I have limited time today to write a blog post and last night I was…

Real wages in Australia continue to plunge but the RBA still falsely claims that wage pressure justifies interest rate hikes

The RBA governor has consistently sought refuge in claims that wage pressures in Australia are building and justify the central bank rate hikes – 9 consecutive increases since May 2022. The RBA has chosen to seriously mislead the Australian public on this issue and when confronted with publicly-available data that justifies that conclusion they claim they have unpublished data that shows a wages problem that is pushing inflation. They won’t publish that data, just as they won’t tell us what their secret meetings with bank traders a few weeks were about, except we saw profit taking from the banks increase immediately after the meetings. Today (February 22, 2023), the Australian Bureau of Statistics released the latest – Wage Price Index, Australia – for the December-quarter, which shows that the aggregate wage index rose by 0.8 per cent over the quarter and 3.3 per cent over the 12 months. Last week, we learned that employment growth had declined for the second consecutive month, while real wages continue to contract. Says a lot about mainstream employment theory that predicts real wage cuts will increase employment. This is the seventh consecutive quarter that real wages have fallen. There can be no sustained acceleration in the inflation rate arising from wages growth under these circumstances. Further with the gap between productivity growth and the declining real wages increasing, the massive redistribution of national income away from wages to profits continues. The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure. None of this offers workers a better future. Further, the conduct of the RBA in this environment is contributing to the damage that workers are enduring. While corporations continue to gouge profits, the RBA, like the schoolyard bully, has singled out some of the most disadvantaged workers in our society (low income earners paying of housing loans) and using them in their relentless push of mainstream ideology. This is a huge problem.

Latest Australian data

The Wage Price Index:

… measures changes in the price of labour, unaffected by compositional shifts in the labour force, hours worked or employee characteristics

Thus, it is a cleaner measure of wage movements than say average weekly earnings which can be influenced by compositional shifts.

The summary results (seasonally adjusted) for the December-quarter 2022 were:

| Measure | Quarterly (per cent) | Annual (per cent) |

| Private hourly wages | 0.8 | 3.6 |

| Public hourly wages | 0.7 | 2.5 |

| Total hourly wages | 0.8 | 3.3 |

| Basic CPI measure | 1.8 | 7.8 |

| Weighted median inflation | 1.6 | 5.8 |

| Trimmed mean inflation | 1.7 | 6.9 |

On price inflation measures, please read my blog post – Inflation benign in Australia with plenty of scope for fiscal expansion (April 22, 2015) – for more discussion on the various measures of inflation that the RBA uses – CPI, weighted median and the trimmed mean The latter two aim to strip volatility out of the raw CPI series and give a better measure of underlying inflation.

So the inflation rate is still well above the wages growth, which fell by 0.3 points in nominal terms in the December-quarter 2022.

Real wage trends in Australia

The summary data in the table above confirm that the plight of wage earners continues in Australia.

Real wages fell again in the December-quarter in both the private and public sectors.

This is at the same time that employment growth has been negative for the last two months.

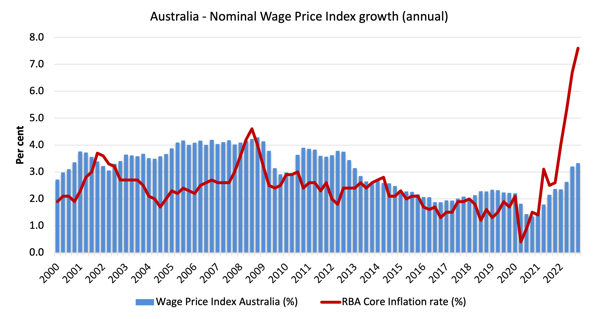

The first graph shows the overall annual growth in the Wage Price Index (public and private) since the December-quarter 2000 (the series was first published in the December-quarter 1997) and the RBA’s core annual inflation rate (red line).

Any blue bar area above the red line indicate real wages growth and below the opposite.

Workers have endured increasing real wage cuts over the last seven quarters.

