sources and living practices – the EU’s self imposed economic straitjacket precludes such effective action by member states.

One wonders what plans the ECB has in place to meaningfully, at the necessary scale, address this escalating existential crisis?

There is no time left for the EU to procrastinate over whether it can ‘afford’ the essential actions to ensure a habitable planet Earth.

“… what plans the ECB has in place to meaningfully …”

The juxtaposition of “plans” and “meaningful” with reference to the EU is an oxymoron.

The EU can no more plan *really* meaningfully than a drunken sailor can. All it can do is amuse itself engaging in building castles in the air. These are flights of fancy relating to a parallel universe (or maybe multiverses) existing only in the dreamers’ imaginations.

Let’s face it. The EU has no capability of conducting rational thought because it is in its entirety a political construct devoid of any basis in rational thought. If that were not so we would not have had the Single European Act, the Maastricht Treaty, the Growth (!) and Stability (!) Pact – straight out of “1984” that – the Fiscal Compact, the “Six Pack”, or any of the rest of the ideologically-fuelled madness that has gone on.

Khafka would instantly have recognised the mindless Brussels bureaucracy for what it is: the creature of a despotic oligarchy which has somehow – ironically enough probably by accident rather than with conscious intent – imposed itself upon the people of Europe. While their elected governments have allowed themselves to be helplessly swept along.

It’s those elected politicians who are the real culprits. Through sheer ineptitude they’ve sold their constituents down the river.

Hi Bill

I can see from the graph fiscal balances that France wants to pull ~1% u turn on its fiscal stance presumably going from -3% to -2%.

Can you give me the source of the data you used to build the graph?

It would be good to get an idea of what that ~1% change means in euros.

The way its going over here the place is going to explode in protests on thursday. More retirement age plans were leaked. So people don’t like being told they have to work until they are 70.

“And with Britain still likely to exit in January 2020, the bean counters in Brussels will further claim there are limited structural funds in their ‘budget’ available to help in the case of a recession.” I must confess that at this point in time, saturated with gross macroeconomic ignorance and bitter, entrenched political division, I have substantial doubts that Brexit will happen in 2020 or anytime soon. I fear that the EU devil the UK currently knows will triumph, at the last moment and for the foreseeable future, over the devil that lurks in fuller economic sovereignty seen through an intransigent neoliberal gaze, instead of through the clarifying lens of MMT. I hope I’m wrong.

Best of it is. They got them all to save flags and sing ode to joy.

As the said Europeans would never be brainwashed again.

I think the stupid tag is too easy to pin on them.

They knew exactly what they were doing in Frankfurt, London and New York.

Dear sam_w (at 2019/12/03 at 2:46 am)

All the data in the graphs some from the European Commission’s AMECO database.

best wishes

bill

At least I could understand most science fiction.

Derek Henry wrote

Tuesday, December 3, 2019 at 4:37:-

“I think the stupid tag is too easy to pin on them.

They knew exactly what they were doing in Frankfurt, London and New York”.

Maybe they *thought* they knew but if so they were shooting themselves in the foot.

You’re not making allowance for the operation of the law of unintended consequences.

Besides I don’t believe they’re anything like as clever as they (and you?) think they are.

It all goes to show the vise-lock the wealthy and the powerful have; politically and economically.