British Labour Party no longer fit for purpose

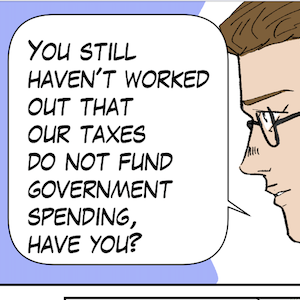

It was interesting to spend a few weeks in London recently and catch up with friends and research colleagues. It always focuses the mind on issues when one is in situ rather than gazing at data and reports from afar. My view of British Labour as being incapable of providing the British people with a progressive solution to the poly crisis the nation confronts has strengthened in the last few weeks and was emphasised once again by the decision of the leadership to backtrack on its £28 billion green investment strategy – its second U-turn on this key policy in the last few years. Touted as making Britain “A fairer, greener future” for Britain, “Labour’s Green Prosperity Plan” certainly differentiated it somewhat from the ruling Tories. Now that differentiation has been abandoned and the Labour politicians are claiming that “Labour’s fiscal rules … [are] … more important than any policy”, which is about as moronic as it gets. More of the same from the so-called political voice of the working class. I told an audience in London a few weeks ago that I considered the ‘institutions’ that had been created in the late C19 and into the C20 to give political voice to the working class had past their use-by date and were no longer fit for purpose. The British Labour Party is one such institution and it has been so captured by ‘conservatism’ of the worst type (sound finance etc) that it no longer is capable of delivering sustainable prosperity.