Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – February 14, 2015 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

One important lesson to be drawn from Modern Monetary Theory (MMT), which is overlooked in the public call for austerity programs, is that when economic growth resumes, the automatic stabilisers work in a counter-cyclical fashion and ensure that the government fsical balance returns to its appropriate level.

The answer is False.

The factual statement in the proposition is that the automatic stabilisers do operate in a counter-cyclical fashion when economic growth resumes. This is because tax revenue improves given it is typically tied to income generation in some way. Further, most governments provide transfer payment relief to workers (unemployment benefits) and this increases when there is an economic slowdown.

The question is false though because this process while important may not ensure that the government budget balance returns to its appropriate level.

The automatic stabilisers just push the budget balance towards deficit, into deficit, or into a larger deficit when GDP growth declines and vice versa when GDP growth increases. These movements in aggregate demand play an important counter-cyclical attenuating role. So when GDP is declining due to falling aggregate demand, the automatic stabilisers work to add demand (falling taxes and rising welfare payments). When GDP growth is rising, the automatic stabilisers start to pull demand back as the economy adjusts (rising taxes and falling welfare payments).

We also measure the automatic stabiliser impact against some benchmark or “full capacity” or potential level of output, so that we can decompose the budget balance into that component which is due to specific discretionary fiscal policy choices made by the government and that which arises because the cycle takes the economy away from the potential level of output.

This decomposition provides (in modern terminology) the structural (discretionary) and cyclical budget balances. The budget components are adjusted to what they would be at the potential or full capacity level of output.

So if the economy is operating below capacity then tax revenue would be below its potential level and welfare spending would be above. In other words, the budget balance would be smaller at potential output relative to its current value if the economy was operating below full capacity. The adjustments would work in reverse should the economy be operating above full capacity.

If the budget is in deficit when computed at the “full employment” or potential output level, then we call this a structural deficit and it means that the overall impact of discretionary fiscal policy is expansionary irrespective of what the actual budget outcome is presently. If it is in surplus, then we have a structural surplus and it means that the overall impact of discretionary fiscal policy is contractionary irrespective of what the actual budget outcome is presently.

So you could have a downturn which drives the budget into a deficit but the underlying structural position could be contractionary (that is, a surplus). And vice versa.

The difference between the actual budget outcome and the structural component is then considered to be the cyclical budget outcome and it arises because the economy is deviating from its potential.

In some of the blogs listed below I go into the measurement issues involved in this decomposition in more detail. However for this question it these issues are less important to discuss.

The point is that structural budget balance has to be sufficient to ensure there is full employment. The only sensible reason for accepting the authority of a national government and ceding currency control to such an entity is that it can work for all of us to advance public purpose.

In this context, one of the most important elements of public purpose that the state has to maximise is employment. Once the private sector has made its spending (and saving decisions) based on its expectations of the future, the government has to render those private decisions consistent with the objective of full employment.

Given the non-government sector will typically desire to net save (accumulate financial assets in the currency of issue) over the course of a business cycle this means that there will be, on average, a spending gap over the course of the same cycle that can only be filled by the national government. There is no escaping that.

So then the national government has a choice – maintain full employment by ensuring there is no spending gap which means that the necessary deficit is defined by this political goal. It will be whatever is required to close the spending gap. However, it is also possible that the political goals may be to maintain some slack in the economy (persistent unemployment and underemployment) which means that the government deficit will be somewhat smaller and perhaps even, for a time, a budget surplus will be possible.

But the second option would introduce fiscal drag (deflationary forces) into the economy which will ultimately cause firms to reduce production and income and drive the budget outcome towards increasing deficits.

Ultimately, the spending gap is closed by the automatic stabilisers because falling national income ensures that that the leakages (saving, taxation and imports) equal the injections (investment, government spending and exports) so that the sectoral balances hold (being accounting constructs). But at that point, the economy will support lower employment levels and rising unemployment. The budget will also be in deficit – but in this situation, the deficits will be what I call “bad” deficits. Deficits driven by a declining economy and rising unemployment.

So fiscal sustainability requires that the government fills the spending gap with “good” deficits at levels of economic activity consistent with full employment – which I define as 2 per cent unemployment and zero underemployment.

Fiscal sustainability cannot be defined independently of full employment. Once the link between full employment and the conduct of fiscal policy is abandoned, we are effectively admitting that we do not want government to take responsibility of full employment (and the equity advantages that accompany that end).

So it will not always be the case that the dynamics of the automatic stabilisers will leave a structural deficit sufficient to finance the saving desire of the non-government sector at an output level consistent with full utilisation of resources.