Allow that to sink in – nearly 2 years of continual undermining of workers’ real purchasing power at a time when interest rates are also rising fast.

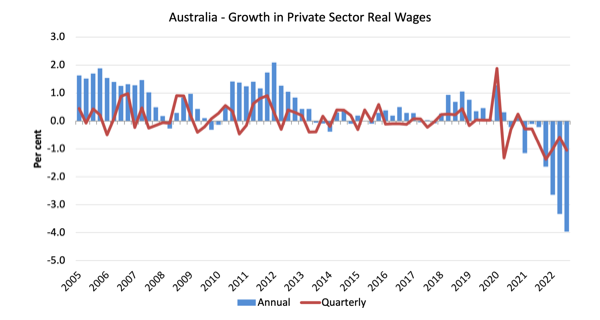

The next graph shows the growth in private sector real wages since the December-quarter 2005 to the December-quarter 2022. The core inflation rate is used to deflate the nominal wages growth.

The blue bars are the annual rate of change, while the red line is the quarterly rate of change.

The fluctuation in mid-2020 is an outlier created by the temporary government decision to offer free child care for the December-quarter which was rescinded in the December-quarter of that year.

Overall, the record since 2013 has been appalling.

Throughout most of the period since 2015, real wages growth has been negative with the exception of some partial catchup in 2018 and 2019.

The systematic real wage cuts indicate that wages are not driving the inflationary episode.

Workers are only able to secure partial offset for the cost-of-living pressures caused by the supply-side, driven inflation.

Industry Variability

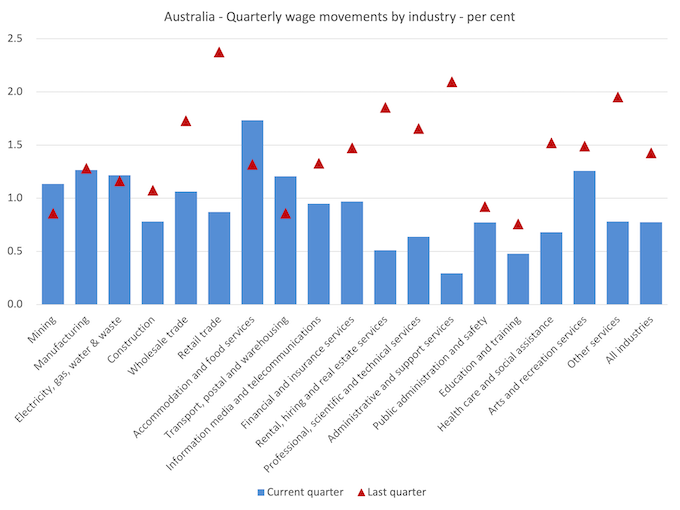

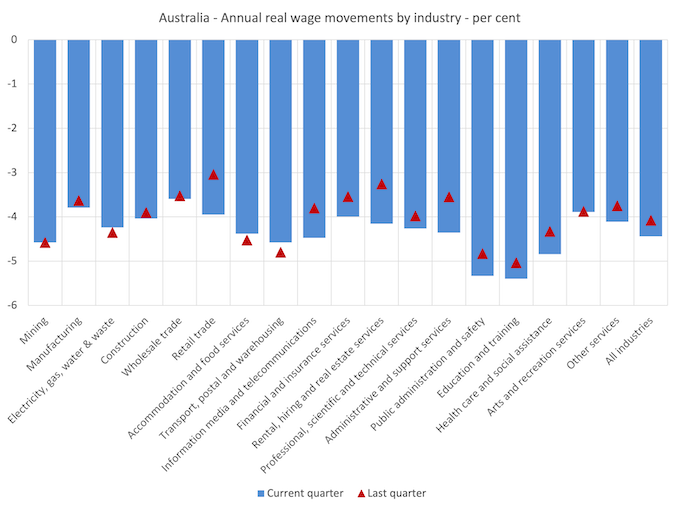

The aggregate data shown above hides quite a significant disparity in quarterly wage movements at the sectoral level, which are depicted in the next graph.

