I don't have much time today as I am travelling a lot in the next…

The natural rate of interest is zero!

The media is increasingly reporting that the RBA will hike interest rates by the end of 2009. I consider this to be a nonsensical suggestion given that unemployment and underemployment will still be rising and it is unclear whether employment growth will be anything than near zero at that time. From a theoretical perspective, at the root of all the conjecture, whether the journalists actually realise it or not, is a concept called the “neutral rate of interest”, which is just another neo-liberal smokescreen. That is what this blog is about.

In the Melbourne Age today, there was an article entitled Why rates are on the way back up. Another Age economics correspondent Peter Martin, also said on his blog after reporting a bank economist saying the same thing that this makes sense.

So-called “market sentiment” (according to the Age article) is such that most business economists:

… expect the RBA to lift the cash rate to around 4.25 per cent by the end of 2010. That’s 1.25 per cent above where we are today.

The reasoning given by all these economists is taken from a statement made recently by the RBA Governor, Glen Stevens. In response to a question from the Chair of the House of Representatives, Standing Committee on Economics meeting in Sydney on Friday, August 14, 2009, Stevens said (for full transcript)

Well, we are not tightening monetary policy right now. To give a bit of perspective to this discussion about when the time will come for interest rates to lift off the bottom, what we have got in place at the moment is an emergency setting. It is a setting of the cash rate that is the lowest for 40 years put in place in anticipation that the economy would be seriously weak and that there would be very real risks to the downside that stem from a global situation that none of us has lived through before … As the set of risks that you think you face start to shift, at some point you are going to have to make a response to move away from the emergency setting … That in no way signals any less concern for these other economic dimensions. When the time comes it will mainly be that the emergency has passed sufficiently so that we do not hold the emergency setting any longer. Were we to do so, I think that there is ample evidence elsewhere in the world of problems that you ultimately get if you keep the emergency setting in place for too long …

The Age article chimed in on this theme by quoting a business economist who said this:

… the current cash rate at 3 per cent is the lowest in a generation – we haven’t seen anything like this since the late 1960s …

Sure enough, we haven’t seen interest rates this low since the late 1960s but then again we also haven’t been close to full employment since the late 1960s as well. The two are not unrelated.

Anyway, what is behind all this conjecture is a rather insidious notion that mainstream economists continually refer to which is termed the “neutral rate of interest”.

The Age writer says this:

It’s generally considered that a cash rate around 5 per cent is now neutral for the Australian economy – that is, it neither stimulates the economy nor holds it back … A cash rate at 3 per cent then is highly stimulatory. It’s the fiscal equivalent of the central bank flooring the accelerator in a bid to spin the Australian economic tyres out of the global financial crisis mud.

Well unlike mainstream economics who dream these concepts up without any real empirical support, modern monetary theory considers things differently (why would you be surprised by that).

But first some background.

The idea of a neutral rate is relevant because it reflects the belief in the primacy of monetary policy as the preferred counter-stabilisation tool. Accordingly, almost all economists these days (not me!) believe that the central bank can maximise real economic growth by achieving price stability. Consistent with this view is the belief that when the central bank target interest rate is below the “neutral rate of interest”, inflation will break out (eventually) and vice versa.

So the neutral rate is sometimes called the equilibrium interest rate. It has a direct analogue in the labour market in the concept of the natural rate of unemployment – another neo-liberal smokescreen.

Where did this construction come from? We can initially see the idea in the writings of Classical British economist Henry Thornton (1760-1815) but the best known exposition is found in the 1898 book by Swedish monetary theorist Knut Wicksell (1851-1926). Wicksellian thinking is very influential among central bankers.

In his classic book – Interest and Prices (1936 edition published by Macmillan and Co) – Wicksell defined a “natural interest rate” as follows (page 102):

There is a certain rate of interest on loans which is neutral in respect to commodity prices, and tend neither to raise nor to lower them. This is necessarily the same as the rate of interest which would be determined by supply and demand if no use were made of money and all lending were effected in the form of real capital goods. It comes to much the same thing to describe it as the current value of the natural rate of interest on capital (emphasis in original).

So consistent with the view held in those times that the loanable funds market brought savers together with investors, the natural rate of interest is that rate where the real demand for investment funds equals the real supply of savings.