The following blogs may be of further interest to you:

- A modern monetary theory lullaby

- Saturday Quiz – April 24, 2010 – answers and discussion

- The dreaded NAIRU is still about!

- Structural deficits – the great con job!

- Structural deficits and automatic stabilisers

- Another economics department to close

Question 3:

The IMF and its Troika partners claim that the recovery in Greece is dependent on internal devaluation and the austerity programs are designed to deflate nominal wages and prices which is claimed will make the economy more competitive as long as real unit labour costs fall faster than their trading partners. However, if wages and prices fall at the same rate, which of the following propositions must also follow if the IMF logic is to be consistent (ignoring whether the logic is correct or not):

1. Labour productivity has to rise and employment remain constant or grow.

2. Labour productivity has to rise and employment must grow.

3. Labour productivity has to rise and what happens to employment is irrelevant.

4. None of the above.

Given the assumption that wages and prices fall at the same rate, the correct answer is:

Labour productivity has to rise and what happens to employment is irrelevant.

The EMU countries cannot improve their international competitiveness by exchange rate depreciation, which is the option always available to a fully sovereign nation issuing its own currency and floating it in foreign exchange markets.

Thus, to improve their international competitiveness, the EMU countries have to engage in “internal devaluation” which means they have to cut real unit labour costs – which are the real cost of producing goods and services. Governments setting out on this policy path have to engineer cuts in the wage and price levels (the latter following the former as unit costs fall).

But the question demonstrates that it takes more than just a nominal deflation. The strategy hinges on whether you can also engineer productivity growth (typically).

Some explanatory notes to accompany the analysis that follows:

- Employment is measured in persons (averaged over the period).

- Labour productivity is the units of output per person employment per period.

- The wage and price level are in nominal units; the real wage is the wage level divided by the price level and tells us the real purchasing power of that nominal wage level.

- The wage bill is employment times the wage level and is the total labour costs in production for each period.

- Real GDP is thus employment times labour productivity and represents a flow of actual output per period; Nominal GDP is Real GDP at market value – that is, multiplied by the price level. So real GDP can grow while nominal GDP can fall if the price level is deflating and productivity growth and/or employment growth is positive.

- The wage share is the share of total wages in nominal GDP and is thus a guide to the distribution of national income between wages and profits.

- Unit labour costs are in nominal terms and are calculated as total labour costs divided by nominal GDP. So they tell you what each unit of output is costing in labour outlays; Real unit labour costs just divide this by the price level to give a real measure of what each unit of output is costing. RULC is also the ratio of the real wage to labour productivity and through algebra I would be able to show you (trust me) that it is equivalent to the Wage share measure (although I have expressed the latter in percentage terms and left the RULC measure in raw units).

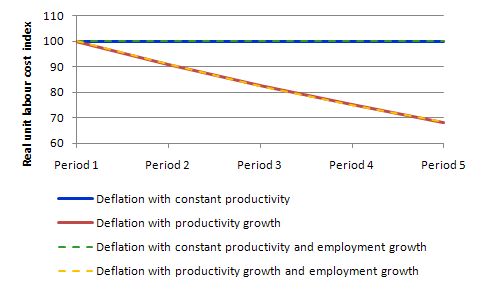

The following table models the constant and growing productivity cases but holds employment constant for five periods. We assume that the nominal wage and the price level deflate by 10 per cent per period over Period 2 to 5. In the productivity growth case, we assume it grows by 10 per cent per period over Period 2 to 5.

It is quite clear that under the assumptions employed, RULC cannot fall without productivity growth. The only other way to accomplish this is to ensure that nominal wages fall faster than the price level falls. In the historical debate, this was a major contention between Keynes and Pigou (an economist in the neo-classical tradition who best represented the so-called “British Treasury View” in the 1930s. The Treasury View thought the cure to the Great Depression was to cut the real wage because according to their erroneous logic, unemployment could only occur if the real wage was too high.

Keynes argued that if you tried to cut nominal wages as a way of cutting the real wage (given there is no such thing as a real wage that policy can directly manipulate), firms will be forced by competition to cut prices to because unit labour costs would be lower. He hypothesised that there is no reason not to believe that the rate of deflation in nominal wage and price level would be similar and so the real wage would be constant over the period of the deflation. So that is the operating assumption here.

The following table models the constant and growing productivity cases as above but allows employment to grow by 10 per cent per period. All four scenarios in the Table are them modelled in the following graph with the Real Unit Labour Costs converted into index number form equal to 100 in Period 1. As you can see what happens to employment makes no difference at all.

I could have also modelled employment falling with the same results.

