I am travelling today to Tokyo and have little time to write here. But with…

Corporate profits boom in Australia undermines our capacity to national prosperity and well-being

Yesterday (November 29, 2021), the Australian Bureau of Statistics released the latest – Business Indicators – for the September-quarter 2021. This dataset provides quarterly estimates of private sector sales, wages, profits and inventories. It provides a means of viewing exactly what has gone wrong with the Australian economy over the last two decades as successive governments have failed to prioritise general well-being, and, have instead, acted as agents of capital. There is a massive imbalance in the capacity of workers and profit-recipients to access national income that is produced by the workers. Profits have been booming while wages growth has been low for a long time now. And if you thought the booming profits would be siphoned into productive investment to lift productivity and create the non-inflationary space for real wage increases, then you would be wrong. The massive lift in profits has gone into unjustifiable increases in executive pay, property booms and financial market speculation. None of the things that help lift national prosperity and well-being.

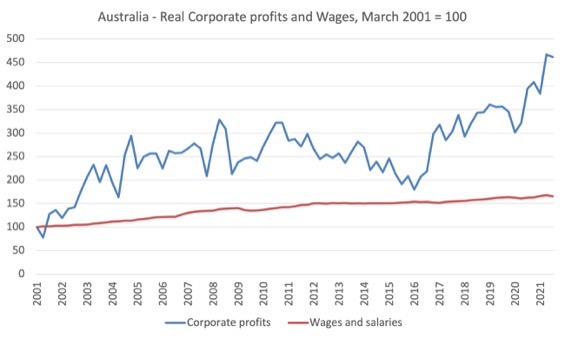

Here is a graph that shows the dramatic imbalance that has occurred in this neoliberal era.

It is a graph that would be replicated more or less across the advanced economies.

It shows corporate profits (from September-quarter 1994) and total wages and salaries (from March-quarter 2001), indexed at 100 in the March-quarter 2001 (when the wage series started).

Over the shared time period, corporate profits have grown to 747.7 (that is, nearly 7.5 times), while total wages and salaries paid have grown by to 268.3 points (that is, 2.7 times).

The ABS note in their data release that:

… estimates of Company Gross Operating Profits have once again included the receipt of COVID-19 related government subsidies as income in the compilation of CGOP, as previously seen from the June quarter 2020 onwards. These government subsidies include stimulus packages provided by both state and federal levels of government.

I know this will fuel the so-called Marxists to argue that fiscal deficits are bad because they underpin corporate profits, which is rather definitional if we are talking about capitalism.

Any spending in a capitalist economy will boost profits because that spending boosts national income and profits are one distributional claim on that national income.

The question that has to be answered though is whether the trajectory shown is reasonable in distributional terms or not rather than whether fiscal policy just lines the pockets of the capitalists.

The point is that fiscal policy per se boosts spending and employment.

But the design of that spending and the accompanying policies will influence the shares in national income.

For example, a public sector job creation program targetted at lower-income workers who are unemployed will boost wages more than profits.

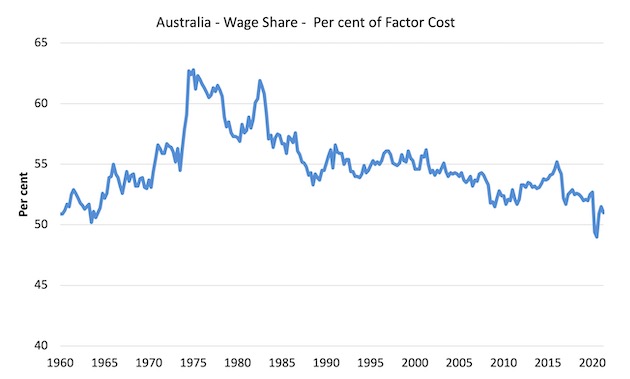

The next graph adjusts for inflation over the period since the March-quarter 2001.

In real terms, corporate profits has risen by 4.6 times, while wages and salaries have risen by 1.65 times.

