Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Australian labour market – weaker and may now be falling in line with the weaker spending and GDP growth

Today (November 14, 2024), the Australian Bureau of Statistics released the latest – Labour Force, Australia – for October 2024, which shows that employment growth was very weak and may signal that the labour market is finally slowing in line with overall spending and GDP growth. Employment growth failed to keep pace with the underlying population growth and the only reason the unemployment rate remained ‘stable’ was because participation fell, in line with the weaker jobs outlook. We should not disregard the fact that there is now 10.4 per cent of the working age population (over 1.6 million people) who are available and willing but cannot find enough work – either unemployed or underemployed and that proportion is increasing. Australia is not near full employment despite the claims by the mainstream commentators and it is hard to characterise this as a ‘tight’ labour market.

The summary ABS Labour Force (seasonally adjusted) estimates for October 2024 are:

- Employment rose 15,900 (0.1 per cent) – full-time employment rose 9.7 thousand (0.1 per cent) and part-time employment rose by 6.2 thousand (0.1 per cent). Part-time share of total was 30.6 per cent.

- Unemployment rose 8.3 thousand to 625,800 persons.

- The official unemployment rate was steady at 4.1 per cent.

- The participation rate fell 0.1 point to 67.1 per cent.

- The employment-population ratio fell 0.1 point to 64.4 per cent (rounded).

- Aggregate monthly hours rose 2.9 million (0.15 per cent).

- Underemployment rate fell 0.1 point to 6.2 per cent – underemployment fell by 11.7 thousand. Overall there are 946.1 thousand underemployed workers. The total labour underutilisation rate (unemployment plus underemployment) was stable to 10.4 per cent. There were a total of 1,571.6 thousand workers either unemployed or underemployed.

In the ABS Media Release – Unemployment rate steady at 4.1% in October – the ABS noted that:

The unemployment rate was steady at 4.1 per cent in October … With employment rising by around 16,000 people and the number of unemployed up by around 8,000, the unemployment rate remained at 4.1 per cent …

While employment grew in October, the 0.1 per cent increase was the slowest growth in recent months. This was lower than each of the previous six months, when employment rose by an average of 0.3 per cent per month …

With population growth in October outpacing the small rise in employment and unemployment, the participation rate fell slightly to 67.1 per cent, while the employment-to-population ratio remained at the historical high of 64.4 per cent …

… monthly hours worked rose by 0.1 per cent in October …

The underemployment rate fell by 0.1 percentage point to 6.2 per cent. This was 0.2 percentage points lower than October 2023, and 2.5 percentage points lower than March 2020.

The underutilisation rate, which combines the unemployment and underemployment rates, remained at 10.4 per cent in October 2024 and well below the 13.9 per cent recorded in March 2020.

General conclusion:

1. Employment growth was weak and lagged behind the pace of the working age population.

2. The only reason the unemployment rate was steady at 4.1 per cent in light of the weak employment growth was due to the deceline in participation (0.1 point).

