I grew up in a society where collective will was at the forefront and it…

Beware of structural explanations of cyclical events

One of the things you can always bet on with surety is that the conservatives will always try to convince the public that a cyclical event is, in fact, a ‘structural’ event. This has two, linked purposes. First, they can downplay any hint that aggregate fiscal policy interventions, which work at the macroeconomic level are necessary no matter how bad the problem is. Second, they can then wheel out their favourite ‘structural’ remedies, all of which just happen to result in national income being distributed to profits or high income earners, less capacity for low-wage workers to enjoy real wage rises or reasonably share in national productivity growth, and lower government income support payments to the disadvantaged. A double-whammy strategy. Here is an example of that sort of lie. The US Employment-Population ratio has fallen dramatically since the onset of the crisis and remains stuck at low levels. The reason is clear – there was a huge collapse in employment in 2008 and 2009 and, in the recovery, the rate of job creation has not been sufficiently strong to reverse that decline. Total employment growth has been around or just above the underlying growth in the civilian population (above 16 years), which is why the ratio is stuck. There needs to be much faster employment growth for the US to make back the ground that was lost in the downturn. While the US civilian population is growing older and that is having an impact on the calculated Employment-Population ratio, the impact is small and doesn’t alter the fact that a huge negative cyclical event occurred in the US and the fiscal intervention was not large enough to fix the problem.

There was a good technical discussion of the Employment-Population Ratio in the February 1981 edition of the US Bureau of Labor Statistics (BLS) journal the Monthly Labor Review.

[Reference: Leon, C.B. (1981) ‘The Employment-Population Ratio: its value in labor force analysis’, Monthly Labor Review , February 1981. http://www.bls.gov/opub/mlr/1981/02/art4full.pdf]

We learn that the unemployment rate is the “best known” summary measure of labour market conditions but is sensitive to shifts in the participation rate. The unemployment rate is the ratio of total measured unemployment as a percentage of the labour force. The labour force can fall in a recession because of the discouraged worker effect and so official unemployment is replaced by ‘hidden unemployment’.

Using the population as the basis for the ratio is better in this sense because the population is invariant to participation rate swings that are of a cyclical nature. The hidden unemployment leave the measured labour force but remain within the population.

The Monthly Review paper provides additional reasons for preferring the Employment-Population Ratio as a more accurate indicator of the state of the labour market. You can follow up if you are interested.

The BLS defines the Employment-Population ratio is the proportion of the civilian noninstitutional population aged 16 years and over that is employed.

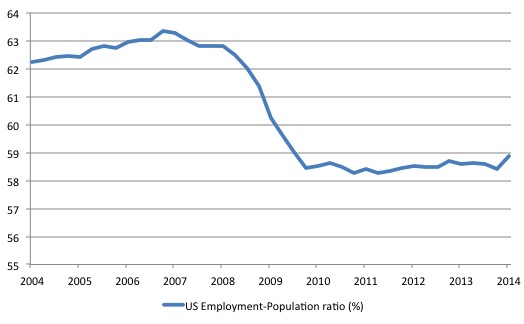

The following graph shows the Employment-Population ratio for the US from the first-quarter 2004 to the first-quarter 2014. The drop off the cliff is symbolic of the extent of the labour market collapse in the US.

The Employment-population ratio also peaked (in terms of the period leading up to the crisis) in the month of December 2006 – 63.4 per cent compared to the dismal 58.9 per cent in the month May 2014.

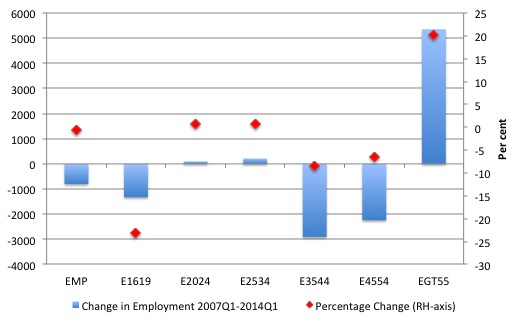

The next graph decomposes the employment shifts into age groups. The blue bars are the absolute change in employment (EMP is total) between the first-quarter 2004 to the first-quarter 2014 and the red diamond is the same change in percentage terms (noting the zero point on the left- and right-axes do not line up.

