These notes will serve as part of a briefing document that I will send off…

Bundesbank remits record profits to German government while Greek health system fails

I am back into my usual patterns, which means that I plan to write less on a Wednesday for my blog than other days. I have a number of projects underway at present – academic and advocacy – and I need to devote writing time to those. Given that yesterday I wrote about the Australian National Accounts data release and today I have to travel a lot, it is another case of Thursday becomes Wednesday and I offer some snippets. I will write a detailed account of my view on how to deal with the coronavirus from an Modern Monetary Theory (MMT) perspective next week. But today I want to highlight something that just ‘goes through to the keeper’ (cricket reference meaning no-one pays attention to it) but is significant in understanding what is wrong with the Eurozone. I refer to information that is contained in the latest – Annual Report 2019 – released last week by the Deutsche Bundesbank. If you juxtapose that with another report on the Greek health system you get a fairly clear view on what is wrong with the whole EU set up.

Bundesbank Annual Report insights

On February 28, 2020, the German central bank released its – Annual Report 2019.

The Bundesbank also accompanied the release of the Report with this Press Release – Bundesbank records significantly higher distributable profit.

What attracted my interest, and mostly these reports are fairly routine exercises, was the Profit and Loss account, which appears from Page 44 of the Annual Report.

We learn:

1. “The Bundesbank posted a profit of €5.8 billion for the 2019 financial year”.

2. “Following adjustment of the reserves, the Bank registered its highest distributable profit since 2008, at €5.9 billion, up from the previous year’s €2.4 billion.”

3. “The Bundesbank has transferred the profit in full to the Federal Ministry of Finance.”

4. This is the “highest distributable profit since 2008”.

So what gives?

Well, the Bundesbank acknowledge that the profits were driven, firstly, by lower “provisioning levels” (risk allocations), but, secondly by:

… variable remuneration on the new series of targeted longer-term refinancing operations and the maturing of assets purchased under the securities markets programme (SMP).

On Page 56, we get more detailed analysis of the assets that the Bundesbank accumulated as part of the “Eurosystem purchase programmes announced by the ECB”.

I have written about the Asset Purchase Programmes (APP) before (among other blog posts):

1. The European Union once again reveals why it should be dissolved (June 27, 2019).

2. Eurozone horror story continues (April 25, 2019).

3. ECB denial is just embarrassing (April 4, 2019).

4. ECB continues to play a political role making a mockery of its ‘independence’ (June 12, 2018).

5. ECB is running out of debt to buy – more smoke and mirrors needed (September 7, 2017).

6. ECB’s expanded asset purchase programme – more smoke and mirrors (May 30, 2016).

The most recent programs are just extensions of the Securities Market Program (SMP) which began life in May 14, 2010 as Member State governments were threatened with insolvency as the GFC ensued.

The SMP involved the ECB buying government bonds in the so-called secondary bond market in exchange for euros, which the ECB could create out of ‘thin air’. The SMP also permitted the ECB to buy private debt in both primary and secondary markets

In my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale – I argued that it was this program and the later versions that saved the Eurozone from breaking up.

Further, despite all the claims by the ECB officials that the large-scale government bond purchases were really to ensure the money market had liquidity (so linked to interest rate policy), the reality was and is that the ECB was funding government deficits – albeit via the secondary market bond purchases rather than direct primary purchases – and that this was in violation of the Treaty’s prohibition on ‘bail outs’.

And while the European Court of Justice had ruled against a German entreaty against QE, the fact is that the ECB was not acting in the ‘spirit’ of the Treaty. Thankfully, in this case.

And in doing so, was really filling the missing ‘fiscal’ function in the Eurozone architecture, which the Delors plan had deliberately suppressed by design – and which has largely made the monetary union dysfunctional.

I considered the SMP in these blog posts (among others):

1. The Eurozone ‘house of cards’ to collapse – doomed from the start (October 26, 2016).

2. The ECB plan will fail because it fails to address the problem (September 11, 2012).

In terms of the SMP portfolio, the Bundesbank is allocated a share of the overall Eurosystem purchases under that scheme – the allocation being based on “prevailing shares among the Eurosystem national central banks”.