The following graph shows the four scenarios shown in the last two tables. I have dashed some scenarios to make the lines visible (given that Case A and Case C) are equivalent as are Case B and Case D. What you learn is that if wages and prices fall at the same rate and labour productivity does not rise there can be no reduction in unit or real unit labour costs.

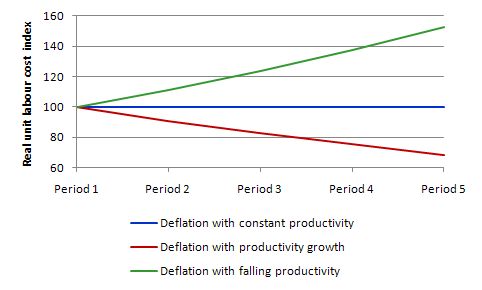

So the internal devaluation strategy relies heavily on productivity growth occurring. The literature on organisational psychology and industrial relations is replete of examples where worker morale is an important ingredient in accomplishing productivity growth. In a climate of austerity characteristic of an internal devaluation strategy it is highly likely that productivity will not grow and may even fall over time. Then the internal devaluation strategy is useless.

This graph compares the two scenarios in the first Table with the more realistic one that labour productivity actually falls as the government ravages the economy in pursuit of its internal devaluation. As you can see real unit labour costs rise as labour productivity falls and the economy’s competitiveness (given the exchange rate is fixed) falls.

Of-course, this “supply-side” scenario does not take into account the overwhelming reality that for an economy to realise this level of output over an extended period aggregate demand would have to be supportive. The internal devaluation strategy relies heavily on the external sector providing the demand impetus.

Given that Greece trade is mostly exposed to developments in the EMU itself, it seems far fetched to assume that the trade impact arising from any successful internal devaluation will be sufficient to overcome the devastating domestic contraction in demand that will almost certainly occur. This is why commentators are calling for a domestic expansion in Germany to boost aggregate demand throughout the EMU, given the dominance of the German economy in the overall European trade.

That is clearly unlikely to happen given Germany has been engaged in a lengthy process of internal devaluation itself and the Government is resistant to any stimulus packages that might improve things within Germany and beyond via the trade impacts.

Further, the recent evidence suggests that tourism, a prime export for Greece, is suffering as a result of the civil disturbances.

The following blogs may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

- EMU posturing provides no durable solution

- Protect your workers for the sake of the nation

- The bullies and the bullied

- Modern monetary theory in an open economy

Question 3:

The conservative Australian government recently scrapped the mining tax that had been introduced by the previous government. The conservatives argued that the higher taxes had distorted the allocation of resources by changing the rates of return on different uses of capital (and labour). The previous tax had taken the form of a Resource Super Profits Tax on mining companies. Leaving aside the arguments that the government does not need revenue to spend, a typical mainstream economist would agree with the conservative government’s decision and conclude that the tax was bad because it reduced mining investment.

The answer is False.

The question doesn’t directly have much to do with Modern Monetary Theory (MMT) at all. It was intended to provide insight into the inconsistencies (doublethink) that mainstream economists get themselves caught up in when they blur their own “pure” theory with political and moral arguments.

Even in mainstream economic theory there are many instances where government intervention is beneficial although you won’t find too many conservatives who continually invoke “competitive text book theory” to make their cases for cutting government intervention etc admitting that.

In fact, most of the commentators who perpetuate “free market” economics do not fully understand it as a body of theory.

The Resource Super Profits Tax introduced by the previous Australian government is in the class of taxes known as Resource Rent Taxes. What are they?

The papers available at the Australian Treasury’s Tax Review site are of interest, particularly Chapter C: Land and resource taxes of the final Report.

There you learn what economic rents are and how they arise:

The finite supply of non-renewable resources allows their owners to earn above-normal profits (economic rents) from exploitation. Rents exist where the proceeds from the sale of resources exceed the cost of exploration and extraction, including a required rate of return to compensate factors of production (labour and capital). In most other sectors of the economy, the existence of economic rents would attract new firms, increasing supply and decreasing prices and reducing the value of the rent. However, economic rents can persist in the resource sector because of the finite supply of non-renewable resources. These rents are referred to as resource rent.

So an economic rent arises to a resource where it is in finite supply and demand drives its return above the minimum required for it to be used in the current use. For example, Madonna would probably work for much less than she does but enjoys rents because people seem to like her performances and records etc.

The point about an economic rent is that if you eliminate it you will not alter the supply of resources.

The Treasury Review Chapter tells us that in mainstream theory (derived from a 1931 article by Hotelling).

