I started my undergraduate studies in economics in the late 1970s after starting out as…

The Australian government is not akin to a household

There was an extraordinary article published on the University of New South Wales News page (January 29, 2015) by a Professor of Finance (Peter Swan) entitled – Federal finances and family budgets have a great deal in common. Juxtapose that with a blog I wrote in December 2012 – Government budgets bear no relation to household budgets. Seems – we have a problem, Houston. Well, Peter Swan has a problem and along with him a raft of mainstream economists, including some who claim to be progressive. They are coming out of the woodwork where they hid during the peak of the crisis, as fiscal stimulus packages were saving the World economies, and are now rehearsing their usual erroneous claims about the dangers of on-going deficits. Their grasp of history and facts appears to be flimsy and their logic nonsensical.

Swan opens by quoting the current Australian Finance Minister who claimed it was:

… unfair to rob our children and grandchildren of their opportunities to pay for today’s lifestyle …

This was trying to justify hacking into government spending now to reduce public debt and thus in the logic of the argument ‘reduce the burden on future generations’.

He also mentioned a shock jock radio presenter who:

… tells his listeners that governments are subject to the same laws of economics, same resource scarcity, and same need not to waste the taxpayer’s scarce dollar as the families whose tax payments make government possible.

The question he then poses is whether the shock jock’s listeners have been conned, which he considers is tantamount to the Finance Minister lying.

The logic he then employs is astounding for someone who earns a high salary as a professor at an Australian university.

First, he wants to discourage people from thinking about the implications of the fact that a sovereign government is never revenue constrained because it is the monopoly issuer of the currency by deliberately misleading them to believe this means that deficits that are not matched by the sale of bonds to the private markets will lead to hyperinflation.

He doesn’t say it in that way because he wants the crude – deficits, printing money wildly, hyperinflation, Zimbabwe causal train to be come out loud and clear – given he knows the mainstream, neo-liberal media has imprinted (excuse the pun) the same thinking onto the minds of the (ignorant) public.

He says:

Certainly, some governments have tried to pay their debts by printing money; Zimbabwe’s Robert Mugabe comes to mind. But so can individuals. Every household and family has a perfect legal right to create its own exclusive fiat money, Peter Swan banknotes.

In this sense, you and I are no different from Zimbabwe and Mugabe. My currency and his are rightly rejected as worthless, forcing Zimbabwe to use US dollar denominated currency, as does, effectively, Hong Kong.

There you go. The Zimbabwe horror story. The only problem is that the case of Zimbabwe does not help his argument. In fact, it undermines it.

I considered that argument in detail in this blog – Zimbabwe for hyperventilators 101.

There was a severe contraction in potential output in Zimbabwe, a fact that the scaremongerers never mention.

The argument can be summarised as follows (and is a similar analysis to the Weimar years in the 1920s, which before Zimbabwe was the case wheeled out to scare people about deficits):

1. The white, racist colonial regimes in Africa created such an unfair sharing of land between the whites and blacks that a backlash was always going to occur. In Rhodesia, whites who constituted 1 per cent of the population owned 70 per cent or more of the productive land.

2. After the civil war of the 1970s and the recognition of independence in 1980s, Mugabe’s government more or less oversaw relatively improved growth with stable enough inflation outcomes.

3. The problems came after 2000 when Mugabe introduced land reforms to speed up the process of equality. The revolutionary fighters that gained Zimbabwe’s freedom from the colonial masters were allowed to just take over productive, white-owned commercial farms which had hitherto fed the population and was the largest employer.

4. From an economic perspective though the farm take over and collapse of food production was catastrophic. Unemployment rose to 80 per cent or more and many of those employed scratch around for a part-time living.

5. The land reforms represented the first big contraction in potential output. A rapid demand contraction was required but impossible to implement politically given that 45 per cent of the food output capacity was destroyed.

6. The capacity contraction was exacerbated by the trashing of other infrastructure which flowed through the supply-chain. For example, the National Railways of Zimbabwe (NRZ) had decayed to the point the capacity to transport its mining export output had fallen substantially. In 2007, there was a 57 percent decline in export mineral shipments.

7. Manufacturing output fell significantly and by 2007, only 18.9 per cent of Zimbabwe’s industrial capacity was being used. This reflected a range of things including raw material shortages. But it also reflected the Reserve Bank of Zimbabwe’s policy of

restricting access to foreign reserves to allow the import of food, such was the farm catastrophe.

8. The causality train was clear – domestic food supply trashed meaning a reliance on imported food. This squeezed importers of raw materials who could not get access to foreign exchange. That led to the manufacturing capacity in the economy being barely utilised. To reduce the pressure on the price level, a catastrophic cut in nominal spending across all sectors (government, households, firms) would have been required within a very short time period.