Since the March-quarter 2016, real profits have risen by 256 per cent, while wages and salaries have risen by just 7.5 per cent in real terms.

What assessment criteria of generalised well-being would consider those outcomes to be acceptable?

Only those who think the production and distribution system is to feed the top-end-of-town based on work generated by the vast majority who get the scraps.

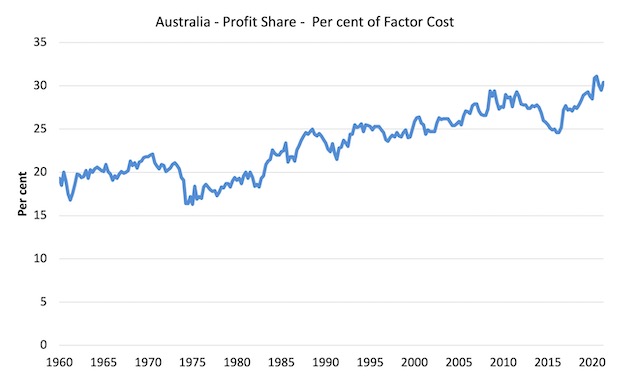

When these distributional shifts started occurring in the 1980s, we were told that workers had gained to greater share of national income and that the real wage overhang (the excessive wage share in normal language) had to be reversed.

Why?

To encourage businesses to investment more in plant, equipment, buildings and knowhow in order to boost productivity.

The story line claimed that if productivity rose, workers would be repaid for their initial sacrifices of real wages growth, by greater real wages growth in the future.

It didn’t happen.

What did happen was that the wage share started to fall as you can see from the following graph.

And the profit share took off.

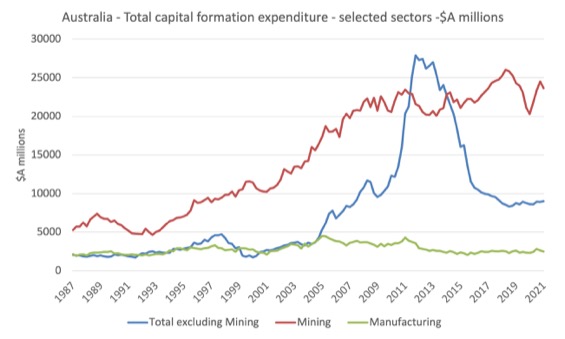

And what happened to private business investment?

The following graph shows various sectoral breakdowns of total business investment in Australia since the September-quarter 1987 (when this consistent dataset began).

Australia, of course, had a once-in-a-hundred-years mining boom which was driven by massive increases in demand for iron ore etc and record terms of trade.

The mining companies are heavily foreign-owned.

Once we exclude the mining investment, you can see that total investment expenditure fell as the wage share fell.

Further, total expenditure less mining has been essentially flat since the GFC.

And, investment in the manufacturing sector, which helps to drive productivity growth has been in decline for years and the boost to corporate profits hasn’t stimulated it.

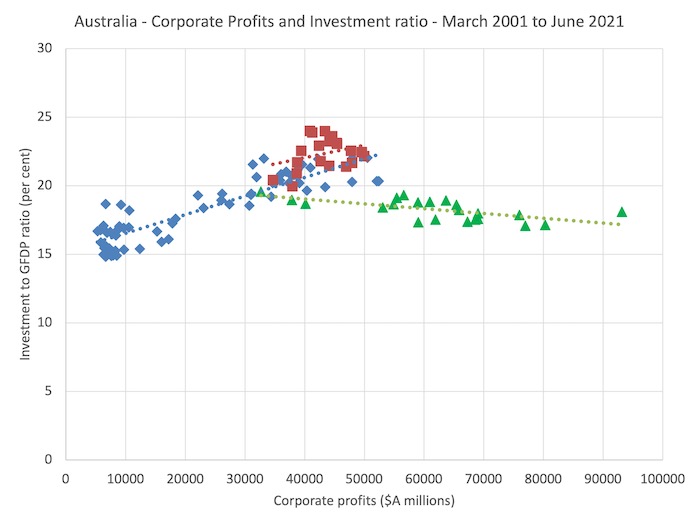

Another way of looking at the recent history is to see if there is any relationship between the movement in corporate profits and the business investment expenditure as a percent of GDP (the ‘investment ratio’).