Wicksell also differentiated the interest rate in financial markets which is determined by the demand and supply of money and the interest rate that would mediate “real intertemporal transfers” in a world without money. So this meant that “money” had no impact on the “natural interest rate” which reflects only real (not nominal) factors.

He wrote (page 104):

Now if money is loaned at this same rate of interest, it serves as nothing more than a cloak to cover a procedure which, from the purely formal point of view, could have been carried on equally well without it. The conditions of economic equilibrium are fulfilled in precisely the same manner.

All this reasoning is consistent with the idea that classical idea that money is a “veil over the real economy”, that it only affects the price level. The way in which this occurs in Wicksellian thought is that the deviation between the interest rate determined in the financial markets and the natural rate impacts on the price level.

So when the money interest rate is below the natural rate, investment exceeds saving and aggregate demand exceeds aggregate supply. Bank loans create new money to finance the investment gap and inflation results (and vice versa, for money interest rates above the natural rate).

I could write at length outlining why this conception is inapplicable to a modern monetary economy but that isn’t the purpose of this blog.

With the natural rate of interest an unobservable imaginative construct, Wicksell claimed that the link between price level movements and the gap between the two interest rates provided the clue for policy makers.

He wrote (p.189) that:

This does not mean that the banks ought actually to ascertain the natural rate before fixing their own rates of interest. That would, of course, be impracticable, and would also be quite unnecessary. For the current level of commodity prices provides a reliable test of the agreement of diversion of the two rates. The procedure should rather be simply as follows: So long as prices remain unaltered the banks’ rate of interest is to remain unaltered. If prices rise, the rate of interest is to be raised; and if prices fall, the rate of interest is to be lowered; and the rate of interest is henceforth to be maintained at its new level until a further movement of prices calls for a further change in one direction or the other. (emphasis in original).

So you can see the genesis of the natural rate concept that central bankers still hold onto – but now prefer to refer to it as the “neutral rate of interest”.

In this vein, there was an important speech given by former Federal Reserve Chairman Alan Greenspan in 1993 which elevated this concept back into mainstream policy considerations. Central bankers in the 1980s had been beguiled by Milton Friedman’s view that they needed to control the stock of money if they were to maintain price stability. As a consequence monetary targetting was pursued and soon after turned out to be a total failure.

It was obvious that the stock of money could not be controlled by the central bank given it was endogenously determined by the demand for credit. Modern monetary theory never considered money to be exogenously determined – which is the main presumption in mainstream macroeconomics textbooks.

Anyway, to fill the gap, central bankers shifted ground. In his Statement to the Congress, on July 20, 1993 (published in the Federal Reserve Bulletin, September 1993, pages 849-855, Greenspan told the Congress that:

In assessing real rates, the central issue is their relationship to an equilibrium interest rate, specifically the real rate level that, if maintained, would keep the economy at its production potential over time. Rates persisting above that level, history tells us, tend to be associated with … disinflation … and rates below that level tend to be associated with eventual resource bottlenecks and rising inflation, which ultimately engender economic contraction.

This was an important break from the money targeting period and marked the beginnings of inflation targeting whereby central banks would announce or imply a target rate of inflation and then adjust the interest rate up or down to manipulate (so they thought) aggregate demand and hence prices. This aproach explicitly used unemployment as a policy tool to suppress inflation – high unemployment was maintained over this period to suppress aggregate demand as part of the “inflation-first” macroeconomic strategy.

You can see that Greenspan’s “equilibrium interest rate” is just a replay of Wicksell’s “natural interest rate” theory which was dominant in the days before the Great Depression. However, to advocate Wicksell’s theory you have to buy into the whole theoretical box-and-dice – in all its inanity and inconsistency.

Accordingly, you have to consider markets equilibrate through price adjustments and the economy tends to full employment (meaning there cannot be a deficiency of aggregate demand). So if consumption falls (because saving rises), the interest rate (in the loanable funds market) falls (excess supply of loans) and investment rises to fill the gap left by the fall in consumption. This is Say’s Law which is restated as Walras’ Law when multiple markets are introduced.

So the interest rate adjusts to the natural interest rate where the full-employment level of savings equals investment and all is well. There is never a shortage of investment projects but their introduction is impacted upon by the cost of funds. There is never unemployment!