9. While the hyperinflation was almost inevitable it provides no intrinsic case against a government that is sovereign in its own currency and who runs permanent deficits to pursue full employment – that is, scale demand to the available productive capacity.

When you so comprehensively mismanage the supply side of your economy as the Zimbabweans did the only way to avoid inflation is to severely contract real spending to match the new lower capacity. More people would have starved and died than already have if the Government had have cut back that severely.

End of that story.

Further, it is true that I can announce Bill Dollars will be the new fiat currency but that doesn’t verify Swan’s claim that:

… you and I are no different from Zimbabwe and Mugabe …

The crucial difference is that I have no powers to impose tax obligations on those who I would like to use my Bill Dollar fiat currency. A national government like Zimbabwe and Australia has that power.

Whether they can make that power stick is a different matter. As an individual I do not have that power, which means I can never get people to hold my Bill Dollar fiat currency.

Swan doesn’t mention that, which means he doesn’t understand it or deliberately does not want his readers to understand it.

He further muddies waters (and leads me to think he doesn’t understand the essential link between tax obligations and the willingness of the public to hold an otherwise worthless currency) when he claims:

The federal government does differ from you and me in one respect, though: it can and does pass laws making Australian banknotes legal tender.

Thus domestic households have to accept Australian dollar denominated currency …

The creation of a legal tender is one thing, but it is not what drives the acceptance of the currency.

Further, I do not have to accept Australian dollars in return for my services. Equally I can use Australian dollars to purchase goods and services in places where it is not legal tender (for example, taxi drivers in Colombo, Sri Lanka will accept AUD).

There was an article in the Financial Times (February 7, 2012) – Money, like hat-wearing, depends on convention, not laws – which claimed that Modern Monetary Theory (MMT) was cranky and the claim that people will use a currency if it is required for the relinquishment of tax obligations is “easily refuted”.

Economist John Kay uses the example:

Suppose the Scottish government would only accept payment in highland cows. There would be an active trade in highland cows to meet tax payments, but people would continue to take their banknotes – English pounds, euros, or US dollars, as Tesco preferred – not cattle to the shops.

Which is true but doesn’t alter the MMT point. Among their portfolio of currencies will still be highland cows, whereas if the Scottish government had not so decreed under its tax law, no one would seek highland cows – other than those carnivore philistines who eat them.

You can go to nations where USD are freely traded but the local currency exists because the government there can bind people to the tax obligation.

Peter Swan claims that if “domestic households”:

… purchase federal government debt denominated in Australian dollars they take the risk of its value being eroded by Australian governments when they create inflation.

Anyone who holds any nominally-denominated securities in a currency runs the risk of the value being eroded by inflation created by any source of overspending (government or non-government).

So what?

Inflation favours debtors and disadvantages the real wealth of creditors. That doesn’t tell us anything about the viability of fiscal deficits.

Swan continued with the claim that:

Australia is a massive capital importing nation depending almost entirely on foreign rather than domestic savings to fund federal government deficits. These lenders are sufficiently sophisticated not to fall into the domestic inflation trap. So much of the borrowing is denominated in American or other global currencies, putting the federal government on a similar basis to the states.

Remember the article is about the dangers of national government deficits.

First, it is true Australia is a capital importing nation.

Second, it is untrue that the government depends “almost entirely on foreign rather than domestic savings to fund federal deficits”.

If we leave aside the argument that bond sales to the private sector do not actually fund fiscal deficits, despite the accounting machinations that the government goes through to make it look as though they do, Swan’s statement is not factually correct.

Please read my blog – On voluntary constraints that undermine public purpose – for more discussion on whether bond sales fund anything.

On the factual point, Swan claim is that the capacity of the Australian government to run fiscal deficits is “almost entirely” dependent on foreigners buying its bonds.

Here are the facts available from the branch of Treasury that deals with the bond tendering and debt management process – the Australian Office of Financial Management (AOFM).

Among the statistics they publish are a break down of outstanding Australian Government Securities (Treasury Bonds, Treasury Indexed Bonds, and Treasury Notes) by country of origin of the purchasers of those securities.

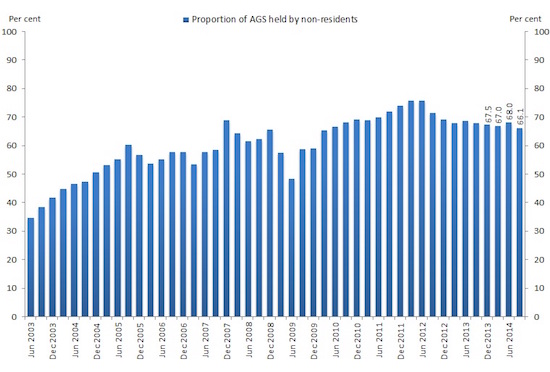

From this summary page – Non-resident holdings of Australian Government Securities – we learn that 66.1 per cent of outstanding securities are held by non-residents.