The blue bars are the current quarterly change, while the red triangles are the previous quarterly change.

Hardly any sectors are recording increasing rates of nominal wages growth (Mining, Accommodation and food services, and Transport, postal and warehousing).

The vast majority of sectors are seeing wages growth decline sharply on the rate of growth in the September-quarter 2022.

It is very hard to see where the RBA sees so-called ‘sectoral wage pressures building up’.

The ABS also reported that:

- Jobs in the Health care and social assistance (0.7%), Manufacturing (1.3%) and Professional, scientific and technical services (0.6%) industries were the main contributors to growth reflecting both the size of these industries and the number and size of wage increases.

- The Accommodation and food services industry recorded the highest quarterly growth at 1.7%. Growth in this industry was mainly driven by the size and timing of the Fair Work Commission Annual Wage Review’s deferred increases for modern awards in the hospitality and tourism industries.

- The Administrative and support services industry recorded the lowest quarterly growth (0.3%).

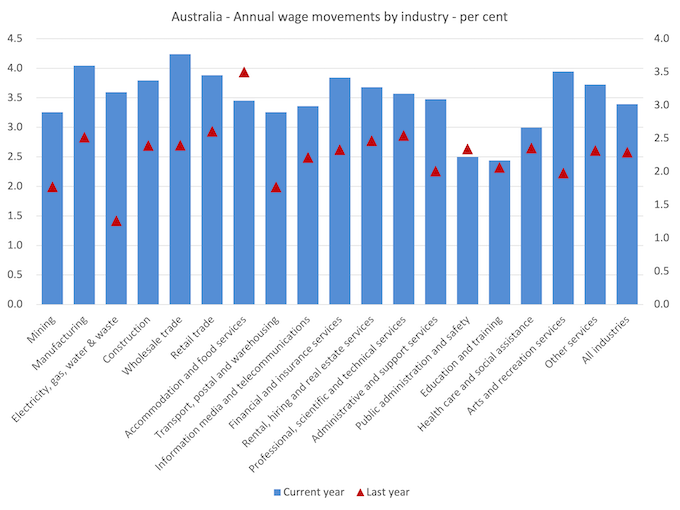

- The Wholesale trade industry recorded the highest annual growth (4.2%), and the Education and training industry recorded the lowest annual growth (2.4%) across industries.

If we consider the situation over the last year, then we can see from the following graph that there is no evidence of any major wages breakout occurring.

There has been an uplift in annual nominal wages growth in most sectors but the rates of growth are still well below the inflation rate.

While nominal wages growth was positive, albeit modest, the next graph shows the movements in real wages across industries and you can see that real wages continued to fall in all sectors.

This is now a chronic situation.

This on-going cut in the purchasing power of workers is almost unprecedented in our wages history and marks a massive redistribution of income towards profits.

Real wages continue to take sharp reductions in all sectors.

In some sectors the real wage cuts are higher in the December-quarter than the September-quarter 2022, while other sectors the contraction is easing – but only by the smallest degree.

One can hardly say that wages push is causing the inflation spike.

The great productivity rip-off continues at a pace

While the decline in real wages means that the rate of growth in nominal wages being outstripped by the inflation rate, another relationship that is important is the relationship between movements in real wages and productivity.

Historically (up until the 1980s), rising productivity growth was shared out to workers in the form of improvements in real living standards.

In effect, productivity growth provides the ‘space’ for nominal wages to growth without promoting cost-push inflationary pressures.

There is also an equity construct that is important – if real wages are keeping pace with productivity growth then the share of wages in national income remains constant.

Further, higher rates of spending driven by the real wages growth can underpin new activity and jobs, which absorbs the workers lost to the productivity growth elsewhere in the economy.