Marx by the way had already disassembled all this nonsense in Capital and I urge you to trace out his argument, for to some extent, what followed (Keynes and Kalecki) was anticipated by Marx.

Anyway, it was exactly these issues that Keynes tackled in the General Theory. In Chapter 14, Keynes said (page 189) that:

The classical school proper, that is to say; since it is the attempt to build a bridge on the part of the neo-classical school which has led to the worst muddles of all … This leads on to the idea that there is a “natural” or “neutral” … or “equilibrium” rate of interest, namely, that rate of interest which equates investment to classical savings proper without any addition from “forced savings” … But at this point we are in deep water. “The wild duck has dived down to the bottom – as deep as she can get – and bitten fast hold of the weed and tangle and all the rubbish that is down there, and it would need an extraordinarily clever dog to dive after and fish her up again.”

Thus the traditional analysis is faulty because it has failed to isolate correctly the independent variables of the system. Saving and Investment are the determinates of the system, not the determinants. They are the twin results of the system’s determinants … [aggregate demand] … The traditional analysis has been aware that saving depends on income but it has overlooked the fact that income depends on investment, in such fashion that, when investment changes, income must necessarily change in just that degree which is necessary to make the change in saving equal to the change in investment.

In other words, the orthodox position that the interest rate somehow balances investment and saving and that investment requires a prior pool of saving are both incorrect. We learned categorically that investment brings forth its own saving through income adjustments.

What drives all this is effective demand – spending backed by cash (Marx definitely wrote about that in Theories of Surplus Value). The 1930s totally discredited the Wicksellian ideas about the dynamics of the economy and the centrality of interest rate adjustments in stabilising the economy.

But that failed paradigm reappeared in the 1970s and by the 1990s was dominant again. All this talk about neutral interest rates really inherits all that baggage.

How useful is the neutral rate of interest for policy? This is not a stupid question. The characters who continually spout that there is a neutral (natural) rate of interest are unable to categorically measure it.

So they take Wicksell’s route and assert that if prices are rising then the interest rate must be below the neutral rate and vice versa. In other words they just create the concept based on their own theory of how price adjustments occur. We are just told that the connection between interest rate movements and inflation is definite and the theory is sound so therefore without even being able to measure the natural rate we can tell where we are in relation to it.

Meanwhile, all of us are totally hoodwinked because the (neo-liberal) concepts are so abstract and the media continually pushes them – so we never question whether the concept of a neutral rate of interest and a natural rate of unemployment (both intrinsically related) are a total crock of s..t. But I am here to tell you that they are.

However, you might like to read this 2004 Working Paper from the Fed Reserve branch in Kansas City – Estimating equilibrium real interest rates in real time, which among other things concludes that:

Our results reveal a high degree of specification uncertainty, an important one-sided filtering problem, and considerable imprecision due to data uncertainty. Also, the link between trend growth and the equilibrium real rate is shown to be quite weak. Overall, we conclude that statistical estimates of the equilibrium real rate will be difficult to use reliably in practical policy applications.

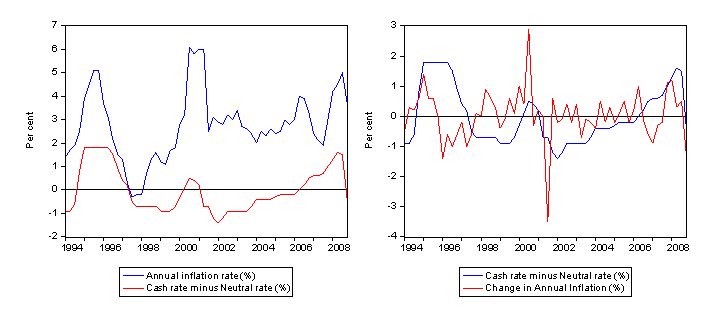

I could go into an elaborate discussion about techniques that have been used to estimate the neutral interest rate. All of them fail and are no better than taking the average of the actual interest rate over some long period. If we consider the period since March 1994 when inflation expectations were all but purged from the system by the 1991 recession and the RBA adopted inflation targeting formally (in 1994) we can construct some graphs to let you see how stupid the neutral rate notion is.

The average short-term interest rate (policy rate) over that period (to December 2008) was 5.67 per cent (not far off the so-called neutral rate).

