In the annals of ruses used to provoke fear in the voting public about government…

Eurozone horror story continues

Eurostat released the latest fiscal data for 2018 on Tuesday (April 23, 2019) which showed that – Euro area government deficit at 0.5% and EU28 at 0.6% of GDP – apparently a cause for celebration if you can believe the news reports that have accompanied the data release. The problem is that these numbers are meaningless without a context. And a relevant context is how well the monetary system is accommodating the advancement of material well-being among the citizens of Europe. On that ‘functional’ criterion, the horror story, more or less continues. Data relating to the real world (as opposed to the world of fiscal numbers on bits of paper) tell us that the damage from the GFC interacting with a dysfunctional monetary system design still lingers and the 19 Member States are still highly vulnerable to the next crisis. The austerity mindset remains and these fiscal outcomes indicate a failure of policy. Nothing to celebrate at all.

Eurostat wrote:

In 2018, the government deficit and debt of both the euro area (EA19) and the EU28 decreased in relative terms compared with 2017. In the euro area the government deficit to GDP ratio fell from 1.0% in 2017 to 0.5% in 2018, and in the EU28 from 1.0% to 0.6%. In the euro area the government debt to GDP ratio declined from 87.1% at the end of 2017 to 85.1% at the end of 2018, and in the EU28 from 81.7% to 80.0%.

Some financial media commentators were beside themselves yesterday when Eurostat released the data.

There were celebratory cries that this was the BEST result since the inception of the common currency.

I read one tweet saying:

… public deficit down for a 9th straight year, to a HISTORICAL LOW of 0.5% of GDP (2009 high: 6.2%) …

The Capitals were apparently to make the point more emphatic.

Just a week before (April 17, 2019), Eurostat published its latest inflation estimates – Annual inflation down to 1.4% in the euro area – which tells you two things:

1. That Euro area economic activity is weak (and getting weaker).

2. That the ECB once again has failed to achieve any semblance of price stability and to meet is stated policy targets and the Board should resign as a result. This failure is not a once off event, but, rather a systematic display of incompetence.

And, approximately a week before that (April 12, 2019), Eurostat announced that – Industrial production down by 0.2% in euro area.

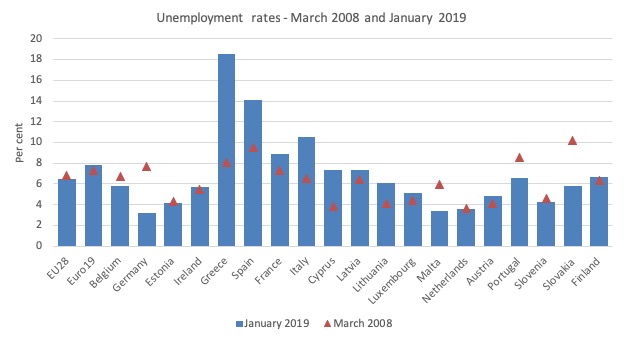

And the latest labour force data (published April 1, 2019) shows there is massive disparity in unemployment rates across the Eurozone and 11 out of the 19 Member States now have higher unemployment than they endured at the outset of the GFC. In many countries, Greece, Spain, France, Italy, Cyprus, Lithuania, that gap is fairly large.

In the core nations of the Eurozone, Spain, Italy, France, unemployment rates are a cumulative 10.2 percentage points higher than they were prior to the crisis.

And Germany might have low unemployment rates, but it has created a broad underclass of low-paid, insecure workers.

This graph compares the unemployment rates as at March 2008 to the January 2019 rates supplied by Eurostat.

So lets be happy and celebrate.

I saw a ridiculous Tweet yesterday, arguing that because Turkey was in a worse shape than the Eurozone Member States that we should be happy about the Eurozone. Sure, get bashed over the head with a 20 tonne weight is worse than a 10 tonne weight. Smile as you die!

The austerity mindset is now so entrenched that we have lost all sense of what these numbers actually mean.

The Eurozone is crawling along the growth gutter, mass unemployment is still at grossly elevated levels, poverty rates have risen, local community services are degraded, essential public infrastructure is in a growing state of disrepair, the banking system is not far from zombie status, and we celebrate government action that is deliberately creating this dystopia.

Concepts have lost all meaning in this neoliberal nightmare.

Moreover, the political elite and the sycophantic economists who provide it with cover keep eulogising the stability of the Treaty structure as if it is something that is superior to how other nations are governed.

Yet they conveniently don’t publicly admit that the only reason their precious euro is still surviving and that nations such as Italy are still solvent (in a manner of speaking) is because their so-called independent central bank has been systematically breaking the laws within the Treaty (TFEU) by funding fiscal deficits of the Member States since May 2010.