The following graph shows the relationship from the March-quarter 2001 to the June-quarter 2021 and splits the sample into three periods coinciding with the trajectory of corporate profits:

1. March-quarter 2001 to the December-quarter 2010 – Corporate profits were rising.

2. March-quarter 2011 to the December-quarter 2015 – profits falling

3. March-quarter 2016 to the June-quarter 2021 – rapid rise in profits.

The dotted lines are simple linear trend regressions to give some summary of what was happening between these variables.

My usual note of caution: correlation is not causation. Cross plots do not prove anything. But they can stimulate useful hypotheses that can be examined with more sophisticated statistical tools (which take us beyond the scope of this blog but which I deploy in my academic work).

You can see that up until the third period as higher corporate profits, other things equal, were associated with higher capital investment ratios.

But this also includes the Mining boom impact. If we took Mining out then the situation would reverse and what I show next would be much worse.

After the March-quarter 2016 that relationship has changed and it is clear that the booming corporate profits are not going into productive investment at the same rate that they used to.

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

We have already concluded it doesn’t go much private capital formation, which has not grown in proportion to the largesse that has been distributed away from workers to capital.

Some of has gone into paying these massive and obscene executive salaries that we are discussing in this blog.

I discussed that issue in these blog posts (among others):

1. CEO pay binge in Australia continues while workers’ wages growth remains flat (August 6, 2018).

2. CEO pay trends in Australia are unjustifiable on any reasonable grounds (August 28, 2017).

3. Executive pay bears no relationship to company performance (January 17, 2017).

4. CEO pay still out of control and diverging again from workers’ earnings (December 21, 2015).

5. CEO pay still out of control (September 18, 2014).

I saw in the Melbourne newspaper this morning this article – Rare untouched London trophy home selling for $65 million.

That is where the corporate profits boom goes, while workers struggle to secure basic housing as investment demand rises.

And some of the redistributed income that has resulted from this profits graph has been retained by firms and invested in financial markets fuelling the speculative bubbles around the world.

We need to return to national productivity wage distribution

When I returned from the UK in the mid-1980s where I was studying for my PhD, I worked briefly in Canberra in the Department of Employment and Industrial Relations. This was a fill-in while I waited to start work as a lecturer at Flinders University in Adelaide.

My job there was to present research evidence to support the wage indexation process and compile productivity measures to aid the wage setting tribunals in there annual productivity wage cases, where the tribunals would come up with an average, nationwide productivity growth estimate and pass that on in the form of nominal wage increases.

The employers hated it because it forced a more equal sharing of productivity growth.

There were issues that had to be resolved – for example, workers in the high productivity sectors which were highly capital intensive (for example, mining) received less that their sectoral productivity growth, while workers in low productivity, labour-intensive sectors (for example, retail) received more than their sectoral productivity growth.

Trying to resolve all those issues and more was my job for a short period. It was very interesting work and taught me a lot about data nuances etc.

But eventually the tribunal would make an award each year and wages would rise for everyone by the quantum set.

And so real wages could rise in line with productivity growth and the wage share could remain more or less constant.

That was considered equitable.

By the late 1970s, the productivity adjustments were being contested and in some years delayed.

As the Right-wing ideology became dominant in the policy debate and some notable industrial cases were engineered to confront the wage setting system, the government shifted to an decentralised enterprise-based wage setting system in the 1980s.

But while some of the old national system was retained – such as the annual mininum wage setting process – the national productivity awards were abandoned.

And never forget that it was the Australian Labor Party (Hawke-Keating) government that did this – attacking the rights of workers to gain a fair share of the output and income they created.

And that is when we started to see real wages growth diverge from productivity growth and the wage share started to tumble and the profit share in national income rise.

We need to return to that sort of framework – where workers can get their fair share.

Conclusion

I think I will go and assemble some Lego.