This graph shows the history since June 2003.

In the 1960s, this proportion was above 60 per cent before falling again in the 1970s. You can get historical data from the – Australian Economic Statistics 1949-1950 to 1996-1997

Occasional Paper No. 8, although matching the data to the current data dissemination framework is tricky.

The point is that 66.1 per cent is not “almost entirely”. To say otherwise is to demonstrate ignorance of the actual data or to be intent on deliberately misleading the reader/listener.

What about the statement “much of the borrowing is denominated in American or other global currencies”? That is a patent lie when applied to the Australian federal government.

The AOFM says that (Source):

There are small amounts of AGS that were issued offshore in foreign currencies. Since 1987, AGS have only been issued in Australian dollars.

The outstanding securities payable in foreign currencies reflect long term issues – and the AOFM data suggests that they are worth about $A5.8 million in a total issuance of $A319,479 million (as at September 2014).

For the past 28 years, the Australian government has only issued debt denominated in its own currency.

Hardly, “almost entirely”!

Swan then claimed that the Australian federal government would become like an Australian state (which is a user of the currency) unless it balanced its ‘budget’. He cites the fact that “Queensland has already lost its AAA credit rating crown”.

That claim violates logic and reality. The Australian government does not even need to issue bonds (unlike Queensland) in order to deficit spend. They do so voluntarily as the linked blog above discusses.

If you examine the bond tender processes the bid-to-cover ratio or the coverage ratio, which is the value of the bids relative to the tender amounts in $A.

The long history of bid-to-cover ratios in Australia tells us that the bond markets cannot get enough public debt. When debt levels start falling below some level (that will provide liquidity to futures markets, for example) the private bond traders demand the government issues more debt even if they are running surpluses.

The coverage ratios are also typically high for the US, the UK, Japan and most nearly all sovereign nations where the relevant data is publicly available.

You can read about the 2002 Australian Treasury Review in this blog – Direct central bank purchases of government debt – where that situation actually happened – fiscal surpluses and the demand by the private sector for more public debt issuance.

We learned categorically during that fiasco that the liquid and risk-free government bond market allowed many speculators to find a safe haven. Which means that the public bonds play a welfare role to the rich speculators.

At the time, the contradiction involved in this position was downplayed by the media and the politicians. But at the time, the federal government was continually claiming that it was financially constrained and had to issue debt to ‘finance’ itself. But, given they were generating surpluses, then it was clear that according to this logic, the debt-issuance should have stopped.

They bowed to the pressure from the investment banks etc to continue issuing public debt to meet the demand for corporate welfare.

What does Peter Swan, the so-called professor of finance have to say about that?

Less than a week later, a related article by a Professor of Economics at a Queensland university, one Ross Guest (February 5, 2015) – Put your hand up if you’d like to pay more tax – appeared and made similar outlandish claims that the Australian government would follow Queensland down the ratings agency drain hole.

I don’t suggest you read the article – it will just give his Conversation account hits which will make him seem popular.

Guest says:

Some say this isn’t true – that governments are not like households that eventually have to repay their debts because governments can simply print money to repay their debts. This is a dangerously naive view for an economy like Australia that borrows heavily from the rest of the world, and it has been debunked in detail elsewhere. Suffice to say that Queensland lost its AAA credit rating several years ago because of its rising debt, which has cost the taxpayer dearly through rising interest payments.

Given Swan’s article came out first, I guess he didn’t copy the line about Queensland’s AAA rating from Guest. Maybe this lot see the AAA downgrading in the same way as Zimbabwe! Whatever, it is irrelevant to a discussion about the viability and usefulness of on-going fiscal deficts in pursuit of full employment.

But Guest’s claim raises another angle (of nonsense) that is often introduced into this discussion. It is in the category of ‘China funds the US government’ – or “Australia … borrows heavily from the rest of the world”.

Is Guest talking about the private domestic sector, the government sector or both? The distinction matters, of course, not that one would discern that from Guest’s article (or any of his other raves about this topic).

He and Swan want to blur the distinction to give the false impression that our government can only spend if foreigners buy its debt.

It is true that the private sector (particularly the banks) are heavily indebted to foreigners. That exposes them to exchange rate risk and the need to generate export earnings to repay the funds, given a fair swag of the private debt will be denominated in foreign currencies.

So what? Well in the early days of the GFC our big four banks went close to the wall because they could not fund debts that were rolling over. They were rescued, despite what they say now, by the Federal government wholesale debt guarantee, which immediately prompted foreign lenders to open the taps again and keep them solvent.

So for the private domestic sector it can matter that they have a high exposure to foreign debt irrespective of how it is denominated.

