Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Wages growth in Australia goes from terrible to bad as real wage cuts continue

Today (November 17, 2021), the ABS released the latest – Wage Price Index, Australia – for the September-quarter 2021. The WPI data shows that nominal wages growth rose above levels recorded in previous quarters and the pattern resembled the pre-pandemic growth path – low to modest. The inflation rate continues to outstrip nominal wages growth, which means that workers in all sectors bar ‘Professional, scientific and technical services’ experienced on-going cuts drops in their real wages (purchasing power). The behaviour of nominal wages in Australia gives us a clear signal that there is little prospect of sustained inflationary pressures emerging from the labour market any time soon. Wages in the public sector grew by only 1.6 per cent over the 12 months as a result of the ridiculous wage freezes and wage caps that the federal and state governments are imposing. There can be no sustained recovery for the economy post Covid without a significant shift in the way we think about wages growth.

The Wage Price Index:

… measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics

Thus, it is a cleaner measure of wage movements than say average weekly earnings which can be influenced by compositional shifts.

The summary results (seasonally adjusted) for the September-quarter 2021 were:

| Measure | Quarterly (per cent) | Annual (per cent) |

| Private hourly wages | 0.6 | 2.4 |

| Public hourly wages | 0.5 | 1.7 |

| Total hourly wages | 0.6 | 2.2 |

| Basic CPI measure | 0.8 | 3.0 |

| Weighted median inflation | 0.5 | 2.1 |

| Trimmed mean inflation | 0.5 | 2.1 |

On price inflation measures, please read my blog post – Inflation benign in Australia with plenty of scope for fiscal expansion (April 22, 2015) – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

What the ABS said:

The ABS Media Release – said that:

The … Wage Price Index (WPI) rose 0.4 per cent in September quarter 2021 with the annual growth rate of 2.2 per cent …

This release of WPI shows the return of a more regular September quarter pattern of wage growth, following the labour market disruptions through 2020 and 2021

Wage and salary reviews around the end of the financial year, scheduled enterprise agreements and annual award rises all contributed to growth. Pockets of wage pressure continued to build for skilled construction-related, technical and business services roles, leading to larger ad hoc rises as businesses looked to retain experienced staff and attract new staff.

So, in some instances, firms are using price inducements to retain skilled staff and attract new employees.

Real wage trends in Australia

The summary data in the table above confirm that the plight of wage earners continues in Australia.

Real wages fell in the September-quarter in both the private sector but public sector after a period of low growth.

It is clear that the public sector wage caps (state and federal) have created an environment where private sector wage rises are being constrained, independently of the state of the private labour market.

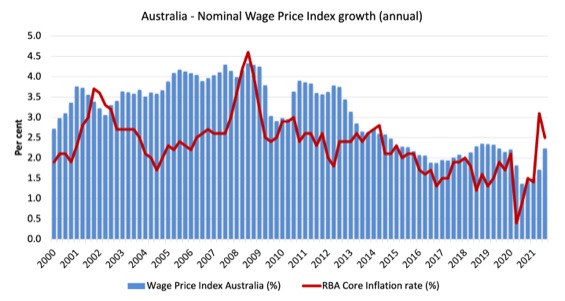

The first graph shows the overall annual growth in the Wage Price Index (public and private) since the December-quarter 2000 (the series was first published in the December-quarter 1997) and the RBA’s core annual inflation rate (red line).

The blue bar area above the red line indicate real wages growth and below the opposite.

In the September-quarter, there was some sign of better wages growth while the inflation rate eased as the temporary factors abated.

