In the annals of ruses used to provoke fear in the voting public about government…

When wages go up, we all benefit – what Starmer should have said

The British Labour Party leader (for now) Keir Starmer gave a – Keynote Speech – to the Annual Conference of the Confederation of British Industry in Birmingham on November 22, 2021. If you read it or heard it you will know that his leadership marks the return of British Labour as class traitors. He started by saying the “Labour is back in business”, which should have been ‘Labour is the agent of business’ He played up the line that Britain’s future depends on the business sector profits growing stronger than they are now and that everyone benefits when profits are high and growing. Even at the most elementary level that statement defies the evidence. But for a Labour leader to make it spells trouble for the Party. So what else is new.

Starmer fell into the neoliberal storyline easily – “our public finances are in a fragile state”.

What does that mean?

What would be a non-fragile state?

He emphasised Labour’s fiscal rules represent a “commitment to fiscal discipline”.

What does that mean?

Well, apparently it means Labour:

… will never spend money just for the sake of it … We really don’t think that the solution to every problem is to throw cash at it.

No government should spend money for the sake of it.

Fiscal policy has a purpose – to advance societal well-being.

That goal has many dimensions which are varied enough to ensure a rich diversity of spending initiatives are required in the face of a non-government sector that rarely desires to spend all its income in each period.

That state ensures that the government has to run a fiscal deficit on a continuous basis or drive the economy into recession.

I discussed that requirement in this blog post – The full employment fiscal deficit condition (April 13, 2011).

With Britain running an external deficit of around 1.5 per cent (or slightly more) of GDP, then the fiscal deficit has to be at least 1.5 per cent of GDP on an on-going basis for the private domestic sector to break even.

If the private domestic sector desires to save overall (and thus be able to reduce its high indebtedness) then the fiscal deficit has to be higher to finance that overall saving.

Fiscal discipline is working within these constraints to ensure that people have jobs and opportunities.

At the Labour Party Conference in September, the shadow Chancellor made these comments in her – Speech:

… we would put in place fiscal rules that will bind the next Labour government to ensure we always spend wisely and keep debt under control, so that we have the means to transform schools, hospitals and communities, and pay for investment in the new industries and jobs that our country desperately needs.

Notice the problem.

Labour thinks that fiscal rules provide the “means” for the British government to spend on necessary items.

How does that work?

How does a self-imposed rule – some spending ratio or another – stop the Bank of England crediting bank accounts on behalf of the Treasury?

And what does keeping “debt under control” mean other than stating the obvious – the issuance of debt by the British government is always under their control – they can do it or not.

How much they issue – is under their control.

What maturities they issue – under their control.

What yields they will pay – totally under their control via the Bank of England.

This sort of talk about debt going out of control leads to the ‘threshold industry’, where wannabee economists manipulate data to come up with levels of public debt beyond which the government risks insolvency.

We saw during the GFC where that led us – down the slippery slope of spreadsheet shenanigans – Rogoff/Reinhardt style.

The current Labour rules seem to be closely related to the – 2-17 Fiscal Credibility Rule – which was basically unworkable.

You can see my critiques of that idiocy in this blog post – The British Labour Fiscal Credibility rule – some further final comments (October 23, 2018) – which contains lots of links to the critique as I built it over time.

Note, just before the 2019 general election, they changed the Rule without any major announcements because they worked out I was right. It was inconsistent and unachievable in its entirety.

The morning before the Speech to the CBI, Starmer wrote an Op Ed piece for City.AM (November 22, 2021) – Political drama has served as a distraction from the crises facing British businesses – which served to define his agenda.

He played the “labour shortages” card, when there is growing evidence that there is less of a shortage than there is an unwillingness of some firms to pay reasonable wages after being able to suppress wages to low levels for years.

But then he claimed that Labour is:

… the party of business.

Not the party of workers, from which it gets its name.

But the party of business.

And then he claimed:

When business profits, we all do. And the role of government in supporting that is unquestionable.

Whether you take a macroeconomic perspective or a sectoral (micro) perspective, that assertion doesn’t appear to stack up with the facts.

It would have been better for a Labour leader to say ‘when wages go up, we all benefit’.

It all depends on what we mean by benefitting.