But is China allowing the US government to spend? The answer is clearly no. Please read my blog – The nearly infinite capacity of the US government to spend – for more discussion on this point.

The US government is the only government that issues US currency so it is impossible for the Chinese to ‘fund’ US government spending.

A rising proportion of foreign-held US public debt is a direct result of the trade patterns between the countries involved (and cross trade positions).

For example, China will automatically accumulate US-dollar denominated claims as a result of it running a current account surplus against the US. These claims are held within the US banking system somewhere and can manifest as US-dollar deposits or interest-bearing bonds. The difference is really immaterial to US government spending and in an accounting sense just involves adjustments in the banking system.

The accumulation of these US-dollar denominated assets is the ‘reward’ that the Chinese (or other foreigners) get for shipping real goods and services to the US (principally) in exchange for less real goods and services from the US. Given real living standards are based on access to real goods and services, you can work out who is on top (from a macroeconomic perspective).

Note that a worker in Detroit who is suffering from unemployment as a result of cheaper imports coming from nations with lower labour standards (pay and conditions) than the US is unlikely to agree with me. In his/her case I wouldn’t agree with me either. But I am writing as a macroeconomist here without regard to equity which isn’t to say that equity isn’t a crucial policy aim as well.

So it is not true that the US government is at all dependent on the Chinese (or any financial markets) to pay its bills. The exact opposite is the truth.

It might be the case that certain accounting procedures are rehearsed by the US Treasury and the Federal Reserve bank before the former spends US dollars. These voluntary constraints – shunting cash from bond sales into a particular account that is then debited when government spending occurs – are just a chimera.

But, the intrinsic financial capacity of the US government is clear – it issues the currency. So it could bring in a rule that said that all Treasury officials had to run a lap of some park in Washington D.C. before each spending transaction was formalised. That would be commensurate with all the other constraints (hoops) it chooses to jump through.

In reality, these relationships operate on a multilateral basis. To buy Australian dollar bonds from the Government, the foreigners have to stump up Australian dollars. Where do they get them from?

They have to run external surpluses against Australia (so the currency swaps occur as part of the trade flows) or they have to purchase them with other currencies. At some point they have acquired the other currencies in trade or financial flows. It doesn’t matter much.

Please read my blogs – Who is in charge? and – Debt is not debt – for more discussion on this point.

The point is that foreigners can only gain access to Australian currency if Australians supply it in exchange for other currencies.

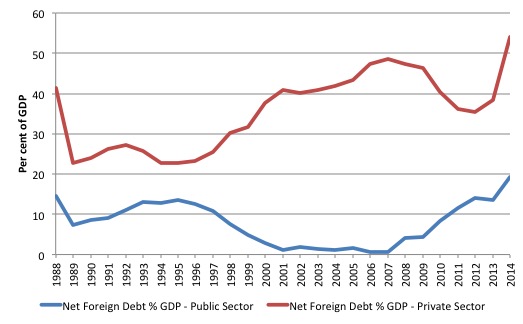

To give you some idea of the relative holdings of foreign net debt, here is the latest data. External debt data is published by the ABS in its Balance of Payments and International Investment Position, Australia (cat. no.5302.0). You can get this publication from HERE. It is quarterly data tied in with the National Accounts releases. The latest issue is September 2014.

External debt equals the borrowing of Australian residents from foreign residents. Net external debt is the gross debt minus the loans that Australian residents make to non-residents. It is often argued that external debt is only part of our external liabilities – the other part reflecting the equity claims that foreigners have as a result of purchasing shares or real estate in Australia. The sum of the two components tells us whether a country is a “net supplier of funds (debt and equity) to the rest of the world, or a net user of funds from abroad” (Source).

While that is true, we tend to concentrate on the net external debt position of a country because this component of our external liabilities involves a “contractual obligation to pay interest and principal and failure to pay then results in default and possible bankruptcy for the borrower concerned. In contrast, equity holders share in the earnings of the enterprise, with dividend payments dependent upon the enterprise having the capacity to pay” (Source).

The following graph shows the evolution of net foreign debt as a per cent of GDP since 1988 for the public and private sectors overall.

The private sector blast off began as the conservative government took office in 1996. The mirror image is no coincidence. The fiscal squeeze (they ran 10 out of the next 11 years in fiscal surplus) created the conditions whereby households and firms had only one way left to continue to enjoy spending growth – increasing debt levels.

This was fuelled by the financial engineers and private debt holdings of foreign debt soared.. The obsession with running fiscal surpluses (shown by the pay down of debt in the blue line) drove these dynamics. The de-leveraging camp usually ignores that causality to the detriment of their overall analysis.

The dramatic build-up in private external debt was largely of a financial nature rather than real producing enterprises seeking investments to build productive capacity. If the debt had have been productively employed the rise in debt would have provided higher potential growth paths and probably pushed us closer to full employment.

