The other day I was asked whether I was happy that the US President was…

The Eurozone ‘house of cards’ to collapse – doomed from the start

There was an interesting interview published in the financial market journal Central Banking this week with Otmar Issing, who was the ECBs first chief economist and a former European Central Bank executive board member. He predicted that as a result of the political corruption of the monetary union ideal, “the house of cards will collapse.” He was referring to the claim that the ECB has become captured by politicians and technocrats in the IMF and the European Commission such that it is now violating essential central banking principles, in addition, to Treaty obligations that were designed to safeguard the financial stability of the system. I have some agreement with his overall view that a federal solution to the Eurozone ills is not viable. But I do not agree that the ills of the Eurozone stem from recent political decisions – to pressure the ECB to engage in QE or other interventions. The reality is that the flawed design of the Eurozone, which reflected the ideological hold of neo-liberalism on the integration discussions in the 1980s and beyond, meant that the only effective fiscal capacity in the currency union was held by the ECB. If the ECB had not started buying up government bonds in May 2010, the monetary union would have collapsed about then. The whole problem is that neo-liberalism brought these Member States together into a monetary architecture that was doomed from the start.

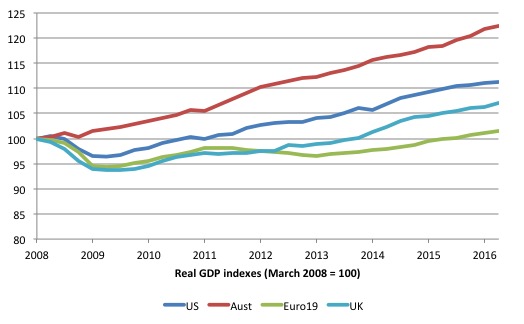

The following graph shows real GDP indexes (March 2008 = 100) 4 the US, Australia, the UK, and the 19 Eurozone nations.

Several points are of relevance:

1. The depth of recession was relatively similar for all the nations shown except for Australia, which did not experience a technical recession during the GFC because the federal government introduced an early and fairly sizeable fiscal stimulus and maintained it through to 2012.

2. Both Australia and the US maintained their fiscal stimulus without major austerity events.

3. After an initial stimulus, the UK followed the Eurozone (upon the election of the Conservative government in May 2010) down the austerity path and their experiences were very similar as a result. The UK in a sense was in denial of its currency-issuing capacity.

4. By 2012, George Osborne facing a major electoral backlash abandoned the austerity path and allowed the deficit to float and expand and at that point the British economy resumed growth and departed from the Eurozone growth path.

5. The interesting comparison is at what point these nations crossed back over the 100 index point line, which is the point at which the economy started to grow again relative to the March 2008 peak.

In the case of the US this occurred in the December-quarter 2010 (11 quarters after peak). In the case of the UK it occurred in the December-quarter 2013 (23 quarters after peak). For the Eurozone, it took 30 quarters (September-quarter 2015) and the index has improved only 1.4 per cent since.

If we examined movements in real output and real per capita income in a federal system such as Australia since 2008 we would find very little discrepancy among the component states and territories. Indeed, while Tasmania has lagged somewhat behind it is still ahead of where it was when the GFC began.

The Australian economy, overall, is 22.4 per cent larger than it was in 2008. The US economy is 11.3 per cent larger and the UK is 7.1 per cent larger. The performance of the US and UK economies is fairly poor but shines out when compared to what has happened in the Eurozone.

Compare that to the discrepancies that exist between the Member States within the Eurozone where the Greek economy is now 27 per cent smaller than it was in the March-quarter 2008, Italy is 8 per cent smaller, Portugal is 6 per cent smaller and the Eurozone overall is only 1.1 per cent larger.

Question: Is the Eurozone an outlier? Answer: Obviously.

I cover the problems of the Eurozone from their historical beginnings in my current book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale.

There was an interesting interview published in the financial market journal Central Banking this week with Otmar Issing, who was the ECBs first chief economist and a former European Central Bank executive board member.

