In the annals of ruses used to provoke fear in the voting public about government…

Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1

I am currently working through the entire Commissaire Maigret detective series written by Belgian author author Georges Simenon. I read a lot as I travel around and I have 74 (out of 75) Maigret novels to read. But don’t let that fool you, I am already becoming familiar with Maigret’s forensic way of thinking (-:. So for the next two blog posts we will be conducting a forensic examination of data to solve a puzzle that appears to be confusing people. This is the sort of puzzle that people (like me), who are interested in data and have a penchant for spy and detective novels like to investigate. For others though, while the nuances might appear to be rather obscure, the importance of this sort of puzzle cannot be understated. Community perceptions are influenced by what I am talking about today. Policy decisions are taken. Industrial relations strategies are designed, implemented, and, in some cases, fought out with significant consequences. The data I am analysing today and tomorrow can provide information about the state of the economy. It can inform us of the way in which the economic is changing in structure over time. It can provide guidance to fiscal and monetary authorities as to the likely impact of policy changes. So, as you will see, ambiguity is not going to be very helpful. The data I am dealing with in this blog post explores the relationships between nominal wages, prices and productivity in the Australian economy. The principles established, though, apply to all economies. What I will show you is that the choice of how we choose to measure key variables can fundamentally alter the way we think and act. This is Part 1 of a two-part series. Now, if only I had a pipe to light! (Maigret joke for insiders).

The wages-productivity relationship

In my regular commentary on the release of the Wage Price Index data, I discuss the relationship between real wages and productivity.

I have also often explored this relationship in my academic papers and Op Ed articles.

For example, in an early blog post – – The origins of the economic crisis (February 16, 2009) – I discussed how real wages in Australia have failed to track GDP per hour worked (in the market sector) and as a result there has been a dramatic redistribution of national income towards capital (profit share).

I noted that several factors were involved including government policy shifts such as privatisation; outsourcing; pernicious welfare-to-work and industrial relations legislation; National Competition Policy to name just a few.

This growing gap between real wages and productivity measures is a feature of the neoliberal era and is repeated across many countries.

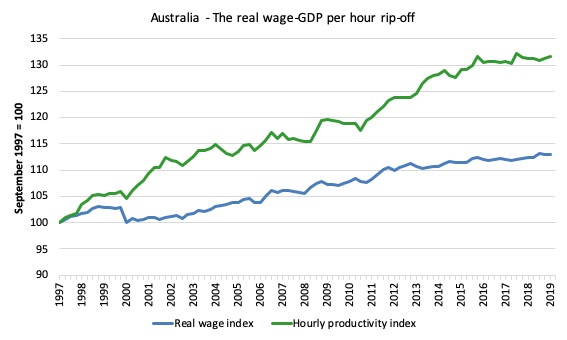

In my most recent wage data commentary – Australia – wages growth continue at record low levels – further evidence of policy failure (November 18, 2019) – I presented the following graph.

It shows the total hourly rates of pay in the private sector in real terms (deflated with the Consumer Price Index) (blue line) from the inception of the Wage Price Index (December-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the September_quarter 2019.

Over the time shown, the real hourly wage index has grown by 13.1 per cent, while the hourly productivity index has grown by 31.7 per cent.

That seems definitive.

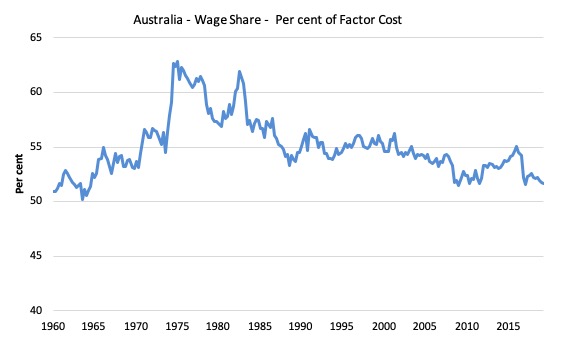

The graph is also consistent with the measure of the wage share in GDP at factor cost, derived from the national accounts.

What is factor cost? When in doubt, I always consult the basic reference for all matters national accounts – Australian System of National Accounts Concepts, Sources and Methods, Australia 2015.

According to the ABS, the Wage share of total factor income is defined as:

20.69 Total factor income (TFI) is the sum of the compensation of employees, gross operating surplus and gross mixed income. Wages share of total factor income is the proportion of total factor income that is made up by compensation of employees.

This graph shows the movements in the wage share from the March-quarter 1960 to the June-quarter 2019.

Further, the only way that the wage share can fall like this, systematically, over time, is if there has been a redistribution of national income away from labour.

And the only way that can occur is if the growth in real wages is lower than the growth in labour productivity.