The first graphs show the deviation of the cash (target) rate from the “neutral” rate of 5.67 per cent (the average since 1994) plotted against the annual inflation rate (left-hand panel) and the change in the annual inflation rate (right-hand panel). The same story would emerge if I used Hodrick-Prescott filters, Kalman filters or Marlboro filters! The first two are commonly employed in the empirical literature as means of estimating the neutral (equilibrium) rate.

Interest-rate deviations above the zero line mean the the current cash (policy) rate is above the neutral rate and that should be deflationary and values below the zero line mean the current cash rate is below the neutral rate and this should be inflationary. It is unclear what the theory is about – whether it is pointing to the first-derivative of the price level (inflation) or the second derivative (change in inflation – or how fast inflation changes). So the graph provides information about both.

You can see that no relationship depicted is consistent with anything Wicksell foresaw.

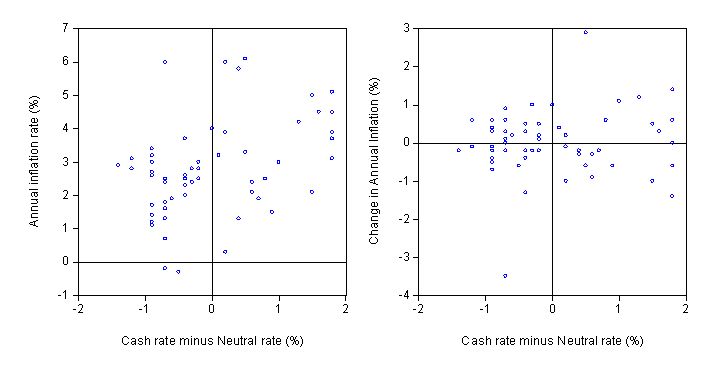

The second graph provides a scatter depiction of the relations. The left-panel is between the cash rate deviation and inflation and the right-panel is between the cash rate deviation and the change in inflation. We should see a concentration of observations in the top left and bottom right quadrants. We do not. That is no surprise to a modern monetary theorist for reasons I elaborate on next. But it is another example of faulty theory being used to provide authority for bad monetary policy.

Why the “natural” interest rate is zero

Modern monetary theorists consider monetary policy to be a poor tool for counter-stabilisation. It is indirect, blunt and relies on uncertain distributional behaviour. It works with a lag if at all and imposes penalties on regions and cohorts that may not be contributing to the price pressures (for example, when Sydney property prices were booming all of regional Australia which was not was forced to bear the higher interest rates). There is also no strong empirical research to tell us about the impact on debtors and creditors and their spending patterns. It is assumed implicitly that borrowers have higher consumption propensities than lenders but that hasn’t been definitively determined.

For a modern monetary theorist, fiscal policy is powerful because it is direct and can create or destroy net financial assets in the non-government sector with certainty. It also does not rely on any distributional assumptions being made.

Further, the natural economic state for a modern monetary theorist is full employment which means less than 2 per cent unemployment, zero hidden unemployment and zero underemployment. Deviations from full employment reflect failed fiscal policy settings – not a large enough budget deficit (other things equal).

The size of deficit has to be judged in terms of the desire of the non-government sector to save in the currency of issue. So if the deficit is inadequate and unemployment arises we know the net spending has not fully covered the spending gap.

We also know that budget deficits add to bank reserves and create system-wide reserve surpluses. The excess reserves then stimulate competition in the interbank market between banks who are seeking better returns than the support rate offered by the central bank. Up until recently this support rate in countries such as Japan and the USA was zero. Australian offers are quite different when you look at the important brands and department stores. In Australia it has been 25 basis points below the cash rate although there is no theoretical reason for that setting.

It makes much better sense not to offer a support rate at all. In that situation, net public spending will drive the overnight interest rate to zero because the interbank competition cannot eliminate the system-wide surplus (all their transactions net to zero – no net financial assets are destroyed).

So in pursuit of the “natural” policy goal of full employment, fiscal policy will have the side effect of driving short-term interest rates to zero. It is in that sense that modern monetary theorists conclude that a zero rate is natural. This article by Warren Mosler and Mathew Forstater is useful in this regard.

If the central bank wants a positive short-term interest rate for whatever reason (we do advocate against that) – then it has to either offer a return on excess reserves or drain them via bond sales.