The optimal rate for exploiting non-renewable resources is, in theory, determined by the required rate of return … The owner of the resource can maximise the value of their resource stock by extracting quantities at a rate such that the expected value of the remaining resources rises over time at the required rate of return.

So even in mainstream economic theory, a resource rent tax will be optimal if it fully taxes the super-normal profits accruing to the companies that have been given the rights to exploit the mineral deposits. In this respect the 40 per cent tax proposed by the Australian government is sub-optimal because it leaves some of the rents in the hands of the rights-owners.

Theory then describes how leaving rents in the system will lead to sup-optimal outcomes. You can read the Treasury Report noted above for more information on that if you are interested.

But the important point is that the tax on the rents will not lead to less investment in mining projects. Firms will still earn more than the competitive return on their capital available elsewhere – 60 per cent of the higher rate of return more!

There are other arguments that can be used to support the tax which are more amenable to MMT. For example, the incidence of the tax (who bears the final burden of it) will most likely fall on high-income investors. In the case of mining this group also involves many foreign interests. Low-wage workers will not bear much if any of the incidence.

The question also of who “owns the resources” is relevant. If the resources are “publicly-owned” by all of us then it appears inequitable to allow foreigners and high-income rights-owners to compile massive wealth arising from exploitation of the resources. These are complex arguments that I will leave alone at the present time.

There are many more arguments that have been used.

From the perspective of MMT, the basic fiscal proposition underpinning the previous government’s justification for the tax, however, was flawed. The previous government had said that by raising funds in this way they will be able to improve infrastructure, pay better retirement benefits etc for Australians who had not directly benefitted from the “mining boom”.

The only MMT justification for the introducing the tax or increasing its rate would be if it helped drain demand at a time when the real capacity of the economy was being exhausted and inflation was threatening. The Australian government has suggested this is one of their motivations.

The other point is to consider the overall tax drain on aggregate demand in terms of the composition of the taxes being used to achieve that drain. Of the available taxes, Resource Rent Taxes advance equity; do not have any disincentive effects (strictly speaking) and are relatively easy to administer.

So shifting towards this type of tax as a vehicle to fight inflation would be sensible.

The following blog may be of further interest to you:

Q2 is wrongly headed as Q3 above.

Essentially Q2 is “which of the following propositions must also follow if the IMF logic is to be consistent?”

Contrary to what is stated above, the correct answer to Q2 is “4. None of the above. ”

None of the other propositions follow from “IMF logic” and none of them is consistent with “IMF logic”.

The above “explanation” given for Q2 depends on the stated assumption that “wages and prices fall at the same rate”, i.e constant real wage . This is assumed in all the numeric calculations above.

But this is all irrelevant because it is not consistent with “IMF logic”.

As indicated in the first sentence of the question: “austerity programs are designed to … make the economy more competitive as long as real unit labour costs fall faster than their trading partners.”

Thus “IMF logic” requires a DECLINE in the real wage, i.e. wages falling faster than prices.

Small addendum to above comment on Q2.

Real unit labour costs would fall with higher labour productivity, assuming constant real wage rates.

But it is not part of “IMF logic” that austerity increases productivity.

As noted in the first sentence of the question, “IMF logic” is that austerity would work through changes in “nominal wages and prices”.

Dear Bill

I don’t get your answer to question 2. If prices in Greece fall because of wage reductions, then Greece will be able to sell its goods abroad cheaper. It therefore becomes more competitive. Let’s illustrate this. In Germany, a worker receives 20 euros per hour and produces 2 widgets per hour. Let’s assume that labor are the only costs. His boss can then sell the widgets for 10 euros a piece and break even. In Greece, a worker receives 15 euros per hour and produces 1 widget per hour. If, by assumption, labor are the only costs, then his boss has to sell the widgets at 15 euros a piece to break even. Greece is therefore not competitive with Germany.

Now the wage of the Greek worker goes down to 10 euros per hour and the price of a Greek widget will go down to 10 euros as well. It is of course being assumed that the Greek worker still produces 1 widget per hour. His boss can now sell the widgets for 10 euros a piece and break even. In other words, he can now sell them for the same price as his German competitor. He has become competitive

It is true of course that wage reductions can’t stimulate domestic demand, but it can make a country more competitive abroad if wage reductions are followed by price reductions. Am I missing something here?

Regards. James

Bill

Thanks so much for your blog, as someone new to MMT I find it very helpful particularly the quizzes. I would be very interested in your views on the MMT solution to Venezuela’a problems – a country which has all the natural resources you could want but which finds itself unable to provide it’s citizens with the basics.

Thanks