The Federal Government was asleep at the wheel during this period totally obsessed with public debt and refusing to acknowledge that what was happening to private debt was ultimately going to come unstuck and create the situation we are now in.

The subsequent rise in public net foreign debt reflects the rise in the fiscal deficit which accompanied the GFC – both as a result of the large fiscal stimulus packages in 2008-09 and the declining tax revenue (automatic stabilisers) that followed the withdrawal of that stimulus and subsequent fiscal austerity.

The transactions involved in a foreigner buying public bonds from the Australian government also are clear and demonstrate there is no sense in which the foreigner holds sway.

At some point, the foreigner has acquired holdings of Australian dollars. For example, an Australian resident might purchase a French car.

The transactions are:

1. Australian buys a nice little French car from a distributor.

2. If cash is paid, then the person’s bank account is debited and the French car dealer’s account is credited – this has the impact of increasing foreign savings of AUD-denominated financial assets. Total deposits in the Australian banking system, so far, are unchanged.

3. If a loan is taken out to buy the car, then the purchaser’s bank balance sheet would record the loan as an asset and creates a deposit (the loan) on the liability side. When the cheque to the car dealer (representing the French firm – ignore intervening transactions) the French car company has a new asset (bank deposit) and the loan boosts overall bank deposits (loans create deposits). Foreign savings in AUDs rise by the amount of the loan.

4. Thus, a trade deficit (1 car in this case) results from the French car firm’s desire to net save AUD-denominated financial assets and sell goods and services to Australia in order to get those assets – it is the only way they can accumulate financial assets in a foreign currency.

What if the French car company then decided to buy Australian Government debt instead of holding the AUD-denominated bank deposits?

Some more accounting transactions would occur.

1. The French company would put in an order for the bonds which would transfer the bank deposit into the hands of the central bank (RBA) who is selling the bond and in return hand over a bit of paper called a bond to the French car maker’s lawyers or representative. Ignore the specifics of which particular account in the Government is relevant and the fact that there would be intervening transactions involving a primary bond dealer

2. The Federal Government’s foreign debt rises by that amount.

3. But this merely means that the Australian Government promises, on maturity of the bond, to credit the French car firm’s bank account (add reserves to the commercial bank the car firm deals with) with the face value of the bond plus interest and debit some account at the central bank (or whatever specific accounting structure deals with bond sales and purchases) in Australian dollars.

4. The dollars actually never leave the Australian banking system (wherever the specific offices are located).

If you understand all of that then you will clearly understand that this merely amounts to substituting a non-interest bearing reserve balance for an interest-bearing Government bond. That transaction can never present any problems of solvency for a sovereign government whoever holds the interest-bearing bond.

Peter Swan then went on the next predictable path:

Printing money simply devalues the Australian dollar, magnifying both the interest and the principal repayment burden.

He should have more precisely said that building bank reserves is inflationary. Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

Please also read – Painstaking, dot-point summary – bond issuance doesn’t lower inflation risk – to disabuse yourself of the idea that if the central bank was to simply facilitate the crediting of private bank accounts to reflect government spending desires that it would be more inflationary than if they issue debt to match the fiscal spending deficit.

Swan is plain wrong on that point.

Conclusion

These articles are written by senior academics in our universities and are in my view misleading and plain wrong in fact in some cases.

What hope do students have if they are up against this sort of analysis.

Update on Australian Progressives

Over the weekend I received an E-mail from the President of the Australian Progressives. You will also notice some comments on Friday’s blog post in this regard.

Here is the full E-mail I received from the President. Given my comments on Friday, I believe it is fair to publish this to square the ledger. This means I have information from both sides of the story. What happens next remains to be seen.

Dear Professor Mitchell,

I have also sent a copy of this email to your Newcastle University email address.

We write in the hope of clearing up the misunderstandings expressed in your blog of 14.2.15 about recent events within the Australian Progressives.

First, to the economic policy stance of the Australian Progressives. The National Interim Steering Committee would like to assure you as a body that we have NOT discarded MMT as a basis of our economic practice. In fact we are very keen to hear more about it.

What has been taken as resistance is in fact only resistance to having one economic philosophy pressed upon us to the exclusion of all others, with unrealistic time pressure applied to adopt it. Our party’s policy process requires that we research different angles thoroughly before adopting a policy, and this takes time. Given that we are still in the process of jumping through the required hoops to be recognised by the AEC as a party and have had the usual teething troubles of forming a new organisation, time is something we’ve been significantly short of.

The second point we would make is that we have recently elected a new interim leadership team. The person you refer to as the ‘President’ did not stand for the presidency in that election and our current President, myself, was elected unopposed. These results have yet to be incorporated into our website, but that is the current status quo and the resignation of the former President was well after that election.