Issing frequently intervenes in the public debate with a high-handed morality dressed up as economic commentary. Indeed, the language of morality has been prominent in the public commentary by conservatives, which has reflected the religious nature of the crusade against fiscal stimulus.

For example, Financial Times journalist Wolfgang Münchau abhorred the September 2009 decision by the French government to abandon any aim to reduce its fiscal deficit to below 3 per cent by 2012 and claimed other governments (Greece, Italy, Portugal and Spain) were similarly recalcitrant.

In contradistinction, his article (October 4, 2009) – Diverging Deficits Could Fracture the Eurozone – Münchau said “Germany … has committed itself to the virtuous path” – a moral valuation. What is virtuous about a particular ‘fiscal deficit’ outcome.

Similarly, in a Financial Times article (February 15, 2010) – Europe Cannot Afford to Rescue Greece – Otmar Issing claimed that Greece “wasted potential savings in a spending frenzy”.

This moral indignation to divert attention is common among German commentators. I could cite many examples. The practice is not, however, confined to Germany.

In his most recent intervention into the public debate (October 13, 2016) – Otmar Issing on why the euro ‘house of cards’ is set to collapse – Issing was discussing the so-called independence of the ECB and the allegations that it has been overly complicit with politicians in its quantitative easing program, which has seen it load its balance sheet up with fairly “low quality” debt instruments.

He considered that the ECB had compromised its independence and had become a political tool of governments who realised that without ECB intervention their banking systems would collapse.

He spoke of the decision in May 2010 to bailout Greece.

By way of background, faced with nations unable to fund themselves but with pending liabilities maturing, the focus in 2010 turned to bailouts.

A new European bully formed, the so-called Troika (the European Union, the ECB and the IMF), to spearhead the austerity push.

Once again the unelected and unaccountable IMF felt its role was to trample on the democratic rights of citizens in Greece and elsewhere. While these interventions initially protected Greece and other nations from insolvency, they imposed destructive conditionality, which made it impossible for the nations under focus to grow.

On May 9, 2010, the European Council (through Ecofin) resolved to create the European Financial Stability Facility (EFSF), which would be its bailout vehicle in cooperation with the IMF. It was replaced in October 2012 by the permanent rescue vehicle, the European Stability Mechanism (ESM). Both institutions shared the same flaws.

The very idea of a bailout seemed at odds with Article 125 of the Treaty, the ‘no bailout’ clause. If the Treaty was so rubbery, why impose the SGP rules in the first place, given their severe negative consequences for economic growth and living standards?

Such inconsistencies among European policy makers were rife during the crisis as the ideologues that designed the rules, came against the reality of the system collapsing from the application of these rules. A desperate pragmatism reigned supreme but was so tainted by ideology (the unsustainable conditionality), that the bailouts just made matters worse.

The first major bailout came in May 2010, when Greece was given a three year €110 billion loan from the Troika with strict conditions attached.

The austerity package was breathtaking in its harshness. Greece was compelled to reduce its deficit by 15 per cent of GDP within three years, which was an impossible task.

The terminology used by the IMF in its – Greece: Staff Report on Request for Stand-By Arrangement – was that the fiscal policy changes were:

… frontloaded with measures of 7½ percent of GDP in 2010, 4 percent of GDP in 2011, and 2 percent of GDP in 2012 and 2013, each, to turn around the fiscal position and help place the debt ratio on a downward path.

Remember, they claimed at the time that spending multipliers will below one, which justified their claim that the austerity would in actual fact stimulate growth. Two years later, the IMF admitted they had made fundamental errors in the calculations of the spending multipliers. Their revised conception indicated that these “frontloaded” measures would devastate the Greek economy – which they did.

It was also obvious that the austerity plan would, in fact, increase the deficits given the loss of tax revenue that would accompany the output and employment losses.