I consulted my databases.

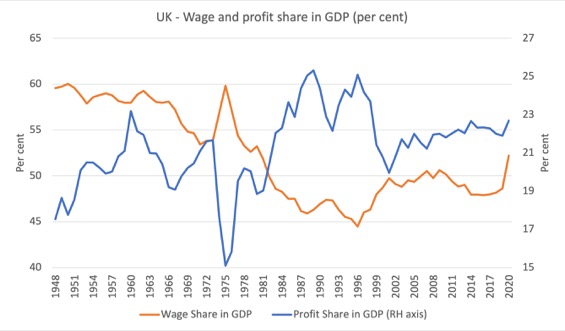

The following graph shows the evolution of the wage and profit shares in the UK from 1948 to 2020.

So the wage share is the total wages bill (from the Blue Book National Accounts) including wages and salaries and employer contributions as a percentage of nominal GDP.

The profit share is total corporate profits as a percentage of nominal GDP.

I have scaled the axis to get more spread in the lines in order to aid interpretation.

The cyclical patterns and the trends are important to distinguish.

It is clear that the profit share has been increasing while the wage share has fallen sharply over this period. That trend accelerated under the Callaghan Labour government (with Dennis Healey as Chancellor) when they turned Monetarist.

Margaret Thatcher’s government just continued that process.

There is no way you can conclude that during this period the increasing profits (in absolute and share terms) was good for everyone.

The vast majority of workers went backwards during this period.

Further, after 2002, the profit share started trending upwards again as the wage share fell.

On a micro scale, I recall reading a few months ago about the disaster that the privatised regional water authorities have become in England.

This UK Guardian article (July 9, 2021) – England’s water system: the last of the privatised monopolies – for now – reported that the water authorities have failed to protected the water system (leaking sewarage into rivers and killing animals), destroying local farming etc.

The authorities have wracked up massive debts which has been used to profit shareholders (via huge dividend payments) rather than “fix leaky pipes or treatment works”.

Over the same period (since privatisation):

… customers’ water bills have increased by 40% above the rate of inflation. It is the water users who have paid for upgrades to the network, such as they are, while shareholders walk off with cash paid for by higher debt.

On June 5, 2018, the GMB Union released the results of a study with Corporate Watch that are summarised in this press release – Water fat cats trouser £58 million as bills soar.

The results speak for themselves.

The bosses of the privatised water authorities banked big salaries and bonuses while wages growth for workers was tepid.

So at this level, Starmer’s claims are vapid.

I could dig into a number of micro examples that would show the same thing.

I was reminded of how dire the progressive narrative is in the UK when I read this article in the allegedly with-it media outlet The New Statesman (January 14, 2019) – Why 70 per cent tax rates would require capital controls.

People keep sending it to me with the message – see, if you MMTers have your way, the global financial markets will close Britain down.

They quote various so-called ‘Left’ characters in public life in Britain as authorities for that statement.

Starmer’s reasoning is consistent with the folly expressed in this article.

The article rehearsed all the anxieties that the Left are obsessed with in the UK, which has hampered the Labour Party since the mid-1970s, when Dennis Healey lied to the people and claimed the government had run out of money and had to borrow from the IMF.

The article, for example, uses the famous austerity turn by François Mitterrand in 1983 as an example of how global capital could successfully engage in economic blackmail of a sovereign government that issues its own currency.

I comprehensively demonstrated that was a false conclusion to draw in my book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015).

We provided more evidence in – Reclaiming the State: A Progressive Vision of Sovereignty for a Post-Neoliberal World (Pluto Books, September 2017).

There was no blackmail.

The Finance minister Delors had become obsessed with a ‘franc fort’ strategy as he embraced the Monetarist kool-aid. He convinced Mitterand that the only way forward for France was to act like Germany and become obsessed about ensuring the franc was strong, which would allow France to dominate moves to integrate further within Europe.

If the French government had have pulled out of the ERM at that time and told the financial markets to go jump, no austerity would have been required.

They wimped out because they had embraced neoliberalism and abandoned the Socialist path.

The real giveaway passage in the article – which really defines the demise of the British Labour Party as a collective voice for advancing workers’ well being is this one – it talks about increasing tax rates on the high income earners (and the same logic would apply to increasing the deficit to help workers):

… but any socialist government that attempted to do so would be punished severely by “the markets”.