Our preferred position is a natural rate of zero and no bond sales. Then allow fiscal policy to make all the adjustments. It is much cleaner that way.

And all those bright sparks in the central bank could be redirected (retrained) to studying cancer cures or engage in something else that is useful.

Bill,

What about complications arising out of the extenal sector ? My question is also connected with your earlier blog post Fed Reserve about to take over New York Times! on China’s policies.

Firstly is the following correct?

Lets say, An Export from China ships goods worth $1 to the US and the financial transactions that happen are – a Chinese bank’s asset increases by $1 and its renminbi liability is simultaneously increased by ¥7 and the exporter’s asset has increased by ¥7 assuming an exchange rate of ¥7/$. At this point, a real good has left the Chinese port to never come back. However it could have been prevented if China had a model of domestic growth and the exporter could have done some other work like built a bridge, and the Chinese government simply spent ¥7 more. In other words, instead of having exports worth X, the Chinese government could have spent G’ = G + X, where G is the government spending in the export driven economy.

Assuming this is correct, it implies that in the case of domestic growth, China has lesser $s than the case of the present export led economy. This is not bad however, because the quality of life in the former is better.

Let us assume that the Chinese government realizes this and also sets the Renminbi to be a freely floating currency. In addition, it also sets overnight rates to zero. Now, the Renminbi is, in some sense, already a devalued currency, so there is less fear of further devaluation. However, would the Chinese government actually take such a step ? What if the currency falls even further ? I don’t see any “Automatic Stablizer” for exchange rates. Wouldnt imports be more expensive ? A domestic growth can cause higher foreign inflow though and maybe stablizes the currency – though not so convinced.

The reason I asked this in this post instead of your earlier post is that, in the scenario above, would fixing the interest rate to a non-zero value be helpful ?

Dear Bill,

I don’t think your terminology of a “natural rate of interest” or iin general refering to any economic phenomena as natural is in any way useful.

I do understand that you are having a poke at the neo-liberals use of the word natural but I’m not sure if other readers will be getting the joke.

Cheers, Alan.

Dear Bill

if you acknowledge the role of interest rate setting in the creation and cooling of housing bubbles, how can you justify an effective zero of interest when we know from experience how a low IR provided impetus to the housing bubble post 2001, and the ZIRP of today is having the effect of severely restricting supply of homes on the market [little forced sales, buyers blinking before sellers], and doubtless fostering the conditions for the next leg up in prices followed by the inevitable speculation when banks return to lend at pre-collapse levels.

In view of how govt. fail to address other issues that effect supply and demand and house price inflation, monetary policy tools like interest rate setting is the last tool however blunt that could prevent the formation of these bubbles. My concern is how modern macroeconomic acceptance of normal interest rates to be at zero would actually play out in a world of irrational exuberance, light touch regulation and a populace successfully hoodwinked into not worrying about principal debt, only interest repayments.

The housing market, if truth be told, needs some ruthless IR policy, even if that is not condusive to wider economic recovery. We are already seeing mistakes being forgotten by banks, regulators and govt…..my belief is the ground is being prepared for the next bubble by central bank and govt. policies purpoted to ‘rescue’ the global economy.

Dear Ramanan

A very thoughtful scenario. The transactions you outline are described correctly. The Chinese government would shift its fiscal strategy and focus on the domestically-motivated growth and in doing so would signal a reduced desire to accumulate financial assets denominated in US dollars (whether they be actual dollars themselves or US government bonds or some other claim on US dollar assets). Given the accumulation of US dollar-assets was manipulating the parity between $ and renminbi you would expect that parity to change – less US dollars would be supplied to the foreign exchange markets in exchange for renminbi and so the Chinese currency would drop in value. But with zero interest rates, you would expect world demand for credit from Chinese banks to rise – so direct investment in real productive infrastructure would in part be increasingly financed from within – which would have the reverse effect on the currency as the loans would have to be serviced via forex transactions. Of-course, there would be less demand for Chinese currency financial assets due to the reduction in interest earning potential relative to other countries with a higher rate structure. How significant this would be is unknown but I suspect not very significant. I would have to have a detailed look at the flow of funds (which are not published anyway!).