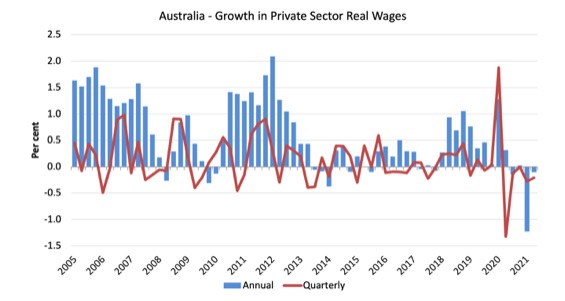

The next graph shows the growth in private sector real wages since the September-quarter 2005 to the September-quarter 2021. The core inflation rate is used to deflate the nominal wages growth.

The blue bars are the annual rate of change, while the red line is the quarterly rate of change.

The fluctuation between the June- and September-quarters 2020 is an outlier created by the temporary government decision to offer free child care for the September-quarter which was rescinded in the September-quarter.

Overall, the record since 2013 has been appalling.

Throughout 2017 and into 2018, real wages growth was negative. But then there were several quarters of modest real wages growth. The trend, however, is towards zero real wages growth.

The sharp spike downwards in the June-quarter 2021 is the result of very moderate nominal wages growth combined with a transitory surge in the CPI inflation rate.

So it is interesting that the ABS think this is a return to the ‘norm’ – which just means the norm is pretty awful.

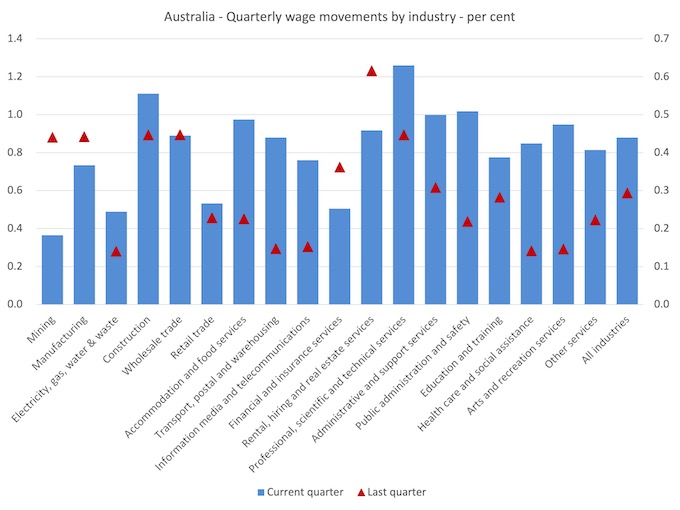

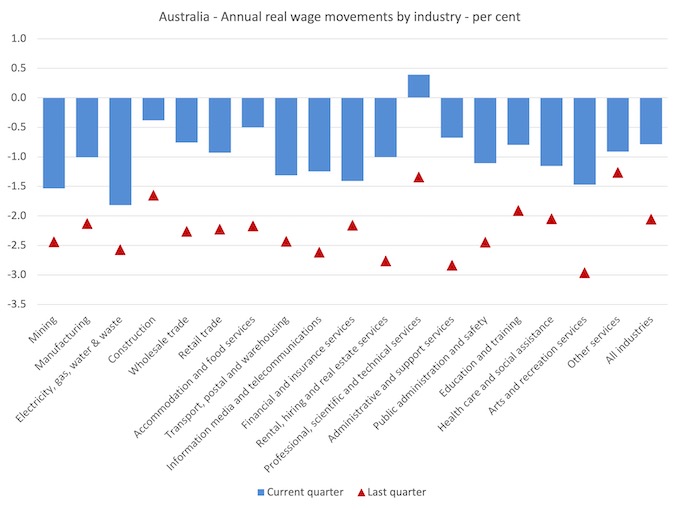

The aggregate data shown above hides quite a significant disparity in quarterly wage movements at the sectoral level, which are depicted in the next graph.

The blue bars are the current quarterly change, while the red triangles are the previous quarterly change.

Sectoral Variability

The aggregate data shown above hides quite a significant disparity in quarterly wage movements at the sectoral level, which are depicted in the next graph.

The blue bars are the current quarterly change, while the red triangles are the previous quarterly change.

