In the annals of ruses used to provoke fear in the voting public about government…

Australian inflation episode well and truly over – please tell the RBA to stop trying to push unemployment up further

Today (November 27, 2024), the Australian Bureau of Statistics (ABS) released the latest – Monthly Consumer Price Index Indicator – for October 2024, which showed that the annual inflation rate was steady at 2.1 per cent and is now at the lower end of the RBA’s inflation targetting range (2 to 3 per cent). It is clear that the residual inflationary drivers are not the result of excess demand but rather reflect transitory factors like weather events and abuse of anti-competitive, corporate power (travel fares etc). The general conclusion is that the global factors that drove the inflationary pressures have largely resolved and that the outlook for inflation is for continued decline. There is also evidence that the RBA has caused some of the persistence in the inflation rate through the impact of the interest rate hikes on business costs and rental accommodation.

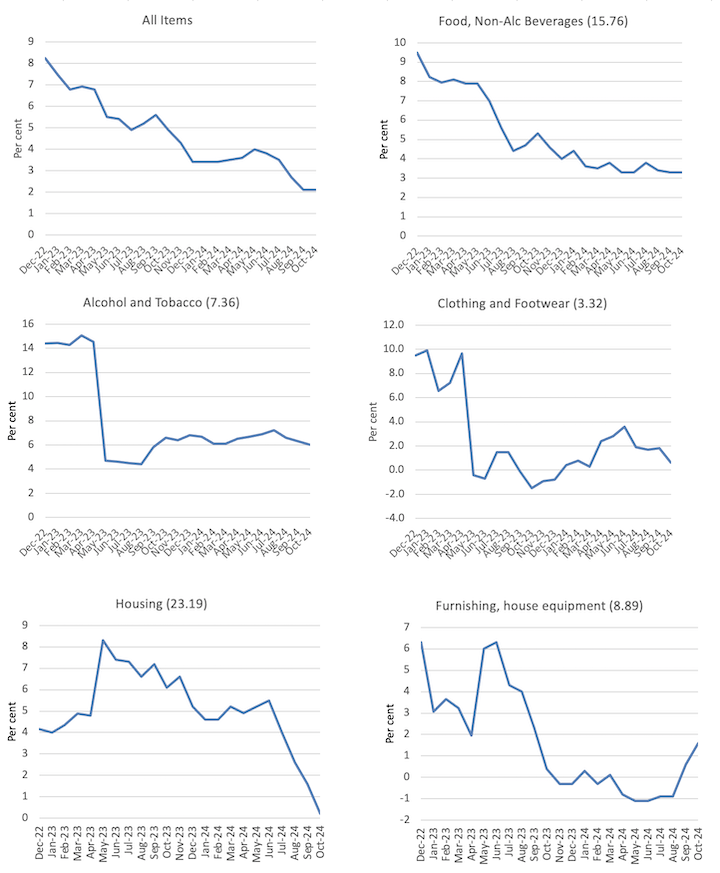

The latest monthly ABS CPI data shows for October 2024 that the annual results are:

- The All groups CPI measure rose 2.1 per cent over the 12 months (steady).

- Food and non-alcoholic beverages 3.3 per cent (steady).

- Clothing and footwear 0.6 per cent (last month 1.8).

- Housing 0.2 per cent (1.6). Rents (6.7 per cent (6.6).

- Furnishings and household equipment 1.6 per cent (0.6).

- Health 3.9 per cent (4.8).

- Transport -2.8 per cent (-3.8).

- Communications -0.7 per cent (-0.8).

- Recreation and culture 4.3 per cent (2,4).

- Education 6.3 per cent (6.4).

- Insurance and financial services 6.3 per cent (6.1).

The ABS Media Release (November 27, 2024) – Monthly CPI indicator rose 2.1% in the year to October 2024 – noted that:

The monthly Consumer Price Index (CPI) indicator rose 2.1 per cent in the 12 months to October 2024 …

… remains the lowest annual inflation since July 2021.

