In the annals of ruses used to provoke fear in the voting public about government…

CEO pay still out of control and diverging again from workers’ earnings

Two things caught my attention among other things last week. The Australian Tax Office (ATO) released the – 2013-14 Report of Entity Tax Information – which tells us about the total income and tax payable was for 2013-14 tax year for 1539 Australian and foreign companies operating in Australia with incomes above $A100 million. The rather startling revelation is that 579 of the largest Australian companies including Qantas did not pay any tax at all in that financial year. The second (unrelated but pertinent) report was released last week by the British Chartered Institute of Personnel and Development (CIPD) – The power and pitfalls of executive reward: a behavioural perspective – which found that the increasing gap between British CEO earnings and their employees is unrelated to company performance and reflects “self-serving tendencies”. They also found in an accompanying report that the increasing gap undermined trust between management and workers and eroded employee motivation – another own-goal type stunt for these management geniuses.

I refer to the own-goal stunt in the context of another blog I wrote recently – Capitalists shooting their own feet – destroy trust and layer management.

In that blog I discussed recent research which has found that when management introduced so-called ‘cost-cutting’ changes in the workplace that increase the precariousness of work, through casualisation, de-skilling, arbitrary dismissal practices, and all the rest of the nasty tactics that have defined the neo-liberal era, they actually have to do introduce new layers of management to control the workers more closely because their cost-cutting destroys trust and motivation.

But then that new layer of management has to also feed on the real income that they extract from the workers. At any rate, the practices have been found to erode shareholder return. But as you’ll read next this doesn’t appear to undermine the capacity of CEOs and their lackeys to amply reward themselves irrespective of the performance of the companies they are in charge of.

I do not intend to analyse the ATO data in detail.

Basically, the ATO data is not explicit enough to know why the companies didn’t pay any tax. But piecing other information together provides some conclusions.

For example, the cleaning group Spotless Group Holdings Limited reported total income in 2013-14 of $A2,267,838,023 and paid no tax. It also is currently embroiled in scandal where they accused of underpaying its staff via so-called ‘sham contracting’.

The ABC Report (October 22, 2015) – Myer cleaners accuse retailer of underpayment, denying entitlements with ‘sham contracting’ practice – tells us that the workers have indicated:

they are paid below the award rate, do not receive penalty rates and are left to pay their own tax, superannuation and insurance.

The matter is under formal judicial investigation at present.

A nasty company no less!

The ATO data also is consistent with widespread corporate tax evasion. The ABC news feature (December 17, 2015) – How do a third of the top Australian companies pay no tax? – that such evasion involves such methods as:

Debt dumping – a company brings debt from one of its overseas subsidiaries into Australia to reduce its taxable income.

Profit shifting – a company sends profits offshore to avoid tax.

The British report from the CIPD was based upon previous research from the High Pay Centre published on August 16, 2015. The report – New High Pay Centre report: Executive pay continues to climb at expense of ordinary workers – concluded (among other things) that:

1. “Current executive pay levels could therefore be regarded as wholly disproportionate, and reflective of weak corporate governance structures; insufficiently challenging oversight; and potential conflicts of interest in the executive pay-setting process”.

2. “If pay for the highest top 1 per cent or even 0.1 per cent of earners within a company increases as a share of the total wage costs or total expenditure, then this could potentially be at the expense of the wider workforce, shareholders or investment in the business”.

3. “Anger at powerful and wealthy elites has already manifested itself in the UK and overseas in a number of ways, from consumer campaigns to political movements”.

The CIPD report summarised some of the trends:

1. “In 2000, the average FTSE 100 CEO earned 47 times more than the average full-time employee; by 2014 this had increased to 120 times more than a full-time employee (IDS 2014).”

2. “some CEOs still receive weighty reward packages that are significantly out of sync with the returns delivered to shareholders.”

3. The trends lend “support to the premise that the UK, in common with other developed countries, has experienced a general pattern of wealth concentration.”

4. “Bonus payments increased at around double the rate of (EPS)”, that is, Earnings Per Share, which is a measure of company performance.

5. “Only 1.3% of the disparity in payments could be attributed to differences in pre-tax profits, despite this being the main measure used in bonus schemes. 73% of the change in long-term incentive payments could not be credited to changes in either EPS or TSR for any year in the period 2004-13.”

6. “CEO pay increased some 2.25 times faster than GDP” between 2002 and 2014.