The ABS also reported that:

- Professional, scientific and technical services recorded the largest quarterly rise of any industry of 1.3%. The annual rate of growth of 3.4% for this industry was both the highest across all industries in the quarter and the highest for this industry since December quarter 2012.

- Mining recorded the lowest quarterly rise of 0.4%.

- Electricity, gas, water and waste services recorded the lowest through the year rise of 1.2%, the slowest rate since the commencement of the series.

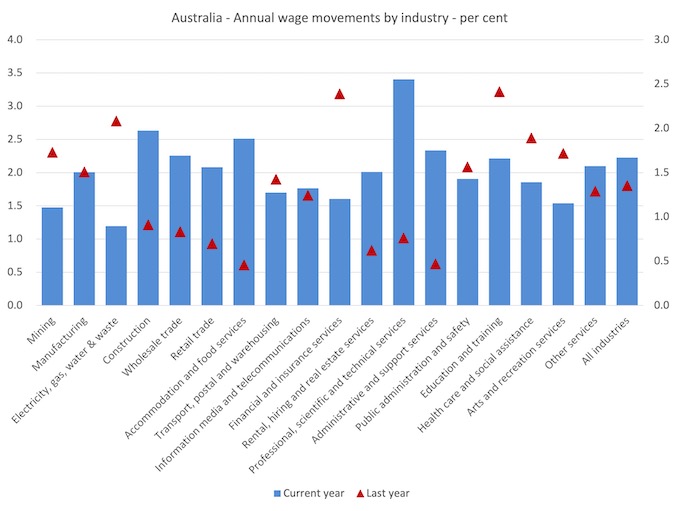

If we consider the situation over the last year, then we can see from the following graph that growth in 15 of the 18 sectors has gone backwards.

Overall, growth is now around the same as it was a year ago.

While nominal wages growth was mostly positive, albeit modest, the next graph shows the movements in real wages and you can see that there is huge disparity in the outcomes across sectors and shifts in fortunes across the quarters.

But, even with the disparity noted, real wages fell in all but one sector.

Workers not sharing in productivity growth

The Non-farm GDP per hour data (productivity) is derived from the quarterly National Accounts and available via the RBA Table H2 Labour Costs and Productivity.

The ABS Information Note: Gross Domestic Product Per Hour Worked – says that:

In Australian National Accounts: National Income, Expenditure and Product (cat. no. 5206.0) and Australian System of National Accounts (cat. no. 5204.0) the term ‘GDP per hour worked’ (and similar terminology for the industry statistics) is generally used in preference to ‘labour productivity’ because:

– the term is more self-explanatory; and

– the measure does not attribute change in GDP to specific factors of production.

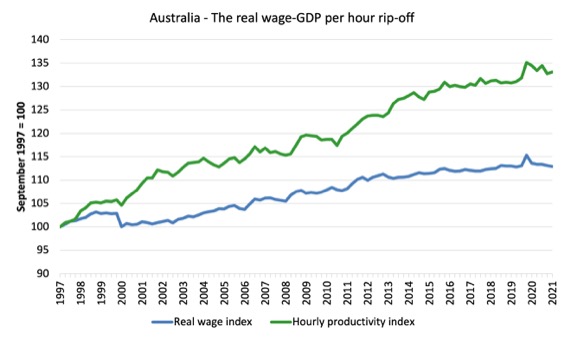

While real wages growth means that the rate of growth in nominal wages is outstripping the inflation rate, another relationship that is important is the relative growth of real wages and productivity.

Historically (for periods which data is available), rising productivity growth was shared out to workers in the form of improvements in real living standards.

In effect, productivity growth provides the ‘space’ for nominal wages to growth without promoting cost-push inflationary pressures.

There is also an equity construct that is important – if real wages are keeping pace with productivity growth then the share of wages in national income remains constant.

Further, higher rates of spending driven by the real wages growth then spawned new activity and jobs, which absorbed the workers lost to the productivity growth elsewhere in the economy.