This story from the UK Guardian (November 30, 2021) – Lego gives its 20,000 employees three days extra holiday after profits rise 140% – at least shows one company that does something small for its workers when times are going well for it.

There is much more that needs to be done and relying on the ‘market’ to correct these massive imbalances is not one of them.

Governments have to introduce frameworks that ensure workers are paid more and share fairly in income growth.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Morning,

What the virus has shown us is there could be massive amounts of work to be done before a job guarentee can be introduced.

I was listening to Nathan Tankus podcast with Joe Weisenthal about the supply chain crises. I honestly believe most countries couldn’t handle the increased demand a JG would deliver after listening to that podcast.

There has been so much less investment in important infrastructure like roads and railways and ports during the neoliberal era. I just don’t think the infrastructure we have would cope with the demand created by a JG.

It is easy to say the private sector will respond to the increased demand but after watching how slow they have been during the pandemic. I’m not sure the private sector could if a JG was introduced during normal times. There are just so many links in the infrastructure and supply chains that could break down easily if it is not fit for purpose.

I could very well be wrong but after listening to Nathan and Joe. I think there has to be some real co-ordination and forward planning before a JG is introduced. To make sure the increased demand can be dealt with both effectively and efficiently. If we are going to cut some taxes consumers alongside a JG that’s going to put even more pressure on the system.

The system has been so used to high taxes on consumers combined with low deficits and low growth for so long now. To suddenly flip the switch to a JG with low taxes on consumers without serious planning and investment beforehand would probably break the system.

We would probably see similar inflation rates in some areas of the economy that we are seeing now with negative knock on effects in the supply chains. If the infrastructure isn’t fit for purpose there is very little the private sector can do to fix it in a hurry. The virus has highlighted this problem clearly.

Which means even if a political party gets elected that supports a JG. How long will it take to actually implement it fully ? How long would they have to stay in power to see it through ?

2 or 3 terms at least ?

What can and should be done about the foreign owned miners?

“I think there has to be some real co-ordination and forward planning before a JG is introduced.”

We need to treat businesses as cattle not pets. And we need a cull of the lame ones that are going nowhere.

The problem is that firms have become optimised for profit extraction efficiency due to the constant supply of cheap labour, which stops innovation happening. Quite a lot of profit seekers need to go bust.

And to do that needs a Job Guarantee, to catch those people who will become out of work, and that will create the reduction in demand that will allow the private sector to reconfigure to a more resilient structure.

It may also require government to become ‘angel investor of last resort’, and lower the cost of actual investment capital to rock bottom for new entrants wanting to create active competitors to existing operations.

One way to alleviate the threat of an ‘investment strike’ is to break the strike. This time we do it on the profit side, not the worker side. Let those willing to have a go make their fortune – if they deliver.

Prices rises are indications of lack of competition from quantity expanders. So create more quantity expanders in bottleneck areas.

The real question is whether we have enough innovators left we could turbo charge, and whether there is political will to clear their path so they can innovate. What the pandemic has shown us is that too many people have got themselves in positions of power who prefer the brake to the accelerator. They will need clearing out.

@Derek Henry

The Job Guarantee could be guided towards improving infrastructure, those are the jobs that would be created… and for all the supply chain problems, inflation is still only 6 per cent annualised, we’ll see if it breaks beyond that. Given we’ve just come out from a major and unique crisis I don’t think the system is in critical shape just yet. At least not enough to postpone JG.

Did enjoy that ep of Nathan’s podcast.

@Bill

That house you linked to is quite infamous in London, it had been apartments for a long time and was then bought and turned into one house at great expense in order to sell to some billionaire as the local real estate market kept booming. It’s been on sale for quite a while, every now and then a new article will appear with the “news” of that fact. Sadly from the article you linked to it looks like they ruined the beautiful exterior with an interior that looks like a four star hotel.

Reminds me of the $500 million LA monstrosity that is impossible to sell and ruined its developer:

https://www.latimes.com/business/real-estate/story/2021-03-08/foreclosure-looms-for-nile-niamis-infamous-mega-mansion-the-one

I’ve talked about the Hawke-Keating “behaviour” to various groups in the past about such matters. Most see the Accord as their masterpiece.