This is why the Labour Party thinks it has to be the party of business.

I get this thrown at me all the time by British media people who interview me or by Labour Party hacks who attack my views.

They need to answer the question – how can the markets actually punish a sovereign government like the British government that floats its exchange rate and issues its own currency?

The proponents of this view point to events in the early 1990s leading up to Black Wednesday (September 16, 1992), which forced Britain out of the ERM after Soros and his thugs attacked the pound.

The problem with that example is that it does not apply to a flexible currency in foreign exchange markets.

Short-selling a currency that is fixed against other currencies and when the speculators know that the government is intent of protecting the parity is one thing.

But trying to do the same speculative strategy when the currency floats and the government declines to intervene is a recipe for disaster for the short-sellers.

None of the proponents of this – ‘the City will kill the pound’ narrative – have been able to articulate exactly how that would happen.

The reality is that capital controls might as some points be required in extreme cases.

But long before that need arises, a sovereign government like in Britain has all the ammunition it needs to render speculative selling unprofitable.

Just ask the speculators who have lost billions trying to short the Japanese government 10-year bond over the last three decades.

There is not a lot of joy for any of them.

Conclusion

Until the British Labour Party breaks out of this mindset – that somehow they have to appease the business lobby, and, specifically, the financial gambling sector, they will come up with wrong-headed policies and risk electoral defeat.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Morning,

It is the same faces that pushed the drop in the £ after Brexit Bill and pushing the inflation mania now.

They say things like “punished severely by “the markets” and ” Money printing causes inflation” and ” pound slumps to 31 year low after Brexit vote” and ” trade deficit is we are living beyond our means” because voters have been house trained like little puppy dogs to sit when certain call signs are called. There’s a good boy.

The £ dropped from 1.6 to below 1.2 and did anything bad happen ?

Only in the minds of those selling vacuum cleaners door to door and luxury bubble bath and oils with their Kaldorian point of view. Just ask the Irish exporters to the UK and EU exporters to the UK who hurt the most and went bankrupt when the £ fell. I would call a drop from 1.6 to 1.2 a severe drop.

They only highlight the drop in the £ part and not the fact that all other currencies have suddenly got stronger against it. If you are a country that has decided to export your way to growth that is a problem for you. Just like when they only talk about the liability side of the deficit and not the asset side of the balance sheet.

Because we all only have a certain amount of disposable income every month after we get paid, after we have paid our taxes and bills and handed over even more to the economic rent seekers for what they charge for privatised public services. What happens when pass through inflation makes imports more expensive ?

We stop buying them that’s what happens. We stop buying imports in our monthly shop when they start getting expensive. We start buying cheaper alternatives or locally grown products instead. Which ends up being a good thing for the local economy.

So when we stop buying imports. The exporters to the UK had some really tough choices to make if they wanted to hold onto their market share. The market share they spent decades building up for themselves.

1. They can cut wages

2. Cut hours worked

3. Sack people

4. Like the Irish mushroom farmers go bankrupt.

5. Cut prices

6. A mixture of all 5.

It is the exporters who are put under pressure and we seen this first hand when the £ dropped. The Irish Times were screaming about it.

https://www.thetimes.co.uk/article/irish-exporters-feel-pain-of-sterling-slump-9km2l5ss7

Now if they pick option 5 and cut their prices. The floating exchange rate adjusts upwards and the £ becomes stronger. The UK government didn’t really need to do anything apart from wait on exporters to the UK to start cutting their prices as they fought to keep their market share.

Business know all of this the ruling class know all of this and is written right through the middle of the Australian white paper on full employment in 1945. They have known for 100’s of years how these things work.

The system is rigged and democracy is a complete and utter sham Bill. There is no intellectual debate to be had they know how it works. What needs to take place is bigger than any paradigm shift. Nothing short of revolt will be needed to get our democracy back.

“None of the proponents of this – ‘the City will kill the pound’ narrative – have been able to articulate exactly how that would happen.”