The report concluded that:

The net result is that CEO pay growth has dramatically outpaced pay increases across the wider economy, without any corresponding increase in company performance … CEO pay has continued to increase, even in times of economic recession, indicating there is no direct link to company performance.

They also argue:

that it has been the ‘greed of those who demand and secure rewards for failure in far too many of our large corporations’ that has done the most damage to the reputation of business and the free market in recent years …

The inner quote here is from the High Pay Centre report.

Interestingly, the CIPD report demonstrates that the normal mainstream economic theories relating to pay determination fail to explain the real world trends in executive pay in Britain. That is hardly a surprise.

Despite the recent attempts by economists to reassert their authority – you know, we all understood a crisis was coming and our textbooks can readily explain why growth has been slow since (the sort of Krugman claims among others) – the capacity of mainstream economic theory to embrace reality is close to zero.

The report suggests that the way in which CEO pay is determined is more in line with “narcissistic CEOs”, who rig the board decision making at the expense of “firm value and operating performance”.

The regime of high salaries is also found to create a “celebrity” environment which conflates corporate success with the individual performance of the CEO.

The report also found that there are massive barriers to changing the way in which these self-serving CEOs inflate their pay packets at the expense of their workforce and the shareholders of the companies they represent. I’ll leave it to you to read about that if you are interested.

Overall, the evidence does not support the view that the high earnings of CEOs are necessary to attract them and to motivate them. The process of CEO pay determination is corrupted by “vested interests” and highly constrained information sets (that is, the company boards are often operating in a state of virtual ignorance).

It also finds that the current trends in CEO pay undermine the sustainability of their companies and do not induce superior performance.

The CIPD also released the results of an accompanying survey of employees’ views on executive pay (December 18, 2015) – The view from below: what employees really think about their CEO’s pay packet.

The Survey found that:

1. “71% agree that CEO pay levels in the UK are generally too high (while only 5% disagree).”

2. “64% disagree that CEO pay levels in the UK inspire employees to work hard (while only 8% agree).”

3. “60% agree that CEO pay levels in the UK demotivate employees (while only 13% disagree).”

4. “54% agree that CEO pay levels in the UK are bad for an organisation’s reputation (while only 11% disagree).”

In the CIPD press release (December 18, 2015) accompanying the report – Dramatic rethink needed on ‘demotivating’ CEOs pay, warns CIPD – the CIPD said that:

The growing disparity between pay at the high and lower ends of the pay scale for today’s workforce is leading to a real sense of unfairness which is impacting on employees’ motivation at work. The message from employees to CEOs is clear: ‘the more you take, the less we’ll give’.

And, in terms of the myths that Ayn Rand propagates in Atlas Shrugged:

Outlandish pay sustains the myth that a single, heroic individual is somehow running a big business on his or her own. That’s simply untrue. Leadership matters, and good leaders should be well rewarded. But the workforce does the work.

The situation is hardly better in Australia.

The Australian Council of Superannuation Investors publishes and annual CEO pay survey. The most recent was published on September 3, 2015 – CEO Pay in ASX200 Companies: 2014 – and covers executive pay for the 200 listed companies on the Australian Stock Exchange.

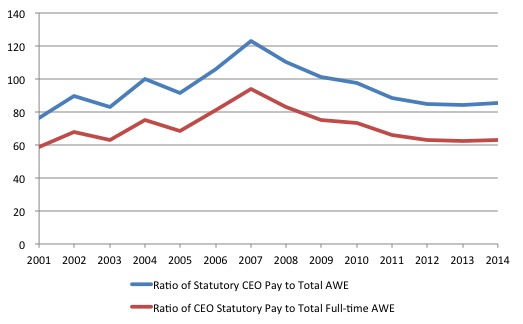

The survey shows that in 2001 (when the first survey was taken) the ratio of average CEO pay to total earnings by workers was 76 to 1. By 2014 this ratio was 85 to 1, although it peaked at 123 to 1 in 2007 just before the crisis.

I have already discussed on several occasions the widening gap between productivity growth and real wages growth, which manifests as an increasing profit share in national income and a decreasing wage share.

This redistribution of national income towards capital has been ongoing for the last three decades or so in most countries and is a characteristic of the neo-liberal era.

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go? Answer: Not in private capital formation, which is not grown in proportion to the largess that has been very distributed away from workers to capital.

Some of the redistributed income has been retained by firms and invested in financial markets fuelling the speculative bubbles around the world.

