I don't have much time today as I am travelling a lot in the next…

On voluntary constraints that undermine public purpose

It was a very quiet day at the office today. The day started out pretty much as normal – a bit of a surf down at Nobbys Beach in small waves with a few of the regulars out. Then as I was driving to work I wondered where everyone was. Anyway, an easy drive. Then I noticed there were no E-mails, no newspapers, no-one at the office … and only one Twitter from Sean Carmody saying he was going off-line for the day. Maybe this is my big chance to take control of economic policy and fix the current malaise? That would be good. There would be some legislative changes immediately. The first I would make (for the US) was the topic of a report in yesterday’s Wall Street Journal (December 24, 2009) which noted that the US Congress had raised the debt ceiling to allow the US Treasury to borrow through to Fedruary 2010. Hmm, get rid of that legislation as a first step. Then on we would go.

The WSJ article reports that “in nearly its final act of the year, the U.S. Senate on Thursday approved a $290 billion increase in the nation’s borrowing limit, a move that sets up a contentious debate about the federal government’s largesse early in 2010.”

The article notes that:

Treasury officials had warned that the current limit of $12.1 trillion was close to being breached. In light of this warning, Senate lawmakers were left facing no choice but to increase the debt limit before they began the holiday recess.

An increase in the debt ceiling is largely symbolic as it represents money already spent by the federal government. In the unlikely scenario where it was ever breached, however, there would be significant consequences for the financial markets. The federal government would be forced to default on its obligations, and could lose its top credit rating, having to pay much higher interest rates as a result.

They also added later on that there will be “another debate before the end of February on the nation’s addiction to red ink.” So no bias in that reporting eh! Not!

Here is another snippet:

Facing what is widely expected to be a tough mid-term election in November next year, Democrats want to avoid drawing the public’s attention to the profligacy of the federal government. President Barack Obama will espouse his dedication to fiscal restraint in the annual State of the Union address at the end of January, and may reveal proposals to rein in federal spending.

The Republicans are aslo responding by planning to introduce new measures to “restrain the federal government’s ability to spend. These include discretionary spending caps, a move to strip out already-committed funding from the fiscal 2010 budget and the creation of a commission to investigate longer-term solutions to the debt issue.”

When you read stuff like that you wonder what planet we are living on. The US is in the throes of its worse economic downturn since the Great Depression. Like … unemployment is over 10 per cent and the US Bureau of Labor Statistics estimates its broader measure of labour underutilisation is around 17 per cent.

GDP (that is, national income generation) which now growing again fell by around 6.5 per cent last year, exports have collapsed (something like down 24 per cent on the peak).

Consumer spending fell by around 4.5 per cent and household wealth plunged. Business investment fell by around 20 per cent last year and the residential housing market collapsed.

We could go on. The automatic stabiliser response alone that is built into the US federal budget has been huge as tax revenues collapsed.

What do the commentators really think would have happened if there had have been tight fiscal rules in place preventing any (or only some) discretionary response in net spending? The economy and the rest of the world economies would have melted.

To call the fiscal response an addiction to “red ink” or “profligacy” shows how ridiculous the mainstream economics commentary has become.

The conservatives (who these WSJ journalists just parrot) who want to further constrain deficit spending would even have the government legislate to stop the operation of the automatic stabilisers. That is what fiscal rules aim to do in general.

The rise in unemployment in the US would have been so great had they done this that social instability would have been likely. It is clear that the fiscal response has been too small and more stimulus is required to get the labour market working again. It is also clear that some of the stimulus has been ill-directed. I am also excluding the stupid TARP from this assessment – that is separable from the fiscal stimulus.

Anyway, I have been interested in this notion that we have established voluntary rules that constrain our governments from acting in our best interests and then we undermine their ability to act within those rules by saying that the voluntary constraints are severe enough.

Both forms of logic – that now pervade the public debate – show how stupid humanity is.

Anyway, the legislation the Congress were amending yesterday dates back to the Liberty Bonds era of the First World War. The Second Liberty Bond Act of 1917 P.L. 65-43, 40 Stat. 288, enacted September 24, 1917 and is currently codified as amended as 31 U.S.C. § 3101 was the first move to place a public debt limit on government in this way. The Second Liberty Bond Source Book is a great reference.

The Liberty Bonds were issued to prosecute the First World War. During the Civil War, for example the government had to deal with a declining tax base and difficulties in raising borrowing (as the economic base collapsed), and in the end, starting issuing “greenbacks” to allow it to keep spending.