That has clearly been the case since the late 1980s. In the March-quarter 1991, the wage share was 56.6 per cent and the profit share was 22.2 per cent.

By the June-quarter 2019, the wage share had fallen to 51.7 per cent and the profit share risen to 29.4 per cent.

I have outlined the link between real wages and productivity in other blog posts (particularly the Quiz answers) where we have come across the concepts of the Wage Share in GDP and Real Unit Labour Costs (RULC).

In fact, the two are conceptually equivalent given their derivation but differ slightly in their empirical application.

Here are the relevant definitions and relationships:

1. Average wage (W).

2. Total employment in persons is L, in hours worked is Lh, where h is the average hours worked per period.

3. Total labour compensation (W times L or in algebra W.L).

4. Nominal GDP is $GDP = P.Y, where P is the average price level and Y is total real output.

5. Labour productivity (LP) is output per unit of input and can be measured in persons or person-hours.

LP (persons) = Y/L

LP (person-hours) = Y/Lh

6. Purchasing power wage (real wage) w = W/P, measures what the nominal wage (W) will buy in terms of goods and services, given the average price (P).

7. Wage share in national income = (W.L)/$GDP

8. The wage share can be re-written (given (4)) as (W.L)/(P.Y)

9. And an equivalent expression for it is (W/P)/(Y/L), which is the real wage (W/P) divided by labour productivity (Y/L).

10. The expression in (9) is also called real unit labour costs (RULC), because ULC = total labour costs per unit (W.L)/Y, and if we express the nominal labour costs in real terms by deflating by P we get (W.L)/P divided by Y, which simplifies to the RULC expression.

11. In other words, in conceptual terms, the wage share is equivalent to RULC.

12. The wage share rises if real wages grow faster than labour productivity and vice versa. The wage share cannot fall conceptually if real wages are growing faster than productivity.

The complications enter when we go to operationalise these concepts through measurement.

The Australian Bureau of Statistics, for example provides the following definitions:

1. Total factor income (TFI) is GDP less taxes less subsidies on production and imports.

2. Current price Gross Value Added (GVA) is compensation of employees + gross operating surplus and gross mixed income + other taxes on production less other subsidies on production. So GVA > TFI by a small margin.

3. Wage share in factor income = (W.L)/TFI.

4. RULC are derived by deflating Average Labour Costs (ALC) by the GDP or output deflator and then dividing the result by Average Labour Productivity (ALP). This is made operation by noting that ALP = (GVA/GDP deflator) divided by Total hours worked (THW).

5. So in practice, there is a slight difference between the RULC and Wage share calculations as presented in the quarterly national accounts data. That difference relates to the fact that “the denominator for RULC, GVA, is slightly larger than the denominator for … total factor income.”

That difference is rather small and represents taxes less subsidies on production and that component has been very stable since 1959, varying between 8 and 12 per cent of GDP.

The puzzle stated – a paradox enters through a picture

Now, consider the following.

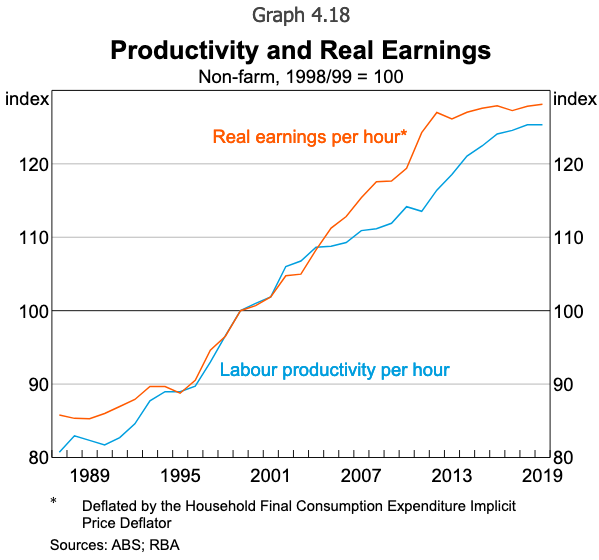

In the latest – Statement on Monetary Policy (November 2019), which is a quarterly document where the RBA provides their “assessment of current economic conditions” and their outlook, this graph appeared in the Chapter on – Inflation (Graph 4.18).

It purports to show labour productivity per hour and real earnings per hour, both measures derived from the national accounts.

The commentary accompanying the graph noted that:

Growth in average earnings per hour in the national accounts (AENA) was a little higher than WPI growth over the past year. AENA is a broader, but more volatile, measure of labour costs because it captures non-wage payments as well as changes in the composition of employment. Real average earnings grew at a much stronger pace than labour productivity over the investment phase of the mining boom (Graph 4.18). Since around 2012, the pace of productivity growth, while subdued, has outpaced growth in real average earnings.