Some of has gone into paying the massive and obscene executive salaries that we are discussing in this blog.

For workers, the problem is that they rely on real wages growth to fund consumption growth and without it they borrow or the economy goes into recession. The former is what happened around the world in the lead up to the crisis (and caused the crisis).

The latter is more or less what is happening now.

One of the essential changes that needs to happen to ensure that another bout of financial instability doesn’t hit soon is that real wages have to grow in proportion with productivity growth – exactly the reverse of what is happening now.

Overall, the dynamic that, in part, created the GFC – suppression of real wage rises in line with productivity growth and the resulting reliance on private debt to maintain consumption spending, is back and the world is building up again for GFC Mark 2.

That will require a fundamental revision of the way executive pay is determined and significantly reduced payout outcomes for the bosses.

The latest Australian data from the Australian Council of Superannuation Investors (ACSI), the body that “provides independent research and advice to assist its member superannuation funds to manage environmental, social and corporate governance (ESG) investment risk”, shows that:

Australia’s 10 highest-paid chief executives collectively reaped $70 million more than reported in their companies’ FY14 annual reports …

See also the accompanying press release (September 3, 2015) – Bountiful harvest for the 2014 CEO crop.

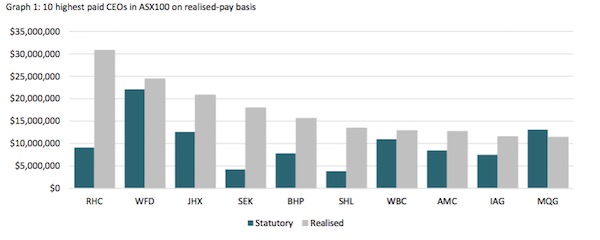

Through and elaborate series of mechanisms involving “exercising options and performance rights, along with the vesting of shares under long term incentive schemes”, the top 10 CEOs earned $171.4 million while they reported for statutory purposes earning $99.63 million in 2014.

The following graph (Graph 1 in the ACSI Report) shows the gap between the reported pay and realised pay for the top 10 CEO earners (the horizontal axis depicts the companies they represent).

The ACSI argued that:

These figures suggest that the existing requirements for reporting executive pay may significantly understate the rewards received in a given year. Statutory reporting is, perhaps, disclosing only the tip of the iceberg in terms of the wealth accruing to senior executives …

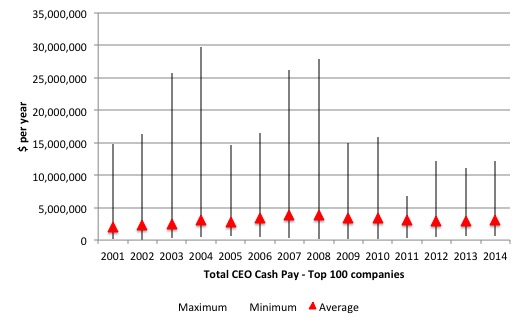

The next graph shows the average total CEO Cash Pay in the Top 100 companies (red triangles) and the maximum and minimum values for each year.

The ACSI define the total cash pay as “fixed pay, cash bonuses and accrual of entitlements”, so more or less what an average worker might receive each year (the bonuses if they are lucky).

There is considerable disparity within the ranks of the CEOs (from max to min). There are some sensationally large salaries and some rather modest ones (in relative terms).

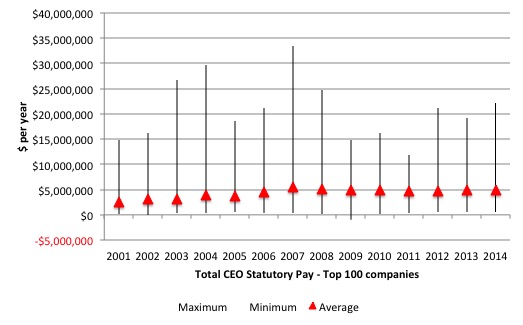

The next graph shows the average total CEO Statutory Pay in the Top 100 companies (red triangles) and the maximum and minimum values for each year (see accompanying table for actual dollar values).

The ACSI define statutory pay as “the total remuneration disclosed for a CEO in a company’s remuneration report, as required by Australian law. It therefore includes the value of share-based payments expensed under accounting standards”.