The older workers (GT55 = above 54 years) have increased their employment by 20.2 per cent over the six-year period while total employment has fell. The big losers in percentage terms have been America’s teenagers, which is a world-wide trend.

In an environment where there are not enough jobs, the least-skilled and more easily vilified (ethnicity, disability, etc) will be shuffled to the end of the jobless queue.

The depth of the current malaise in the US is also seen when we examine the shift in participation rates. The maximum participation rate in the US was 67.3 in the first three months of 2000. The most recent (pre-crisis) peak has been 66.4 in December 2006-January 2007. The current participation rate (May 2014) is 62.8. So participation is now 3.6 percentage points below that pre-crisis peak indicating a massive withdrawal of the workforce.

One might be tempted to say that was due to a surge in retirements associated with the ageing population, which is the argument used by those who wanted to downplay the cyclical nature of the collapse.

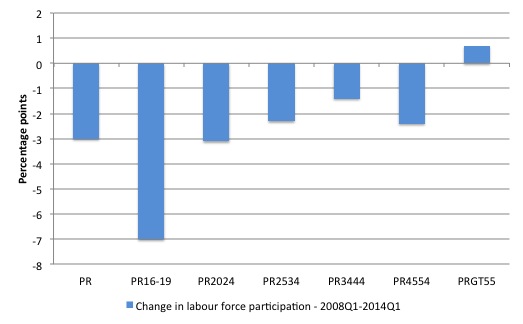

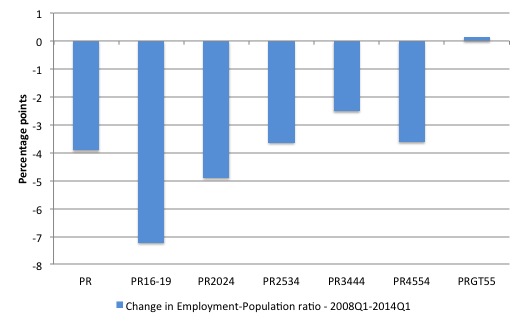

But the following graph suggests otherwise. It shows the change in labour force participation rates between the first-quarter 2008 to the first-quarter 2014 in percentage points.

Consistent with the growing employment for the over 55-years cohort in the previous graph, their participation rate has risen. All other age groups have experienced a fall in their participation rate, none greater in percentage point terms than the teenagers.

So not only are the 16-19 year olds losing out in employment significantly, they are also dropping out. Not a good sign for America’s future. That is also a common trend in the job-starved advanced economies and a principal casualty of the austerity obsession. These nations will live to regret this myopia.

The last thing to do is see whether the ageing population is the reason the Employment-Population ratio has plunged so far and is not improving. The argument is if more people with a lower ratio are now in the population then you can see a decline in the ratio because of that compositional shift alone with no intrinsic changes in each cohorts fortunes. That is easy to test.

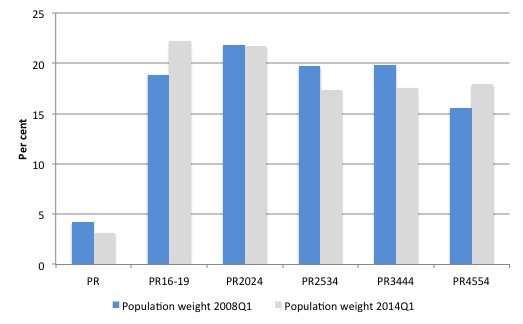

First, there is ageing in the US population. The following graph shows the weights in the civilian population above 16 years for the first-quarter 2008 (blue bars) and the first-quarter 2014 (grey bars).

The following graph shows the shifts in the Employment-Population ratio between the first-quarter 2008 and the first-quarter 2014 for the different age-groups in the civilian population above 16 years. It is quite clear that the fortunes of each demographic group have been quite different.