“Prices rises are indications of lack of competition from quantity expanders. So create more quantity expanders in bottleneck areas.”

Yes, but I’m thinking more of Just the motorways, duel carriageway’s, railways and ports and shipping that these characters would use to get stuff from A to B and C in the UK.

Most of the roads and ports are at breaking point already. The railways don’t go where they need to go. Try going anywhere between May and Sept in Scotland or the Lakes and the coast.

I could be wrong as I’ve only thought about it after listening to the podcast, but as it currently stands there is a very good chance the UK infrastructure as it is, couldn’t handle a significant tax cut for consumers never mind the JG. It is just so out dated and the major road links and ports were at breaking point before the virus.

The way I’m thinking about it is similar to Brexit. When Brexit happened they knew for years there was a shortage of truck drivers and would be a skill shortage in other areas yet never even planned for it in advance. They expected the free market tooth fairy to fix it for them and move people around like ingots of steel.

I think they’ve underestimated how bad the playing board is. The infrastructure playing board that these competitors once created have to play on to move goods and services from A to B and then C. In the same way they underestimated how bad the tooth fairy response was to the skill shortages. The M6 could grid to a halt and the roads in Scotland and Wales.

Cutting taxes and introducing the JG would probably increase imports. When you run trade deficits you are sending less shipping containers than what are being sent to you. I doubt they have the space available on What to do with the excess containers never mind getting them from A to B and then C once they get here.

If they are going to take climate change seriously. When they stopped flights during the pandemic that removed goods and services being transported by air because those are used to transfer stuff. Which put even more pressure on road and rail. I don’t even think they have thought about that until now.

It is not just that they have become optimised for profit extraction efficiency due to the constant supply of cheap labour, It is also the whole playing board that professor Plum, colonel Mustard and Miss Scarlet has to play on when they compete is no longer fit for purpose.

The playing board can’t handle larger deficits, tax cuts and the JG as it is now. The question is what will it take to get there and I could be wrong but for me it is going to take “Beveridge” style coordination and planning on infrastructure to get us there. The whole playing board across the UK is going to have to be redesigned. Redesigned with climate change front-end centre never mind fixing how our of date it is.

They probably thought the neoliberal era of low deficits, unemployment rates of 4-5% and low growth would last forever after brainwashing 2 generations to believe in it. Never thought that playing board would become an issue.

The left are about as ready to win an election as the right were for Brexit. They both underestimate the scale of “levelling up” required. Both believe the tooth fairy will save its magic wand and fix it for them.

Eugenio Triana

” The Job Guarantee could be guided towards improving infrastructure, those are the jobs that would be created”

The Job Guarantee is more than a Green New Deal job creation policy

https://billmitchell.org/blog/?p=41150

The provenance of the Job Guarantee concept in MMT

https://billmitchell.org/blog/?p=44754

A conversation between MMT founders

https://billmitchell.org/blog/?p=44010

The basic income people have definitely not thought it through.

It was a very bad idea to begin with but thinking about it this way makes it 10 times worse. They fully expect the free market tooth fairy to supply the goods and services at a snap of a finger anywhere in the country. Using the infrastructure we currently have. When they give everyone extra to money to spend on top of what they earn as wages.

I worked as an audit manager for Royal Mail. People wouldn’t believe what it takes to get a first class letter from the Isle Of Lewis in Scotland to Truro in Cornwall on the next day unless you showed them. Every type of transport is used starting with a ferry. One part of the cog fails it isn’t going to make it.

A basic income guarentee under normal infrastructure playboard conditions. Would be like the Xmas rush in Royal Mail. When you have to post your Xmas cards weeks in advance and hope that they get there by Xmas. That’s Royal Mail planning 10 months ahead for it figuring out what they need to do. With improvements in productivity every year. With each machine sorting thousands of letters every hour. Machines now even sorting parcels.