Don’t be fooled by the different scale of the axes in each graph – the statutory pay is a huge step up on the total cash pay although clearly well below the ultimate realised earnings (as detailed in the first graph).

The next graph shows the Ratio of CEO Statutory Pay to Total Average Weekly Earnings (blue line) and Total Average Weekly Full-time Earnings (red line) from 2001 to 2014.

The ratio for the former started at 76.2 in 2001, peaked at 123.1 in 2007 at the height of the ‘greed is good’ frenzy and is now back to 85.3 and is rising again.

The ratio for the latter started at 58.6 in 2001, peaked at 93.7 in 2007 and is now back to 62.8 but it is also rising.

These differentials are always justified by the conservatives and the business lobby as being essential to attract top quality executives. But then we know that company performance is not closely linked at times to the pay that the CEOs get, which puts a hole in that argument.

When the 2013 data was released on September 18, 2014, an accompanying press report – Pay for Australian CEOs is down, but it’s still too high said:

The boom that lit the fuse of the global crisis then overwhelmed commonsense and decency … Pay was out of control at that time in almost every way. Short-term bonus hurdles were too low, shares were vesting too quickly and on terms that were too generous, and termination payments were too big.

Company leaders offered various excuses, all of them lame.

This is the ‘greed is good’ frenzy that was associated with the total failure of the financial market and associated labour markets to self-regulate along the lines that the mainstream economics and finance textbooks claimed.

Just as the CIPD report in Britain has found, the idea that CEO salaries a market determined is ridiculous. There is very limited scrutiny by shareholders, and company boards boards are bullied or cajoled by celebrity CEOs who reward compliance with personal gain.

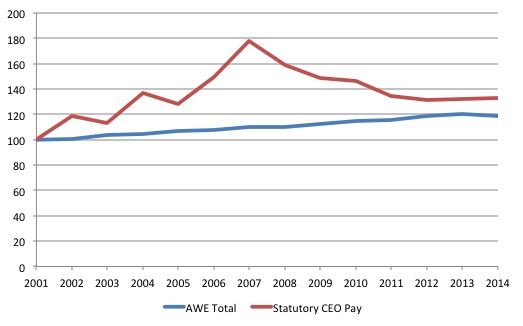

The following graph shows the movement in Average Weekly Earnings (blue line) and Statutory CEO pay (red line) both indexed to 100 in 2001. The data is also deflated using the Consumer Price Index, so reflects real growth.

I also use Average Weekly Total Earnings (which provides some measure of the shift towards part-time work) and a better indicator of the central tendency in the labour market.

You can see that the CEO Statutory pay has grown over the period in real terms by 33.3 per cent whereas the average worker enjoyed only a 19.1 per cent increase over the 13-year period.

Of course, the CEO real pay exploded in the financial market frenzy before the crisis and by 2007 their real pay had risen by 77 per cent since 2001, compared to the average worker’s real wage rise of 11.2 per cent over the same period.

Conclusion

There is a stream of research being published that demonstrates how fractured modern (financial) capitalism has become. In the post Second World War II period, the Cold War warriors in the West lampooned communism on the basis that the capitalist dream was spreading its rewards to the workers as well is the owners of the capital.

The full employment consensus that emerged in that period, mediated by Social Democratic governments, achieved both productivity and real wage growth and more or less comprehensive Welfare States, which raised the material living standards of workers rapidly. At least, in the developed world.

There was a sense that the exploitation of workers in poorer countries in Asia, Latin America, Africa and elsewhere was increasing to allow the West to satisfy the demands of more organised workers in the advanced nations for better living standards.

With the abandonment of the full employment consensus, variously, around the mid 1970s and beyond (depending on the nation), and the emergence of Monetarism and its micro-economic manifestation (privatisation, deregulation, etc), that lull in worker exploitation in the advanced nations came to an end.

Capital found a way to co-opt the state to work in its favour more fully and abandon its role as a mediator in the class conflict, which up until then, following the end of the War, had helped workers improve working conditions, pay levels, and provided social wage benefits in the form of public education, public health, public transport and all rest of it.

It’s interesting that the Left have bought the myth that the state is no longer relevant or has the capacity to influence national economies in the face of globalisation and global financial flows.

But the state never went away. It is still as important as a never was. It is just now, that it openly works in the interests of capital rather than acts as the mediator.

This ongoing CEO salary binge, even though it is clearly now at the expense of their own companies well-being, is a sign that capitalism is once again getting ahead of itself.