As at December 31, 2019, it held government bonds for Greece, Ireland, Portugal, Italy and Spain, which reflected the earlier ECB purchases to stop the yield spread between the German bund and the bonds for these Member States diverging too much and sending the States insolvent.

The SMP portfolio shrunk by 5,721 million euro between December 31, 2019 and a year later, reflecting the maturing of the bonds held.

But you will note that there was a significant positive divergence between the market value of the year-on-year change and the balance sheet value.

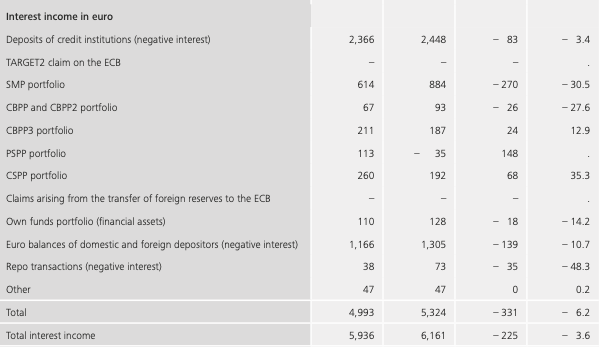

And then later, on Page 67, we come across the “Net interest income” Table. The following section shows the “Interest income in euro” as reported.

Now this is in the context of increasingly low yields on held fixed income assets and the ultra-loose negative interest rate policy (that acts as a tax on financial institutions holding reserves at the central bank).

Total interest income in euro was €5.936 billion.

After expenses, total net interest income in euros was €4.643 billion.

From the Table snapshot, you can see that the negative interest rate return courtesy of the ECB pushing interest rates into negative terrain in search of rising inflation, was €2.366 billion.

The distribution to the Ministry of Finance from the Bundesbank significantly helps the German government achieve a fiscal surplus, which constrains domestic demand and relies on other nations running external deficits to maintain German growth.

The distribution, in part, is from income received from the Member States issuing the SMP and PSPP bonds, including Greece.

The negative interest rates reflect the obsession with monetary policy as the primary macroeconomic policy tool and the suppression of fiscal policy as a tool for prosperity advancement.

The whole thing is out of kilter with any responsible reality.

And meanwhile, a new study was released by the Greek non-profit research and policy institute – DiaNEOsis – on February 27, 2020 which shows that “Greek workers face a growing health crisis amid attacks on the public National Health System (ESY).”

The Report notes that after years of austerity that has increased poverty rates and created persistent and elevated levels of unemployment:

The difficulties of accessing and using health services have grown particularly for those who need them most, thus jeopardising the element of equality and social justice …

20 per cent of Greeks can no longer pay for essential health care – the situation is now “catastrophic”.

60 per cent of diabetics cannot afford the necessary care.

25 per cent of Greeks now have some chronic disease.

The Troika savaged health care spending in Greece.

This article – New study reveals growing health crisis in Greece (February 27, 2020) – makes for harrowing reading and indicts Syriza for “rapidly betraying the masses and implementing the austerity diktats of the EU”, which have resulted in youth unemployment of around 35 per cent and overall unemployment rates persisting at 178 odd per cent.

They write that:

Syriza strengthened Greece’s police apparatus, which it used against workers and students during protests as well as against helpless refugees fleeing from war.

When I was in Athens recently, I noticed several things.

1. Lots of police everywhere – often interrogating people in public squares in a rather bullying manner.

2. When I caught up with Yanis Varoufakis, I asked him whether it was a public holiday (it was a Monday). He asked why would I think that. I said because there were so many children and prime-age men in the streets, which in Melbourne or Sydney would signal a public holiday.

The reality is that it was not – these people have been left behind. I saw young children – sort of reminded me of Oliver Twist – playing small accordians in the streets – Fagan’s kids – begging for coins.