Taking a longer view, the following graph shows the total hourly rates of pay in the private sector in real terms (deflated with the CPI) (blue line) from the inception of the Wage Price Index (December-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the September-quarter 2021.

It doesn’t make much difference which deflator is used to adjust the nominal hourly WPI series. Nor does it matter much if we used the national accounts measure of wages.

But, over the time shown, the real hourly wage index has grown by only 12.9 per cent, while the hourly productivity index has grown by 33.1 per cent.

So not only has real wages growth been somewhat flat for some years, the gap between real wages growth and productivity growth continues to widen.

If I started the index in the early 1980s, when the gap between the two really started to open up, the gap would be much greater. Data discontinuities however prevent a concise graph of this type being provided at this stage.

For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog post – Australia – stagnant wages growth continues (August 17, 2016).

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

Answer: Mostly to profits.

The next graph shows the gap between the real wage index and the labour productivity index in points.

It provides an estimate of the cumulative redistribution of income to profits as a result of real wage suppression.

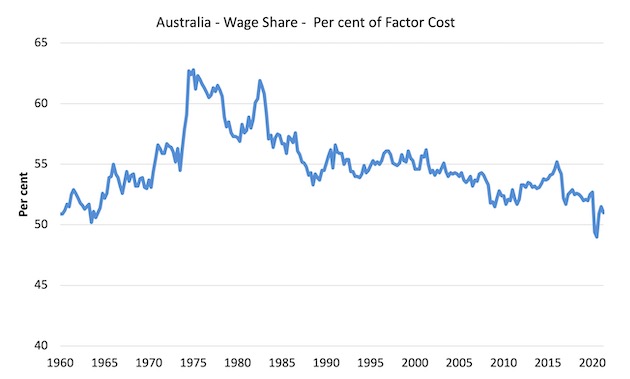

Now, if you think the analysis is skewed because I used GDP per hour worked (a very clean measure from the national accounts), which is not exactly the same measure as labour productivity, then consider the next graph.

It shows the movements in the wage share in GDP (at factor cost) since the September-quarter 1960 to the June-quarter 2021 (latest data).

While the series moves around from quarter to quarter, the trend is obvious.

The only way that the wage share can fall like this, systematically, over time, is if there has been a redistribution of national income away from labour.

I considered these questions in a more detailed way in this blog post series:

1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1 (November 20, 2019).

2. 1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 2 (November 21, 2019).

And the only way that can occur is if the growth in real wages is lower than the growth in labour productivity.

That has clearly been the case since the late 1980s. In the September-quarter 1991, the wage share was 56.6 per cent and the profit share was 22.2 per cent.

By the September-quarter 2021, the wage share had fallen to 51 per cent and the profit share risen to 30.4 per cent.

There has been a massive redistribution of income towards profits has occurred over the last 40 years.

The relationship between real wages and productivity growth also has bearing on the balance sheets of households.

One of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations.

The suppression of real wages growth has been a deliberate strategy of business firms, exploiting the entrenched unemployment and rising underemployment over the last two or three decades.

The aspirations of capital have been aided and abetted by a sequence of ‘pro-business’ governments who have introduced harsh industrial relations legislation to reduce the trade unions’ ability to achieve wage gains for their members. The casualisation of the labour market has also contributed to the suppression.

The so-called ‘free trade’ agreements have also contributed to this trend.

I consider the implications of that dynamic in this blog post – The origins of the economic crisis (February 16, 2009).

As you will see, I argue that without fundamental change in the way governments approach wage determination, the world economies will remain prone to crises.

In summary, the substantial redistribution of national income towards capital over the last 30 years has undermined the capacity of households to maintain consumption growth without recourse to debt.

One of the reasons that household debt levels are now at record levels is that real wages have lagged behind productivity growth and households have resorted to increased credit to maintain their consumption levels, a trend exacerbated by the financial deregulation and lax oversight of the financial sector.