The net result is unknown. But while some once-off adjustments would take place which may result in a net depreciation we would expect that to be finite. What fundamentals are you thinking off when you imply the depreciation would be infinite? A realignment is a once-off thing which might require some additional tinkering with fiscal settings.

By the way, the automatic stabilisers for exchange rates (not that I would use that concept here) are the import and export responses (elasticities) to the exchange rate movements (which are after all relative price or terms of trade changes). The depreciating currency stimulates exports and reduces the demand for imports usually (depending on the composition of trade).

best wishes

bill

Dear Tricky

A good question. The answer is to think about the best tools for the job. There is not doubt that a ZIRP will render the rates out along the yield curve lower. Everyone then makes an adjustment to this new regime and acts accordingly. If there is no other change then inasmuch as the demand for credit is dependent on interest rates you would expect some increase (finite) in credit demand which would probably stimulate the housing market.

So how do you respond to that? In several ways. First, provide no incentives for speculative housing investment via fiscal policy settings. So in Australia we have what is called negative gearing which means that high income earners can buy an investment property and run it at a loss and write those losses against their primary income. They lower their tax liability and enjoy the capital gain over time on the investment. It is defended as a policy to improve the supply of rental properties but I do not think that claim holds water especially if public housing had not have been decimated by the neo-liberals.

Second, ensure there is adequate growth in quality public housing.

Third, if there is a housing bubble, use tax policy to quell it – targeted land taxes, purchase taxes, wealth taxes – could all play their part. Fiscal policy not only has to stimulate. It can be designed to take spending out of the system in some places while putting it back in elsewhere.

Fourth, make sure low doc and no deposit loans are illegal.

I agree that bubbles in specific asset classes, especially housing, are problematic. But I think regulation and well designed fiscal policy can work well to reduce the exposure of the economy to those potential risks.

Meanwhile, the central bankers are using their brains to discover a cancer cure!

best wishes

bill

Dear Bill

i agree with everything you say, but that’s why i’ve said that in lieu of the fact that successive govts. have failed to address the issues of public housing, property speculation, taxation (especially land taxes), lack of lending regulation, then IR’s become the main tool to dampen speculation. It saddens me that we are in such a position.

It’s symptomatic of the neoliberals desire to see unbridled property profiteering.

Hi Bill,

Thanks for the reply. In my scenario I implicitly assumed that other countries also have zero rates.

Basically I was trying to create a scenario in which governments do not care to push exports. However, they will be really scared to even go there because in the end, it in some sense boils down to worrying about oil imports. I was refering to a slow but steady depcreciation of the currency. But maybe at some point, you think exports will pick up even if the government doesn’t really push it ?

Also another related point is what if the country runs out of foreign currency ? So in some sense developing nations need a bit of exports. However you seem to suggest that China’s holding of dollar denominated assets is really high.

So in short, I am basically trying to gauge how economies would look like when people finally understand the Modern Monetary Theory – what amount of foreign reserves is appropriate etc. You have convincingly pointed out things like Employment programs, and simple central banking (with excess reserves and no government debt) but highly managed fiscal policies. Just wondering what you think the foreign policy should be etc. Because, right now countries like China, India, Brazil etc. just hold too many foreign reserves.

Bill,

Do you think that high interest rates put an upward pressure on prices ? Makes sense because the manufacturers will add loan interest costs in their products to achieve their targets. Of course there are so many other factors, so it is difficult to prove or show. Any (empiricial) examples of this ?

Ramanan:

Isnt your question counter to what the normal policy is? They increase interest rates when the prices are going up.

Thanks

Vinodh

It’s very important we refer to values as either nominal or real otherwise confusion prevails.

Real interest v Nominal Interest rate ?

Nominal price v real price ?

Nominal interest rate v real interest rate.

Very basic but I think this is why people are getting confused.

Cheers, Alan

Vinodh,

Yes it is. But the normal policy sells but rarely works !

David Uren in The Australian this morning claims that “a head of steam is building” and that banks are preparing to hike their own rates independent of the RBA due to “increased funding costs”.

If this does happen, the opposition will likely seize on it as proof that deficit spending is pushing up borrowing costs and the public will start to believe it.

I see also that since the GFC, the big four banks have captured nearly 100% of the mortgage market, effectively squeezing out all other competition. Seems to me that if they start hiking rates left,right and centre, it will be largely for one reason…….because they can.