Historians will recall that serious inflation emerged during this period. By the end of 1863 prices had risen by 13 times (Source). The inflation was no surprise given the collapse of the production capacity. A modern variant of that is Zimbabwe which I discuss in this blog.

The point is that spending without bond issuance is not inevitably inflationary as long as there is a productive capacity in place to service the nominal demand growth. When you destroy productive infrastructure at the rate which occurred during the Civil War (or in Zimbabwe in modern times) you have to severely cut spending to avoid inflation. But then that would have been impossible in the US in 1861 or so.

By the onset of World War 1, the US was operating under a gold standard with fixed exchange rates and as such the Federal government was effectively financially constrained.

The government could have issued bonds to the Federal Reserve (central bank) who would create a deposit account on behalf of the Treasury but the fear of inflation and what that would mean for the maintenance of the gold standard (it would fail) meant that the government had to “fund” its spending. In those times, the concept of the gold standard was held in the highest regard – a system that had to be preserved above anything else.

So the government could either raise taxes or issue bonds. There were interesting debates at the time about the proportions which each would be used. The Treasury Secretary of the time William Gibbs McAdoo thought that a 50/50 split would be best: (a) to recognise the argument that soldiers should not have to come home and pay higher taxes (to pay back the bonds); and (b) to ensure that taxes were not so high that the wealthy would start disputing the need to maintain the war effort.

You can find a lot of information about the debates etc from the The American Libraries Archive.

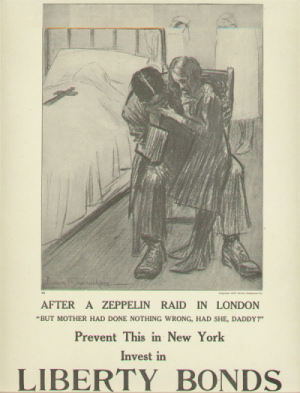

Anyway, in 1917 a new tax act was passed (War Revenue Act) and also the creation of the Liberty Bonds was announced. The following poster was part of the campaign that I describe below to engender public support for the Liberty Bonds.

Prior to World War 1, Congress had to approve every tranche of US Government borrowing – including the volume of bonds, the coupon rate and the maturity.

This was considered inflexible and time-consuming and so with the successful transition of the Second Liberty Bond Act in 1917, the U.S. Treasury was given a public debt limit.

This meant it could borrow up to that amount with seeking the approval of Congress. All details of the bond issues also became the discretion of the Treasury.

Unfortunately the on-line Congressional Record which records all the debates in Congress only goes back to 1983 and as its is Xmas day I cannot visit the University Library here to access the records manually.

You can also search the New York Times historical archive for editions of their newspaper in those times. Here is an example from the June 28, 1918 about the bill. You can find many other pages from that era.

From an historical perspective the rhetoric in the Source Book was interesting. On page 17 you read about the first issue of the liberty loan:

The loan was not merely as success, it was a triumph and a splendid demonstration of the patriotism and financial ability of the country … Secretary McAdoo mae especial efforts to make the loan a popular loan and to distribute the bonds among the individual citizens of the country as widely as possible. He made two speaking tours through the country arousing and informing people as to the needs of the situation, the value of the bonds, and the duty and wisdom of their investment in them.

The campaign was marked by such cooperation and assistance from the people, the newspapers, National and State banks and trust companies, bond houses, and other corporations and business concerns and private firms and individuals, as well as fraternal, social, industrial, and other organisations, as to make it a great national movement …

Never before was the business and the patriotism of the country so coordinated in a great national public service, and it was this that made the greatest loan in our history the most successful in our history.

And so on. The sentiment expressed in that time is totally different to what we read in the media and hear from commentary from business etc. Someone said to me once what will it take to solve unemployment (during the 1990s when it was very high and persistent in Australia following the severe 1991 recession). My reply was simple: we need another war.

But I followed it up by noting we needed a war on unemployment to conjure up the solidarity that used to emerge when nations were under threat. I distinguish that solidarity from the partisan and divisive conflicts that have largely followed the Second World War (Vietnam to the unlawful invasion of Iraq).

On Page 19 there is a discussion about whether the money raised is being “tied up” – you read that the “money” is being:

… spent in this country and therefore immediately paid back to the people for labor and products of the United States. So far from being “tied up” this money is in effect never withdrawn from circulation.