The basic income using the infrastructure we have now. Would produce similar results to what we have seen over the last year or so during normal times. Because the unemployed are off painting and line dancing and playing the triangle and standing up at local council meetings to get the basic income. Good luck with that.

“The playing board can’t handle larger deficits, tax cuts and the JG as it is now. ”

It can. We saw that over the last year. Despite most people being offline we managed just nicely. Which tells us that quite a lot of jobs are a complete waste of time and effort.

So when those jobs cease to exist you don’t need to replace them.

The space comes not from an expansion, but a reconfiguration and redistribution. As we’re seeing presently with truck drivers.

Once you have a Job Guarantee, then having a spring clean of the overpaid in those who oppose you is a lot easier to get through.

@ Neil Wilson: ‘Despite most people being offline we managed just nicely. Which tells us that quite a lot of jobs are a complete waste of time and effort.’ Absolutely, and so much obviously needs work but won’t be correctly directed by the market. We are certainly getting to the point, if not reached long ago, where neo-liberal capitalism delivers far worse outcomes than oft criticised examples of state planned economies. Of course not Mao’s China with its deliberate impoverishment/starving of the population while exporting food in exchange for weapons technology.

I’m not so sure about that Neil,

Most people were saving or paying off debt. People lost their jobs. Whole sectors were closed down.It wasn’t as simple as we cut down on non essentials and everything was fine. Fine for the middle and upper class who could work from a home they owned.

I think you are taking it as a given that the infrastructure we have can cope and I’m saying what if it can’t ? I’m saying what happens if it can’t, do we work it all about beforehand and figure it out or Just flip the switch and cross our fingers?

The only thing that gives me a little bit of hope is Japan and Bills post today. That shows under full employment we all save more so saving instead of spending will take some of the pressure away. With zero interest rates house building will expand but as Japan shows households save more over longer time periods to get the same returns they would with higher rates. Granny bonds could change that because they would save less.

It is not easy to determine what it would look like as both views are guess work. Surely taking a look and planning is the safest option before flicking the switch ?

That significant forward planning is required to ensure that the fiscal policy can be relatively responsive to the cycle rather than cross our fingers and hope. We have already established that the neo-liberal era has also been marked by a major reduction in Departmental capacity to design and implement fiscal policy – given the obsession with monetary policy and the major outsourcing of “fiscal-type” government services to the private sector.Many of the major government policy departments in the advanced nations are now just contract managers for outsourced service delivery.

That would have to be fixed first and how long will it take to sort out ? How long will it take to introduce the infrastructure to start a JG from the bottom up ? how long will it take to set up a competition and monopoly commissioning some teeth ? How long will it take to sort out the commercial banks and central bank to serve public purpose ?

None of this is going to happen overnight.

Are these not the reasons why they set up the US National Resources Planning Board in 1933. Was linked in closely with the major research communities like the Social Science Research Council, the Public Administration Clearing House and the National Bureau of Economic Research?

Are these not the reasons why Beveridge created his Central Precinct Structure Plan?

Not waiting for the ‘market’ to solve all problems but setting in place all the required planning to allow government spending to be turned on and off when required yet providing for socially beneficial output.

Planning public works – history has a lot to say if we listen properly

https://billmitchell.org/blog/?p=37930

I have a twinge in my knee that tells me the current playing board we have is not ready. You think It is and will cope with tax cuts and a JG.

I’m saying let’s find out before we fire the starting gun but also asking how long would that take and if

the playing board is found to be insufficient how long will it take to fix it ? How long would a MMT party have to be in power to get it done? If they don’t plan and co-ordinate and get it wrong will they be voted out long before completion. Is it actually possible to start a JG in the first 100 days?

For example the Tories were in power from 1979 to 1990 and still hadn’t finished their project. New Labour had to finish the job for them by 2007. It took them nearly 30 years to complete it.

We can’t answer the question how long it will take, because we don’t have a ” What MMT can do you for you ” manifesto in place. We haven’t created a to do list and how we are going to change things list to work from.