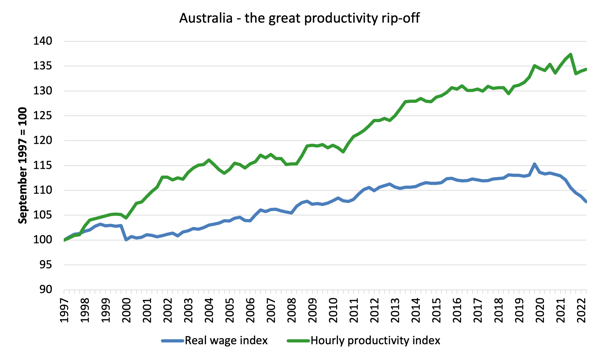

Taking a longer view, the following graph shows the total hourly rates of pay in the private sector in real terms (deflated with the CPI) (blue line) from the inception of the Wage Price Index (December-quarter 1997) and the real GDP per hour worked (from the national accounts) (green line) to the December-quarter 2021.

It doesn’t make much difference which deflator is used to adjust the nominal hourly WPI series. Nor does it matter much if we used the national accounts measure of wages.

But, over the time shown, the real hourly wage index has grown by only 7.7 per cent (and falling sharply), while the hourly productivity index has grown by 34.4 per cent.

So not only has real wages growth turned negative over the last year or so, but the gap between real wages growth and productivity growth continues to widen.

If I started the index in the early 1980s, when the gap between the two really started to open up, the gap would be much greater. Data discontinuities however prevent a concise graph of this type being provided at this stage.

For more analysis of why the gap represents a shift in national income shares and why it matters, please read the blog post – Australia – stagnant wages growth continues (August 17, 2016).

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go?

Answer: Mostly to profits.

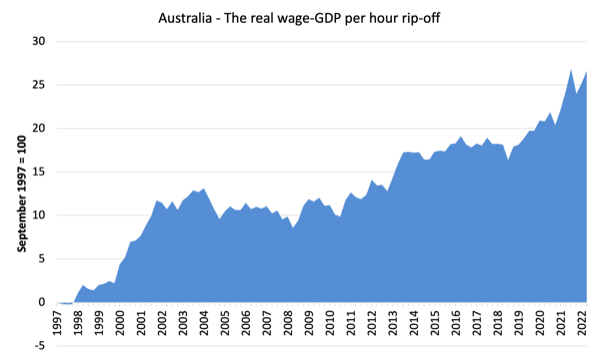

The next graph shows the gap between the real wage index and the labour productivity index in points.

It provides an estimate of the cumulative redistribution of income to profits as a result of real wage suppression.

Now, if you think the analysis is skewed because I used GDP per hour worked (a very clean measure from the national accounts), which is not exactly the same measure as labour productivity, then consider the next graph.

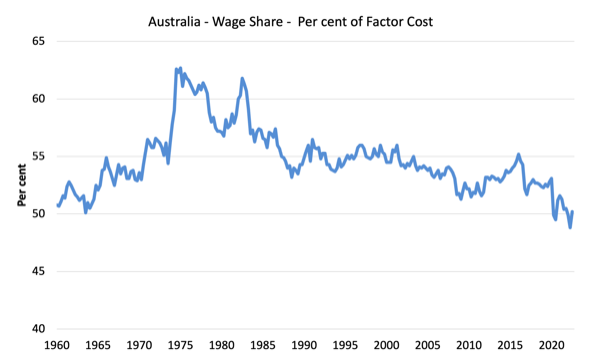

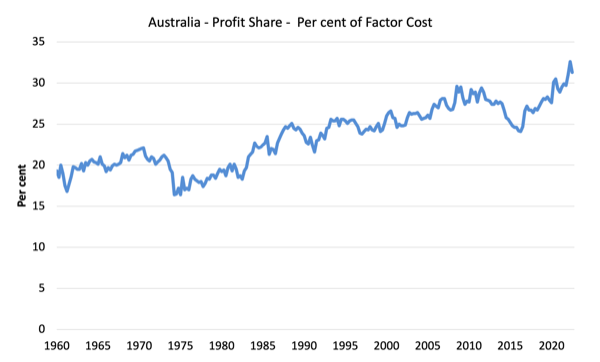

It shows the movements in the wage share in GDP (at factor cost) and profit share since the December-quarter 1960 to the September-quarter 2022 (latest data).