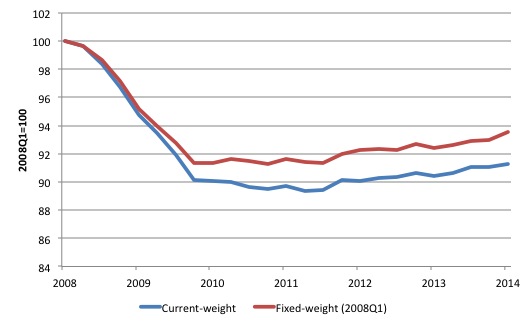

Finally, we can see what the Employment-Population ratio would be if there had been no change in these weights by computing a fixed-weight ratio (using the weights as at the first-quarter 2008).

The following graph shows the current-weight ratio (using the actual proportions of each demographic group) and the fixed-weight ratio (holding the first-quarter weights constant). The two time-series are indexed to 100 as at the first-quarter 2008.

There is some impact of the changing demographics apparent. The decline in the fixed-weight Employment-Population ratio from the first-quarter 2008 to its trough is of the order of 5.8 percentage points whereas using current weights the decline was 6.6 percentage points (as at the last-quarter 2009).

The current difference between the two series is around 1.5 percentage points or about 25 per cent of the total change in the Employment-Population ratio from the first-quarter 2008 to the first-quarter 2014.

The predominant reason the Employment-Population ratio has fallen so much and is struggling to recover is the shortage of jobs rather than the shifting age-composition of the civilian population.

Conclusion

Whenever you see a rapid surge or decline in an economic time-series that is cyclically variable you can be almost certain that the cause is cyclical in nature. Structural shifts work over longer periods of time.

The point is that structural change is on-going but should never divert the policy debate from dealing with the cyclical issues.

The neo-liberals try to muddy the waters by introducing these structural red-herrings. The big return on policy would be for the government to directly stimulate employment to push the ratio up instead of wondering about the ageing civilian population.

What I find interesting about the employment/population ratio is how incredibly stable it has been in the UK (ONS sequence MGWG).

Over the period shown about it has always been between 63% and 64% throughout the entire recession period.

Even when the series is taken back to 1971 the rate has only once gone above 64% (in the yuppie boom of the late 1980s) and once below 62% (during the monetarist nonsense of the early 1980s).

Which puts the shift in the US figures in stark relief.

I only read the first two or three sentences of Bill’s article and decided I was going to agree with the rest of it, so stopped reading at that point!!

Professor Mitchell-I never cease to be amazed by your prolific output of comprehensive detail on complex economic issues. I am not an economist-and came to this point from a totally different direction–can barely wander into the weeds until I am lost, and make no pretense of being an economist. I came across your blog, quit by accident, several years back in search of answers about our economy in America which didn’t make sense. The attached letter, sent only yesterday, will detail that, in part, but to cut to the chase-common sense, alone, tells me that full employment is a pro-market concept-[even setting aside that full employment is essential in creating a decent society]–but this is not on the agenda in America, far from it-otherwise, and if we were talking about the bottom line, or cutting into corporate profits-our policy-makers might take a totally different approach to our unemployment crisis [and with 11 million still unemployed, we are still in crisis]-In any case, I crafted the following to call attention to this issue:

3% is the zero-sum threshold above which unemployment triggers inflation by diminishing labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, and reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

Admittedly, I gleaned some of the technical concepts from established, but clearly relevant, economic language-and I must confess that I pulled the 3% out of my arse-[sorry, at 80 don’t have time to mince words] –but that percent is out there-maybe it is less than 3%–but if you can point me to any research on this specific issue it would be greatly appreciated.

With highest regards,

Jim Green

Letter sent to White House 6/10/14:

Council of Economic Advisers:

How do we solve the problem of unemployment in America when the market cannot create enough jobs?

Under our current system-we stand on one foot and then the other as the market inches toward recovery-and in spite of gaining back all of the jobs lost in the Great Recession [DOL 6/6/14]—we still have 11 million jobless-with the CBO projecting it will be 2017, on our current path, before we return to even an anemic 5.5% unemployed…. with unemployment benefits long since expired…and if the market fails in the interim….the jobless are out of luck!