We saw it at the end of the 19th century, which provoked the rise of trade unions and broad social movements designed to force elected governments to act more broadly in terms of the interests that it served.

These movements led to the Social Democratic era in the West. The lesson was that workers will only take so much and when their material living standards are so threatened, they retaliate and will not remain passive.

At some point, this neo-liberal era will be brought to an end by some similar type of worker reorganisation and uprising. I hope it comes within my own lifetime.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

The failure of the Left in the UK is quite staggering as is the seeming somnolence of the population that reads the garbage newspapers. The main difference with the end of the 19th Century is that there is now a massive media ‘manufacturing of consent’, not so present then. The obsession with ‘zombies’ in film and video game has always struck me as a projection of a populace that is losing its inner life. The daily press attacks on Corbyn that amount to an obsessive frenzy just show how scared of any change at all our financial system is, given Corbyn has hardly suggested anything that might be considered an assault on mainstream economics as yet.

I also hope the change happens in my lifetime, but I’m not so sure it will, I suspect it will run and run until its much worse than now-the UK has become like America, if you are poor it’s just your ‘own fault and you are a loser.’ I even think the next crash will be explained away as a natural part of the business cycle!-and people will just fall asleep again. Still, one has to live hopefully!

Dear Bill,

I note the Productivity Commission has recommended hospitality workers’ Sunday pay rates be reduced to the Saturday level. Its up to Fair Work Australia to accept or reject the recommendation.

“they retaliate and will not remain passive.” If wishes were horses beggars would ride.

The proles might “retaliate” by hitting some drug of choice and they will remain passive until the burr in their bum compels them to get off their backside. I won’t be holding my breath waiting.

Meanwhile the oligarchy continue on their merry,shortsighted, exploiting way ably assisted by their friends and fellow travelers in government and quasi government bodies like the Productivity Commission.

Sensible thing to do would be to make a law that says that a highest paid in an organization can only earn certain ratio over lowest paid. Say, CEO can only earn 50 times more than lowest paid. That would give an incentive for CEOs to raise workers pay, and how else could you keep their power to remunerate themselves in check? Money follows power and conflicts drive inflation.

IMO, the CEO class is competing within it’s own class. They just ignore the actual company wealth or earnings profile to see who amongst themselves can get the highest remuneration. After all they mix together and don’t regard employees as important enough to be worthy of respect. So if one CEO gets a rise beyond what is currently doing the rounds the others are going to go for it as well. Company management boards are made up of these CEO’s and wannabe CEO’s. It’s vicious cycle. Only a crash will cut it down. I wouldn’t be relying on staff to get angry enough. They are worried about whatever jobs they have and can’t afford to stir the pot.

This great blog post points out there is really no layer of abstraction that justifies CEO pay relative to workers.

An amusing corollary:

A ‘chief executive officer’ makes strategic decisions. (however grotesque the pay level is).

The very sort of thing that AI will replace. This is exactly the kind of thing expert systems, machine learning/data learning would be best suited for.

You dont need CEO’s because they cant make correct decisions as well from considering large data sets.

They are terrible at managing an organisation, have poor ‘market’ predicitve power, wreck companies because they by and large maximise short term value at the cost of long term strategic goals.

Better to eliminate the inefficiencies in the corporate structure just have department heads in an anarchistic structure collaborate and get advice from AI. I doubt there are many CEO’s whom understand complexity theory for instance or could build or use a system that predicts which product would be best for its own market.

When we’re told about some strata of a workforce being displaced because of an imminent technology ‘automation’ its funny how they never bring into the conversation the top level being displaced by some ‘automation’.

In the UK the ‘workers’ are sandwiched between the carrot of the mythical housing ladder (whose first rung is too high to climb on) and the threat of benefit sanctions. The rentier landlord will soon be a god (many of these already Tory MP’s with those in social housing marginalised as ‘scroungers’ because they are not on the same treadmill – it’s the psychology of the peching order- kiss the arse of those in power and you might, just might, get a few crumbs from their table while you piss on those that are struggling marginally more than you are- an evolutionary psychologists paradise.

Just as Marx foretold, capitalism has become the machine that has destroyed the soul of everyone subservient to it, including the capitalist. It’s a fate that is built right into that system and cannot be removed without turning it into something else.

Real growth cannot compound into infinity so why do we continue to follow an economic model that pretends that it can?