Yet we, of course, can articulate precisely why it wouldn’t, and have done just that: https://www.researchgate.net/publication/351764940_Modern_Monetary_Theory_the_United_Kingdom_and_Pound_Sterling

The British Labour Party is currently a waste of everybody’s time.

Excellent analysis of Labour’s betrayal. Non-wealthy people have been hit every which way. I’m assuming the big salaries and bonuses of the bosses are included in the wage share of GDP, while their dividends from shares are in the profits, so leaving even less for those lower down in the enterprise. Those able to grab that wealth, aided by the unregulated banks and govt. then screwed the housing market and supply of utilities to further squeeze the common man/woman. And further, ensure all the unearned income can be inherited by fortunate offspring. Except for the wealthy unfortunate enough to need social rather than NHS care, but now their wealth is protected too.

Just sent this to all the members of Labour Party Economy Business and Trade Commmission (including Shadow Chancellor). I didn’t bother to read through again to see if it’s likely to get me expelled;o)

This is just another version of the blairite antics, doomed to failure.

The traditional socialist parties have been collapsing all over Europe (and behond).

They all have been contaminated with oligarch’s money and they all have failed to serve the people who casted their vote on them.

Once they disappear (like the French socialist party), the money goes to create new parties, often the populist kind, many times even, far-right demagogues, trying to pluck the fruits of austerity, that they created.

A so-called socialist party, who has bretayed Workers, is a good culprit to point your finger on.

Hi Bill.

While Labour economics has been obviously flawed for years now, they are also unelectable because of other policies.

It often feels like, anything the conservative government can do, the labour party can do worse. For example, instead of being completely against vaccine passports, they say it needs to be “fairer” by including people that have already had SARS Cov 2 (anti-bodies). To me this is not “fairer” when the option to participate in society is either economic duress or catching a disease.

I am reminded of Isaiah Berlin. He believed that nothing could be more worse than a person being forced to do something under the guise of freedom to the point that the person believes they are acting freely.

I suppose my point is less about Vax passports, rather, Labour provides no meaningful opposition. Its like the left leave all over again, very few of the labour party against the wrongheadedness of current politicks.

@ Carol Wilcox I suspect the Labour Party Commission members will do as Harold Wilson did to Tony Benn’s industrial strategy i.e. dismiss without reading. Though one of them may be tasked with reviewing for any views that could be used as an excuse to expel – criticism of fiscal rules or Israel for instance.

Meanwhile in Australia… actually Jim Chalmers (shadow treasurer) wasn’t too bad yesterday. He even said out loud “In election campaigns, the focus has been on the difference in levels of spending, not the quality of spending”! (though the SMH “economics” reporters helpfully added that the “…pandemic has left the federal budget mired in the red…”).

I do question their strategy though, pitching for the shrinking middle class and repeating that awful focus-tested phrase “working families” (get me a bucket). He even says that the middle class is down to 58% of the population and shrinking. Do they think they are going to win 70% of the same shrinking demographic that the Libs/Tories are targeting, and just abandon the working class to the lunatics?

Sounds like a strategy to sleep their way to the middle.

Instead of narrowcasting to “working families” (retch), why not build a larger constituency of all the Aussies who have been economically exploited for a decade? (actually decades but the government has been there 10y so…). Maybe paint the picture by appealing to all the small businesses being squeezed between suppliers and landlords, all the professionals working so hard they don’t have time for a life, all the workers who haven’t had a decent pay rise for a decade. Or something.

Anyway @Carol Wilcox you can always come to The Greens if Labour are too far gone. We are actually having an internal debate on a Jobs Guarantee! (cant say “MMT” as we are still too afraid of being made to look like economic nincompoops – by the likes of the SMH “economics” reporters!)

@Patrick B, I’m a rep – we’re not all bad. Most of the ordinary members like me are left-wingers. Membership includes some left trade unionists – they’re worth trying to influence. I also sent to a TUC officer and some from my Unite branch. Last time we met I asked Reeves if she had read Deficit Myth. I’m still expecting a response from her PA to my request for a promised meeting.

It’s these sort of opportunities, and membership of good Labour-only groups such as Labour CND which stops me from resigning. I’m not high enough profile to be kicked out … yet. I know so many good people who have:-(

Jeremy Corbyn for PM.