When announcing the terms of the bailout to the Greek people, Prime Minister George Papandreou wore a dark purple coloured tie, the colour that Greeks wear to funerals. But his days were numbered. Soon afterwards the Troika got rid of Papandreou and put one of ‘their men’ into the role, the central banker Lucas Papademos. It didn’t matter what the people who vote might think!

In that context, Issing reflected this week along the following lines:

It was clear over the weekend that if nothing happened by Monday, there might be turmoil in financial markets. It was obvious Greece could not meet its payments. Finance ministers were unable to deliver a solution. So the ECB was put in a lose-lose situation. By not intervening in the market, the ECB was at risk of being held responsible for a market collapse. But by intervening, it would violate its mandate by selectively buying government bonds – its actions would be a substitute for fiscal policy. The ECB had respectable arguments to intervene.

But it turned out that the ‘ECB had crossed the Rubicon.’ Of course, Julius Caesar had to go on and conquer Rome. But there was no need for the ECB to say that in the future in the same situation, it would act in a similar manner. It could have been made clear that this was a once-only event and would never happen again. Otherwise, it is a slippery road.”

The fact is that on 14 May 2010, the ECB established its Securities Markets Program (SMP), which saw it buying government bonds in the so-called secondary bond market in exchange for euros, which the ECB could create out of ‘thin air’. The SMP also permitted the ECB to buy private debt in both primary and secondary markets.

To understand this more fully, the decision meant that private bond investors (including private banks) could offload distressed state debt onto the ECB.

The action also meant that the ECB was able to control the yields on the debt because by pushing up the demand for the debt, its price rose and so the fixed interest rates attached to the debt fell as the face value increased. Competitive tenders then would ensure any further primary issues would be at the rate the ECB deemed appropriate (that is, low).

There was hostility at the time from the Germans. For example, the fiscally conservative boss of the Bundesbank at the time, Axel Weber, who was being touted to replace Jean-Claude Trichet as head of the ECB, was vehemently opposed. He resigned his post as an ECB Board Member.

Weber’s successor as head of the Bundesbank, Jens Weidmann, maintained the criticism, albeit in a more muted manner.

Similarly, another ECB Executive Board member, Jürgen Stark, also resigned in protest over the SMP in November 2011. Stark told the Austrian daily Die Presse that the ECB was heading in the wrong direction by pushing aside the crucial no bailout clauses that provided the bedrock of the EMU.

He also said that the ECB had panicked by caving in to the pressure from outside of Europe.

Whatever spin one wants to put on the SMP, it was unambiguously a fiscal bailout package.

The SMP amounted to the central bank ensuring that troubled governments could continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

Whether it breached Article 123 is moot but largely irrelevant.

The SMP reality was that the ECB was bailing out governments by buying their debt and eliminating the risk of insolvency. The SMP demonstrated that the ECB was caught in a bind.

It repeatedly claimed that it was not responsible for resolving the crisis but at the same time, it realised that as the currency issuer, it was the only EMU institution that had the capacity to provide resolution.

So while I agree with Issing that the ECB was put in that situation by the conduct of the Eurofin and European Commission in general, the fact remains that the SMP saved the Eurozone from breakup.

Without the SMP, Spain, Portugal, Ireland, Greece and a bit later Italy, would have become bankrupt given the movements in the private bond markets at the time.

The reality is that the flawed design of the Eurozone, which reflected the ideological hold of neo-liberalism on the integration discussions in the 1980s and beyond, meant that the only effective fiscal capacity in the currency union was held by the ECB.

The Stability and Growth Pact constraints on fiscal policy and the bloody-minded approach adopted by the European Commission, particularly the Finance Ministers’ group (Eurofin), left the Member States impotent in the face of a major non-government spending collapse to defend their economies.

The flawed design of the Eurozone, which saw the Member States surrender their currency monopolies and adopt, what is in effect a foreign currency – the euro – meant that the Member States were dependent on the private bond markets for deficit funding.

When those bond markets demanded increasingly higher spreads on the German bund to fund the peripheral economies who were devastated by a decline in aggregate spending and production, the only way out was for the ECB to use its currency capacity to resolve the crisis.