Employment rose 15,900 (0.1 per cent) in October 2024

1. Full-time employment rose 9.7 thousand (0.1 per cent) and part-time employment rose by 6.2 thousand (0.1 per cent).

2. The employment-population ratio fell 0.1 point to 64.4 per cent (rounded).

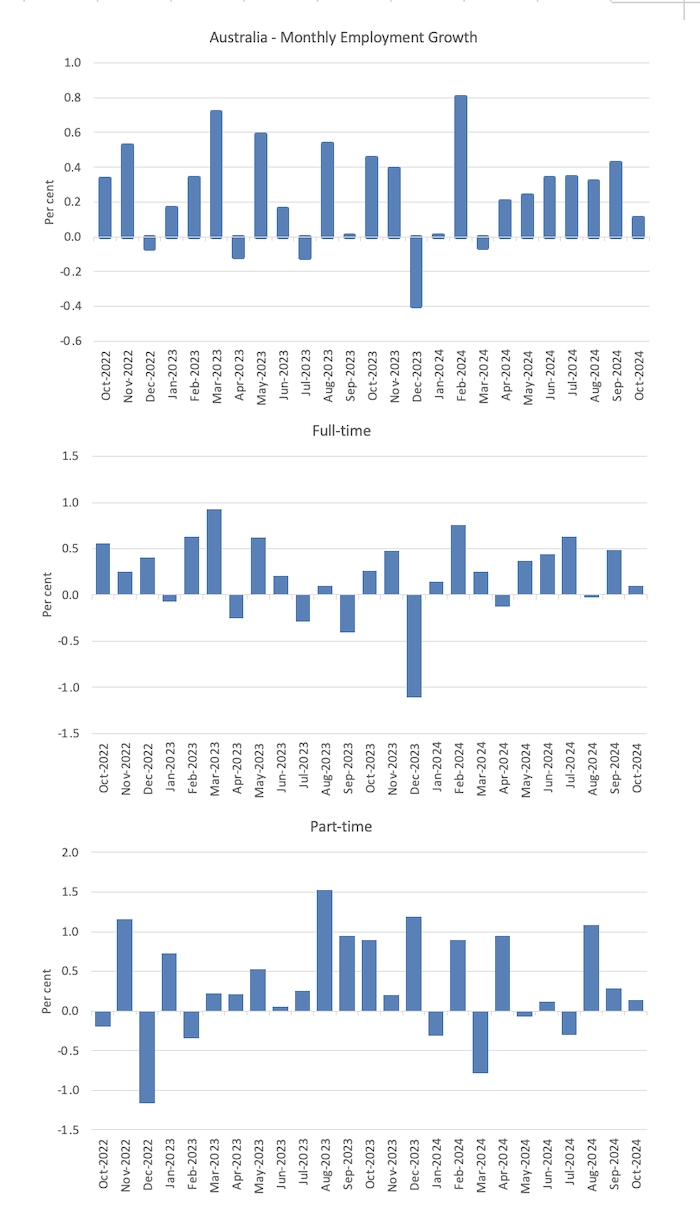

The following graph show the month by month growth in total, full-time, and part-time employment for the 24 months to October 2024 using seasonally adjusted data.

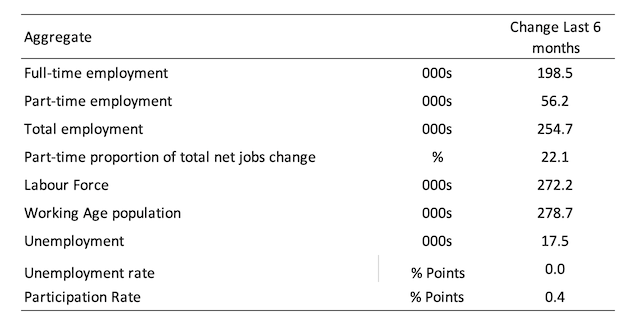

The following table provides an accounting summary of the labour market performance over the last six months to provide a longer perspective that cuts through the monthly variability and provides a better assessment of the trends.

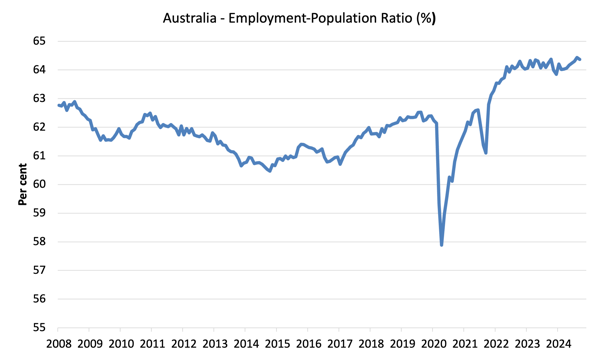

Given the variation in the labour force estimates, it is sometimes useful to examine the Employment-to-Population ratio (%) because the underlying population estimates (denominator) are less cyclical and subject to variation than the labour force estimates. This is an alternative measure of the robustness of activity to the unemployment rate, which is sensitive to those labour force swings.

The following graph shows the Employment-to-Population ratio, since April 2008 (that is, since the GFC).