@Carol Wilcox. Keep at it, Carol. Some of us in the UK LP are with you and trying to help spread the knowledge. Copernicus won in the end.

Kier Starmer would be good as a manager of the system but is clearly not a visionary.

Jeremy Corbyn didn’t have a strategy to bring people together.

Unless or until labour/politicians move away from the Overton Window, nothing will change.

The money system is politicised with politician dishing out favours based on their ideology.

An obvious observation is that Neo-liberalism will keep on winning and that started under Thatcher ably supported by Blair and Brown.

No vision = no hope for whoever decides to vote.

Labour do need a visionary leader, the trouble is they are never going to get one unless they innovate and challenge the status quo.

Innovation is often needed but always seen as too radical.

Me – I’m not going to vote for any of these monkeys!

“The rule of the rich,” in one form or another, has been all that humankind has known since we evolved from the hunter/gatherer tribe and early agrarian village. So said Edward Bellamy in the late 19th Century and things haven’t changed but gotten worse. Truth be told, we’ve been relentlessly conditioned over millennia to fear our overlords, a deeply ingrained, almost instinctive fear not easily overcome. Note the terror and abject submission in this single quote: “if you MMTers have your way, the global financial markets will close Britain down.” Bill and other MMTers can brush off this threat, knowing better because they’ve freed their minds and summoned their courage. As for most of the rest of us, we quiver in our boots when we hear words like these and beg to continue licking the boots of our overlords. THAT is what MMT is up against–far, far, more than the challenge of winning an intellectual argument.

https://twitter.com/jon_trickett at 53:50 Jon Trickett (was in Jeremy Corbyn’s front bench and is a friend and my MP) in this webinar: ‘The Nature of Wealth in Britain’ answers my Q in the chat: ‘I wonder what the panel thinks about the school of thought that emphasises tax as important to curb (abolish) the power of the rich whilst emphasising that governments with their own sovereign currency do not NEED the money of the rich to enable them (the government) to spend. This distinction is considered by them to be of vital importance. I know Prof Sikka did touch on this. Joe Guinan mentioned new wealth?’ I report this as I interpreted Jon’s answer as not hostile ie I think he is probably already there.

@Michael Galvin

IMO almost everyone misses the point that one purpose of taxes and the Gov. is to take money from the rich and give it to the poor.

This is necessary because money rises in the economy as it circulates until it reaches the top earners. It will accumulate there unless there is something in the culture that sends it back down to the bottom earners.

The rich may hate ‘redistribution’, but it is necessary. Without it, there can be no equilibrium in an economy. Capitalist economies are not like the gas in a jar. The heat in the jar spreads until the air is all at the same temp. However, money in an economy moves toward the richest part and accumulates there. This continues until the ‘temp’ there is so high is causes a revolution.

Prof. Mark Blyth says that in the US’s Golden Age of the 50s and 60s the rich felt they were not getting enough, because Unions had too much power. In the early 70s the rich stopped investing and this caused a drop in the growth in production, and this created a shortage of stuff. This cause inflation to start. Other factors were spending on the Vietnam War, and OPEC raising the price of oil a lot twice. The result was stagflation.

This caused neo-liberalism to win over the minds of economists.

You can see that Union power is what was taking money from the rich and sending it to the workers. There was also a 77% top bracket tax rate.

Neo-liberalism swept away both of these ways to redistribute money from the rich to the poor and workers. The result 40 years later is the rich have all the wealth and the workers have seen a slow drop in real wages for 40 years (if an accurate CPI was used to make the wages ‘real’).

So, not only do we want to tax the rich to take away their power, we want to tax the rich so that their share of the wealth remains constant. We must do this because if their share always grows (no matter how slowly), someday the poor will make a revolution against their poverty.

The rich can and must be content with competing within their own group for part of the money that Gov. deficit spending adds to the economy each year. The rich must allow all to prosper.

Recently I realized that nation’s economies are like a sports league. Leagues often have drafts of new talent to see that winning teams do not use their wealth to hire all of the best new talent, which makes them dynasties, like the NY Yankees of the 20s.

In the same way, nations must redistribute wealth from the rich down to the bottom so it can again start to rise in the economy giving buying power to each level as it rises toward the top.