The third point is that the two members of the NISC who left did so for reasons that had nothing to do with MMT. One of the incoming members of the executive, someone who I personally invited to join the executive, is a great advocate of MMT.

Lastly, the comment on economic policy which was leaked to you is not representative of the entire Party’s views; rather that of an individual (and a non-executive member at that) expressing his point of view.

We’re not sure why you were given such incorrect information. I hope this provides some clarity, and I look forward to further discussions with you. I would appreciate it if you could update your blog in light of this new information. I’d be happy to answer more questions if needed.

If you are still interested in educating us more about MMT, please let me know in your response. We assure you that we’re ready, willing and able to listen.

Yours faithfully,

Vinay Orekondy

President, The Australian Progressives

If you are keen to help a new political party form and develop appropriate macroeconomic policy – which means understanding MMT fully – then you can write to the President on – vorekondy@australianprogressives.org.au. If you remain silence and they turn into neo-liberals then you know what the conclusion is.

That is enough for today!

(c) Copyright 2015 William Mitchell. All Rights Reserved.

A persistent problem with Homo Saps is the power of fashionable thinking. This is why so very few of the “intelligentsia” will question the current conventional wisdom. Most often it is just the lack of basic intelligence (despite a much vaunted education) but sometimes it is fear of the contempt of their peers and being ostracised.

The few who defy the herd instinct deserve support. Other than breaking out the pitchforks I don’t know what can be done to undermine and ultimately destroy the System which oppresses us.

“First, it is true Australia is a capital importing nation”

The kill question is what else are they going to do with their Aussie Dollars instead?

Australia is a capital importing nation because people exporting to Australia know they have to take Aussie Dollars if anybody is going to buy their stuff and not the stuff of some competing nation or company.

Honestly these neo-classical economists really do need to get out in the real world and experience how *hard* it is to make an export sale. They need to see how many backhanders, bribes and (at best) smooching goes on as the nations compete with each other to get those sales.

Nobody is selling bonds to foreigners. They are buying them as a consequence of enabling their exporters. Causality matters!

This absurd piece of nonsense written by Peter Swan may have been published in the Australian as a rejoinder to recent pieces bearing the opposite message by Geoff Harcourt, Warwick Smith, and other economists -including more recently Ross Gittins (Sydney Morning Herald, http://www.smh.com.au/business/comment-and-analysis/dont-fix-budget-while-economy-weak-20150215-13es44.html), all of whom have a far better understanding of the principles by which federal budgets operate, and are well aware that they differ in fundamental ways from the principles governing household budgets.

It is time for such Professors of “Finance” to shut up and stop demeaning themselves by revealing their gross ignorance of macroeconomic principles. Their ill-informed outpourings are a disgrace, and should learn to eat a little humble pie, leaving meaningful and informed commentary in this area to economists like Bill who have specialist knowledge of how the monetary system and financial system really operate.

This business is one of the three stages in getting a new theory accepted.

First it is decried as ridiculous. No one will employ you.

Second it is treated to a lot of misinformation, like what happened here.

Third It is accepted as self evident.

The Australia Greens economic policy is largely very passable on MMT grounds. The problem point is point 9 under Principles. It incorporates two or three neoliberal myths. In a previous post on an earlier topic I illustrated how it could be re-written to remove the neoliberal myths yet not “scare the horses” in the interim.

Overall, the Australian Green’s policies appear very enlightened and far more so than any other existing party that actually gets seats. I would advise Bill to work with the Australian Greens but to do so initially with gentle guidance rather than strong “proselytising” first up. The method would be to suggest subtle re-wordings to avoid express neoliberal myths and neoliberal hot words and hot phrases like “intergenerational theft”.

Explanations could be advanced as to why the neoliberal myths and hot phrases are unwise and not genuinely illuminating for the electorate. Such explanations do not need to be explicitly MMT. I mean this in the sense of using simple warnings not to buy into neoliberal discourse nor to debate matters on their terms. The warning not to buy into misleading neoliberal DISCOURSE will certainly be understood. It might be possible in some cases to advance explanations which are almost “orthodox” in a Keynesian or post-Keynesian sense without express recourse to the “rabbit-hole” aspects of MMT.

Bill will understand my reference to “rabbit-hole” aspects. These are the seemingly paradoxical aspects of MMT which at first (and often persistently for some) baffle people habituated to the invalid conceptual inversions of neoliberal economics.

Note 1: There is one aspect of MMT which I would not insist upon but which Bill in full explanation mode would very probably insist upon. I just mention this to flag that I do retain one rather logico-philosophical disagreement (a formal system / real system issue) with MMT. I don’t want to go into that here because I am suggesting that Bill not go into full explantion mode straight away anyway. Rather, I am suggesting this. Steer the Greens away from express neoliberal myths first. Only later expand the full explanatory development of MMT. Even then, the general public will have to be prepped and primed over time to invert an existing inversion of understanding.