In short, the original question is not even on the table, as we persist in the anachronistic belief that “The market can provide anybody wanting a job, with a job.” It is a fairytale, evident by the CBO projection-and a roomful of empirical data as confirmation.

So why is this question not being asked?

It is well and good to be giving high-fives because the picture is improving….but this is of no benefit to the 11 million with little prospect for employment for several years.

And the other downside to our current system-which makes the path we are on now even more perplexing-is that the market, as well, is undermined by high unemployment. People do not buy the stuff manufactured for the market, when they are jobless-with an adverse ripple-effect throughout our economy-i.e., the market thrives when we have a robust, employed, consuming workforce….

In short, there is NO upside to unemployment-the jobless lose, and the market loses.

And the irony in all of this is that we have the legal “authorization”, on the books, to reduce our unemployment to 3%, or less, tomorrow [15 USC § 3101]-but currently no method for putting this “authorization” into effect.

HR 870, introduced by Congressman Conyers provided such a specific solution but it never even made it out of Committee-for lack of muscle behind this obvious next step in our economic evolution.

The bottom line is: Humphrey-Hawkins [15 USC § 3101] was ahead of its time-when it was signed into law in 1978, by President Carter-Now it is Indispensable to the Effective functioning of our 21st Century economy.

So coming full circle: How do we solve the problem of unemployment in America when the market cannot create enough jobs?

Please see: WINNERS WANT OTHERS TO WIN, on Amazon/Kindle

Jim Green, Democrat opponent to Lamar Smith, Congress, 2000

“So coming full circle: How do we solve the problem of unemployment in America when the market cannot create enough jobs?”

This presumes that “the market” is some form of independent entity which exists independently of government and society. Similar sorts of questions were also asked prior to WW2 . Roosevelt’ s New Deal had some effect but it wasn’t until the war started in earnest that the problem of unemployment was fixed. And not by the market!

So the challenge is to repeat that exercise without getting involved in a new war! So, philosophically, we have to start with an acceptance of the idea that it at least possible.

So I’d advise starting reading Warren Mosler’s book The seven deadly innocent frauds which is available for free in pdf format:

http://moslereconomics.com/wp-content/powerpoints/7DIF.pdf

Then read as much as you can by Warren, Stephanie Kelton, Randall Wray, and Bill (of course) !

“The hidden unemployed leave the measured labour force but remain within the population.”

I understand what you mean but it is of course the case that some leave the population too due to despair (suicide) and illness induced by poverty and joblessness. Sucide takes many forms of course. There is “suicide by cop” (provoking the police to shoot oneslef which is especially easy to do in the US and more so if you are black). There is “suicide by drug abuse” and so on.

Our youth (15 to 25) have become a very gloomy cohort IMO. I can provide anecdotal evidence only but it seems to me that they often feel gloomy and hopeless about everything from poor unemployment prospects to the knowledge that unrestrained CO2 emissions and climate change are probably going to wreck their world and their future.

I hope for a change of direction in our society soon. Unfortunately, it will take three things to effect it. One, a very large salutary disaster, unambiguously attributable to climate change, will have to happen to a large first world nation. Two, a second more severe economic crisis will have to strike plunging all or most of the globe into a veritable second great depression. Three, there will have to be revolutions to overthrow plutocratic capitalism over most of the globe. Unfortunately nothing less will change this ossified, maladaptive, inhumane and highly inequitable system.

In a sense, this process has already started. Hurricane Sandy, and the increase in tornadoes in the US and the increase in 1 in a 1000 year flooding events all over the world indicates climate change is already biting. A significant number of countries are now in depression (Greece, Spain, Haiti, Somalia, Sudan to name a few) or in depression, civil war or civil war presursor events (Libya, Syria, Egypt, Ukraine, Nigeria, Iraq and son on).

These events are all connected to a globally triumphant system (capitalism) that despoils the natural environment and exploits and impoverishes vast sections of the world population.