The rich must be content with $1M/yr in after tax income. They must *not* use their power to impoverish some part of the economy in their race to accumulate more and more wealth and income.

“The rich may hate ‘redistribution’, but it is necessary. Without it, there can be no equilibrium in an economy. Capitalist economies are not like the gas in a jar. The heat in the jar spreads until the air is all at the same temp. However, money in an economy moves toward the richest part and accumulates there. This continues until the ‘temp’ there is so high is causes a revolution.”

That belief is the problem with the left. They can’t get their head around the fact that there isn’t a fixed amount of money and they are all ‘feel gooders’ who like to value signal to each other about how Robin Hood they are.

There is never a revolution. It is a leftist fantasy. But it is a founding fantasy that they can’t get beyond.

When you can continually supply heat to the bottom, it no longer matters how hot the top gets. And that’s because their excess saving acts exactly like taxation – it eliminates monetary spending in the economy. So you no longer need to tax elsewhere.

The left overtax, and they want to continue as the middlemen shuffling tax from the top to the bottom. Why? Because it gives ‘feel gooder’ lefties control over the income flow, a job as middlemen and they can direct it to their favoured projects.

In that sense they are no different from the finance and bankers on the right who insert themselves as middlemen to direct the spending flow to their favoured projects.

MMT shows that neither lefties with a fetish for Lincoln Green, nor bankers and bond traders are required. And they hate that.

It’s not the redistribution we need to be concerned about. It is eliminating the middle class middlemen – of the left and right varieties. Both are a pox on society, both keep the poor in servitude, both deliberately stop the root cause of societal problems being solved just to maintain their own worthless jobs.

@Neil Wilson re: ‘When you can continually supply heat to the bottom, it no longer matters how hot the top gets. And that’s because their excess saving acts exactly like taxation’. I agree with you in part, that transferring the £s of set-aside savings to the extinguished through taxation record, makes no difference to the economy, but the problem remains that the excessive spending power of the wealthy, with those savings backing it and reducing risk, distorts the market, particularly for land but also for other goods, with resources diverted to satisfying the luxury market.

@Neil Wilson,

With all due respect, in the US and maybe all advanced nations. Gov. deficit spending mostly goes directly into the pockets of the rich and the corps they own.

Another big chunk goes into the pockets of the well of but not rich.

Rather little goes directly into the pockets of the workers or poor.

In the US the rich can buy politicians with pocket change,

This can’t be stopped because the USSC says so.

And anyway the rich already own Congress, and they have a few moles in the Progressive wing of the Dems who will block any meaningful legislation.

If i understood you correctly, you said there has never been a revolution by the people in western history. I’ve seen the French Rev. Also a bunch around 1990 that threw the Communists out of many Eastern European nations. Maybe the American Rev. can be included. Then, there were the Rev. in South and Central America. And Cuba, the Caribbean, etc.

Why do you claim such rev. have never happened?

Why do you accuse me of virtue signaling, when you have no idea if that is true?

In fact, I have no desire to be wealthy. I spent my whole adult life living small, because the Club of Rome Report said we all have to do our bit. I could not convince many to do the same. Just recently millions more have groked what I have know for 50 years.

You need to stop attacking your allies in the fight.

.

@Neil, I agree with almost all you say. I’ve been escoriated for challenging the Lincoln Green fetishists long before I ‘got’ MMT. But as a leftie I’m in favour of abolishing all taxes on earned income and elimating as much economic rent as possible via taxation. I don’t consider that overtaxing.

@Carol Wilcox Taxation needs to be thought of and then redone in a completely different way. Away from earned income as you say, on unearned income and on environmental harm. Should be popular.

Dear Bill

I sent this to members of the Labour Party Economy Business and Trade Commission and today received this response from one of them:

” I would be very interested to see the data behind the chart. (I struggle a bit with Blue Book data.) I don’t understand why the wage share and the profit share sum to less than 100%. Where does the rest go?”

I’d be grateful if you could give a response.

Carol

Dear Carol Wilcox (at 2021/11/30 at 8:51 pm)

The government takes a share in the form of taxes, which are usually netted out when calculating the wage and profit share. That is why they do not sum to 100 per cent in this case.

best wishes

bill