While the series move around from quarter to quarter, the trend is obvious.

The only way that the wage share can fall like this, systematically, over time, is if there has been a redistribution of national income away from labour.

I considered these questions in a more detailed way in this blog post series:

1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 1 (November 20, 2019).

2. 1. Puzzle: Has real wages growth outstripped productivity growth or not? – Part 2 (November 21, 2019).

And the only way that can occur is if the growth in real wages is lower than the growth in labour productivity.

That has clearly been the case since the late 1980s. In the December-quarter 1991, the wage share was 56.6 per cent and the profit share was 22.2 per cent.

In the December-quarter 2022, the wage share stood at 50.2 per cent of total income.

There has been a massive redistribution of income towards profits has occurred over the last 40 years.

The relationship between real wages and productivity growth also has bearing on the balance sheets of households.

One of the salient features of the neo-liberal era has been the on-going redistribution of national income to profits away from wages. This feature is present in many nations.

The suppression of real wages growth has been a deliberate strategy of business firms, exploiting the entrenched unemployment and rising underemployment over the last two or three decades.

The aspirations of capital have been aided and abetted by a sequence of ‘pro-business’ governments who have introduced harsh industrial relations legislation to reduce the trade unions’ ability to achieve wage gains for their members. The casualisation of the labour market has also contributed to the suppression.

The so-called ‘free trade’ agreements have also contributed to this trend.

I consider the implications of that dynamic in this blog post – The origins of the economic crisis (February 16, 2009).

In summary, the substantial redistribution of national income towards capital over the last 30 years has undermined the capacity of households to maintain consumption growth without recourse to debt.

One of the reasons that household debt levels are now at record levels is that real wages have lagged behind productivity growth and households have resorted to increased credit to maintain their consumption levels, a trend exacerbated by the financial deregulation and lax oversight of the financial sector.

Real wages growth and employment

The standard mainstream argument is that unemployment is a result of excessive real wages and moderating real wages should drive stronger employment growth.

As Keynes and many others have shown – wages have two aspects:

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

I usually publish a cross-plot that consistently shows no relationship between annual growth in real wages and the quarterly change in total employment over a long period.

The graph has issues at present due to Covid-19 outliers, although the conclusion doesn’t change.

There is also strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity. That evidence supports the positive relationship between real wages growth and employment growth.

At present, we are seeing employment growth turning negative after a prolonged period of real wage cuts – exactly the opposite prediction that mainstream economists make.

They were always wrong on this score.

Conclusion

In the December-quarter 2022, Australia’s wage growth remained well below that necessary to restore the purchasing power losses arising from price level inflation.

The data shows that the significant cuts to workers’ purchasing power continue, and, in my view, constitute a national emergency.

There can be no sustained acceleration in the inflation rate arising from wages growth under these circumstances.

Further with the gap between productivity growth and the declining real wages increasing, the massive redistribution of national income away from wages to profits continues.

The business sector, as a whole, thinks it is clever to always oppose wages growth and the banks love that because they can foist more debt onto households to maintain their consumption expenditure.

None of this offers workers a better future.

Further, the conduct of the RBA in this environment is contributing to the damage that workers are enduring.

While corporations continue to gouge profits, the RBA, like the schoolyard bully, has singled out some of the most disadvantaged workers in our society (low income earners paying of housing loans) and using them in their relentless push of mainstream ideology.

This is a huge problem.

That is enough for today!

(c) Copyright 2023 William Mitchell. All Rights Reserved.

ISTM that central bankers are really just maintaining a dirty peg to the US dollar – an informal Bretton Woods – and then post-hoc justifying their decisions to follow the crowd.

They appear scared to death of ‘imported inflation’.

There doesn’t appear to be any independent monetary policy outside of Japan.

How much longer are workers going to tolerate this?