The Eurozone would have broken up in 2010 had not the ECB worked around the Article 123 restrictions by buying massive volumes of struggling government debt in the secondary markets.

It was not so much a reflection of political pressure, which implies there were options. Rather, at that time ECB was the only option, given the flawed nature of the Eurozone architecture.

Issing also made some predictions in the interview. The question was asked: “How long can everything keep going before something gives? The politicians do not want to take action … So what happens next?”.

He replied:

Realistically, it will be a case of muddling through, struggling from one crisis to the next. It is difficult to forecast how long this will continue for, but it cannot go on endlessly. Governments will pile up more debt – and then one day, the house of cards will collapse.

In other words, the monetary union is built on fragile and untenable foundations.

Issing considered that the major problem was that:

The moral hazard is overwhelming …

This is a regular theme he indulges in.

In his November 30, 2011 Financial Times article – Moral Hazard will result from ECB bond buying – Issing invoked the thoughts of Walter Bagehot (from his 1873 book Lombard Street), considered to be a founder of the concept of “the central bank as lender of last resort”.

Accordingly, any loans provided to the banking sector by the central bank should be a prohibitive rates to discourage the mentality that the central bank can always bail out poor commercial decisions.

Issing was not opposed to the ECB adopting a lender of last resort role (indeed he considered it an essential part of its operation). His point of contention was that the ECB was “offering unlimited liquidity to the banking system … on extremely low interest rates, not on a penalty rate”.

He argued in that article “that the central bank will be taken hostage by politics” if it acts “as the ultimate buyer of public debt”.

As a result:

Pressing the ECB into the role of ultimate buyer of public debt of individual member states would create the biggest conceivable moral hazard.

In the current interview, he repeated the theme that the ECB had become captive of the political process.

The point he doesn’t make or, perhaps, even recognise, is that the entire creation of the monetary union was a political (ideological) artefact. It had no foundation in any reasonable understanding of monetary systems or economic processes like regional convergence etc.

It’s not that the politicians have taken over the situation and guided an otherwise sound monetary architecture into this desperate corner that it now finds itself in.

The architecture was tainted from day one by neo-liberalism.

Had the founders of the Eurozone listened to the advice from those who understood how federal systems need to be constructed and operated they would not have created the Economic and Monetary Union, in the form that came out of Maastricht in the early 1990s.

They would have understood that the nature of the Member States that eventually became part of the monetary union were not commensurate with any reasonable notion of convergence. History, culture, language, economic structure and more militated against putting all these nations together in a common monetary arrangement.

Further, no federal system can operate effectively without a federal fiscal capacity (spending and taxation), which is closely tied in with the currency capacity of the central bank.

The problem is that the politicial processes since have had to become pragmatic to some extet to save the entire edifice from collapse.

The SMP was an example.

The treatment of French and German fiscal deficits in 2003 were examples.

The current way the European Commission has allowed Spain to violate the rules is another example.

The politicians know that the system they created is unworkable in its rigid form. Rules that are constantly quoted are also constantly ignored.

Issing says that:

The Stability and Growth Pact has more or less failed. Market discipline is done away with by ECB interventions. So there is no fiscal control mechanism from markets or politics. This has all the elements to bring disaster for monetary union.

I agree that the Stability and Growth Pact has failed. It was neither a stability nor growth initiative. In fact, it was exactly the opposite. By constraining governments in their flexibility to respond to major spending collapses, the fiscal thresholds were unworkable.

As we have seen, enforcing the rules made matters worse. They had to be broken or the system would have already collapsed.

The problem has been that they have been enforced or relaxed in a non-systematic manner, which has, in effect, exacerbated the crisis. In the case of Greece, the enforcement has devastated that nation. In the case of Spain, the relaxation of the rules allowed the economy to grow again, but has had the effect (planned) of propping up an austerity-biased Conservative government.