Note 2: I am not a member of the Australian Greens. I did vote for their candidate at the last (Qld) election.

I have been reading your blogs for some weeks as I am a retired accountant and am interested to understand how macroenomics works. A good Australian friend of mine pointed me in the direction of MMT and your blogs.

So far I am getting my head around what seems to be a counter-intuitive principle, and don’t fully understand it yet. Give me time.

Meanwhile I might mention that I am not convinced your example of the French car manufacturer in today’s blog necessarily works.

For many years I was involved in importing goods to the UK, mainly from Italy. I have also exported goods to Australia. If I bought goods from another country the supplier would require to be paid in their own national currency, not sterling. I don’t believe Citroen, for example, holds reserves of Australian dollars. Albeit I suspect Fiat does. So there is an intermediate process here, because when I paid my Italian supplier I would have had to exchange my pounds sterling for lire or, more recently, Euros. So whoever effects the exchange is the one who is going to hold the foreign exchange reserve. No matter, it amounts to the same thing in macroeconomic terms.

Hi Nigel, please divulge the particular MMT principle you are having trouble with.

Nigel Hargreaves -“”” I have also exported goods to Australia. If I bought goods from another country the supplier would require to be paid in their own national currency, not sterling. I don’t believe Citroen, for example, holds reserves of Australian dollars”””

If in the example said car manufacturer has a large business in Australia (some form of tax liabilities), employs staff, sources parts and other services within Australia it certainly has interest in holding reserves of Australian dollars beyond chequing accounts.

Renault was on the 8pm news a year ago (france 2) saying that their cars are very popular in Australia despite stagnation in europe and their business was expanding.

“””So far I am getting my head around what seems to be a counter-intuitive principle, and don’t fully understand it yet.”””

Its worth looking at blogs like new economic perspectives and research papers as tey have all the stock flow consistent accounting models which is the meachanics behind MMT MCT etc: http://www.levyinstitute.org/

Bill thanks for reviewing the shocker of an article by Peter Swan. Its amazing that pontificating professors with imaginary ideas can get so much traction these days especially post 2008 (no doubt every opinion will be voiced as the terminal government gets closer to fiscal statement night). He literally recounts the entire littany of factually incorrect/debunked concepts in one interview despite real world edvidence clobbering his arguments 😉

Nigel

So, how did transaction go? From your foreign account onto French selers account, how it goes trough banking system? You are claiming that you know how banks do transfer from your to French account. But how is done when French wants to carry it out of the country their account is? DO you know how that goes, because that is what Bill is talking about, not how you paid to them within importer country or exporter country. Bill is talking about how those funds go from one country to another, how funds do not cross borders. Did you carry funds acros borders?

Bill,

Another excellent expose of the battle proponents of MMT have to fight. By coincidence I asked on Sunday’s blog how MMT could help Venezuela overcome its current plight. Your description of what happened in Zimbabwe describes what has and is still happening in Venezuela today. The question is how MMT principles would allow Venezuela to recover from its parlous state? By continuing to follow your blog I am starting to get the answers.

Thanks

Graham

Nigel H, be careful how you interpret importers and exporters. If you phone up an Italian shop, from the UK, and buy something, it is the same as if you had exchanged Pounds for Euro, gone to the Italian shop and bought your goods. The Italian shop is not exporting; it will be a domestic purchase, in the sovereign domestic currency of Italy; the Euro, as far as the Italian shop is concerned. Instead of doing the trip you could let your bank do the currency conversion and wire the money.

If that Italian shop opened up another shop in the UK, and became an “exporter”, you would buy the same goods with the sovereign domestic currency of the UK; the Pound. The Italian’s UK shop would end up with a lot of UK Pounds, in the same way that China has about 3 trillion US Dollars worth of currency; securities and Park Avenue Penthouses. Chinese workers are paid in Yuan not US Dollars! Likewise German workers are paid in Euro, not numerous foreign currencies amassed by a 7% German export surplus. See the problem?

Read Bill’s https://billmitchell.org/blog/?p=25760 on the external economy.

I would also be interested in hearing your take on Venezuela. There is high inflation and apparent goods shortages and the mainstream view would be that government spending on the poor was unaffordable and led to the current crisis. Corruption might get a mention, plus the lack of honest price signals.

How can MMT help ordinary Venezuelans?

Today while in a cafe having a cafe I looked at the Daily Telegraph. I wouldn’t deign to buy a copy.

In it is an article by former treasurer Peter Costello.

He still spouts the views like Peter Swan’s. Peter Swan is far from alone!

Costello actually says Governments have two sources of revenue, Taxation and borrowings.