If real wages growth outstripped productivity growth then the wages share in national income should have risen over this period, or, equivalently, that Real Unit Labour Costs (RULC) should have risen overall.

Right? Or Wrong?

Answer: it all depends.

There is clearly a conflict between the RBA graph and the wage share graph (and my real wage/productivity graph).

Some regular readers also asked me to explain this apparent anomaly with respect to my own long-standing analysis and claim that real wages have lagged badly behind productivity growth over the neoliberal period, which broadly covers the time span of this graph.

Some forensic analysis is required to provide an explanation that both graphs – the RBA’s graph and my real wage/productivity graph – are correct.

The first thing to do in these cases is to try to replicate the conflicting graph via the underlying data. That led me to suspect that the major difference was in the earnings series and the way the nominal was converted into real (more about this in Part 2 tomorrow).

I wrote to the RBA to request the exact data definitions they were using to establish whether my surmise about the deflators was reasonable.

In their E-mail reply (November 18, 2019), they said:

The Productivity series is from the National Accounts release (series ID: A2529347C).

The real hourly earnings series is constructed using data from the annual and quarterly national accounts releases. It is constructed as the ratio of nominal hourly wages and the Household Final Consumption Expenditure (HFCE): Implicit Price Deflator (A2420886C).

Nominal hourly wages is constructed as non-Farm Compensation of Employees (A2421476F) divided by total hours worked, where total hours worked is non-farm average hours per employee multiplied by total non-farm employees. Each of the hours and employees series is data we receive by special request from the ABS.

The tension you noted in the difference between this measure of real wages growth and the labour share is likely due to the choice of deflator. Graph 4.18 uses consumer prices to deflate wages (which gives a measure of purchasing power of workers). The measure of real wages that underpins the national accounts measure of the labour share is the ratio of nominal wages to producer (or output) prices, A broader discussion of this is available in La Cava 2019 (specifically the discussion around Graph 4).

I appreciate the willingness of the RBA to engage with researchers like this.

I also read the RBA Bulletin article (March 2019) – The Labour and Capital Shares of Income in Australia – by Gianni La Cava, which notes that:

In Australia, the labour share of income – the share of total domestic income paid to workers in wages, salaries and other benefits (‘compensation of employees’) – rose over the 1960s and early 1970s but has gradually declined since then (Graph 1). Since the 1970s there has been a gradual increase in the capital share of income – the share of domestic income going to capital owners in profits (or ‘gross operating surplus’). The income accruing to unincorporated business owners (or ‘gross mixed income’) declined as a share of the economy over the 1960s and 1970s. Gross mixed income reflects a mix of labour and capital income and it is hard to say how much of the profits to business owners is the return to labour and how much is the return to capital. Regardless, it has not been an important driver of the trends in the factor shares since the 1980s …

The article also reiterates the point I have regularly made:

The labour share is typically thought of as the ratio of total wages and salaries to total income in the economy. But an alternative way of thinking about it is as the ratio of real wages to labour productivity. Both ratios capture earnings accrued by labour, divided by the value of the output produced by that labour. If the labour share is declining, this is because real wages growth is not keeping up with labour productivity growth.

So the puzzle is this: How can the RBA say that workers enjoyed real wage increases above labour productivity growth in the early 2000s up to around 2012, when we know the wage share has been falling more or less over the entire period?

As I will demonstrate tomorrow, the clue is in the deflators used to convert the nominal earnings aggregate into the real equivalent.

In the RBA graph, the earnings per hour measure was deflated by the Household final consumption expenditure implicit price deflator rather than the GDP (output) implicit price deflator that is used to compute the Wage Share and RULC measures.

In my graph, the Wage Price Index is deflated using the Consumer Price Index.

And in the national accounts, the wage share (and RULC) measures are deflated using the GDP output deflator.

Conclusion

Tomorrow, we will go full-geek and show how the way we measure variables can fundamentally alter the way we interpret the data and what policy outcomes might be recommended.

It is no small issue in fact.

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Bill, you wrote,

“2. Total employment in persons is L, in hours worked is Lh, where h is the average hours worked per period.

3. Total labour compensation (W times L or in algebra W.L).”

I think the word ‘in’ there {is L, ‘in’ hours} is the wrong word. What do you think?

I think the a period these days is not the right symbol for multiplication. I think we all have computers so you should use “*” because that is what a computer makes you use on a spredsheet.

You can delete this if you want.

Steve, he explains the equation in English and then uses notation. I would think you could live with that. And the word “in” makes perfect sense to me for that usage.

I’ve seen some great analysis from CoPS on the producer real wage versus the consumer real wage and the extent this drives decision making and economic outcomes. The beauty of the Accord was that unions agreed to limit the increase in producer real wages because Hawke would cut income taxes thereby providing a much stronger rise in the consumer real wage. Simply put, this was good for businesses and good for households.