The top contributors to the annual movement at the group level were Food and non-alcoholic beverages (+3.3 per cent), Recreation and culture (+4.3 per cent), and Alcohol and tobacco (+6.0 per cent) …

Annual CPI inflation has fallen from 3.8 per cent in June to 2.1 per cent in October due, in part, due to significant price falls in Electricity and Automotive fuel …

Housing rose 0.2 per cent in the 12 months to October, down from a 1.6 per cent annual rise to September. The large fall in electricity prices mostly offset higher rents and new dwelling prices …

The annual rise in Rents of 6.7 per cent was partly offset by an increase in Commonwealth Rent Assistance (CRA).

So a few observations:

1. There is no case to be made that inflation remains in danger of accelerating.

2. It is now at the bottom of the RBA’s targetting range yet they refuse to reduce interest rates, which tells us that their motivation is to push up unemployment rather than contain accelerating inflation.

3. The major drivers – energy and fuel – are in retreat – because supply factors are abating or the government is offsetting the price gouging (electricity) with subsidies. These movements have nothing to do with the monetary policy settings, which means the RBA really cannot claim its policy shifts over the last few years have been the reason inflation has fallen so quickly.

4. The on-going rent inflation is partly due to the RBA’s own rate hikes as landlords in a tight housing market just pass on the higher borrowing costs – so the so-called inflation-fighting rate hikes are actually driving inflation.

5. The electricity component is significantly lower after the introduction of the federal and state government rebates offsetting the profit-gouging in the energy sector. Expansionary fiscal policy can be an effective tool in combatting inflation.

6. The main drivers of the current inflation situation are not sensitive to the RBA’s interest rate changes.

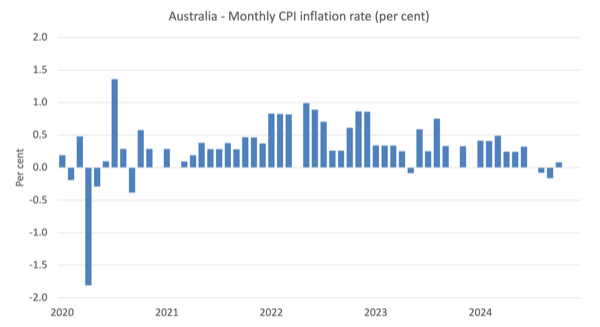

The next graph shows the monthly rate of inflation which fluctuates in line with special events or adjustments (such as, seasonal natural disasters, annual indexing arrangements etc).

There is no hint from this data that the inflation rate is accelerating or needs any special policy attention..

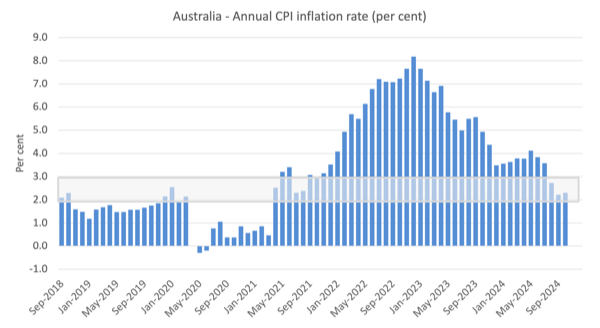

The next graph shows the annual movement with the shaded area showing the RBA targetting range.

Inflation peaked in December 2022 as the supply factors pertaining to the pandemic, Ukraine and OPEC started to abate.

The RBA kept hiking through 2023 claiming that there was a danger that wages growth would ‘breakout’ despite the fact that the data was showing such growth at record or near record low rates.

It is also useful to note that prior to the inflationary episode, the RBA largely failed to keep the annual inflation rate within their target zone, which tells us about the effectiveness of the monetary policy tool in relation to its stated objective.

The next graphs show the movements between December 2022 and October 2024 for the main components of the All Items CPI (the decimal numberfifi next to the component title is the weight of that component in the overall CPI where the sum is 100).

In general, most components are seeing dramatic reductions in price rises as noted above and the exceptions do not provide the RBA with any justification for further interest rate rises.