I saw men with their families in doorways homeless begging for coins.

And the Bundesbank and the German Ministry of Finance profits from that.

Book recommendation

When I spoke in Manchester recently, I met an author, Stef Benstead and she presented me with a signed copy of her 2019 book – Second Class Citizens: The treatment of disabled people in austerity Britain

I read the book on the journey home to Australia and it was hard going – not because of the writing style (which is really fluent) but because of the content.

But it documents in deep detail the plight of British people generally who need state support but are denied it by the neoliberal psychopaths.

The book describes “the impact of austerity, neoliberal ideology and welfare myths on sick and disabled people.”

Just the people we should be protecting and giving opportunities to so they can maximise their life outcomes in the face of their personal issues.

You can purchase the book at that address and I urge all my readers to support this project and purchase the bok.

The price is £10 plus postage.

It will make you unhappy and angry, which is just what is required to take on the bastards who have created this intolerable system.

Call for MMTed Support

We are making progress in developing the program that will become MMTed. I ran my first Masterclass in London recently and it was well attended. I received good (useful) feedback from several people which will help tune the way we run these face to face classes.

There are other Masterclasses in the wind (May in Australia, June in Europe, September in the US).

And on-line curricula is being developed.

But we still need significant sponsors for this venture to ensure that we can run the educational program with negligible fees.

If you are able to help on an ongoing basis that would be great. But we will also be appreciate of once-off and small donations as your

You can contribute in one of three two ways:

1. Via PayPal – which is our preferred vehicle for receiving donations.

The PayPal donation button is available via the MMTed Home Page.

2. Direct to MMTed’s Bank Account.

Please write to me to request account details.

3. Via the Foundation for Monetary Studies (FMS) which provides tax claim status for those in the US paying tax to the IRS.

Go to – Foundation for Monetary Studies Inc. – aka The MMT Foundation which serves as a legal vehicle to raise funds and provide financial resources for the MMTed Project.

Please help if you can.

We cannot make the MMTed project viable on a sustainable basis without funding support.

We will always maintain strict anonymity with respect to donations received, except if the donor desires to be publicly associated with the venture and gives their permission in writing to appear on the Donors Page.

Up until now, all donors have wished to remain private.

Musical item

Sometimes one has to go back to basics – to the music they listened to when they first started to listen to music and I don’t mean the nonsense we were fed at school, which was designed to turn us into good, compliant citizens who would foster capitalist profit.

I mean the music of our teenage revolt in the late 1960s.

So I play Jimi Hendrix or Peter Green – which together provide an almost a perfect representation of that era and the feelings some of us had when we formed a visceral, then reasoned hatred for the establishment.

Here is one of the greatest guitar players – Peter Green – who recorded this after replacing Eric Clapton in John Mayall’s Bluesbreakers.

The whole album from John Mayall’s Bluesbreakers – A Hard Road – which was recorded in 1966 is exceptional, but this track – The Supernatural – is one of the best guitar tracks of all time.

The control he gets on his reverb and sustain is something else.

2:52 minutes of pure tone and very hard to cover!

That is enough for today!

(c) Copyright 2020 William Mitchell. All Rights Reserved.

“In the long run we are all dead. Economists set themselves too easy, too useless a task if in tempestuous seasons then can only tell us that when the storm is long past the ocean is flat again.”

Guess I have to wait some more to maybe next week or so. But you did provide tools I can use for thinking about this and I will use them as I see fit in the meantime.

Bill wrote, “… which have resulted in youth unemployment of around 35 per cent and overall unemployment rates persisting at 178 odd per cent.”

? 178% ?

Did you mean 17.8%? Or something else because of the “odd” there?

Benstead book ordered. I hope you get her interested in MMT if she does not already know about it.

Steve. I assumed the decimal point was missing. According to Trading Economics it was 16.3% in December 2019, but as always it depends on what report you read and what measure it uses.