This is almost getting us to the point of understanding that the public spending is underpinning jobs and wealth creation and because of the restrictive institutional arrangements of the day (gold standard) the only way the public could pursue such ventures was by cooperation from its citizens – to swap their liquidity for wealth and allow the governments to spend to create a broader concept of wealth.

On Page 21 they discuss the security of the bond and the income flow – and we read that:

The wealth of the United States is back of the bonds issued by the Government. Since the present organization of the United States in 1790 no debts have ever been repudiated. The money borrowed has always been repaid …

The interest on these bonds is a part of the Government’s expense. Should the power of our Government fail, not even cash would be of value, so high is our standing.

While it was clearly possible under a gold standard for the nation to go broke and have to default on outstanding public debt (as the UK did in 1931 when it was faced with a significant depletion of its gold reserves) the fact is that it was unlikely.

The point being made is that the Government has the capacity if they keep the economy strong to repay its debt even under a gold standard. But clearly we need to understand that under a fiat monetary system there is no risk of insolvency – irrespective of the state of the economy.

On Page 22 we read that that in Great Britain and elsewhere the government loans were seen in positive light by investors such that:

… there sprang up a largel class of financiers and public economists who maintained that a great national debt was a great national blessing. While this opinion is not generally entertained, the idea of a Government being indebted to its own citizens in large sums of money is regarded as not at all analogous to indebtedness by an individual. The direct personal financial interest each citizen bondholder has in the Government is recognized as a valuable national force.

The source book then documents all the advantages to the bond holder in terms of risk-free wealth accumulation, risk-free income flows etc. So that is

This interesting note documents the features of the Act. This paper from the Congressional Research Service is also interesting in understanding details of the Act etc in a modern setting.

One discussion of later changes to the bill appears in The Public Debt Limit written in 1954 by H.J. Cooke and M. Katzen (both working at the time at the New York Federal Reserve) and published in the The Journal of Finance, 9(3), 298-303. If you have access to JSTOR then you can get it via this LINK. I am sorry but licensing rules prevent me from making the article available publicly here as a download.

Cooke and Katzen trace the developments relating to the Second Liberty Bond Act 1917 and relate an interesting period immediately after WWII as the very large deficits that were required to prosecute the war effort (large is in relative historical terms) saw public debt levels rise significantly.

In 1949, a new ceiling was requested from Congress and this was immediately approved by the House but was obstructed by the Senate. Cooke and Katzen say (p.302) that in the Senate:

… the ceiling was viewed as an instrument for forcing economy on the executive branch of the government. During subsequent months, the statutory ceiling limited the scope for both new money borrowing and refunding transactions, but the Treasury by drawing down the level of its operating cash balance and by relying more heavily on private financing in certain programs held the public debt within the ceiling, although for a time by a small margin.

So politics politics.

If you thought there was any logic to the rules then think again. From a modern monetary theory (MMT) perspective these rules and the restrictive accounting procedures that they lead too are just voluntary constraints that have been inherited from the gold standard days where exchange rates were fixed and governments were financially contrained.

In the era of fiat currency systems, the rules have been perpetuated by the mainstream economics ideology to constrain government to give more latitiude for “market activity”. The lunacy of that stance is that the private sector actually does better when there is a strong fiscal involvement.

Anyway, the public debt limit is one such voluntary constraint that could be easily legislated out of existence if the public truly understood how the monetary system operated and that time has moved on since 1971 when the convertible currency system collapsed.

There are two components of total US public debt:

- The debt held by the public as a result of the “total net amount borrowed to cover the federal government’s accumulated budget deficits” – that is the government just borrows back what it spends. Sounds like a make work scheme for those who administer this system.

- The debt that is held in so-called government accounts which is “the total net amount of federal debt issued to specialized federal accounts, primarily trust funds (e.g., Social Security)”. Under US law, any surpluses that the trust fund has have to be invested in “special federal government securities”.

If you consult the data from the The Bureau of the Public Debt you will find that as at November 30, 2009 total US public debt outstanding was $US12,113,048 million and of that $US7,712,387 was held by the public (63.7 per cent) 4,400,660 was held by intergovernment accounts (36.3 per cent).

The US social security system set up during the Great Depression requires that specially identified payroll taxes be levied to help pay for social security. If there is an excess of revenue raised in any year it goes in to the Social Security Trust Fund which is the responsibility of the US Treasury – see more also HERE.