The neoliberal globalists did have a very efficient and effective to do list and knew exactly how they were going to change things and it took them 30 years. Who knows how many years of planning before they even got a chance to redesign the playing board the way they wanted it.

Surely we have to learn from that and stop spending so much time trying to win the intellectual debate. The Tories and New Labour completely ignored the intellectual debate and steamrolled over the top of everybody. A plan with a manifesto is what we need then we might get the chance of a new political party running with it.

Trying to get Labour or any current left win party in the UK to run with it is a fools game. A complete waste of time. They are spending all their time trying to reverse Brexit and introduce a PR voting system so we can never escape from neoliberal globalism ever again.

The Labour remainer reshuffle

https://www.spiked-online.com/2021/11/30/labours-remainer-reshuffle/

Simon Wren Lewis and Jonathan Portes new plan combined with fiscal referees. Now the liberals are in charge of Labour they are going to push for it. Was in the top 3 topics of the Labour party conference.

https://mobile.twitter.com/sjwrenlewis/status/1463833523329060874

Time to start planning instead of debating endlessly with a bunch of ideological driven madmen.

” Is it actually possible to start a JG in the first 100 days?”

Yes, because it is already there.

UC is a Job Guarantee. It already has a work requirement. What it lacks is the correct wage, and the option to choose to go on it.

That is the simplest thing that will work to start with until we can scale out the existing ‘jobs for the people’ system to widen out the work options. Yes it already exists, yes the processes are written down, defined and are in place with people operating them. No, government doesn’t know what the overall cost of that system is because they don’t keep those figures. And I have asked them.

Alongside that we have the elimination of the DMO – since it is no longer required once you’re stabilising via the labour market. That’s a sizeable dead loss cost there that will be redirected.

We’re fortunate in the UK in that the financial system is already there with legislation in place. For the most part we need very little primary legislation to get things moving, and with our constitutional system it isn’t that difficult to get the necessary legislation anyway.

Derek you wrote:

“Trying to get Labour or any current left wing party in the UK to run with it is a fools game. A complete waste of time. They are spending all their time trying to reverse Brexit and introduce a PR voting system so we can never escape from neoliberal globalism ever again.”

I fail to understand the logic that proportional representation voting will lock in neoliberal globalism. Surely neoliberalism was implemented because the two party bloc system that is inherent to first past the post seat based parliaments and therefore governments that most of the Anglosphere has, was captured by those powerful vested interests that wanted neoliberalism and it was almost impossible for ‘third’ political parties to arise and gain sufficient power to change that neoliberal policy direction?

New Zealand alone in the Anglosphere has however adopted Germany’s Mixed Member Proportional voting system which I see as a very good voting system as new parties outside the duopoly can arise and form part of government in coalition. Both countries have relatively powerful Green parties as a direct result and despite frequent criticism on this blog for example, these Green parties remain to the progressive left of the main social democratic party including on fiscal policy and the size of any deficits willing to be allowed.

Similarly the Australian Greens have had most electoral success in the Australian states/territories of Tasmania and the Australian Capital Territory that are the only jurisdictions with lower house of parliament proportional representation voting where they use the Hare-Clark voting system. The federal Senate also has a proportional representation voting system and that is where the balance of power is held by a variety of minor parties and independents from across the political spectrum.

The lower house of the Australian federal parliament – The House of Representatives which uses a first past the post seat based voting system but with preferencing delivers some very undemocratic results. For example the 151 member HOR has one Green Party MP even though the Greens get about 10% of the first preference national vote and also has 10 ultra conservative National Party MP’s that form a significant part of the ruling coalition LNP federal government even though that party only gets less than 5% of the first preference national vote. Parties with widely dispersed voting bases are under represented and those that have concentrated voting bases such as the National Party in regional Australia, are over represented.

Proportional representation voting systems more fairly represent all minor parties and micro parties allowing these parties to deliver a political return to their voters and to grow in support as a result and conversely for any unrepresentative mainstream parties to be punished and even to decline into oblivion eventually.

Of course a competent and balanced mass media and an engaged and well informed electorate is an essential prerequisite for any voting system.