John Mayall and the Bluesbreakers. Saw them so many times in the 60s as supporting act.

I always felt ‘Have you Heard’ was a better track than ‘The Supernatural’ but, good choice, early Peter Green is nothing to be sniffed at. I also dug out this source which further elaborates on the Greek healthcare crisis:

https://www.thenationalherald.com/285644/greeces-health-system-not-working-says-think-tank-report/

Dear Bill,

Interesting to read you’ve had a meeting with Yanis Varoufakis, since you have been criticising his pro EU stance for many years now and his efforts to democratise Europe with DiEM25. Have you met with other parties or persons in Greece that support Greece’s exit from the EZ?

Dear Konstantinos (at 2020/03/06 at 3:37 am)

Yanis and I are friends. We are working out ways that we can collaborate together, notwithstanding our different views over time on tactics in breaking down the European Union.

best wishes

bill

“…his efforts to democratise Europe with DiEM2…”

An oxymoron if there ever was one.

Replacement of one hegemonic elite with another.

Dear Bill,

Thanks for your reply. Looking forward to the outcome of your trip to Athens, which as you said is going to be announced in the following months.

Best regards,

Konstantinos.

Henry Rech writes:

“Replacement of one hegemonic elite with another”.

Well that’s what happens when we don’t have an international rules based system.

So now we watch all the gun-runners in the world (including Trump) profiting from the murder of children in Syria and Yemen, in wars “without solutions”.

And Pence (or Pompeo?) today is abusing the ICC for obvious reasons, but it’s way past time for the US to continue as world policeman. The responsibility for that job ought to belong to an UNSC minus veto.

So Varoufakis is reduced to working to create a democratic EU; I still think it’s possible for a MMT informed ECB (one day) to achieve prosperity within all EU states, given the resources and productive capacity of Europe.

Greece has a great healthcare system…as long as you can afford to travel elsewhere. Actually, Greece is renowned for its IVF success rate (albeit questionable ethical standards).

A recent trip through Athens suggested that things weren’t as bad as 2011, but nowhere as good as the early 2000s. Good luck to the Greeks who chose to stay.

“I still think it’s possible for a MMT informed ECB (one day) to achieve prosperity within all EU states, given the resources and productive capacity of Europe”.

Accepting the “given”, isn’t achievement of prosperity (throughout Europe) intrinsically the sphere of a putative Europe-wide fiscal policy? How can that task properly fall to a central bank to discharge – other than as an agent (overtly or covertly) of *somebody”s* fiscal policy? And having in any case only the – for that purpose very limited, monetary – instruments at its own disposal?

All of which takes us back to square one:- the rooted opposition on the part of all the constituent states for all the historical and cultural reasons which Bill (among many others) has written about to the creation of a European *federal” fiscal organ, answerable directly to a *federal* legislature – which is exactly what got us to where we are today. That would seem to be an inherently insurmountable obstacle: is it conceivable that Germany (as only the most conspicuous example of many) could ever willingly agree to become but one (non-sovereign) part in a federation or confederation? What then would have been the point of ever having striven for a “united Germany”? Or a “united Italy” come to that?

It took a bloody civil war (ie massive, sacrificial, coercion) to bring that to fruition in the Americans’ case – and *they* all spoke the same language and had a common cultural and historical heritage.

And that’s without even starting to contemplate the possibility of the same thing on a world-wide scale (“an international rules-based system”).

Of course none of us can know what might come about in the (remote) future. But, as the man famously remarked:- “In the long run we are all dead”.

I googled ICC and still don’t know what you mean.

ICC: International Criminal Court

I just saw a report that the Fed. cut interest the rate by 0.5% to prop up the economy and the stock market in the face of the coronavirius.

We here know this will have no real effect. I hope Bill and other MMTers will rub their noses in it when it does have no real effect.

ICC is where the world must learn what the eurogroup did to Greece. Even if it takes 30 years and they’re all in wheelchairs.

Oliver Twist in 21st century Europe, is not something anyone should get away with.