Normally revenue exceeds payouts and the law requires that the surpluses are invested in “special series, non-marketable U.S. Government bonds” which mainstream economists take to mean that the payroll taxes (that is, the Social Security Trust Fund) “finance” US federal government net spending (deficit).

Is the phrase smoke and mirrors starting to emanate from your mouth? Definitely from mine.

The Trust fund can be supplemented from the US government at any time they like (subject to legislation). The only time this has happened was in 1982 when accrording to the Annual Report the assets of the Trust Fund were close to being depleted and the US Congress allowed the Old Age and Survivors Insurance Trust Fund (OASI), which is the largest of the funds to borrow from elsewhere in the federal system.

The bottom line is that US federal government can always fund its social security obligations and any other nominal obligations that it faces. There is no need for these elaborate arrangements to “store up” spending capacity.

Certainly, from a transparency perspective, the public should know exactly where spending is going. But to think that having these “funds” will help governments “afford” commitments in the future is inapplicable to a fiat monetary system.

Anyway, the point is that the public debt limit applies to both components of total US public debt – which means that the federal government can reach its public debt ceiling even though the federal budget is balanced (if the Trust Fund surpluses are significant as they might be in a growing economy).

The whole public debt limit debate is exemplified in the regular US debate in relation to the solvency of the Social Security Trust Fund. The idea is that these accumulated surpluses allegedly stored away will help government deal with increased public expenditure demands that may accompany the ageing population is crazy.

The same lunacy pervades the so-called intergenerational (or aging society) debate.

While it is moot that an ageing population will place disproportionate pressures on government expenditure in the future, MMT tells us that the concept of pressure is inapplicable because it assumes a financial constraint.

In a fiat monetary system, unless you impose voluntary financial constraints on the national government, such as we have discussed above, then the assumption is erroneous.

Without these ridiculous constraints, the national government can spend up to what is offered for sale.

Further, the idea that “taxpayers’ funds” will be squeezed to repay debt or service the health needs of the future society is also nonsensical. MMT tells us that taxpayers do not fund “anything”. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same.

The notion that these “debited funds” have some further use is not applicable to anything. When taxes are levied the revenue does not go anywhere. The flow of funds is accounted for, but accounting for a surplus that is merely a discretionary net contraction of private liquidity by government does not change the capacity of government to inject future liquidity at any time it chooses.

The standard mainstream intertemporal Government Budget Constraint analysis that deficits lead to future tax burdens is also problematic. The problem is that the GBC is not a “bridge” that spans the generations in some restrictive manner.

Each generation is free to select the tax burden it endures through the political system. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

When I say that there is no intrinsic financial constraint on federal government spending in a modern monetary system, I am not, as if often erroneously claimed, saying that government should therefore not be concerned with the size of its deficit.

I have never advocated unlimited deficits. Rather, the size of the deficit (surplus) will be market determined by the desired net saving of the non-government sector. This may not coincide with full employment and so it is the responsibility of the government to ensure that its taxation/spending are at the right level to ensure that this equality occurs at full employment.

Accordingly, if the goals of the economy are full employment with price level stability then the task is to make sure that net public spending is just enough to ensure that is it not inflationary (adding to much nominal demand in relation to the real capacity of the economy to absorb it) nor deflationary (not filling the spending gap left by non-government saving).

This insight puts the idea of sustainability of government finances into a different light. If the federal government (anywhere) tries to run budget surpluses to keep public debt low then it will ensure that further deterioration in non-government savings will occur until aggregate demand decreases sufficiently to slow the economy down and raise the output gap.

The goal should always be to maintain efficient and effective public services and full employment. Clearly the real public command on resources matters by which I mean the resources that are employed to deliver the public services. So real infrastructure and real know how etc define the essence of an effective provision of public goods.

The actual deficit figure is irrelevant in making this assessment.

Finally, all of this is about political choices rather than government finances.

The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline”, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

Clearly fiscal discipline may help maintain low inflation (or even induce deflation) because it acts as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. Fiscal discipline also reduces non-government savings and so undermines the capacity of households to manage their own life risks.

Federal-state relations in the US

Related to this argument is the current problems California is having as a fixed exchange rate, non-currency issuer government. Bloomberg reported yesterday (December 24, 2009) that “Schwarzenegger Seeks Obama’s Help for Deficit Relief”.