That was when they introduced the Securities Market Program (SMP) which was the first in a series of large-scale government bond purchasing programs.

The most recent incarnation being the Public Sector Purchase Programme (PSPP).

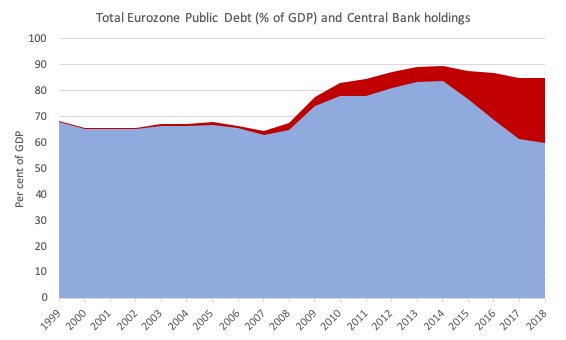

To see what impact those programs have had on the debt build up in the EMU I constructed this graph.

The current debt ratio (as a per cent of GDP) for the consolidated Eurozone is 86.2 per cent.

The ECB (through the Eurosystem of central banks) hold around 21 per cent as by the end of 2018 (around 18 per cent of Eurozone GDP).

The public debt ratio would drop to around 68 per cent if all that debt was written off. And remember it would take just one keystroke (well actually around 19 or so) to achieve that.

The sky would not fall in and it would free the Member States of one of the constraints that they face as a result of the ridiculous fiscal rules imposed by the European Commission.

And the real joke is that the ECB Board continually tries to spin the line that the massive buildup in its holding of Member State government debt was the result of ‘operational’ or ‘liquidity’ factors (relating to their open market operations).

If you believe that, then you would believe anything!

And what if Italy?

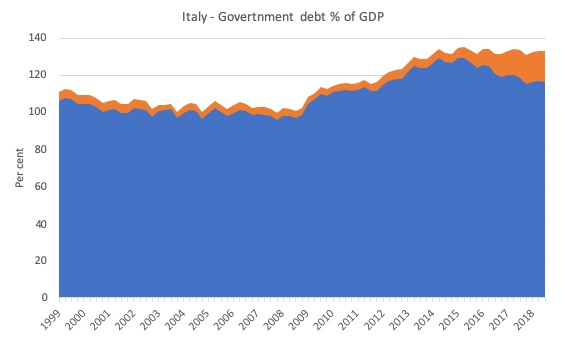

The next graph shows the same data as above for just Italy.

The data is drawn from the Bank of Italy’s Balance Sheet and Ministry of Finance statistics.

I remind everyone Italy has still not regained the GDP level it was at when the GFC ensued. The Italian economy is around 8 per cent smaller than it was in 2008, with the rising social problems that accompany that sort of economic performance.

And the only reason it’s government has remained solvent is because the ECB and its system of national central banks has been buying its debt in large volumes.

The graph shows that Italy’s gross public debt ratio (per cent of GDP) was 133.2 per cent at the end of 2018.

The Bank of Italy now holds 17 per cent of that debt. Before the crisis, it held around 3.9 per cent.

Italy’s debt ratio would be 116 per cent rather than 133 per cent if the Bank wiped off its holdings.

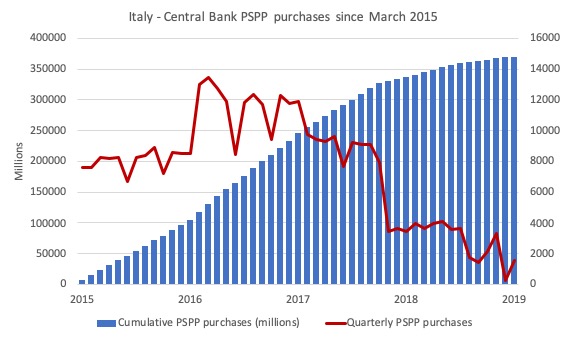

And to put that in perspective, here is the PSPP purchases of Italian government debt by the central banking system from the inception of the program in March 2015 to March 2019.

The red line is the monthly purchases, while the blue bars accumulate them in the stock held by the central bank.

As at March 2015, the central bank held 370,477 million euros of total Italian governemnt debt.

Had the ECB/BoI not intervened in this way, both with the PSPP and the SMP before that, the Italian government would have been rendered insolvent.

The central bank has played a fiscal role – funding deficits via the back door (secondary bond market purchases) – which has not only given the private bond dealers the security to keep lending to the Italian government but has made then a tidy profit as they have been offloading increasing amounts of that debt onto the central bank.

The only problem is that this quasi ‘fiscal authority’ has only one goal – to keep Italy from declaring insolvency and leaving the Eurozone.