Further, if the private bond markets had been allowed to dominate, then as noted above, the monetary union would have collapsed in 2010.

Issing said that:

The ECB is now buying corporate bonds that are close to junk, and the haircuts can barely deal with a one-notch credit downgrade … The decline in the quality of eligible collateral is a grave problem. The ECB is now buying corporate bonds that are close to junk, and the haircuts can barely deal with a one-notch credit downgrade. The reputational risk of such actions by a central bank would have been unthinkable in the past.

This apparently, in his own words, put the ECB on a “slippery slope” because much of this debt will generate ‘losses’ for the bank.

However, this is not what I would call a “grave problem”. The ECB would be well advised to write all of that debt off immediately. There would be very little consequence of it doing so.

The problem, in the first place, was a lack of oversight of the private banking sector as it fuelled a debt binge in the pre-crisis period.

Issing also believes that talk of political union is wasted because it is not a possibility. I agree that the Member States are so different in history and culture etc that they will never surrender political autonomy in the same way they surrendered their currency autonomy.

In that sense, the basic flaws in the monetary union are beyond political solution.

But unlike me, who considers the creation of such a federal fiscal capacity is an essential requirement, and, in its absence, the Eurozone must break up, Issing maintains the view that:

Such a system would erode the budgetary sovereignty of the member states and violate the principle of no taxation without representation.

That is the issue. If the Member States want to retain “budgetary sovereignty” then they have to retain their currency sovereignty.

That means the monetary union collapses. The only other option is to create a true federal fiscal capacity grounded in a democratic institution such as the European Parliament to be consistent with the “the principle of no taxation without representation”

That option is not going to happen.

Conclusion

I agree with Issing that what has emerged is a system that is inherently recessive and deflationary. Mass unemployment is the norm and increasing poverty the outcome.

As a result, political processes are moving increasingly towards the extreme.

An orderly breakup is the best way forward now.

That is enough for today!

Someone {S.H.} clutching at straws?

“Prof. Steve Hanke @steve_hanke 11h11 hours ago

Broad money growth in #Eurozone supporting growth. PMI hitting 10 month high should be no surprise.”

“that the bailouts just made matters worse.”

Well that rather depends upon your view of what the bailouts were there to do. They bailed out the private creditors that were on the hook pretty effectively and therefore from the corporate elite point of view they were a roaring success.

Everything else is collateral damage.

It seems to be getting worse by the week and some appear to dwell in some kind of fantasy land. Schaeuble has said that monetary policy has reached its limits, that there is too much liquidity in the system, while Draghi has indicated he is going to intervene more. Schaeuble has even talked about investment in Africa, while ignoring the same in Europe itself. Carney, a tad more realistic, has said that monetary policy has reached its limits and has called on the UK government to spend more. Hammond has indicated he might, while May has kind of contradicted him. We will find out in a few weeks. Meanwhile, European banks are claiming that they are incredibly safe, contradicting the evidence, with DB being among the most likely to suffer from a deflationary scenario. None of them want to increase their capital requirements, as, according to them, they have no need to do so. This is ridiculous.

You clearly are right. Obviously the financial crisis had a severely negative effect on output. But Issing is right too. The Greek politicians’ (I am Greek) policies have such a negative effect on output and are so scandalously favoring their favorite recipients that for them to blame the Eurozone is more of a smokescreen. That is the moral hazard that Issing talks about. How to deal with this conundrum? The only way is by demolishing the monetary union.

The budgetary sovereignty issue is quite complicated in the US. Individual states retained certain of their sovereignty over some issues. They insisted on this, otherwise they would not sign the Articles of Confederation. Hence, some activities carry penalties in some states but not in others, the rest being covered by federal statutes.

Nevertheless, there are complications. For example, kidnapping is a state or local crime unless the person kidnapped is carried across a state line, whereupon it becomes a federal crime. The rights accorded to the states in the Articles are states’ rights. While the boundary between what is state and what is federal can move, it can not be eliminated.