Real wages growth and employment

The standard mainstream argument is that unemployment is a result of excessive real wages and moderating real wages should drive stronger employment growth.

As Keynes and many others have shown – wages have two aspects:

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

I usually publish a cross-plot that consistently shows no relationship between annual growth in real wages and the quarterly change in total employment over a long period.

The graph has issues at present due to Covid-19 outliers, although the conclusion doesn’t change.

There is also strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity. That evidence supports the positive relationship between real wages growth and employment growth.

Conclusion

In the September-quarter 2021, Australia’s wage growth rose above levels recorded in previous quarters and the pattern resembled the pre-pandemic growth path – low to modest.

There can be no sustained recovery for the economy post Covid without a significant shift in the way we think about wages growth.

There can also not be any sustained acceleration in the inflation rate while wages growth is at these levels.

The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure.

The problem is that the federal government supports wage suppression because that attracts funding for the conservatives from the corporate lobbies which help them stay in power.

It is a pretty bleak outlook for workers.

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

Here in the UK, any outside prospect of real wages growth causes panic and calls for higher interest rates. The BBC had an expert from JP Morgan on just the other day to say so.

Excellent Bill,

Yesterday’s piece and Today’s article all fits like a jigsaw puzzle. It is so easy to create a fairy tale world when the mainstream deliberately leave out pieces of the puzzle. Then back fit and introduce imaginary lags over a certain time frame that fits what political narrative and framing they are trying to get across. Using the Kaldorian view of exchange rates that just make matters worse.

For me that it what the economics profession has become, an advertising agency that sells a business product for business. That’s where the money is and economists have become door to door salesmen of vacuum cleaners and luxury bubble bath and oils. Bursting with crystallised salt rocks from the bottom of the Pacific Ocean with the lava from an overflowing volcano on Java with a tea tree and Jasmine fusion sales techniques.

The last 2 articles yesterday’s and Today’s is why I left The Scottish independence movement.

The left and right across the UK are so divided all critical thought goes out of the window. Everybody are selling things they all have become salesmen and women on twitter selling luxury bubble bath and oils.

If you were a remainer or support Scottish independence then the empty shelves are Because of Brexit even though large parts of the country are still working at home or self isolating. Critical thought and facts do not matter. The only thing that matters to these people are Scottish independence and the Brexit result is reversed. They don’t even care if they are being truthful or not it has gone way past.

They are even attacking the increased wages workers are now getting and screaming for free movement of people to be reintroduced. Now Support the flow of cheap labour as long as the polls move towards independence or reversing Brexit. To try and move the left now openly support the following.

Business advertises for a person to work very long hours for a pittance, nobody applies for it.

Business goes running to nanny shouting ‘skill shortage’ and demands visas. Government gives in to business because businesses are treated like pets, not cattle. The job is advertised abroad foreign nations, exporting their people like cargo, welcome the visas and encourage people to leave rather than sort the social problems out at home.

So the elite class in both countries get what they want.

The poor country gets rid of their poor unskilled workers that are competing for what little resources there are and who may send some foreign currency back which the elites can appropriate through taxes, financial discounting or even occasionally producing goods for people.

The rich country gets cheap labour that will stack high in tenement blocks and work all hours for a lower wage. The elite cream off the surplus and socialise the losses onto the school system, the health system and the social services who then advertise for people to expand and find that there aren’t any skilled staff to work in those areas. The public sector then asks for visas, advertises abroad…the cycle feeds on itself.

What you get, in effect, is the same process at a country level that we had initially in the industrial revolution at a city level. 1840s Manchester followed the same process, but with the surrounding rural areas rather than areas thousands of miles away in a different country. Birmingham, Glasgow and others followed the same process. It will end up in the same way it always does - the rich living in gated wonderlands while the poor live in slums squashed in like sardines.