That goal has been achieved at massive cost to the Italian citizens in the form of suppressed incomes, increased unemployment, increased income insecurity, increased poverty rates, decaying infrastructure – a slow drip death.

Greece

And, just think about Greece for a moment. It recorded a fiscal surplus of 1.1 per cent of GDP in 2018. In 2015, its fiscal deficit was 5.6 per cent.

But it’s actually worse than that.

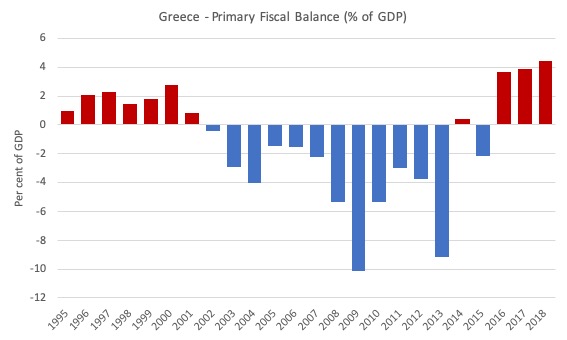

Have a look at this graph, which shows the primary fiscal balance since 1995. The Primary fiscal balance is government expenditure net of interest payments on outstanding debt minus government revenue.

I deliberately shaded the primary surpluses red to indicate periods when the central government has been undermining growth and prosperity in Greece.

The surplus periods in the late 90s corresponded to the period when Greece was trying to fudge its fiscal accounts (with the deception provided by Goldman Sachs) to meet the convergence criteria to enter stage III of the transition to the currency union.

In 2018, the Eurostat data shows that Greece ran a primary surplus of 4.4 per cent of GDP, even though its target under its ‘colonial administration’ from Brussels was 3.5 per cent.

If you include net interest receivable, the primary surplus comes in at 4.2 per cent of GDP in 2018.

A primary surplus of this magnitude amounts to criminal negligence in the context of the state of the Greek economy.

The 3.5 per cent target was irresponsible enough. But the actual 2018 result, adds an extra €1.5 billion that has been withdrawn by the government under its austerity program from the Greek spending cycle.

Imagine how many jobs €1.5 billion could provide.

The lying and traitorous Greek government, now facing an election, is claiming that it will cut taxes to provide some relief.

If I was a Greek voter I’d be rushing to the polling booths on election day to kick Syriza out and make sure they never achieve government again. They have betrayed the progressive movement and are irredeemable.

Conclusion

That anyone could think that the latest fiscal data from the Eurozone is a sign of success or is a good outcome indicates that the austerity mindset has become a deep-seated pathology.

Any government can ultimately achieve the sorts of outcomes that Eurostat published this week if they are prepared to savage public services, run down public infrastructure, cut income support, and all the rest of it.

However, to think that is the role of government, in general, and fiscal policy, in particular, shows how far we have come from an appreciation of what the purpose of our institutional frameworks in society are meant to be.

Fiscal policy is not about achieving some low deficit or primary surplus. How do we know whether a 2 per cent deficit (in relation to GDP) is more appropriate than a 10 per cent deficit or a 2 per cent surplus?

We need a context!

That context is about people, their jobs, their incomes, the support mechanisms put in pace to help those who need it, the quality of our schools, hospitals, transport systems, water and energy systems and more.

On those real criteria, the Eurozone is a total failure and should be disbanded.

But wait, Portugal has just recorded its lowest fiscal deficit in the 45 years of democracy. Time to break out the balloons!

That is enough for today!

(c) Copyright 2019 William Mitchell. All Rights Reserved.

Dear Bill

As a follower of your blog it seems you have given up on poor old Aus and are spending your time telling is that Europe is screwed – which we all accept. As far as the Brexit argument goes, surely that the Brits having their own currency has the consequence that the UK does not face the same disaster as others in the Euro currency? So really, is Brexit all that important apart from the nuisance of Euro bureaucracy.

At the moment we have an election pending here and we need some economic sense in the discussion which you well could provide.

cheers

Rob Holmes

“A primary deficit of this magnitude amounts to criminal negligence in the context of the state of the Greek economy.”

Gone over to the dark side Bill? I’m sure you meant “surplus” .

Dear Rob Holmes (at 2019/04/25 at 11:51 am)

I comment and analyse in detail all the major Australian data releases and political statements.

No other writer provides as much consistent detail on these matters as I do in Australia.

What more would you have me do?