With the Californian deficit reflecting the severe burden that the State has borne in the current crisis, the Report says that:

Instead of seeking one-time stimulus money or a bailout, the most-populous U.S. state wants the federal government to reduce mandates and waive rules stipulating expenditures on programs such as indigent health care …

Anyway, I will analyse this in more detail another day (when the Governor makes his annual State of the State address on January 6 or thereabouts.

But the point is that the constraints on US states to balance their budgets makes them equivalent to a Eurosystem country. They can go broke unless the Federal component of the system is prepared to “bail them out”.

It doesn’t make any sense first for the Federal government not to ensure that the Californian economy is robust. It is a huge state with huge impact on the national economy.

But the fiscal constraints – totally voluntary – also make no sense in a fiat currency system. In Australia, the states are not prevented from running deficits as long as they can raise the revenue or borrow sufficient amounts. In general, the political system (we can kick them out each election) has meant that insolvency is not an issue.

When the Australian states were bitten by the neo-liberal bug (in the 1990s) and started telling us all they were great because they were running surpluses finally and that debt was bad they forgot to tell us that in about 10 years time (about now) public infrastructure would start crumbling, trains would be late always; public hospital waiting lists would increase and all the rest of it.

If the US is really a strong democracy then let the states run their own budgets as they see fit and be prepared to wear the consequences at the ballot box.

But at present the only solution for California is not to savage state spending or raise taxes – but to receive enough federal support to ensure employment growth emerges very quickly.

The solution to California’s fiscal crisis is to get people back into work.

The other way they could get round it is to revive their plan to introduce IOUs. Please read my blog – California IOUs are not currency – but they could be! – for more discussion on this point.

Conclusion

The debate about public debt limits is arcane in the extreme and harks back to gold standard logic which is no longer applicable.

There is no defensible case that can be made to retain this legislation and as such it should be repealed. The US federal government may want to issue debt for liquidity management reasons but a better strategy would be to run a zero interest rate policy.

How much the government spends is not a point of interest nor is the nominal size of the public deficit. We should judge the effectiveness of the government activities by the ability to achieve and sustain full employment and price stability and all the rest of the goals that the political system may at any time define as being within the domain of public purpose.

Now I am going home to see where every one got to today?

Mega hard Saturday Quiz coming

Tomorrow, as usual, a Saturday Quiz will emerge (sometime).

thanks for the great blog. I started reading it several weeks ago and since then always try to catch up with your posts and cross-references. I have to say it is hard to accomplish 🙂 I am still confused in many regards but your blog is definitely opening my eyes. The idea that inflation can be controlled by money supply was one of the first to go out of the window after I realized the other day (directly or indirectly by your blog) that inflation is driven not by money balance but by real demand/supply of the given product. And today you confirmed here my “fear” that by taxing/net spending the government can control price of any good in the economy. So taking this to extreme the government could declare absolute price stability and execute on it. This would automatically render all monetary ideology redundant. And reallocate resources for more productive use.

I do not think I can produce any meaningful question or remark at the moment but I am trying hard to catch up. I never felt so excited about all things fiscal. And now I can not decide whether I want to read your blog or any related things or I want to read some fiction book. Life is difficult. And thank you for making it this way 😉

Dear Sergei

Thanks for your nice comment and I am glad you are finding my writing to be of use.

But it is always best not to think in absolutes when it comes to price stability. It is a stochastic world and so nominal demand is always fluctuating. The role of government is to make sure it is not to inflationary or deflationary. It is a fine balance.

And … I am especially glad you separated my blog from “some fiction book”. (-:

Anyway, please keep reading – there are more than a million words so far this year …. plenty to catch up on.

best wishes

bill

Bill:

A quick note to say happy holidays and happy new year. Your blog is fantastic and I look forward to reading it every day – it is a true gift. One day I will consistently score 5 of 5 on Saturdays, but I have to eliminate my neo-liberal tendencies. Just wanted to say thanks so much.

PE Bird

Hi, Bill-

Thanks for being on the case today!

“Further, the idea that “taxpayers’ funds” will be squeezed to repay debt or service the health needs of the future society is also nonsensical. MMT tells us that taxpayers do not fund “anything”. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same.”

I was curious about this statement. If the government issues bonds, then it is taking up the obligation of paying interest for the life of those bonds (or buying them back at some future date, which is unlikely). Given that, in the normal state of affairs, the government will be roughly balancing incomes and outgoes to the private sector as you generally state under MMT theory, (to achieve monetary stability), these future interest payments displace something else, like more productive direct spending … or lowering taxes. They constitute an obligation that is not cost-free to future governments, even though those governments are free to rebalance their various incomes and outgoes as they may desire.