It’s not just at the low level this process happens. Agriculture is notorious for it, but it also happens in IT. The larger firms put pressure on the government to let them import ‘skilled staff’ just as soon as the local workers develop any pricing power.

In reality they just want to pay less, and the prevailing economic orthodoxy uses a ‘reserve army of the unemployed’ to keep wages under control. In their belief system, inflation control has to be done on the labour side of the equation, never on the capital side. That why we have concepts like NAIRU, but never a NAIRC (non-accelerating inflation rate of competition).

Let’s see how long Scottish farmers keep growing a crop that can’t be picked when Nanny turns around and says no visas will be provided. A crop that is in excess anyway and is exported away for other countries to consume. Invest and produce machines that do the job or change the crop. Compete or go out of business time to decide instead of being propped up by cheap labour. You are there to produce if not step out of the way and give the land to somebody who can.

Then out of the other side of their mouths these people support the job guarentee. Speaking out of both sides of their mouths but saying different things. It has been like that ever since day one. I wouldn’t trust them to put my bins out or take my granny to the bingo.

When you look at a country with a different approach - Japan - you find, that even with a declining population and GDP relatively static overall, the GDP per capita is rising. That’s because they are automating and treating their elderly with respect. Fast food places are closing because they can’t get the staff. People get their cars washed by machines and their coffee from machines. All that drives forward productivity which then maintains and improves the standard of living - because they have to.

It’s not all perfect. The Japanese elite are gripped with neoliberalism like everywhere else. There is unnecessary unemployment and unhappiness. There are strong pushes for more ‘guest workers’. But the language, writing barrier and general culture stops them throwing open the doors. They have developed a different way for an island nation to bumble along relatively happily but with a net migration rate of about zero.

When you read any of the immigration literature put out by economists have a look and see if you can find Japan mentioned. You won’t find them in there - because it doesn’t fit the prevailing narrative.

Yet, use Japan on other occasions when it suits them. When they try to move the polls for their own vested interests.

The reason why these people are not consistent in their views is because if they were consistent and used the MMT lens to tell the truth. Then they would have been leavers and supported Brexit. In favour of a skills based immigration policy instead of an open the gates policy they support on social media. Simply refuse to support the liberal world order as it currently stands and what the SNP stand for.

I said it all fits like a jigsaw puzzle Bill and each piece has its place. These people remove pieces from the puzzle for political purposes when it suits them. They are selling bubble bath. That is exactly why you see them jumping from one economist or MMT economist to another.

Monday it is Richard Murphy the next day it is Stephanie Kelton and on Thursdays it is Mark Blyth and over the weekend it is Dirk Ehnts. It all depends what piece of the jigsaw the economists are holding on that day and they jump on the bandwagon if it suits their political cause.

It hasn’t worked and it never will work. After years of pimping themselves around like that the polls haven’t moved. Brexit support is as strong as ever and Scotland remaining part of the UK has not lost any support. How many times does the Tories have to win before they get the message ? How many times do they have to face defeat before they are forced to become the genuine article ? Speak with one mouth and one voice instead of forked tongue.

They should give up and start selling vacuum cleaners. Or join the conservatives because all they have done on every occasion is increase the conservatives share of the vote.

Let everybody in and open the borders and provide everybody with a basic income they cry ……….

Basic income, open borders, growth commission, attack wage increases and the liberal left wonder why they are losing and keep on losing. Productivity isn’t even in their vocabulary apart from the terminator ‘s are coming to steal the middle class metropolitan elite luxury lifestyle from them that they’ve become accustomed to by standing on the throats of the working class.

Gidday Professor Mitchell. I’m slowly learning what makes the world go round, in an economic sense.

Your blog yesterday and today disclose the disservice done to Australian democracy when Our ABC collaborates with the mainstream press with the propagation of the economic garbage preferred by the financial community.

Yesterday, there was further debate on the ABC regarding unemployment, wage rises and around the importation of the current American problem of employees quitting.