The employment-to-population ratio is still demonstrating stability with minor fluctuations around the current level.

For perspective, the following graph shows the average monthly employment change for the calendar years from 1980 to 2024.

1. The average employment change over 2020 was -10.5 thousand which rose to 36.3 thousand in 2021 as the lockdowns eased.

2. For 2022, the average monthly change was 45.1 thousand, and for 2023, the average change was 31.5 thousand.

3. So far in 2024, the average monthly change is 38.9 thousand (and falling as the year progresses).

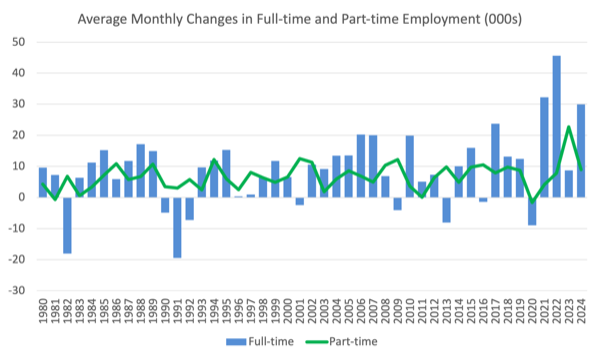

The following graph shows the average monthly changes in Full-time and Part-time employment in thousands since 1980.

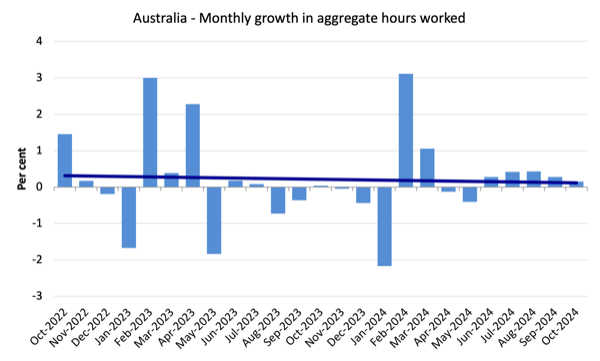

Aggregate monthly hours rose by 29 million hours (0.15 per cent)

The following graph shows the monthly growth (in per cent) over the last 48 months (with the pandemic restriction period omitted).

The dark linear line is a simple regression trend of the monthly change.

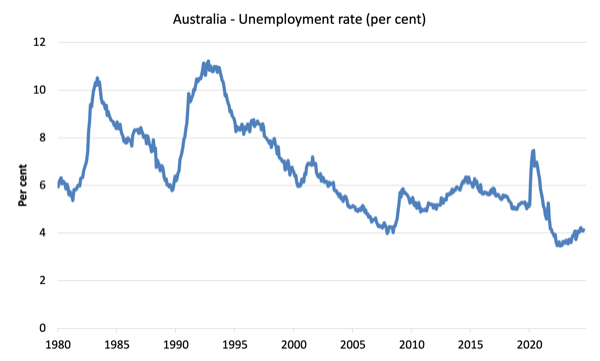

Unemployment rose 8.3 thousand to 625,800 persons in October 2024

While the ABS reported a stable unemployment rate, in fact it edged up a little – from 4.079 per cent in September to 4.127 per cent in October, although sampling error makes that difference fairly meaningless.

The reality is that employment growth is trailing population growth and it was only the small decrease in participation that held the unemployment rate ‘stable’.

The following graph shows the national unemployment rate from April 1980 to October 2024. The longer time-series helps frame some perspective to what is happening at present.