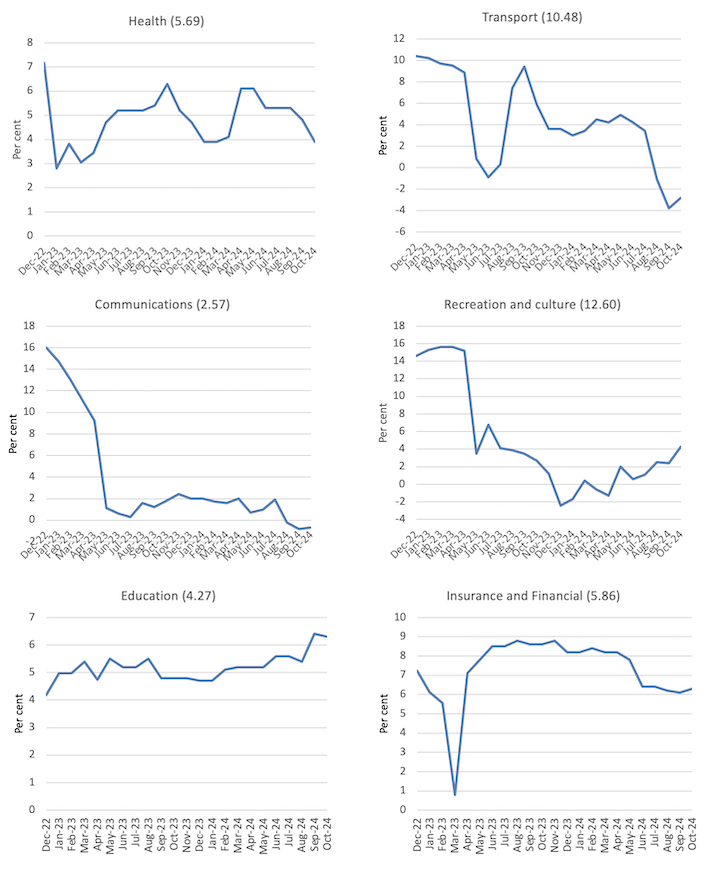

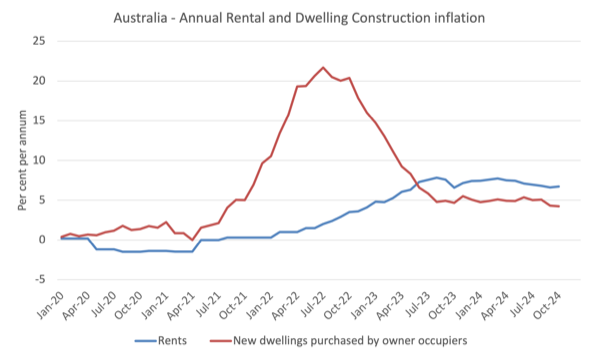

The next graph shows the movements in the housing component (with rents separated out from the new dwelling purchase by owner-occupiers.

The rent component has risen almost in sync with the RBA interest rate hikes and now the rate hikes have ended (for now), the rent inflation has levelled off.

The construction costs for new dwellings have been in retreat since early 2022 as the supply constraints arising from natural disasters (fire burning down forests), the pandemic (building supply disruptions), and the Ukraine situation have eased.