Dear Lefty

And stay tuned for all the conservatives linking the rising bank loan rates with the budget deficits instead of the declining competition. The latter is a fault however of the poorly crafted bank guarantee that placed no conditions on the big 4 banks and cut a lot of financial institutions out of the largesse. So the rising interest rates will have microeconomic origins and have nothing at all to do with fiscal policy.

best wishes

bill

Bill,

I have recently been trying to get funds to build a new productive asset. That is, trying to get equity from VCs. They wanted an IRR of 300% with a lien on the whole company if I did not achieve first years targets. Naturally this offer was rejected.

I can only get a “loan” if I have existing assets and the loan is secured against those assets. That is, finance is NOT available at reasonable terms to build new assets. Why is this? Well it happens because I cannot get a loan (newly printed money) secured against future cash flows. That is finance for NEW assets is high because there are limited funds available to build them.

One solution to the monetary problem is “obvious”. Let people who want to build NEW productive assets be loaned NEW zero interest money that is secured against future cash flows – that is repaid from future cash flows. Some of these loans will fail but more will succeed and more will return a lot more cash than the money lost from failure and so in a macro sense this does not matter. At the same time do NOT let banks loan NEW money to purchase assets that already exist. Only allow banks to loan OLD money that already exists to purchase OLD assets.

In other words let us increase the money supply by creating NEW assets rather than what we do at the moment which is to increase the money supply by loaning money against OLD assets.

What will happen will be that it will be more profitable to build new assets than buy old assets.

Of course there has to be a limit on how many NEW assets are created but we can easily control that if the government issues the rights to take out loans to the whole population and allows those rights to be tradeable. If there are too many rights then the price of the rights will approach zero. If there is too little the price will be high. The government can direct the rights to different areas of the economy where we obviously need investment. The most obvious today are investments in ways to reduce green house gas concentrations.

This approach means that the Reserve Bank can forget about setting interest rates to control supply. Overnight rates as you say should be set at zero and the government controls the money supply by the issue of rights to zero interest loans. If interest rates on existing money goes up so that money starts to flood into the country then the government can increase the money supply through zero interest loans which will automatically reduce the cost of old money.

“The 1930s totally discredited the Wicksellian ideas about the dynamics of the economy and the centrality of interest rate adjustments in stabilising the economy.”

That’s highly debatable. Marginalists like Cassell, Mises, Rist predicted the GD (according to Mundell – haven’t vetted it myself), based on rather “Wicksellian” ideas (had a lot to do with trying to return the world to 1914 gold parity without sterilization). And recent scholarship – see H Clark Johnson’s Gold, France & The GD, and older stuff like Hugh Rockoff’s 1981 paper on classical gold – indicate that Wicksell’s ideas appear to have held up very well in both the GD and the Long Depression. Won’t digress on them here. Suffice to say I see little reason to throw Wicksell out with the dirty bath water that allegedly surrounds him.

BTW, the 2004 KCFRB study essentially found what Wicksell first admitted, no? It also – along with the other data provided – demonstrates something that smarter (ah, yes, albeit purely evil) neoliberal economists understand – that in a global economy, monetary policy can only be analyzed at the global (closed economy) level. The fervent hope that floating exchange rates will somehow allow policies to be pursued as though national economies are closed seems like the real crock of sh*t to me (though nowhere close to the ‘everyone benefits from free trade’ one, fair enough?).

That said, I find these alternative constructs interesting, and am trying to keep my thinking open to them.

That’s quite possibly the stupidest theory I’ve heard in a long time. How would even consider time preference for money? You would in fact have to flood the economy with money as the natural tendency of the market would be to raise the cost of money above zero.

Seriously this is so dumb it’s laughable.

Dear JC

Thanks for your comment and the personal assessments.

But before you label people dumb and stupid I might recommend you gain a thorough understanding of how liquidity management works in the real world. And you might like to explain how the BOJ keeps the policy rate and the short-term market rate at zero or thereabouts and has done for nearly two decades without any issues at all.

The cash system only has to be in excess overnight by a small sum for the competition to keep the short rates aligned at zero. Then the rest of the term structure reflects market forces unless further intervention occurs at different maturity ranges.

best wishes

bill

Nonsense. Interest rates cannot be zero because of default risk.