Amazing how they “target” public debt/GDP ratios like 100% etc and put a ceiling. If we were living in Neptune, one “year” would have been 165 times and public debt/GDP would have been less than 1% since 1 “year” is stretched. Thankfully we don’t stay in Venus. One year on Venus is about 225 Earth days long – that would have meant that the US government stopped spending at $8.6T by law and we would have had another Great Depression.

Free education ! Will live in Japan anyday

http://economictimes.indiatimes.com/Japan-unveils-record-1-trillion-budget/articleshow/5378313.cms

Yes – can’t say I have anything against the tribal rituals – nice to see people relaxed and just enjoying themselves and each other for a change; they shouldn’t really need an excuse to do that. Turning this beautiful planet and human existence into a factory, a sweat-shop or a war zone – that’s dumb! It’s such a distorted view of the potential and miracle that is a human being. I aim to thoroughly enjoy each day regardless of the play (my little effort at non-conformity yo-ho-ho). Just being alive is the most exquisite gift!

On the battlefield of concepts, MMT is a breath of fresh air! Obviously, it refreshes people to read your blog Bill.

It’s a pity the battle of concepts need spill out onto the plains. If we could only lock our leaders up in a room somewhere and let them punch it out without involving the rest of us. Maybe the guy left standing would then be ready to listen to the obviousness of concepts like MMT and environmental notions of common sense. That was the failure of Copenhagen I reckon – they didn’t lock the door! Most people just want to get on with their lives.

True prosperity in the fabled kingdoms I read of when I was a kid, was always conditional on the simple wisdom of Peace!

Hi Bill,

Some of the recent comments on your blog suggest the need to spread the word on MMT. Have you considered a coordinated effort (attack) in the comments section of some of the more popular blogs. I have seen Mosler post on Hamilton/Chinn’s blog; but one small effort (no matter how hard hitting) gets little results. Maybe a few of you with credentials (you, Mosler, Wray, Fullwiler, to name a few) supported by the rest of us can have an influence. I know you are busy with you own blog and work, but if the students don’t come to you, maybe you need to go the the students.

You’ve upset my Boxing Day plans (Detroit is close to Canada, but Boxing Day is not actually recognized here) with this fun and informative reading. It’s 3PM in Detroit and I’m still reading your blog and haven’t yet dressed. (c:

Sorry Detroit Dan

This is a desperate situation. I would also caution wearing clothes while reading my blog in case unfortunate associations between the two are made (-:

best wishes

bill

What an interesting post!

But how do you define “destruction of productive capacity” versus government consuming too many resources, or even issuing too many Greenbacks (e.g. overpaying for the resources it did consume)?

Industrial output increased during the civil war, so the Zimbabwe analogy is false. You can argue that output grew more slowly than it did prior to the civil war, or in the enormous boom that followed the civil war, but output did increase, and substantially so — what is the explanation of inflation then?

“But at present the only solution for California is not to savage state spending or raise taxes – but to receive enough federal support to ensure employment growth emerges very quickly.”

Why? Won’t this just include more profligate behavior on the part of California? I don’t disagree with your assertions on the way that MMT works, but what exactly was bad with the gold standard? If you spent too much and didn’t have the money, then prices would have to adjust and there would be deflation. This deflation, however, cleans out the economy, setting the stage for new and honest growth. There is also nothing ideological about this, but it does not redistribute and reward the risk takers at the expense of savers, like a fiat system does.

Poor profligate California, sending $1.00 in revenue to the central government for every 70 cents in federal spending. It should be more like honest Alabama, that sends $1 to the government in exchange for $2 of spending.

How dare California ask that the central government drain less? After all, it accounts for 13% of the nation’s Gross Domestic Output, even though it has 11% of the population. Clearly California is not pulling its weight, because it should be happy to subsidize all the other states with lower productivity — how dare it ask that the Central Government siphon less money out of it each year?

After all, profligate California has a lower debt/GDP ratio than every state other than Wyoming and Nevada. This type of profligate behavior needs to be punished! Then we can have the glories of deflation and depression, with “honest” misery that conforms to the psychotic delusions of “savers” , rather than “falsely” living up to our productive potential.

Great post- thanks for linking to it. I am also going to check out this “Mega hard Saturday quiz” you mention here and see how I do on it.