Yesterday, the Reserve Bank of Australia finally lowered interest rates some months after it became…

Australia – latest wage data shows real wages continue to decline

Today (November 13, 2024), the Australian Bureau of Statistics released the latest – Wage Price Index, Australia – for the September-quarter 2024, which shows that the aggregate wage index rose by 3.5 per cent over the 12 months (down 0.6 points on the last quarter). In relation to the September-quarter CPI change (2.8 per cent), this result suggests that workers achieved modest real wage gains. However, if we use the more appropriate Employee Selected Living Cost Index as our measure of the change in purchasing power then the September-quarter result of 4.7 per cent means that real wages fell by 1.2 points. Even the ABS notes the SLCI is a more accurate measure of cost-of-living increases for specific groups of interest in the economy. However, most commentators will focus on the nominal wages growth relative to CPI movements, which in my view provides a misleading estimate of the situation workers are in. Further, while productivity growth is weak, the movement in real wages is such that real unit labour costs are still declining, which is equivalent to an ongoing attrition of the wages share in national income. So corporations are failing to invest the massive profits they have been earning and are also taking advantage of the current situation to push up profit mark-ups. A system that then forces tens of thousands of workers out of employment to deal with that problem – that is, the reliance on RBA interest rate hikes – is void of any decency or rationale. That is modern day Australia.

Latest Australian data

The Wage Price Index:

… measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics

Thus, it is a cleaner measure of wage movements than say average weekly earnings which can be influenced by compositional shifts.

The summary results (seasonally adjusted) for the September-quarter 2024 were:

| Measure | Quarterly (per cent) | Annual (per cent) |

| Private hourly wages | 0.8 (+0.1 points) | 3.5 (-0.6 points) |

| Public hourly wages | 0.8 (-0.1 points) | 3.7 (-0.2 points) |

| Total hourly wages | 0.8 (stable) | 3.5 (-0.6 points) |

| Employee Selected Cost-of-Living measure | 0.6 (-0.7 points) | 4.7 (-1.5 points) |

| Basic CPI measure | 0.2 (-0.8) | 2.8 (-1.0 points) |

| Weighted median inflation | -0.3 (stable) | 3.8 (-0.3 points) |

| Trimmed mean inflation | -0.4 (-0.3 points) | 3.5 (-0.4 points) |

On price inflation measures, please read my blog post – Inflation benign in Australia with plenty of scope for fiscal expansion (April 22, 2015) – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean.

The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

The ABS press release – Wages grow 3.5 per cent for the year – notes that:

The Wage Price Index (WPI) rose 0.8 per cent in September quarter 2024, and 3.5 per cent for the year …

September annual wage growth was 3.5 per cent, falling below 4.0 per cent for the first time since June quarter 2023 …

The average size of hourly wage change was lower in September quarter 2024 (+3.7 per cent) compared to the same period in 2023 (+5.4 per cent) …

… annual public sector wage growth was higher than private sector growth for the first time since December quarter 2020 …

Annual growth in the private sector was 3.5 per cent in the September quarter 2024. This is the lowest private sector annual growth since the September quarter 2022.

Summary assessment:

1. The quarter’s results show a softening in nominal wages growth and a modest real wage gain using the CPI figure.

2. However, in saying that, we have to consider what is the most appropriate cost-of-living measure to deploy (see below).

3. When the price movements for the expenditure patterns that employees follow, real purchasing power continues to decline.

Inflation and cost of living measures

There is a debate as to which cost-of-living measure is the most appropriate.

The most used measure published by the Australian Bureau of Statistics (ABS) is the quarterly ‘All Groups Consumer Price Index (CPI)’.

Reflecting the need to develop a measure of ‘the price change of goods and services and its effect on living expenses of selected household types’, the ABS began publishing a new series in June 2000 – the Analytical Living Cost Indexes – which became a quarterly publication from the September-quarter 2009.

In its technical paper (published October 27, 2021) – Frequently asked questions (FAQs) about the measurement of housing in the Consumer Price Index (CPI) and Selected Living Cost Indexes (SLCIs) – the ABS note that:

The CPI and SLCIs are closely related. All these indexes measure changes in prices paid by the household sector (consumers) for a basket of goods and services provided by other sectors of the economy (e.g. Government, businesses). The weights in the ‘basket’ represent amounts of expenditure by households on goods and services bought from other sectors. Goods traded between households (like buying and selling existing houses) are excluded as both sides of the transaction occur within the household sector.

I discuss these indexes in detail in this blog post – Australia – real wages continue to decline and wage movements show RBA logic to be a ruse (August 16, 2023).

In effect, the SLCIs represent a more reliable indicator of ‘the extent to which the impact of price change varies across different groups of households in the Australian population’.