Lyonwiss, interest rates can be negative and you should check the reality in this world before making such nonsensical statements

Lyonwiss,

It depends which interest rate we are talking about. The default risk can be moderated – this is a political issue.

Economics is not physics and “zero” may be a small positive number. Is this close enough?

http://epp.eurostat.ec.europa.eu/statistics_explained/index.php?title=File:3-month_money_market_rates_in_the_euro_area,_the_US_and_Japan.PNG&filetimestamp=20090430095959

http://www.businessinsider.com/henry-blodget-swedish-central-bank-tries-negative-interest-rates-to-force-banks-to-lend-2009-8

Sergei, it is obvious that real interest rates can be negative, but nominal cannot. Central banks can set their target rates to zero, or near enough e.g. BoJ and the Fed. But these only influence the actual interest rates used in the economy and people do not logically lend money at zero (nominal) interest rates.

Lyonwiss, in this world on this planet central bank set nominal interest rates can be negative as well. You are just not fully aware of this but it is happening out there right now. Swedish central bank as of today has nominal negative interest rate on deposits at -0.25%

http://www.riksbank.com/templates/Page.aspx?id=43332

And for businesses it is much more common but this information is not so public.

Sergei. The Riksbank is not lending at negative nominal rates. Show me a business that lends at negative nominal rates.

Lyonwiss, with its deposit facility Riksbank is not lending it is borrowing. However commercial bank do “lend” money to Riksbank. According to the latest report from Riksbank the utilisation of this deposit facility was 14 mil SEK meaning that commercial banks “lent” 14 mil of SEK to Riksbank at negative -0.25%.

You could also check secondary yields for short-term treasuries. Once in a while they turn negative effectively meaning that buyers of these securities are happy earning negative income. And these buyers are not necessary banks.

Sergei,

Rates on bonds do occasionally dip negative — it’s happened in the U.S. and in Japan as well, but in that case you can short the instrument risklessly and get a guaranteed profit. Such a situation tends to last for only a few seconds, and is best thought of as a hiccup, rather than the rates really being negative.

But yes, in the interbank market, the lending rates can be whatever the CB sets: -0.25%, -2%, etc.

Yet another example of why lending rates in the interbank market are not the same as interest rates in the credit markets, and why deposit accounts with the central bank are not the same as bonds. You cannot short a deposit account, as you can with credit market instruments.

RSJ, it is not only about interbank market. I did not want to give this example because you would simply have to believe me but in a business where I work we charge our customers -1% interest rate on all CHF deposits. Yes, it is our business decision and yes we probably want to get rid of CHF deposits but it is a real life example.

Though you have to take it face value 🙂 However I would not be surprised if going forward in existing macroeconomic developments this situation did not get really widespread: core vs non-core business in a very low and flat interest rate environment

Oh, I believe you, Sergei — you do want to get rid of your depositors 🙂 If you did not want to do that, then you would create a money market mutual fund that holds short term debt and paper, and you would be able to offer your customers zero rates even if the CB rates are negative.

But it’s a free world — nothing prevents someone from getting rid of customers; or perhaps you offer some value add that will make them accept the return. Nevertheless, the MZM yields are not negative.

Sergei, 14 million SEK is basically “noise” compared to 720 billion SEK of liabilities on the Riksbank’s balance sheet. This can easily happen when commercial banks accidentally overpay their debt to the Riksbank.

In case someone is unsure of negative interest rates, please check these two very nice articles by Scott – written last year.

Why Negative Nominal Interest Rates Miss the Point

Why Negative Nominal Interest Rates Miss the Point, Part II-Understanding the Excess Reserve Tax

Lyonwiss, noise is something which defines the difference between between a proper policy and an absolutely improper one as Ramanan suggested by the links above. Anyway I believe we agree now that your initial statement was too bold.

Sergei, you cannot be serious in suggesting that the commercial banks are actually lending to the Riksbank at negative nominal interest rates.

Lyonwiss – in case you check back on this page, you are foolishly conflating the risk-free IR relevant to the govt/CB as monopoly issuer of currency, and actual IRs to non-riskless borrowers who are users of currency.

Bill’s article is about the former; clearly whatever that level is will be augmented by credit charges, or spreads, when commercial lending takes place – the latter.

You seem obsessed with the latter, missing Billl’s point.