Further, Brexit is not about currency freedom. It is about legislative freedom. Under EU law, enforced by the European Court of Justice, the British legislation can be challenged by corporations if they deem it to be not in their best interests, irrespective of whether the laws are in the wider interest. It goes well beyond whether EU membership is a nuisance or not.

best wishes

bill

Dear MattR (at 2019/04/25 at 3:59 pm)

No, I am safely this side of the ‘dark side’. I was rushing in an airport lounge to finish before I had to catch a flight.

Thanks for picking that up.

best wishes

bill

Does the action of the ECB mean that moral hazard as a banking concept in the Eurozone is dead? If governments know the ECB will buy their debt, why doesn’t Italy (for example) simply ignore its commitments to SGP targets and simply keep issuing debt to finance its investment plans? The alternative is that Italy crashes out of the prison, sorry, club, and brings the walls down on its way out?

bill,

“Under EU law, enforced by the European Court of Justice, the British legislation can be challenged by corporations if they deem it to be not in their best interests, irrespective of whether the laws are in the wider interest.”

I am no lawyer, but It seems to me the above statement is not entirely accurate.

From the website of the European commissions:

“As a general rule, only Member States, the institutions of the European Union and national courts can refer cases to the Court of Justice. In some circumstances, a firm or a private individual can bring a case before the Court. This is the case for appeals to the Court regarding decisions taken by the institutions of the European Union in the field of competition, Community grants, contracts with European Union institutions or the European public service.”

I talked to a worker who came from the UK originally.

It was some time ago. We were talking about brexit. She said UK never used the Euro but kept the pound.

So whats the story here? How come the UK has been subjected to EU/ECB rules in terms of running government budgets?

Oh well. Time to do some research to nail these things down…

Bill,

If not Syriza, then whom else should Greek citizens vote for? PASOK and New Democracy are austerity parties too-even moreso. So who is left as an alternative? The KKE (communist party)?

What’s the story? In one word: Treaties.

In several words: Maastricht, Nice, Rome, and Lisbon. If I have missed any, I’m sure someone will jump in.

Under the Maastricht Treaty, we are supposed to conform to certain norms when it comes to fiscal deficits and cumulative public debt. We are also constrained with VAT rates, and certain other things.

There is also the intention that in time, all EU countries will move to the Euro, although there appears to be no mechanism for the EU to enforce this. Also, supposedly, the UK has an “Opt Out” from joining the Euro, although I have never seen the specific text of this opt-out, and I am not sure exactly where it is enshrined. Some say it’s written into the Maastricht Treaty, but I have my doubts about that.

Although Tony Blair (when Prime Minister) was known to be in favour of our joining the Euro, he did announce (although it was really Gordon Brown’s work) what became well known as the Five Criteria for joining it, and Brown was canny enough to make sure they were quite unlikely to be satisfied, at least, any time soon.

It’s also not clear whether these Five Criteria could be said to bind any future government or Prime Minister. (I doubt it).

Anyway, I’m very suspicious of this so-called Opt-Out. First because I won’t believe it until I see the text, and any conditions attached to it. But also because in the future, especially as the EU moves towards more integration, I could easily see the UK coming under pressure to waive its Opt-Out, and I could easily see a Prime Minister in the same mould as Tony Blair (without a Gordon Brown at his side), or a David Cameron caving in, and doing so willingly.

So for me, Brexit absolutely is about currency, as well as the other things, because I think that so long as we remain in (and the Revokers are determined for us to do so, despite this being a denial of democracy), our currency is at risk, albeit a long-term risk.

Thanks Mike. That clears up quite a bit.

Hi Bill,

Much of the analysis of real economies you provide on the blog (including today’s post) evaluate policy outcomes in terms of growth in GDP. I can see why that is in some sense inevitable (given the measures everyone uses) but at another level it seriously rankles because many progressives (including me) have come around to the view that we need to find a framework that does not depend on continuous growth for ecological reasons.

How are policy recommendations informed by MMT impacted by political priorities to limit growth and resource usage? Is this another area where MMT simply makes the political choices more transparent, or are there other angles?

Cheers,

Matt

“If not Syriza, then whom else should Greek citizens vote for?”

Matthew,

MeRA25, of course… part of the DiEM25 movement, founded by Yanis Varoufakis.

Cheers, Bruce

But he wanted Greece to stay in the Euro, and for Britain to remain in the EU….in spite of what he knew about the EU and especially the “Troika”.

I’ve looked at their programme (at least according to Wikipedia). It’s “interesting”, without being exactly radical.

Mike,

Yes, Varoufakis accepts that once in the EU it’s better to stay and fight for change than to jump ship. Which is what DiEM25 is all about – a pan-European party.

Cheers, Bruce

Which sounds to me like a triumph of hope over experience.

It’s a brave, and perhaps visionary, idea, but I fear has about as much chance of working as the EU has of reforming.