There are four separate SLCIs compiled by the ABS:

- Employee households.

- Age pensioner households.

- Other government transfer recipient households.

- Self-funded retiree households

The most recent data – Selected Living Cost Indexes, Australia – was published by the ABS on November 6, 2024 for the September-quarter 2024.

Between the September-quarter 2023 and the September-quarter 2024, the growth in the respective SLCIs has been:

- Employee households: 4.7 per cent (-1.5 points).

- Age pensioner households: 3.9 per cent (-0.2 points).

- Other government transfer recipient households: 4.4 per cent (-0.2 points).

- Self-funded retiree households: 2.8 per cent (-1.1 points).

The ‘All groups CPI’, by contrast, rose 2.8 per cent over the same period (as in above Table).

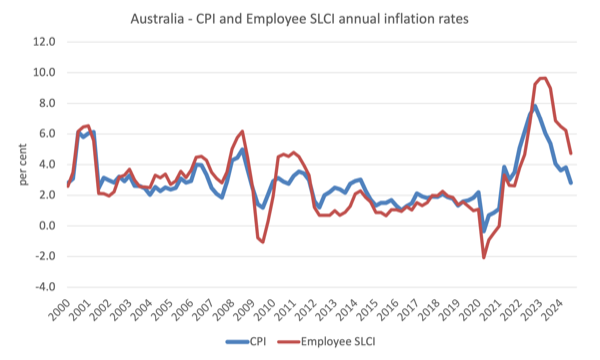

The following graph shows the differences between the CPI-based measure and the Employee SLCI measure which better reflects the changes in cost-of-living.

Thus, when specific household expenditure patterns are more carefully modelled, the SLCI data reveals that the cost-of-living squeeze on ‘employee households’ is more intense than is depicted by using the generic CPI data.

The ABS considers the ‘Employee households SLCI’ to be its preferred measure designed to capture cost-of-living changes more accurately for ‘households whose principal source of income is from wages and salaries’.

The relevant cost-of-living measure for workers has risen by 4.7 per cent over the last year while wages growth was just 3.5 per cent – a decrease in the real purchasing power of wages of1.2 per cent.

However, the media wrongly focus on the CPI as the relevant inflation measure and conclude that with the rise in the CPI of 2.8 per cent, the nominal wage growth of 3.5 per cent delivers a real wage rise of 0.7 points.

Which is misleading in terms of the purchasing power movements.

Real wage trends in Australia

The summary data in the table above confirm that the plight of wage earners continues in Australia.

The extent of the real wage decline over the last 12 months depends on the cost-of-living measure used (see previous graph for a comparison between the CPI measure and the Employee SLCI measure).

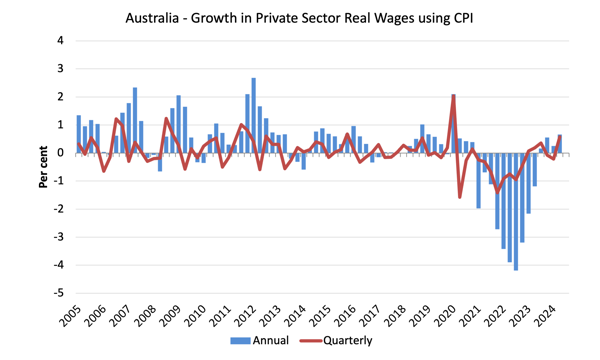

To further reinforce that point, the following graphs use the Employee SLCI measure (first graph) and the CPI (second graph) to show the movement of real wages in the private sector from 2005 to the September-quarter 2024.

In terms of the SLCI measure, there has been a dramatic drop in real wages in the economy over the last 12 quarters.

Workers in the private and public sectors have both experienced sharp declines in the purchasing power of their wages.

This is at the same time as interest rates have risen significantly.

The fluctuation in mid-2020 is an outlier created by the temporary government decision to offer free child care for the September-quarter which was rescinded in the September-quarter of that year.

Overall, the record since 2013 has been appalling.

Throughout most of the period since 2015, real wages growth has been negative with the exception of some partial catchup in 2018 and 2019.

The systematic real wage cuts indicate that wages have not been driving the recent inflationary episode.

Workers are only able to secure partial offset for the cost-of-living pressures caused by the supply-side, driven inflation.

The second graph shows the real wage calculation using the CPI as the deflator.

The situation for workers is only marginally better given the CPI inflation rate is lower than the SLCI rate.

However, as explained above, this measure does not adequately capture purchasing power shifts for employees.

The great productivity rip-off continues

While the decline in real wages means that the rate of growth in nominal wages being outstripped by the inflation rate, another relationship that is important is the relationship between movements in real wages and productivity.