States control their education systems with the consequence that standards vary from state to state. Nurses, after their university “training”, have to take a national examination. If they obtain a sufficiently high enough score, they can practice in any state, whereas if they do not achieve this level, they will be able to practice only in states that have an agreement with the state where they obtained their qualifications. States generally have complete control of their education budgets. But absurdities can arise.

While every state receives a “grant” every year from the federal government, sometimes the federal government tries to do more. At one time, the federal government offered to provide funds for medical education in the form of books and lab equipment with no attached requirement on what books or equipment the funds would be spent on. AMA representatives testified before Congress that the medical education system neither needed nor wanted the government’s help, and even referred to this assistance as creeping Communism. The state universities could have used the assistance.

The tax situation is rather complicated. Individuals owe federal taxes, state taxes, county taxes, and, in many cases, city taxes (some of these in the form of a city income tax). Some situations are absurd, however. For instance, NYC imposes a sales tax on items bought there unless the item is to be transported to Connecticut. Many financially well off people work in NYC while living in CT, letting them off paying any city sales tax. (I have ignored items to be shipped out of the country, as these are usually exempt from general taxation.)

Budgetary sovereignty in the US is not very straight-forward. I realize Bill was restricting his discussion to nation states, but complications such as these would be encountered in any attempts to federalize the Eurozone.

Quote:

larry says:

Thursday, October 27, 2016 at 2:10

[…] Carney, a tad more realistic, has said that monetary policy has reached its limits and has called on the UK government to spend more. Hammond has indicated he might, while May has kind of contradicted him. We will find out in a few weeks.

(Interesting: Carney was complaining recently about being told what to do by a government minister, but it seems it’s ok for him to tell the government what to do (although he happens to be right in this case)

Presumably the (recently announced) extension to Heathrow airport would involve considerable government spending. It’s a pity though that this was probably the worst of the possible choices they could have made (and has caused one Tory MP to resign), and in any case, I don’t think work could start for at least a couple of years, so it’s not going to help right now. In passing, I think May (despite her stern reputation) is garnering a reputation as a serial ditherer, who finally ends up making the wrong decision every time.

Larry – As long as the states all demand payment in the same currency why is their a problem ? If they demanded payment in different currencies then I could see things being complicated.

Damning with faint praise, Bill?

“Both Australia and the US maintained their [absolutely meager] fiscal stimulus without major austerity events.”

Define major. Our electorate is not far behind on the resulting slippery slope. I wouldn’t let our NeoLiberals off much better than those running the EuroZone.

see our COMMITTEE TO NEUTER THE FIAT http://crfb.org/

http://mikenormaneconomics.blogspot.com/2015/07/committee-to-f-middle-class-suggests.html

otherwise known as the Committee for Irresponsible Semantics

What’s wrong with the EU nations restoring their individual currencies, but keeping the EU trade agreements? It’s not like the forex market is going to have any trouble trading 20 or more ‘new’ currencies.

“Budgetary sovereignty in the US is not very straight-forward. I realize Bill was restricting his discussion to nation states, but complications such as these would be encountered in any attempts to federalize the Eurozone”

not sure whats so complicated larry.

all each euro zone country has to do is state that payments of any kind within its jurisdiction will be made in the national currency, and all debts will be honoured in the national currency, and this includes taxes.

the hard part is all the technical stuff like changing the software that runs the banking system for instance.

“What’s wrong with the EU nations restoring their individual currencies, ” a lot unless they never got loans, nor lent, beyond their borders. Nor have contracts in Euro with foreign contractors.

@ Antoni Jaume,

Of course there are bound to be legal disputes, and some initial disruption, but the restoration of individual currencies has to be accompanied by a resignation of debts into those currencies.

Probably the easiest way would be for each country to have its own version of the euro, which they already do if you look closely at the structure of the EZ. Initially the currency will be pegged to everyone else’s euro but that will quickly be broken as soon as the ECB withdraws support. The currency and accompanying debt is then automatically repriced.