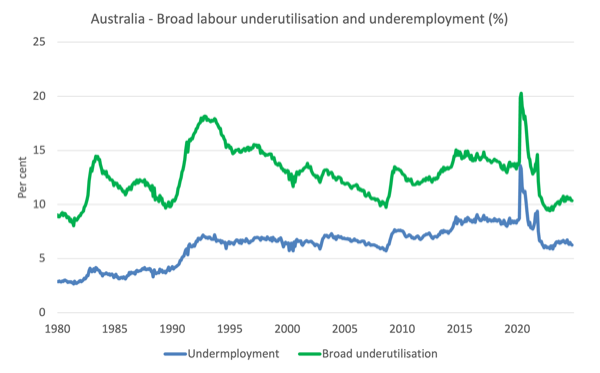

Broad labour underutilisation was stable at 10.4 per cent in October 2024

1. Underemployment rate fell 0.1 point to 6.2 per cent – underemployment fell by 11.7 thousand.

2. Overall there are 946.1 thousand underemployed workers.

3. The total labour underutilisation rate (unemployment plus underemployment) was stable to 10.4 per cent.

4. There were a total of 1,571.6 thousand workers either unemployed or underemployed.

Assessment:

Nothing much to note that hasn’t been explained above.

The following graph plots the seasonally-adjusted underemployment rate in Australia from April 1980 to the October 2024 (blue line) and the broad underutilisation rate over the same period (green line).

The difference between the two lines is the unemployment rate.

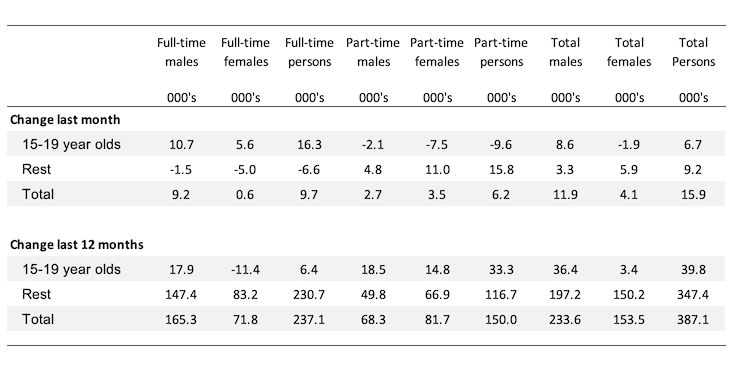

Teenage labour market improves in October 2024

Overall teenage employment rose by 6.7 thousand and full-time employment rose by 16.3 thousand, which is a good sign.

The following Table shows the distribution of net employment creation in the last month and the last 12 months by full-time/part-time status and age/gender category (15-19 year olds and the rest).

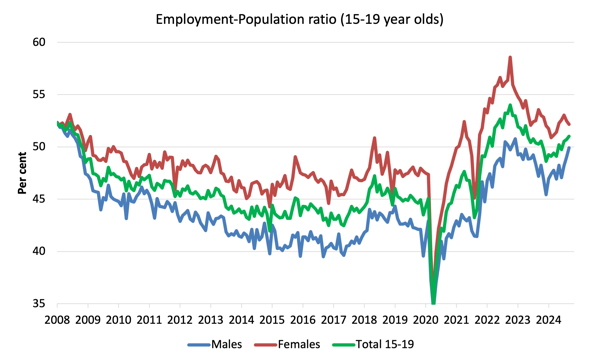

To put the teenage employment situation in a scale context (relative to their size in the population) the following graph shows the Employment-Population ratios for males, females and total 15-19 year olds since July 2008.

You can interpret this graph as depicting the change in employment relative to the underlying population of each cohort.

In terms of the recent dynamics:

1. The male ratio rose 0.9 points over the month.

2. The female ratio fell 0.3 points over the month.

3. The overall teenage employment-population ratio rose 0.3 points over the month.

Conclusion

My standard monthly warning: we always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented.

My overall assessment is:

1. Employment growth was very weak and may signal that the labour market is finally slowing in line with overall spending and GDP growth.

2. Employment growth failed to keep pace with the underlying population growth and the only reason the unemployment rate remained ‘stable’ was because participation fell, in line with the weaker jobs outlook.

3. We should not disregard the fact that there is now 10.4 per cent of the working age population (over 1.6 million people) who are available and willing but cannot find enough work – either unemployed or underemployed and that proportion is increasing.

5. Australia is not near full employment despite the claims by the mainstream commentators and it is hard to characterise this as a ‘tight’ labour market.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

This Post Has 0 Comments