When you have people at the top, who are just playing monopoly with money while consciously acting in ways that diminish any real net benefit to society due to corporate activity, you know the limit has been reached.

Neither the powerful state nor powerful private sector groups nor the current or past marriages of the two into corporatism have ever shown any hope of producing a stable and sustainable path forward for society, or the ability to even take hold in the absence of totalitarian control over individuals in either the overt or inverted form.

If we wanted to save capitalism, ideas like MMT with it’s job guarantee will be needed because the space left for societal participation in the real productive capitalist sphere is diminishing so fast we will need a microscope to see it soon.

Is it even worth saving though? Is there anything of real net benefit left to be obtained from capitalism? Currently capitalist productions main purpose seems to generating fodder for landfill and ruining the quality of land, air and water. Very little of our total output and labor effort, when jobs can be found, produces anything with real or lasting use value.

Slow erosion of the pay and conditions of the middle class in the OECD countries [reforms]combined

with sacrificing the underclass will make this run and run.Remember the increasing impoverishment

of the poor is an excellent example to discipline the squeezed middle.

The irony is it is the stupidity of the balance the government sector argument and its influence

which is most likely to kill the goose which lays the golden egg for the wealthy by strangling aggregate demand.

If the wealthy can embrace fiscal stimulus and limit government direction of resources to the rest of us

they can continue their quest to have it all.

“In the UK the ‘workers’ are sandwiched between the carrot of the mythical housing ladder (whose first rung is too high to climb on) and the threat of benefit sanctions. The rentier landlord will soon be a god (many of these already Tory MP’s with those in social housing marginalised as ‘scroungers’ because they are not on the same treadmill – it’s the psychology of the peching order- kiss the arse of those in power and you might, just might, get a few crumbs from their table while you piss on those that are struggling marginally more than you are- an evolutionary psychologists paradise.”

I’ll try:

* The “conservatives” are about the boosting of the benefits of *incumbency* rather than specific classes. It used to be the benefits of feudal or anyhow large landowning incumbents and some professionals, currently it is about business and finance incumbents and owners of urban land.

* Conservatives in anglo-american culture countries, particularly in the USA, UK, Australia, have created a coalition of the 1%+the 50-60% below them, with the vision of a “plantation” economy, an alliance of high income/wealth and above average income/wealth voters to make below average income/wealth voters pay most taxes/fees and above average voters get most advantages. The rallying cries are “cheap hired help is hard to find today” and “property prices are not high enough to reward the aspirations of conservative voters”.

* The “plantation” economy vision is based on an old study that shows that incumbents in the property of houses and shares (and cars) vote for conservatives parties almost regardless of income and social class, because they think themselves to be landladies of the suburban mini-manor.

* So yes it is largely about boosting the profits of land speculation of the older middle classes, but also about letting those profits be cashed-in tax free with remortgages, and maintain a high level of benefits to middle aged and older women voters.

* Because it is also heavily sex based politics: women tend to be more conservative than men, especially when welfare for men is involved, and since women live rather longer than men, and own property and shares far more commonly (in part because of divorces and widowhood), middle aged and older women are in general far more commonly incumbent rentiers than men, and also outnumber them at voting time (no upper age limit, more assiduous voters), and they tend to be swing voters rather than “tribal” voters like men. IIRC men pay for around 2/3 of the cost of the welfare state and women get around 2/3 of the benefits, for various cultural and structural reasons. The “triple lock” on pensions is of course targeted mostly at women voters.

* It is also heavily regional based, not just sex based politics: since the North vote Labour regardless, they don’t matter either to Labour or the Conservatives, and anyhow most of their properties are not worth bothering much about and they tend to be too poor to have significant shares.

The conclusion is that the prized swing voters in marginal seats in the South East tend to be middle aged and retired women with property and remortgages (“old aunts”) and what they want is:

* higher property prices,

* lower taxes on property,

* lower remortgage interest rates,

* lower wages for workers, especially young men,

* lower benefits for men, especially from the North.

* higher benefits and protections for women, especially older ones, especially in the South East.

The Conservatives have delivered quite a bit of that, and New Labour did too before them.

If you score the Conservative policies of the past few years they are almost always benefiting Souther voters, especially older property owning women, and hitting men, especially Northern, working class and younger ones.

For example the UK government (it has been a bipartisan policy) negotiated hard to include Bulgaria and Romania in the EU, and to encourage cheap Bulgarian and Romanian workers to immigrate to work in the UK.