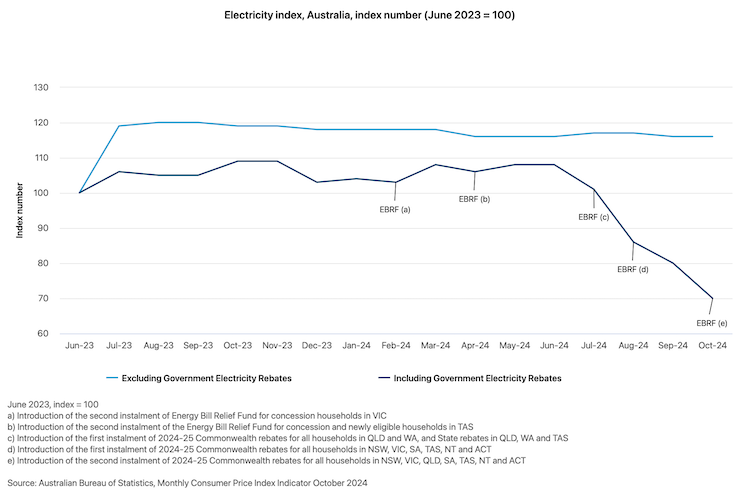

The ABS also published an interesting graph, which compares the electricity prices under the Federal government’s – Energy Bill Relief Fund – rebates which were introduced in July 2023 and what they would have been in the absence of that fiscal intervention.

The Relief Fund provided subsidies to households and small businesses depending on the locality.

The ABS report that:

The EBRF rebates were first introduced in July 2023 and were extended and expanded to all households in July 2024. These rebates have had the effect of reducing electricity costs for households. Including government electricity rebates, electricity costs for households have fallen by 30.2% since June 2023. Excluding these rebates, electricity costs for households would have increased 16.1% since June 2023.

Here is the impact of that simple and very modest scheme.

It demonstrates that targetted expansionary fiscal policy can indeed be anti-inflationary, which means that the spending-inflation nexus is never straightforward as the mainstream narratives might have you believe.

This was the approach the Japanese government took to quickly contain the cost-of-living increases for households.

It works.

Austerity is not required when the inflation is sourced from the supply-side as it was in 2021 and 2022.

Migration from Twitter to Bluesky

As I noted last week, I am quitting Twitter and am now using Bluesky to post information about my work.

My Bluesky address is: @williammitchell.bsky.social

That should be easy to find.

I now have 20.5 thousand people following my Twitter posts and I appreciate the interest all of you have in my work.

I hope you will follow me on Bluesky as my Twitter account evaporates (today).

There are some resources available that help people migrate and find their friends (Thanks to Liz for these tips):

1. https://www.theverge.com/24295933/bluesky-social-network-custom-how-to

2. https://chromewebstore.google.com/detail/sky-follower-bridge/behhbpbpmailcnfbjagknjngnfdojpko

3. https://www.youtube.com/watch?v=m_V2PiMgs4c

So please come across and continue to follow my work on Bluesky.

Music – Jimi Hendrix

This is what I have been listening to while working this morning.

I consider two guitarists to be a level above the rest – Peter Green – and – Jimi Hendrix.

This track was recorded on October 11, 1968 at the famous – Winterland Ballroom – in San Francisco, when Jimi Hendrix was at the height of his powers.

It was released in 1992 as one of three bonus tracks on the – Live at Winterland – album.

The original 13-song album came out in 1987.

Here is a version of the song – Like a Rolling Stone – written by – Bob Dylan – that redefines creativity and sonic brilliance.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

I agree with you, but the RBA will be focused on the 3.5% annual trimmed mean CPI inflation. Of note, there are still a few prominent economists who want to see rates with a 5-handle! Even an unforeseen Trump shock would make that outcome unlikely.

I’d like to see those Reserve Bank economists and any other fans of high interest rates trying to service farm debt in the changing climate while paying the 10% that commercial banks require for their exorbitant profit margins at present.

There was once an understanding that those who lived on rent missed out when the seasons didn’t deliver, but not in our modern world. Now they get first go at the trough.

On a more cheerful note it was exhilarating to hear Jimi Hendrix’s take on “Like a Rolling Stone”!

How he could apply his unique style and incredible playing while still acknowleging Mike Bloomfield’s inspired original backing, and sing at the same time is hard to imagine.

Amazing.

It’s pretty much the same story in the UK. Rachel Reeves’ is aiming to fill a so-called £22bn black hole by a process of fiscal tightening at the same time as the BoE is being ultra tardy in lowering interest rates. Base rate is currently 4.75%.

All supposedly to “fix the foundations” of the economy.

There’s big trouble ahead!