These so-called “debates”, always involve a mainstream economics journalist, generally from either the Murdoch, or Nine News services or an economist from one of the banks, trading organisations, or some think tank.

The current “debate” revolves around the inevitability of wage rises creating inflation and necessitating RBA intervention with interest rate rises.

It seems to me that in all the debates about the economy and employment, the working class is never represented. We are subjected to the problems of “The Market” which in current discussion concerns the stock exchange and the opinions of a few either biased or ill-informed commentators.

What can be done to motivate change at Our ABC In the interests of democracy?

I’m getting old now and maybe I’ve waded too deep in “bitter creek” but the way I see it as follows. This is the short version and I won’t pull punches. I am talking about the era 1975 to the present day.

Capital has defeated labor. Labor capitulated. People were too gutless to strike properly and extensively. The labor party and many comfortable labor officials became class traitors. Capital outsmarted labor at every turn. Capital used the political-economic weapons of wedge politics, selective compensation, obfuscation, propaganda, capturing government, capturing legislation and global labor arbitrage. That is the short list. The overall methods included monetarism, neoliberalism, market fundamentalism, privatisation, globalisation, trade policy and legalism including in the investor state disputes settlement space.

We have to “Reclaim the State” as many, including Bill Mitchell and Thomas Fazi, say. The state currently belongs to the capitalists. They own it, almost literally. They pay for the politicians (election processes, advertising and other propaganda) and for the legislation itself. Of course, what has happened, what is happening and what will likely happen unless the state is reclaimed by the people, does fill and will fill books. I won’t try to write any more in this post.

@Derek: “The poor country gets rid of their poor unskilled workers”. The poor country also loses its highly skilled workers – that’s the tragedy.

Seen yesterday on Twitter: “Universal basic income could become a reality in South Korea under a presidential candidate who once likened himself to Bernie Sanders”. I had intended to respond, but I just lost the tweet. I got very concerned when I read in the Morning Star a few weeks ago that Welsh First Minister Mark Drakeford (who’s a good bloke) was going to pilot UBI. Turns out it’s nothing of the sort. I really shouldn’t waste any more time on it because it’s just never going to happen.

@Ikonoclast re: . ‘Labor capitulated. People were too gutless to strike properly and extensively. The labor party and many comfortable labor officials became class traitors.’ My thought, with regard to the UK, labour, Labour Party: it doesn’t help that people here are indoctrinated to be essentially conservative, and piled high with debt, but it is extremely difficult to overturn the power of the state, maybe more so a modern capitalist one. The overthrow of Eastern European stalinist dictatorships was extraordinary, but they were states particularly propped up by an outside power. The Chinese dictatorship has killed millions of its own people, yet hasn’t looked at risk (though every dynasty has eventually fallen). In the UK, the miners, not well led, certainly weren’t gutless, but were crushed by police and stockpiles of coal, and that was just for not wanting to be thrown on the scrapheap overnight. The Labour Party’s treachery has become ever more evident.

@Carol Wilcox. I would very much hope the Welsh First Minister, dependent on the UK govt. wouldn’t go anywhere near UBI. And why would the Morning Star be going anywhere near a UBI except to criticise.

@Patrick, I’m afraid MStar editorial staff are not too economically literate. I arranged for Bill to meet the Editor a few years ago, see here: https://morningstaronline.co.uk/article/f/modern-monetary-theory-meet-economists-fighting-economy. But they pay more attention to Meadway. I’ve had lots of letters published on MMT and UBI.

I’m in touch with Drakeford because he’s a member of our Labour Land Campaign. I first had wind of this pilot last year and I sent his PA several articles on UBI, probably including my own, published in MStar before I understood MMT. I’d intended to go to the World Transformed event where Drakeford was speaking about UBI but forgot. I would have been relieved to find that “the pilot project will involve all care-leavers in Wales and it will be universal for all that group”.