As part of their attempt at justifying the interest rate hikes, the RBA has been making a big deal of the fact that wages growth is too high relative to productivity growth.

Historically (up until the 1980s), rising productivity growth was shared out to workers in the form of improvements in real living standards.

In effect, productivity growth provides the ‘space’ for nominal wages to growth without promoting cost-push inflationary pressures.

There is also an equity construct that is important – if real wages are keeping pace with productivity growth then the share of wages in national income remains constant.

Further, higher rates of spending driven by the real wages growth can underpin new activity and jobs, which absorbs the workers lost to the productivity growth elsewhere in the economy.

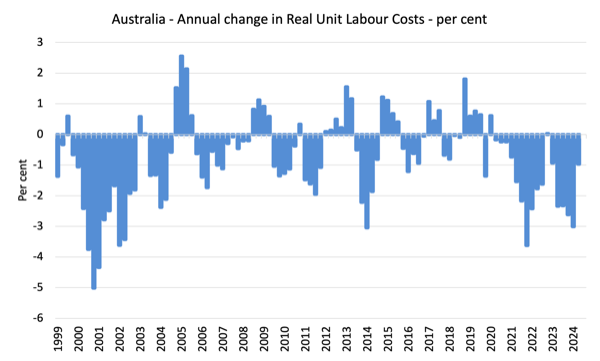

The following graph shows the annual change (per cent) in Real Unit Labour Costs from the September-quarter 1999 to the September-quarter 2024 using the CPI measure to deflate nominal wages.

Real Unit Labour Costs (also equivalent to the wage share in income) is the ratio of real wages to labour productivity.

The real wage measure uses the SLCI index to deflate the nominal wage.

Even though productivity growth has been weak or sometimes negative recently, RULCs have continued to fall, because the real wage growth has been weaker than the productivity growth (or in the current period, the fall in real wages has outstripped the fall in productivity growth).

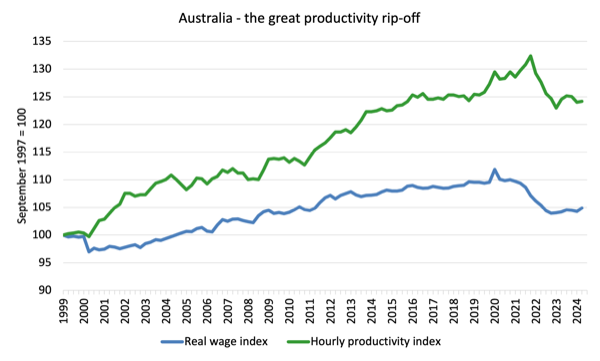

We can see that in the following graph which shows the total hourly rates of pay in the private sector in real terms deflated with the CPI (blue line) and the real GDP per hour worked (from the national accounts) (green line) from the June-quarter 1999 to the September-quarter 2023.

It doesn’t make much difference which deflator is used to adjust the nominal hourly WPI series. Nor does it matter much if we used the national accounts measure of wages.

But, over the time shown, the real hourly wage index has grown by only 4.9 per cent (and falling sharply), while the hourly productivity index has grown by 24.2 per cent.

So not only has real wages growth turned negative over the 18 months or so, but the gap between real wages growth and productivity growth continues to widen.

If I started the index in the early 1980s, when the gap between the two really started to open up, the gap would be much greater. Data discontinuities however prevent a concise graph of this type being provided at this stage.

For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog post – Australia – stagnant wages growth continues (August 17, 2016).

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

Answer: Mostly to profits.

These blog posts explain all this in more technical terms:

1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1 (November 20, 2019).

2. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 2 (November 21, 2019).

Conclusion

In the September-quarter 2024, Australia’s nominal wage growth grew by 3.5 per cent.

While most commentators will focus on the nominal wages growth relative to CPI movements, the more accurate estimate of the cost-of-living change is the Employee Selected Living Cost Index, which is still running well above the CPI change – meaning that real purchasing power of the nominal wages is still falling sharply.

Further with the gap between productivity growth and the declining real wages increasing, the massive redistribution of national income away from wages to profits continues.

This is no time for workers to celebrate the recent wage rises.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

What would happen to inflation in Australia if the federal government:

1. Operated a savings bank like the CBA used to be?

2. Set the cash rate target at 0 and left it there?

3. Offered all forms of insurance cover?

4. Stopped selling bonds?

5. Owned and operated its own airline?

6. Ran telecommunications again (Telecom)?

7. Taxed unearned income?

8. Abandoned compulsory superannuation in favour of an appropriate aged pension?

9. Stabilised Australia’s population thus reducing real estate speculation?

10. Offered a job guarantee?