Petermartin2001-I do not know what country you are speaking from, but in the U.S. the powers that be, the almost universal consensus is that “private-sector” jobs have an almost religious fervor to them, i.e., if the market cannot create a job….it doesn’t [or shouldn’t] exist-part of this is from the lingering insanity of McCarthyism, with haunts America to this day-but my purpose is to point out the unreality of this-indeed, the downright harm to our economy by clinging to this anachronistic mind-set. Bill and I are totally on the same page-I advocate incorporating into our law The Buffer Stock Employment Model-triggered by a law we have on the books, Humphrey-Hawkins-i.e., triggered anytime our unemployment rises above 3%….and I created-for the fun of it let’s call it Green’s Theory-to change the dialogue-to show that high unemployment [is not only harmful to the jobless]-but is harmful, and substantially cuts into corporate profits! The corporate/oligarchy opposition to public-sector jobs in America [and I suspect throughout the OECD] is cutting off their nose to spite their face. Again:

3% is the zero-sum threshold above which unemployment triggers inflation by diminishing labor training and skills, under-utilizing capital resources, reducing the rate of productivity advance, increasing unit labor costs, and reducing the general supply of goods and services–and the loss in income to the Market is compounded exponentially with each percentage point of increase in unemployment, above 3%.

3% fits nicely with Humphrey-Hawkins, and don’t know if they considered this in crafting their law-I leave to academe to give a more precise percent-my purpose was to make a point-to call attention to the harm caused to the market by unemployment. Jim Green

Petermartin2001: To expand briefly in response to your post-I would like to use an analogy-and this relates, solely, to the U.S.-I have no idea of the social evolution of this issue in other countries [we have factions that are just plain Bat-sh-t-that want to relegate America to the 8th Century, BC, but that is another subject for another day]-the analogy is this:

20 years ago gays getting married was on no one’s radar-it simply wasn’t discussed. Perhaps it started with a single couple who saw this as a right-but in the years since the consensus grew and currently the majority of Americans believe gays should have the right to marry. My point is that the same dynamic could be applied in our economic evolution re the unemployed. Currently, when we speak of our jobless, we speak of their plight-and that is in no sense diminished by our looking at the other side of this equation-unemployment is a “social” problem, with oft dire social consequences, we as a society have the responsibility to address. To get the oligarchy/plutocracy on board, however, we need to change the dialogue-we need to change the message to the loss in corporate profits-resulting from unemployment. Currently, the oligarchy/plutocracy still have one foot on the plantation, and cling to the anachronistic and erroneous belief that they need “a pool of slaves” to be used and discarded “at will” [the current status of employment law in America, and I suspect throughout the OECD]-but they are cutting off their nose to spite their face in the process. My point is to get them to see this. The point is to get this into the dialogue-so that it can build consensus-and I would strongly suggest that we are not going to fix the problem of insidious unemployment in our market-driven economies, the OECD, and America in particular-until we do.

Bill,

Scientists & engineers in many other professions would suggest you go even further and say “beware of static explanations of dynamic processes”

3% is the zero-sum threshold above which unemployment triggers inflation ….

That sounds more like a recipe for deflation Jim, which does indeed seem to be the current story.

The consolidated government-business sector, whilst wringing its hands in public over the high levels of unemployment actually seems pretty comfortable with a buffer-stock of ‘official’ unemployment around the 5% mark. Any concern expressed is a sham.

Back in the ‘golden age’ of full employment any government presiding over figures half that would’ve been out on its ear. We’ve since been groomed to accept that any attempt to get unemployment below the so-called natural rate will trigger inflation reminiscent of the late ’70s.

Perhaps we’re starting to catch the first glimmers of Keynes’ utopia wherein he believed that within a hundred years (of 1930) technological advances would mean that nobody would need to work more than 15 hours a week.

The utopia however will only be for the privileged few who have appropriated the spoils of technology based productivity advances to themselves, a process that been going on now for 30 years and showing no signs of stopping.

Business seems to managing quite well without the custom of a million unemployed in Australia. Nobody gives a stuff about them.

I’ll be watching for increased sales of pitchforks.

Ralph, you never cease to astonish me. Normally, one doesn’t stop reading unless they know what is going to occur next, not simply because they will believe what they think is going to follow whatever it might be. It is possible that a surprise might be lurking therein.