The battle-cry of the neo-liberal counter-revolution (against the New Deal overhang, otherwise known as “the postwar consensus”) was the infamous Powell Memorandum entitled “Attack on the American Free Enterprise System”, written in 1971. For anyone who doesn’t know It represented organised labour as in effect an agent (consciously or not – it was all the same) of – you’ve guessed it – THE INTERNATIONAL COMMUNIST CONSPIRACY and called upon capital to respond accordingly.

Capital duly did – and the rest, as they say, is history (although come to think of it didn’t history *end*, according to the neoliberal-approved version, with the “final” victory of neoliberalism aka the fall of the Soviet Union?).

Bill’s charts clearly show how labour’s share of national income peaked immediately before, as counselled in Powell’s war-plan (archetypal but not of course isolated), the neoliberal counter-attack began and declined in step with that onslaught’s mounting force. It feels not unlike watching a slow-motion train-crash, with the sheer inevitability of its outcome (seen in retrospect) being striking to behold..

Is there a particular labour share of national income that would be optimal from an economic justice standpoint?

Nicholas Haines asked:-

“Is there a particular labour share of national income that would be optimal from an economic justice standpoint”?

Personally I can’t see how there could ever be.

What is “economic justice” and how is its supposedly ineffable verdict to be arrived-at? Isn’t the struggle between capital and labour always fated to be just that? To a considerable extent it’s bound to be experienced as a zero-sum game, more especially so when times are hard.

In any circumstances where that is the dominant outlook their relative shares are going to reflect pretty faithfully which of the participants can exert the greater pressure on the other. I don’t see how that way of deciding the outcome can be improved-upon short of capitalism itself being dismantled; and what do you then replace it with which would be better?

Nicholas Haines, you wrote, “In any circumstances where that is the dominant outlook their relative shares are going to reflect pretty faithfully which of the participants can exert the greater pressure on the other. I don’t see how that way of deciding the outcome can be improved-upon short of capitalism itself being dismantled; and what do you then replace it with which would be better?”

The huge problem with this is that it totally matters what the rules that govern the pushing match or as you said “exert[ing] … pressure” match. Dr. Mark Blyth says that the rules favored Labor too much in the 50s, 60s, and 70s, then it has swung totally to Capital starting in the 80s, took off in the 90s with NAFTA, and continued swinging more since.

So, apparently we went from one extreme to the other, and never have had a happy medium.

Bill, this may be too political, delete it if so.

I have suggested that in the US, to get around Citizens United, that we impose a 90 to 99% tax in political donations to things like PACs and a 90% “sales and service” tax on political ads made by all except candidates and parties. The maker must be clearly listed to not pay the tax.

My intent to to keep capital from flooding the airways with ads to get the politicians they want elected.

Steve, have you got a reference for Blyth for this particular contention? In asking, I am not thereby suggesting you are mistaken.

@ Steve

“So, apparently we went from one extreme to the other, and never have had a happy medium”.

As things stand what you call “the rules” are determined by the interplay of a wide variety of factors including – in some eras in some countries – some form of third-party “umpiring”. But in the final analysis when and if that breaks down as it always will when either of the parties are pushed beyond their “red lines” it becomes a question of who blinks first.

With negotiation, it was ever thus.

I’m not clear what you’re proposing instead. And incidentally what you quote Mark Blythe as asserting is, I would have thought, just stating the obvious.

Surely if the natural rate of interest is 0%, the natural rate of return on capital is also 0%?

Calling for a “happy medium” is just another self serving framing technique to create negotiating space between the genuine claims of actual wealth producers and the imagined claims of rent seekers and finance gatekeepers.

brendanm, you ask “Surely if the natural rate of interest is 0%, the natural rate of return on capital is also 0%?”

That question is not all that simple. First off, there are many different interest rates and that is natural to the extent that there are different levels of risk involved with different loans. If the ‘natural rate of interest’ is zero, that would only extend to totally risk free types of loans. Second, even if the risk free rate of interest is zero, it does not follow that return on capital would or should be zero. I think that there is always some risk involved with providing capital for any endeavor, at least for the private sector. Capital can wear out, can become obsolete, and it always can turn out there is little market for the product it helps produce. So investing in capital is risky and probably won’t happen much without expectations of returns.

larry, you wrote, “Steve, have you got a reference for Blyth for this particular contention? In asking, I am not thereby suggesting you are mistaken.”

Yes, here is one.

https://www.politicsforum.org/forum/viewtopic.php?f=45&t=177076&p=15040045#p15040045

You might also get a kick out of this one of Mark’s too.

http://macroncheese.com/wage-stagnation … mark-blyth