As ChrisD always says, the evidence is that this results in a net boosts to the UK “economy” (weasel word!), for example via a larger working population; thus boosting property and share prices, and driving down below-average wages.

The benefits in lower labor prices and higher property prices (and higher NI and other taxes paid by young immigrants who won’t be costing the state much for many decades) accrue mostly to the 1%+50-60% and in particular Southern property owning older landladies, and the lower wages and higher unemployment hit mostly Northern males especially if younger, but since the hit to the latter is smaller than the benefits to the former the “economy” gets boosted.

And it is all because the amounts of money involved are GIGANTIC… My usual “money shot” quote:

http://www.bbc.co.uk/news/business-19288208

«In 2001, the average price of a house was £121,769 and the average salary was £16,557, according to the National Housing Federation. A decade on, the typical price of a property is 94% higher at £236,518, while average wages are up 29% to £21,330»

That’s an average between the North and the South, and it does not really apply to the North.

But even it taking it as it is, that means £12,000 a year for a decade of tax-free effort-free income for a working class family in the South earning around £16,000 after tax.

£12,000 a year of tax-free effort-free windfall is GIGANTIC, especially if it recurs every year for 10 years as per the above numbers; and actually it has been going on for 20-30 years. And for the millions of people with a house in London it has been even bigger than in the rest of the South.

Do people really realize what an extra £12,000 a year of (purely redistributive rentier) windfall going on for decades can mean on top of an earned after tax income of £16,000? For millions if not a dozen million families?

Do readers here realize what that means to “aspirational” Southern voters and what they are prepared to vote for to keep it coming?

Also that these people are “right-wing” is not quite right, those voters are rather socialist and left-wing when it comes to their own civil rights and their own incomes, just like the traders and executives in the City and in business. They want a big-state for me, but a small-state for thee. They are ferociously right-wing when it comes to the civil rights and incomes of “scroungers” and “nasties”, Northerners and men.

Also because a large chunk of South East property owning middle aged and older landladies are baby boomers who grew very liberated during the 60-70s and a lot of them got rid of their husbands one or more times. They are both Thatcherite and “socially/sexually liberal”, so not a mixed situation.

Relevantly Cameron owes a large part of his being leader of the Conservatives to his targeting that constituency. For example, why ever did he work so hard for the rights of queers, despite the reluctance of his party? They are a small minority of voters. I guess that it was a dog whistle to liberated, socially progressive but economically and politically conservative baby boomer landladies.

«Normally, I’d expect the “swing voters” in any country to be in the (local) centre, between the left-wing loyal voters and the right-wing loyal voters…»

Not quite here, in part because as quoted above «This makes it imperative that, in government, the Tories move the centre to the right» and that mission was accomplished by Thatcher and Blair.

But in part because “left” and “right” are not merely ideological positions, they are also heavily ethnical/regional and sex based, especially in countries like the UK, the USA and Australia where parties are strongly segmented by ethnicity and sex.

A bit (actually a lot) like Rangers and Celtic…

Also in part because I have come to think that “right” and “left” don’t exactly overlap with “sell-side” (speculators) and “buy-side” (producers).

Looking at maps of politics and culture and other statistics, in the UK:

* The North, of whatever income and social class, don’t vote Conservative. A little mentioned fact is that Conservative policy did not just pauperize the Northern working class that was already in trouble, but also smashed the Northern middle and professional classes, and they are not going to forget that. The North know that the Conservatives see them as tribal enemies.

* The South upper and professional classes (the top 10-30% by income) just won’t vote progressive (they will vote New Labour, which is little “t” one-nation tory, as long as they deliver property capital gains).

* The genius of Thatcher (or perhaps her advisors) was to figure out that the Southern middle income classes were willing to swing for the right price, and then to bribe them with enormous discounts on the sale of state property and the promise of squeezing the “living-in-luxury” poor until the pips squeak with ever higher property prices and rents and the immigration of cheaper workers from very poor countries. The genius of Blair was to do the same, but less viciously.

Put another way, swing voters vote their “book”, they don’t much care about “left” and “right”; other voters vote “tribally”, vote their “traditional identities”, especially men.

Latest: “CEO pay increased some 2.25 times faster than GDP” between 2002 and 2014 in the UK..

Classic case of delinking if you ask me – clearly we need to introduce a formula based approach to ensure wage moderation and prevent wage push inflation.