Puts it all in a nutshell doesn’t it???

@John Doyle:

Peter (unleash the hounds) Reith has also appeared in the MSM, telling us that “time is running out” to fix the debt.

I find it hard to believe that these people actually believe this stuff. They spent years in cabinet.

This is obviously a concerted propaganda campaign to push these lies.

Nigel

In that case surely the balances of foreign reserves held by both central banks would be adjusted accordingly.

I don’t see how it affects the argument.

Steve

My take on the Venezuelan situation is that the government’s spending on the poor was done in such a way that it did not increase the output of the economy either in the short term or in the future. This coupled with the fact that the government’s other actions a la Zimbabwe reduced the productive capacity of the economy has led to the current state. MMT practices don’t obviate the need for the economy to be run efficiently or for the job guarantee or other spending on the poor to be done in such a way that it improves the skills of the those involved thereby increasing the productive capacity of the economy.

Graham

If the politicians and the Neo-con economists really believe sovereign currency issuing governments are just like households, then the rejoinder could be; why do we need economists like you running them, or old white male politicians for that matter?

We would do better, given their logic, to let women who run households also run the country. This is meant to be humour, but also I’m partly serious. They could do no worse than the current lot. At least they probably would not cause so much damage.

Steve, as mentioned by others, MMT is a theory, not a policy. It can’t ‘fix’ anything without policies in line with MMT thinking.

Jol: Whether they are men, women or lizard-men – if they think it is like a household they will do all the wrong things and do just as much damage. Maybe the women will be less cruel and heartless, but you can’t be sure.

Totaram: I largely agree with you. House managers are unlikely to do that well and I was ‘tongue in cheek’ but at least they would not be overtly following ideological agendas and deliberately causing damage to the social fabric. However, my main point is that the obscenely paid Joe Hockey types with their $100,000 expense claims for their house in Canberra owned by banker wives, on top of big salaries, while they wreck the joint with austerity, and the captive economists spouting nonsense to support them, while also on large salaries, could be challenged: if they really believe what they are spouting- that the government is like a house, yet things are getting worse, then why not challenge them to save us money and let house managers run things? Replacing them would be the ultimate austerity!

Prof. Mitchell focuses merely on the solvency of the Australian government. He points out that the government can print AUD so the payment of interest and redemptions to foreigners “can never present any problems of solvency for a sovereign government”.

This ignores the real costs of government debt held by foreigners. Assuming that the economy is managed as close as possible to full employment, the real resources available to the Australian government, firms and consumers will be reduced when interest and redemptions of debt are paid to foreigners.

These real costs arise because foreigners will spend most of their new AUD. Some will be spent on Australian goods. This directly reduces the resources available for domestic investment or consumption by Australians.

Most of the rest of the new AUD will be exchanged for foreign currency, causing a devaluation. This increases the demand for exports and import substitutes, which also reduces the resources available for domestic investment or consumption by Australians.

Prof. Mitchell’s analysis ignores these costs.

The 66% of Australian Government Securities held by foreigners WILL be a burden on future generations.

Conversely the debts of foreigners and foreign governments held as assets in sovereign (or private) funds WILL benefit future generations of counties owning such assets.

Abba Lerner recognised in 1948 that his argument that government debt is not a burden on future generations does not apply to international debt.

Dear Kingsley Lewis (at 2015/02/19 at 14:08)

Thanks for your comment.

First, you introduce the notion of real costs involved in income payments in Australian dollars to foreigners, which then permits them to command real resources for sale in the Australian economy.

You say I ignore that when discussing solvency. Well it is a separate issue to solvency and I have never ignored it.

Second, some of the $A received might be spent on Australian goods and services. The Government has the capacity to control which goods and services are allowed to be purchased by foreigners, which means that it can, for example, prevent them buying real estate should that be seen as a way of depriving domestic residents the chance to purchase housing.

The purchases also sustain local employment and motivate further investment and innovation thus expanding the resources available to local residents.

It also means that the fiscal deficit would be lower.

Third, you note the exchange rate effects. Most nations run current account deficits and Australia’s is around 4 per cent of GDP and has been varying around that mark for several decades. So even if there was a depreciation of the currency as the foreigners cash in their AUD, it is highly unlikely that it will result in an external surplus. It might at the margin, reduce the net flow of goods and services that Australians enjoy from other lands.

Further, if there is a significant depreciation that punishes the foreigner holders of the $A’s which suggests your statement that “debts of foreigners and foreign governments held as assets in sovereign (or private) funds WILL benefit future generations of counties owning such assets” is not accurate. The exchange rate risk is all in Australia’s favour in this respect.

But, it is clearly true that the foreign income flows give foreigners access to our resources.

Finally, ultimately, my preferred position is for the government never to issue any debt.

best wishes

bill